Technical & Derivatives Report

January 04, 2016

Sensex (26161) / Nifty (7963)

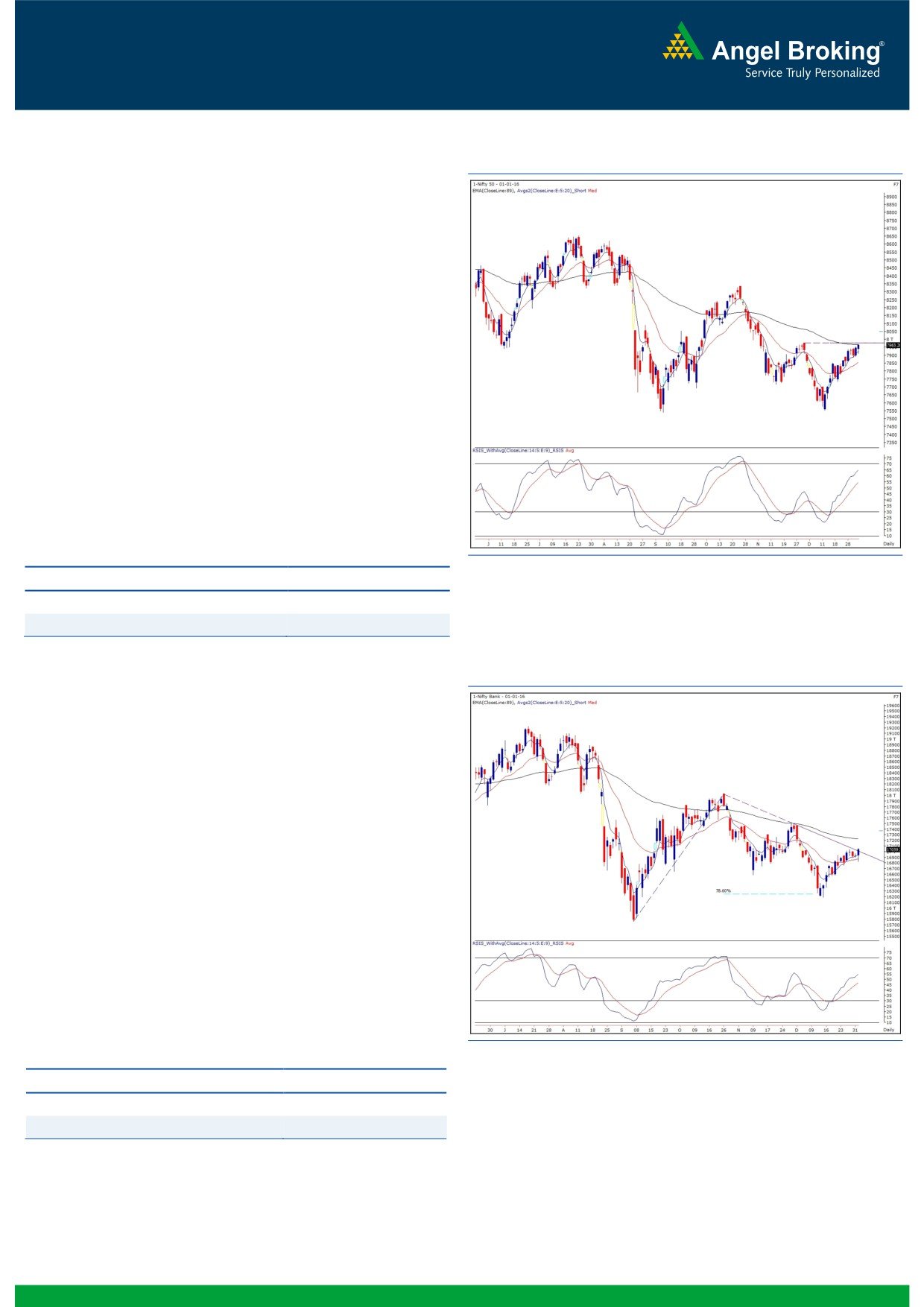

Exhibit 1: Nifty Daily Chart

We have been mentioning about the key points of 7950 -

7970 on the Nifty since the past couple of weeks. The index

has now reached these levels and is nearing its recent high of

7979. This level coincides with the daily ‘89 EMA’ and thus,

can be considered as a strong hurdle in the near term. If the

Nifty has to extend this up move, then it needs to break the

psychological level of 8000 decisively. If it’s able to do so,

then we may witness an extension of the move towards 8080 -

8120 levels. On the flip side, the Nifty could slip towards 7890

- 7850 levels if investors resort to some amount of profit

booking on lack of conviction in the market in the near term.

Traders are advised to stay light on positions and wait for

further developments on the charts. As of now, we expect the

Nifty to remain within a small range of 7850 - 8000. During

the concluded week, a number of individual stocks performed

favorably and we expect such outperformance to continue in

the coming week as well. Traders should stick to stock centric

approach with a proper exit strategy.

Key Levels

Support 1 - 7890

Resistance 1 - 7979

Support 2 - 7850

Resistance 2 - 8000

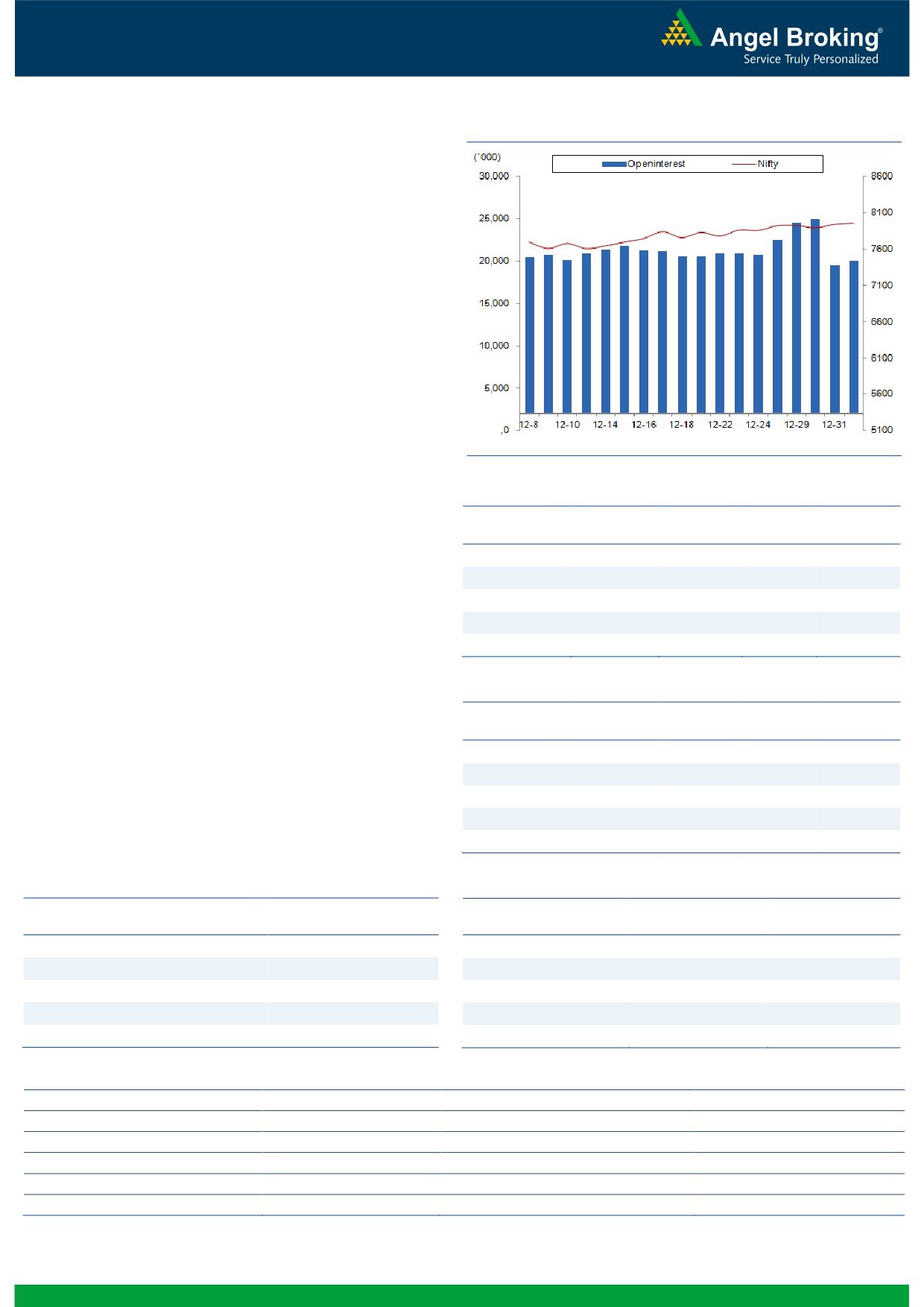

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (17039)

The Nifty Bank index opened on a flat note on Friday and

traded with the negative bias in the first half of the sessions.

However, the sudden spurt in the banking counters in the

second half pulled the index higher. Eventually, the banking

index ended the session with the gains of 0.69 percent. On

weekly basis, the banking index traded in the narrow range of

243 points and managed to close in the green for the third

consecutive week.

After the sideways movement of three sessions, the Nifty Bank

index has given a breakout in yesterday’s session. The

momentum may continue in upcoming sessions too. Traders

are advised to be with the trend till it holds 16800 levels.

Going forward, the immediate support for the index is placed

at 16900 and 16800 levels. While, 17080 and 17215 would

now act as intraday resistance levels.

Key Levels

Support 1 - 16900

Resistance 1 - 17080

Support 2 - 16800

Resistance 2 - 17215

1

Technical & Derivatives Report

January 04, 2016

Comments

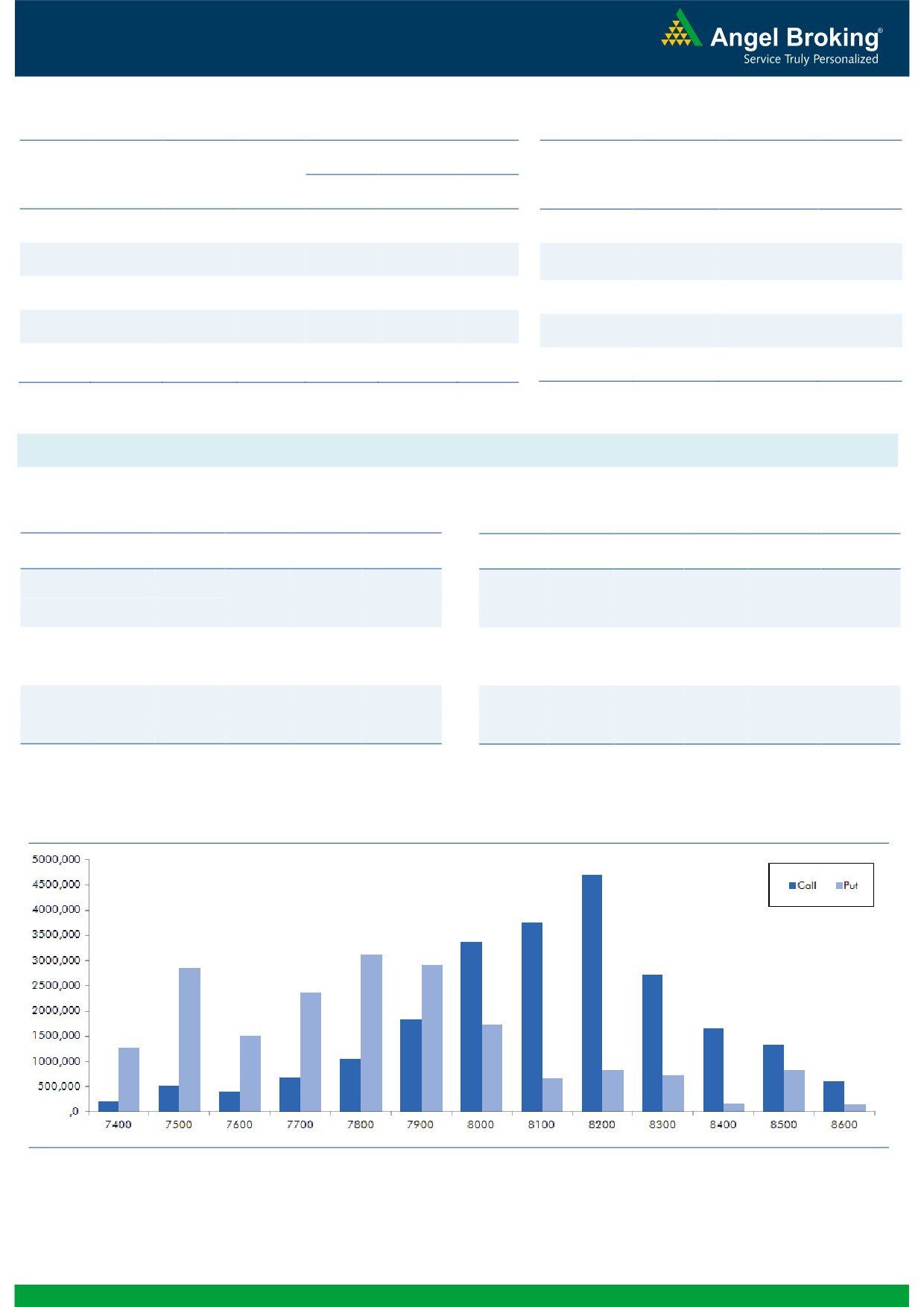

Nifty Vs OI

The Nifty futures open interest has increased by 2.66%

BankNifty futures open interest has increased by 4.36%

as market closed at 7963.20 levels.

The Nifty January future closed at a premium of 18.80

points against a premium of 5.70 points. The February

series closed at a premium of 39.70 points.

The Implied Volatility of at the money options has

increased from 12.43% to 13.05 %.

The total OI of the market is Rs. 1,71,366/- cr. and the

stock futures OI is Rs. 62,545/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, ADANIPOWER, UNITECH,

NHPC and IFCI

OI Gainers

Views

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

FIIs were net buyers in equity segment to the tune of Rs.

ENGINERSIN

2486000

14.60

250.30

3.20

228 crores. While in Index Futures they sold marginally

BEML

597500

14.24

1310.30

1.86

with decent rise in open interest, this indicates blend of

DLF

43420000

11.72

122.25

4.85

both long and short positions in Friday’s trading session.

RELINFRA

9418500

10.95

593.30

9.64

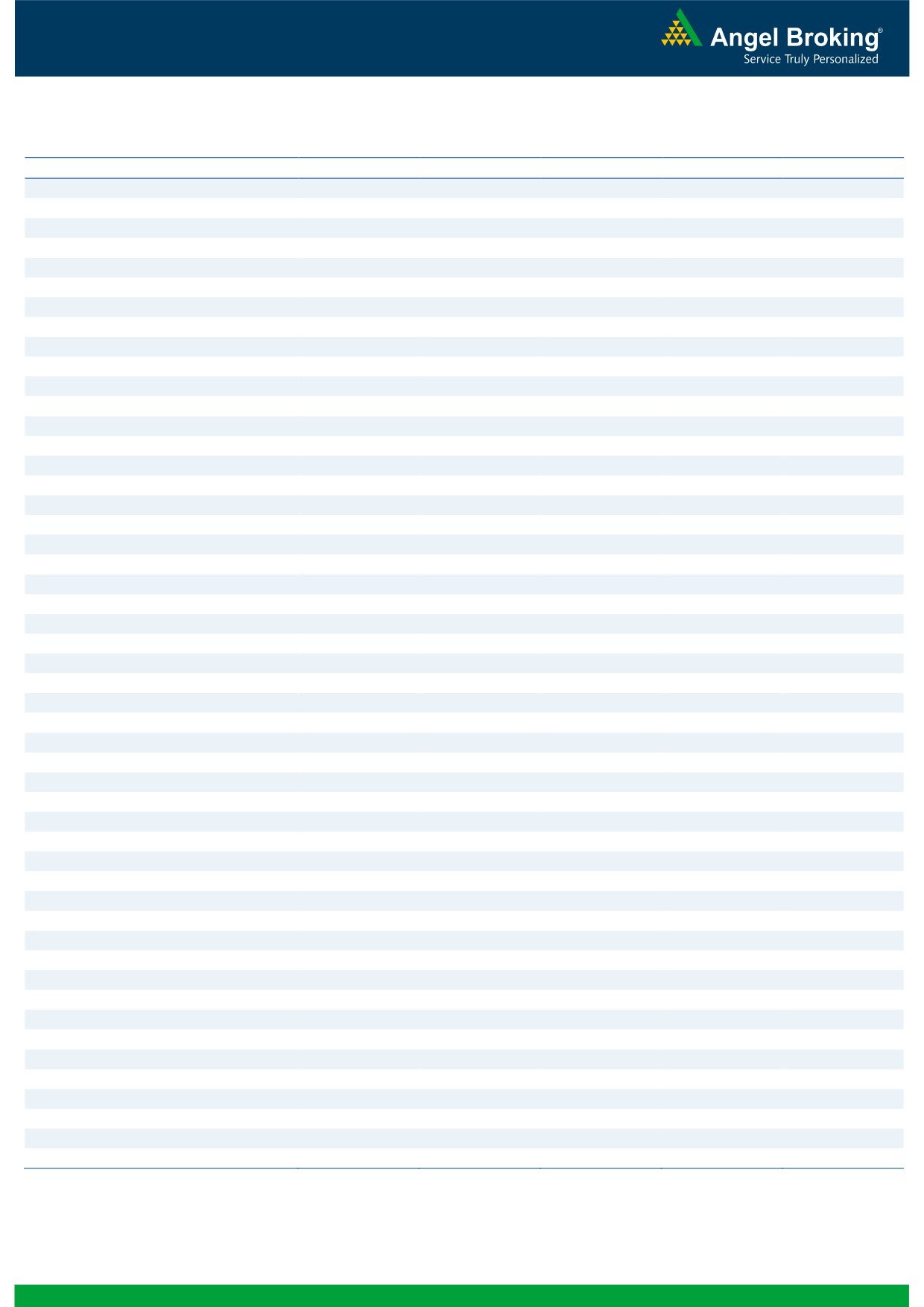

In Index Options front, FIIs were net buyers of worth Rs.

HAVELLS

7660000

10.25

322.60

5.42

566 crores with good amount of rise in open interest. In

call options, we saw out of the money strikes, 8100-

OI Losers

8400 to be quite active and they also added decent

OI

PRICE

amount of fresh OI. While in put options, some build-up

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

was witness in 7900 strike price. FIIs have been forming

RPOWER

59592000

-12.31

59.15

3.59

decent fresh longs in Index Futures from past few days;

CADILAHC

9409500

-8.24

333.35

1.28

we believe the resistance of 8100-8150 may be tested.

HINDZINC

1964800

-4.66

149.35

1.46

So, one should trade accordingly.

TATACHEM

4582600

-3.70

410.75

2.09

PAGEIND

43050

-2.82

13417.35

0.58

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ADANIENT

55.92

NIFTY

0.77

0.62

WOCKPHARMA

41.50

BANKNIFTY

1.04

0.79

RELINFRA

67.81

SBIN

0.45

0.37

RELCAPITAL

46.94

LT

0.67

0.36

HAVELLS

45.77

RELIANCE

0.61

0.59

Strategy Date

Symbol

Strategy

Status

2

Technical & Derivatives Report

January 04, 2016

FII Statistics for 01-January 2015

Turnover on 01-January 2015

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

467.28

541.81

(74.52)

249867

14641.29

2.32

151271

8431.70

-61.57

FUTURES

FUTURES

INDEX

INDEX

4020.08

3453.75

566.33

617233

36719.62

5.22

999548

59280.73

-82.43

OPTIONS

OPTIONS

STOCK

1556.15

1775.05

(218.89)

978828

49484.03

0.32

STOCK

FUTURES

394786

22002.91

-66.68

FUTURES

STOCK

STOCK

905.29

832.05

73.24

12847

668.55

474.81

OPTIONS

159000

9419.41

-52.19

OPTIONS

TOTAL

6948.80

6602.65

346.15

1858775

101513.49

2.76

TOTAL

1704605

99134.75

-77.73

Nifty Spot = 7963.20

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8000

105.30

Buy

7900

80.30

41.55

58.45

8041.55

27.60

72.40

7872.40

Sell

8100

63.75

Sell

7800

52.70

Buy

8000

105.30

Buy

7900

80.30

69.15

130.85

8069.15

47.10

152.90

7852.90

Sell

8200

36.15

Sell

7700

33.20

Buy

8100

63.75

Buy

7800

52.70

27.60

72.40

8127.60

19.50

80.50

7780.50

Sell

8200

36.15

Sell

7700

33.20

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Jan. Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

January 04, 2016

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,351

1,362

1,371

1,383

1,392

ADANIPORTS

257

262

265

271

274

AMBUJACEM

202

204

205

207

208

ASIANPAINT

872

875

880

884

889

AXISBANK

442

446

449

453

457

BAJAJ-AUTO

2,501

2,509

2,520

2,528

2,539

BANKBARODA

154

157

158

161

162

BHARTIARTL

334

337

341

344

347

BHEL

167

169

170

173

174

BOSCHLTD

18,293

18,746

19,023

19,476

19,753

BPCL

885

891

896

902

908

CAIRN

136

137

139

140

141

CIPLA

644

650

654

660

664

COALINDIA

322

328

331

338

341

DRREDDY

3,074

3,091

3,107

3,124

3,140

GAIL

363

366

372

375

381

GRASIM

3,709

3,738

3,764

3,794

3,819

HCLTECH

837

841

848

853

860

HDFC

1,242

1,250

1,259

1,267

1,275

HDFCBANK

1,071

1,080

1,085

1,094

1,099

HEROMOTOCO

2,666

2,676

2,685

2,696

2,705

HINDALCO

83

84

85

85

86

HINDUNILVR

849

853

857

861

866

ICICIBANK

256

259

262

265

267

IDEA

141

142

143

144

146

INDUSINDBK

955

959

966

970

977

INFY

1,087

1,096

1,102

1,112

1,118

ITC

324

326

327

329

331

KOTAKBANK

704

716

723

734

741

LT

1,266

1,278

1,284

1,296

1,303

LUPIN

1,819

1,832

1,845

1,859

1,872

M&M

1,249

1,257

1,268

1,277

1,288

MARUTI

4,571

4,605

4,636

4,670

4,702

NTPC

143

144

145

146

147

ONGC

236

239

241

245

247

PNB

115

116

117

119

119

POWERGRID

140

141

141

142

142

RELIANCE

1,003

1,009

1,014

1,020

1,025

SBIN

223

225

227

230

231

VEDL

89

91

91

92

93

SUNPHARMA

802

809

813

820

825

TATAMOTORS

363

382

393

412

423

TATAPOWER

67

68

69

70

70

TATASTEEL

250

254

257

260

263

TCS

2,396

2,406

2,423

2,433

2,449

TECHM

515

517

521

524

528

ULTRACEMCO

2,747

2,786

2,806

2,845

2,866

WIPRO

551

554

557

559

562

YESBANK

717

725

730

738

743

ZEEL

428

431

434

436

440

4

Technical & Derivatives Report

January 04, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5