Technical & Derivatives Report

August 01, 2016

Sensex (28052) / Nifty (8639)

Exhibit 1: Nifty Hourly Chart

The Nifty continued with its uptrend in the week gone by and

tested the 8655 mark, which was on our expected lines. If we

observe the daily chart meticulously, the last three weeks’ up

move in the index has led to a formation of a ‘Rising Wedge’

pattern. Such a pattern is usually formed at the end of an uptrend

and a breakdown of the same generally leads to a reversal in the

trend. However, on this occasion, even in case of a confirmation

of this pattern, we still do not expect any trend reversal. On the

contrary, we would rather look at it as just a loss of momentum in

the ongoing optimism. Traders however should not pre-empt any

reversal as other technical indicators have not shown any

divergence from the broader uptrend. Thus, going by the Dow

Theory tenet - “Trend is your friend”, positional traders should

continue to trade with a positive bias until there is a pronounced

confirmation of the trend reversal supported by a wider number

of indicators.

In the near term, the immediate support for the Nifty is placed

around 8572 and only its breach could possibly result in a loss

in the upward momentum. In the last three trading sessions, the

bulls have vehemently tried to surpass the 8675 mark on the

Nifty. We see a higher probability of the index surpassing the

mark and reaching its next resistance zone of 8750 - 8800.

Key Levels

Support 1 - 8600

Resistance 1 - 8675

Support 2 - 8572

Resistance 2 - 8750

Nifty Bank Outlook - (18953)

Exhibit 2: Nifty Bank Daily Chart

In Friday's trading session, the Nifty index opened marginally

higher. However, the bulls were unable to continue the previous

day's momentum and the index ended the session with loss of

0.56 percent over its previous day's close.

The up move of last three weeks in the Nifty Bank index too has

led to formation of a 'Rising Wedge' pattern on the daily charts.

However, other technical indicator are in sync with the broader

uptrend and hence, traders are advise not to pre-empt any

reversal unless there is confirmation of the same. In near tern, the

support for the index is placed around 18800 and only breach of

this support will lead to loss of the ongoing positive momentum.

Till then, traders are advise to trade with positive bias and trade

on stock specific opportunities with proper risk management. The

near term support for the index is placed around 18800 and

18690 whereas resistances are seen around 19158 and 19229.

Key Levels

Support 1 - 18800

Resistance 1 - 19158

Support 2 - 18690

Resistance 2 - 19229

1

Technical & Derivatives Report

August 01, 2016

Comments

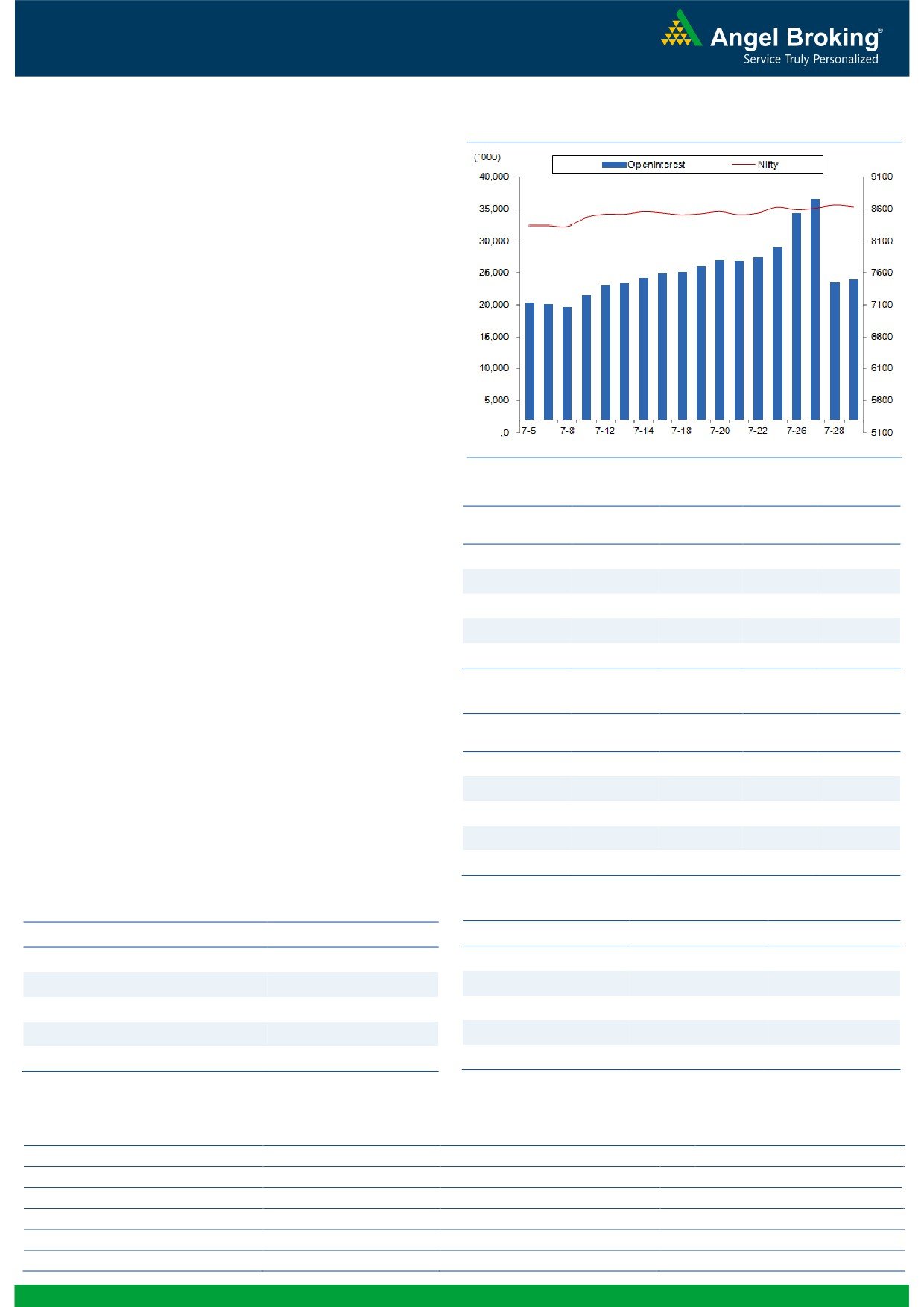

Nifty Vs OI

The Nifty futures open interest has increased by 1.81%

BankNifty futures open interest has increased by 1.79%

as market closed at 8638.50 levels.

The Nifty August future closed with a premium of 48.10

points against a premium of 35.60 points in previous

session. The September series closed at a premium of

96.65 points.

The Implied Volatility of at the money options has

decreased from 13.84% to 13.75%.

The total OI of the market is Rs. 2,06,385/- cr. and the

stock futures OI is Rs. 68,427/- cr.

Few of the liquid counters where we have seen high cost

of carry are TV18BRDCST, PTC, ARVIND, JSWENERGY

and ICIL.

Views

OI Gainers

FIIs activity in cash market segment remained subdued.

OI

PRICE

While, they were marginal buyers of Rs. 85 crores in

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Index Futures with rise in open interest, suggesting blend

AMARAJABAT

685800

22.64

943.30

4.60

of long and short formation in last trading session.

WOCKPHARMA

2755200

18.66

1015.80

1.75

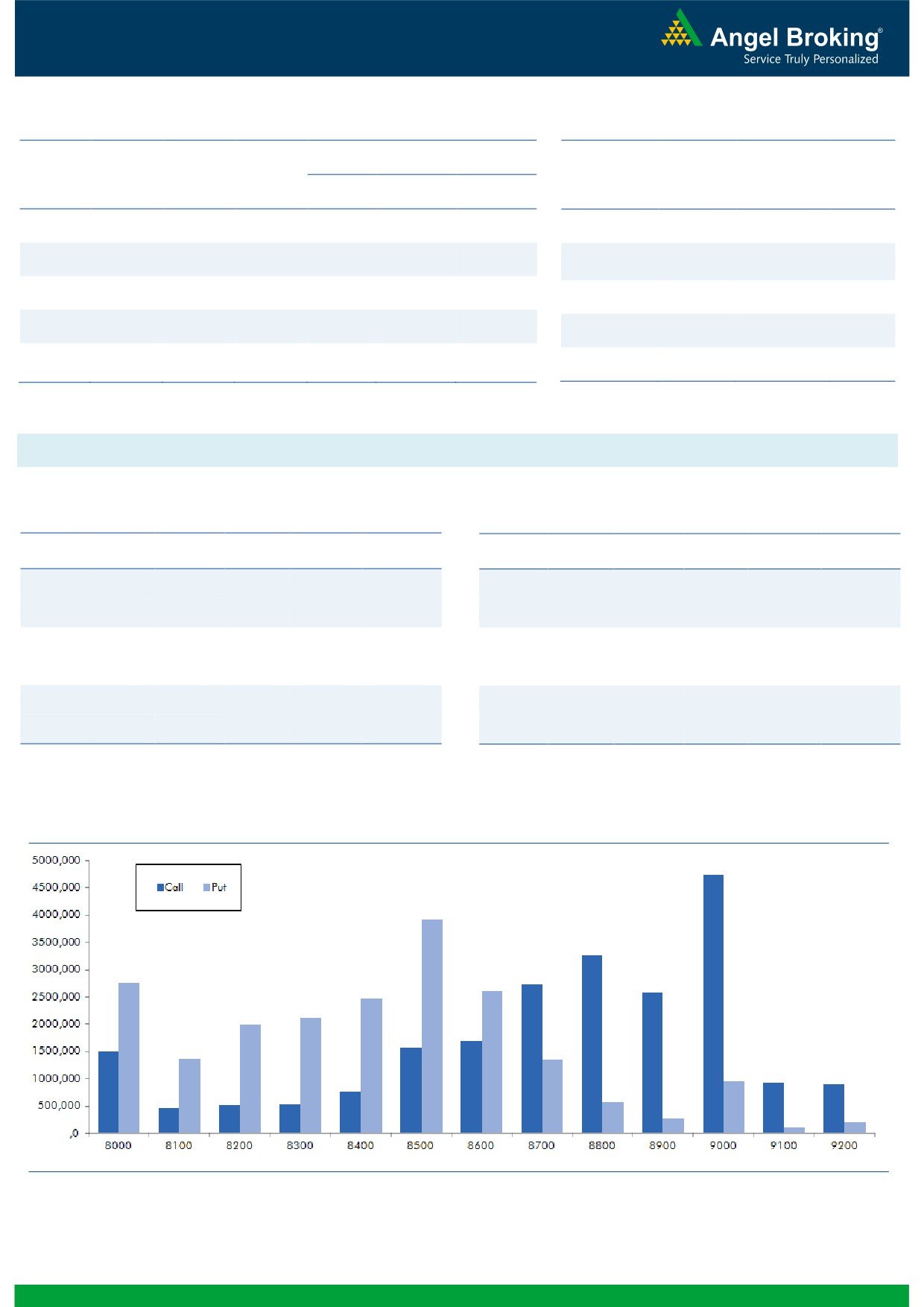

In Index Options segment, FIIs bought significantly of

LT

6402500

18.31

1551.25

-1.07

worth Rs. 1393 crores with rise in OI. In call options,

8700-9000 strikes were active and they also added

PIDILITIND

1875000

15.17

735.55

-2.92

some fresh open interest. On the other hand in put

CONCOR

423000

14.63

1512.30

2.28

options, some build-up was visible in 8600 and 8700

strike. Highest buildup in August series is placed at 9000

OI Losers

call and 8500 put options.

OI

PRICE

SCRIP

OI

PRICE

Rollover in Nifty is on the lower side in terms of

CHG. (%)

CHG. (%)

percentage; but, is high if open interest is considered.

M&MFIN

13237500

-5.16

332.50

2.81

Last series we saw huge long formation and we believe

BEML

1022500

-4.71

1016.45

0.47

some longs are still intact. Seeing the above data, we

KOTAKBANK

6736000

-4.33

766.75

1.81

believe we may see Nifty testing 8750-8800 levels.

HAVELLS

4310000

-3.97

390.85

2.08

Traders are suggested to start booking profits near these

ANDHRABANK

15170000

-3.74

60.35

0.75

levels.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

DISHTV

57.90

NIFTY

0.94

1.01

EICHERMOT

39.02

BANKNIFTY

0.85

0.92

AMARAJABAT

33.85

ICICIBANK

0.55

0.59

BATAINDIA

33.97

LT

0.77

0.74

RELINFRA

44.61

DRREDDY

0.24

0.30

Strategy Date

Symbol

Strategy

Status

2

Technical & Derivatives Report

August 01, 2016

FII Statistics for 29-July 2016

Turnover on 29-July 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2058.52

1973.91

84.61

285472

18895.42

1.25

161086

11039.23

-60.49

FUTURES

FUTURES

INDEX

INDEX

22104.82

20711.96

1392.87

758213

49449.35

7.18

1600023

110550.26

-81.12

OPTIONS

OPTIONS

STOCK

5008.79

5874.63

(865.84)

777349

50757.02

2.18

STOCK

FUTURES

571069

40184.91

-61.31

FUTURES

STOCK

STOCK

2609.15

2602.00

7.15

21974

1457.39

1149.23

OPTIONS

260001

18687.92

-55.95

OPTIONS

TOTAL

31781.28

31162.49

618.79

1843008

120559.18

5.20

TOTAL

2592179

180462.33

-76.25

Nifty Spot = 8638.50

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8700

122.15

Buy

8700

135.00

44.15

55.85

8744.15

41.45

58.55

8658.55

Sell

8800

78.00

Sell

8600

93.55

Buy

8700

122.15

Buy

8700

135.00

76.10

123.90

8776.10

71.75

128.25

8628.25

Sell

8900

46.05

Sell

8500

63.25

Buy

8800

78.00

Buy

8600

93.55

31.95

68.05

8831.95

30.30

69.70

8569.70

Sell

8900

46.05

Sell

8500

63.25

Note: Above mentioned Bullish or Bearish Spreads in Nifty (August Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

August 01, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,638

1,664

1,691

1,716

1,743

ADANIPORTS

223

228

231

235

238

AMBUJACEM

266

269

272

274

278

ASIANPAINT

1,083

1,098

1,118

1,134

1,153

AUROPHARMA

773

782

790

800

808

AXISBANK

538

542

547

551

556

BAJAJ-AUTO

2,631

2,666

2,695

2,730

2,759

BANKBARODA

149

150

153

154

157

BHEL

143

144

147

148

151

BPCL

576

585

591

599

605

BHARTIARTL

353

358

365

369

376

INFRATEL

387

391

396

401

406

BOSCH

24,565

24,771

24,956

25,162

25,347

CIPLA

512

520

528

535

543

COALINDIA

322

325

330

332

337

DRREDDY

2,894

2,915

2,946

2,967

2,998

EICHERMOT

21,168

21,815

22,167

22,814

23,166

GAIL

376

379

383

386

390

GRASIM

4,803

4,849

4,883

4,929

4,963

HCLTECH

740

746

752

759

765

HDFCBANK

1,229

1,237

1,244

1,252

1,259

HDFC

1,350

1,362

1,385

1,397

1,420

HEROMOTOCO

3,138

3,171

3,207

3,240

3,276

HINDALCO

130

132

134

135

137

HINDUNILVR

894

908

917

931

939

ICICIBANK

256

260

265

269

275

IDEA

103

104

105

106

107

INDUSINDBK

1,160

1,168

1,176

1,184

1,193

INFY

1,062

1,068

1,072

1,078

1,083

ITC

248

250

253

256

259

KOTAKBANK

743

753

760

770

777

LT

1,524

1,541

1,567

1,585

1,611

LUPIN

1,685

1,712

1,731

1,759

1,777

M&M

1,439

1,453

1,466

1,480

1,494

MARUTI

4,664

4,711

4,767

4,814

4,871

NTPC

156

157

158

160

161

ONGC

217

219

221

223

226

POWERGRID

173

175

176

177

179

RELIANCE

1,005

1,010

1,018

1,023

1,031

SBIN

226

228

230

232

234

SUNPHARMA

811

820

830

840

849

TCS

2,582

2,601

2,618

2,636

2,654

TATAMTRDVR

317

320

326

329

335

TATAMOTORS

496

499

505

509

514

TATAPOWER

70

71

72

73

74

TATASTEEL

347

351

355

359

363

TECHM

479

483

487

492

495

ULTRACEMCO

3,640

3,679

3,709

3,748

3,779

WIPRO

537

541

547

551

557

YESBANK

1,194

1,205

1,221

1,232

1,248

ZEEL

471

484

492

505

514

4

Technical & Derivatives Report

August 01, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

5