Technical & Derivatives Report

June 02, 2016

Sensex (26714) / Nifty (8180)

Exhibit 1: Nifty Daily Chart

Post marginal gap up opening, the Nifty surpassed the 8200

mark initially, but once again, weak traders chose to exit their

longs and as a result, we witnessed a gradual decline to trim

some part of morning gains. Eventually, Nifty ended the session

by adding 0.24% over its previous close.

Yesterday’s session was almost a replica of previous two days

movement as the index failed to sustain at higher levels. The

overall trading range has shrunk drastically after seeing a

humongous rally from 7700. Still, the chart structure remains

intact and hence, our view remains unchanged. We reiterate that

in case of any minor intraday dips, traders should look to go long

as we expect upward bias to continue in the forthcoming days as

well. We would like to keep highlighting one key point, the

market has entered a strong bullish zone and thus, traders should

now look at the support levels rather than finding resistances. The

immediate support is at 8140 - 8120 and intraday resistances at

8220 - 8250.

Key Levels

Support 1 - 8140

Resistance 1 - 8220

Support 2 - 8120

Resistance 2 - 8250

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (17423)

In yesterday's trading session, the Nifty Bank index opened

marginally in the positive; however; it started correcting from the

opening tick and crept lower throughout the session to conclude

with losses of 1.12% over its previous session’s close.

In yesterday's report, we had mentioned about the formation of

'Dragonfly Doji' candlestick pattern in Nifty Bank index on daily

charts. It is a reversal pattern and generally implies reversal of the

trend. Although, the pattern got activated yesterday as the low of

17462 was breached, we are expecting this pattern to lead to a

temporary halt in the ongoing momentum and not reversal of the

uptrend. The prime reason for not turning bearish in spite of the

reversal pattern is the chart structure of the individual heavyweight

stocks which continues to depict the bullish trend. Hence, traders

with long positions are advised to keep holding their long

positions and not create short positions in anticipation of trend

reversal. The near term support for the index is placed around

17320 and 17100; whereas, resistances are seen around 17670

and 17780.

Key Levels

Support 1 - 17320

Resistance 1 - 17670

Support 2 - 17100

Resistance 2 - 17780

1

Technical & Derivatives Report

June 02, 2016

Comments

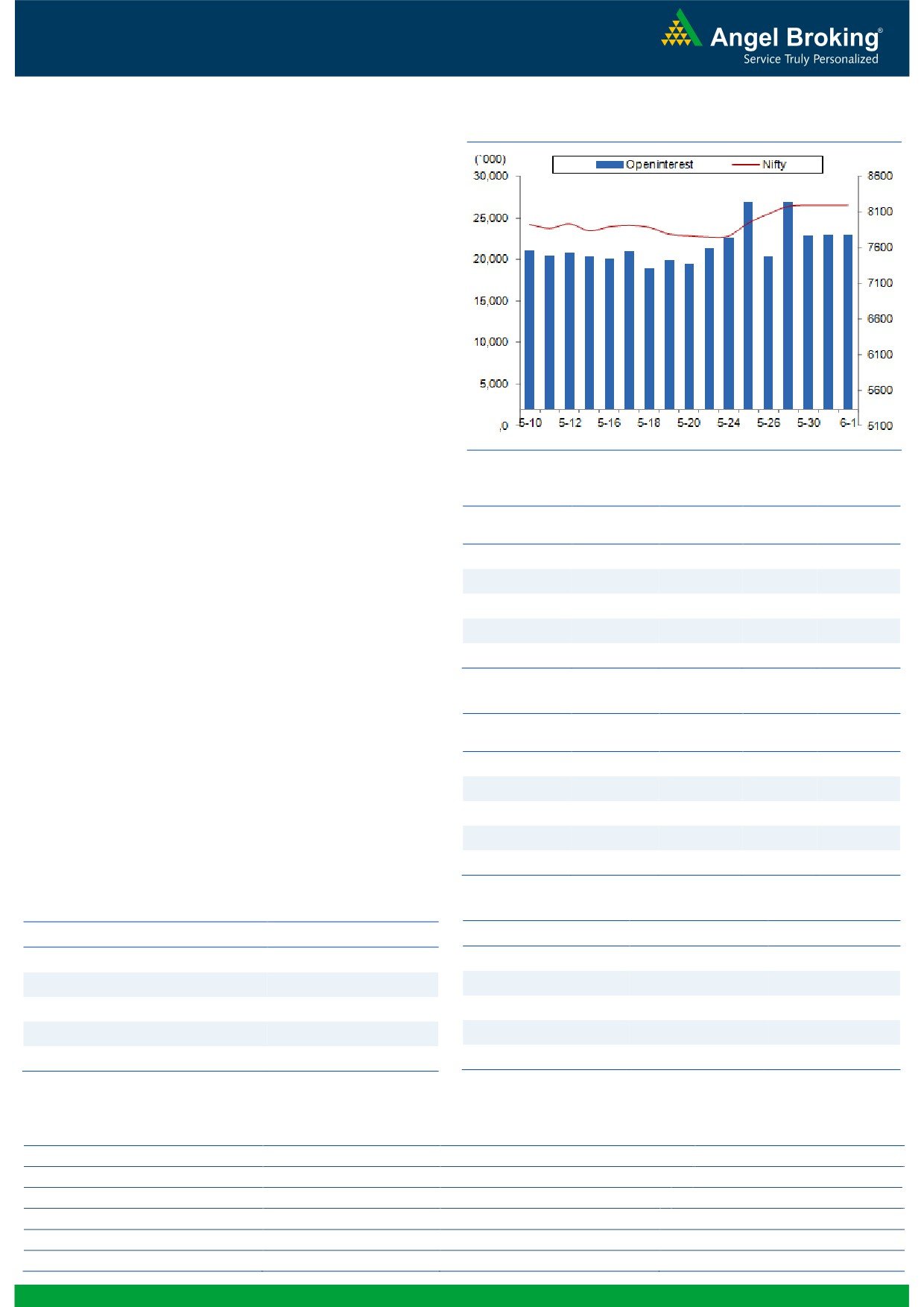

Nifty Vs OI

The Nifty futures open interest has increased by 0.12%

BankNifty futures open interest has decreased by 2.35%

as market closed at 8179.95 levels.

The Nifty June future closed with a premium of 14.60

points against a premium of 30.80 points in previous

session. The July series closed at a premium of 35.15

points.

The Implied Volatility of at the money options has

increased marginally from 14.24% to 14.27%.

The total OI of the market is Rs. 1,97,682/- cr. and the

stock futures OI is Rs. 61,205/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, AJANTPHARMA,

KOTAKBANK and RCOM.

Views

OI Gainers

OI

PRICE

FIIs were net buyers in cash market segment yesterday;

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

they bought to the tune of Rs. 260 crores. In Index

ASIANPAINT

4043400

14.57

1021.70

3.30

Futures, they sold of Rs. 287 crores with rise in OI,

ABIRLANUVO

1209750

11.94

1080.25

3.31

indicating some short formation in last trading session.

PIDILITIND

1009000

11.49

717.65

2.04

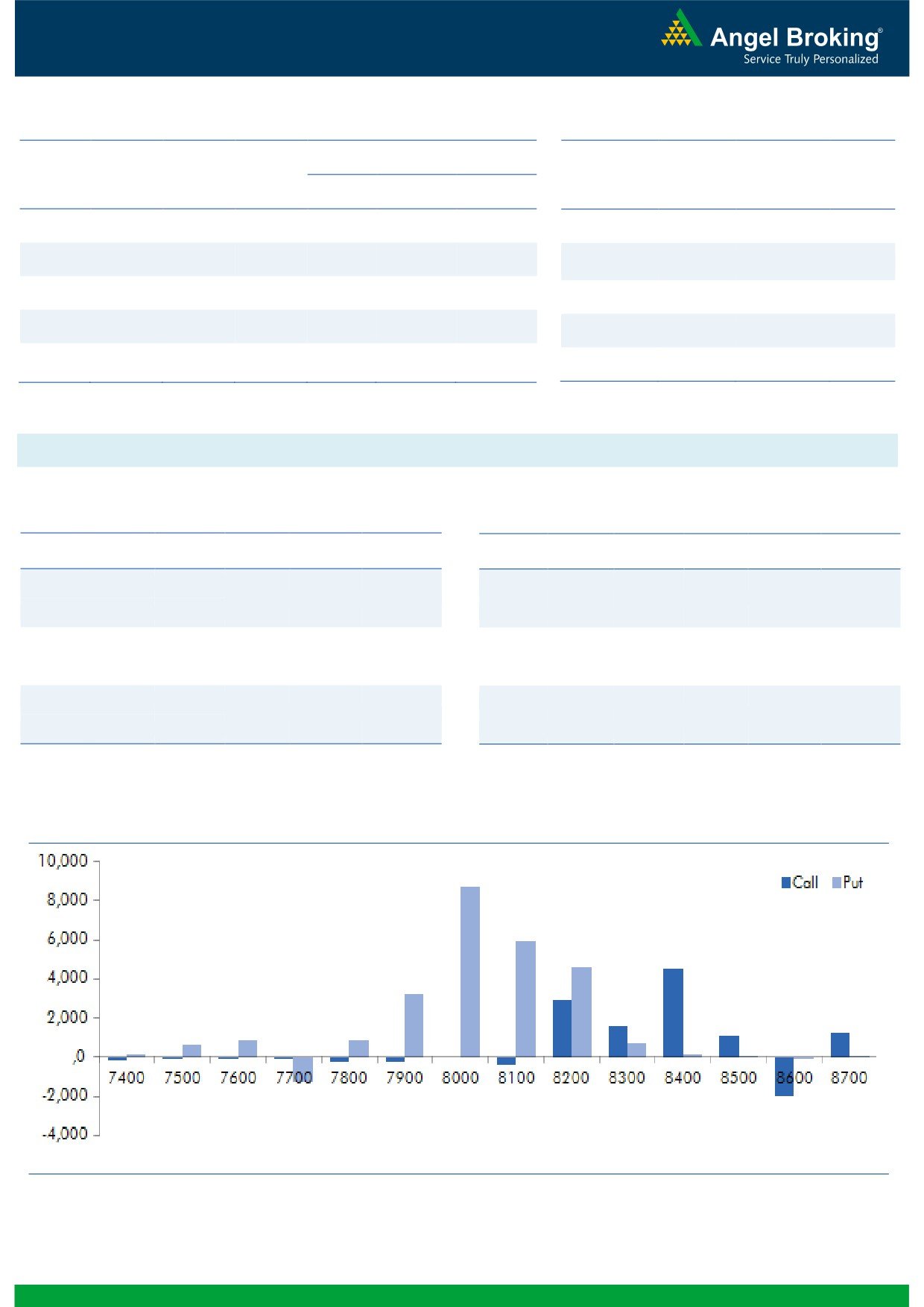

In Index Options front, FIIs bought of worth Rs. 350

crores with good amount of rise in open interest. Overall

NMDC

8871000

8.17

86.60

-2.08

activity in call options remained subdued. While in put

HAVELLS

5490000

7.69

356.65

-1.74

options, 8000 & 8100 strikes added some build-up.

Maximum build-up in June series is visible in 8400 call

OI Losers

and 8000 put options. We believe 8000-8050 levels

OI

PRICE

SCRIP

OI

PRICE

may now act as a very strong support for market.

CHG. (%)

CHG. (%)

Yesterday’s selling figure in Index Futures is far less than

JUSTDIAL

1802200

-10.36

695.50

2.57

the quantum of buying witness in the last week of May

TORNTPHARM

177600

-7.50

1362.70

1.31

series and first two days of current series. One should

SRF

566400

-6.72

1287.85

-1.03

avoid forming any shorts at current junction, it’s a buy on

AJANTPHARM

291600

-5.08

1529.85

0.90

dip market for us.

CROMPGREAV

14958000

-4.85

68.25

3.30

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

ASIANPAINT

29.82

NIFTY

1.04

1.00

BHARTIARTL

32.92

BANKNIFTY

0.88

0.90

APOLLOHOSP

33.42

SBIN

0.85

0.59

EXIDEIND

35.02

ICICIBANK

0.52

0.56

RCOM

52.40

RELIANCE

0.74

0.50

Strategy Date

Symbol

Strategy

Status

May 30, 2016

TCS

Ratio Bull Call Spread

Active

2

Technical & Derivatives Report

June 02, 2016

FII Statistics for 31-May 2016

Turnover on 31-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

1475.96

1762.50

(286.54)

293473

17672.80

1.70

233701

13472.77

-3.97

FUTURES

FUTURES

INDEX

INDEX

21995.71

21645.72

349.99

884552

53771.42

4.27

2081752

122112.71

6.09

OPTIONS

OPTIONS

STOCK

5029.87

4469.12

560.74

1041846

51586.40

2.06

STOCK

FUTURES

578417

29550.65

-23.92

FUTURES

STOCK

STOCK

2667.55

2618.05

49.50

65860

3373.76

16.20

OPTIONS

304778

15864.24

-14.74

OPTIONS

TOTAL

31169.08

30495.39

673.69

2285731

126404.38

3.22

TOTAL

3198648

181000.38

-2.99

Nifty Spot = 8179.95

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

126.40

Buy

8200

134.05

47.40

52.60

8247.40

38.75

61.25

8161.25

Sell

8300

79.00

Sell

8100

95.30

Buy

8200

126.40

Buy

8200

134.05

81.25

118.75

8281.25

66.85

133.15

8133.15

Sell

8400

45.15

Sell

8000

67.20

Buy

8300

79.00

Buy

8100

95.30

33.85

66.15

8333.85

28.10

71.90

8071.90

Sell

8400

45.15

Sell

8000

67.20

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

June 02, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,515

1,534

1,547

1,566

1,579

ADANIPORTS

189

195

199

206

210

AMBUJACEM

227

229

231

233

235

ASIANPAINT

976

999

1,012

1,035

1,048

AUROPHARMA

776

782

793

799

809

AXISBANK

498

505

517

524

537

BAJAJ-AUTO

2,578

2,591

2,613

2,626

2,648

BANKBARODA

135

137

140

142

146

BHEL

115

117

119

121

124

BPCL

975

981

988

995

1,002

BHARTIARTL

348

356

360

368

372

INFRATEL

370

378

382

389

393

BOSCH

21,907

22,087

22,286

22,466

22,665

CIPLA

456

460

467

472

479

COALINDIA

285

291

295

301

306

DRREDDY

3,144

3,164

3,192

3,211

3,240

EICHERMOT

18,365

18,539

18,674

18,848

18,983

GAIL

366

369

372

375

378

GRASIM

4,301

4,329

4,359

4,387

4,417

HCLTECH

724

729

737

742

750

HDFCBANK

1,164

1,170

1,176

1,182

1,188

HDFC

1,222

1,233

1,241

1,251

1,259

HEROMOTOCO

3,036

3,062

3,097

3,124

3,159

HINDALCO

101

102

104

105

107

HINDUNILVR

838

846

855

864

872

ICICIBANK

235

238

242

244

248

IDEA

113

115

117

119

121

INDUSINDBK

1,091

1,098

1,103

1,109

1,114

INFY

1,235

1,247

1,258

1,269

1,280

ITC

350

356

359

365

368

KOTAKBANK

736

741

745

750

755

LT

1,447

1,456

1,470

1,479

1,493

LUPIN

1,467

1,479

1,489

1,501

1,511

M&M

1,314

1,324

1,336

1,346

1,359

MARUTI

4,122

4,144

4,172

4,194

4,222

NTPC

140

142

144

146

147

ONGC

208

209

211

213

215

POWERGRID

147

148

149

150

152

RELIANCE

943

948

957

963

971

SBIN

189

194

201

206

213

SUNPHARMA

741

748

759

766

778

TCS

2,543

2,588

2,617

2,662

2,691

TATAMTRDVR

302

305

312

315

322

TATAMOTORS

438

443

451

457

464

TATAPOWER

71

72

73

74

76

TATASTEEL

324

328

334

338

344

TECHM

534

537

540

543

546

ULTRACEMCO

3,180

3,204

3,232

3,256

3,284

WIPRO

542

548

552

558

562

YESBANK

991

1,004

1,019

1,033

1,047

ZEEL

438

444

448

454

458

4

Technical & Derivatives Report

June 02, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5