Initiating coverage | Healthcare

December 17, 2012

TTK Healthcare

BUY

CMP

`551

Restructuring: a re-rating trigger

Target Price

`643

TTK Healthcare (TTKH), a part of the TTK group is present across businesses like

Investment Period

12 Months

pharmaceuticals, consumer products, medical devices and foods. The company has

leading brands like Woodward’s Gripe Water with more than 50% market share and

Stock Info

Eva which is a leader in women’s deodorant segment. TTKH’s continuous

Sector

Healthcare

advertisement spend has resulted in suboptimal RoE, although the same is expected to

reap benefits in the long term. With termination of the low margin condoms

Market Cap (` cr)

428

distribution business, the top-line is expected to be impacted by ~20%. The

Net Debt (` cr)

(53)

company’s increasing focus on branded foods

- a high RoE business, and

Beta

1.3

orthopaedic implants - a niche product in a nascent stage; provide long term growth

52 Week High / Low

598/330

opportunities. We initiate coverage on the stock, with a Buy recommendation and a

target price of `643.

Avg. Daily Volume

31,530

High advertisement cost to reap benefits in future: TTKH in FY2012 spent ~ `45cr on

Face Value (`)

10

advertising and sales promotion, which is very high at 191% of PBT. Though this

BSE Sensex

19,244

continued spend is likely to lead to near term sub-optimal ROE, we believe it would

Nifty

5,858

provide a strong growth momentum to the company over next 4 to 5 years.

Reuters Code

TTKH.BO

Food business - a long term driver: TTKH is focusing on the foods business especially

Bloomberg Code

TTKP IN

pellets, which is a high RoE business. In addition to being a major supplier to players

like PepsiCo, the company is planning to launch branded pellets under its own brand.

We believe this could be a long term growth driver for the company.

Shareholding Pattern (%)

Orthopaedic implants- a niche play: TTKHs knee implants in the orthopaedic segment

Promoters

65.4

are better suited for Indian markets and are competitively priced in an import

MF / Banks / Indian Fls

0.1

dominated market, thus providing it an edge over its competitors. This niche segment

being in the nascent growth stage provides immense future growth prospects.

FII / NRIs / OCBs

5.9

Outlook and Valuation: We expect TTKH to post a 9.6% and 27.6% CAGR in its

Indian Public / Others

28.6

revenue and net profit respectively, over FY2012-14E, while the EBITDA margin is

expected to expand by 275bp over FY2012-14E to 9.5%. The company has a strong

balance sheet with RoIC as high as 73.6% for FY2012. At the current market price,

Abs. (%)

3m 1yr

3yr

the stock is trading at EV/sales of 0.8x for FY2014E. We initiate coverage on the stock

Sensex

3.8

24.2

13.9

with a target price of `643 based on a target EV/sales of 1.0x for FY2014E.

TTK Healthcare

48.5

36.5

139.6

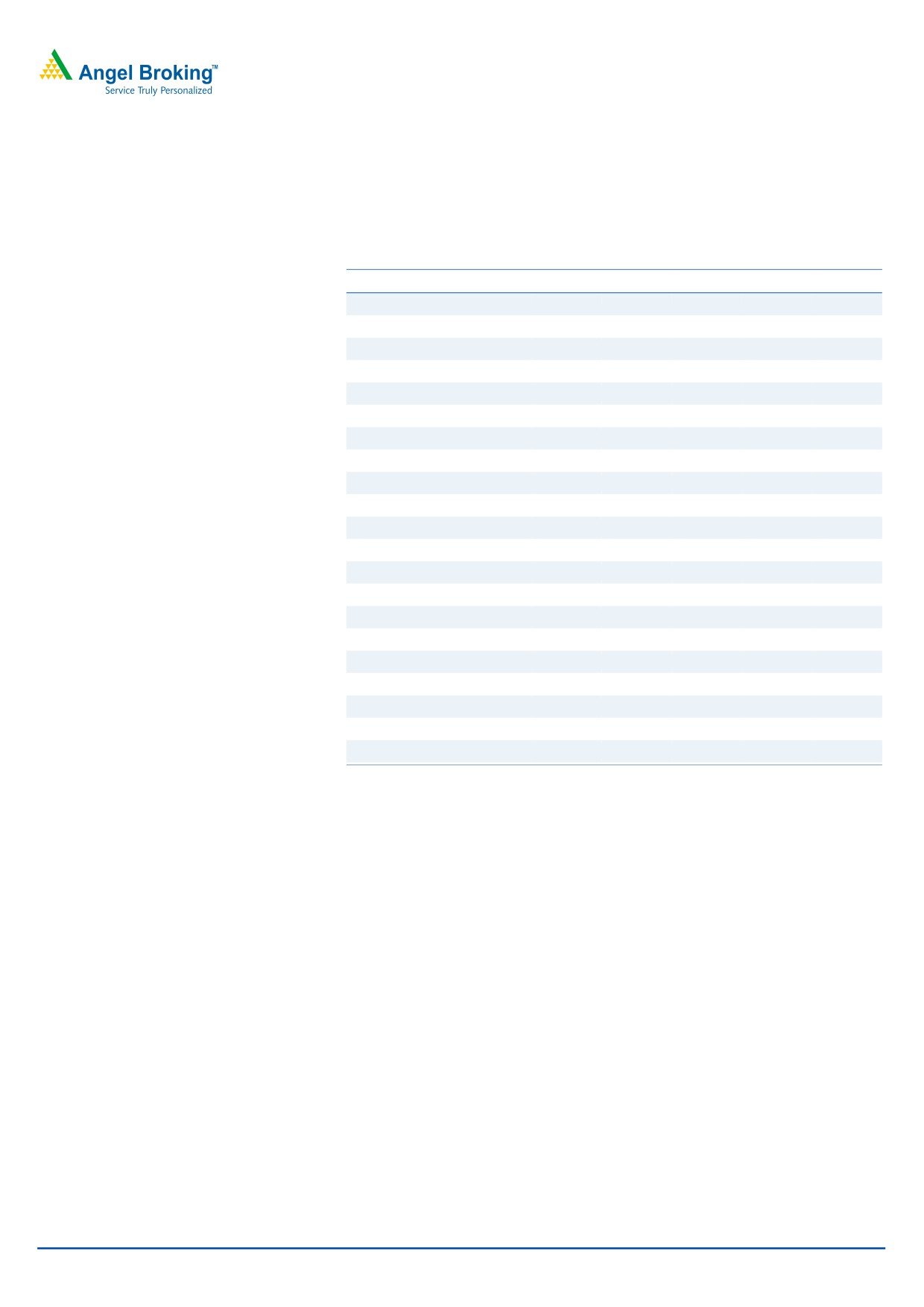

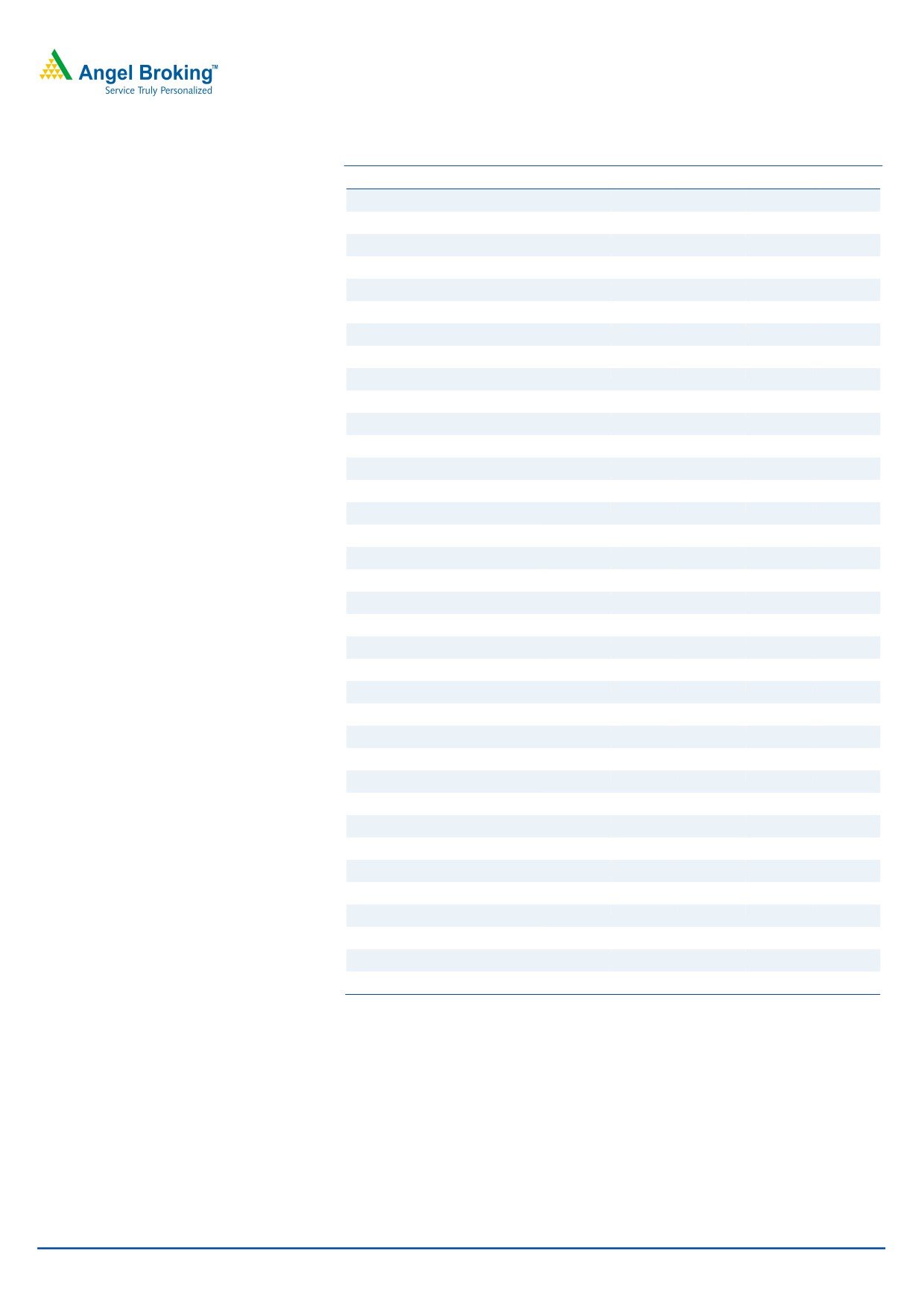

Key Financials

Y/E March (` cr)

FY2011

FY2012 FY2013E

FY2014E

Net Sales

311

354

374

425

% chg

23.3

13.8

5.8

13.5

Net Profit

14

16

19

25

% chg

54.1

11.3

19.2

36.0

EBITDA (%)

6.9

6.7

7.9

9.5

EPS (`)

19.0

20.1

24.1

32.7

P/E (x)

29.0

27.4

22.9

16.8

P/BV (x)

5.7

4.9

4.2

3.5

RoE (%)

20.1

19.2

19.7

22.5

RoIC (%)

91.9

73.6

71.1

84.5

Shareen Batatawala

EV/Sales (x)

1.2

1.1

1.0

0.8

+91-22-3935 7800 Ext: 6849

EV/EBITDA (x)

17.3

15.9

12.3

8.8

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

TTK Healthcare | Initiating coverage

Investment Rationale

High advertisement spends to reap benefits in future

Benefits from high advertisement spend

TTKH has been consistently spending on advertising to build brands like Eva and Durex &

to fructify over 4-5 years

Kohinoor brands of condoms in India. Eva is a market leader in the women’s

deodorant category with ~20% share. The advertisement spend of the company has

grown at an 18.7% CAGR over FY2007-12 to `45cr in FY2012. At this level, the

advertisement cost as percentage of PBT stands at 191%. We believe that the high level

of advertisement has resulted in suboptimal-RoE. This continued focus on advertisement

spend is expected to lead to near term sub-optimal ROE in the short-term, which

subsequently will provide growth momentum over the next 4 to 5 years.

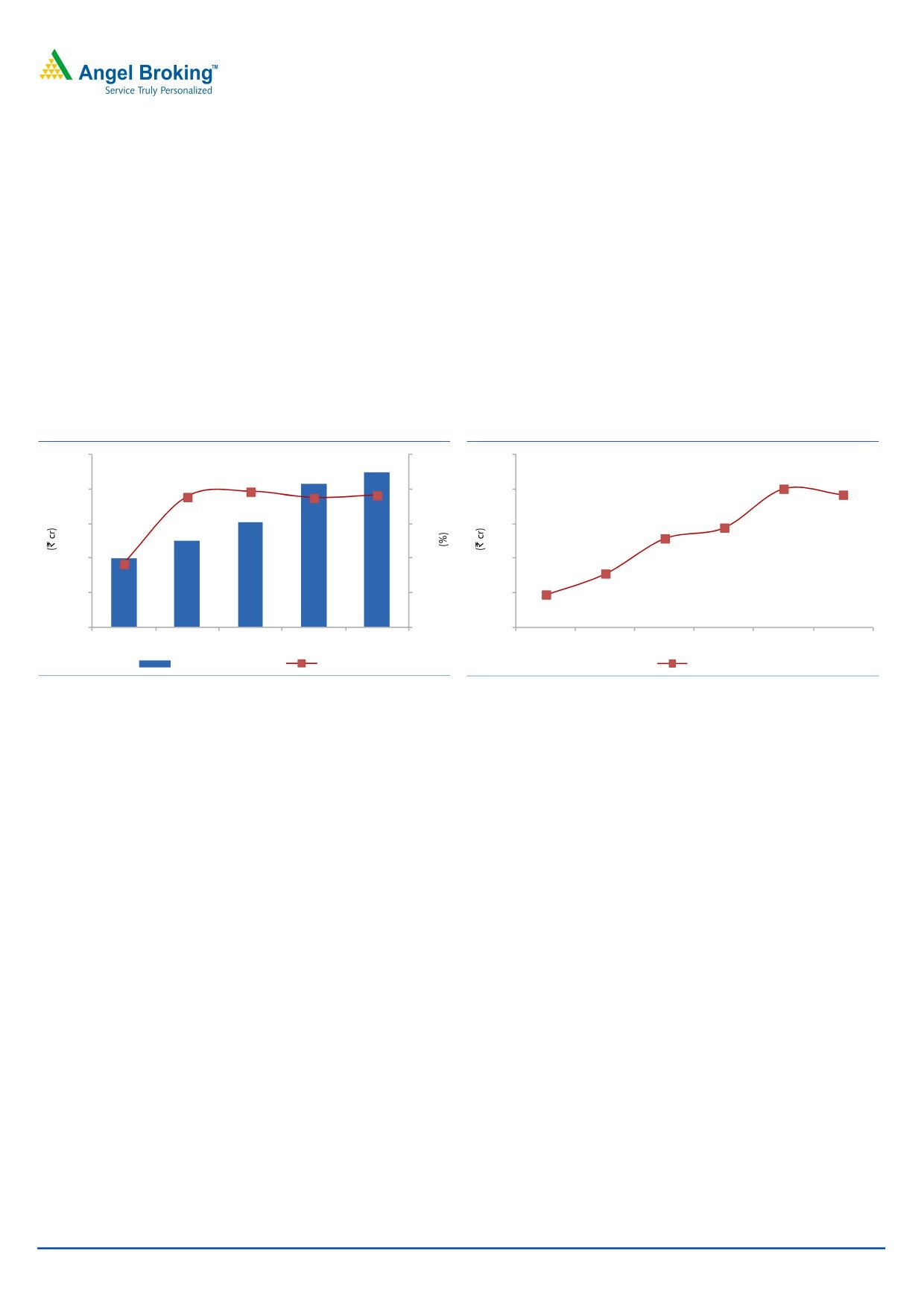

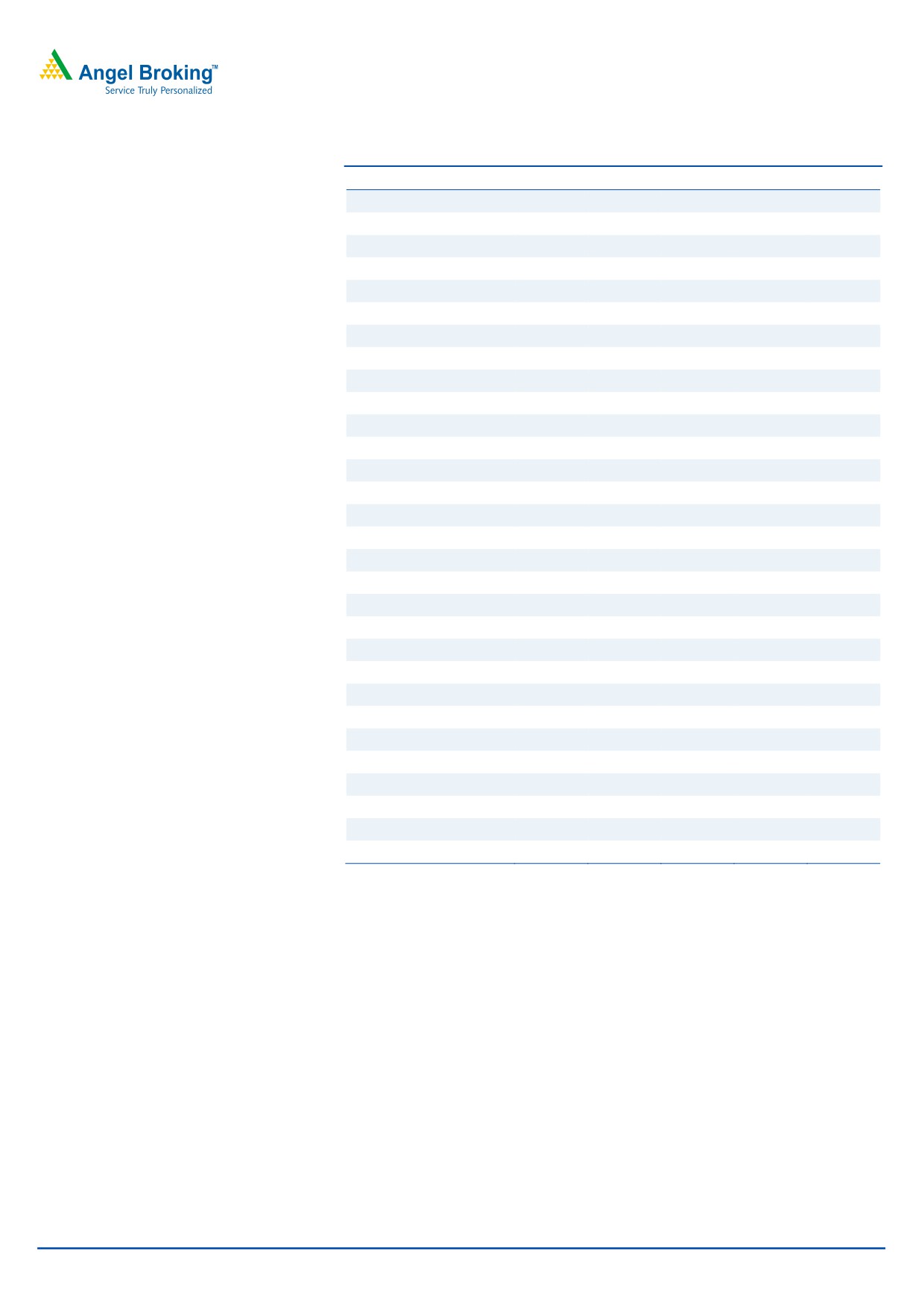

Exhibit 1: Continued focus on advertisement spend

Exhibit 2: Suboptimal RoE profile

50

250

25

196

40

187

200

20

20.1

189

191

19.2

30

150

15

14.4

12.9

20

100

10

91

7.8

10

50

5

4.7

20

25

30

42

45

0

0

0

FY2008

FY2009

FY2010

FY2011

FY2012

FY2007

FY2008

FY2009

FY2010

FY2011

FY2012

Advertisement spend

% of PBT

RoE

Source: Company, Angel Research

Source: Company, Angel Research

Foods business a long term driver

Focus on profit lucrative branded food

TTKH, in its foods division, manufactures potato and cereal based pellets for

business to drive long term bottom-line

markets in India and abroad. The company has been continuously investing in its

growth

three year old food business which has started yielding improved and innovative

products. The company is currently focusing on branded pellets (Pappads) with

plans to further invest `40cr in the food business over the next couple of years.

TTKH has increased its focus on the branded pellets and plans to have ~20% of

the revenue of the foods division contributed by the branded business over the next

3-4 years. TTKH has been supplying its products to multinational companies in

India and abroad. Moreover, the product manufactured by the company has a

huge export potential. The division has turned profitable in the last three quarters

and we believe this high RoE business would contribute to growth in the long term.

Orthopaedic implants- a niche play

TTKH’s competitively priced knee

Orthopaedic implants are a niche segment in India and the market is currently

implants better suited for Indian market

dominated by imported products. However, knee implants manufactured by TTKH

provides massive growth prospects

are better suited to the Indian market in addition to being competitively priced.

This provides the company an edge over imported products. We believe this

segment being in the nascent stage provides immense growth prospects for the

company.

December 17, 2012

2

TTK Healthcare | Initiating coverage

Termination of condom business to improve operating margins

Short term revenue impact from

TTK-LIG, a condom manufacturing company, was a JV between TTK (parent

termination of condom business to serve

company of TTKH) and Reckitt Benckiser, wherein both the holding companies -

long term operating benefit

TTK and Reckitt Benckiser were in a tussle for over a year-and-a-half on various

management related issues. TTK bought Reckitt Benckiser’s 49.9% stake in TTK-LIG

for ~`150cr in November 2012, while the rights of Durex and Kohinoor were to

rest with Reckitt India. This would have a short term impact on the revenue of TTKH

since the condom distribution business contributed ~20% to the total revenue;

however the bottom-line would be marginally impacted owing to lower

contribution to the net profit from the business. Meanwhile, TTKH would now

distribute condoms manufactured by TTK-LIG under its own brand Skore.

Opportunity from untapped therapeutic segments

Focus on untapped therapeutic space-

TTKH is majorly present in therapeutic areas like calcium supplements,

an opportunity to expand its wings in

haematinics, cervical dilators, thrombolytic agents, rejuvenators, multimineral

pharmaceutical space

supplements, liver correctives and pain management products providing herbal

and allopathic formulations. The company has plans to foray in new therapeutic

segments like gynaecology, thyrocare, etc which have low penetration in the Indian

pharmaceutical market. The same would provide an opportunity to the company to

spread its base in the pharmaceutical space.

Strong Balance sheet

Low debt:equity and high RoIC

-

TTKH has miniscule debt in its books with a debt: equity ratio of 0.2x for the last

attractive for investors

four years. Moreover, the company has a strong RoIC profile with 73.6% RoIC and

net cash of ~`50cr for FY2012. We believe that the company would retain its high

RoIC profile at 84.5% with a net cash of `89cr for FY2014E.

December 17, 2012

3

TTK Healthcare | Initiating coverage

Financials

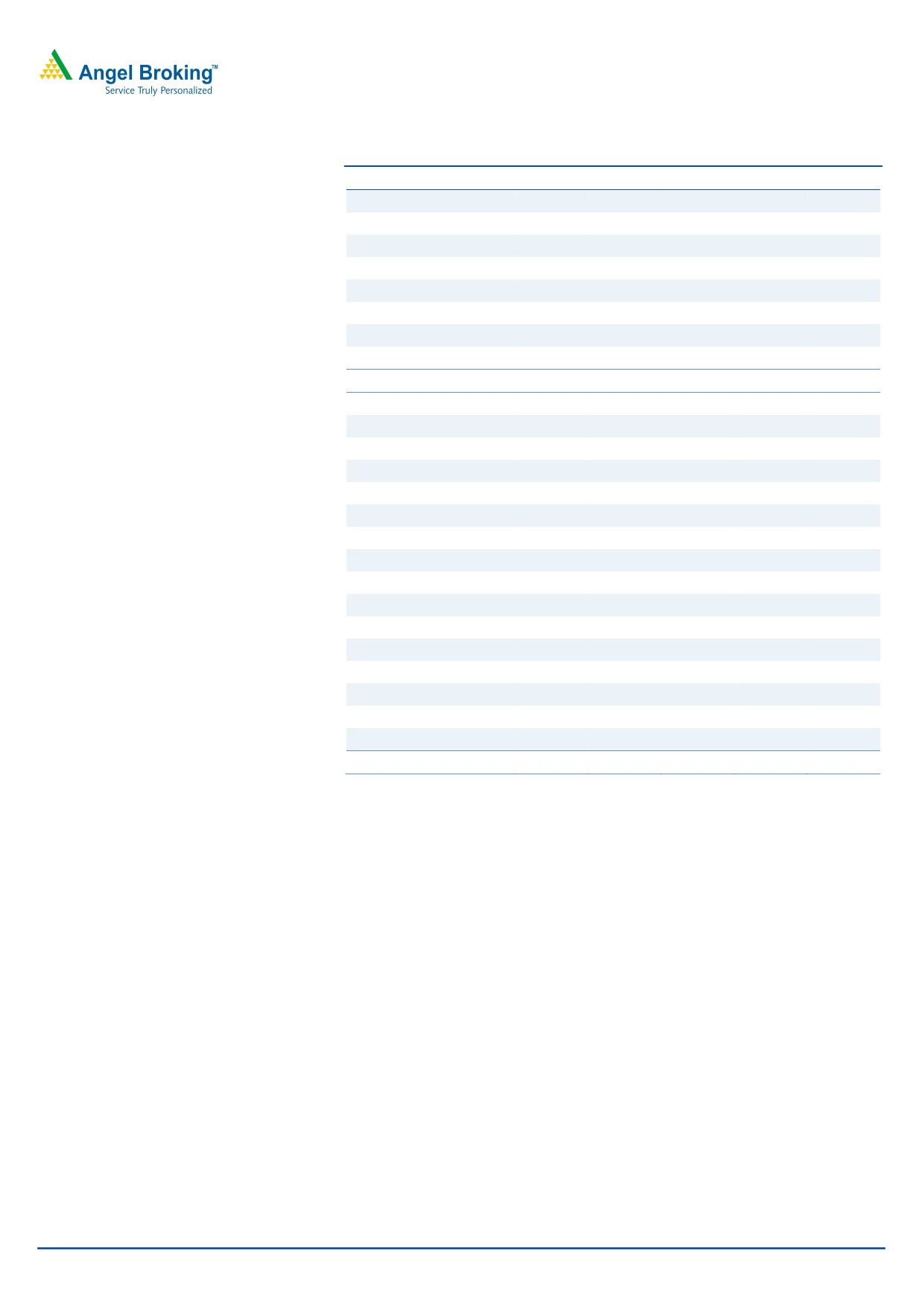

Exhibit 3: Key Assumptions

Revenue Growth (%)

FY2013E

FY2014E

Pharmaceuticals

15.0

15.0

Medical Devices

5.0

7.0

Consumer Products Distribution

(15.0)

3.6

Foods

110.0

50.0

Source: Angel Research

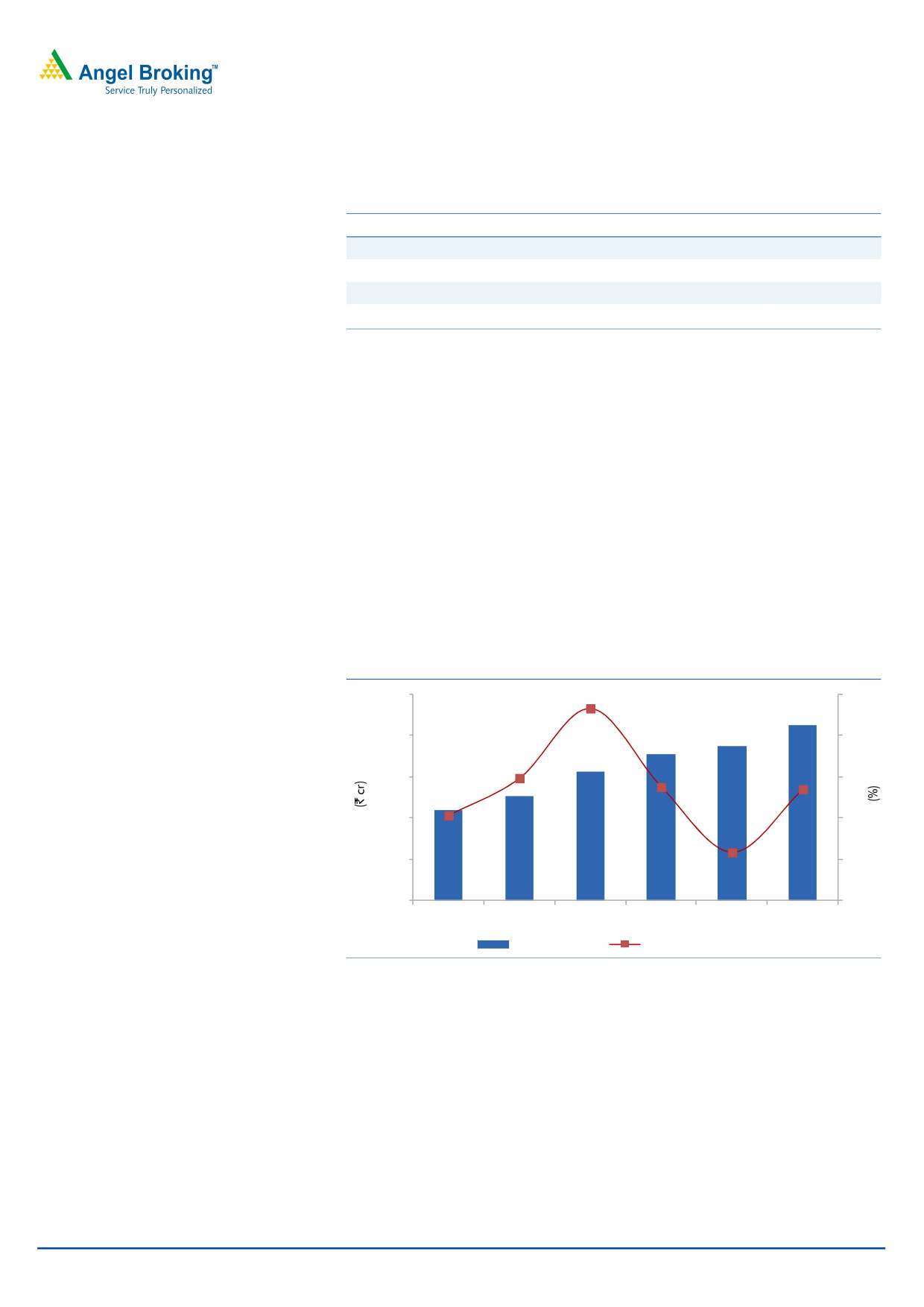

Revenue growth to witness a short-term slowdown

We expect TTKH to post a CAGR of 9.6% over FY2012-14E in its revenue to

`425cr in FY2014E. The restructuring plans of the company would lead to a short-

term slowdown in revenue growth on account of termination of condom (Durex

and Kohinoor) distribution which contributed ~20% to the company’s top-line.

Strong brands in the consumer products division like Woodward’s Gripe Water

and Eva are expected to facilitate a modest 5.8% revenue growth in FY2013E.

TTKH’s plans to sell condoms (manufactured by TTK-LIG) under its own brand

have commenced with the launch of Skore. Moreover, the company’s increased

focus on the foods business, orthopaedic implants and pharmaceutical business

would lead to recovery in revenue growth to 13.5% in FY2014E.

Exhibit 4: Revenue growth to revive in FY2014E

500

25

23.3

400

20

300

14.8

15

13.8

13.

5

200

10.3

10

5.8

100

5

220

252

311

354

374

425

0

0

FY2009

FY2010

FY2011

FY2012

FY2013E FY2014E

Revenue (LHS)

Revenue growth (RHS)

Source: Company, Angel Research

December 17, 2012

4

TTK Healthcare | Initiating coverage

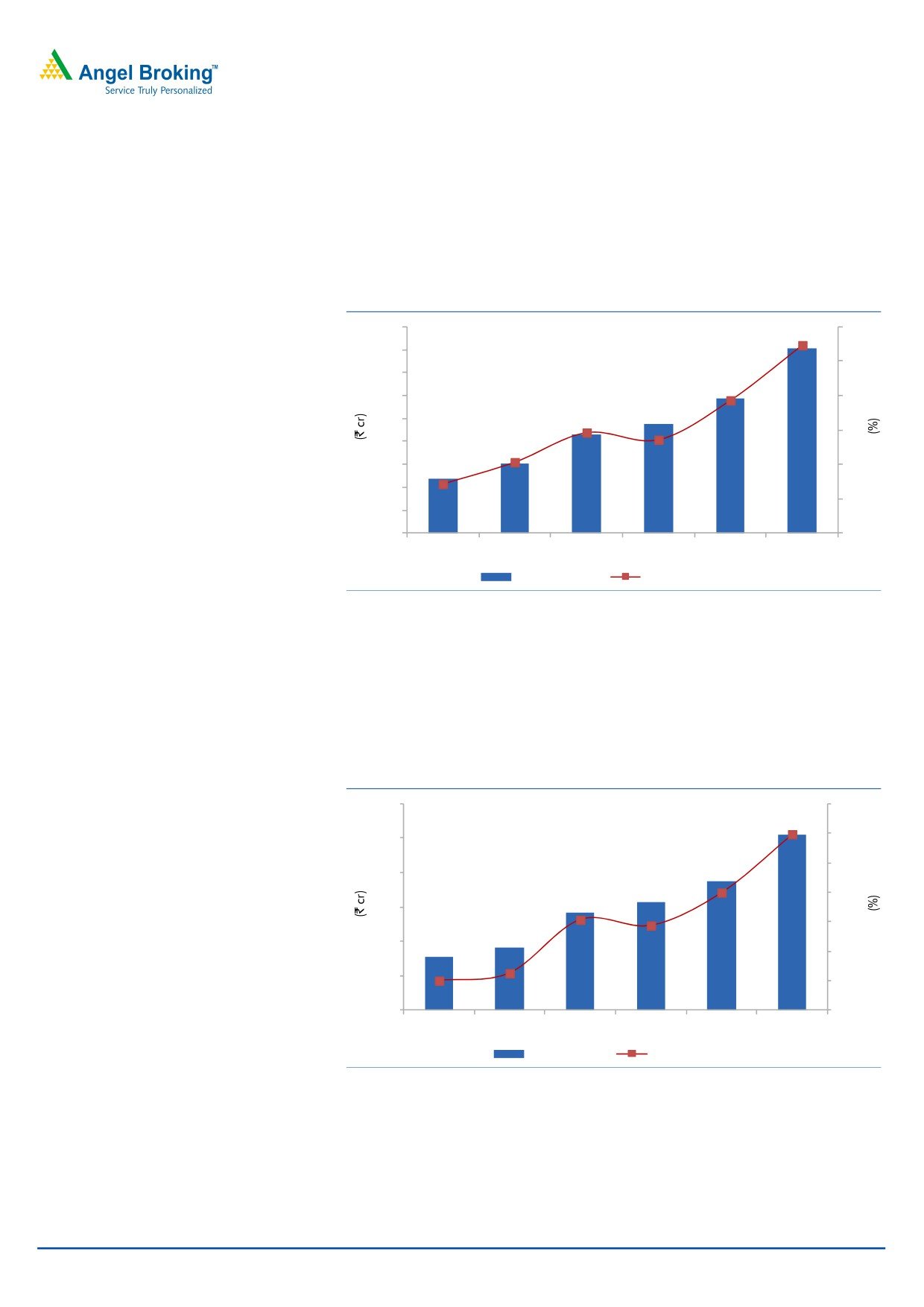

EBITDA margin to improve with focus on high margin business

TTKH’s EBITDA margin is expected to expand by 275bp over FY2012-14E to 9.5%

in FY2014E primarily due to termination of the low margin condom (Durex &

Kohinoor) distribution business and increased focus on high margin businesses like

branded foods, consumer products and pharmaceuticals.

Exhibit 5: EBITDA margin to move northwards

45

10

40

9.5

9

35

30

8

7.9

25

6.9

7

20

6.7

15

6.1

6

10

5.4

5

5

12

15

22

24

29

40

0

4

FY2009

FY2010

FY2011

FY2012

FY2013E FY2014E

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

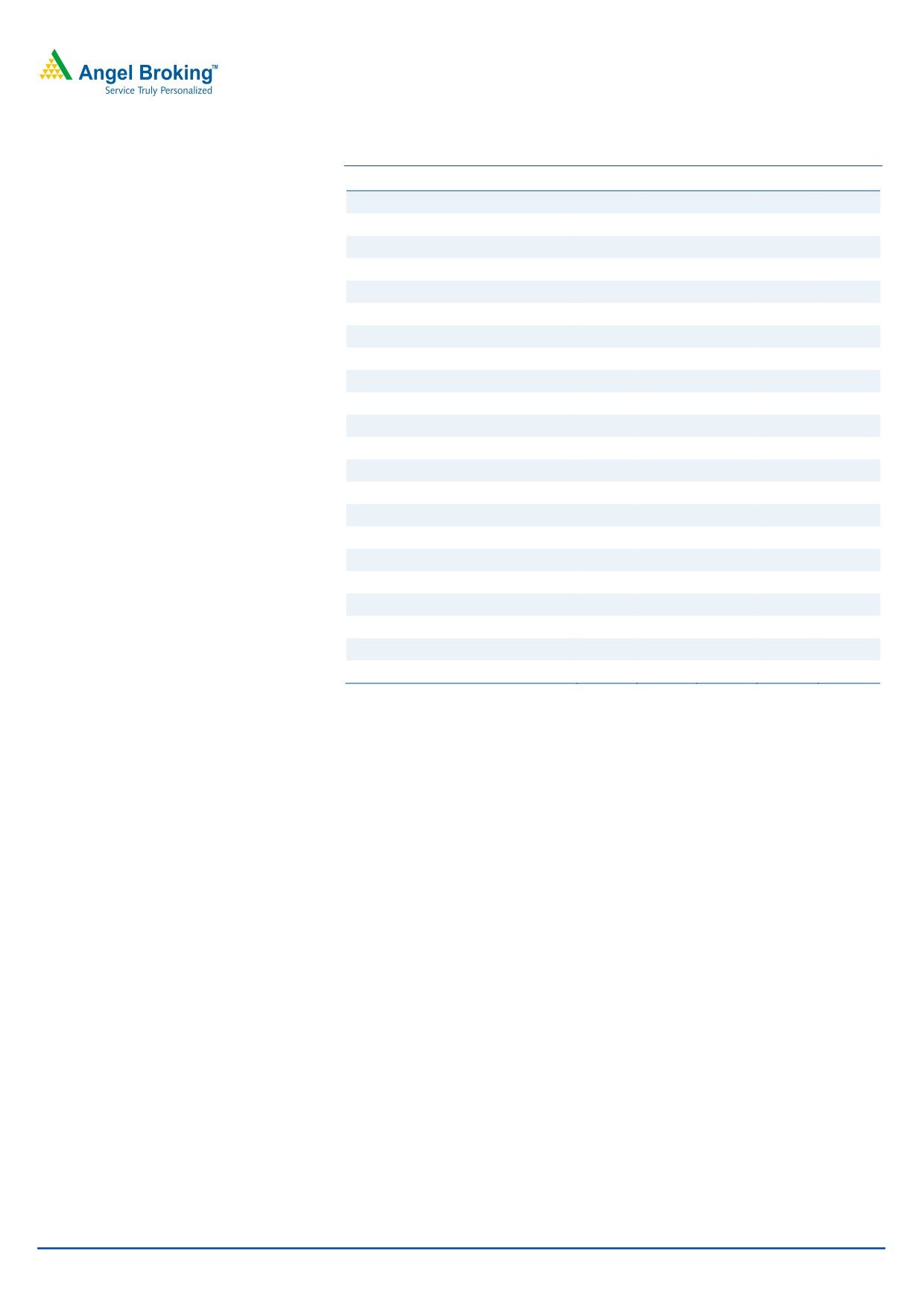

Net profit margin on an uptrend

Pickup in revenue growth in FY2014E coupled with improvement in EBITDA margin

is expected to result in a 27.6% CAGR in net profit over FY2012-14E to `25cr in

FY2014E from `16cr in FY2012.

Exhibit 6: Increased focus on high margin business to improve PAT

30

6.5

6.0

6.0

25

5.5

20

5.0

5.0

15

4.5

4.5

4.4

10

4.0

5

3.6

3.5

3.5

8

9

14

16

19

25

0

3.0

FY2009

FY2010

FY2011

FY2012

FY2013E FY2014E

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research

December 17, 2012

5

TTK Healthcare | Initiating coverage

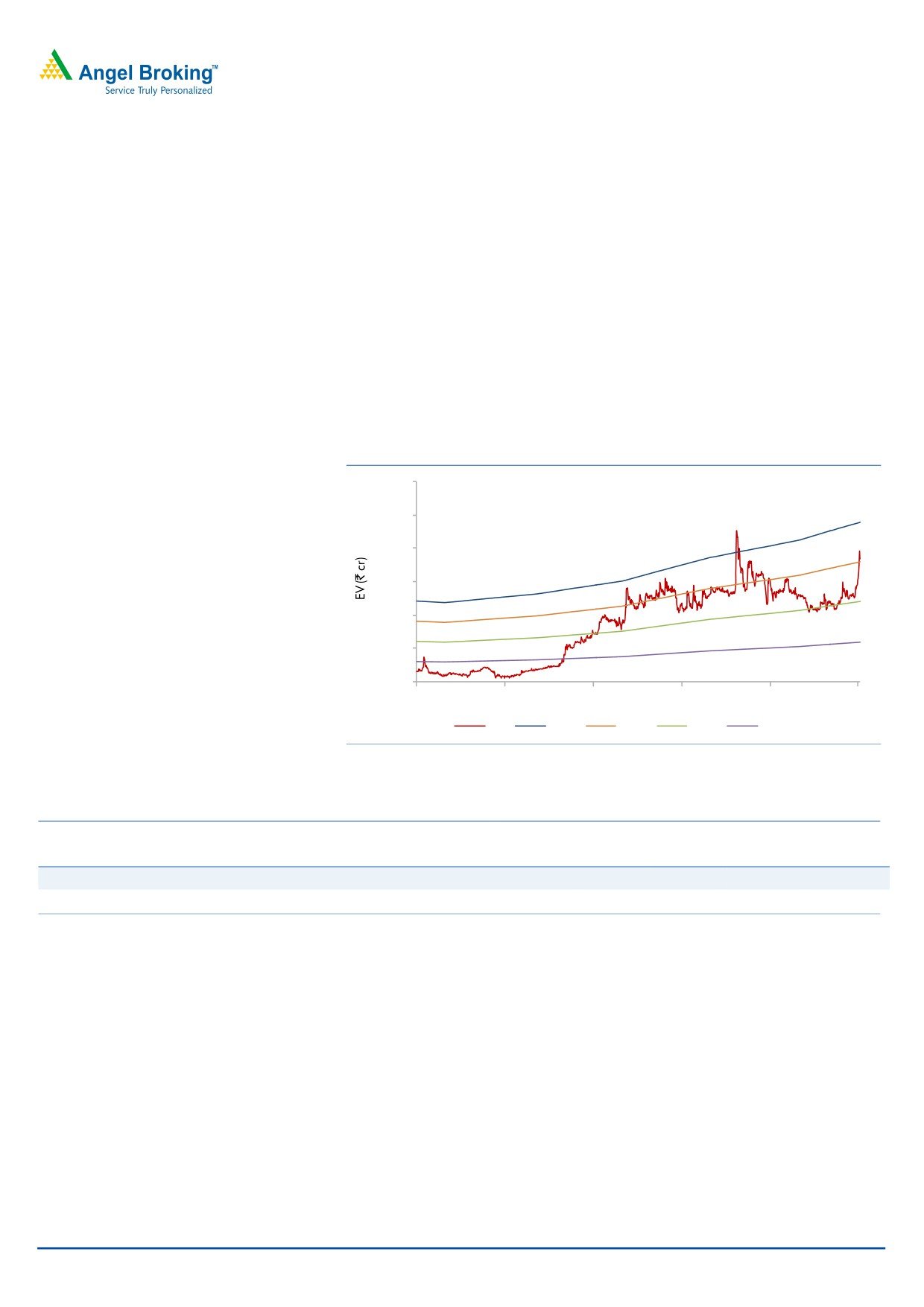

Outlook and Valuation

We expect a modest revenue growth of

9.6% over FY2012-14E owing to

termination of distribution of Durex and Kohinoor brands of condoms since the

right of the brands has been retained by Reckitt Benckiser after TTK (Parent

company) acquired TTK-LIG in November 2012. However, with the terminated

businesses being low margin, the company would benefit on the margin front, thus

leading to an expansion in EBITDA margin by 275bp over FY2012-14E to 9.5% in

FY2014E. Consequently, the net profit is expected to post a 27.6% CAGR over

FY2012-14E to `25cr in FY2014E. At the current market price, the stock is trading

at EV/sales of 0.8x for FY2014E, which we believe is attractive. Thus, we initiate

coverage on the stock with a Buy recommendation and a target price of `643

based on a target EV/sales of 1.0x for FY2014E.

Exhibit 7: One-year forward EV/sales band

600

500

400

300

200

100

0

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

EV

1.2x

0.9x

0.6x

0.3x

Source: Company, Angel Research

Exhibit 8: Relative Valuation (Standalone)

Relative

Net Sales

OPM

PAT

EPS

RoE

P/E

P/BV

EV/EBITDA

EV/sales

TTM ended Sep’12

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

TTKH

378

6.6

17

110.8

17.3

25.6

4.4

15.0

1.0

Amrutanjan Health

117

15.8

13

43.5

12.3

17.8

2.2

9.0

1.4

Source: Company, Angel Research

Key concerns

High attrition rate in Pharmaceutical division: The growth of the Pharmaceutical

division is dependent on its manpower. High rate of attrition prevalent in the

division could hamper the growth of the company.

Failure to revive Heart valve division: The performance of the heart valve division

had been impacted during FY2012 due to lower off-takes under the Government -

sponsored Welfare Programmes. Failure to retain volumes in the division could

hamper company’s growth.

December 17, 2012

6

TTK Healthcare | Initiating coverage

Company Background

TTK Healthcare, a part of the TTK group, is involved in different business like

pharmaceuticals, consumer products, biomedical devices and foods.

Exhibit 9: Segmental Revenue & EBIT

FY2008

FY2009

FY2010

FY2011

FY2012

Revenue (` cr)

Pharmaceuticals

98

114

127

153

178

Medical Devices

13

16

19

20

17

Consumer Products Distribution

79

80

96

125

141

Condoms

43

45

49

59

63

EVA & others

36

35

46

66

78

Foods

-

-

9

10

13

Others

10

10

2

4

4

Total

200

220

252

311

354

EBIT (` cr)

Pharmaceuticals

11

14

16

24

26

Medical Devices

1

7

8

7

4

Consumer Products Distribution

(1)

(4)

(2)

(1)

0

Foods

-

-

(1)

(0)

(0)

Others

1

(1)

(1)

(1)

(0)

EBIT margin (%)

Pharmaceuticals

11.7

12.4

13.0

15.4

14.7

Medical Devices

5.8

44.4

41.4

35.7

24.4

Consumer Products Distribution

-

-

-

-

0.2

Foods

-

-

-

-

-

Others

11.8

-

-

-

-

Source: Company

Pharmaceutical Division: This division is present across various therapeutic

segments like calcium supplements, haematinics, cervical dilators, thrombolytic

agents, rejuvenators, multimineral supplements, liver correctives and pain

management products providing herbal and allopathic formulations. Besides

these, the company also caters to the requirements of veterinarians, hatcheries,

poultry farms and dairy farms through a variety of herbal and allopathic

formulations.

Consumer Products Division: The Consumer Products Division (CPD) markets and

distributes Woodward's Gripe Water - the undisputed market leader in the baby

care category - and the recently introduced Woodward's Baby Soap. The division

also markets the Eva range of deodorants and talcum powders in a variety of

fragrances such as fresh, doll, dreams, sweet, zing, chic and wow. The CPD has

introduced many variations in packaging and has also forayed into the skincare

segment with a new range of moisturizers which is backed by the expertise of TTK's

Research.

The division was involved in the distribution of Durex and Kohinoor condoms which

were imported from TTK-LIG, a JV between TTK group and Reckitt Benckiser. Post

the acquisition of TTK-LIG by TTKH, the rights of Durex and Kohinoor were retained

December 17, 2012

7

TTK Healthcare | Initiating coverage

by Reckitt Benckiser, which resulted in termination of sale of condoms by TTKH.

However, the division still distributes Brylcreem haircare and toiletry products and

Kiwi's shoe care range.

Biomedical devices: This division manufactures and distributes indigenous heart

valve prosthesis- the tilting-disc TTK Chitra Heart Valve. This is the only Indian

made price friendly heart-valve and ~18,000 Chitra valves have been successfully

implanted in patients. The division also manufactures and markets Clinimesh - a

versatile prosthesis for surgical reconstruction of thoracic and abdominal wall

defects. The biomedical devices division also manufactures high-quality

orthopaedic implants and instruments under the brand name "Altius".

Foods: This division manufactures potato and cereal based pellets for domestic

and international markets. The cereal and potato based pellets come in various

shapes, such as wheels (mini & penta), tubes (mini, short, long & square), sticks, 3

rings, ribbed, star, checks, chips, drops etc besides onion rings. The customer base

for TTK ready-to-fry snack pellets includes multinationals and the trade in India.

The exports division services the foreign countries and the products are regularly

exported to the overseas markets.

December 17, 2012

8

TTK Healthcare | Initiating coverage

Profit & Loss Statement

Y/E March (` cr)

FY2010

FY2011

FY2012

FY2013E

FY2014E

Gross sales

252

311

354

374

425

Less: Excise duty

0

0

-

-

-

Net Sales

252

311

354

374

425

% chg

14.8

23.3

13.8

5.8

13.5

Net Raw Materials

134

163

186

183

196

Personnel

30

37

44

50

57

Other expenses

72

90

100

112

132

Total Expenditure

237

289

330

345

385

EBITDA

15

22

24

29

40

% chg

28.2

40.8

10.3

23.9

36.6

(% of Net Sales)

6.1

6.9

6.7

7.9

9.5

Depreciation

2

2

2

3

4

EBIT

13

20

21

26

36

% chg

32.4

45.1

9.4

22.2

37.9

(% of Net Sales)

5.3

6.3

6.1

7.0

8.5

Interest & other charges

2

2

3

3

3

Other Income

4

4

5

5

5

(% of Net sales)

1.5

1.4

1.3

1.3

1.2

PBT

16

22

24

28

38

% chg

21.3

21.3

21.3

21.3

21.3

Tax

6

7

8

9

13

(% of PBT)

41.1

33.5

33.6

33.5

33.5

PAT (reported)

9

15

16

19

25

Extraordinary (Exp)/Inc.

(0)

1

(0)

-

-

ADJ. PAT

9

14

16

19

25

% chg

19.0

54.1

11.3

19.2

36.0

(% of Net Sales)

3.6

4.5

4.4

5.0

6.0

Basic EPS (`)

11.8

19.0

20.1

24.1

32.7

Fully Diluted EPS (`)

11.8

19.0

20.1

24.1

32.7

% chg

16.7

61.3

6.0

19.7

36.0

December 17, 2012

9

TTK Healthcare | Initiating coverage

Balance Sheet

Y/E March (` cr)

FY2010

FY2011

FY2012

FY2013E

FY2014E

SOURCES OF FUNDS

Equity Share Capital

8

8

8

8

8

Reserves& Surplus

52

63

75

90

111

Revaluation Reserves

5

5

5

5

5

Shareholders’ Funds

65

76

88

102

124

Total Loans

14

13

18

20

21

Deferred Tax Liability (Net)

2

2

2

2

2

Other Long-term liabilities

-

7

8

8

8

Total Liabilities

81

98

116

132

154

APPLICATION OF FUNDS

Gross Block

46

56

60

67

82

Less: Acc. Depreciation

22

24

26

29

34

Net Block

24

33

33

38

48

Capital Work-in-Progress

6

5

6

7

6

Investments

8

7

7

7

7

Long term Loans & adv

-

1

1

1

1

Current Assets

116

147

166

180

205

Cash

49

61

62

79

89

Loans & Advances

21

27

34

34

40

Inventory

23

27

33

30

35

Debtors

23

32

37

37

42

Other current assets

-

-

-

-

-

Current liabilities

73

95

97

101

112

Net Current Assets

42

52

68

80

93

Misc. Exp. not written off

-

-

-

-

-

Total Assets

81

98

116

132

154

December 17, 2012

10

TTK Healthcare | Initiating coverage

Cash Flow Statement

Y/E March (` cr)

FY2010

FY2011

FY2012 FY2013E FY2014E

Profit before tax

16

22

24

28

38

Depreciation

2

2

2

3

4

Change in Working Capital

6

2

(15)

6

(3)

Other income

(4)

(4)

(5)

(5)

(5)

Direct taxes paid

(6)

(7)

(8)

(9)

(13)

Others

6

11

8

-

-

Cash Flow from Operations

19

25

6

23

22

(Inc.)/Dec. in Fixed Assets

(11)

(9)

(4)

(8)

(14)

(Inc.)/Dec. in Investments

-

(1)

(0)

-

-

(Inc.)/Dec. in L.T. Loans & advances

-

(1)

0

-

-

Other income

4

4

5

5

5

Others

(4)

0

(5)

-

-

Cash Flow from Investing

(11)

(7)

(4)

(3)

(9)

Issue of Equity

(0)

-

-

-

-

Inc./(Dec.) in loans

(1)

(1)

5

2

1

Inc./(Dec.) in Other long term liabilities

-

7

1

-

-

Dividend Paid (Incl. Tax)

(3)

(4)

(4)

(4)

(4)

Others

(4)

(9)

(3)

-

-

Cash Flow from Financing

(9)

(7)

(1)

(2)

(3)

Inc./(Dec.) in Cash

(1)

11

1

17

10

Opening Cash balances

50

49

61

62

79

Closing Cash balances

49

61

62

79

89

December 17, 2012

11

TTK Healthcare | Initiating coverage

Key Ratios

Y/E March (` cr)

FY2010

FY2011

FY2012

FY2013E

FY2014E

Valuation Ratio (x)

P/E (on FDEPS)

46.8

29.0

27.4

22.9

16.8

P/CEPS

46.8

29.0

27.4

22.9

16.8

P/BV

6.6

5.7

4.9

4.2

3.5

Dividend yield (%)

0.6

0.7

0.7

0.8

0.8

EV/Sales

1.5

1.2

1.1

1.0

0.8

EV/EBITDA

25.1

17.3

15.9

12.3

8.8

EV / Total Assets

4.8

3.8

3.3

2.7

2.3

Per Share Data (`)

EPS (Basic)

11.8

19.0

20.1

24.1

32.7

EPS (fully diluted)

11.8

19.0

20.1

24.1

32.7

Cash EPS

14.1

21.5

23.1

28.3

38.0

DPS

3.5

4.0

4.0

4.5

4.5

Book Value

83.2

97.5

112.9

131.7

159.1

Dupont Analysis

EBIT margin

5.3

6.3

6.1

7.0

8.5

Tax retention ratio

0.6

0.7

0.7

0.7

0.7

Asset turnover (x)

3.2

3.5

3.3

3.0

3.0

ROIC (Post-tax)

10.0

14.6

13.3

14.1

16.8

Cost of Debt (Post Tax)

7.0

8.8

10.9

10.0

9.7

Leverage (x)

(0.7)

(0.7)

(0.6)

(0.6)

(0.6)

Operating ROE

24.7

35.3

33.8

34.2

39.6

Returns (%)

ROCE (Pre-tax)

16.9

21.9

20.1

21.1

25.2

Angel ROIC (Pre-tax)

66.9

91.9

73.6

71.1

84.5

ROE

14.4

20.1

19.2

19.7

22.5

Turnover ratios (x)

Asset Turnover (Gross Block)

5.8

6.1

6.1

5.9

5.7

Inventory / Sales (days)

31

29

31

31

28

Receivables (days)

32

32

36

36

36

Payables (days)

103

106

106

106

106

WC cycle (ex-cash) (days)

(6)

(9)

(1)

4

2

Solvency ratios (x)

Net debt to equity

(0.7)

(0.7)

(0.6)

(0.6)

(0.6)

Net debt to EBITDA

(2.8)

(2.5)

(2.1)

(2.2)

(1.9)

Interest Coverage (EBIT / Interest)

7.7

10.8

8.4

9.2

12.2

December 17, 2012

12

TTK Healthcare | Initiating coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

TTK Healthcare

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

December 17, 2012

13

TTK Healthcare | Initiating coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Viral Shah

Sr. Analyst (Infrastructure)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, FMCG)

Yaresh Kothari

Analyst (Automobile)

Ankita Somani

Analyst (IT, Telecom)

Sourabh Taparia

Analyst (Banking)

Bhupali Gursale

Economist

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Tejas Vahalia

Research Editor

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

December 17, 2012

14