Technical & Derivatives Report

November 01, 2016

Sensex (27930) / Nifty (8625)

Exhibit 1: Nifty Daily Chart

The Nifty opened with upside gap on Diwali Muhurat Trading and

closed with marginal loss over its previous closing session.

It has been yet another week of uncertainty for the market as the

tussle between both counterparties (the bulls and bears) continued

for the near term dominance. A decent correction during the

midst of the week has validated our view on giving importance to

the 8745 mark. However, on the other hand, the bulls are not

willing to give up as the 8500 has been repeatedly acting a sheet

anchor since last few days. Thus, going by this price development,

it can now be concluded that the index has stuck in a range of

8745 - 8500 and only a sustainable breakout on either side

would dictate the near term trend for our market. At this juncture,

we would continue with the cautious stance as long as 8745 is not

violated convincingly. Most of the indicators are still hinting

towards a possible downside. As far as levels are concerned, a

sustainable move below 8500 would unfold lower levels of 8400

- 8287; whereas in case of an upside breakout, the cautious view

will be negated above 8745 and in this scenario, Nifty may retest

8806 - 8893 levels in the near term. Since, the market is still

lacking clear direction, we would advise traders to stay light as

long as the Nifty remains within a range and wait for a breakout

to happen from the mentioned range in order to take a direction

call on the market.

Key Levels

Support 1 - 8580

Resistance 1 - 8660

Support 2 - 8550

Resistance 2 - 8700

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (19524)

In Friday's trading session, the Nifty Bank index traded with

positive bias which was followed by a range bound session during

the Muhurat Trading on Diwali.

The recent high in the Nifty Bank index had resisted around the

61.8 percent retracement of the previous corrective move.

However, although the index corrected post that, it has not

breached the previous low. Hence, the index has managed to

form a lower top and a higher bottom in intraday charts. This

indicates higher probability of range bound trading in near term.

On a breach of the range of 19200 - 19910 will lead to next

directional move and till then, traders are advised to focus on

stock specific moves. The intraday supports for the Nifty Bank

index are placed around 19400 and 19310 whereas resistances

are seen around 19680 and 19740.

Key Levels

Support 1 - 19400

Resistance 1 - 19680

Support 2 - 19310

Resistance 2 - 19740

1

Technical & Derivatives Report

November 01, 2016

Comments

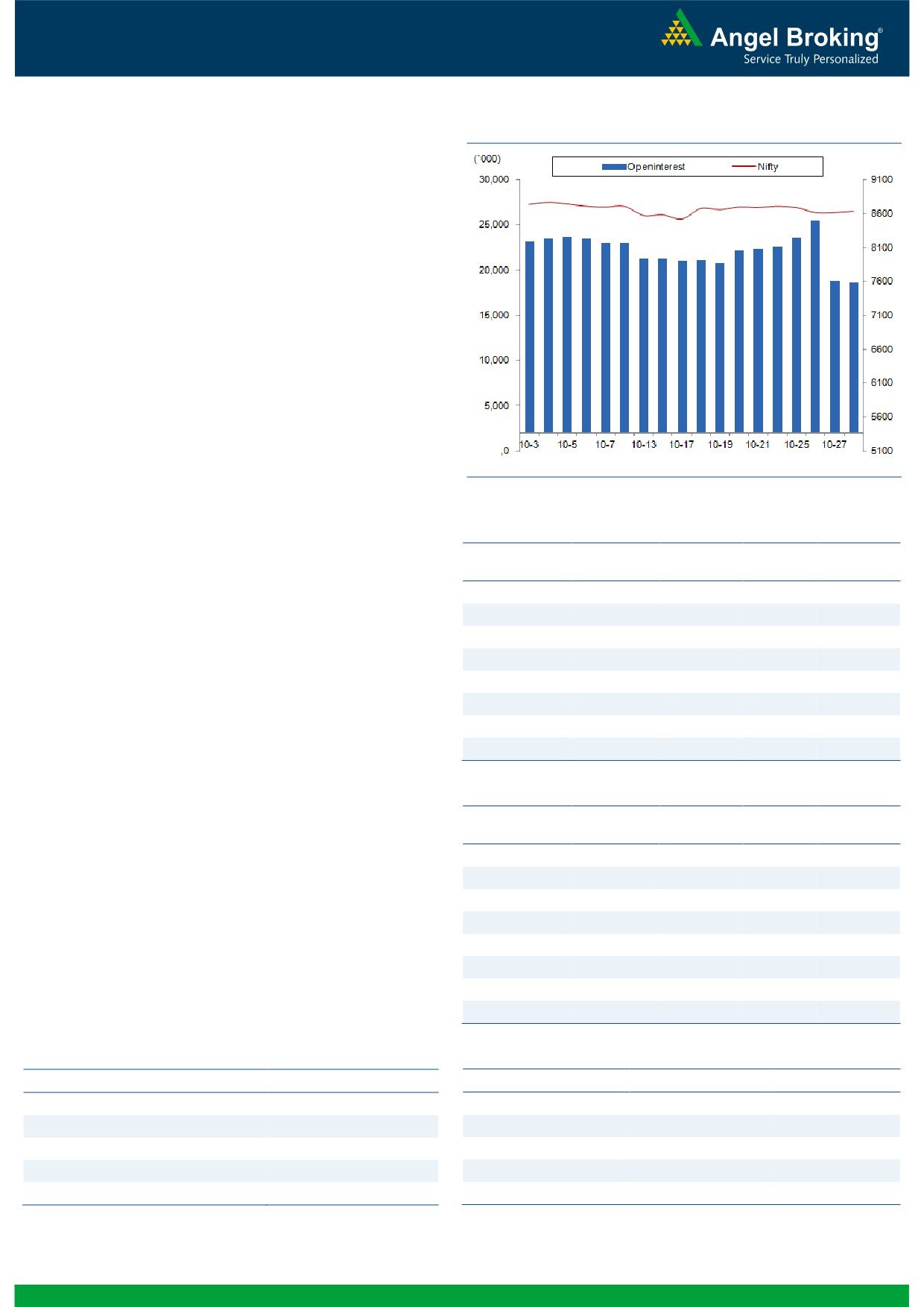

Nifty Vs OI

The Nifty futures open interest has decreased by 0.96%

BankNifty futures open interest has decreased by 0.61%

as market closed at 8638.00 levels on Friday.

The Nifty November future closed with a premium of

29.40 against the premium of 40.00 points in last

trading session. The December series closed at a

premium of 81.60 points.

The Implied Volatility of at the money options has

increased from 13.13% to 13.34%. At the same time, the

PCR-OI of Nifty has increased from 0.97 to 0.99 levels.

The total OI of the market is Rs. 2,16,117/- cr. and the

stock futures OI is Rs. 76,596/- cr.

Few of the liquid counters where we have seen high cost

of carry are TITAN, BEL, NIITTECH, TATAELXSI and

ADANIPOWER.

Views

FIIs were net seller in both equity cash and index future

OI Gainers

segment on Friday. They sold equities worth Rs. 778

OI

PRICE

SCRIP

OI

PRICE

crores. While, in index futures, they were net seller to the

CHG. (%)

CHG. (%)

tune of Rs. 1117 crores with marginal rise in open

BEL

1298250

35.07

1311.40

3.43

interest, indicating blend of long unwinding and fresh

ORIENTBANK

13398000

33.63

128.70

-2.24

short formation on Friday.

CANBK

11739000

29.74

313.00

-0.79

www.angelbroking.com

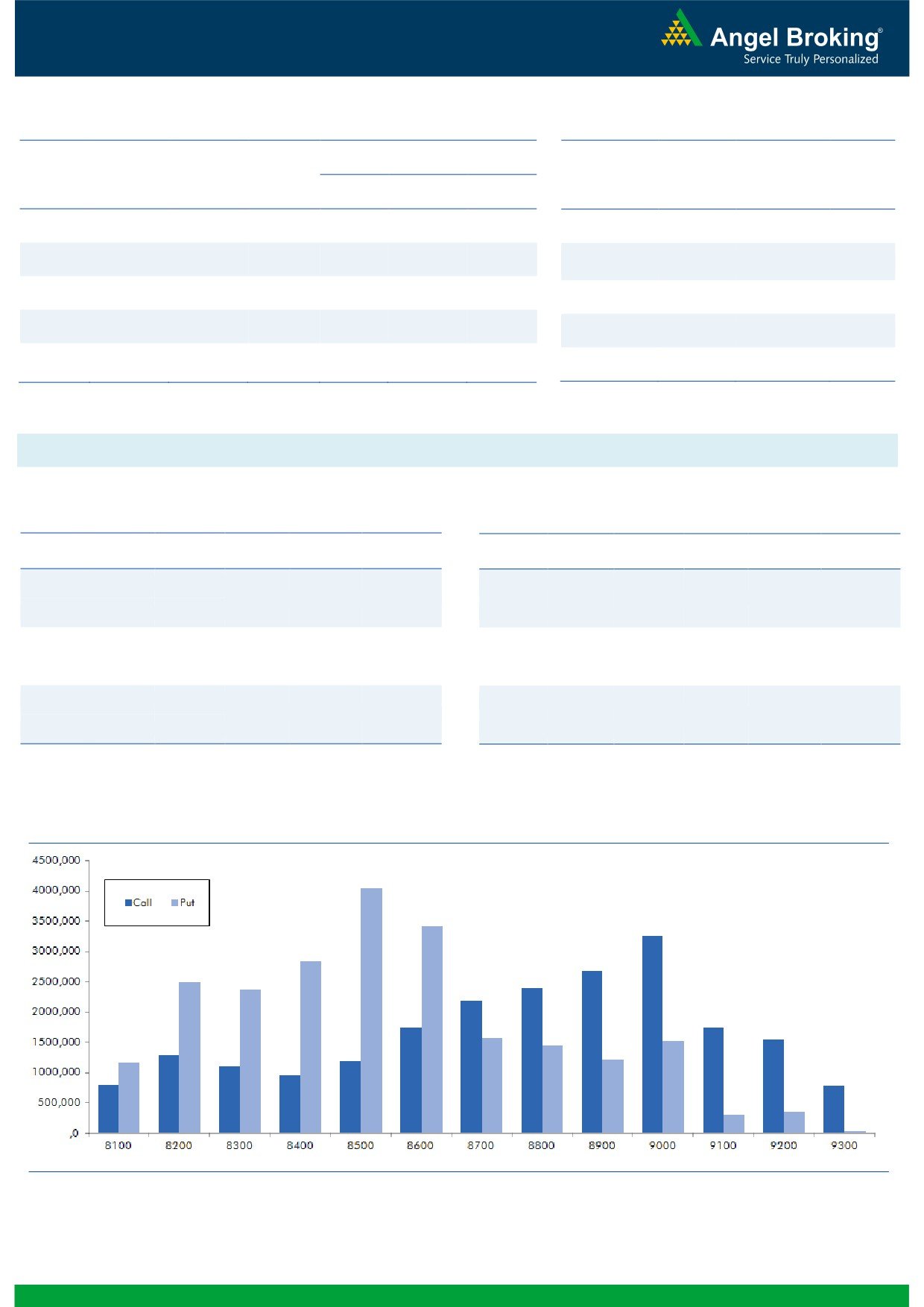

On Index Options front, FIIs bought of worth Rs. 2177

DCBBANK

1858500

25.91

131.75

2.69

crores with significant rise in OI. In call options, 9000,

TORNTPHARM

428000

15.68

1423.10

-0.89

8900 and 8700 strikes were active and added good

CAIRN

20482000

14.77

227.45

1.02

amount of build-up. On the other hand, in put options,

ASIANPAINT

5255400

14.08

1074.05

-1.54

8500 and 8600 strikes added huge positions. Data

NMDC

14400000

13.15

131.60

6.30

suggests that FIIs have added fresh long in these Puts.

Maximum OI in November series has been placed at

OI Losers

9000 call and 8500 put options.

OI

PRICE

SCRIP

OI

PRICE

November series has begun with lower open interest,

CHG. (%)

CHG. (%)

most of the long positions formed since June series have

ZEEL

9977500

-8.97

521.70

2.73

been lightened up. At current juncture, 8500 - 8550

TATACHEM

6517500

-7.06

546.10

0.72

seems to be an immediate support zone for Nifty.

HEROMOTOCO

1486200

-6.94

3366.05

0.89

Looking at the above data, we believe Nifty may breach

CROMPGREAV

10236000

-5.33

76.70

3.09

these support levels in the short run provided we see

UNIONBANK

12732000

-4.96

147.75

2.04

continuation of decent amount of fresh short formation.

OIL

1599700

-4.27

417.35

0.63

Thus, traders are suggested to avoid forming long

TORNTPOWER

1848000

-4.20

174.50

0.84

position unless we see any relevant change in derivatives

RCOM

99946000

-4.09

46.80

1.19

data.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

STAR

60.29

NIFTY

0.99

0.98

BEL

26.79

BANKNIFTY

1.02

0.84

CADILAHC

50.63

AXISBANK

0.36

0.42

NHPC

33.80

RELIANCE

0.48

0.41

TECHM

40.37

ICICIBANK

0.54

0.68

2

Technical & Derivatives Report

November 01, 2016

FII Statistics for 28, October 2016

Turnover on 28, October 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

1216.22

2333.60

(1117.38)

206540

13764.47

0.25

209203

14545.19

-57.54

FUTURES

FUTURES

INDEX

INDEX

30533.12

28356.58

2176.55

765613

50318.88

8.28

2390102

171927.06

-77.39

OPTIONS

OPTIONS

STOCK

6972.11

6198.56

773.55

854666

55751.25

4.62

STOCK

FUTURES

551098

38613.33

-68.00

FUTURES

STOCK

STOCK

2739.06

2582.65

156.41

29001

1987.45

401.49

OPTIONS

250435

18094.15

-60.68

OPTIONS

TOTAL

41460.51

39471.39

1989.12

1855820

121822.04

6.92

TOTAL

3400838

243179.73

-74.70

Nifty Spot = 8638.00 (Friday’s close)

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

108.00

Buy

8600

100.65

43.70

56.30

8743.70

30.50

69.50

8569.50

Sell

8800

64.30

Sell

8500

70.15

Buy

8700

108.00

Buy

8600

100.65

73.60

126.40

8773.60

53.05

146.95

8546.95

Sell

8900

34.40

Sell

8400

47.60

Buy

8800

64.30

Buy

8500

70.15

29.90

70.10

8829.90

22.55

77.45

8477.45

Sell

8900

34.40

Sell

8400

47.60

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

Note : All Derivative data and levels are as per Friday’s close.

3

Technical & Derivatives Report

November 01, 2016

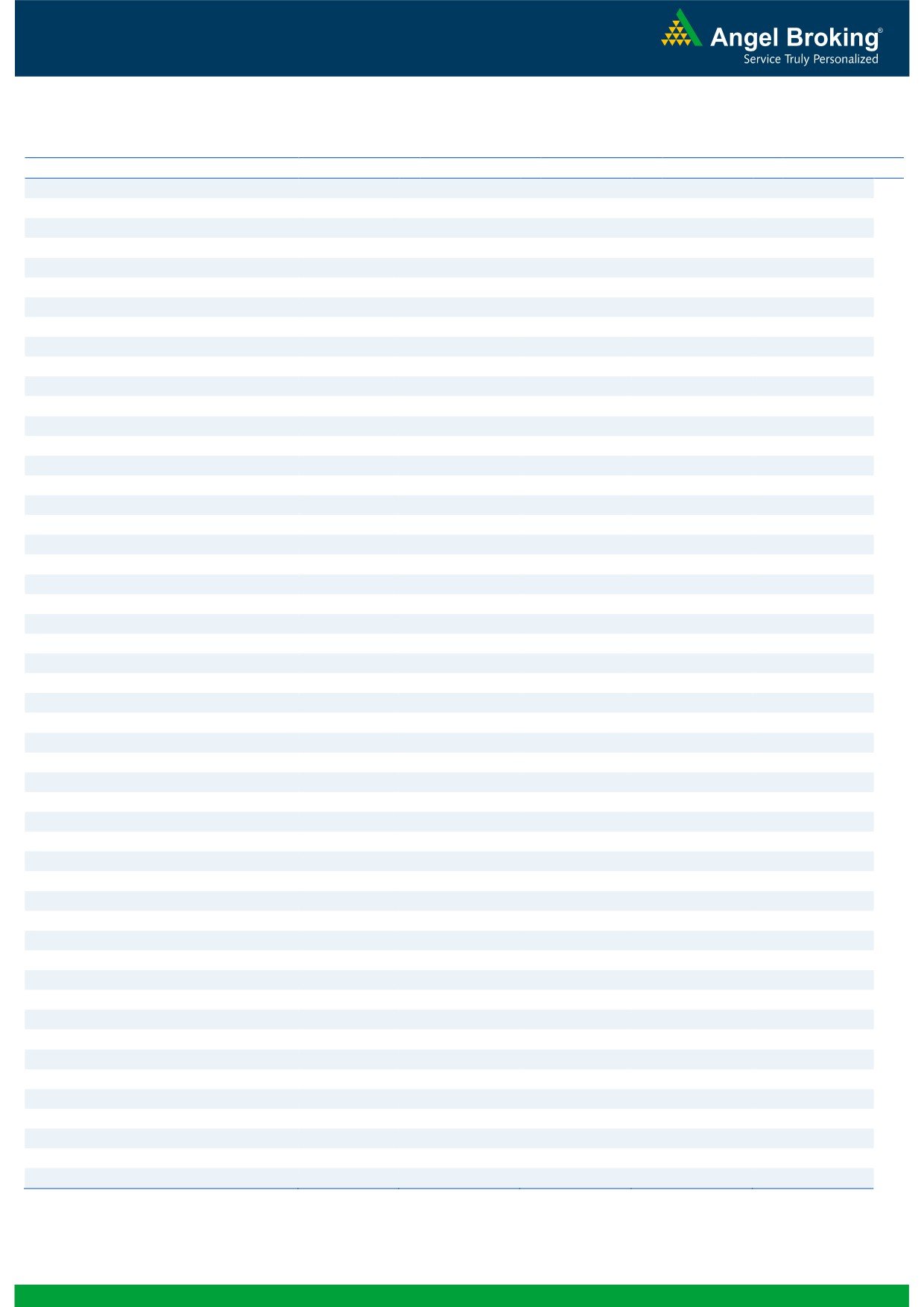

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,495

1,504

1,518

1,528

1,542

ADANIPORTS

299

303

306

310

314

AMBUJACEM

239

240

242

243

244

ASIANPAINT

1,047

1,058

1,078

1,089

1,109

AUROPHARMA

788

800

813

825

838

AXISBANK

479

483

489

492

498

BAJAJ-AUTO

2,729

2,792

2,825

2,888

2,920

BANKBARODA

152

154

155

158

159

BHEL

137

138

139

140

141

BPCL

660

665

671

675

681

BHARTIARTL

315

317

320

322

325

INFRATEL

334

340

349

355

364

BOSCH

21,424

21,630

22,005

22,211

22,587

CIPLA

565

569

578

582

591

COALINDIA

311

318

323

329

334

DRREDDY

3,274

3,315

3,357

3,398

3,440

EICHERMOT

23,019

23,484

24,141

24,607

25,264

GAIL

427

431

433

437

439

GRASIM

938

952

966

980

994

HCLTECH

748

756

769

777

790

HDFCBANK

1,232

1,245

1,254

1,267

1,275

HDFC

1,352

1,372

1,382

1,402

1,413

HEROMOTOCO

3,287

3,316

3,345

3,374

3,403

HINDALCO

147

148

149

151

152

HINDUNILVR

826

832

839

845

852

ICICIBANK

271

274

278

281

285

IDEA

74

75

77

78

80

INDUSINDBK

1,161

1,181

1,191

1,211

1,221

INFY

983

990

1,000

1,007

1,017

ITC

237

240

242

245

247

KOTAKBANK

792

806

814

828

836

LT

1,454

1,468

1,476

1,489

1,498

LUPIN

1,472

1,484

1,494

1,506

1,516

M&M

1,282

1,298

1,307

1,323

1,331

MARUTI

5,827

5,851

5,890

5,914

5,953

NTPC

148

150

152

155

157

ONGC

280

284

289

292

298

POWERGRID

170

173

175

178

180

RELIANCE

1,038

1,047

1,052

1,061

1,066

SBIN

252

255

257

260

262

SUNPHARMA

736

740

746

750

756

TCS

2,374

2,386

2,401

2,413

2,428

TATAMTRDVR

330

339

345

354

360

TATAMOTORS

519

528

534

543

549

TATAPOWER

76

77

79

80

83

TATASTEEL

394

400

403

409

412

TECHM

421

428

436

443

451

ULTRACEMCO

3,853

3,916

3,953

4,016

4,053

WIPRO

449

455

461

468

473

YESBANK

1,248

1,260

1,269

1,280

1,289

ZEEL

497

509

516

527

534

4

Technical & Derivatives Report

November 01, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5