Technical & Derivatives Report

December 02, 2016

Sensex (26560) / Nifty (8193)

Exhibit 1: Nifty Daily Chart

Yesterday, our markets opened higher on the back of positive

cues from the Asian bourses. However, we saw strong selling

pressure at higher levels which dragged the index lower to close

tad below the 8200 mark with a cut of 0.38% over its previous

close.

Yesterday’s correction, though it has come due to a strong

resistance of daily ‘20 EMA’; but it was certainly not expected for

us. We were expecting a follow-up rally in the banking

conglomerates, but the entire space disappointed us after a very

good start. This was probably because of the weekly expiry factor

in ‘Bank Nifty’. But now, despite yesterday’s corrective move, we

are still convinced on the further move towards 8250 - 8320.

Technically speaking, the index is trading in the vicinity of ‘200

SMA’ as well as ’89 EMA’ on the hourly chart. Hence, 8170 -

8130 would be seen as a strong support zone. In addition, the

‘RSI-Smoothened’ on daily chart has turned northwards from the

oversold territory with a positive crossover; indicating strength in

prices. Hence, traders are still advised to stay away from going

short and focus more on individual stocks which are likely to give

a decent bounce in forthcoming sessions.

Key Levels

Support 1 - 8170

Resistance 1 - 8250

Support 2 - 8130

Resistance 2 - 8320

Nifty Bank Outlook - (18428)

Exhibit 2: Nifty Bank Daily Chart

As mentioned above, the Nifty Bank index unexpectedly corrected

in yesterday's session and ended the day with loss of

1.07

percent.

Although the bears seemed to be active in the banking stocks

yesterday, we advise traders to refrain from creating short

positions in the index. If we analyze the trading activity in last few

sessions, the index, post a consolidation has managed to close

firmly above the resistance of '20 DEMA' after 11 trading sessions.

This, coupled with the positive crossover of momentum readings

on lower time frame charts indicates limited downside which

should lead to a pullback move in near term. Traders are also

advised to trade with proper risk management. The intraday

supports for the index are placed around 18300 and 18160

whereas resistances are seen around 18650 and 18845.

Key Levels

Support 1 - 18300

Resistance 1 - 18650

Support 2 - 18160

Resistance 2 - 18845

1

Technical & Derivatives Report

December 02, 2016

Comments

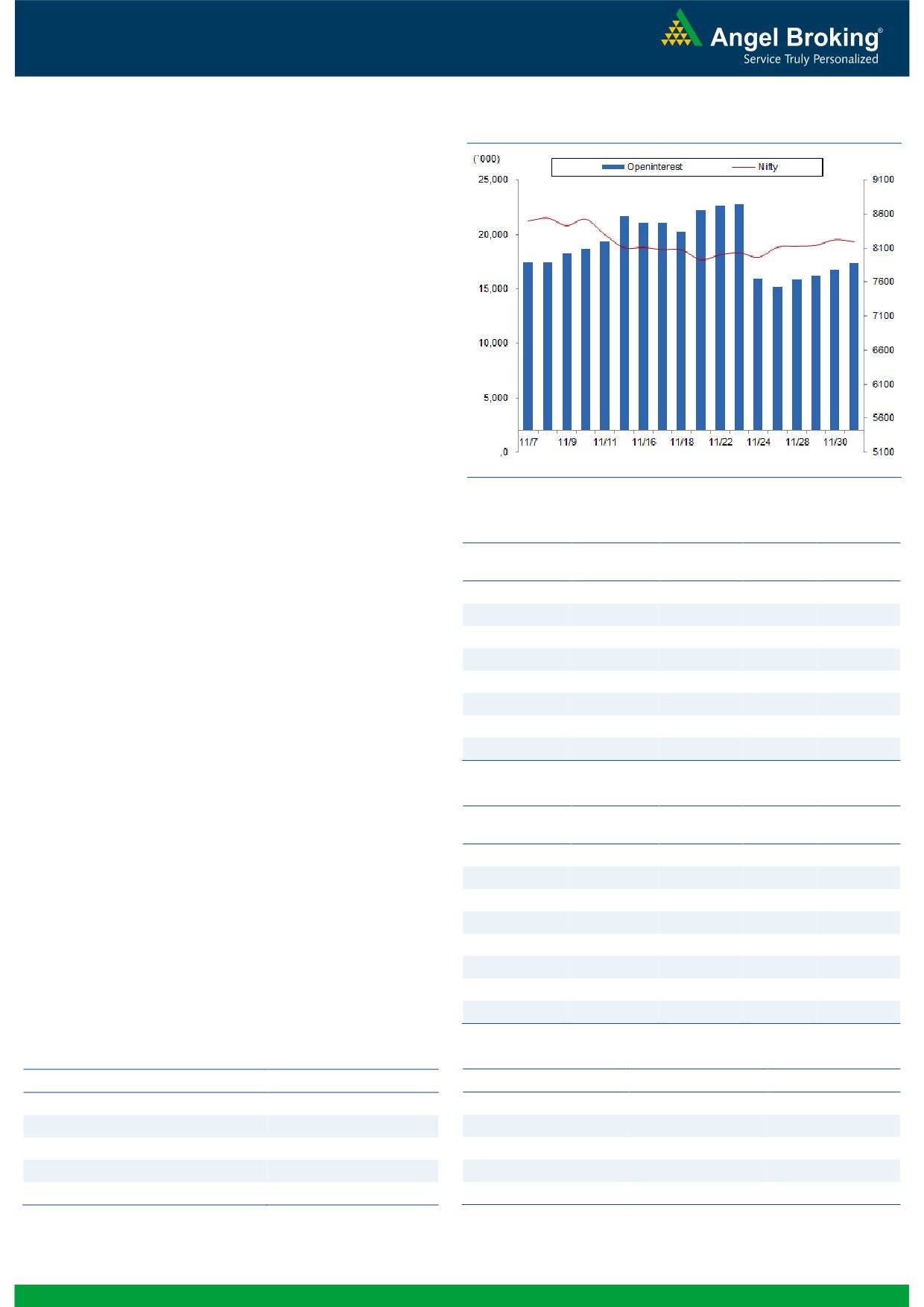

Nifty Vs OI

The Nifty futures open interest has increased by 6.99%

BankNifty futures open interest has decreased by 7.69%

as market closed at 8192.90 levels.

The Nifty December future closed with a premium of

19.10 against the premium of 35.85 points in last

trading session. The January series closed at a premium

of 54.40 points.

The Implied Volatility of at the money options has

increased from 13.91% to 14.41%. At the same time, the

PCR-OI of Nifty has increased from 1.05 to 1.06 levels.

The total OI of the market is Rs. 2,46,710/- cr. and the

stock futures OI is Rs. 66,621/- cr.

Few of the liquid counters where we have seen high cost

of carry are RPOWER, TATAELXSI, DCBBANK, ADANIENT

and IBREALEST.

OI Gainers

Views

OI

PRICE

SCRIP

OI

PRICE

Yesterday also, FIIs remained net seller in cash market

CHG. (%)

CHG. (%)

segment. They sold equities worth Rs. 403 crores. While,

IDFCBANK

51424000

77.23

67.85

-0.88

in index futures, they were net buyers worth Rs.

708

ULTRACEMCO

2530200

57.61

3560.25

-0.78

crores with rise in open interest, indicating fresh long

BPCL

14985600

30.79

628.70

-2.18

www.angelbroking.com

formation in previous trading session.

TORNTPHARM

279600

26.63

1394.00

0.60

In Index options segment, FIIs were net buyers of Rs. 724

HINDPETRO

23169300

23.98

448.50

-4.25

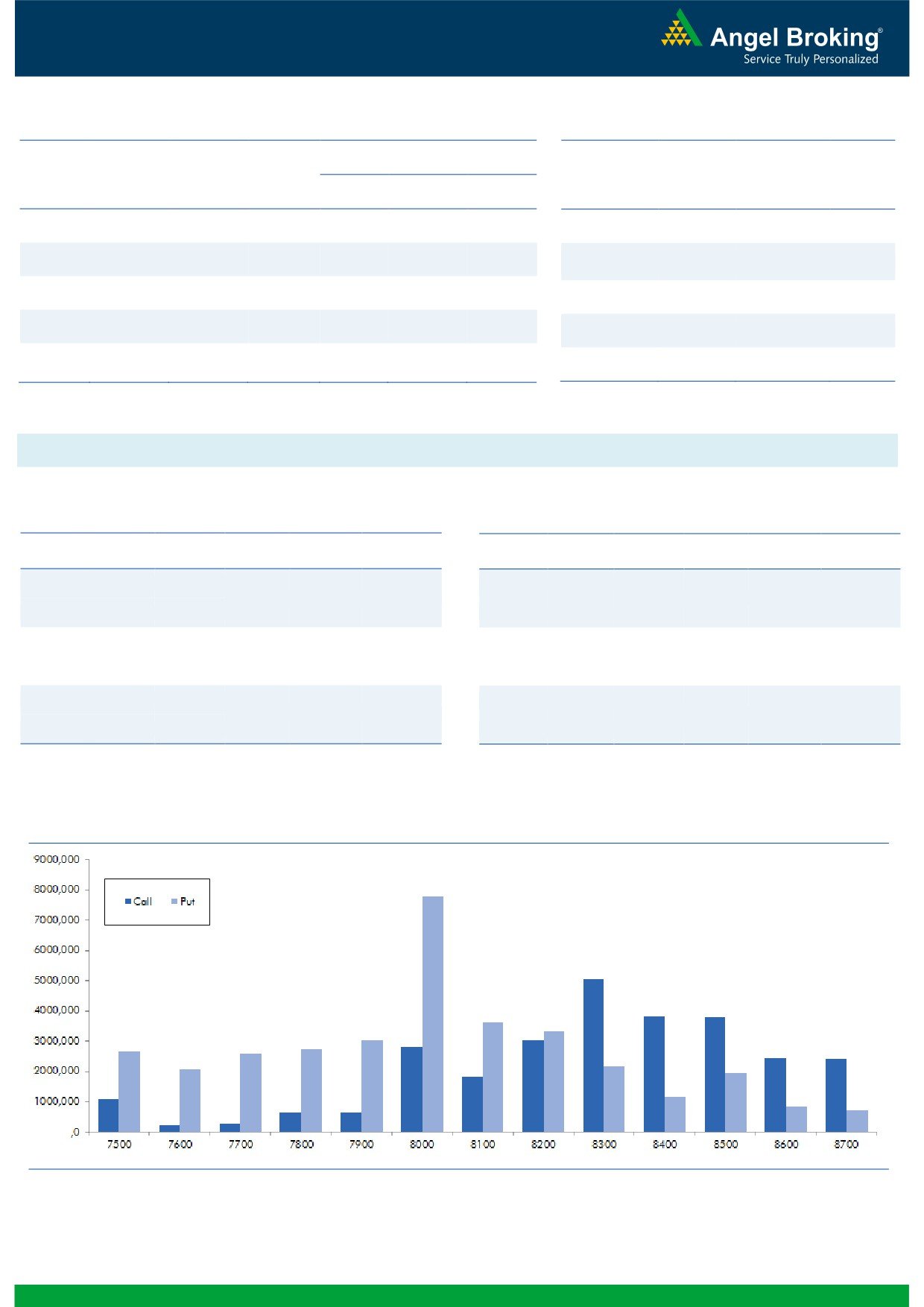

crores with some rise in open interest. In call options,

APOLLOHOSP

556800

21.78

1211.55

0.86

8300 strike was quite active and added decent amount

OIL

1358300

20.15

430.20

1.97

of positions; followed by some unwinding in 8200 strike.

IGL

1481700

17.95

839.90

0.75

While in put options, OI addition was seen in 8000 -

8200 strikes. Highest OI in current series is visible in

OI Losers

8300 call and 8000 put option.

OI

PRICE

SCRIP

OI

PRICE

FIIs continued their buying streak in both Index Futures

CHG. (%)

CHG. (%)

and Stock Futures segment for third consecutive session.

MARUTI

2496300

-18.20

5255.85

-0.42

However, they continued to sell in cash segment.

PETRONET

3889500

-9.24

382.05

-1.77

Considering above data, we believe that the Nifty may

GODREJCP

434800

-9.19

1497.75

2.49

continue to show strength towards its near term

ICICIBANK

57247500

-9.13

260.55

-2.09

resistance of 8300 - 8350 in upcoming sessions. Thus,

DHFL

14499000

-9.07

249.10

-3.07

traders are advised to trade with a positive bias with

GODREJIND

1267500

-7.45

382.40

-1.89

proper exit strategy.

HDIL

23592000

-7.41

61.40

-1.37

AMARAJABAT

553200

-6.11

947.35

0.37

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

IDEA

53.51

NIFTY

1.06

0.95

HINDPETRO

45.70

BANKNIFTY

0.76

0.85

POWERGRID

36.82

SBIN

0.58

0.49

RCOM

61.23

RELIANCE

0.54

0.42

BPCL

26.59

MARUTI

1.09

0.80

2

Technical & Derivatives Report

December 02, 2016

FII Statistics for December 01, 2016

Turnover on December 01, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1619.35

911.79

707.57

180599

11432.86

5.51

197248

13277.23

-22.12

FUTURES

FUTURES

INDEX

INDEX

36427.53

35703.07

724.46

949788

59284.45

1.61

5896963

424685.26

43.15

OPTIONS

OPTIONS

STOCK

6470.45

6166.85

303.59

848194

51848.95

0.43

STOCK

FUTURES

476718

31349.55

-9.10

FUTURES

STOCK

STOCK

2942.76

2889.26

53.50

55199

3569.18

10.96

OPTIONS

252533

16905.41

8.56

OPTIONS

TOTAL

47460.09

45670.97

1789.12

2033780

126135.45

1.68

TOTAL

6823462

486217.45

33.66

Nifty Spot = 8192.90

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8300

85.10

Buy

8100

96.00

36.75

63.25

8336.75

25.00

75.00

8075.00

Sell

8400

48.35

Sell

8000

71.00

Buy

8300

85.10

Buy

8100

96.00

60.30

139.70

8360.30

44.55

155.45

8055.45

Sell

8500

24.80

Sell

7900

51.45

Buy

8400

48.35

Buy

8000

71.00

23.55

76.45

8423.55

19.55

80.45

7980.45

Sell

8500

24.80

Sell

7900

51.45

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 02, 2016

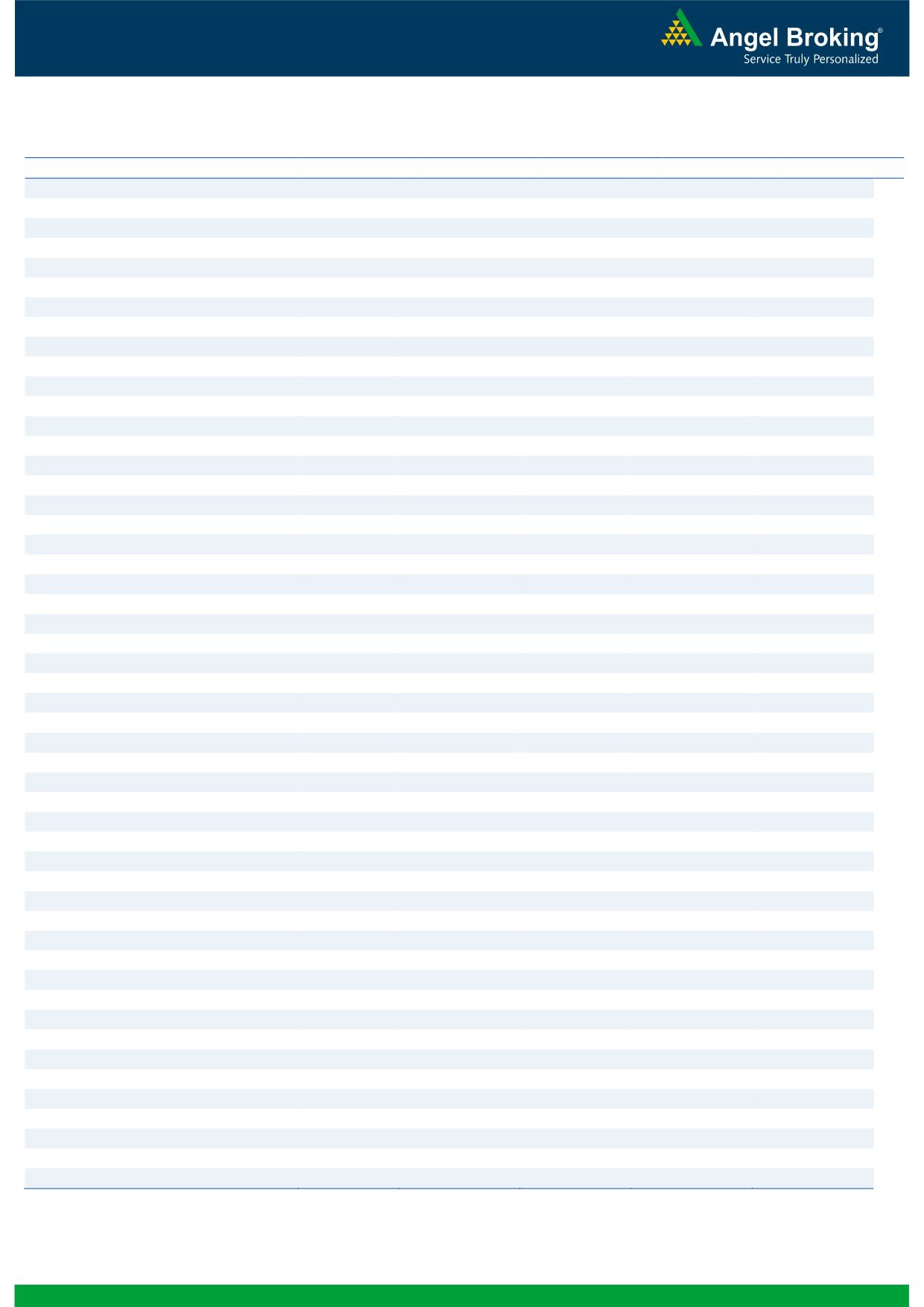

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1 312

1 325

1 340

1 353

1 368

ADANIPORTS

267

271

276

280

284

AMBUJACEM

202

204

209

211

215

ASIANPAINT

916

927

948

959

980

AUROPHARMA

728

735

746

754

765

AXISBANK

458

462

468

472

478

BAJAJ-AUTO

2 643

2 669

2 693

2 719

2 744

BANKBARODA

158

160

163

165

168

BHEL

126

128

129

131

132

BPCL

608

618

629

640

651

BHARTIARTL

308

313

319

324

330

INFRATEL

362

375

385

397

407

BOSCH

20 001

20 192

20 371

20 562

20 741

CIPLA

558

563

571

577

585

COALINDIA

302

304

307

309

312

DRREDDY

3 176

3 207

3 227

3 259

3 279

EICHERMOT

21 267

21 734

22 089

22 557

22 912

GAIL

418

429

437

448

456

GRASIM

852

862

873

883

893

HCLTECH

786

795

801

809

815

HDFCBANK

1 184

1 191

1 199

1 206

1 214

HDFC

1 245

1 258

1 272

1 284

1 298

HEROMOTOCO

3 102

3 146

3 189

3 233

3 276

HINDALCO

165

168

173

176

181

HINDUNILVR

833

841

848

856

863

ICICIBANK

251

255

262

266

272

IDEA

69

71

74

76

79

INDUSINDBK

1 063

1 072

1 080

1 089

1 098

INFY

959

967

975

984

992

ITC

229

231

233

235

237

KOTAKBANK

732

739

748

754

763

LT

1 358

1 373

1 388

1 403

1 418

LUPIN

1 478

1 495

1 517

1 534

1 556

M&M

1 133

1 147

1 170

1 184

1 207

MARUTI

5 151

5 202

5 255

5 305

5 358

NTPC

159

160

163

164

166

ONGC

286

289

294

297

302

POWERGRID

178

181

187

190

196

RELIANCE

983

990

1 003

1 010

1 023

SBIN

251

253

257

260

263

SUNPHARMA

700

711

718

728

735

TCS

2 233

2 248

2 269

2 284

2 305

TATAMTRDVR

286

289

294

298

303

TATAMOTORS

440

444

451

455

462

TATAPOWER

71

72

73

74

76

TATASTEEL

401

405

412

416

423

TECHM

463

469

477

483

491

ULTRACEMCO

3 525

3 548

3 584

3 607

3 644

WIPRO

461

465

468

471

475

YESBANK

1 140

1 150

1 168

1 178

1 195

ZEEL

450

454

459

463

467

4

Technical & Derivatives Report

December 02, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5