Technical & Derivatives Report

August 02, 2016

Sensex (28003) / Nifty (8637)

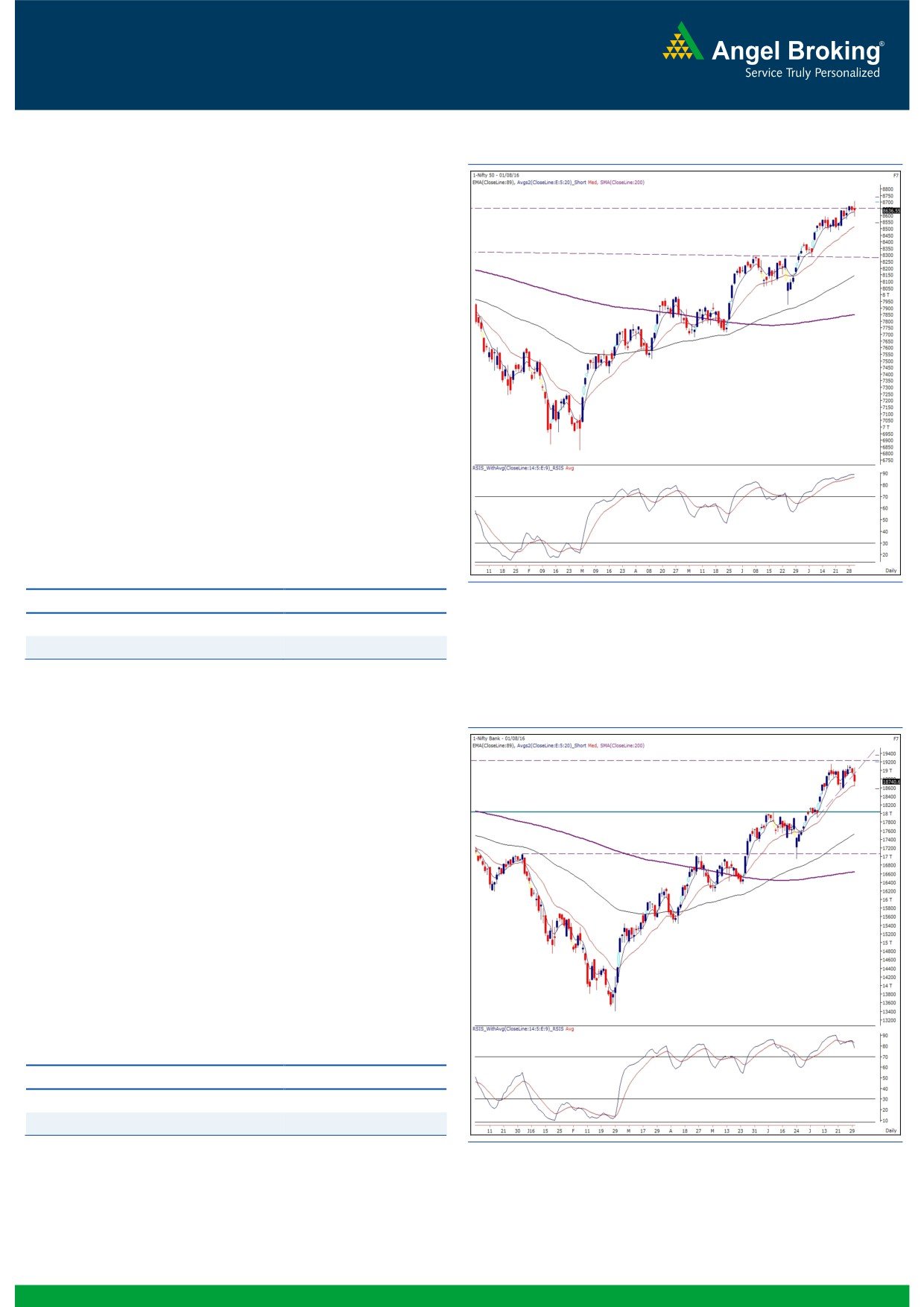

Exhibit 1: Nifty Daily Chart

Trading for the week began slightly higher owing to mix cues

from the global bourses. Subsequently, we witness a continuation

of the ongoing optimism and within no time the index reached yet

another milestone of 8700. Things were looking good; but,

suddenly we saw sharp decline in the market mainly inflicted by

two index heavyweights, ICICI Bank and L&T. Due to modest

recovery in the last hour of the trade trimmed some losses to close

convincingly above the 8600 mark.

In our earlier report, we had advised on avoiding aggressive

positions in the market. In line with our view, the index traded

with higher volatility and surprised everyone my correcting sharply

from days high. In the coming trading session, we expect the Nifty

to face a resistance around 8675 - 8710 levels; whereas on the

downside, 8572 would be seen as immediate support levels.

Although, the higher degree trend remains positive, we now

expect some range bound action with enhanced volatility. It’s

advisable to trade with proper exit strategy.

Key Levels

Support 1 - 8572

Resistance 1 - 8675

Support 2 - 8540

Resistance 2 - 8710

Nifty Bank Outlook - (18741)

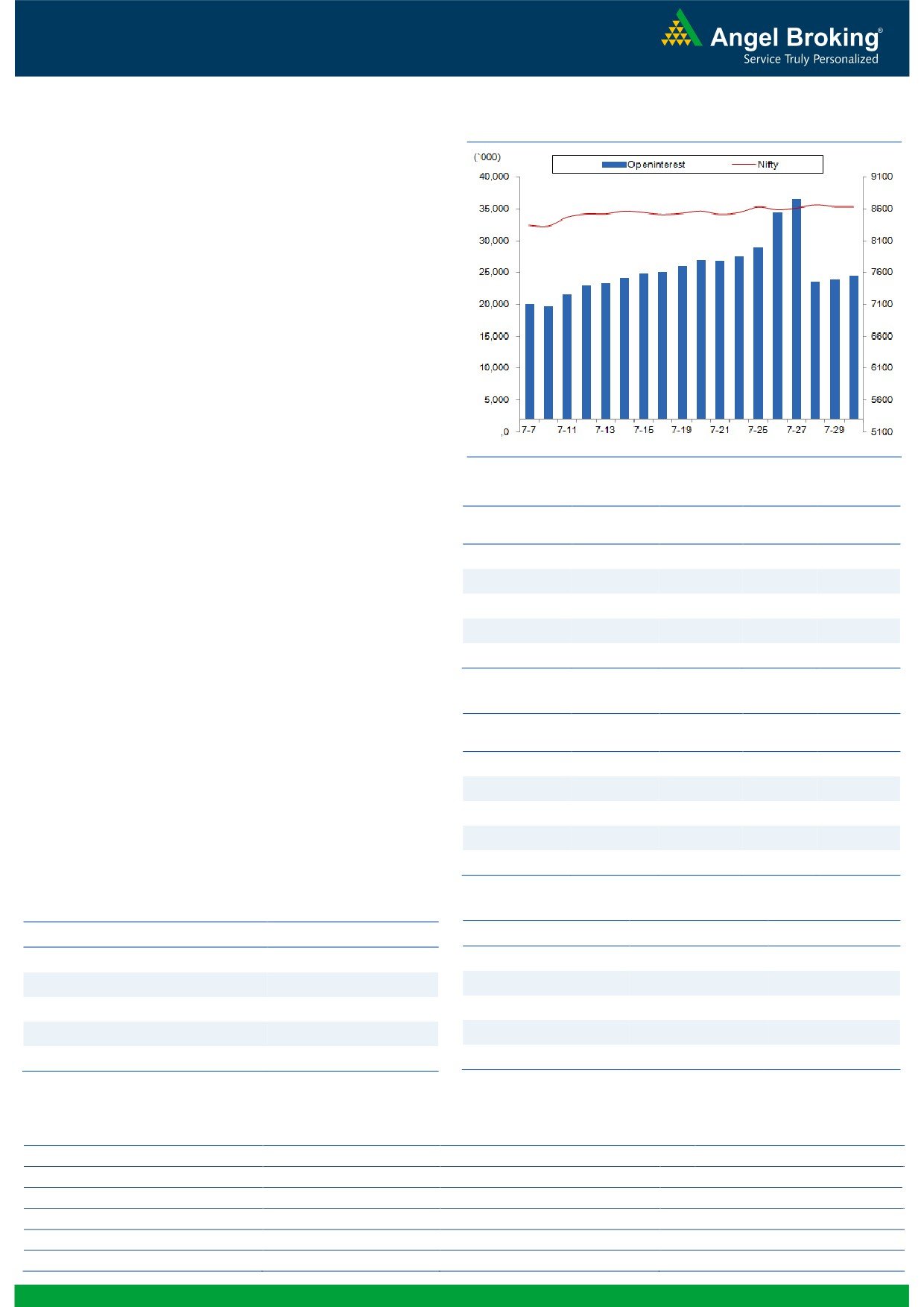

Exhibit 2: Nifty Bank Daily Chart

Yesterday, in line with benchmark index, we saw Bank Nifty

adding some gains to the bull's kitty. But, suddenly, the banking

index took a nosedive after the heavyweight constituent the ICICI

Bank started correcting fiercely from morning high. In the

process, the index went on to breach the support level of 18800.

As expected, this led to a weakness in the index to shed nearly a

percent during the session.

Going forward, the Bank Nifty is likely to face a resistance around

the 18900 - 19050 levels; whereas on the other hand, a

sustainable move below yesterday's low may result into further

weakness towards 18600 -

18500 levels. Traders are thus

advised to stay light on positions and follow strict stop losses for

existing positions.

Key Levels

Support 1 - 18600

Resistance 1 - 18900

Support 2 - 18500

Resistance 2 - 19050

1

Technical & Derivatives Report

August 02, 2016

Comments

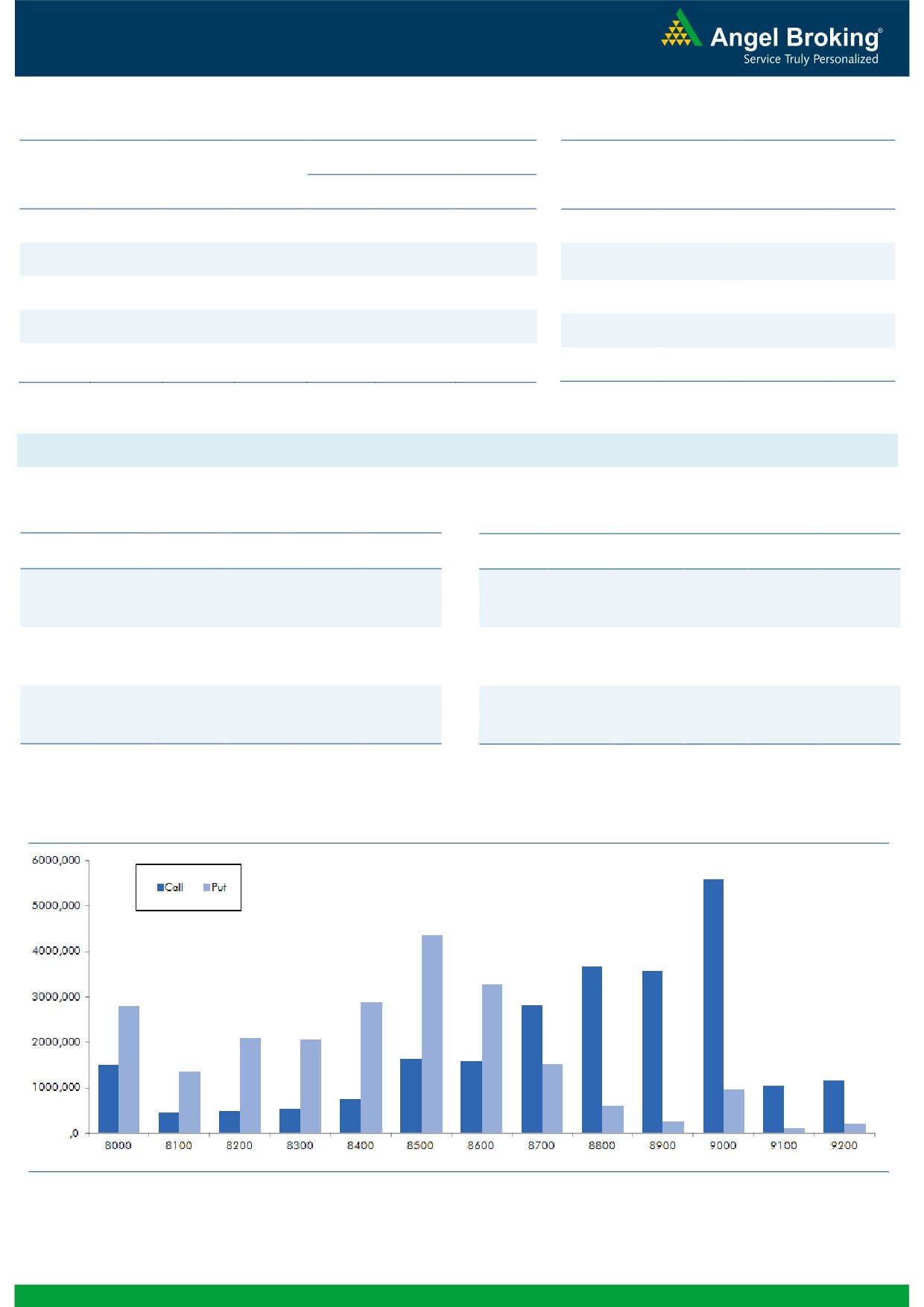

Nifty Vs OI

The Nifty futures open interest has increased by 2.23%

BankNifty futures open interest has increased by 9.60%

as market closed at 8636.55 levels.

The Nifty August future closed with a premium of 45.45

points against a premium of 48.10 points in previous

session. The September series closed at a premium of

92.10 points.

The Implied Volatility of at the money options has

increased from 13.75% to 14.34%.

The total OI of the market is Rs. 2,23,187/- cr. and the

stock futures OI is Rs. 70,121/- cr.

Few of the liquid counters where we have seen high cost

of carry are HINDALCO, HDFCBANK, PTC, TATACOMM

and IBREALEST.

Views

OI Gainers

Yesterday, FIIs were net buyer in both cash market and

OI

PRICE

Index Futures segment. They bought equities to the tune

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

of Rs. 726 crores. While, they were net buyer in Index

VOLTAS

6262000

36.61

370.15

5.80

Futures worth Rs. 632 crores with rise in open interest,

LT

7997500

24.91

1486.00

-4.21

indicating formation of long positions.

EXIDEIND

10208000

18.31

178.05

-1.19

In Index Options segment, FIIs bought of worth Rs. 673

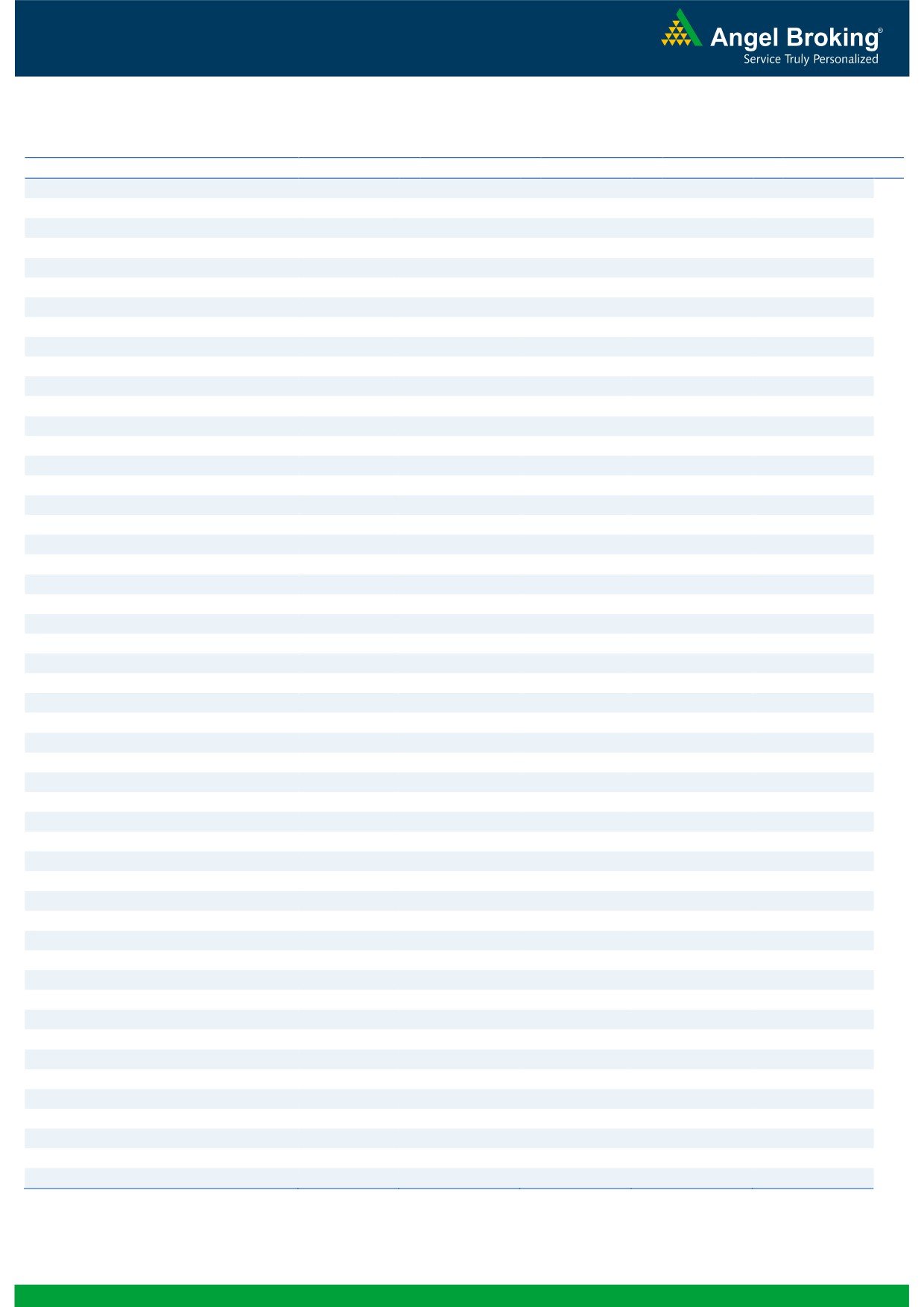

crores with rise in OI. In call options, 8900-9000 strikes

JINDALSTEL

61371000

17.47

89.75

6.65

were active and they also added good amount of fresh

ICICIBANK

60732500

15.28

251.05

-5.12

open interest. On the other hand in put options, some

build-up was visible in

8400-8600 strikes. Highest

OI Losers

buildup in August series is placed at 9000 call and 8500

OI

PRICE

SCRIP

OI

PRICE

put options.

CHG. (%)

CHG. (%)

Despite market being under pressure yesterday, FIIs

TVSMOTOR

6572000

-10.73

296.75

1.18

continue to pour in liquidity. We believe if FIIs continue

ANDHRABANK

14010000

-7.65

60.10

-0.41

their buying trend, NIFTY may touch its resistance zone of

UPL

5457600

-6.15

615.10

-1.78

8750-8800 levels. Traders are suggested to hold one to

DISHTV

36316000

-5.64

105.25

1.54

their longs as of now and start booking profits once Nifty

OIL

739500

-5.23

369.85

0.05

is near its resistance zone.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

VOLTAS

37.40

NIFTY

0.94

0.91

PETRONET

30.58

BANKNIFTY

0.63

0.75

HCLTECH

28.31

ICICIBANK

0.40

0.46

BAJFINANCE

63.21

LT

0.57

0.71

LT

35.83

INFY

0.30

0.29

Strategy Date

Symbol

Strategy

Status

01-08-2016

RELIANCE

Ratio Bear Put Spread

Active

2

Technical & Derivatives Report

August 02, 2016

FII Statistics for 01-August 2016

Turnover on 01-August 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2561.09

1929.36

631.72

293676

19425.88

2.87

261109

17958.64

62.68

FUTURES

FUTURES

INDEX

INDEX

43380.04

42707.26

672.78

805377

52567.04

6.22

2928979

204670.91

85.14

OPTIONS

OPTIONS

STOCK

5855.15

6829.91

(974.76)

795277

51991.81

2.31

STOCK

FUTURES

625156

44036.61

9.58

FUTURES

STOCK

STOCK

4479.06

4520.69

(41.63)

41337

2738.48

88.12

OPTIONS

351916

24982.89

33.68

OPTIONS

TOTAL

56275.33

55987.22

288.11

1935667

126723.22

5.03

TOTAL

4167160

291649.05

61.61

Nifty Spot = 8636.55

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

114.80

Buy

8700

134.30

43.35

56.65

8743.35

42.25

57.75

8657.75

Sell

8800

71.45

Sell

8600

92.05

Buy

8700

114.80

Buy

8700

134.30

74.55

125.45

8774.55

73.10

126.90

8626.90

Sell

8900

40.25

Sell

8500

61.20

Buy

8800

71.45

Buy

8600

92.05

31.20

68.80

8831.20

30.85

69.15

8569.15

Sell

8900

40.25

Sell

8500

61.20

Note: Above mentioned Bullish or Bearish Spreads in Nifty (August Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 02, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,659

1,674

1,689

1,704

1,718

ADANIPORTS

220

224

230

235

241

AMBUJACEM

268

269

271

273

275

ASIANPAINT

1,104

1,113

1,123

1,132

1,142

AUROPHARMA

767

778

792

802

817

AXISBANK

540

545

552

557

563

BAJAJ-AUTO

2,672

2,704

2,742

2,774

2,812

BANKBARODA

142

145

149

152

157

BHEL

136

139

144

147

152

BPCL

583

589

596

602

609

BHARTIARTL

359

362

364

367

369

INFRATEL

385

391

400

405

414

BOSCH

24,207

24,465

24,857

25,115

25,507

CIPLA

513

519

527

532

540

COALINDIA

322

324

328

330

334

DRREDDY

2,922

2,951

2,977

3,006

3,032

EICHERMOT

21,821

22,073

22,463

22,716

23,106

GAIL

373

377

382

385

390

GRASIM

4,866

4,927

4,973

5,034

5,080

HCLTECH

736

758

775

797

813

HDFCBANK

1,212

1,227

1,243

1,258

1,274

HDFC

1,350

1,362

1,380

1,392

1,409

HEROMOTOCO

3,178

3,197

3,223

3,241

3,267

HINDALCO

132

134

137

139

141

HINDUNILVR

910

917

924

931

938

ICICIBANK

240

245

253

258

266

IDEA

102

103

104

105

107

INDUSINDBK

1,161

1,181

1,193

1,213

1,225

INFY

1,061

1,073

1,080

1,093

1,100

ITC

246

248

252

254

257

KOTAKBANK

735

744

757

766

778

LT

1,427

1,460

1,523

1,556

1,619

LUPIN

1,684

1,704

1,726

1,746

1,768

M&M

1,436

1,453

1,473

1,491

1,511

MARUTI

4,728

4,797

4,841

4,910

4,954

NTPC

156

158

159

160

162

ONGC

215

217

220

222

226

POWERGRID

173

175

178

180

182

RELIANCE

996

1,003

1,012

1,018

1,027

SBIN

221

224

228

232

236

SUNPHARMA

815

826

833

843

850

TCS

2,595

2,652

2,688

2,745

2,781

TATAMTRDVR

322

326

330

334

338

TATAMOTORS

500

504

510

514

519

TATAPOWER

70

71

72

73

74

TATASTEEL

350

357

362

370

374

TECHM

470

480

486

497

503

ULTRACEMCO

3,706

3,731

3,750

3,775

3,795

WIPRO

538

548

555

565

572

YESBANK

1,189

1,205

1,220

1,236

1,251

ZEEL

485

495

502

512

519

4

Technical & Derivatives Report

August 02, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5