Please refer to important disclosures at the end of this report

1

Tarsons Products Ltd is a leading Indian manufacturing company by revenue in

India in laboratory consumable and life sciences industry with ~9-12% market

share in the labware market in 2020 (Frost & Sullivan Report). Tarsons’ product

portfolio is classified into three key categories which include Consumables,

Reusables, and Others. The company generated ~23% of its revenue from the sale

of Reusables in FY21 while 5-7% of its revenue from others segment. Tarsons

currently operates five manufacturing facilities in West Bengal as of June’21 and

had a diversified product portfolio with over 1,700 SKUs products across 300

distinct products. Its distribution network across India comprises over 141

authorized distributors and has 45 distributors in the overseas market. Some of its

end customers include Dr Reddy's Laboratories, Syngene International Dr. Lal Path

Labs, Metropolis Healthcare, Mylab Life Solutions, among others.

Positives: (a) Leading Indian supplier to life sciences sector with strong brand

recognition and quality products. (b) Provides a diverse range of labware products

across varied customer segments. (c) large addressable market with long-standing

relationships with key end customers. (d) pan India sales and distribution network.

Investment concerns: (a) Company imports over 75.00% of its raw materials. (b)

86.32% of total manufacturing revenue contributed by manufacturing units located

at Dhulagarh and Jangalpur, WB. (c) Moderate scale of operations, working

capital intensive in nature of business (high inventory and low payable days) (d)

Continuing impact of the COVID-19.

Outlook & Valuation: Tarsons has been manufacturing plasticware for over 36

years and has built a recognized brand in the domestic market. Although the scale

of operations is modest, the same as grown over the years aided by diversified

portfolio and distribution network. Tarsons’ is well placed to capture the growth

arising from shift from glassware to plastic ware, growth for end users and,

continued gains for domestic manufacturers among others. Tarsons has good ROE

aided by hi margins which can sustain with growing scale of operations. The IPO

proceeds will enable Tarsons to invest in capacities to capture growth going ahead.

At `662, Tarsons is commanding 51.1x/40.6x FY21/TTM earnings. Given 33%

earnings CAGR over FY19-21 and potential to maintain such earnings growth, we

believe the valuations are fair. We have a “SUBSCRIBE” rating on the issue.

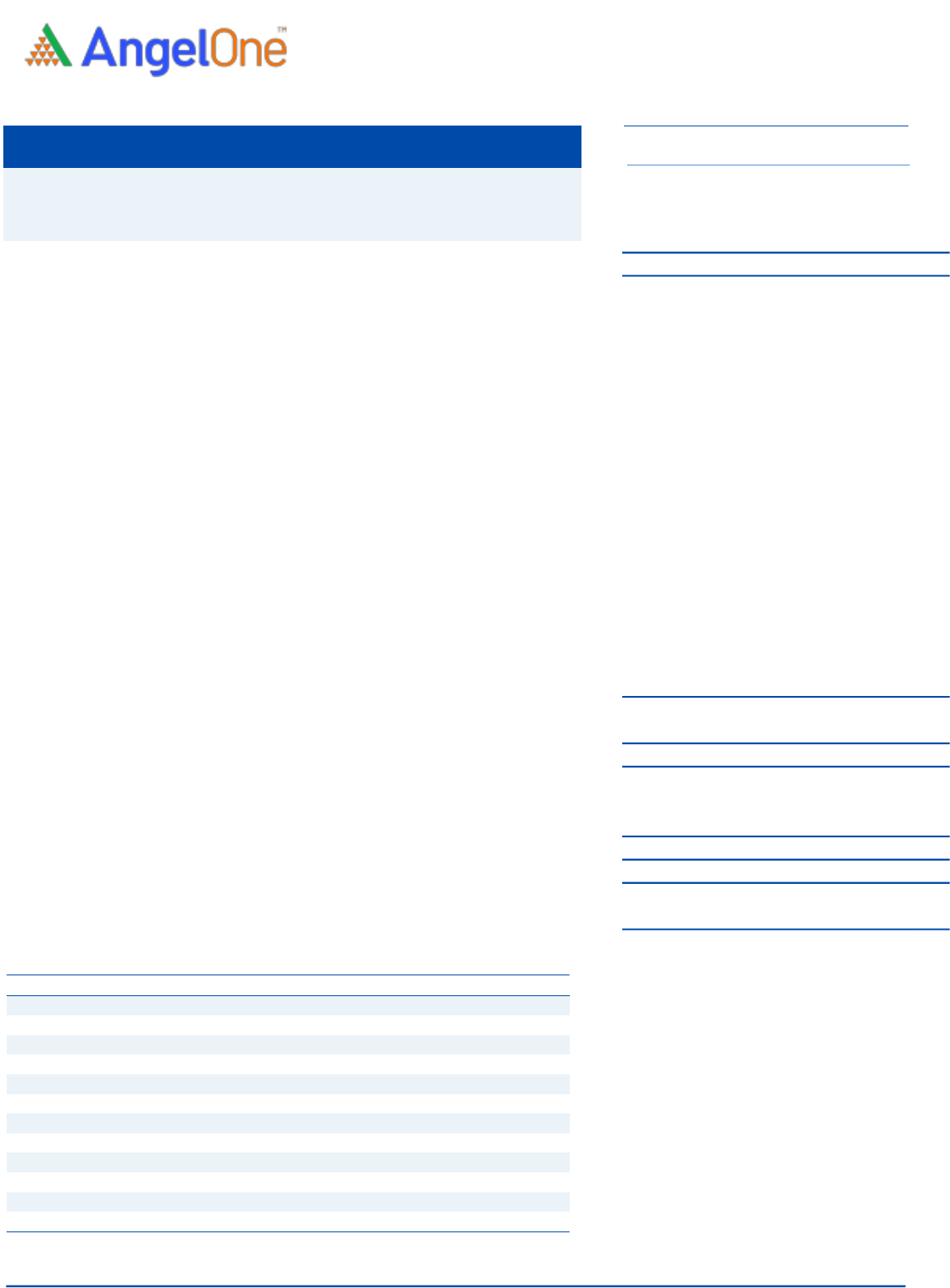

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021*

Q1FY21

Q1FY22*

Net Sales

179

176

229

42

69

% chg

-

-1.6

30.1

-

64.6

Reported Net Profit

53

52

80

10

26

% chg

-

-1.4

53.5

-

172.7

EBITDA (%)

48.0

46.1

50.2

33.7

55.0

EPS (`)

7.3

7.6

12.9

1.3

4.7

P/E (x)

90.4

86.9

51.1

-

-

P/BV (x)

26.0

17.8

14.4

-

-

ROE (%)

57.6

24.4

31.2

-

-

ROCE (%)

44.0

20.8

27.7

-

-

EV/EBITDA

50.0

51.0

34.3

-

-

EV/Sales

20.1

20.1

15.5

-

-

Source: Company, Angel Research;

Note: Valuation ratios at upper price band; *Consolidated

SUBSCRIBE

Issue Open: Nov 15, 2021

Issue Close: Nov 17, 2021

Offer for Sale: `874 cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 47.3%

Others 52.7%

Fresh issue: `150 cr

Issue Details

Face Value: `2

Present Eq. Paid up Capital: `10.2 cr

Post Issue Sha reholding Pattern

Post Eq. Paid up Capital: `10.2cr

Issue size (amount): `1,023 cr

Price Band: `635-662

Lot Size: 22 shares and in multiple thereafter

Post-issue mkt. cap: * `3,385 cr - ** `3,522 cr

Promoters holding Pre-Issue: 50.78%

Promoters holding Post-Issue: 47.3%

*Calculated on lower price band

** Calculated on upper price band

Book Building

TARSONS PRODUCTS LTD

IPO NOTE TARSONS PRODUCTS LTD.

November 12, 2021

November 12, 2021

2

Tarsons Products Limited| IPO Note

Company background

Tarsons Products Ltd is an Indian labware company engaged in designing,

development, manufacturing, and marketing of consumables, reusables and

others including benchtop equipment, used in various laboratories across research

organizations, academia institutes, pharmaceutical companies CROs, diagnostic

companies and hospitals. Consumables’ category includes products such as

centrifuge ware, cryogenic ware, liquid handling, PCR consumables and petri dish,

transfer pipettes and others. Reusables category includes products such as bottles,

carboys, beakers, measuring cylinders and tube racks. Others category includes

benchtop instrumentation such as vortex shakers, centrifuges pipettors and others.

Tarsons is also engaged in the manufacturing of a range of quality labware

products which helps scientific discovery and improve healthcare. Tarsons currently

operates through our five manufacturing facilities located in West Bengal. Tarsons

distributes its products to its end customers on a pan-India basis through

authorised distributors. The company is among the top three plasticware

laboratory equipment manufacturing companies by revenue in India to provide

extensive range of life science products, scientific equipment, and scientific

instruments and both general and specialized laboratory supplies

Issue details

The IPO is made up of fresh issue of `150 Cr and offer for sale of up to 1.32 Cr

shares by promoter & selling shareholders.

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

2,58,66,033

50.78

2,51,66,033

47.30

Public

2,50,74,387

49.22

2,80,40,248

52.70

Total

5,09,40,420

100.00

5,32,06,281

100.00

Source: Company, Angel Research & RHP.

Objectives of the Offer

`78.5 Cr for repayment/prepayment of certain borrowings.

`60 for funding capex to develop a new manufacturing facility in Panchla,

West Bengal

General corporate purposes

Key Management Personnel

Sanjive Sehgal is the Chairman and Managing Director and individual Promoter of

the company. He holds a bachelor’s degree in science from Xavier College,

Calcutta. He has over 30 years of experience in the company.

Rohan Sehgal is the Whole-Time Director and individual Promoter of the

Company. He holds a bachelor’s degree in science (management) from the

University of Manchester. He has over 7 years of experience in the company.

Santosh Agarwal is the Chief Financial Officer of the company. He holds a

B.Com degree from the University of Calcutta. He is a Chartered Accountants

and has over 20 years of experience having previously worked with Polar

Fans, Genpact, ICA group and Gruas Jaso Group.

November 12, 2021

3

Tarsons Products Limited| IPO Note

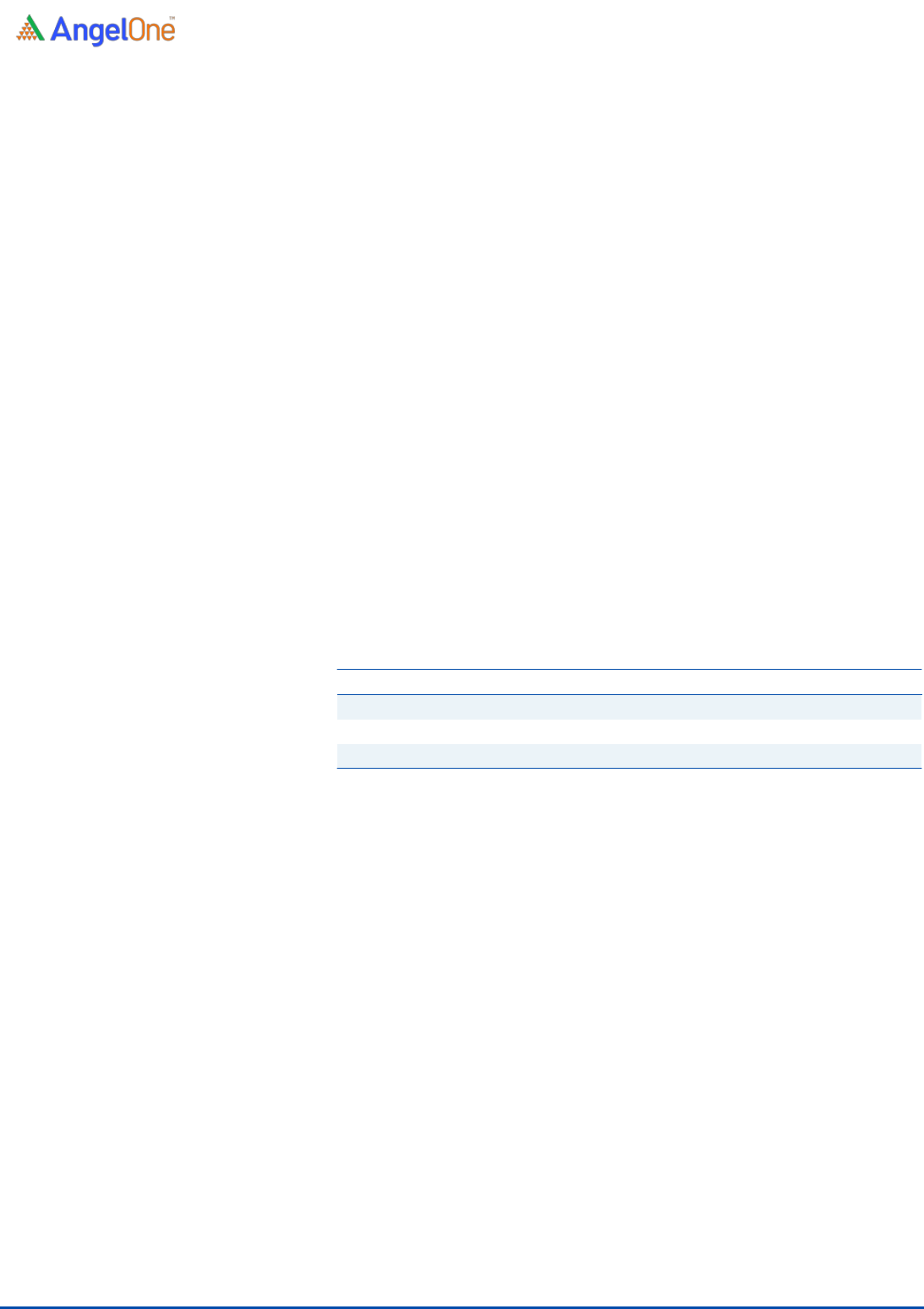

Exhibit 1: Profit & Loss Statement

Y/E March (` Cr)

FY2019

FY2020

FY2021*

Q1FY21

Q1FY22*

Total operating income

179

176

229

42

69

% chg

-

-1.6

30.1

-

64.6

Total Expenditure

93

95

114

28

31

Cost of materials consumed

56

50

56

12

18

Changes In Inventories

(5)

(1)

5

5

(5)

Employee benefits expense

16

20

24

6

8

Other expenses

40

38

40

8

12

EBITDA

72

69

103

12

37

% chg

-

-3.4

49.4

-

218.5

(% of Net Sales)

40.1

39.4

45.2

27.5

53.2

Depreciation& Amortization

15

14

14

3

5

EBIT

57

55

90

8

32

% chg

-

-3.5

63.0

-

284.6

(% of Net Sales)

31.9

31.3

39.2

19.9

46.6

Finance costs

7

6

3

1

1

Other income

6

4

5

2

2

(% of Sales)

3.3

2.4

2.4

3.7

2.9

Recurring PBT

50

49

87

8

31

% chg

-

-1.8

77.7

-

302.5

Exceptional item

-

-

-

-

-

Tax

17

13

24

2

9

PAT (reported)

39

41

69

7

25

% chg

-

4.0

69.9

-

256.5

(% of Net Sales)

21.8

23.0

30.1

16.6

35.9

Basic & Fully Diluted EPS (Rs)

7.3

7.6

12.9

1.3

4.7

Source: Company, Angel Research; Note - *Consolidated

November 12, 2021

4

Tarsons Products Limited| IPO Note

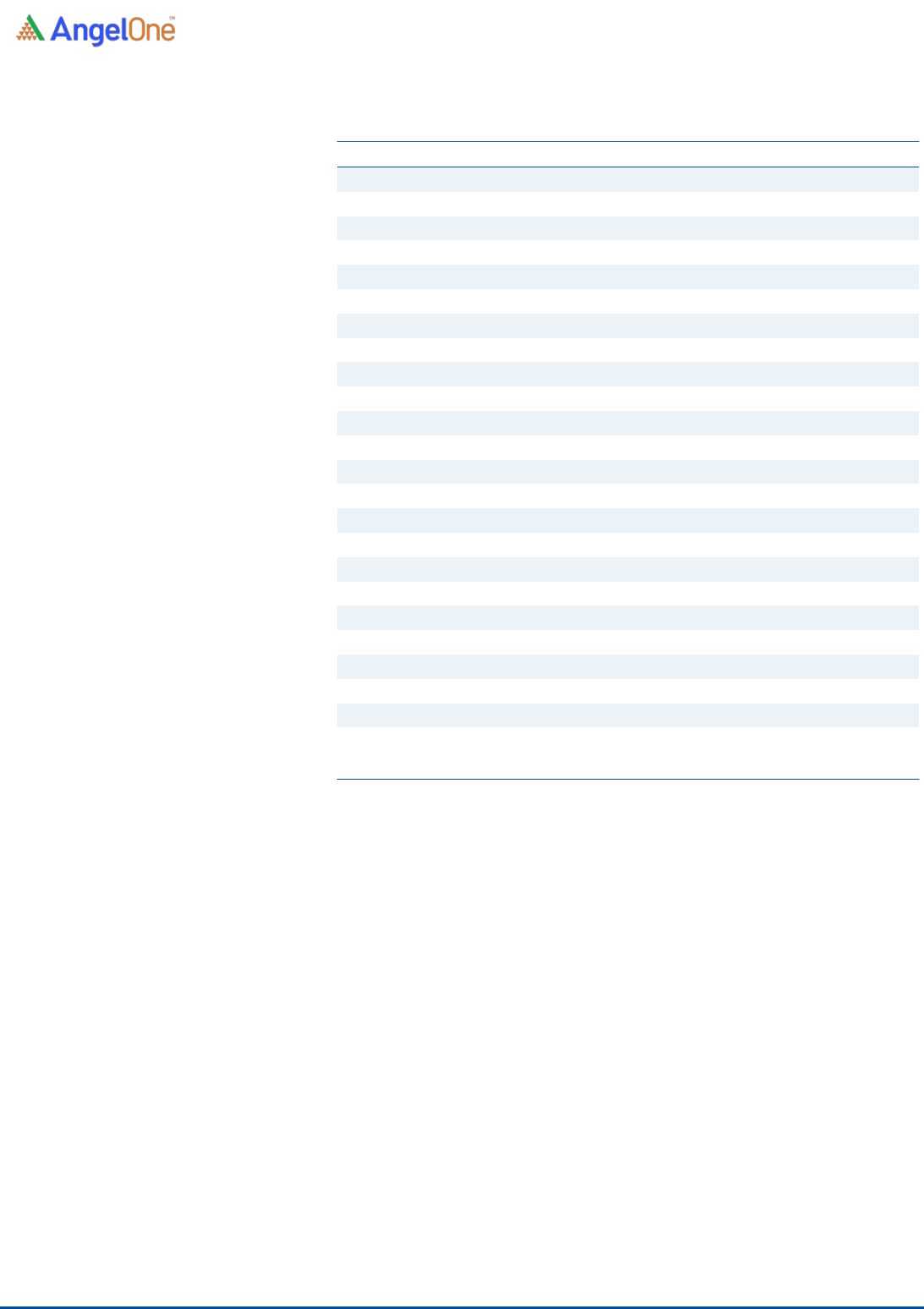

Exhibit 2: Consolidated Balance Sheet

Y/E March (` Cr)

FY2019

FY2020

FY2021*

Q1FY21

Q1FY22*

SOURCES OF FUNDS

Equity Share Capital

0

0

0

0

10

Other equity

135

197

244

182

259

Shareholders’ Funds

135

198

244

182

269

Total Loans

65

36

34

35

65

Other liabilities

4

5

6

5

8

Total Liabilities

204

238

284

222

341

APPLICATION OF FUNDS

Property, Plant and Equipment

85

88

114

85

127

Right-of-use assets

4

4

7

4

7

Capital work-in-progress

7

19

22

24

33

Intangible assets

-

-

-

-

1

Non-Current Investments

-

-

-

-

-

Other Non-Current Asset

19

18

41

24

56

Current Assets

97

120

113

98

141

Inventories

46

49

47

46

59

Investments

-

-

-

-

-

Trade receivables

45

38

47

36

49

Cash and Cash equivalents

1

26

3

2

14

Loans & Other Financial Assets

0

0

0

0

1

Other current assets

5

7

16

14

18

Current Liability

8

10

12

13

23

Net Current Assets

89

110

101

85

118

Total Assets

204

238

284

222

341

Source: Company, Angel Research; Note - *Consolidated

November 12, 2021

5

Tarsons Products Limited| IPO Note

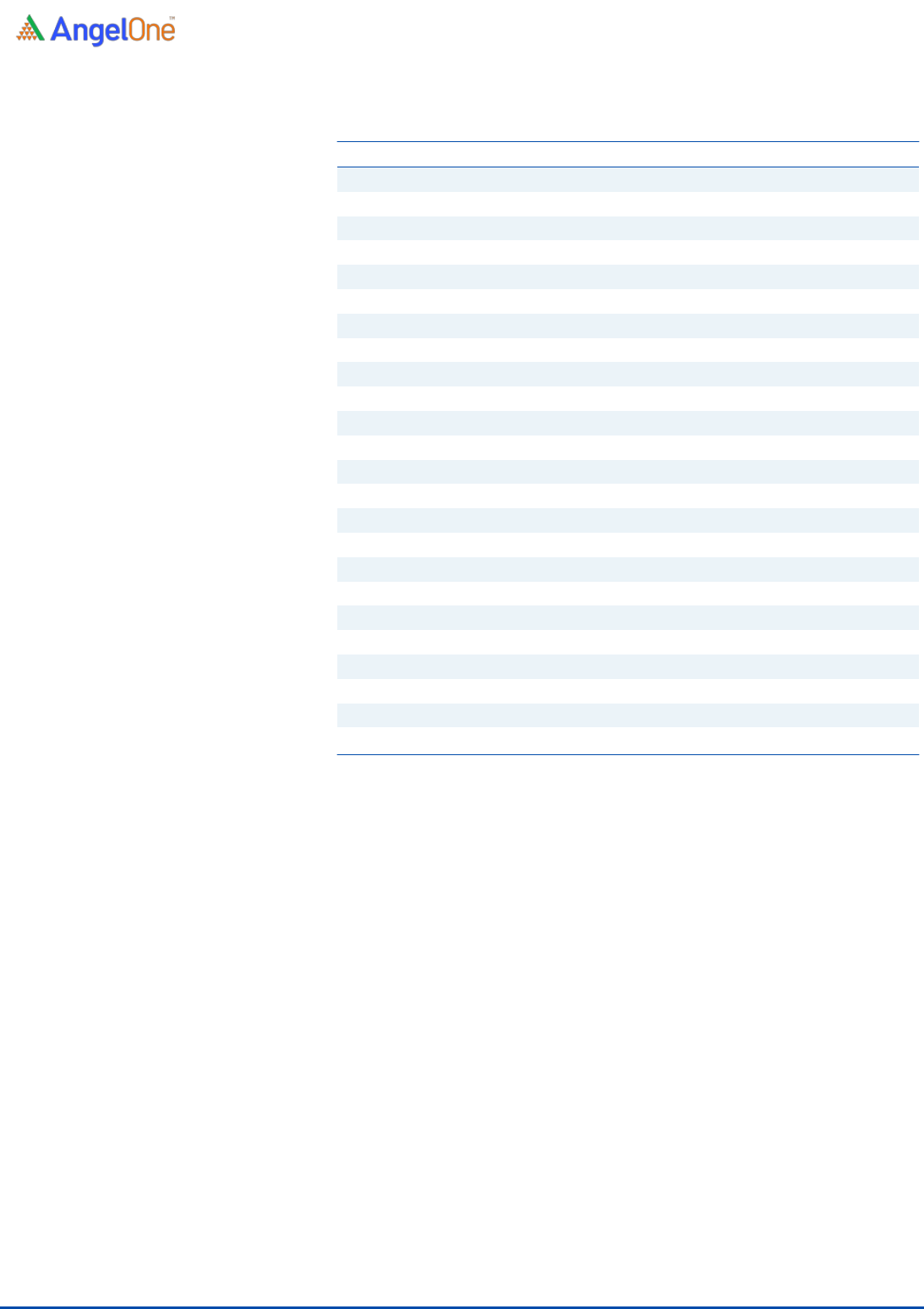

Exhibit 3: Consolidated Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021*

Q1FY21

Q1FY22*

Operating profit

56

53

92

9

33

Net changes in working capital

(9)

6

(16)

1

(10)

Cash generated from operations

21

20

16

3

4

Direct taxes paid (net of refunds)

(17)

(15)

(24)

(3)

(4)

Net cash flow from operating activities

51

64

68

11

23

Purchase of Assets

(34)

(26)

(64)

(11)

(42)

Interest received

0

1

0

0

0

Others

0

0

0

(0)

(0)

Cash Flow from Investing

(34)

(25)

(64)

(11)

(42)

Repayment (long term borrowings)

(30)

(11)

(7)

(2)

10

Repayment (short term borrowings)

(5)

2

7

1

21

Proceeds from issue/repayment CCDs

22

-

(22)

(22)

-

Interest paid

(6)

(5)

(5)

(1)

(1)

Interest on Lease liabilities

(0)

(0)

(0)

-

(0)

Dividend Paid

(0)

0

(0)

(0)

(0)

Cash Flow from Financing

(18)

(14)

(27)

(23)

30

Inc./(Dec.) in Cash

(0)

25

(23)

(23)

11

Acquisition

-

-

-

-

-

Opening Cash balances

1

1

25

25

2

Closing Cash balances

1

25

2

2

13

Source: Company, Angel Research; Note - *Consolidated

November 12, 2021

6

Tarsons Products Limited| IPO Note

Key Ratios

Y/E March

FY2019

FY2020

FY2021*

Valuation Ratio (x)

P/E (on FDEPS)

90.4

86.9

51.1

P/CEPS

65.8

64.4

42.7

P/BV

26.0

17.8

14.4

EV/Sales

20.1

20.1

15.5

EV/EBITDA

50.0

51.0

34.3

Per Share Data (Rs)

EPS (Basic)

7.3

7.6

12.9

EPS (fully diluted)

7.3

7.6

12.9

Cash EPS

10.1

10.3

15.5

Book Value

25

37

46

Returns (%)

ROE

57.6

24.4

31.2

ROCE

44.0

20.8

27.7

Turnover ratios (x)

Receivables (days)

91

79

75

Inventory (days)

333

365

277

Payables (days)

14

44

35

Working capital cycle (days)

409

400

317

Source: Company, Angel Research

November 12, 2021

7

Tarsons Products Limited| IPO Note

Research Team Tel: 022 - 40003600

E-mail: research@angelbroking.com

Website: www.angelone.in

DISCLAIMER

Angel One Limited (formerly known as Angel Broking Limited) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity

& Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has

not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

1.Financial interest of research analyst or Angel or his Associate or his relative No

2.Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3.Served as an officer, director or employee of the company covered under Research No

4.Broking relationship with company covered under Research No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

Hold (Fresh purchase not recommended)