Technical & Derivatives Report

September 02, 2016

Sensex (28423) / Nifty (8775)

Exhibit 1: Nifty Monthly Chart

Yesterday's session opened on a flat note in-line with mixed

global cues. Subsequently, the index extended its previous

session's optimism to surpass the 8800 mark. However, we

witnessed some selling pressure at higher levels. As a result, the

index corrected below 8800 and then consolidated for the

remaining part of the day.

Yesterday, we saw some hints of profit booking as the cautious

traders chose to take some money off the table after entering our

mentioned resistance zone of 8800 - 8850 levels. However, still

there is no sign of trend reversal on the chart. We would maintain

our view that traders should to keep booking profits in the

mentioned zone. Now, we expect some consolidation in the

market; but, meanwhile, stock specific moves are likely to

continue and hence traders should keep following stock specific

approach with proper exit strategy. The intraday support for the

Nifty are placed around 8750 and 8696.

Key Levels

Support 1 - 8750

Resistance 1 - 8800

Support 2 - 8696

Resistance 2 - 8850

Nifty Bank Outlook - (19789)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index opened yesterday's session on a flat note

and rallied higher till noon. In the course of action, the index

tested the range of 19900 - 20000 which we had mentioned in

our last couple of day's outlook. The index ended on a flat note

and formed a 'Doji' candle on daily charts.

Going ahead, we are expecting stock specific momentum to

continue and hence, traders are advised to follow stock centric

approach with proper risk management. The individual

heavyweights could continue with the positive momentum and

since there are no signs of reversal, traders should refrain from

creating short positions. The intraday support for the index are

placed around 19664 and 19620 whereas resistance is seen in

range of 19900 - 20000.

Key Levels

Support 1 - 19664

Resistance 1 - 19900

Support 2 - 19620

Resistance 2 - 20000

1

Technical & Derivatives Report

September 02, 2016

Comments

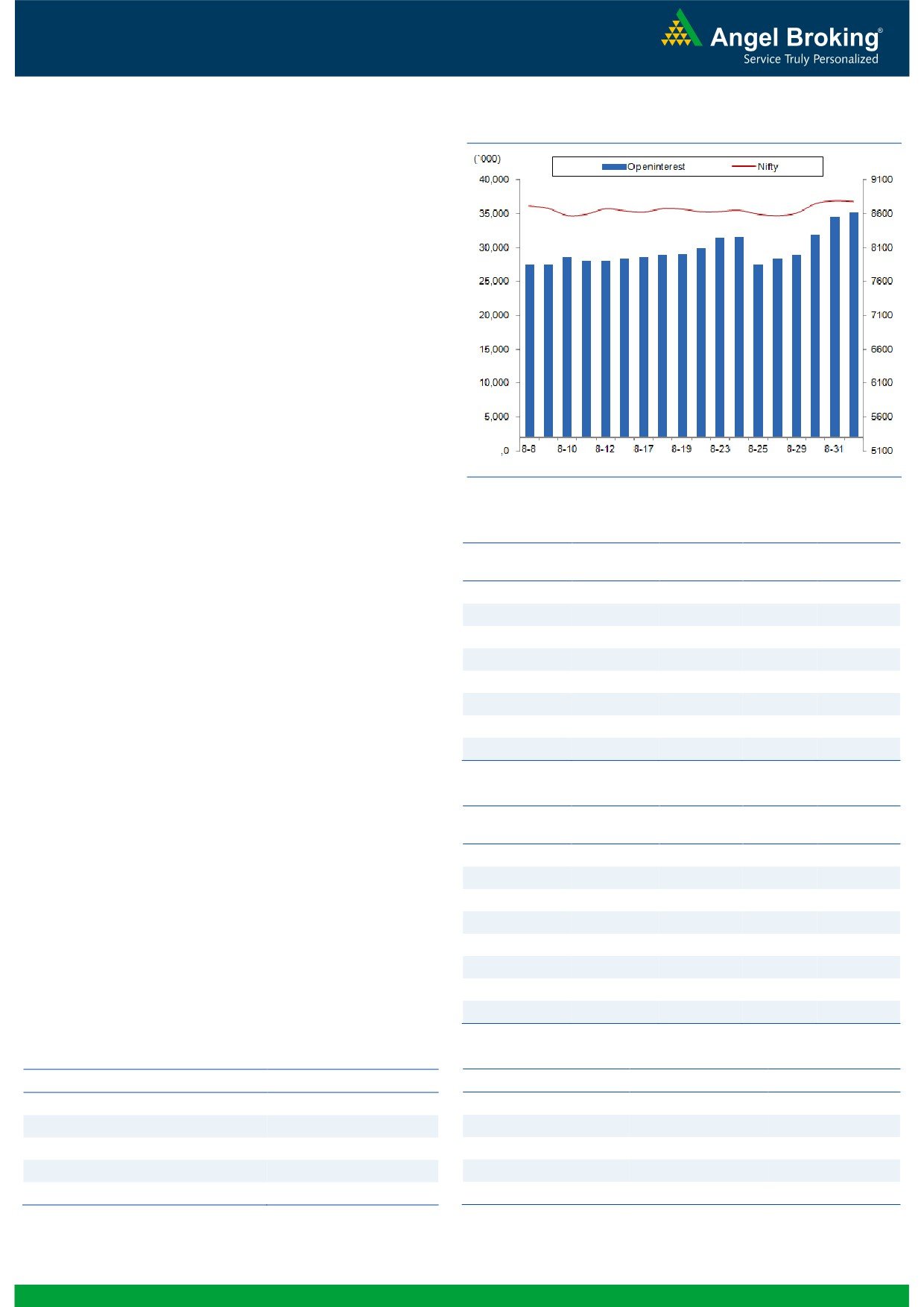

Nifty Vs OI

The Nifty futures open interest has increased by 1.87%

BankNifty futures open interest has increased by 2.88%

as market closed at 8774.65 levels.

The Nifty September future closed with a premium of

33.70 points against a premium of 49.95 points in

previous session. The October series closed at a

premium of 73.85 points.

The Implied Volatility of at the money options has

decreased from 11.55% to 11.47%. At the same time,

the PCR-OI of Nifty has increased from 1.09 to 1.11.

The total OI of the market is Rs. 2,89,641/- cr. and the

stock futures OI is Rs. 82,401/- cr.

Few of the liquid counters where we have seen high cost

of carry are INDIACEM, CESC, ICIL, CEATLTD and

TATAELXSI.

Views

OI Gainers

OI

PRICE

Yesterday, FIIs were net seller in equity cash segment

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

worth Rs. 302 crores. This sell number can be mainly due

IDEA

57825000

24.57

83.00

-11.18

to huge delivery based selling seen in telecom

BHARTIARTL

31810500

19.23

310.35

-6.98

companies. On the other hand, they bought Index

IBREALEST

46360000

15.41

79.10

-4.41

Futures to the tune of Rs. 364 crores with.riseeinrOI,ng.com

ULTRACEMCO

951400

15.35

4078.25

0.68

indicating formation of long positions in last trading

ENGINERSIN

5981500

14.31

269.45

2.94

session.

RELIANCE

23680000

11.75

1036.30

-2.54

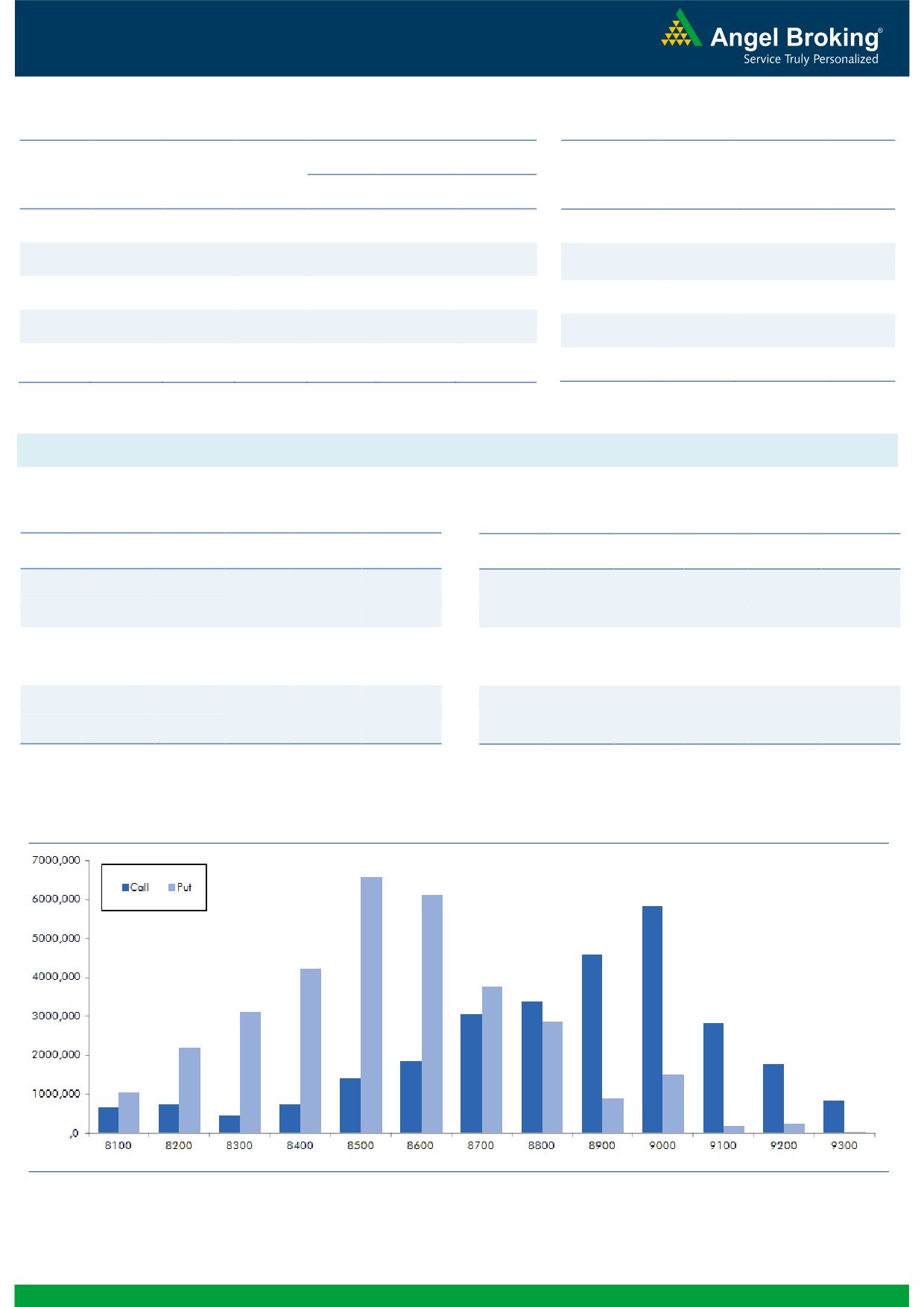

On Index Options front, FIIs were net buyers of Rs. 806

RCOM

139170000

9.65

49.35

-9.28

crores with good amount of rise in OI. In call options,

INDIACEM

24052000

9.22

152.65

1.09

8900 was active and added fresh positions. While in put

options, except some unwinding in 8400 strike, we didn’t

witness any meaningful activity in any strikes. Highest OI

OI Losers

OI

PRICE

in September series is visible in 9000 call and 8500 put

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

options.

NCC

28200000

-7.84

86.20

0.76

FIIs continued their buying streak in index future segment

FEDERALBNK

32241000

-7.71

69.90

1.23

for fifth consecutive session. They also bought call

SRF

299500

-5.52

1713.30

-0.59

options in last few sessions. At current juncture, there is

PFC

26394000

-5.48

122.30

-1.53

no sign of weakness in market as per derivative data.

APOLLOTYRE

9855000

-5.30

186.75

1.58

Thus, intraday dips are buying opportunities in Nifty as

HAVELLS

3094000

-5.27

424.60

0.90

we may see 8950-9000 in near term. Hence, traders are

SYNDIBANK

13176000

-5.18

74.20

-4.26

advised to trade with positive bias.

M&M

6713000

-4.85

1460.50

0.92

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

IDEA

70.40

NIFTY

1.11

1.19

BHARTIARTL

43.76

BANKNIFTY

1.28

0.94

RCOM

60.35

RELIANCE

0.45

0.55

RPOWER

30.15

SBIN

0.79

0.67

KSCL

39.31

TATAMOTORS

1.17

0.89

2

Technical & Derivatives Report

September 02, 2016

FII Statistics for 01, September 2016

Turnover on 01, September 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2042.38

1678.68

363.70

441567

29683.45

4.07

194664

13972.89

-25.01

FUTURES

FUTURES

INDEX

INDEX

43716.68

42910.76

805.92

1021953

68520.40

4.58

5287812

402277.44

35.57

OPTIONS

OPTIONS

STOCK

6595.38

7000.48

(405.10)

870715

57872.13

0.90

STOCK

FUTURES

624470

41988.59

-14.04

FUTURES

STOCK

STOCK

5115.60

5098.01

17.59

74851

5097.75

11.56

OPTIONS

379718

24920.90

6.41

OPTIONS

TOTAL

57470.04

56687.94

782.11

2409086

161173.74

3.33

TOTAL

6486664

483159.82

24.64

Nifty Spot = 8774.65

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8900

69.00

Buy

8700

73.95

30.65

69.35

8930.65

24.60

75.40

8675.40

Sell

9000

38.35

Sell

8600

49.35

Buy

8900

69.00

Buy

8700

73.95

49.50

150.50

8949.50

40.80

159.20

8659.20

Sell

9100

19.50

Sell

8500

33.15

Buy

9000

38.35

Buy

8600

49.35

18.85

81.15

9018.85

16.20

83.80

8583.80

Sell

9100

19.50

Sell

8500

33.15

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

September 02, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,654

1,671

1,685

1,702

1,716

ADANIPORTS

254

256

260

262

266

AMBUJACEM

270

273

276

280

283

ASIANPAINT

1,132

1,145

1,154

1,167

1,176

AUROPHARMA

756

765

779

787

801

AXISBANK

586

591

597

602

608

BAJAJ-AUTO

2,928

2,963

2,991

3,026

3,054

BANKBARODA

158

160

162

163

166

BHEL

131

133

137

139

142

BPCL

569

578

592

601

616

BHARTIARTL

284

297

315

328

346

INFRATEL

332

338

348

353

363

BOSCH

23,562

23,840

24,235

24,513

24,908

CIPLA

567

573

577

583

587

COALINDIA

330

334

337

340

343

DRREDDY

3,048

3,073

3,091

3,116

3,134

EICHERMOT

22,525

22,650

22,800

22,924

23,075

GAIL

378

385

390

397

402

GRASIM

4,493

4,549

4,636

4,692

4,779

HCLTECH

774

779

784

789

795

HDFCBANK

1,268

1,276

1,283

1,291

1,298

HDFC

1,395

1,410

1,420

1,435

1,445

HEROMOTOCO

3,488

3,518

3,556

3,586

3,625

HINDALCO

154

156

158

160

162

HINDUNILVR

907

916

923

932

939

ICICIBANK

256

258

261

264

266

IDEA

76

80

87

91

97

INDUSINDBK

1,171

1,178

1,187

1,194

1,203

INFY

1,028

1,033

1,037

1,041

1,045

ITC

257

259

261

263

265

KOTAKBANK

802

806

812

816

822

LT

1,493

1,500

1,509

1,516

1,524

LUPIN

1,468

1,485

1,498

1,515

1,528

M&M

1,425

1,439

1,452

1,466

1,479

MARUTI

4,979

5,020

5,060

5,101

5,141

NTPC

156

158

159

160

162

ONGC

233

235

237

239

241

POWERGRID

181

183

184

185

187

RELIANCE

996

1,012

1,043

1,059

1,090

SBIN

249

250

253

254

256

SUNPHARMA

760

765

772

777

784

TCS

2,462

2,485

2,510

2,533

2,558

TATAMTRDVR

339

342

345

347

350

TATAMOTORS

537

540

543

547

550

TATAPOWER

76

77

79

80

82

TATASTEEL

366

370

374

378

382

TECHM

461

465

471

475

481

ULTRACEMCO

3,906

3,984

4,039

4,117

4,172

WIPRO

477

480

485

489

493

YESBANK

1,351

1,358

1,367

1,374

1,384

ZEEL

526

531

538

542

549

4

Technical & Derivatives Report

September 02, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5