Technical & Derivatives Report

May 03, 2016

Sensex (25437) / Nifty (7806)

Exhibit 1: Nifty Daily Chart

The opening session of the week began with a marginal downside

gap and corrected in the first half of the session. However, similar

to Friday's session, we witnessed a modest recovery in the latter

half to close the session tad above 7800.

If we closely observe yesterday's low, the Nifty manages to find a

support around the mentioned support zone of 7800 - 7750

which coincides with multiple technical evidences, namely, the

daily ’20 EMA’, ‘Parabolic SAR’ indicator and an ‘Upward Sloping

Trend Line’. We reiterate our view that as long as the Nifty

manages to hold these important supports, the possibility of it

surpassing the 8000 mark increases while the 7750 mark on the

downside should be seen as a trend deciding level in the near

term. A sustainable move below this level could possibly

accelerate the ongoing downward momentum. We suggest one

should now look for buying opportunities, invariably backing up

trades with strict stop losses, given that the Nifty has a strong

support at 7750.

Key Levels

Support 1 - 7750

Resistance 1 - 7860

Support 2 - 7700

Resistance 2 - 7910

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (16543)

In yesterday's trading session, the Nifty Bank index opened with a

gap down opening and traded in a narrow range throughout the

session before closing with losses of about 1.50%.

In our earlier reports, we have been mentioning about the

cautious signs in the Nifty Bank index as indicated by negative

crossover in RSI with its average post testing the overbought zone.

The index has thus shown marginal corrective move from the high

of 17029.85 registered on 26th April. However, the correction

has been led by few of the heavyweights such as ICICI Bank and

not due to broader market participation. The higher top higher

bottom formation is not yet negated and hence, the previous high

around 16280 is now a support for the index.Thus, we are not

expecting any sharp correction further in the index. In case the

index again moves higher without breaching the above

mentioned support, it could then lead to resumption of uptrend.

Traders are advised not create an short positions in the index. The

intraday support for the Nifty Bank index is placed around 16387

and 16280 whereas resistance are seen around 16841 and

17024.

Key Levels

Support 1 - 16387

Resistance 1 - 16841

Support 2 - 16280

Resistance 2 - 17024

1

Technical & Derivatives Report

May 03, 2016

Comments

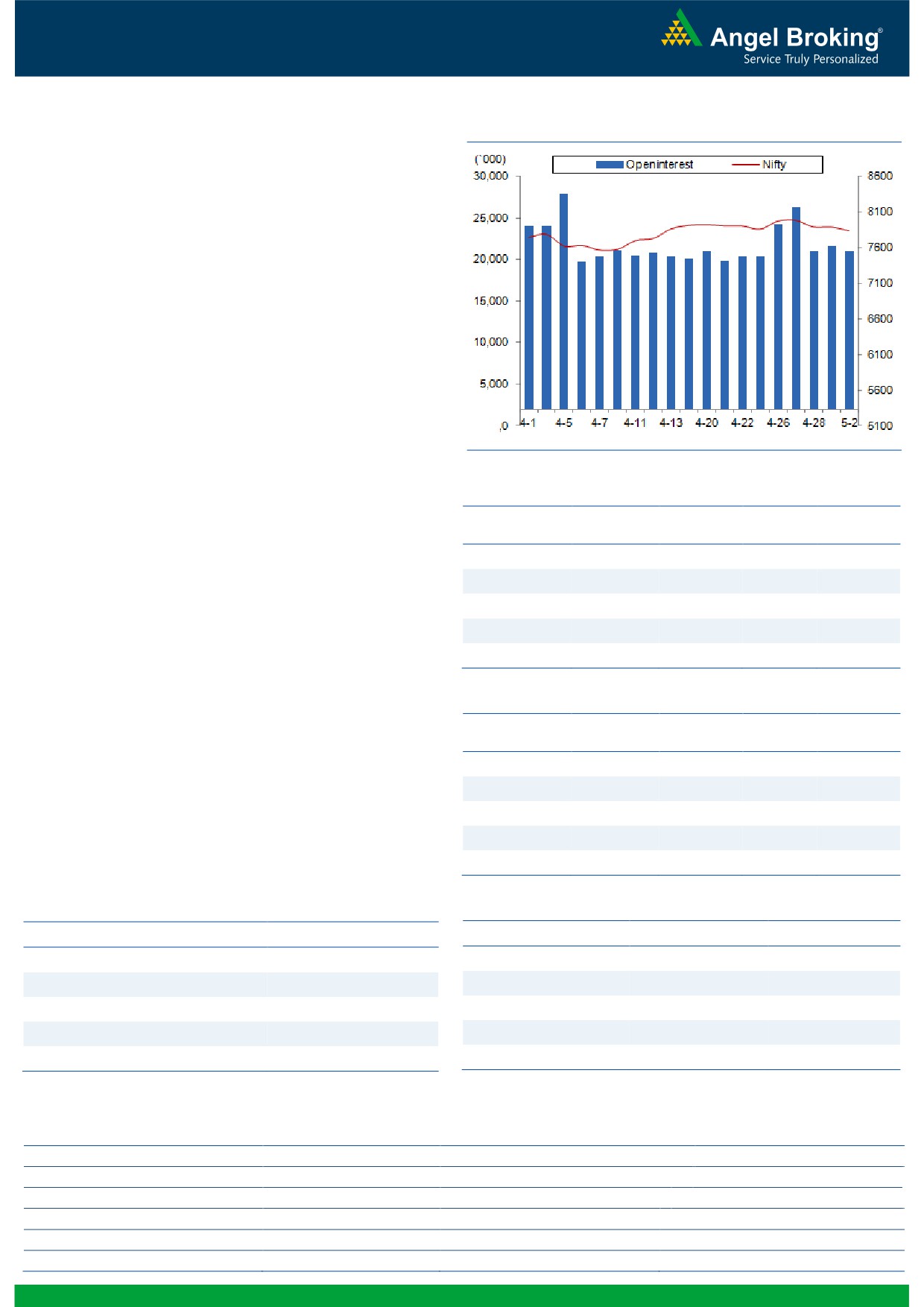

Nifty Vs OI

The Nifty futures open interest has decreased by 3.30%

BankNifty futures open interest has increased by 1.00%

as market closed at 7805.90 levels.

The Nifty May future closed at a premium of 34.20

points against a premium of 45.00 points. The June

series closed at a premium of 47.60 points.

The Implied Volatility of at the money options has

increased from 15.03% to 15.54%.

The total OI of the market is Rs. 1,87,274/- cr. and the

stock futures OI is Rs. 58,393/- cr.

Few of the liquid counters where we have seen high cost

of carry are UNITECH, NHPC, JISLJALEQS, KPIT and

HEROMOTOCO.

Views

FIIs were net buyers in cash market segment to the tune

OI Gainers

of Rs. 435 crores. While in Index Futures, they sold of Rs.

OI

PRICE

SCRIP

OI

PRICE

1340 crores with fall in OI, which suggests long

CHG. (%)

CHG. (%)

UPL

7856000

22.58

594.90

10.62

unwinding in last trading session.

SRTRANSFIN

2703000

17.23

1083.00

14.98

In Index Options front, FIIs sold marginally with decent

NCC

11704000

12.89

80.15

2.74

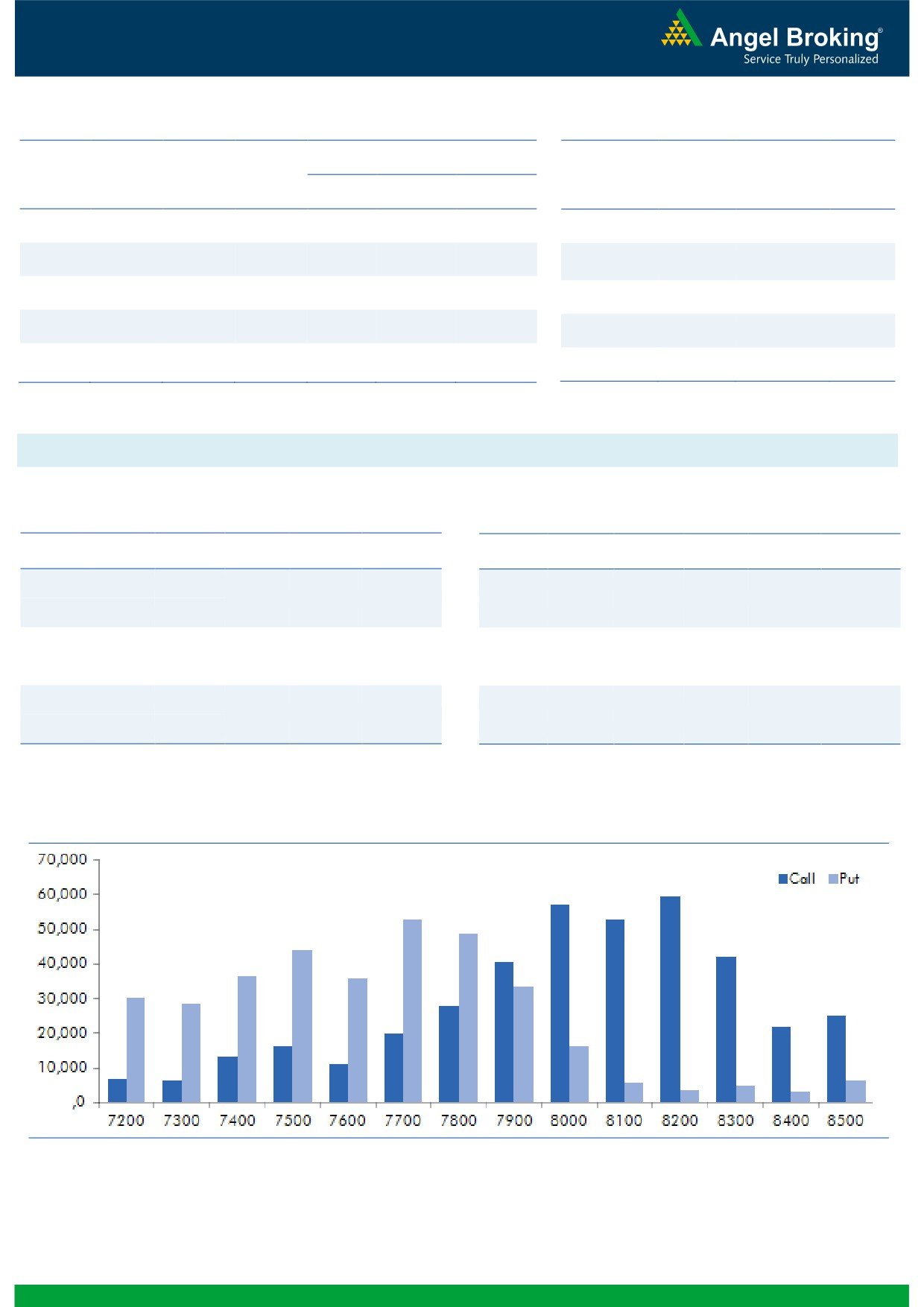

rise in OI. In call options, 8000 strikes added good

BANKINDIA

21171000

9.97

90.10

-2.54

amount of open interest. While in put options, the overall

IBREALEST

28980000

9.67

67.50

0.00

activity was subdued. Maximum OI in May series is

visible in 8200 call and 7700 put options. From last two

trading session, we are witnessing long unwinding and

OI Losers

some short formation in Index Futures. We would suggest

OI

PRICE

SCRIP

OI

PRICE

trader to be light in this market till we see any

CHG. (%)

CHG. (%)

M&M

3255200

-3.90

1336.55

0.16

meaningful change in data. Large cap counters that

added higest OI are HEROMOTOCO, VEDL, DRREDDY,

ARVIND

3806300

-3.41

286.85

3.20

HCLTECH and PNB.

INFRATEL

3993600

-3.24

375.65

0.28

BPCL

4986000

-3.12

969.55

-0.63

TCS

3921800

-3.02

2526.70

-0.28

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

SRTRANSFIN

74.09

NIFTY

0.90

0.84

UPL

61.81

BANKNIFTY

0.83

0.84

DABUR

43.96

SBIN

0.55

0.47

L&TFH

48.70

ICICIBANK

0.48

0.64

GODREJCP

37.67

RELIANCE

0.40

0.38

Strategy Date

Symbol

Strategy

Status

02-05-2016

NIFTY

Long Strangle

Active

2

Technical & Derivatives Report

May 03, 2016

FII Statistics for 02-May 2016

Turnover on 02-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

864.35

2204.68

(1340.33)

287048

16503.43

(2.90)

262833

14497.98

-31.76

FUTURES

FUTURES

INDEX

INDEX

16241.72

16336.58

(94.86)

803281

46690.95

3.75

1938968

113173.02

-27.04

OPTIONS

OPTIONS

STOCK

3866.24

4276.09

(409.86)

955068

46253.74

0.73

STOCK

FUTURES

510197

26084.49

-18.35

FUTURES

STOCK

STOCK

1822.98

1816.97

6.01

29547

1479.29

28.45

OPTIONS

243753

12513.09

-20.85

OPTIONS

TOTAL

22795.29

24634.32

(1839.03)

2074944

110927.40

1.66

TOTAL

2955751

166268.57

-25.81

Nifty Spot = 7805.90

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7800

145.70

Buy

7800

107.00

50.95

49.05

7850.95

34.15

65.85

7765.85

Sell

7900

94.75

Sell

7700

72.85

Buy

7800

145.70

Buy

7800

107.00

88.00

112.00

7888.00

57.90

142.10

7742.10

Sell

8000

57.70

Sell

7600

49.10

Buy

7900

94.75

Buy

7700

72.85

37.05

62.95

7937.05

23.75

76.25

7676.25

Sell

8000

57.70

Sell

7600

49.10

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

May 03, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,397

1,409

1,428

1,439

1,458

ADANIPORTS

229

231

234

236

239

AMBUJACEM

217

220

222

226

228

ASIANPAINT

857

861

864

868

871

AUROPHARMA

756

763

768

776

781

AXISBANK

463

467

473

478

484

BAJAJ-AUTO

2,409

2,444

2,484

2,519

2,559

BANKBARODA

153

154

156

158

160

BHEL

121

125

127

130

132

BPCL

953

961

974

983

995

BHARTIARTL

351

355

360

363

368

INFRATEL

368

372

375

379

382

BOSCH

19,302

19,453

19,651

19,803

20,001

CIPLA

530

536

540

545

550

COALINDIA

286

287

288

290

290

DRREDDY

2,957

2,984

3,033

3,060

3,109

EICHERMOT

19,598

19,726

19,928

20,056

20,258

GAIL

351

360

365

373

378

GRASIM

4,024

4,047

4,074

4,097

4,124

HCLTECH

730

736

746

752

762

HDFCBANK

1,107

1,112

1,121

1,126

1,135

HDFC

1,071

1,081

1,089

1,100

1,108

HEROMOTOCO

2,863

2,884

2,907

2,928

2,951

HINDALCO

92

95

98

101

104

HINDUNILVR

850

857

862

869

874

ICICIBANK

222

225

228

230

233

IDEA

114

116

118

120

121

INDUSINDBK

1,032

1,039

1,047

1,053

1,061

INFY

1,188

1,194

1,203

1,209

1,218

ITC

317

319

322

324

326

KOTAKBANK

706

712

718

725

731

LT

1,228

1,239

1,248

1,259

1,268

LUPIN

1,593

1,606

1,616

1,629

1,640

M&M

1,300

1,318

1,332

1,350

1,363

MARUTI

3,719

3,775

3,807

3,863

3,896

NTPC

132

135

138

141

143

ONGC

213

216

218

220

223

POWERGRID

140

142

143

144

145

RELIANCE

971

979

986

994

1,000

SBIN

184

185

187

188

190

SUNPHARMA

799

805

811

817

822

TCS

2,489

2,508

2,519

2,538

2,549

TATAMTRDVR

289

292

295

298

301

TATAMOTORS

399

403

407

411

415

TATAPOWER

69

69

70

71

72

TATASTEEL

341

344

347

351

354

TECHM

470

474

479

483

489

ULTRACEMCO

3,110

3,143

3,170

3,203

3,230

WIPRO

541

545

549

553

557

YESBANK

932

938

948

955

964

ZEEL

409

413

415

419

421

4

Technical & Derivatives Report

May 03, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5