Technical & Derivatives Report

March 02, 2016

Sensex (23779) / Nifty (7222)

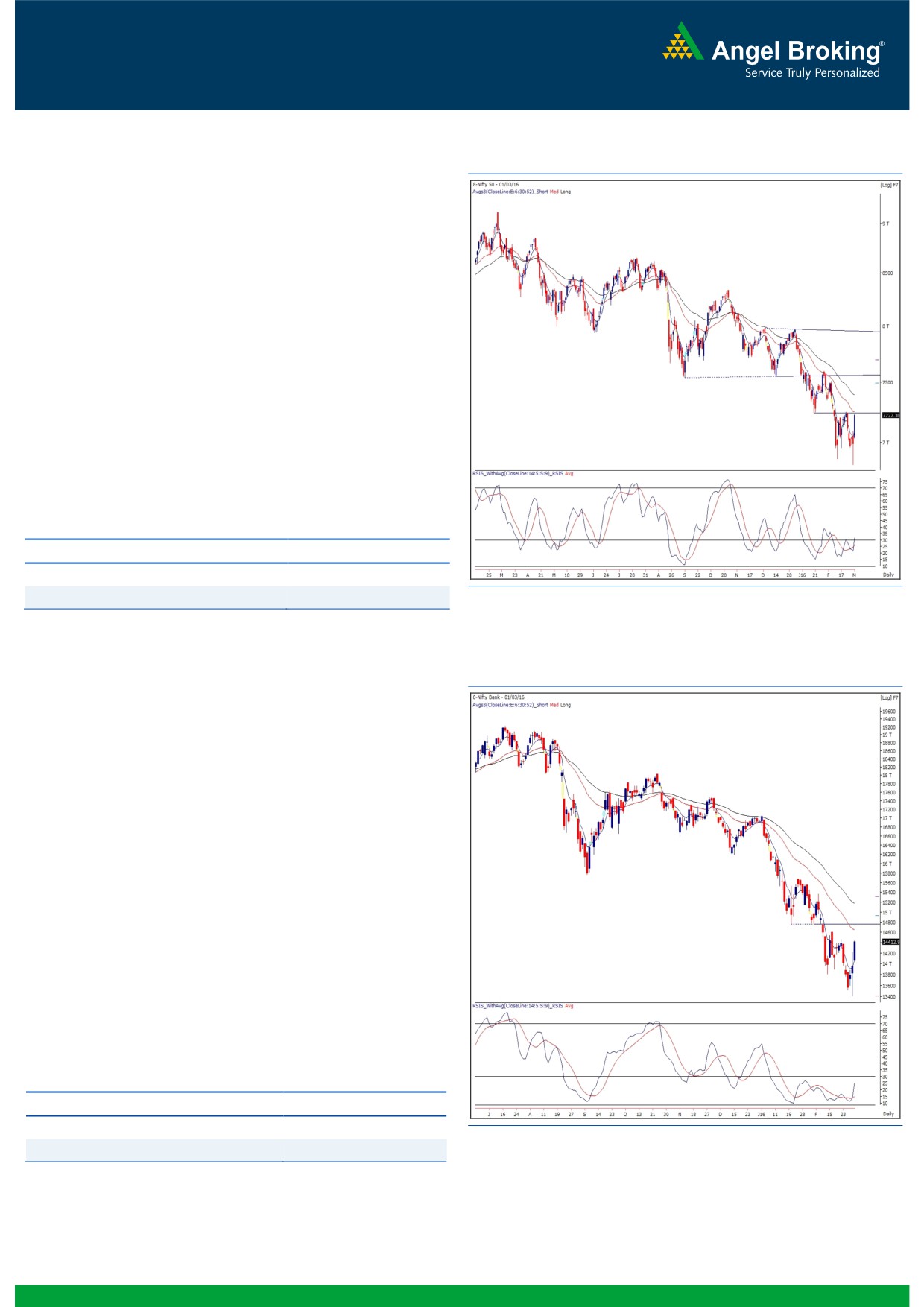

Exhibit 1: Nifty Daily Chart

After witnessing a see-saw ride on ‘Union Budget Day’, our

benchmark index opened on a cheerful note. The optimism

accelerated in the initial hour and as a result, the Nifty went

on thrash previous day’s high of 7094.60 with an ease. This

positive development provided impetus to broad based rally

throughout the session. As a result, the Nifty managed to close

well above the 7200 mark by posting whopping single day

gains of 3.37 percent.

As discussed in the previous report, a positive divergence in

‘RSI-Smoothened’ oscillator on the daily chart certainly played

its part. Now, Nifty has confirmed a trend line breakout with a

strong daily closing above 7200. We expect this optimism to

continue beyond recent swing high of 7252. A next important

hurdle would be then seen at 7350. On the flipside, 7177 -

7094 would act as important support levels.

Key Levels

Support 1 - 7177

Resistance 1 - 7252

Support 2 - 7094

Resistance 2 -

7350

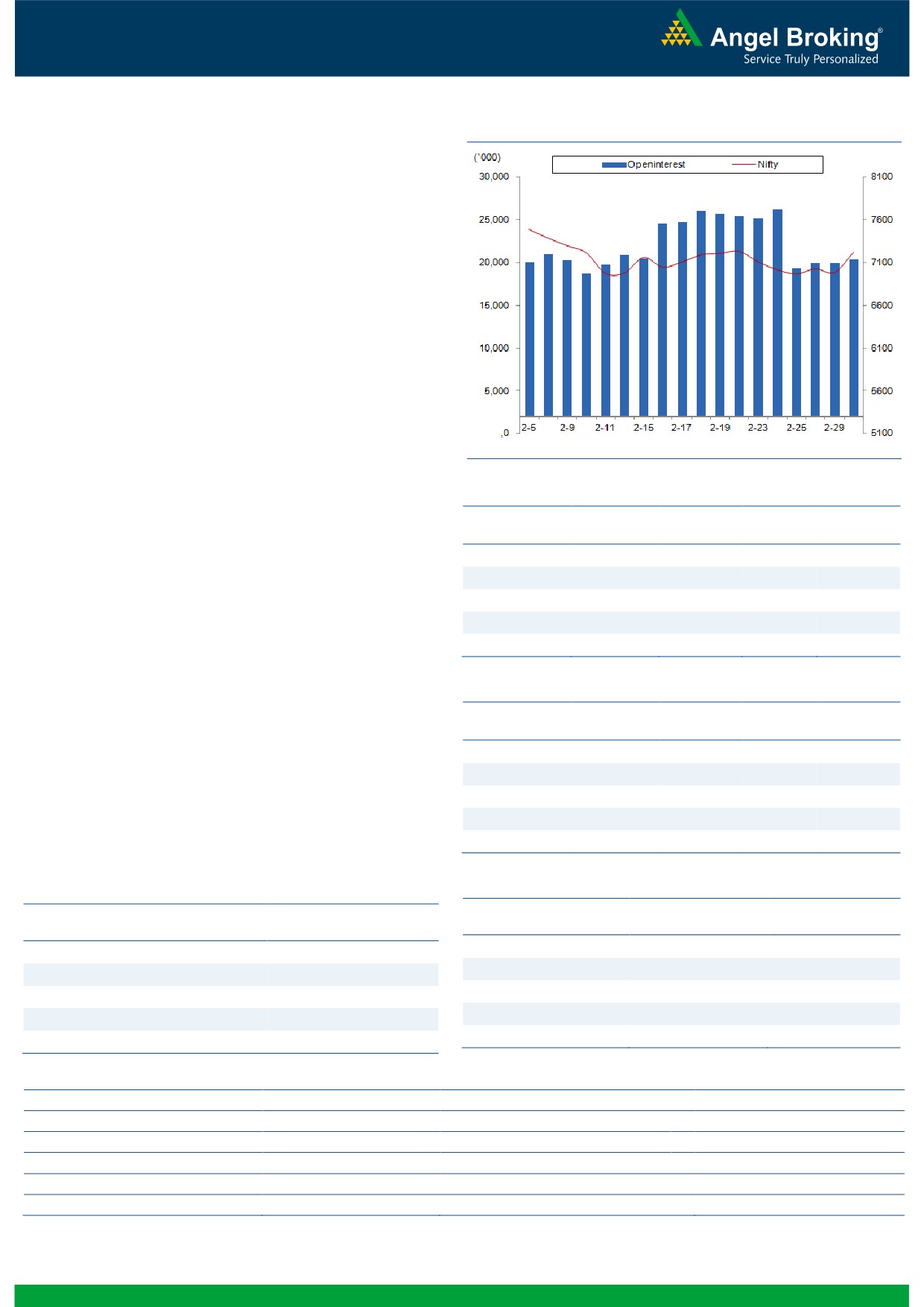

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (14413)

The Nifty Bank index opened on a positive note yesterday and

formed 'Higher Top Higher Bottom' throughout the session to

end the day with the huge gains of 3.34℅.

As we had mentioned in yesterday's report, the index had

formed a 'Spinning Top' candlestick pattern on Monday which

indicated indecisiveness amongst market participants.

Yesterday's upmove indicates that the buyers were more

aggressive post tug of war on Monday and this could lead to a

short term positive momentum. The private sector banks have

taken the lead and since they constitute major part of the Nifty

Bank index, we could see further upside in the index in near

term. Hence traders are advised to trade with positive bias

until any reversal signs seen on lower time frame charts. The

near term support for the index are placed around 14222 and

14060, whereas resistances are seen around 14600 and

14755.

Key Levels

Support 1 - 14222

Resistance 1 - 14600

Support 2 - 14060

Resistance 2 - 14755

1

Technical & Derivatives Report

March 02, 2016

Comments

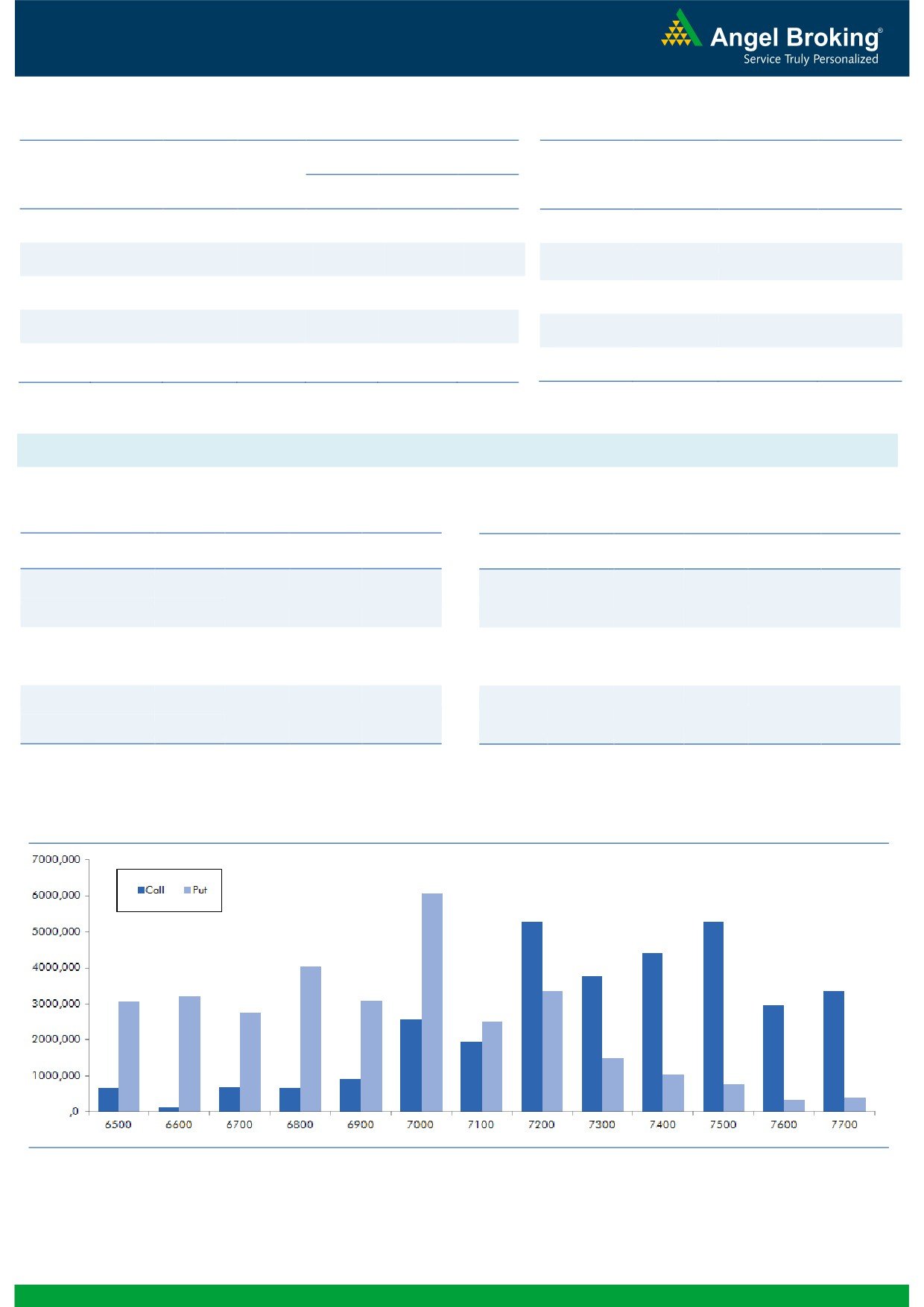

Nifty Vs OI

The Nifty futures open interest has increased by 3.34%

BankNifty futures open interest has increased by 2.61%

as market closed at 7222.30 levels.

The Nifty March future closed at a premium of 6.75

points against a premium of 21.90 points. The April

series closed at a premium of 32.90 points.

The Implied Volatility of at the money options has

decreased from 19.04% to 17.32%.

The total OI of the market is Rs. 1,89,767/- cr. and the

stock futures OI is Rs. 5,33,78/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, IFCI, ADANIENT

and GMRINFRA.

Views

FIIs after long time have been net buyers in equity

OI Gainers

segment, they bought to the tune of Rs. 1760 crores.

OI

PRICE

SCRIP

OI

PRICE

While in Index Futures, they continue buying of Rs. 706

CHG. (%)

CHG. (%)

crores with decent rise in OI, suggesting fresh long

TATAELXSI

280500

51.79

1805.50

6.00

formation in yesterday’s trading session.

GRANULES

1160000

47.77

113.25

5.84

In Index Options front, FIIs bought sigfnificantly with

CUMMINSIND

60000

47.06

834.85

2.00

good amount of rise in OI. In call options, 7200 and

PCJEWELLER

1248000

39.94

324.80

3.51

7400 strikes were quite active and they also added freshng.com

ICIL

119500

26.46

898.55

7.98

build-up. We believe these OI addition in call options is

long formation expecting further strenght. Whereas, in

OI Losers

put options, 7000-7200 strikes added good amount of

OI

PRICE

SCRIP

OI

PRICE

fresh build-up, which may be lend of long and shorts.

CHG. (%)

CHG. (%)

Maximum OI in current series is visible in 7500 call and

POWERGRID

12496000

-8.74

133.90

2.37

7000 put options. From last three trading sessions, FIIs

KSCL

1469250

-6.67

361.80

2.43

have been net buyers in Index Futures, these is positive

GAIL

6223000

-6.62

321.70

5.03

sign. We believe Nifty may breach 7300-7350 levels,

IOC

6974400

-6.54

386.50

4.18

trade with a positive bias.

HAVELLS

2690000

-6.40

286.55

4.81

Historical Volatility

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

SCRIP

HV

NIFTY

0.87

0.91

ITC

53.30

BANKNIFTY

1.00

0.79

HEROMOTOCO

46.06

SBIN

0.57

0.38

MARUTI

55.32

ITC

1.65

0.76

TCS

34.13

ICICIBANK

0.79

0.46

IBULHSGFIN

59.91

Strategy Date

Symbol

Strategy

Status

Feruary 29, 2016

RELIANCE

Ratio Bull Call Spread

Active

2

Technical & Derivatives Report

March 02, 2016

FII Statistics for 01-March 2016

Turnover on 01-March 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2916.29

2210.11

706.17

231519

11944.62

4.25

382343

19100.15

-42.92

FUTURES

FUTURES

INDEX

INDEX

36770.25

31952.76

4817.49

1056860

56768.65

11.74

3489649

183972.96

-39.44

OPTIONS

OPTIONS

STOCK

4201.18

3706.08

495.10

1090497

46782.48

0.44

STOCK

FUTURES

596703

25760.82

-21.37

FUTURES

STOCK

STOCK

1942.56

1808.32

134.24

39555

1655.01

36.52

OPTIONS

285397

12651.36

-19.58

OPTIONS

TOTAL

45830.28

39677.27

6153.01

2418431

117150.76

5.95

TOTAL

4754092

241485.29

-37.39

Nifty Spot = 7222.30

Lot Size = 75

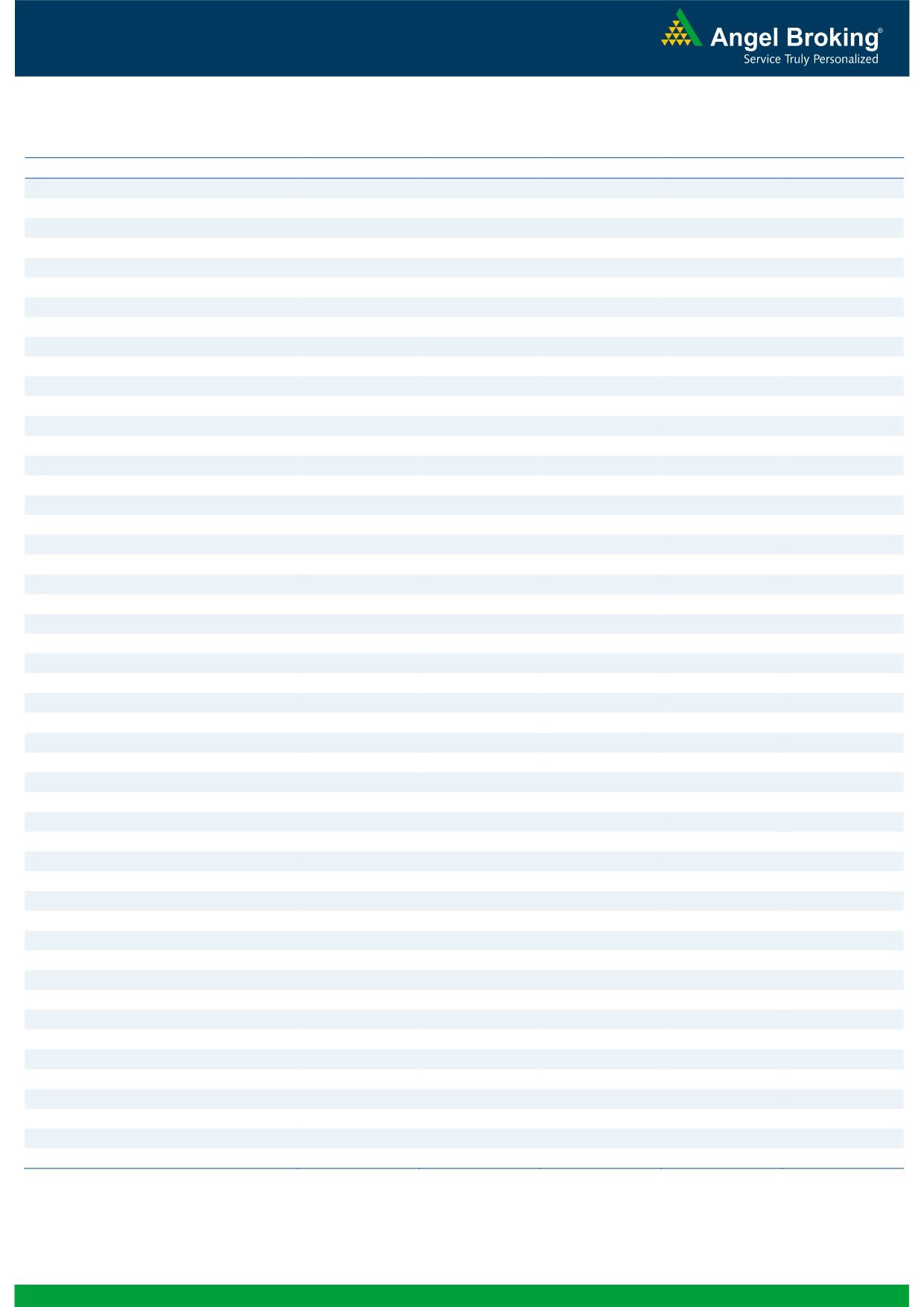

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

7300

104.00

Buy

7200

127.85

38.90

61.10

7338.90

34.90

65.10

7165.10

Sell

7400

65.10

Sell

7100

92.95

Buy

7300

104.00

Buy

7200

127.85

65.50

134.50

7365.50

61.00

139.00

7139.00

Sell

7500

38.50

Sell

7000

66.85

Buy

7400

65.10

Buy

7100

92.95

26.60

73.40

7426.60

26.10

73.90

7073.90

Sell

7500

38.50

Sell

7000

66.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

March 02, 2016

Daily Pivot Levels for Nifty 50 Stocks

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,175

1,204

1,224

1,253

1,272

ADANIPORTS

192

200

204

211

215

AMBUJACEM

187

189

190

192

193

ASIANPAINT

841

856

866

881

890

AXISBANK

375

384

388

397

402

BAJAJ-AUTO

2,182

2,220

2,243

2,282

2,305

BANKBARODA

131

134

135

138

139

BHARTIARTL

306

313

318

325

330

BHEL

90

91

92

94

95

BOSCHLTD

16,570

16,797

16,968

17,195

17,366

BPCL

757

775

788

806

818

CAIRN

113

118

121

126

130

CIPLA

504

510

516

522

528

COALINDIA

306

312

315

321

325

DRREDDY

2,975

3,000

3,025

3,049

3,074

GAIL

296

309

316

329

336

GRASIM

3,259

3,342

3,394

3,477

3,529

HCLTECH

795

814

828

846

860

HDFC

1,037

1,053

1,063

1,080

1,090

HDFCBANK

966

975

981

990

996

HEROMOTOCO

2,443

2,555

2,618

2,731

2,794

HINDALCO

68

69

70

71

72

HINDUNILVR

812

818

824

830

836

ICICIBANK

191

198

202

209

213

IDEA

102

104

105

107

108

INDUSINDBK

821

841

854

874

888

INFY

1,081

1,103

1,117

1,139

1,152

ITC

297

311

319

333

341

KOTAKBANK

612

625

633

646

654

LT

1,063

1,094

1,111

1,142

1,159

LUPIN

1,713

1,737

1,760

1,784

1,806

M&M

1,180

1,224

1,252

1,296

1,324

MARUTI

3,093

3,294

3,402

3,603

3,711

NTPC

118

120

122

124

125

ONGC

186

189

191

194

197

PNB

71

72

73

74

75

POWERGRID

129

131

133

135

137

RELIANCE

957

969

977

989

997

SBIN

157

159

161

164

166

VEDL

69

72

74

77

79

SUNPHARMA

843

855

864

877

886

TATAMOTORS

295

305

311

321

327

TATAPOWER

56

57

58

59

60

TATASTEEL

242

250

254

261

266

TCS

2,118

2,197

2,241

2,321

2,364

TECHM

409

421

428

440

447

ULTRACEMCO

2,717

2,801

2,857

2,941

2,997

WIPRO

517

526

533

542

548

YESBANK

680

700

711

730

742

ZEEL

367

379

387

399

406

4

Technical & Derivatives Report

March 02, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5