Technical & Derivatives Report

June 01, 2016

Sensex (26668) / Nifty (8160)

Exhibit 1: Nifty Daily Chart

Yesterday too, our markets opened with a modest upside gap

citing to positive cues from the Asian peers. However, this lead

was very short lived as the index corrected a bit from the early

morning high and then continued with its mildly negative bias to

end the session with a nominal loss of 0.22% over its previous

close.

It was clearly yet another day of consolidation after witnessing a

sharp rally during the second half of the previous week. Since

there is no major change in the chart structure; our view remains

unchanged. We reiterate that in case of any minor intraday dips,

traders should look to go long as we expect upward bias to

continue in the forthcoming days as well. We would like to keep

highlighting one key point, the market has entered a strong

bullish zone and thus, traders should now look at the support

levels rather than finding resistances. The immediate support is at

8140 - 8120 and intraday resistances at 8220 - 8250.

Key Levels

Support 1 - 8140

Resistance 1 - 8220

Support 2 - 8120

Resistance 2 - 8250

Exhibit 2: Nifty Bank Daily Chart

Nifty Bank Outlook - (17621)

Yet another session, the Nifty Bank index traded in a narrow

range; but showed its outperformance over the benchmark index

by concluding the session in the positive territory with a gain of

0.57%.

In last two sessions, the index has traded in a narrow range which

just seems to be a breather within the short term uptrend. The

index has formed a 'Dragon Fly Doji' candle on daily charts,

which could act as a reversal pattern if the low of the candle

(17462) is broken. However, looking at the ongoing momentum

in the stocks within the sector, we are not expecting any reversal

or major correction from current levels. Hence, traders are

advised not to short the index and continue to hold the long

positions. The near term support for the index is placed around

17462 and 17370; whereas, resistances are seen around 17780

and 18050.

Key Levels

Support 1 - 17462

Resistance 1 - 17780

Support 2 - 17370

Resistance 2 - 18050

1

Technical & Derivatives Report

June 01, 2016

Comments

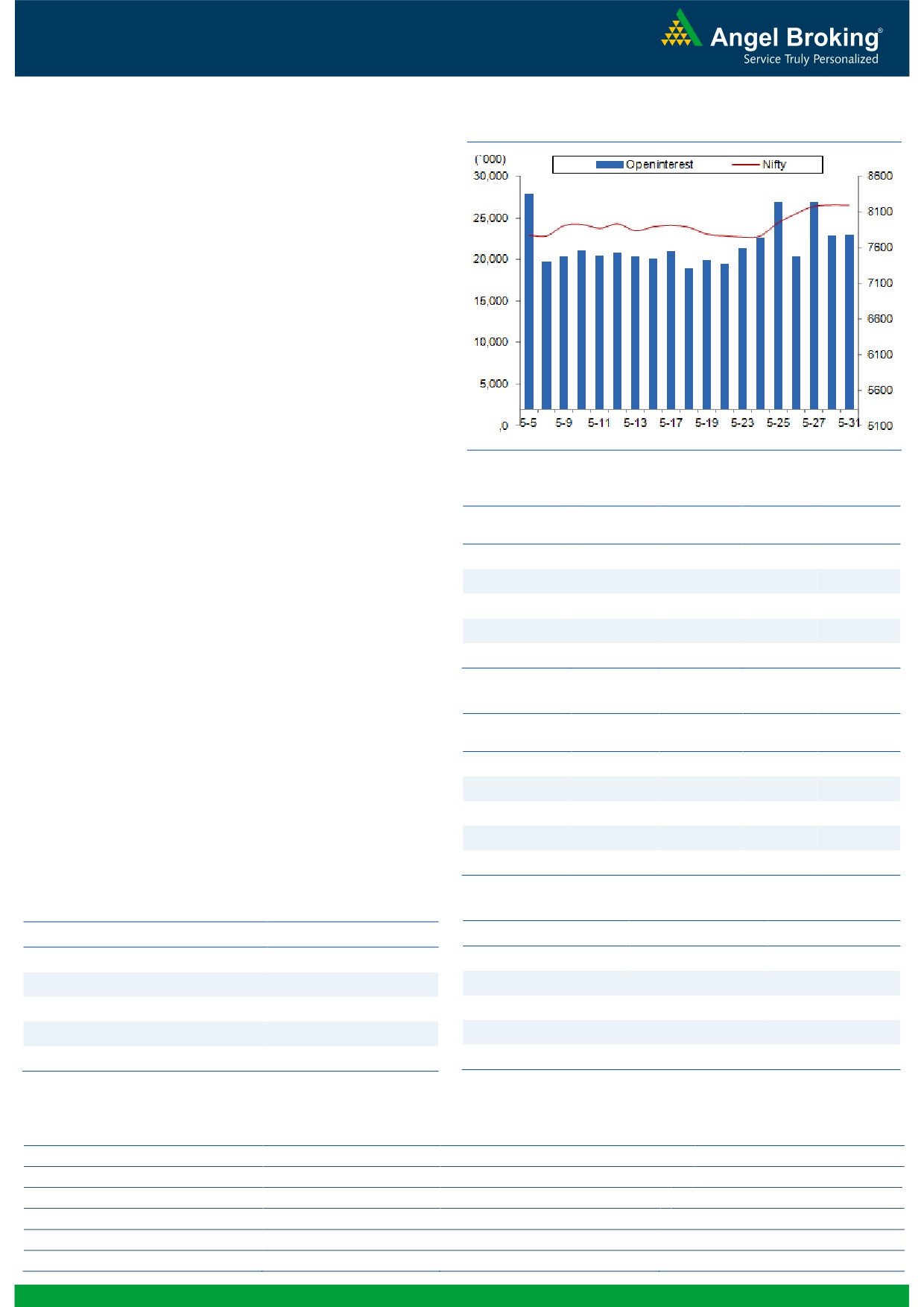

Nifty Vs OI

The Nifty futures open interest has increased by 0.28%

BankNifty futures open interest has decreased by 0.53%

as market closed at 8160.10 levels.

The Nifty June future closed with a premium of 30.80

points against a premium of 15.80 points in previous

session. The July series closed at a premium of 51.40

points.

The Implied Volatility of at the money options has

increased from 14.18% to 14.24%.

The total OI of the market is Rs. 1,97,682/- cr. and the

stock futures OI is Rs. 61,205/- cr.

Few of the liquid counters where we have seen high cost

of carry are JPASSOCIAT, UNITECH, IFCI, PTC and

INDIACEM.

Views

OI Gainers

FIIs sold marginally in cash market segment yesterday. In

OI

PRICE

Index Futures, they were net buyers of Rs. 599 crores with

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

fall in OI, indicating covering of shorts formed earlier in

HAVELLS

5098000

55.71

364.50

-2.62

last trading session.

BAJFINANCE

602250

47.57

7588.80

-0.63

In Index Options front, FIIs were marginal sellers with rise

TITAN

10117500

40.37

360.50

-1.29

in open interest. Overall activity in Nifty options segment

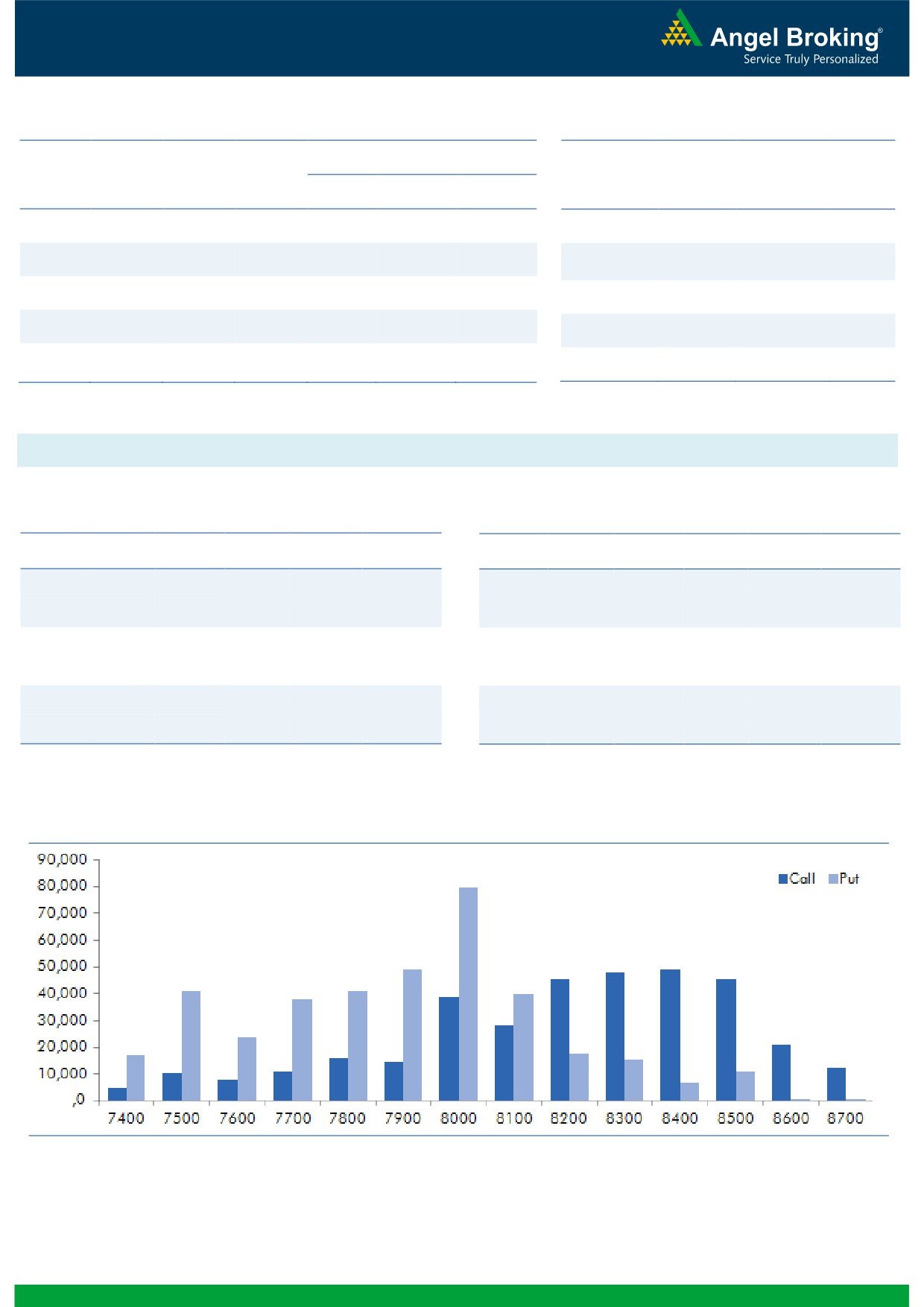

remained subdued, 8500 call and 8000 put options

UBL

3331500

27.89

725.60

1.64

were active and they also added some build-up.

RCOM

114102000

16.68

46.95

-3.85

Maximum build-up in June series has shifted from 8200

to 8400 call options and of put options is intact at 8000

OI Losers

strike. We believe 8000 levels may now act as a very

OI

PRICE

SCRIP

OI

PRICE

strong support zone. FIIs have been buying in Index

CHG. (%)

CHG. (%)

Futures since last 3-4 trading session, we believe one

BATAINDIA

1330700

-11.03

572.40

0.70

should trade with positive bias. Large cap counters like

BHARTIARTL

20858400

-9.78

351.40

-0.52

TATAMOTORS, YESBANK, SBIN and TATASTEEL added

SRF

607200

-7.94

1297.10

-0.45

good amount of fresh longs. While HCLTECH,

TATAMTRDVR

16900800

-5.44

314.50

11.51

SUNPHARMA, POWERGRID and BPCL from front line

MOTHERSUMI

10620000

-5.26

284.75

0.32

added shorts in yesterday’s trading session.

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

TATAMTRDVR

64.50

NIFTY

1.02

0.93

TATAMOTORS

57.64

BANKNIFTY

1.09

0.97

SUNPHARMA

46.10

SBIN

1.04

0.52

JISLJALEQS

41.27

ICICIBANK

0.59

0.43

GLENMARK

26.86

RELIANCE

0.80

0.51

Strategy Date

Symbol

Strategy

Status

May 30, 2016

TCS

Ratio Bull Call Spread

Active

2

Technical & Derivatives Report

June 01, 2016

FII Statistics for 31-May 2016

Turnover on 31-May 2016

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Contracts

( in Cr. )

(%)

Contracts

Change (%)

(in Cr.)

INDEX

INDEX

2939.49

2340.69

598.80

288563

17398.05

(2.38)

241248

14029.47

25.38

FUTURES

FUTURES

INDEX

INDEX

20768.31

20831.65

(63.34)

848308

51512.14

2.24

1917347

115097.85

6.65

OPTIONS

OPTIONS

STOCK

9428.14

9681.99

(253.86)

1020824

50666.28

2.70

STOCK

FUTURES

739722

38843.40

43.79

FUTURES

STOCK

STOCK

3269.50

3319.47

(49.97)

56678

2964.75

18.86

OPTIONS

343719

18606.44

16.87

OPTIONS

TOTAL

36405.44

36173.81

231.63

2214373

122541.22

2.19

TOTAL

3242036

186577.16

15.14

Nifty Spot = 8160.10

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8200

126.65

Buy

8200

138.05

46.30

53.70

8246.30

39.25

60.75

8160.75

Sell

8300

80.35

Sell

8100

98.80

Buy

8200

126.65

Buy

8200

138.05

79.00

121.00

8279.00

68.35

131.65

8131.65

Sell

8400

47.65

Sell

8000

69.70

Buy

8300

80.35

Buy

8100

98.80

32.70

67.30

8332.70

29.10

70.90

8070.90

Sell

8400

47.65

Sell

8000

69.70

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

3

Technical & Derivatives Report

June 01, 2016

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,507

1,518

1,532

1,543

1,557

ADANIPORTS

183

188

191

196

199

AMBUJACEM

224

226

230

232

235

ASIANPAINT

972

979

987

993

1,002

AUROPHARMA

745

765

780

800

816

AXISBANK

507

511

515

519

523

BAJAJ-AUTO

2,582

2,600

2,621

2,639

2,660

BANKBARODA

134

139

141

145

148

BHEL

117

119

121

123

125

BPCL

953

967

987

1,001

1,021

BHARTIARTL

342

347

352

357

362

INFRATEL

363

369

378

384

393

BOSCH

21,622

21,985

22,263

22,626

22,904

CIPLA

466

469

474

478

483

COALINDIA

284

288

292

295

299

DRREDDY

3,142

3,163

3,181

3,201

3,219

EICHERMOT

17,956

18,221

18,535

18,800

19,114

GAIL

360

365

373

378

386

GRASIM

4,287

4,322

4,351

4,386

4,415

HCLTECH

726

733

743

750

760

HDFCBANK

1,173

1,178

1,182

1,186

1,190

HDFC

1,211

1,224

1,236

1,250

1,261

HEROMOTOCO

3,039

3,069

3,099

3,129

3,159

HINDALCO

100

103

105

108

110

HINDUNILVR

836

842

851

857

866

ICICIBANK

237

241

245

249

253

IDEA

110

112

114

117

119

INDUSINDBK

1,090

1,096

1,102

1,108

1,114

INFY

1,224

1,236

1,251

1,264

1,279

ITC

343

347

353

357

363

KOTAKBANK

735

741

745

751

756

LT

1,456

1,465

1,476

1,485

1,496

LUPIN

1,446

1,460

1,478

1,492

1,509

M&M

1,296

1,309

1,327

1,340

1,358

MARUTI

4,007

4,084

4,132

4,209

4,257

NTPC

136

139

144

147

152

ONGC

206

209

212

214

218

POWERGRID

148

149

151

152

153

RELIANCE

946

952

962

968

979

SBIN

193

199

202

208

212

SUNPHARMA

730

746

773

789

816

TCS

2,508

2,539

2,593

2,624

2,678

TATAMTRDVR

291

303

310

322

329

TATAMOTORS

437

448

457

468

476

TATAPOWER

72

73

74

75

76

TATASTEEL

313

324

331

341

348

TECHM

530

535

542

547

553

ULTRACEMCO

3,185

3,206

3,228

3,249

3,271

WIPRO

538

542

547

551

556

YESBANK

1,007

1,020

1,033

1,046

1,059

ZEEL

433

438

444

449

454

4

Technical & Derivatives Report

June 01, 2016

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

5