Technical Report

Date : 29/11/2010

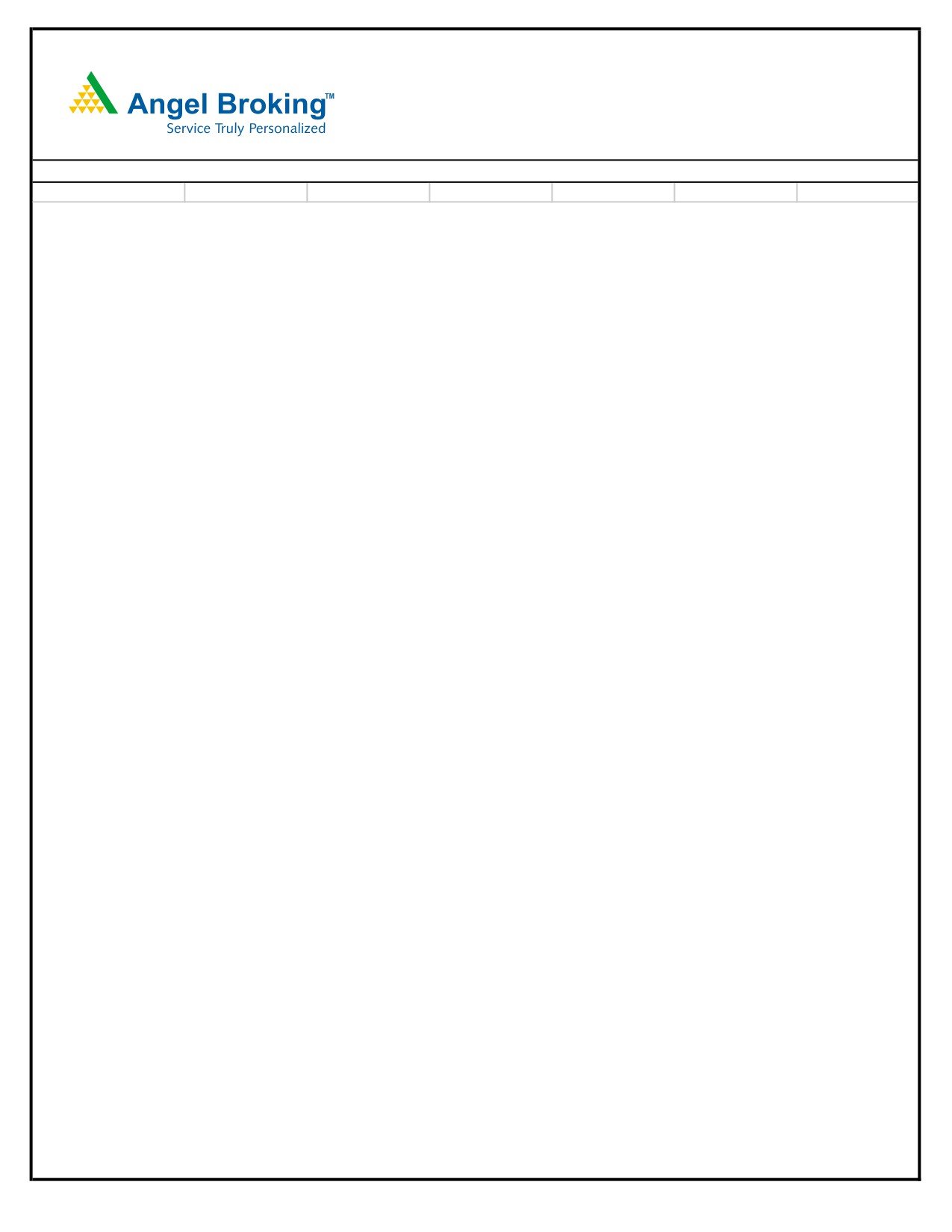

Market Summary

Indices

Top 5 Gainers

Top 5 Losers

Sectoral Watch

Nifty

Sensex

Stocks

% Gain

Stocks

% Loss

Sector

% G / L

Open

5829

19392

SAIL

3.50

JPASSOCIAT

7.42

REALTY

(4.68)

High

5839

19418

CIPLA

2.38

RELINFRA

6.79

CD

(3.90)

Low

5690

18955

TCS

2.37

CAIRN

5.57

METAL

(2.54)

Close

5752

19137

DRREDDY

1.69

SESAGOA

5.50

POWER

(2.13)

% Chg

(0.94)

(0.82)

HCLTECH

1.49

RCOM

5.04

FMCG

(1.92)

Source : Falcon

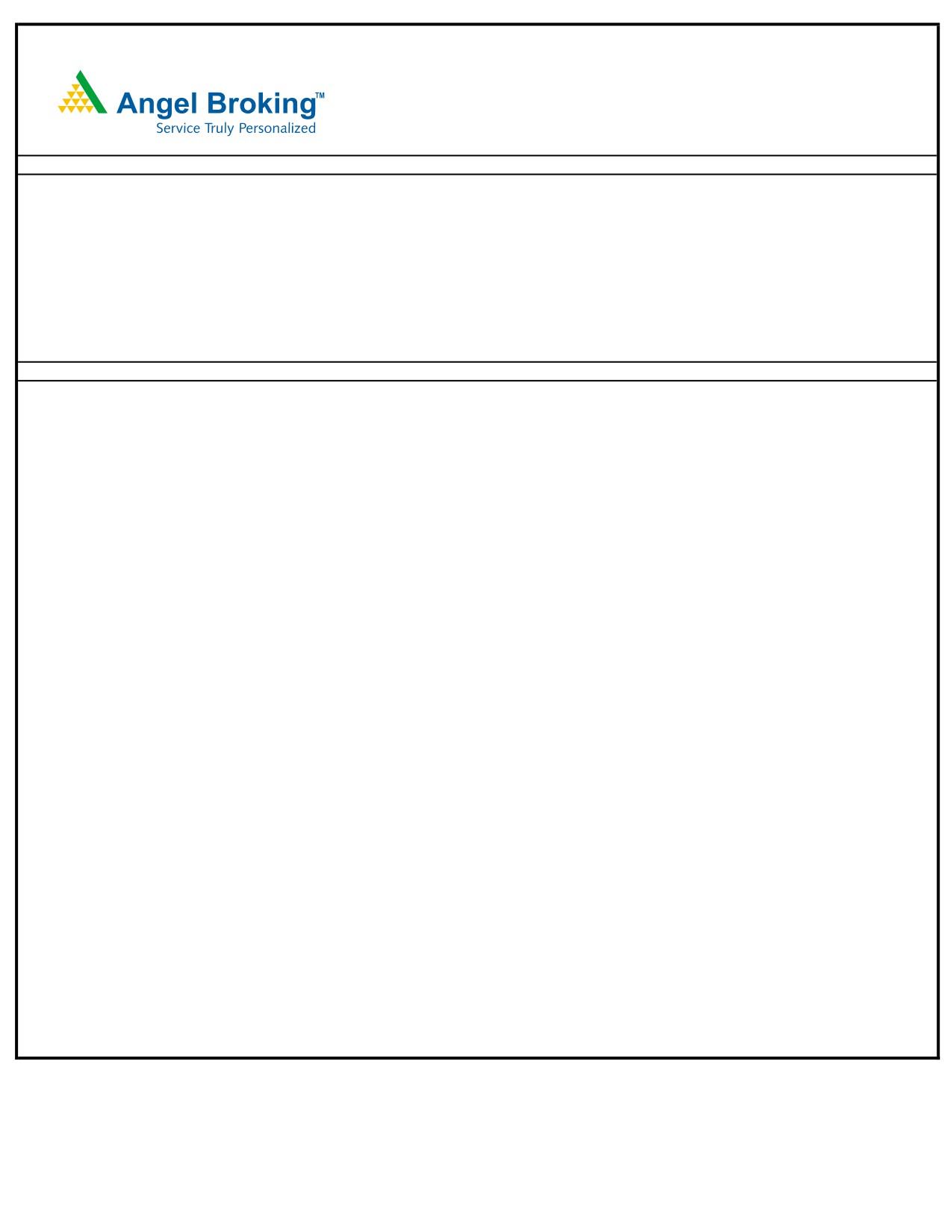

SENSEX DLY CHART

Markets, after a sharp fall, have retraced 61.8% of the entire up-move, which started from 17819 to 21109 / 5349

to 6339, and this is a Fibonacci support level. Further, we are observing that the upper trendline of the Channel,

which was earlier acting as a resistance is expected to act as a support for the markets going ahead. Even the

upward gap (18823 to18845) on the Sensex coincides with the upper trendline, which could act as a support for

the markets. In view of the above observation, we are of the opinion that the markets are likely to witness a

bounce. On the upside, 19680 - 20000 / 5900 - 6000 levels in the coming week cannot be ruled out as the daily

and weekly oscillators are in an oversold zone.

Stocks +ve Bias

Stocks -ve Bias

The stocks mentioned above are given considering the general direction of the trend expected over a period of 2 or

3 days. Investors / Traders are expected to use their own discretion while taking any action related to the stock.

For Private Circulation Only.

Technical Report

RESEARCH TEAM

Shardul Kulkarni

Head - Technicals

Mileen Vasudeo

Technical Analyst

Sameet Chavan

Technical Analyst

Research Team: 022-3952 6600

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or

redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions.

Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and

others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and

investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be

true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company

takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim,

demand or cause of action.

Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make

such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this

document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price

and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain

transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all

investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a

company's fundamentals and as such, may not match with a report on a company's fundamentals.

We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information

herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to

update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from

doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without

notice.

Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or

short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn

brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent

with any recommendation and related information and opinions.

Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services

in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past.

Sebi Registration No : INB 010996539

For Private Circulation Only.