Initiating Coverage | Auto Ancillary

January 8, 2014

Subros

BUY

CMP

`67

Well poised to ride passenger vehicle recovery

Target Price

`80

Investment Period

12 Months

Passenger vehicle industry to grow in double-digits over the next two

years: After two consecutive years of no growth, the passenger vehicle industry

has shown signs of recovery in the last few months. In the YTD FY2015 period

Stock Info

(April to November 2014), the industry witnessed a growth of 3%. Green shoots

Sector

Auto Ancillary

of revival in the industry are clearly visible and we expect the growth to accelerate

Market Cap (` cr)

404

over the next two years. Consumer sentiments have improved considerably and

Net Debt (` cr)

401

we expect the passenger vehicle industry to report a double-digit growth

Beta

1.5

(11% CAGR) over FY2015-2017 on account of (a) Improved economic outlook

52 Week High / Low

81 / 23

resulting in higher disposable incomes among consumers, (b) Downwerd trend in

Avg. Daily Volume

15,183

fuel prices resulting in lower cost of ownership, and (c) Expected reduction in

Face Value (`)

2

interest rates.

BSE Sensex

27,275

In-house manufacturing, higher capacity utilization, and JPY

Nifty

8,235

weakening to aid in margin improvement: Subros is targeting to reduce its

Reuters Code

SUBR.BO

raw material costs by increasing in-house manufacturing of components. It has

Bloomberg Code

SUBR@IN

started manufacturing certain components like evaporators, compressors and

heat exchange parts and invested in a tooling room which would enable it to

further localize other components. It aims to increase the localization of

Shareholding Pattern (%)

components and further bring down material costs to 65% of sales (from current

Promoters

40.0

68%) over the next two to three years. Also, a strong double-digit growth in the

MF / Banks / Indian Fls

10.1

passenger vehicle industry would improve its capacity utilisation levels (current

capacity utilization stands at ~55%), thus resulting in operating leverage. Further, the

FII / NRIs / OCBs

26.6

recent weakening of the Japanese Yen (JPY) would also boost margins, given that

Indian Public / Others

23.3

50% of the raw materials consumed by the company are JPY denominated imports.

Outlook and Valuation: We expect Subros to clock a revenue CAGR of 13% over

Abs. (%)

3m 1yr 3yr

FY2014-FY2017 aided by a recovery in the passenger vehicle industry and

Sensex

3.9

31.6

72.1

market share regain by its key clients. Initiation of supplies to Denso Corporation

would also boost Subros’ top-line. Also, Subros’ margins are expected to improve

Subros

2.7

149.7

199.1

owing to increased localisation, operating leverage and weakness in JPY. We also

expect the company’s interest costs to recede, given the reduction in the debt

levels. We expect Subros to report a PAT CAGR of 29% over FY2014-FY2017. At

the current market price of `67, the stock trades at 15.3x and 9.2x its FY2016

and FY2017 earnings, respectively. We initiate coverage on the stock with a Buy

recommendation and target price of `80 based on 11x FY2017E EPS, indicating

an upside of 19% from the current levels.

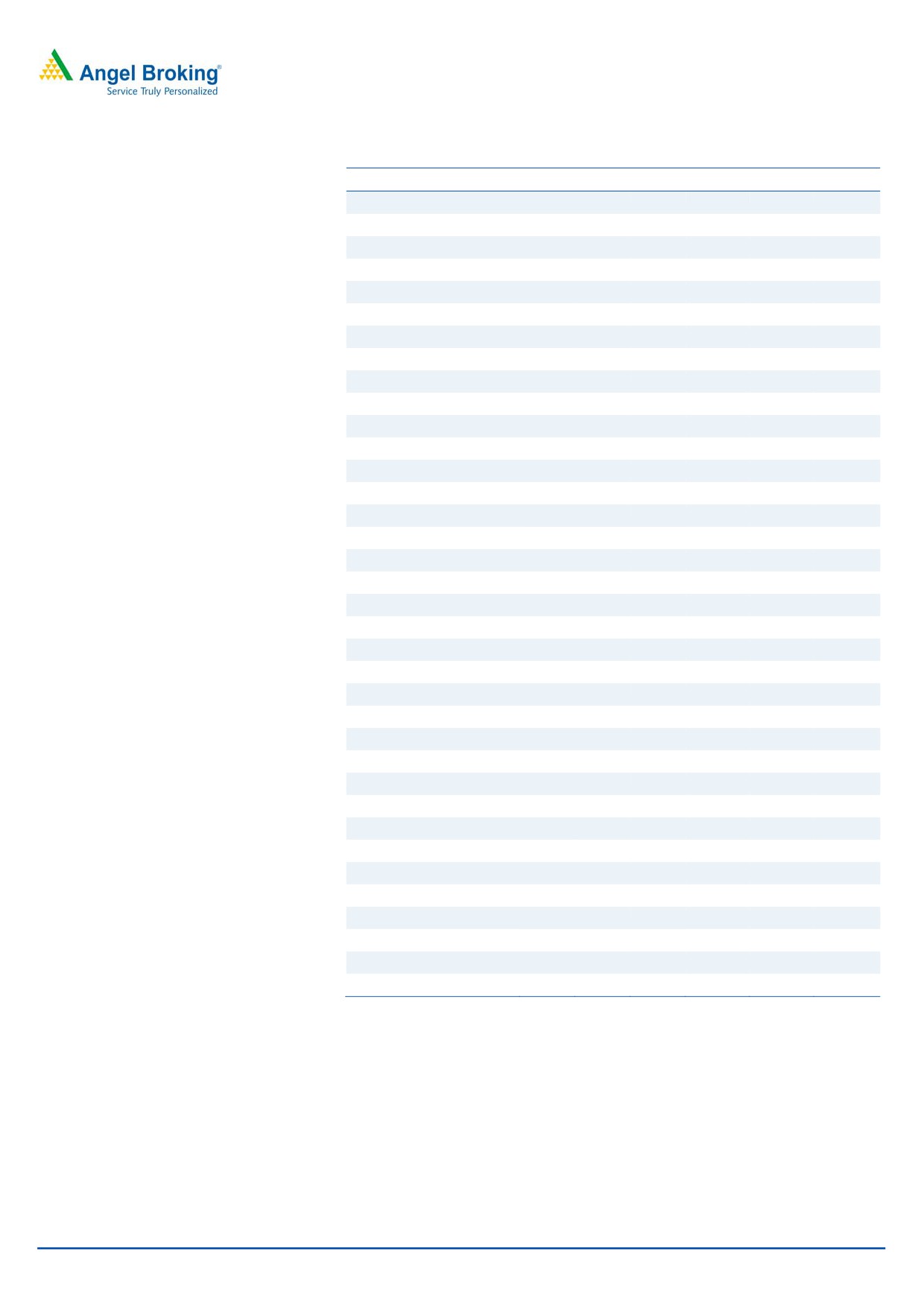

Key financials

Y/E March (` cr)

FY2014

FY2015E

FY2016E

FY2017E

Net sales

1,171

1,255

1,416

1,706

% chg

(7.9)

7.2

12.8

20.6

Net profit (Adj.)

20

19

26

44

% chg

(0.9)

(5.2)

36.8

66.1

EBITDA margin (%)

11.2

11.2

11.3

11.3

EPS (`)

3.4

3.2

4.4

7.3

P/E (x)

19.8

20.9

15.3

9.2

P/BV (x)

1.3

1.3

1.2

1.1

RoE (%)

6.9

6.2

8.1

12.4

RoCE (%)

7.7

7.4

9.0

12.3

Bharat Gianani

EV/Sales (x)

0.6

0.6

0.5

0.4

022-39357800 Ext: 6831

EV/EBITDA (x)

6.1

5.8

5.0

4.0

Source: Company, Angel Research, Note: CMP as of January 8, 2015

Please refer to important disclosures at the end of this report

1

B

Subros | Initiating Coverage

Investment Arguments

PV industry recovery to accelerate; set to grow in double-digits in

FY2016-17

For two consecutive years (FY2013 and FY2014), the demand for passenger

vehicles remained flat (declining by about 1%). The industry staged a recovery in

FY2015 on back of improved consumer sentiments post the election of the new

government. Passenger vehicle volumes have grown by 3% in YTD FY2015

(April-November 2014). Early signs of recovery are clearly visible and we expect

the pent up demand to drive passenger vehicle volumes. We expect the recovery to

accelerate further over FY2016-17 on account of (a) Improved economic growth

outlook with the government’s focus on policy reforms, (b) Stable/downward trend

in fuel prices, (c) Inflation being in a downward trajectory which is likely to lead to

lowering in interest rates. We expect the passenger vehicle industry to grow at a

CAGR of 11% over the next two years thereby retracting to its long term double

digit CAGR growth.

The passenger vehicle segment contributes by about 88% to Subros’ revenues. An

expected upcycle in the segment would thus boost Subros’ revenues.

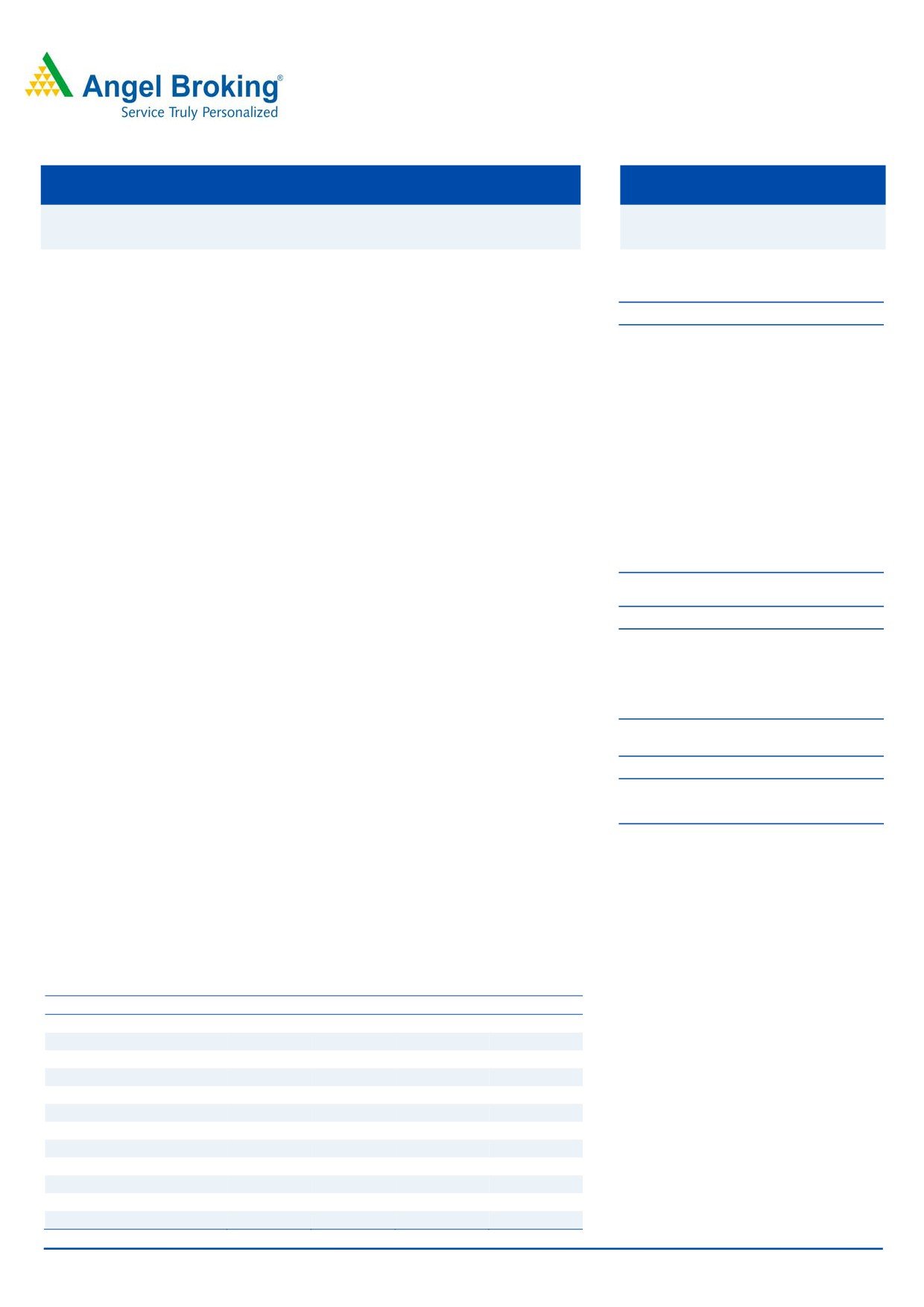

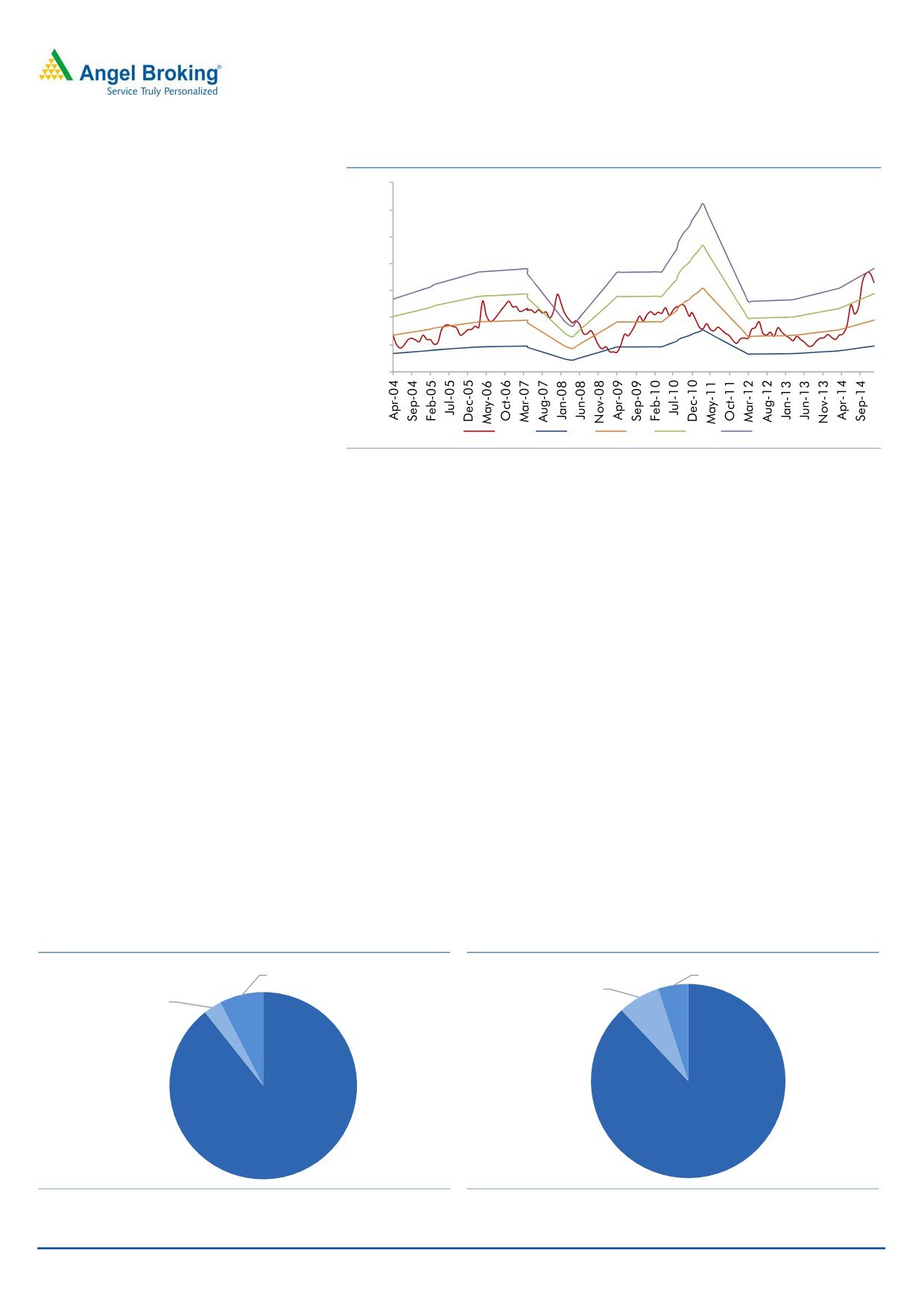

Exhibit 1: Correlation with PV volumes

Exhibit 2: PV industry growth trend

30

45,00,000

30.0

40,00,000

25.0

25

35,00,000

20.0

20

30,00,000

15.0

25,00,000

10.0

15

20,00,000

5.0

15,00,000

10

10,00,000

0.0

5

5,00,000

(5.0)

0

(10.0)

0

FY08

FY09

FY10

FY11

FY12

FY13

FY14

1H FY15

(5)

PV industry Growth (%)

Subros Kits Growth (%)

(10)

PV industry (units)

Growth yoy (%)

Source: Company, Angel Research

Source: SIAM, Angel Research

Market share regain by key clients to help Subros outpace PV

industry growth

Maruti Suzuki is the largest client for Subros constituting about 80% of the overall

revenues. M&M and Tata Motors contribute about 15% of the overall revenues.

Maruti Suzuki has outperformed the passenger vehicle industry in YTD FY2015 and

is likely to retain market share on back of new launches. Subros’ other customers

Mahindra & Mahindra (M&M) and Tata Motors however, have underperformed in

the last two years due to lack of new models and limited presence in the fast

growing petrol segment. The two lost market share by 250bp and 510bp,

respectively, over the aforementioned period. Overall, the market share of Subros’

customers viz Maruti Suzuki, M&M and Tata Motors, declined by ~400bp, over the

past two years.

January 8, 2015

2

Subros | Initiating Coverage

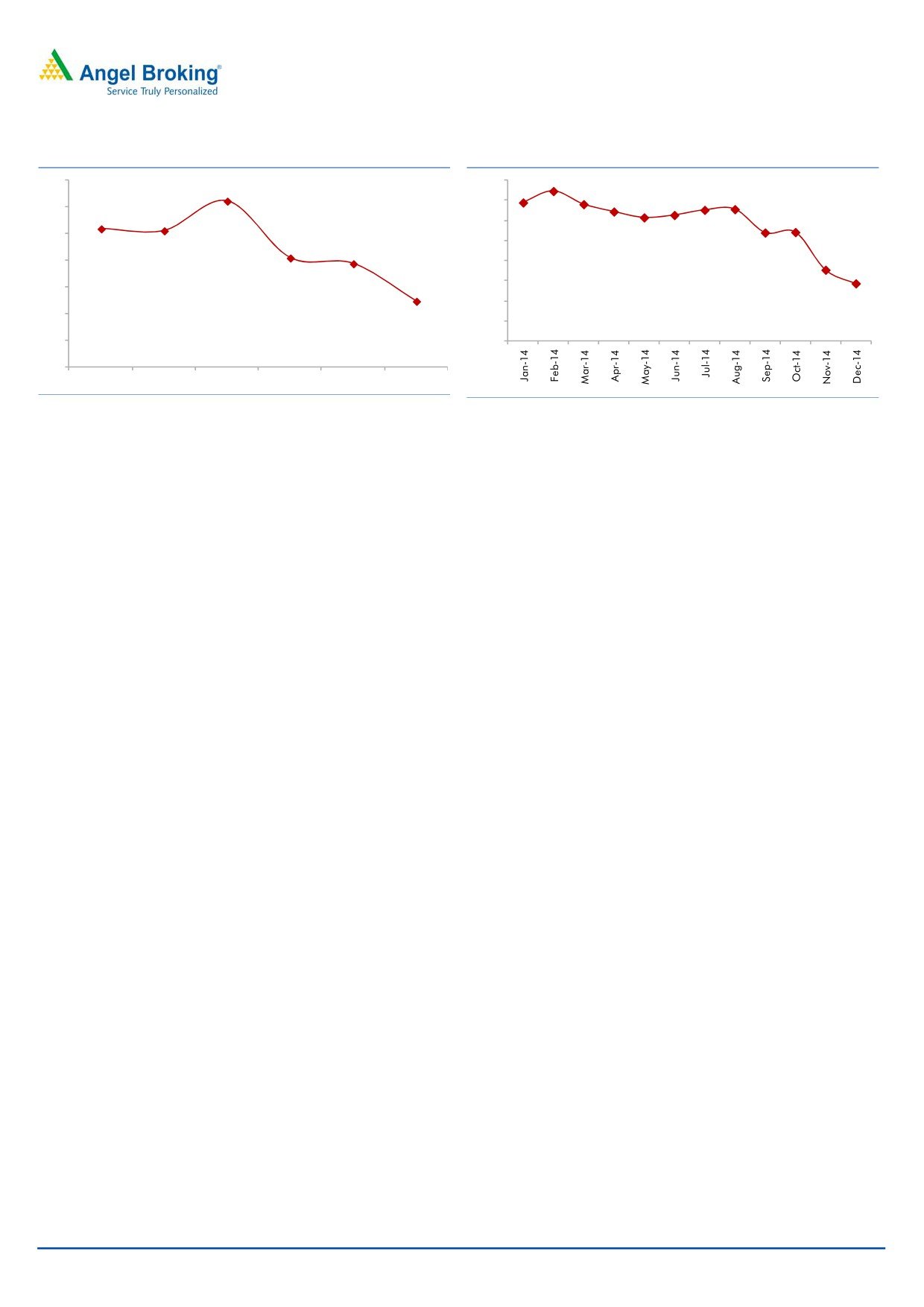

Exhibit 3: Cumulative Market share of key clients

64

62

60

58

56

54

52

50

48

46

FY2010

FY2011

FY2012

FY2013

FY2014

YTD FY2015

Source: SIAM, Angel Research

However, both M&M and Tata Motors have lined up new products which would

enable them to regain market share. M&M has planned three new product

launches in the compact UV space. It also aims to launch petrol variants

commencing from 4QFY2015. Further, Tata Motors has recently introduced “Zest”

and also plans to launch compact car “Bolt” in 4QFY2015. New product launches

by Subros’ key customers would enable it to outpace growth in passenger vehicles.

Exhibit 4: New product launches by key clientle

Clients

New launches

Maruti Suzuki

Crossover, Utility vehicle and LCV

M&M

Two compact utility vehicles and new LCV

Tata Motors

Bolt (hatchback) Nexon (Compact UV)

Source: Angel Research

Improving passenger vehicle outlook

Increased in-house manufacturing, operating leverage and JPY

coupled with new launches by key

depreciation to keep margins at elevated levels

customers will enable to outpace

Subros is focusing on increasing in-house manufacturing of components in order

industry growth

to reduce material costs. It earlier procured raw materials in the CKD format and

has recently shifted focus on in-house manufacturing. Increased localization has

enabled the company to bring down raw material costs from 72% of sales in

FY2012 to 69% in FY2014, thus resulting in margin improvement. Subros is

working on localization of critical parts such as evaporators, compressors and heat

exchangers. Further, it has also invested in the tooling center at Noida to prepare

dies and moulds, leading to in-house manufacturing of critical components. It

aims to accelerate the localization process further and is targeting to bring down

the raw material cost by about 300bp to 65% of sales over the next three years.

January 8, 2015

3

Subros | Initiating Coverage

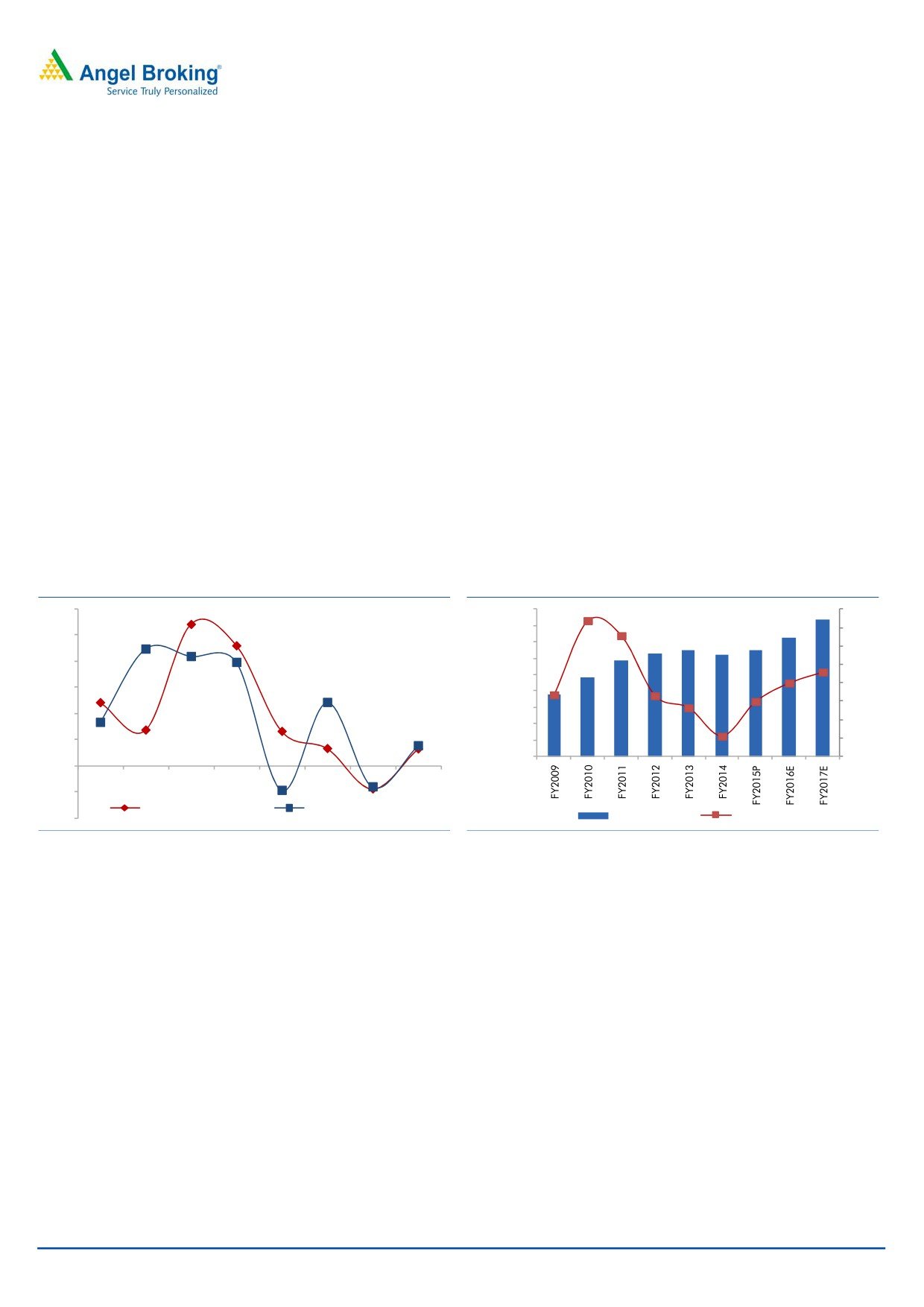

Exhibit 5: Raw material costs (% of sales)

Exhibit 6: INR-JPY trend

78

0.62

0.60

76

0.58

74

0.56

72

0.54

0.52

70

0.50

68

0.48

66

0.46

64

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

Source: Company, Angel Research

Source: Angel Research

Subros’ capacity utilisation levels are expected to improve on back of increased

offtake from its key customers. We expect the utilization levels to inch up from 55%

currently to 75% in FY2017, thus resulting in benefits of operating leverage. Also,

JPY has recently depreciated against the INR on back of monetary easing policy by

the Japanese government. The outlook for JPY remains weak in the medium term.

Subros would be the prime beneficiary of the weak JPY as raw material imports

from Japan constitute about 30% of overall sales.

Supply to Denso Corporation for Cooling modules and Radiators

to boost top-line and turnover ratios

Subros entered into a MoU with Denso Corporation for supply of cooling modules

and radiators. Subros would manufacture these products at its Manesar plant and

supply to Denso Corporation. The production would commence by early FY2017

and the company is aiming at revenues of `80cr in FY2017. At full utilization, the

project has a revenue potential of `200cr. The agreement entails a capex of `50cr

to be invested over FY2015-2017. The new order will require minimal capex as

the radiators would be manufactured at the existing Manesar plant and would also

utilize current machinery. Thus, the new order is expected to boost Subros’ top-line

and turnover ratios, going forward.

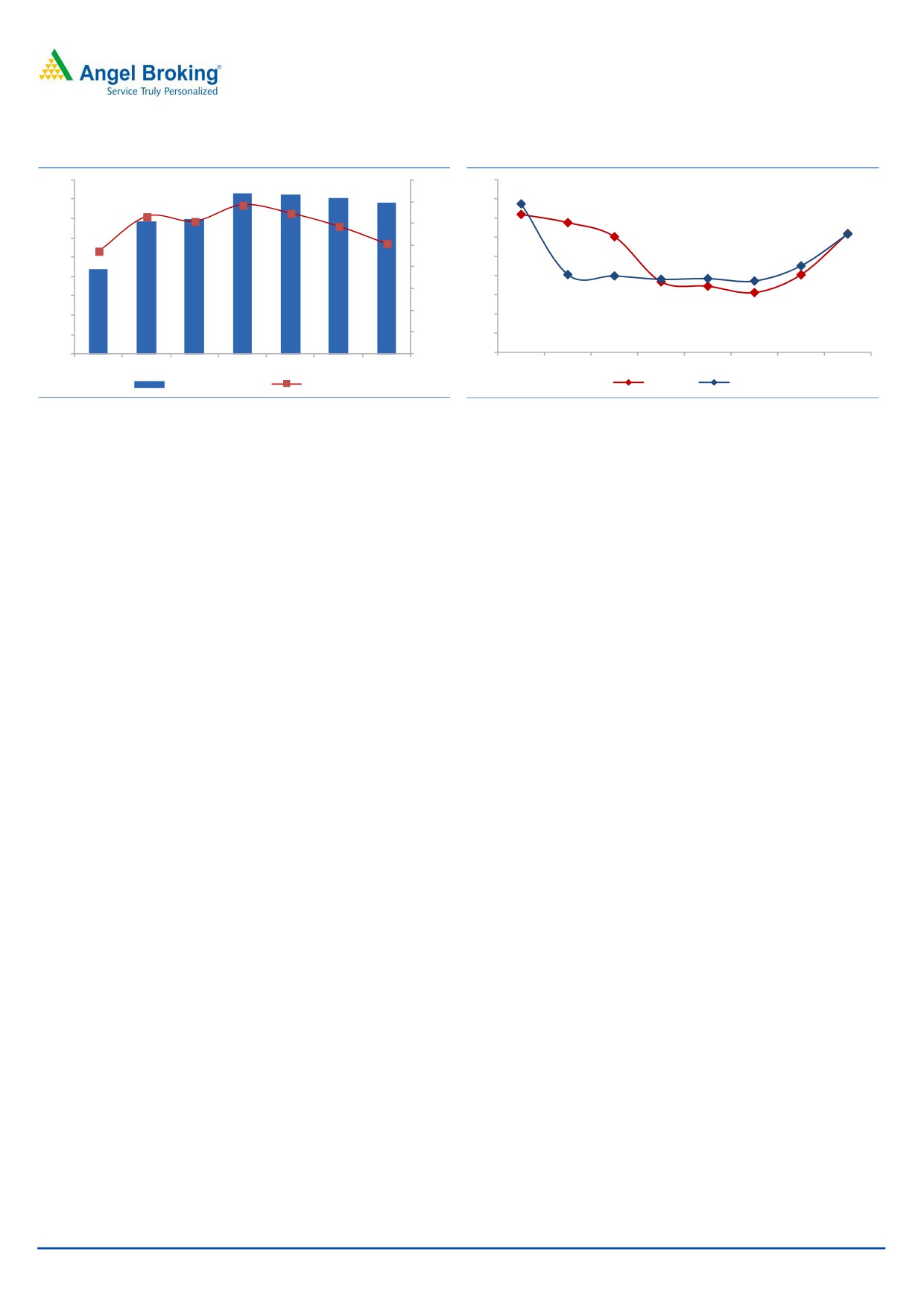

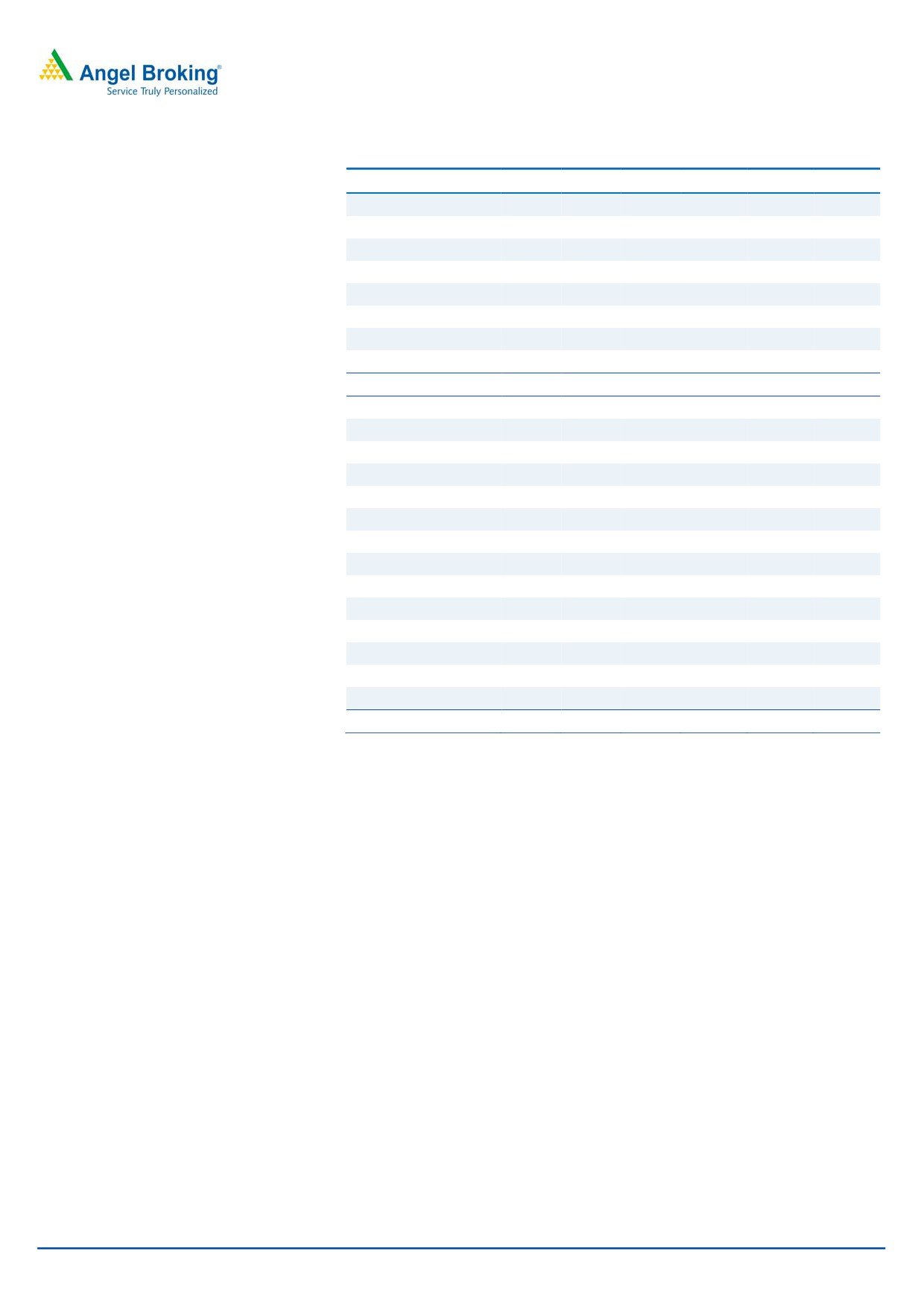

Capex cycle over, return ratios to improve on back of increased

capacity utilisation and debt reduction

Post the recent commissioning of the Chennai plant and increase in the kits

capacity, there is no major capex lined up for Subros over the next two years. The

capacity utilization is expected to improve due to recovery in the passenger vehicle

segment. Also, Subros plans to reduce the debt levels going ahead which will

boost its return ratios. We expect the company’s ROCE to improve from 7.7% in

FY2014 to 12.3% in FY2017. Similarly, ROE is estimated to reach 12% in FY2017

from 7% levels currently.

January 8, 2015

4

Subros | Initiating Coverage

Exhibit 7: Debt levels

Exhibit 8: Return ratios

450

1.60

18

400

1.40

16

350

14

1.20

300

12

1.00

250

10

0.80

200

8

0.60

150

6

100

0.40

4

50

0.20

2

0

0.00

0

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E FY2017E

FY2010

FY2011

FY2012

FY2013

FY2014 FY2015E FY2016E FY2017E

Debt (` cr)

D/E Ratio (x)

ROE (%)

ROCE (%)

Source: Company, Angel Research

Source: Company, Angel Research

Commercial vehicle A/C and refrigerated units to provide the

next leg of growth

The trend for air-conditioning (A/C) in commercial vehicles is expected to pick up

going forward. State Transport Undertakings are increasingly placing orders for

air-conditioned buses to improve passenger comfort. Also, light commercial

vehicle (LCV) manufacturers such as Tata Motors, M&M and Ashok Leyland have

introduced air conditioned cabins in their top-end vehicles. We expect commercial

vehicle manufacturers to increasingly opt for A/C systems in line with the trend in

the developed markets. However, we expect the trend to take some time and a

meaningful opportunity to emerge only after two to three years. Subros, being the

only integrated manufacturer with established supplies to the passenger vehicle

segment, would benefit immensely from this trend.

Also, in order to tap new business segments, Subros provides complete

refrigerated solutions to automotive OEMs. It offers fully integrated solutions

comprising of refrigeration kit and a specially insulated container which is fitted on

vehicle chassis. It currently supplies to Ashok Leyland “Dost” vehicles and has also

tied up with Tata Motors and M&M. Subros aims to ramp supplies to CV

manufacturers from its Chennai plant, enabling it to diversify its business model

and reduce concentration on a particular segment.

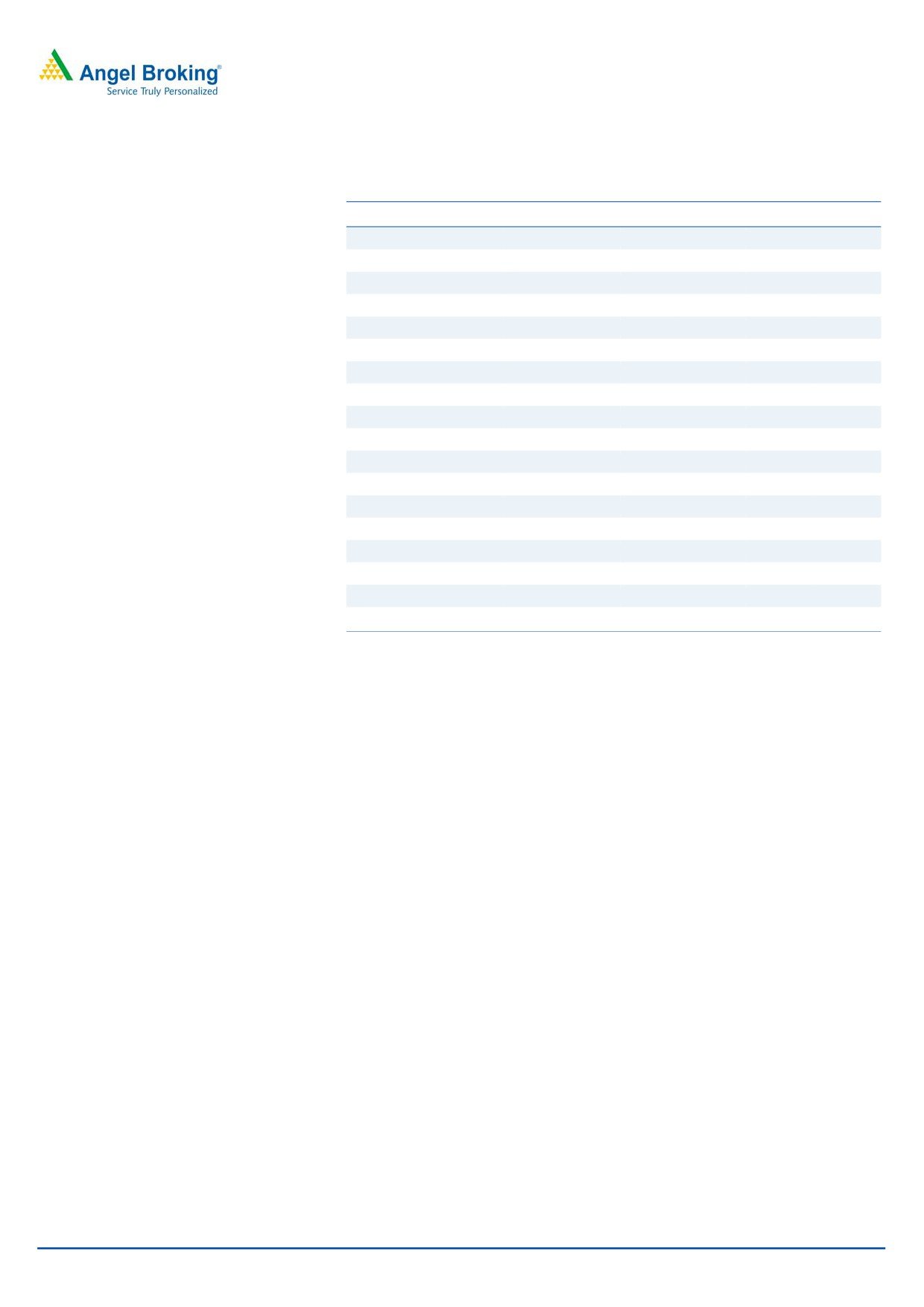

Outlook and Valuation

We expect Subros to clock a revenue CAGR of 13% over FY2014-FY2017 aided by

a recovery in the passenger vehicle industry and market share regain by its key

clients. Initiation of supplies to Denso Corporation would also boost Subros’

top-line. Also, Subros’ margins are expected to improve owing to increased

localisation, operating leverage and weakness in JPY. We also expect the

company’s interest costs to recede, given the reduction in the debt levels. We

expect Subros to report a PAT CAGR of 29% over FY2014-FY2017. At the current

market price of `67, the stock trades at 15.3x and 9.2x its FY2016 and FY2017

earnings, respectively. We initiate coverage on the stock with a Buy

recommendation and target price of `80 based on 11x FY2017E EPS, indicating

an upside of 19% from the current levels.

January 8, 2015

5

Subros | Initiating Coverage

Exhibit 9: One-year forward P/E band

140

120

100

80

60

40

20

0

Price

4x

8x

12x

16x

Source: Company, Angel Research

Company Background

Subros was incorporated in 1985 as a joint venture company with 40% ownership

by Suri family and

13% each by Denso Corporation and Suzuki Motor

Corporation. Subros, in technical collaboration with Denso, is the leading

manufacturer of thermal products for automotive applications. It is the only

integrated manufacturer for Auto air-conditioning units. It manufactures

compressors, condensers, heat exchanges and all connecting elements required to

complete AC loop. Subros caters to all the automotive segments viz passenger

vehicles, commercial vehicles, off-roaders and railways. It has a well diversified

presence and is located at almost all automobile manufacturing hubs. It has plants

in Noida and Manesar (Northern region), Pune and Sanand (Western region) and

has recently set up a plant in Chennai to cater to South based OEMs.

The passenger vehicle segment, contributing about 88% of the overall revenues, is

its prime segment. Subros has 30% market share in the segment, supplying to key

customers like Maruti Suzuki, M&M and Tata Motors. The commercial vehicle

segment forms about 7% of the overall revenues with the company supplying to

Force Motors, Ashok Leyland and Daimler (Bharat Benz). It also supplies

refrigerated vans to customers besides supplying to the Railways.

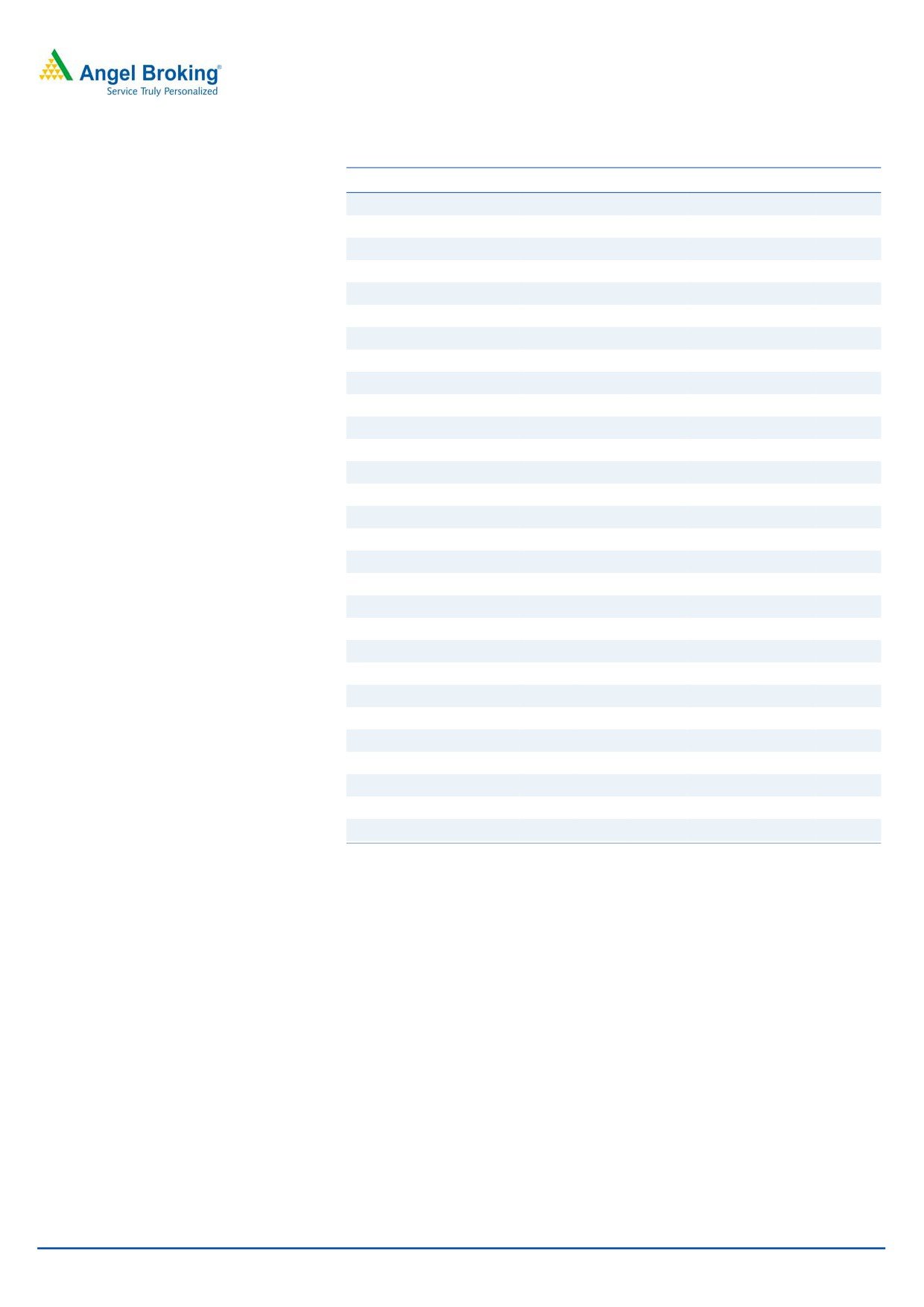

Exhibit 10: Product-wise break up

Exhibit 11: Segment wise revenue break up

Ventilator-Fan

Others, 8%

Commercial

Others, 5%

Motor

vehicle, 7%

Assembly, 3%

Air

Conditioning

Passenger

System, 89%

vehicles, 88%

Source: Company, Angel Research

Source: Company, Angel Research

January 8, 2015

6

Subros | Initiating Coverage

Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Total operating income

1,116

1,272

1,171

1,255

1,416

1,706

% chg

2.4

14.0

(7.9)

7.2

12.8

20.6

Total Expenditure

1,019

1,150

1,040

1,114

1,256

1,513

Net Raw Materials

805

912

807

867

980

1,181

Other Mfg costs

60

63

58

64

72

87

Personnel

84

100

105

110

120

145

Other

69

74

69

73

84

101

EBITDA

97

122

131

141

160

193

% chg

30.3

26.1

7.5

6.9

13.8

20.9

(% of Net Sales)

8.7

9.6

11.2

11.2

11.3

11.3

Depreciation & Amortisation

53

73

77

85

91

97

EBIT

44

50

54

56

69

96

% chg

29.7

13.1

9.1

3.3

23.5

39.3

(% of Net Sales)

3.9

3.9

4.6

4.5

4.9

5.6

Interest & other Charges

26

36

37

41

41

40

Other Income

22

11

2

4

5

6

PBT (reported)

40

25

19

18

33

62

% chg

22.3

(39.1)

(21.6)

(4.1)

77.8

89.8

Extraordinary Expense/(Inc.)

18

0

0

0

0

0

PBT (adjusted)

59

25

19

18

33

62

Tax

10

4

(1)

(1)

7

19

(% of PBT)

17.4

16.4

(5.3)

(4.0)

20.0

30.0

PAT (reported)

48

21

20

19

26

44

ADJ. PAT

30

20

20

19

26

44

% chg

2.1

(32.2)

(0.9)

(5.2)

36.8

66.1

(% of Net Sales)

2.7

1.6

1.7

1.5

1.9

2.6

Basic EPS (`)

8.1

3.4

3.4

3.2

4.4

7.3

Fully Diluted EPS (`)

5.0

3.4

3.4

3.2

4.4

7.3

% chg

2.1

(32.2)

(0.9)

(5.2)

36.8

66.1

January 8, 2015

7

Subros | Initiating Coverage

Balance sheet statement

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

12

12

12

12

12

12

Reserves& Surplus

259

275

290

304

323

359

Shareholders Funds

271

287

302

316

335

371

Total Loans

342

349

414

416

409

389

Deferred Tax Liability

25

28

27

27

27

27

Other long term liab.

0

0

0

0

0

0

Long term provisions

2

3

2

2

2

2

Total Liabilities

640

667

745

761

774

790

APPLICATION OF FUNDS

Gross Block

720

848

963

1,054

1,132

1,210

Less: Acc. Depreciation

334

403

480

564

655

752

Net Block

386

445

483

490

477

458

Capital WIP

90

107

103

116

125

133

Investments

3

3

3

4

4

4

Loans and adv.

41

42

51

51

51

51

Other non curren assets

0

0

0

0

0

0

Current Assets

324

285

273

285

325

393

Cash

12

11

11

6

11

15

Loans & Advances

58

38

25

31

35

43

Other

255

236

238

247

279

336

Current liabilities

204

214

168

185

209

250

Net Current Assets

120

71

105

100

116

143

Total Assets

640

667

745

761

774

790

January 8, 2015

8

Subros | Initiating Coverage

Cash flow statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015E FY2016E FY2017E

Profit before tax

59

25

19

18

33

62

Depreciation

53

70

76

85

91

97

Change in Working Capital

(59)

48

(34)

1

(12)

(23)

Others

22

3

(11)

(0)

-

-

Other income

(22)

(11)

(2)

(4)

(5)

(6)

Direct taxes paid

(10)

(4)

1

1

(7)

(19)

Cash Flow from Operations

42

131

49

100

100

112

(Inc.)/ Dec. in Fixed Assets

(189)

(145)

(111)

(105)

(86)

(86)

(Inc.)/ Dec. in Investments

(0)

0

0

(1)

(0)

(0)

Other income

22

11

2

4

5

6

Cash Flow from Investing

(167)

(134)

(109)

(102)

(82)

(81)

Issue of Equity

0

0

(0)

0

0

0

Inc./(Dec.) in loans

124

7

64

3

(7)

(20)

Dividend Paid (Incl. Tax)

8

5

5

6

7

8

Cash Flow from Financing

117

2

59

(3)

(14)

(28)

Inc./(Dec.) in Cash

(9)

(1)

(0)

(4)

5

4

Opening Cash balances

20

12

11

11

6

11

Closing Cash balances

12

11

11

6

11

15

January 8, 2015

9

Subros | Initiating Coverage

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

12.9

19.0

19.3

20.9

15.3

9.2

P/CEPS

4.7

4.2

4.0

3.9

3.4

2.9

P/BV

1.4

1.4

1.3

1.3

1.2

1.1

Dividend yield (%)

1.7

1.1

1.1

1.2

1.5

1.6

EV/Sales

0.6

0.5

0.6

0.6

0.5

0.4

EV/EBITDA

7.4

6.0

6.0

5.8

5.0

4.0

EV / Total Assets

1.1

1.1

1.1

1.1

1.0

1.0

Per Share Data (`)

EPS (Basic)

5.0

3.4

3.4

3.2

4.4

7.3

EPS (fully diluted)

5.0

3.4

3.4

3.2

4.4

7.3

Cash EPS

13.9

15.5

16.2

17.3

19.5

23.5

DPS

1.1

0.7

0.7

0.8

1.0

1.1

Book Value

45.1

47.8

50.3

52.6

55.8

61.8

Dupont Analysis

EBIT margin

3.9

3.9

4.6

4.5

4.9

5.6

Tax retention ratio

0.8

0.8

1.1

1.0

0.8

0.7

Asset turnover (x)

2.1

2.0

1.7

1.7

1.9

2.2

ROIC (Post-tax)

6.8

6.5

8.2

7.8

7.3

8.8

Cost of Debt (Post Tax)

7.6

8.7

10.3

10.4

8.0

7.0

Leverage (x)

1.0

1.2

1.3

1.3

1.2

1.1

Operating ROE

5.8

3.8

5.6

4.4

6.4

10.7

Returns (%)

ROCE (Pre-tax)

8.0

7.6

7.7

7.4

9.0

12.3

Angel ROIC (Pre-tax)

7.0

7.6

7.4

7.4

9.1

12.4

ROE

12.0

7.3

6.9

6.2

8.1

12.4

Turnover ratios (x)

Asset Turnover (Gross Block)

1.7

1.6

1.3

1.2

1.3

1.5

Inventory / Sales (days)

58

55

55

55

55

55

Receivables (days)

21

17

16

17

17

17

Payables (days)

62

60

51

52

52

52

WC cycle (ex-cash) (days)

26

24

24

27

26

25

Solvency ratios (x)

Net debt to equity

1.2

1.2

1.3

1.3

1.2

1.0

Net debt to EBITDA

3.4

2.8

3.0

2.9

2.5

1.9

Interest Coverage (EBIT / Int.)

1.7

1.4

1.5

1.3

1.7

2.4

January 8, 2015

10

Subros | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Subros

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

January 8, 2015

11

Subros | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research (Banking)

Amarjeet Maurya

Analyst (FMCG, Media, Mid-Cap)

Bharat Gianani

Analyst (Automobile)

Rahul Dholam

Analyst (Metal, Oil & Gas)

Santosh Yellapu

Analyst (Infrastructure)

Shrenik Gujrathi

Analyst (Cap Goods, Cement)

Umesh Matkar

Analyst (Banking)

Twinkle Gosar

Analyst (Mid-Cap)

Tejas Vahalia

Research Editor

Technicals and Derivatives:

Siddarth Bhamre

Head - Technical & Derivatives

Sameet Chavan

Technical Analyst

Sneha Seth

Associate (Derivatives)

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Assistant Manager

Production Team:

Dilip Patel

Production Incharge

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 - 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 /

NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

January 8, 2015

12