Technical & Derivatives Report

December 01, 2016

Sensex (26653) / Nifty (8225)

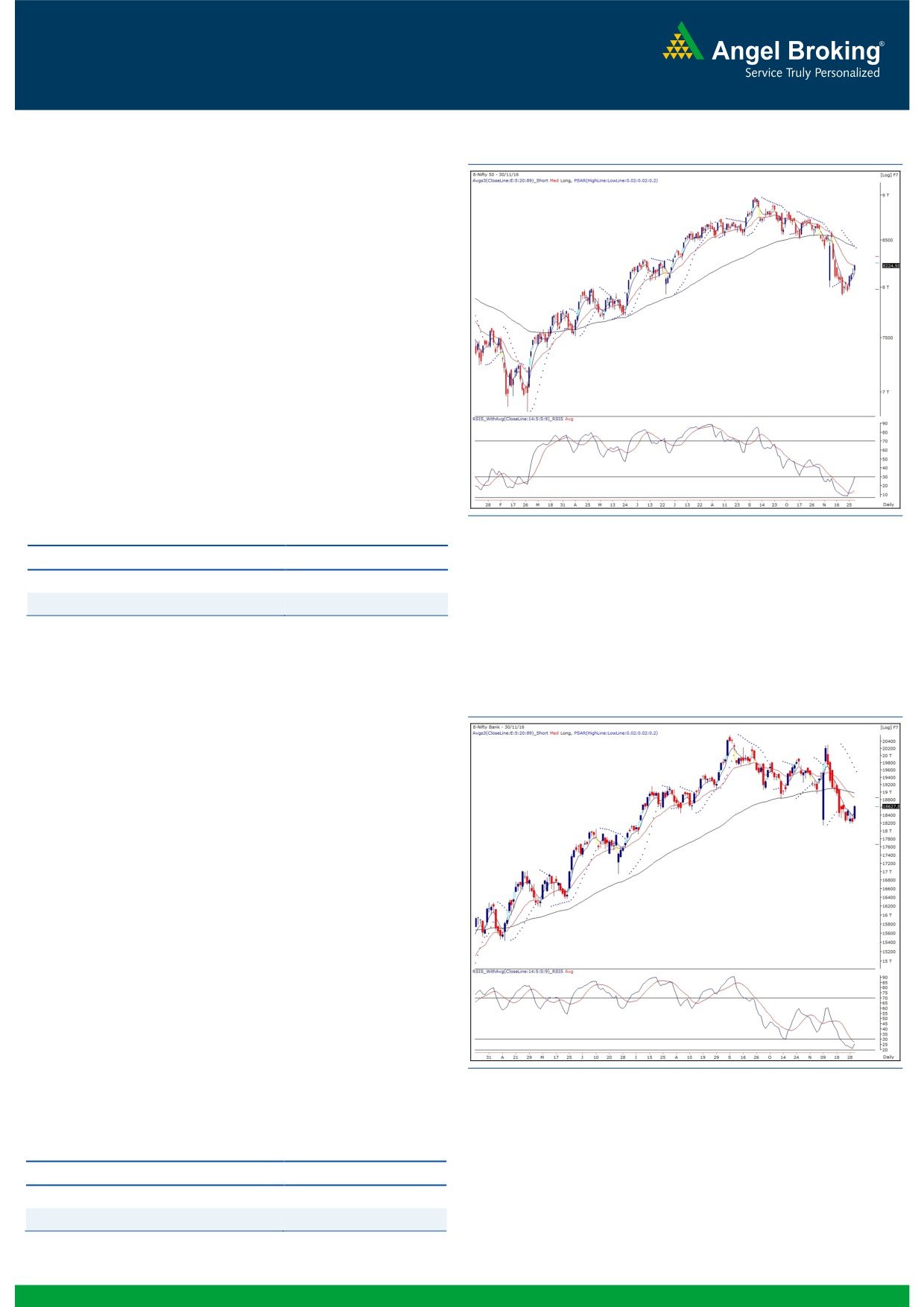

Exhibit 1: Nifty Daily Chart

Yesterday's session opened tad higher owing to positive global

cues. Subsequently, we saw a bit of tussle between market

participants during the first half. However, a sharp up move in

banking conglomerates during the second half propelled a strong

rally in our benchmark index to close convincingly above the

8200 mark.

The move has been very much on our expected lines as we have

been quite vocal on a probable bounce since last 4 - 5 trading

sessions. We expect this bounce back to extend towards 8250 -

8300 levels; whereas on the lower side, 8180 - 8150 would now

act as a strong support zone for the market. Going forward, we

expect stock specific bounce to continue in the market and hence,

traders should look for a buying opportunity in individual stocks

that have hammered down in the recent past and are trading

around their strong supports.

Key Levels

Support 1 - 8180

Resistance 1 - 8250

Support 2 - 8150

Resistance 2 - 8300

Nifty Bank Outlook - (18628)

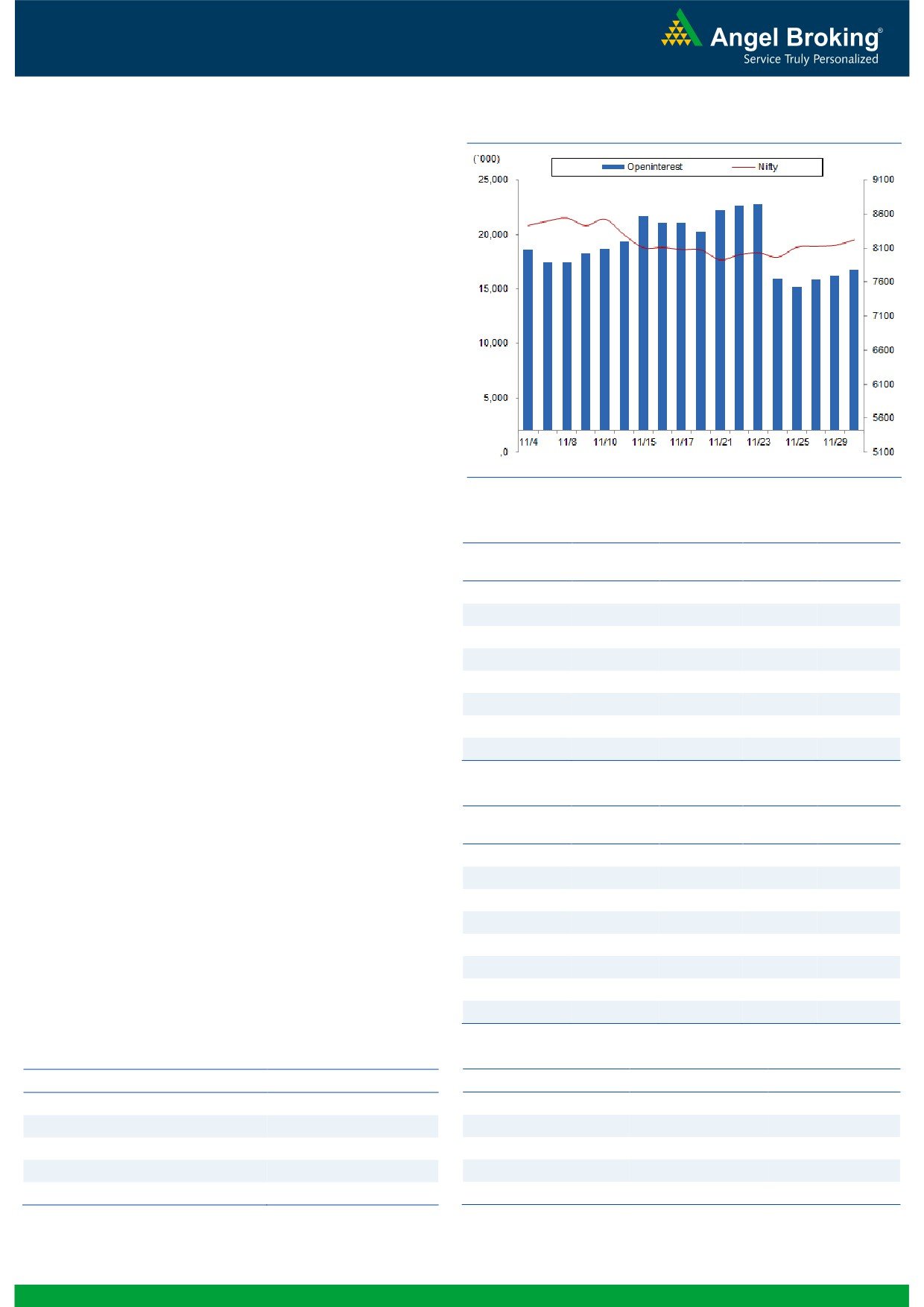

Exhibit 2: Nifty Bank Daily Chart

Yesterday, the Nifty Bank index opened with marginal gains and

started moving higher from initial trades. Due to strong

momentum in banking heavyweights, the Nifty Bank index

continued to make higher highs throughout the session.

Eventually, the index posted gains of 2.22 percent over its

previous session's close.

Since last few days, we have been mentioning about how the

‘5DEMA’ had acted as resistance in the recent corrective move in

the Nifty Bank index. In yesterday's session, the index crossed over

the mentioned average which led to a sustainable upmove during

the day. After 12 trading sessions the index has managed to close

firmly above the ‘5DEMA’. Also, the momentum readings on

lower time frame chart are indicating positive traction from the

oversold zone. This should lead to further upmove in the index

upto 18860 - 18980. Thus short term traders are advised to trade

with positive bias. The intraday supports for the index are placed

around 18450 and 18340 whereas resistances are seen around

18845 and 18960.

Key Levels

Support 1 - 18450

Resistance 1 - 18845

Support 2 - 18340

Resistance 2 - 18960

1

Technical & Derivatives Report

December 01, 2016

Comments

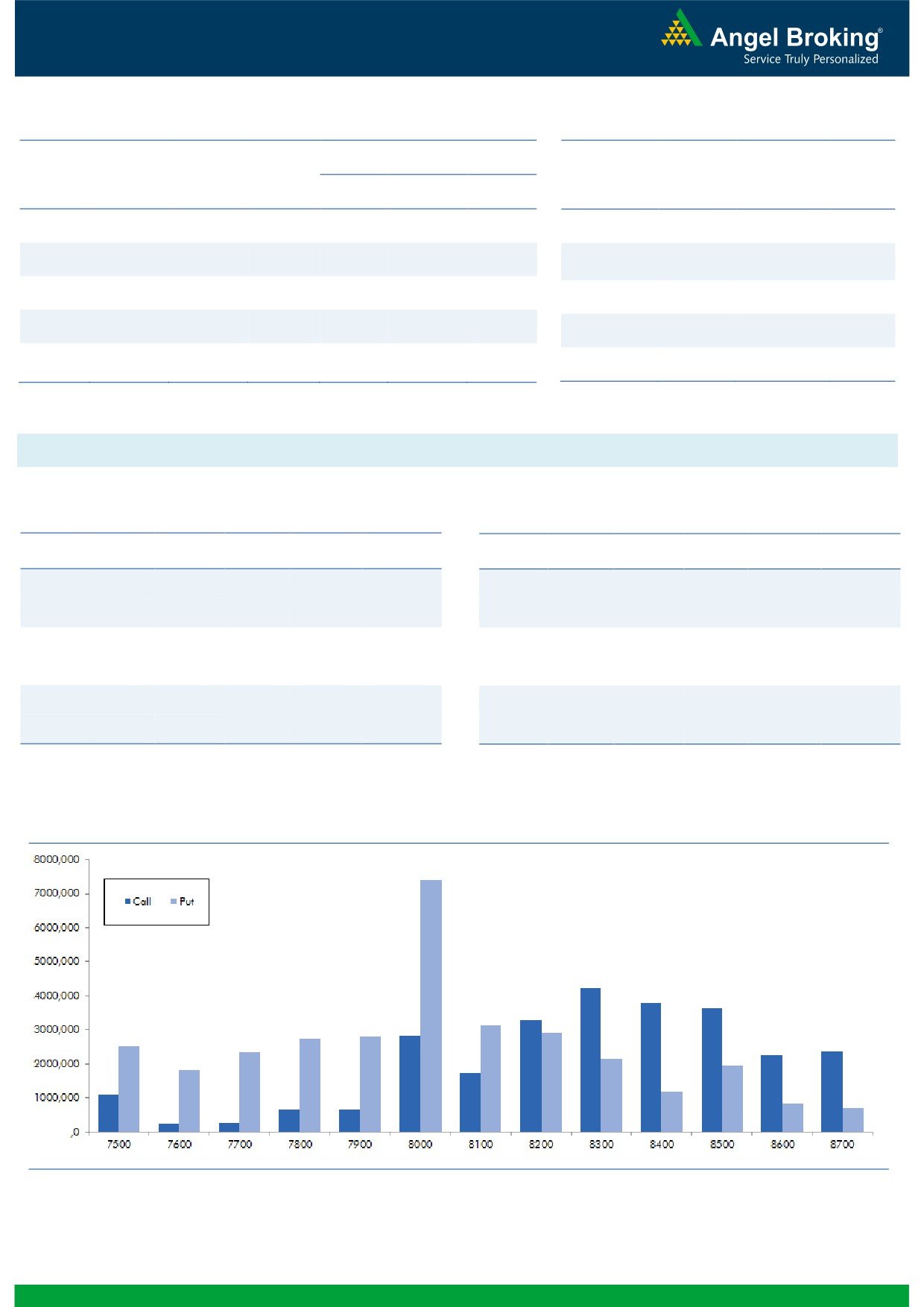

Nifty Vs OI

The Nifty futures open interest has increased by 3.61%

BankNifty futures open interest has decreased by 10.39%

as market closed at 8224.50 levels.

The Nifty December future closed with a premium of

35.85 against the premium of 29.90 points in last

trading session. The January series closed at a premium

of 70.10 points.

The Implied Volatility of at the money options has

decreased from 14.38% to 13.91%. At the same time,

the PCR-OI of Nifty has increased from 1.03 to 1.05

levels.

The total OI of the market is Rs. 2,30,457/- cr. and the

stock futures OI is Rs. 67,374/- cr.

Few of the liquid counters where we have seen high cost

of carry are CAIRN, MCLEODRUSS, SOUTHBANK, NCC

and ANDHRABANK.

OI Gainers

Views

OI

PRICE

FIIs continue selling in cash market segment to the tune

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

of Rs. 434 crores. While, in index futures, they were net

IDFCBANK

52232000

80.01

68.45

-3.46

buyers worth Rs. 659 crores with some rise in open

ULTRACEMCO

2469000

53.79

3588.15

1.79

interest, indicating fresh long formation.

TORNTPHARM

287200

30.07

1385.75

-1.28

In Index options segment, FIIs were net buyers of Rs. 481ng.com

BPCL

14870400

29.79

642.70

-0.34

crores with rise in open interest. We hardly saw any

HINDPETRO

23889600

27.83

468.40

-1.54

meaningful build-up in options front. However, 8400 call

APOLLOHOSP

574000

25.55

1201.20

-2.23

and 8100 put options were comparatively active and

OIL

1317500

16.54

421.90

1.10

they also added some positions. Highest OI in December

MRF

28635

15.14

50196.90

1.94

series is visible in 8300 call and 8000 put option.

Since past two days, we are witnessing fresh long

OI Losers

formation in Index Futures by stronger hands. While, they

OI

PRICE

continue buying in stock futures too. Yesterday, banknifty

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

bounced due to good amount of short covering. While,

HDIL

23728000

-6.88

62.25

1.47

heavy weight counters like ICICIBANK, KOTAKBANK and

ICICIBANK

58857500

-6.58

266.10

3.66

HDFCBANK also showed decent amount short covering.

GODREJIND

1281000

-6.46

389.75

1.19

Large cap counters like ULTRACEMCO, ONGC,

DHFL

15153000

-4.97

257.00

1.90

EICHERMOT, ASIANPAINT and POWERGRID added

AMBUJACEM

12885000

-4.73

211.20

2.55

fresh longs. Thus, seeing the overall activity in Index and

TATAPOWER

20349000

-4.32

74.25

2.34

Stock Futures, we believe Nifty may continue to show

AMARAJABAT

564600

-4.18

943.85

1.29

strength. Hence, traders are suggested to trade with a

ORIENTBANK

13068000

-4.10

120.45

2.99

positive bias.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

IBULHSGFIN

51.01

NIFTY

1.05

1.08

TVSMOTOR

43.25

BANKNIFTY

1.23

0.91

TORNTPOWER

34.93

SBIN

0.62

0.46

CEATLTD

53.90

RELIANCE

0.58

0.48

LT

24.39

MARUTI

1.32

0.68

2

Technical & Derivatives Report

December 01, 2016

FII Statistics for November 30, 2016

Turnover on November 30, 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2872.34

2213.79

658.55

171168

10917.20

2.83

254727

17047.55

22.27

FUTURES

FUTURES

INDEX

INDEX

32011.89

31530.98

480.91

934738

58676.42

3.18

4214418

296669.83

50.48

OPTIONS

OPTIONS

STOCK

7933.11

7562.29

370.82

844544

52214.43

2.91

STOCK

FUTURES

507839

34489.69

15.11

FUTURES

STOCK

STOCK

2485.32

2447.77

37.55

49748

3259.12

11.64

OPTIONS

221325

15572.94

4.40

OPTIONS

TOTAL

45302.66

43754.83

1547.83

2000198

125067.17

3.23

TOTAL

5198309

363780.01

42.12

Nifty Spot = 8224.50

Lot Size = 75

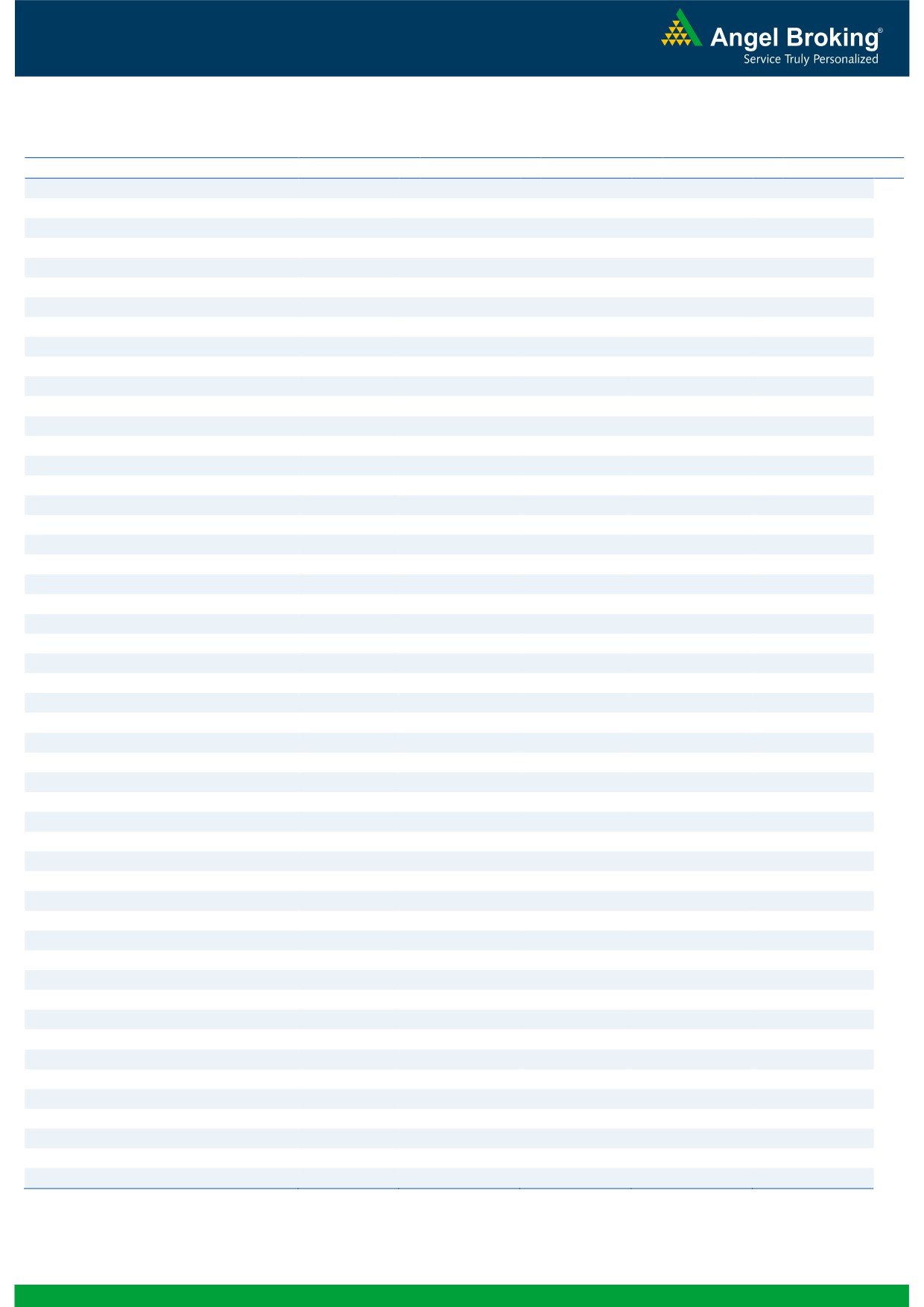

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8300

105.90

Buy

8200

107.40

42.65

57.35

8342.65

28.60

71.40

8171.40

Sell

8400

63.25

Sell

8100

78.80

Buy

8300

105.90

Buy

8200

107.40

72.05

127.95

8372.05

49.75

150.25

8150.25

Sell

8500

33.85

Sell

8000

57.65

Buy

8400

63.25

Buy

8100

78.80

29.40

70.60

8429.40

21.15

78.85

8078.85

Sell

8500

33.85

Sell

8000

57.65

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

December 01, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,309

1,325

1,340

1,357

1,372

ADANIPORTS

273

275

279

281

284

AMBUJACEM

203

207

209

213

215

ASIANPAINT

943

957

966

979

988

AUROPHARMA

730

735

742

748

755

AXISBANK

459

464

468

473

477

BAJAJ-AUTO

2,654

2,669

2,680

2,695

2,706

BANKBARODA

160

162

163

166

167

BHEL

128

129

130

131

133

BPCL

628

636

644

651

659

BHARTIARTL

322

323

325

326

328

INFRATEL

353

364

371

382

389

BOSCH

19,989

20,257

20,418

20,686

20,847

CIPLA

558

562

568

572

578

COALINDIA

302

306

308

311

314

DRREDDY

3,158

3,178

3,198

3,217

3,237

EICHERMOT

20,857

21,239

21,505

21,886

22,152

GAIL

416

421

427

431

437

GRASIM

829

850

863

883

896

HCLTECH

792

798

804

810

817

HDFCBANK

1,173

1,186

1,194

1,207

1,215

HDFC

1,223

1,243

1,258

1,278

1,292

HEROMOTOCO

3,119

3,142

3,158

3,182

3,198

HINDALCO

170

173

176

179

182

HINDUNILVR

823

833

842

853

861

ICICIBANK

252

259

263

269

273

IDEA

75

76

78

79

81

INDUSINDBK

1,041

1,064

1,080

1,103

1,119

INFY

955

965

971

981

987

ITC

227

230

232

235

237

KOTAKBANK

732

744

752

764

772

LT

1,333

1,358

1,375

1,399

1,416

LUPIN

1,467

1,486

1,516

1,536

1,566

M&M

1,171

1,178

1,188

1,195

1,205

MARUTI

5,034

5,150

5,216

5,332

5,398

NTPC

161

162

163

164

165

ONGC

279

284

288

293

296

POWERGRID

186

189

191

194

196

RELIANCE

979

984

992

998

1,006

SBIN

250

254

257

261

265

SUNPHARMA

699

704

712

717

725

TCS

2,219

2,247

2,271

2,300

2,323

TATAMTRDVR

291

294

297

300

303

TATAMOTORS

451

455

459

464

468

TATAPOWER

70

72

73

75

77

TATASTEEL

400

408

412

419

423

TECHM

477

481

485

490

494

ULTRACEMCO

3,515

3,559

3,600

3,644

3,684

WIPRO

457

461

466

470

475

YESBANK

1,132

1,153

1,167

1,188

1,202

ZEEL

445

450

456

462

468

4

Technical & Derivatives Report

December 01, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5