May 24, 2011

Technical Research |

Daily Technical Report

Sensex (17993) / NIFTY (5386)

Markets witnessed a gap down opening in the wake of weak

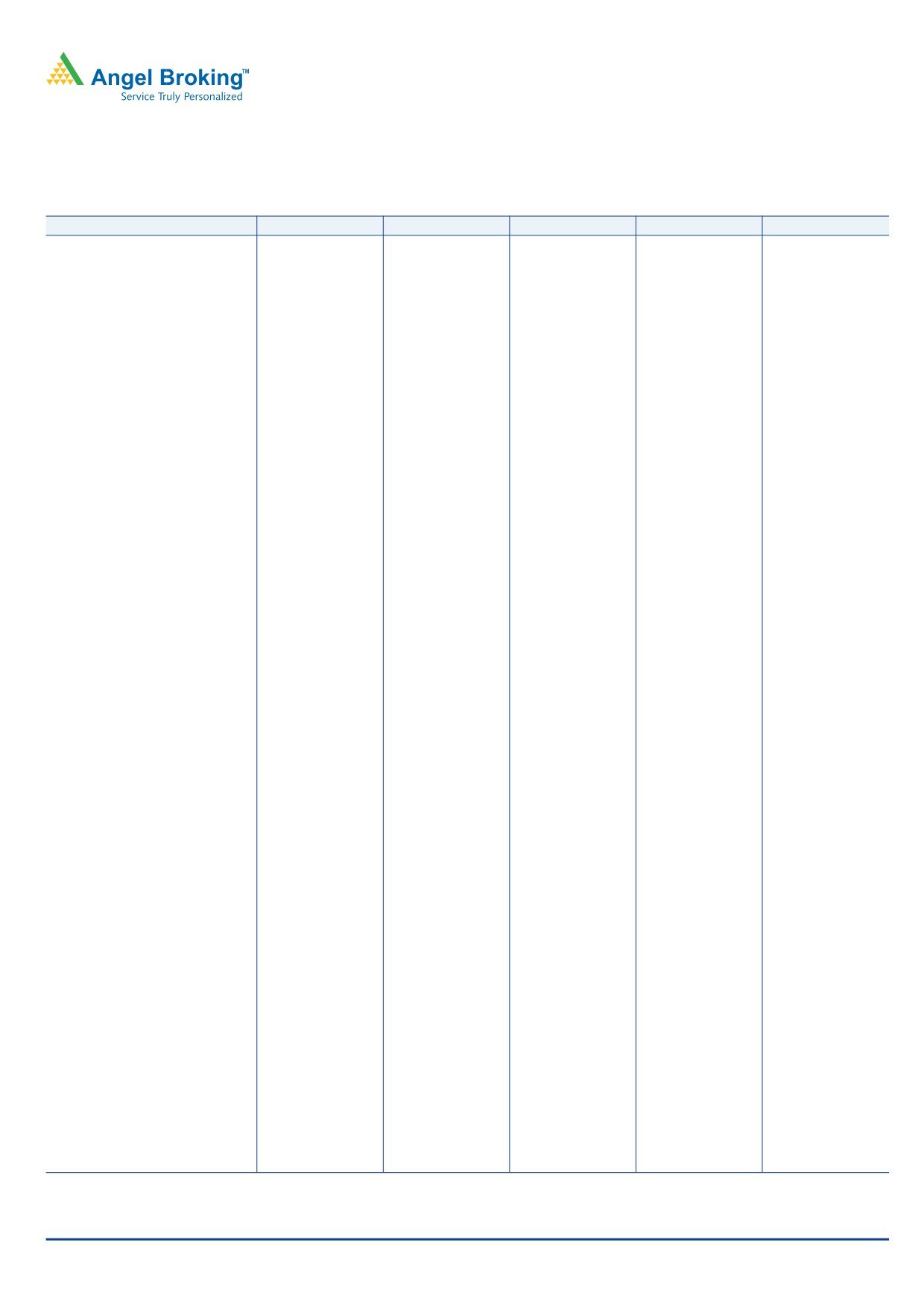

Exhibit 1: Sensex Daily chart

global cues.The advance decline ratio was in favour of declining

counters (A=821 D=1998) which lead the indices to close near

days low. The selling pressure was again lead by Consumer

Goods, Auto, Realty, Metal and Bankex. FMCG ended with

marginal gains.

Formation

On the Daily chart we are observing that prices have taken

Source: Falcon

resistance near the falling 20-daySMA and has formed a

negative candle which suggests continuation of down move.

Trading strategy:

After sharp fall the Indices have breached the low of the Hammer

pattern on the weekly chart and have formed a negative candle

on the daily chart. This suggests continuation of downfall. In

coming trading session if Indices trade convincingly below

17971 / 5370 levels then they may test 17718 / 5308 level.

On the upside, 18144 - 18200 / 5428 - 5450 levels may act

as resistance for the day.

Stock Recommendations:

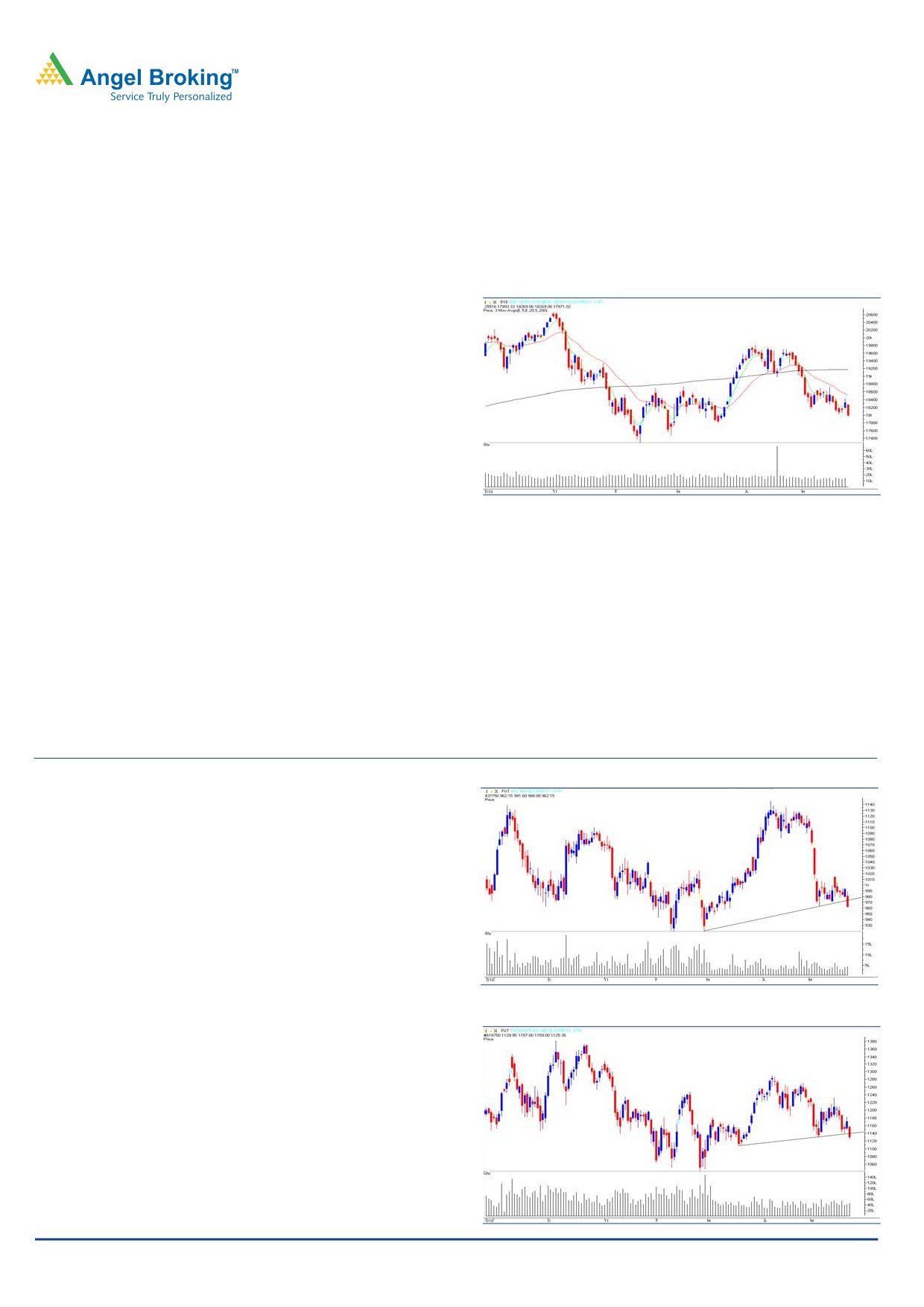

Exhibit 2: ACC (May futures)

Stock - ACC (May fut.)

Action - Sell

Selling Range

:

`976.00 - 980.00

Stop Loss

:

`994.25

Target

:

`938.00

Source: Falcon

Exhibit 3: Tata Motors (May futures)

Stock - Tata Motors (May fut.)

Action - Sell

Selling Range

:

`1,144.00 - 1,150.00

Stop Loss

:

`1,161.00

Target

:

`1,105.00

Source: Falcon

For Private Circulation Only | Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP00000154 6 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

1