Please refer to important disclosures at the end of this report

1

TCS Buyback | IT Services

January 21, 2022

TATA Consultancy Services

Buyback 2022

Buyback 2022 details

Particulars

Details

No. of Shares

4,00,00,000

Buyback Price

4,500

Premium to CMP

17.6

%

Buyback Size

`

18,000 Cr

Record Date

TBA

Small Shareholding

<

`

2Lk based on closing

price on record date

Small Shareholder Reservation

15%

Max # of shares to be held

44

Source: Company, Angel Research

The Board of Directors of Tata Consultancy Services Ltd (TCS), at its meeting held on

January 12, 2022 has approved a proposal to buyback up to four crore shares at

`

4,500 per share. The buy-back aggregates to

`

18,000 Cr, which represents

1.08% of

the total, paid up equity share capital. The buyback will be via the tender off

er route

and as per SEBI regulations, 15% of the offer size (~

`2,700 crore) will be reserved for

small shareholders holding shares upto a value of INR `2 lakh as on the record date.

As per the buyback norms, the reserved portion for the small shareholders is 15% or 6

0

lakh shares. At the price of `

4,500 per share the maximum number of shares held by an

individual will be 44 to qualify for the small

shareholder criteria. Based on the offer

letters and post buyback announcement for the last three buybacks, the total shares

held by such shareholders was <1% of the total outstanding shares.

Historically the

participation rate by small investors has been

less than 100% in all the three buybacks

between 2017 to 2020. However the participation rate has increased from 49.8% in the

2017 buyback to 76.6% and may

increase further in the forthcoming buyback given likely

increase in retail participation.

Therefor

e we believe that the acceptance ratio in the small shareholder category would

be lower than the past buybacks and could be in the range of 30-

50% in the forthcoming

buyback. Although the total returns can vary depending on the acceptance ratio, a

30%

to 50% acceptance ratio can yield profits between 5.8% to 8.8

% assuming that

investors are able to sell the balance shares at current price of `3,827 per share.

Shares held by small shareholder

s as determined at the record date

Buyback Year

% of total o/s shares

2017

0.9

2018

0.7

2020

0.5

Source: Company, Angel Research; Note: Above data is for the small shareholder category

CMP

`

3,827

Not Rated

Stock Info

Sector

Bloomberg Code

Shareholding Pattern (%)

Promoters 72.2

MF / Banks / Indian Fls 8.0

FII / NRIs / OCBs 15.0

Indian Public / Others 4.8

IT Services

Market Cap (` cr)

14,15,461

52 Week High / Low

4,043 / 2,880

Avg. Daily Volume

25,23,805

Face Value (

`)

1

BSE Sensex

59,465

Nifty

17,757

Reuters Code

TCS.BO

TCS.IN

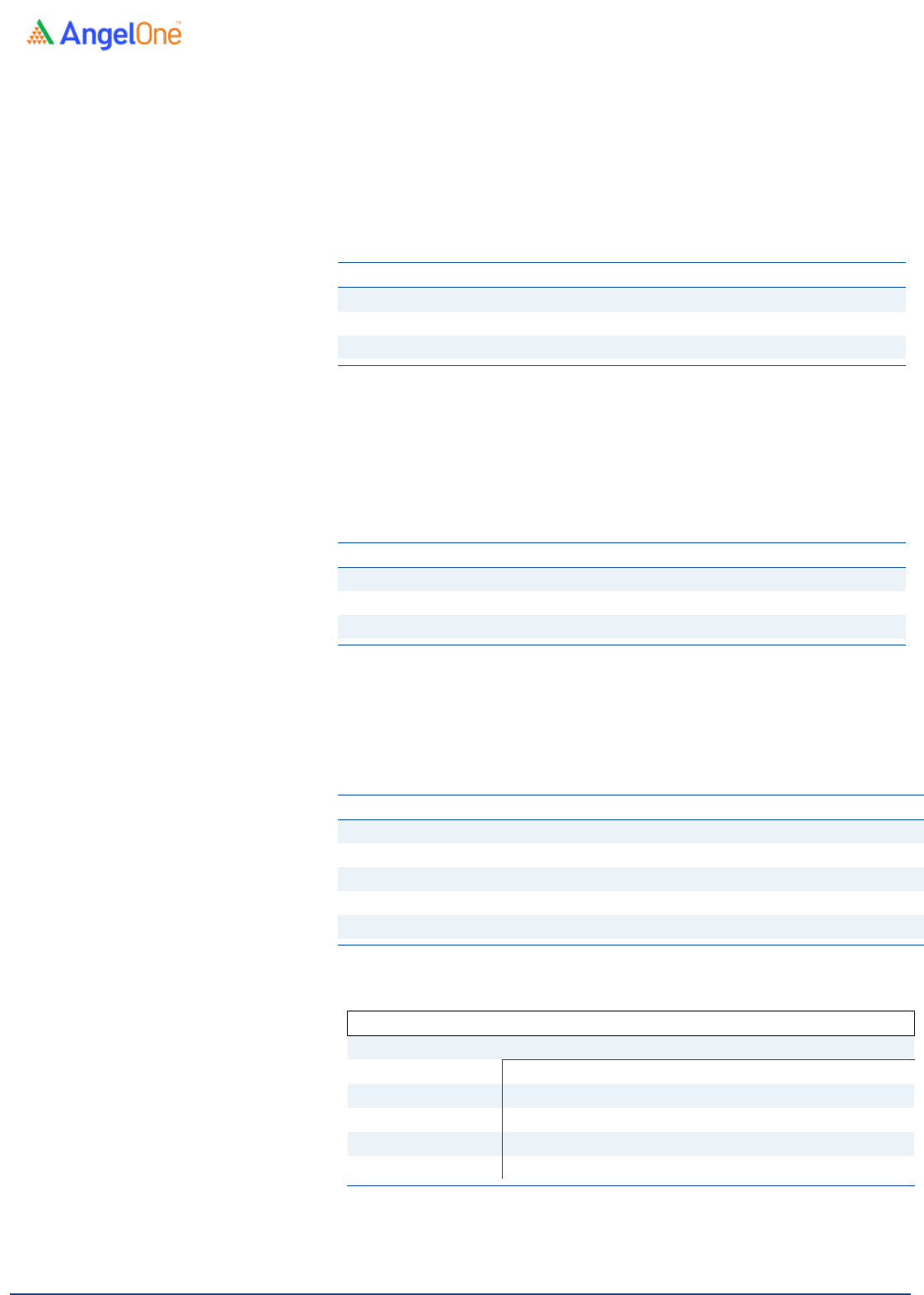

Price Chart

Source: Company, Angel Research

Jyoti Roy

022

-4000 3600 Ext: 6842

jyoti.roy@angelbroking.com

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Dec-18

Mar-1 9

Jun-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

Nov-20

Feb-21

May-21

Aug-21

Nov-21

TCS |Buyback Update

January 21, 2022

2

As seen in the table(s) below, this group of category has higher entitlement and

has seen limited participation which bodes wells from acceptance perspective.

The past entitlement ratios have come down from 45% to 40% and it is likely that

the upcoming entitlement ratio can trend lower between 35%-40%.

Past entitlement ratios

for tendering of shares for small shareholders

Buyback Year

Shares

Entitled

Against

held

Ratio (%)

2017

9

20

45.0

2018

43

96

44.8

2020

2

5

40.0

Source: Company, Angel Research; Note: Above data is for the small shareholder category

Based on the below exhibit, the participation level for this category has been less

than 100% which improves the chances of shares being accepted. Over the past three

buybacks, the average response rate has been ~54% with 2020 seeing higher

response rate of 76.6%.

Response

by small shareholders has been less than 100%

Buyback Year

Shares

Reserved

Shares

Tendered

Response (%)

2017

84,21,052

41,97,408

49.8

2018

1,14,28,572

40,16,984

35.1

2020

80,00,000

61,25,386

76.6

Source: Company, Angel Research; Note: Above data is for the small shareholder category

Although the total returns can vary depending on the acceptance ratio, a 30% to 50%

acceptance ratio can yield profits between 5.8% to 8.8% assuming that investors are

able to sell the balance shares at current price of `3,827 per share.

Potential return assuming 50% acceptance and unchanged price

Particulars

Shares

Price (`)

Value (

`)

Initial Purchase

44

3,826.6

-

1,68,368

Shares Tendered

22

4,500

.0

99,000

Price Impact on Balance Shares

22

3,826.6

84,184

Total

14,816

Returns

8.8%

Source: Company, Angel Research; Note: Calculation based on NSE closing as on 20 Jan, 2022

Sensitivity analysis of returns

Stock Price

Acceptance Ratio

3,367

3,597

3,827

4,056

4,286

30%

-

3.3%

1.0%

5.2%

9.4%

13.7%

40%

-

0.6%

3.1%

6.8%

10.5%

14.2%

50%

2.8%

5.8%

8.8%

11.8%

14.8%

60%

5.5%

7.9%

10.4%

12.9%

15.3%

65%

6.8%

9.0%

11.2%

13.4%

15.6%

Source: Company, Angel Research; Note: Calculation based on NSE closing as on 20 Jan, 2022

TCS |Buyback Update

January 21, 2022

3

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)

Research Team Tel: 022 - 40003600 E-mail: research@angelbroking.com Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the

report or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market

making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is

for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation

or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors

to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that

prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in

the subject company. Research analyst has not served as an officer, director or employee of the subject company.