Technical & Derivatives Report

November 03, 2016

Sensex (27527) / Nifty (8514)

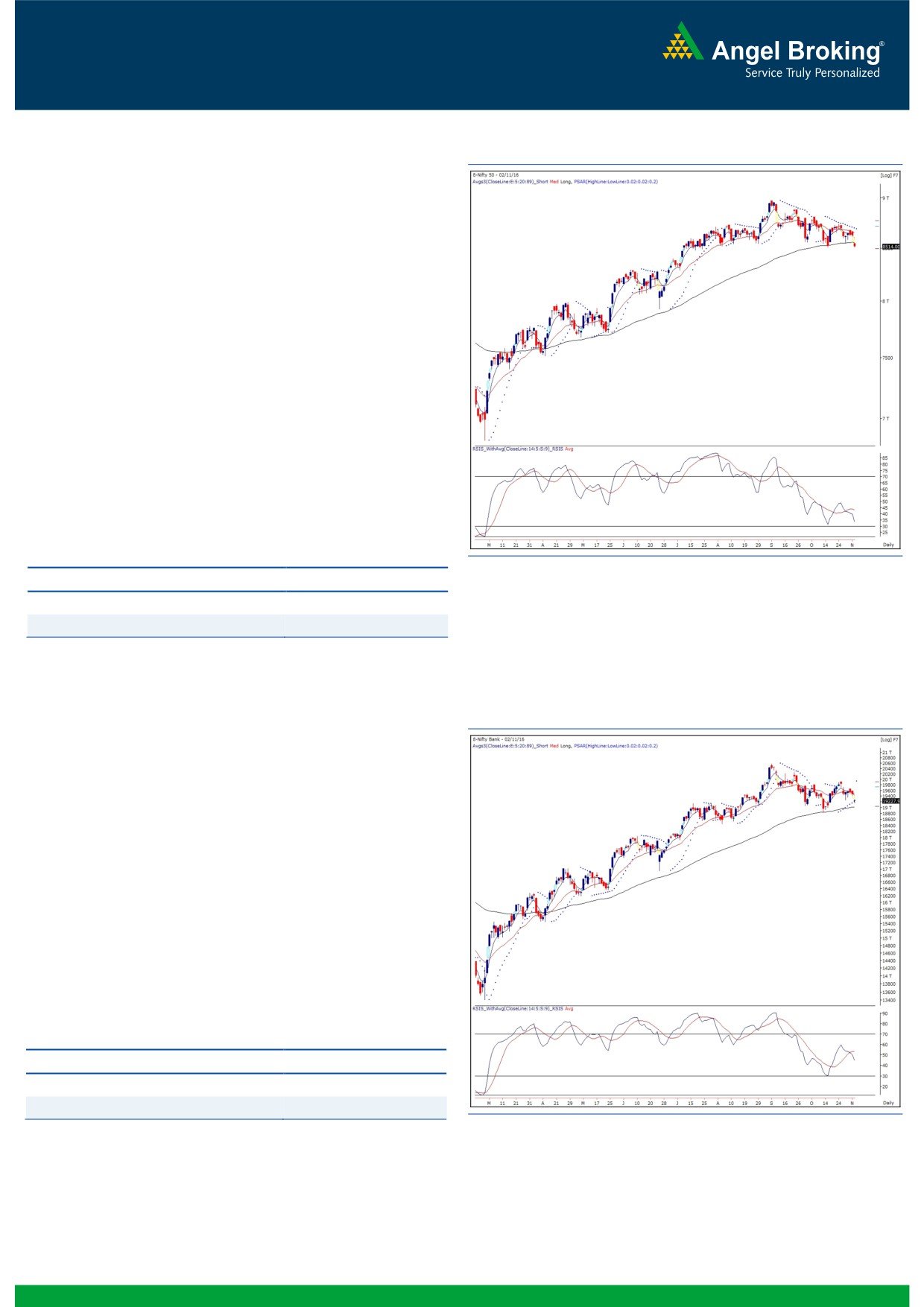

Exhibit 1: Nifty Daily Chart

Yesterday, our market opened with the downside gap of around a

percent on back of weakness in global bourses. Post the gap

down opening, the Nifty traded in a narrow range with negative

bias and eventually ended the session with loss of 1.30 percent

over its previous close.

Yesterday’s fall was in-line with our view as we already had

cautious stance on market from last few sessions. Yesterday, the

Nifty index breached ‘Trend line’ support and ‘89 EMA’ on daily

chart with a gap and continued to move down, which does not

bode well for Bulls. At current juncture, the Nifty is trading around

its previous swing lows of 8480 - 8500 levels. But, since, there is

no sign of strength seen on chart, we believe that the index may

breach that support zone and move down towards 8400 - 8355

levels. Thus, traders are advice to remain light and avoid bottom

fishing at current levels. Going forward, intraday resistance for

the index is placed at 8550 and 8615 levels.

Key Levels

Support 1 - 8480

Resistance 1 - 8550

Support 2 - 8400

Resistance 2 - 8615

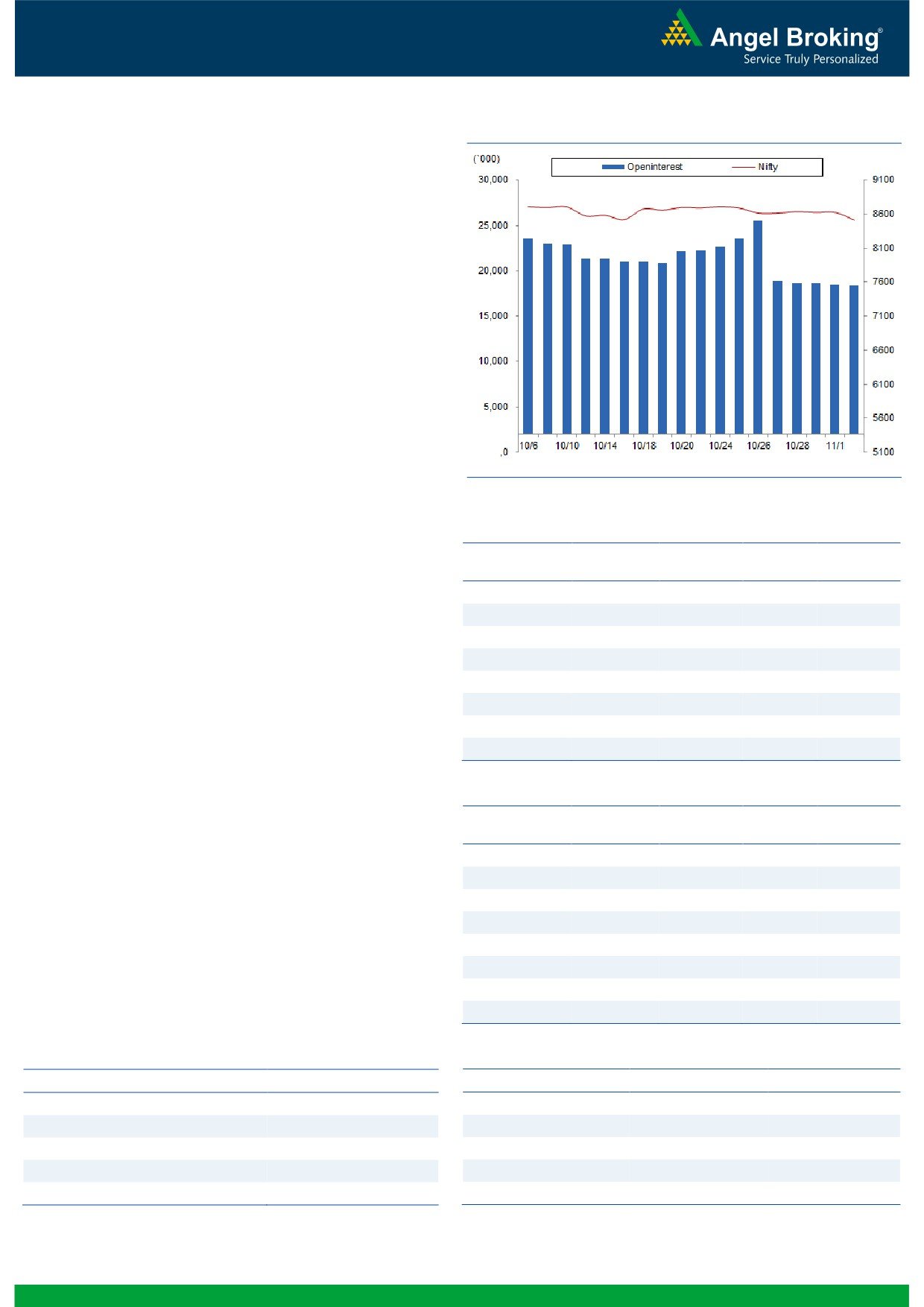

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19228)

The Nifty Bank index too opened with a gap down opening and

ended the session with loss of 1.19 percent over its previous

session's close.

The gap down opening yesterday was definitely a negative sign

as the index traded lower post the recent consolidation. Although

on a larger degree the current correction seems to be a corrective

move within an uptrend, the index is expected to trade volatile

with negative bias in near term. The near support for the Nifty

Bank index is placed in range of 19050 - 19000 whereas

resistance is placed in range of 19460 - 19570. We continue to

advise traders to remain cautious and trade with proper risk

management.

Key Levels

Support 1 - 19050

Resistance 1 - 19460

Support 2 - 19000

Resistance 2 - 19570

1

Technical & Derivatives Report

November 03, 2016

Comments

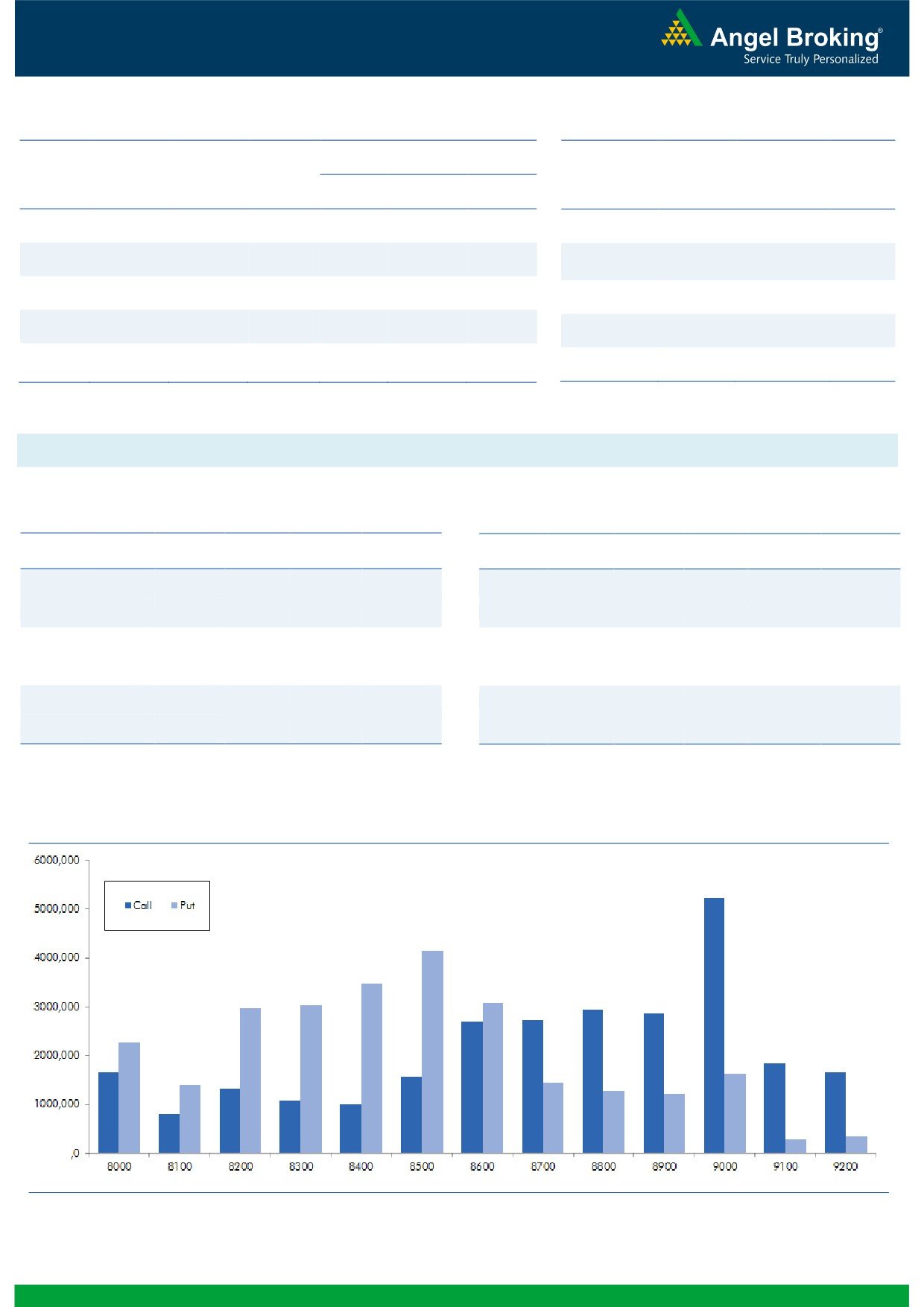

Nifty Vs OI

The Nifty futures open interest has decreased by 0.60%

BankNifty futures open interest has increased by 11.14%

as market closed at 8514.00 levels.

The Nifty November future closed with a premium of

28.60 against the premium of 25.50 points in last

trading session. The December series closed at a

premium of 80.65 points.

The Implied Volatility of at the money options has

increased from 14.52% to 16.12%. At the same time, the

PCR-OI of Nifty has decreased from 0.97 to 0.95 levels.

The total OI of the market is Rs. 2,40,184/- cr. and the

stock futures OI is Rs. 76,242/- cr.

Few of the liquid counters where we have seen high cost

of carry are ADANIPOWER, SOUTHBANK, GAIL, KPIT

and DISHTV.

Views

OI Gainers

Yesterday, FIIs were net seller in both equity cash and

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

index future segment. They sold equities worth Rs. 667

UBL

1565900

18.36

869.85

-1.56

crores. While, in index futures, they were net seller to the

BANKINDIA

24918000

18.35

107.90

-5.43

tune of Rs. 803 crores with some rise in open interest,

ORIENTBANK

14376000

9.11

120.70

-5.63

indicating blend of long unwinding andw.freshlbshortng.com

ONGC

20687500

7.99

274.35

-3.82

formation.

DISHTV

45738000

7.01

93.55

-4.30

On Index Options front, FIIs bought of worth Rs. 608

PTC

15928000

5.57

72.70

-3.32

crores with good amount of rise in OI. In call options,

MINDTREE

3670400

5.28

436.00

-1.36

decent amount of build-up was seen in 8600 and 9000

HINDZINC

7900800

5.02

269.20

-0.96

strikes. On the other hand, in put options, 8300 and

8400 strikes remained active and they also added some

fresh positions. Maximum OI in November series is

OI Losers

placed at 9000 call and 8500 put options.

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

From last three sessions, we are witnessing good amount

IGL

1428900

-9.85

860.65

-1.30

of long unwinding and fresh short formation in Index

OIL

1421200

-8.53

410.20

-2.14

Futures by stronger hands. At current juncture, 8500 -

CENTURYTEX

7994800

-8.17

1000.00

-2.84

8550 seems to be a crucial support zone for Nifty.

SRTRANSFIN

3365400

-7.17

1062.00

0.86

Looking at the above data, we believe Nifty may breach

CADILAHC

2598400

-6.77

407.30

-4.37

these support levels in the short run provided we see

CROMPGREAV

9264000

-6.20

77.30

-0.26

continuation of decent amount of fresh short formation.

Thus, traders are advised to remain light and focus more

AMARAJABAT

537000

-6.09

1032.40

-0.84

on stock specific moves.

MRF

42690

-5.79

49553.55

-1.14

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

CANBK

50.25

NIFTY

0.95

0.97

BANKINDIA

48.57

BANKNIFTY

0.94

0.92

GRANULES

38.58

AXISBANK

0.42

0.43

ONGC

36.76

RELIANCE

0.47

0.37

M&M

28.76

SBIN

0.69

0.63

2

Technical & Derivatives Report

November 03, 2016

FII Statistics for 2, November 2016

Turnover on 2, November 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1354.17

2157.05

(802.89)

210309

13907.55

1.00

216038

14796.54

29.06

FUTURES

FUTURES

INDEX

INDEX

35975.01

35367.20

607.81

855488

55659.02

7.95

3917442

284190.92

64.55

OPTIONS

OPTIONS

STOCK

6028.75

6092.14

(63.39)

869757

55656.75

0.50

STOCK

FUTURES

483398

34128.32

-10.71

FUTURES

STOCK

STOCK

4196.57

4128.17

68.40

59053

3990.55

33.65

OPTIONS

276905

20278.61

-2.79

OPTIONS

TOTAL

47554.49

47744.56

(190.07)

1994607

129213.87

4.41

TOTAL

4893783

353394.39

45.28

Nifty Spot = 8514.00

Lot Size = 75

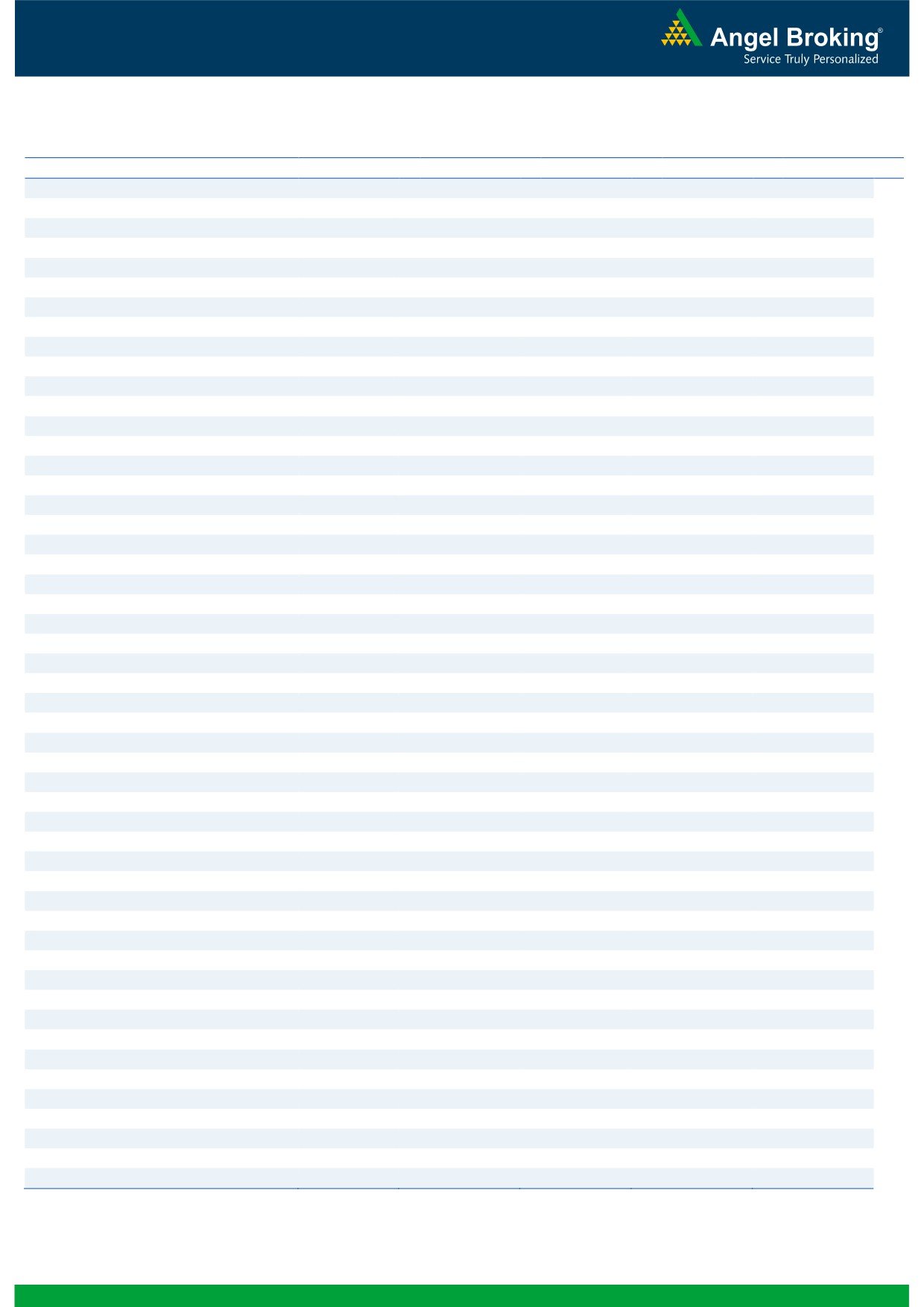

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8600

102.85

Buy

8500

114.50

41.00

59.00

8641.00

33.85

66.15

8466.15

Sell

8700

61.85

Sell

8400

80.65

Buy

8600

102.85

Buy

8500

114.50

68.90

131.10

8668.90

58.30

141.70

8441.70

Sell

8800

33.95

Sell

8300

56.20

Buy

8700

61.85

Buy

8400

80.65

27.90

72.10

8727.90

24.45

75.55

8375.55

Sell

8800

33.95

Sell

8300

56.20

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

November 03, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1 465

1 477

1 494

1 506

1 523

ADANIPORTS

293

297

300

304

307

AMBUJACEM

237

239

242

243

246

ASIANPAINT

1 039

1 051

1 067

1 079

1 095

AUROPHARMA

777

783

793

799

809

AXISBANK

463

470

475

482

488

BAJAJ-AUTO

2 746

2 783

2 806

2 842

2 866

BANKBARODA

148

149

151

152

154

BHEL

135

136

138

139

141

BPCL

647

653

662

668

677

BHARTIARTL

304

307

311

314

318

INFRATEL

341

354

363

375

384

BOSCH

21 293

21 486

21 843

22 036

22 393

CIPLA

550

555

563

568

575

COALINDIA

321

324

327

330

333

DRREDDY

3 194

3 227

3 284

3 317

3 374

EICHERMOT

24 446

24 613

24 898

25 065

25 351

GAIL

414

421

426

433

439

GRASIM

915

925

944

954

972

HCLTECH

757

761

767

771

777

HDFCBANK

1 234

1 240

1 248

1 254

1 262

HDFC

1 385

1 395

1 402

1 411

1 419

HEROMOTOCO

3 296

3 311

3 336

3 351

3 376

HINDALCO

151

154

156

159

161

HINDUNILVR

824

833

841

849

857

ICICIBANK

267

269

271

274

276

IDEA

73

74

75

76

77

INDUSINDBK

1 186

1 207

1 222

1 244

1 258

INFY

975

978

983

986

990

ITC

233

235

237

239

241

KOTAKBANK

792

798

802

808

812

LT

1 428

1 438

1 447

1 457

1 465

LUPIN

1 465

1 479

1 502

1 515

1 538

M&M

1 274

1 322

1 354

1 402

1 434

MARUTI

5 735

5 765

5 815

5 845

5 895

NTPC

151

154

156

158

160

ONGC

270

273

280

283

290

POWERGRID

173

174

175

176

177

RELIANCE

1 007

1 016

1 029

1 037

1 051

SBIN

247

249

253

255

258

SUNPHARMA

700

707

720

727

740

TCS

2 265

2 285

2 314

2 334

2 363

TATAMTRDVR

327

331

338

342

348

TATAMOTORS

504

508

517

522

531

TATAPOWER

76

77

77

78

79

TATASTEEL

402

407

412

418

422

TECHM

417

424

429

435

440

ULTRACEMCO

3 826

3 861

3 913

3 948

4 000

WIPRO

449

453

457

462

466

YESBANK

1 179

1 194

1 216

1 231

1 253

ZEEL

494

498

502

505

509

4

Technical & Derivatives Report

November 03, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5