Technical & Derivatives Report

August 03, 2016

Sensex (27982) / Nifty (8623)

Exhibit 1: Nifty Daily Chart

Yesterday’s session opened on a flat note despite the SGX Nifty

having indicated a soft start for our market. Quite similar to the

previous session, the Nifty inched higher in the first half, however,

as expected; we saw a gradual decline in the market immediately

post the mid-session to close with marginal losses.

Unlike Monday’s session, we were not so surprised by yesterday’s

corrective move in the latter half. We were prepared for this

intraday weakness as couple of technical evidences, such as the

‘Super Trend’ and the 78.6% Fibonacci retracement level (of

Monday’s down move) on hourly chart was placed around the

8680 mark. Since last three days, we have been repeatedly

advocating on avoiding aggressive positions in the market as the

overall volatility has increased substantially and the index is now

undergoing a consolidation phase. We reiterate that traders

should now stay light on positions and avoid taking undue risks.

For the coming session, 8590 - 8572 and 8640 - 8680 would

act as immediate supports and resistances, respectively.

Key Levels

Support 1 - 8590

Resistance 1 - 8640

Support 2 - 8572

Resistance 2 - 8680

Nifty Bank Outlook - (18708)

Exhibit 2: Nifty Bank Daily Chart

In yesterday's trading session, the Nifty Bank index traded in a

narrow range and ended the session with marginal loss of 0.17

percent. The PSU Banking stocks were the outperformers where

the Nifty PSU Bank index gained 0.72 percent over its previous

sessions close.

During the last couple of days, the index has corrected marginally

and has breached trendline support on hourly chart. Also, the

indicators such as 'Super Trend' and 'PSAR' are indicating

resistance in range of 18870 - 18950 and the bulls have

herculean task to cross the mentioned resistance for resumption

of the up move. Meanwhile, the support on higher degree (daily)

charts is placed around 18550. Though there is no major sign of

trend reversal at this juncture, we are expecting increased volatility

in near term and thus, traders are advised to stay light and trade

on stock specific moves.

Key Levels

Support 1 - 18550

Resistance 1 - 18870

Support 2 - 18500

Resistance 2 - 18950

1

Technical & Derivatives Report

August 03, 2016

Comments

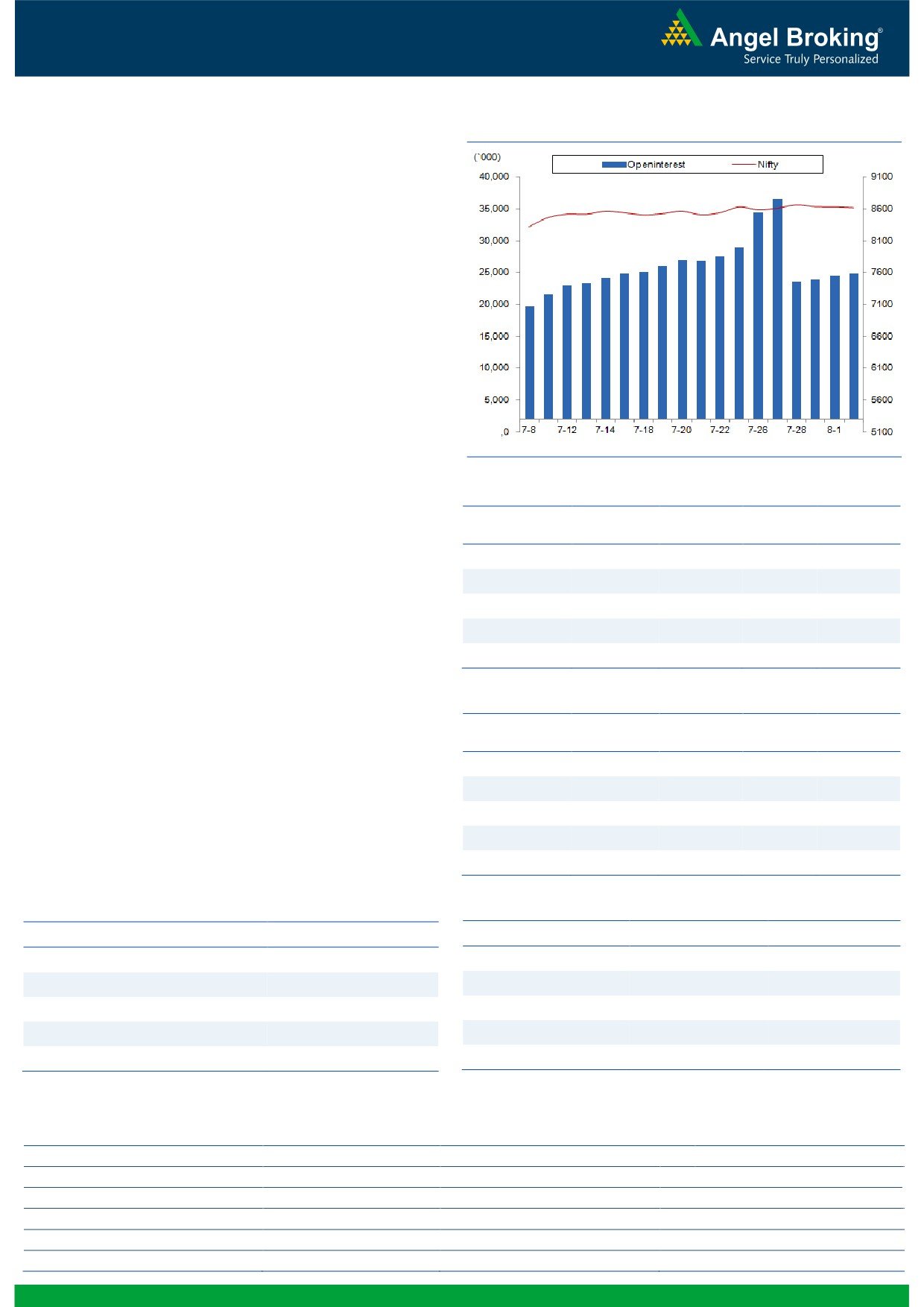

Nifty Vs OI

The Nifty futures open interest has increased by 1.45%

BankNifty futures open interest has increased by 1.11%

as market closed at 8622.90 levels.

The Nifty August future closed with a premium of 37.40

points against a premium of 45.45 points in previous

session. The September series closed at a premium of

86.45 points.

The Implied Volatility of at the money options has

increased from 14.34% to 14.68%.

The total OI of the market is Rs. 2,34,232/- cr. and the

stock futures OI is Rs. 70,668/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, SUNTV, JSWSTEEL,

HDFCBANK and GMRINFRA.

Views

OI Gainers

Yesterday, FIIs were net buyer in equity cash segment

OI

PRICE

worth Rs. 536 crores. While, their activity remained

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

subdued in index future segment with marginal rise in

HCLTECH

7886900

30.04

801.80

2.76

open interest, indicating blend of both long and short

BATAINDIA

2591600

27.77

580.65

-3.49

build-up.

TATACOMM

4177600

18.27

464.00

6.13

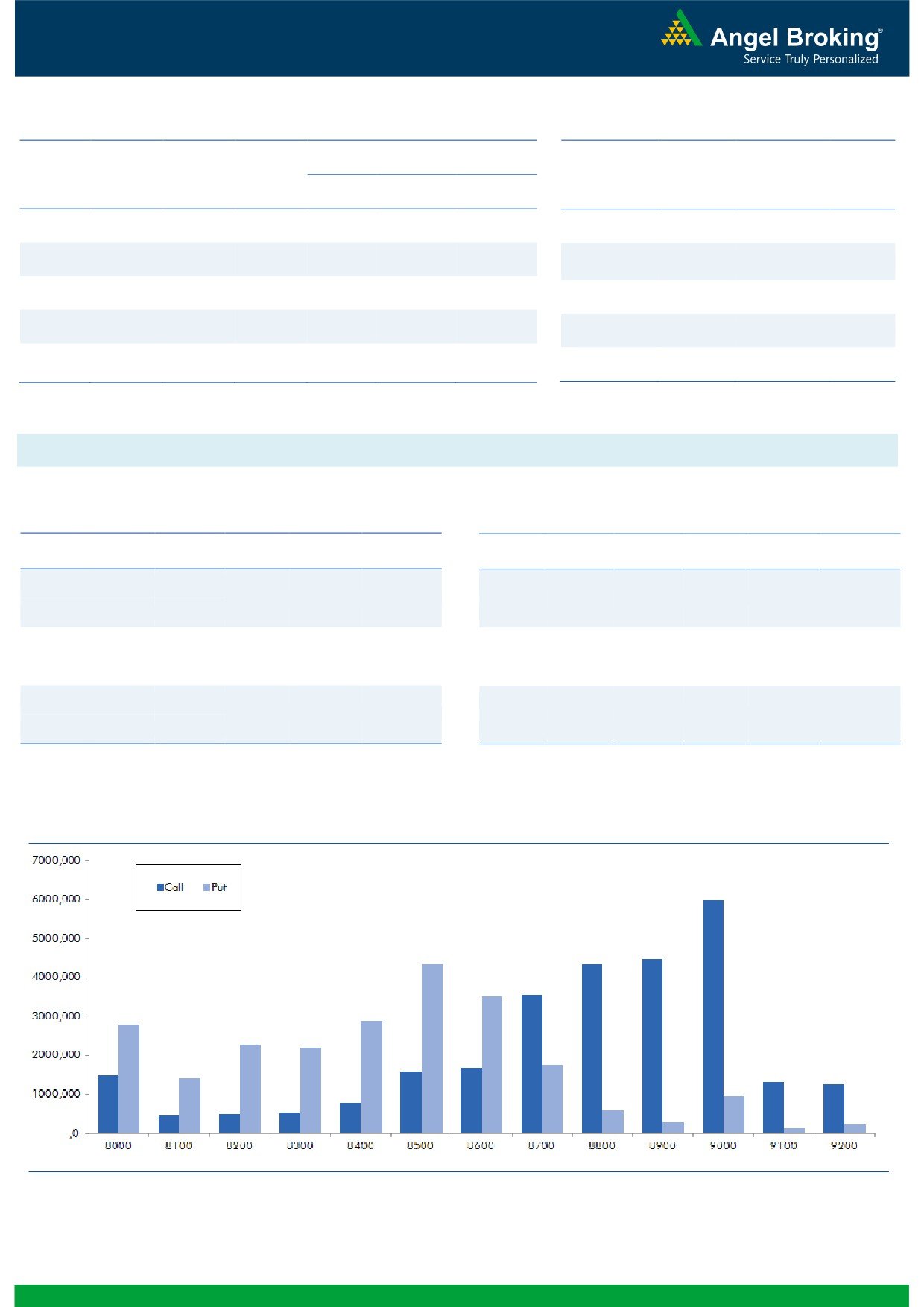

In Index Options segment, FIIs bought worth Rs. 520

crores with rise in OI. In call options, 8700-8900 strikes

BHARATFIN

7765000

18.19

828.05

-9.71

were active and added good amount of fresh positions.

ABIRLANUVO

2867250

15.01

1465.95

-1.01

On the other hand, we didn’t witness any major activity

in put options, except marginal OI addition in 8700 and

OI Losers

8600 strikes. Highest build-up in August series is placed

OI

PRICE

SCRIP

OI

PRICE

at 9000 call and 8500 put options.

CHG. (%)

CHG. (%)

Since, FIIs are continuously buying in both cash and

TORNTPHARM

260400

-18.73

1485.30

1.26

index future segment and yet there is no sign of reversal

TECHM

6986100

-7.20

502.15

2.11

seen on derivative data; we advise traders to trade with

ADANIENT

14328000

-6.67

78.10

-0.13

positive bias and use declines to initiate fresh positions.

JINDALSTEL

57420000

-6.44

84.00

-6.41

Support for Nifty is placed at 8500 - 8550 levels; while,

SRTRANSFIN

2490600

-6.32

1288.30

-1.21

resistance is at 8800 - 8850.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TATACOMM

38.76

NIFTY

0.91

0.88

BHARATFIN

68.96

BANKNIFTY

0.62

0.75

IDFC

50.64

ICICIBANK

0.37

0.34

SIEMENS

31.73

LT

0.54

0.51

ITC

30.60

INFY

0.29

0.23

Strategy Date

Symbol

Strategy

Status

01-08-2016

RELIANCE

Ratio Bear Put Spread

Active

2

Technical & Derivatives Report

August 03, 2016

FII Statistics for 02-August 2016

Turnover on 02-August 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1453.95

1450.09

3.87

299208

19751.14

1.88

184012

12565.78

-30.03

FUTURES

FUTURES

INDEX

INDEX

38846.72

38326.90

519.82

830821

54101.47

3.16

2561669

179178.45

-12.46

OPTIONS

OPTIONS

STOCK

5695.23

6536.30

(841.06)

814984

52819.22

2.48

STOCK

FUTURES

587064

41073.42

-6.73

FUTURES

STOCK

STOCK

3402.92

3474.33

(71.41)

48137

3192.85

16.45

OPTIONS

307197

21892.75

-12.37

OPTIONS

TOTAL

49398.83

49787.62

(388.79)

1993150

129864.67

2.97

TOTAL

3639942

254710.39

-12.67

Nifty Spot = 8622.90

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

107.20

Buy

8600

101.45

41.10

58.90

8741.10

33.25

66.75

8566.75

Sell

8800

66.10

Sell

8500

68.20

Buy

8700

107.20

Buy

8600

101.45

69.80

130.20

8769.80

56.20

143.80

8543.80

Sell

8900

37.40

Sell

8400

45.25

Buy

8800

66.10

Buy

8500

68.20

28.70

71.30

8828.70

22.95

77.05

8477.05

Sell

8900

37.40

Sell

8400

45.25

Note: Above mentioned Bullish or Bearish Spreads in Nifty (August Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 03, 2016

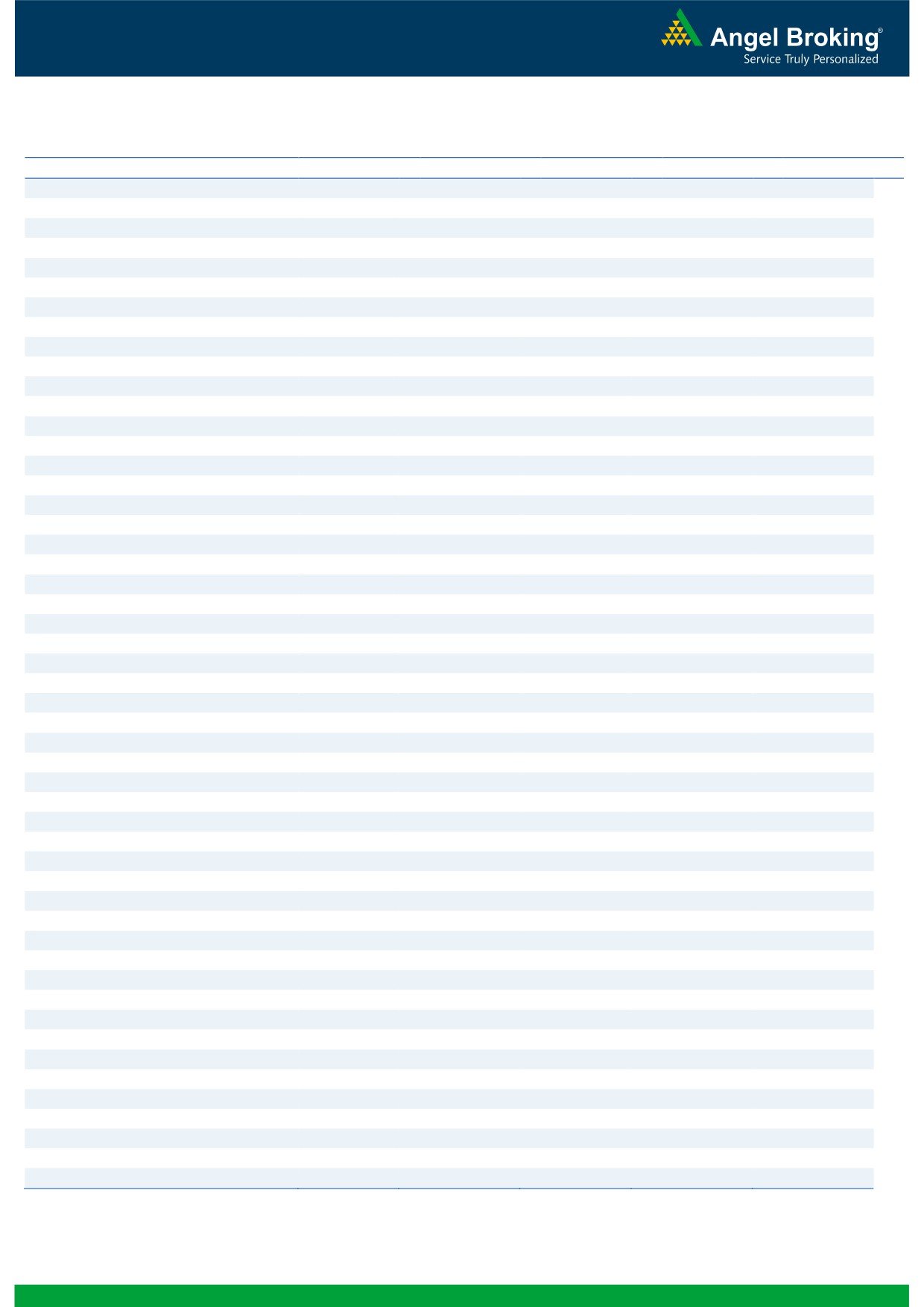

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,644

1,657

1,673

1,687

1,702

ADANIPORTS

219

222

227

230

235

AMBUJACEM

258

261

266

269

273

ASIANPAINT

1,104

1,114

1,128

1,138

1,152

AUROPHARMA

741

753

773

784

804

AXISBANK

542

546

551

554

559

BAJAJ-AUTO

2,697

2,723

2,751

2,776

2,805

BANKBARODA

144

148

150

154

156

BHEL

134

136

140

142

146

BPCL

563

571

585

594

608

BHARTIARTL

350

354

359

363

369

INFRATEL

374

381

394

400

413

BOSCH

23,931

24,192

24,596

24,857

25,260

CIPLA

508

513

521

527

535

COALINDIA

318

320

325

327

332

DRREDDY

2,946

2,962

2,980

2,996

3,014

EICHERMOT

21,315

21,581

22,065

22,331

22,815

GAIL

370

373

377

381

385

GRASIM

4,927

4,959

5,003

5,035

5,078

HCLTECH

772

786

796

810

819

HDFCBANK

1,231

1,237

1,247

1,253

1,263

HDFC

1,311

1,326

1,350

1,366

1,389

HEROMOTOCO

3,162

3,212

3,246

3,296

3,329

HINDALCO

132

134

136

138

140

HINDUNILVR

914

921

931

937

947

ICICIBANK

242

244

247

248

251

IDEA

101

102

104

105

107

INDUSINDBK

1,176

1,184

1,198

1,207

1,221

INFY

1,071

1,078

1,081

1,088

1,091

ITC

247

254

258

265

269

KOTAKBANK

745

752

758

765

771

LT

1,479

1,491

1,502

1,515

1,526

LUPIN

1,667

1,684

1,715

1,732

1,763

M&M

1,429

1,444

1,466

1,480

1,503

MARUTI

4,809

4,898

4,968

5,057

5,127

NTPC

157

158

160

161

162

ONGC

216

219

220

223

225

POWERGRID

174

177

178

181

183

RELIANCE

999

1,006

1,013

1,020

1,027

SBIN

225

227

229

230

232

SUNPHARMA

814

821

834

842

855

TCS

2,676

2,687

2,702

2,713

2,727

TATAMTRDVR

313

318

326

331

340

TATAMOTORS

479

486

499

506

519

TATAPOWER

71

71

72

72

73

TATASTEEL

354

358

364

368

375

TECHM

473

486

498

511

523

ULTRACEMCO

3,601

3,639

3,698

3,736

3,795

WIPRO

541

545

552

556

563

YESBANK

1,210

1,219

1,232

1,241

1,254

ZEEL

488

494

500

505

511

4

Technical & Derivatives Report

August 03, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5