OFS note | Petrochemicals

May 20, 2013

Styrolution ABS

SUBSCRIBE

sue Open: March 21, 2013

Is

Attractive Valuation

Issue Close: March 21, 2013

Company Background

Styrolution ABS (name changed from INEOS ABS India Ltd. effective from

Issue details

(`)

March 1, 2012) is a leading manufacturer of an engineering plastic namely

Face Value

10

styrene monomer, polystyrene and ABS. The company is a 50/50 joint venture

Present Equity Paid-up Capital

17.59cr

between BASF and INEOS ABS formed by combining the styrenic business of two

Offer size

86.7cr

of the largest global chemical companies. In the domestic market, Styrolution is the

Post Equity Paid-up Capital

17.59cr

market leader and holds 60% market share in ABS resins segment and 68% in

Issue Size (no of shares)

2,167,562

SAN resins segment.

Issue Size (amount)

86.7cr

The Promoter, Styrolution Jersey, also the parent company proposes to sell

OFS Floor Price

400

2,167,562 equity shares (12.3% of total paid up equity capital) at `400 per share

Promoters holding Pre-Issue

87.3

in order to abide by the June 2010 amendment of ‘Securities Contract Act’

Promoters holding Post-Issue

75.0

mandates listed companies to have a minimum 25% of public shareholding by

June 2013.

Persisting short supply coupled with capacity expansion to boost growth

Styrolution which has expanded its capacity (ABS from 60,000TPA in 2010 to

Post Issue share-holding Pattern

(%)

80,000TPA in 2011) has an opportunity to reap benefits owing to domestic ABS

Promoter

75.0

demand supply gap (met by imports) which has persisted for long and continues to

MF/Banks/Indian Fls/FII/NRIs

25.0

exist. Further, CRISIL Research estimates that the domestic supply of ABS would

/OCBs/Public/Others

grow at 17% CAGR in order to meet the demand growth of 10% CAGR during

CY2010-15E, providing revenue visibility for the company. Thus, persisting short

supply and continued demand growth coupled with capacity expansion is to

enhance the top-line growth of the company.

Outlook and valuation

We expect Styrolution’s revenue to post a CAGR of 11.2% over CY2012-14E to

`1,223cr in CY2014E on the back of consistent developments by the company.

The EBITDA and net profit are expected to post a CAGR of 11.1% and 11.8%

respectively over CY2012-14E. At OFS floor price, the stock is attractively valued at

5.2x PE for CY2014E earnings and at 23% discount to its last traded price

(20th May, 2013). Hence we recommend investors to Subscribe for Styrolution OFS.

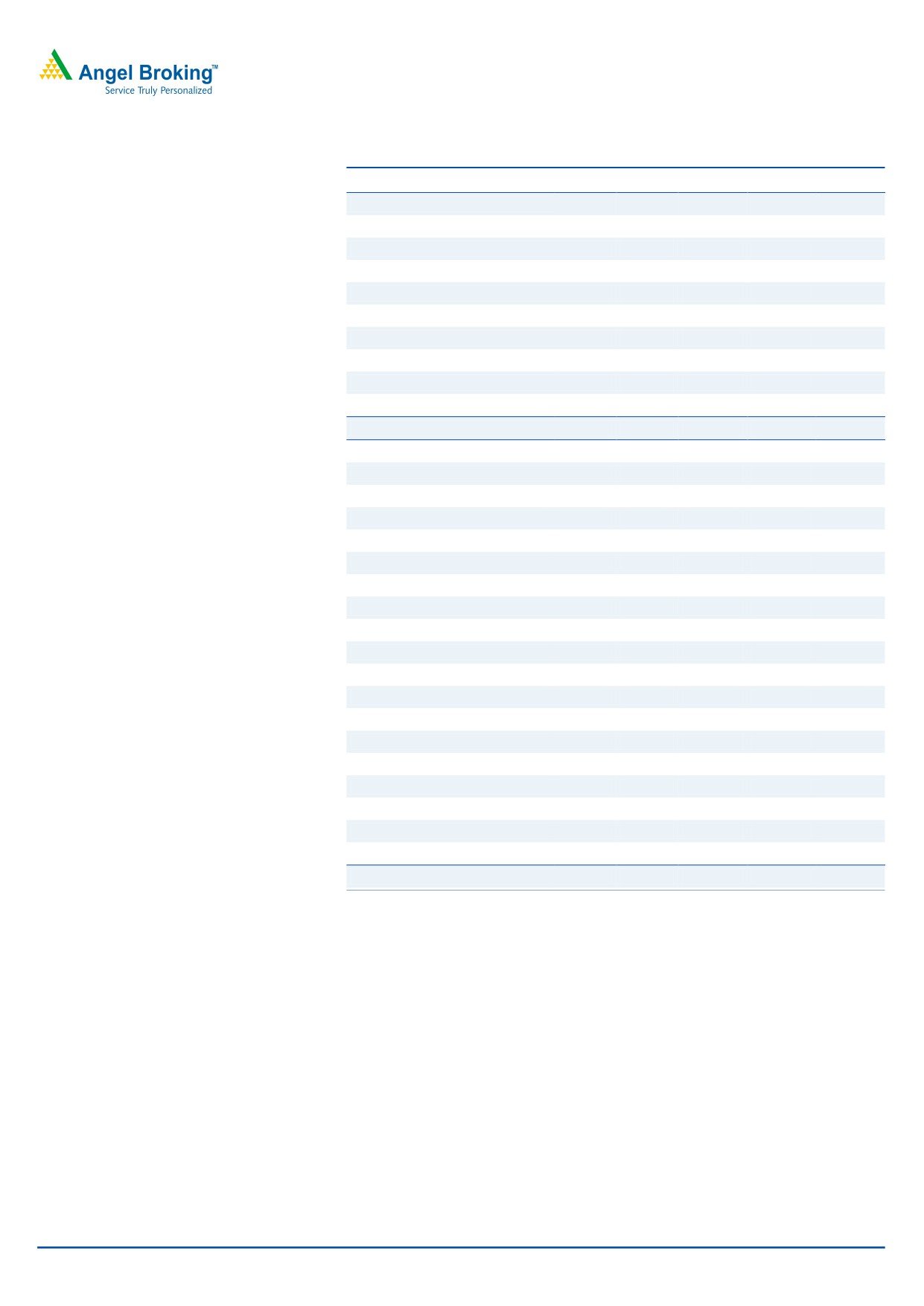

Key Financials (Standalone)

Y/E Dec (` cr)

CY2010

CY2011 CY2012 CY2013E

CY2014E

Net Sales

742

825

989

1,068

1,223

% chg

32.8

11.2

19.8

8.1

14.4

Net Profit

70

54

62

67

78

% chg

43.0

(22.9)

14.8

7.9

15.8

EBITDA (%)

15.2

9.9

9.6

9.6

9.6

EPS (`)

39.8

30.7

35.3

38.1

44.1

P/E (x)

13.1

17.0

14.8

13.7

11.8

P/BV (x)

2.7

2.4

2.1

1.9

1.6

RoE (%)

23.1

15.1

15.2

14.4

14.7

RoCE (%)

50.7

17.9

16.9

17.0

18.5

Twinkle Gosar

EV/Sales (x)

1.0

1.1

0.9

0.8

0.7

Tel: 022- 3935 7800 Ext: 6848

EV/EBITDA (x)

6.8

10.8

9.8

8.8

7.4

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Styrolution ABS | OFS note

Company Background

Styrolution ABS (name changed from INEOS ABS India Ltd. effective from March 1,

2012) is a leading manufacturer of an engineering plastic namely styrene

monomer, polystyrene and ABS. The company is a 50/50 joint venture between

BASF and INEOS ABS formed by combining the styrenic business of two of the

largest global chemical companies. In the domestic market, Styrolution is the

market leader and holds 60% market share in ABS resins segment and 68% in

SAN resins segment.

Styrolution (Promoters held 83.33% stake in Dec’11) made an open offer to the

shareholders with the offer cash price of `606.8 for balance 16.67% stake.

Resultant to open offer 4% of the shares were received and Promoters stake stood

at 87.33%.

Issue details

The Promoter, Styrolution Jersey, also the parent company proposes to sell

2,167,562 equity shares of face value `10 each representing 12.3% of the total

paid up equity share capital of the company. The stake sell is offered in order to

abide by the June 2010 amendment of ‘Securities Contract Act’ which mandates

listed companies to have a minimum 25% of public shareholding by June 2013.

Styrolution has fixed the OFS floor price at `400 per share.

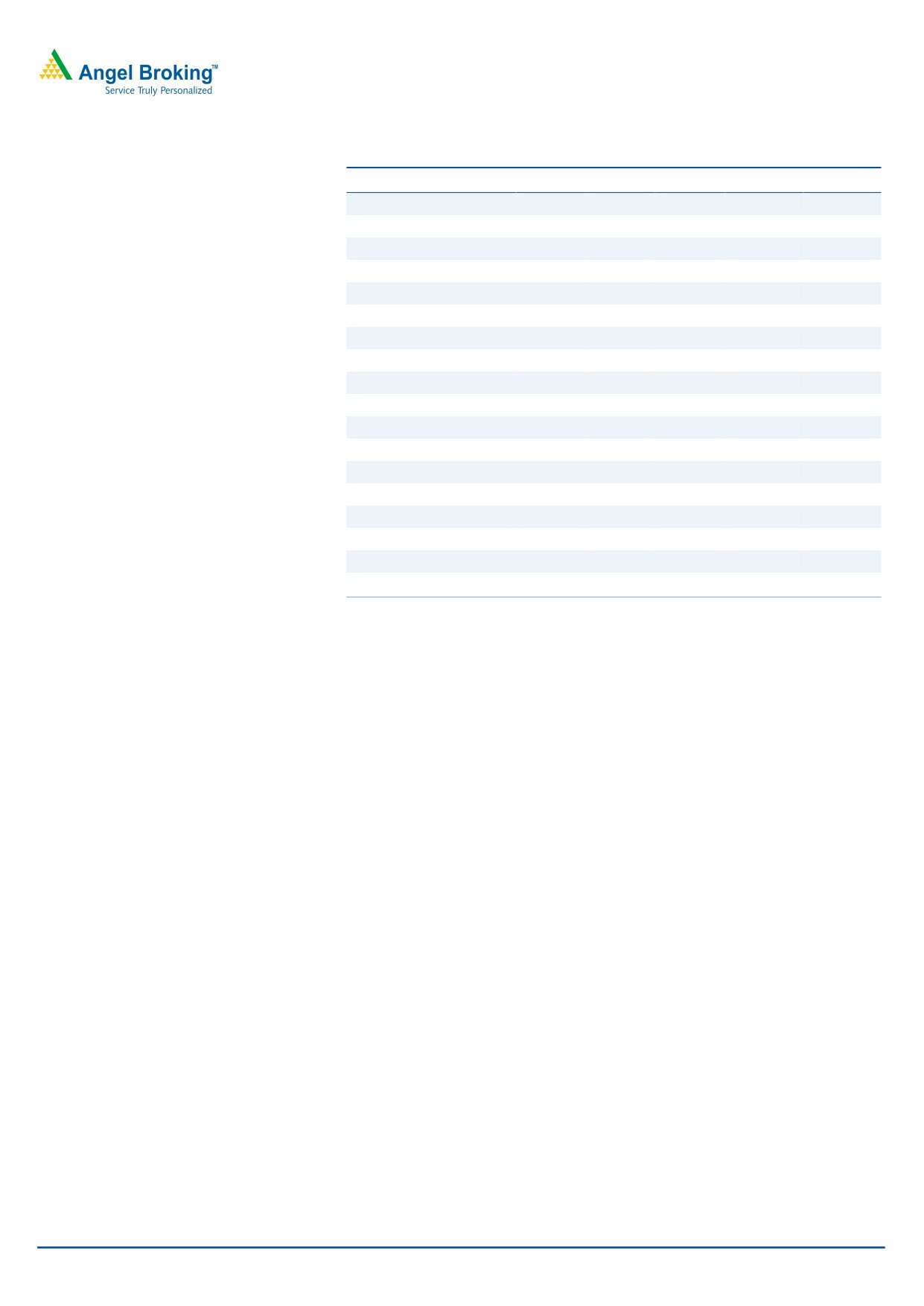

Exhibit 1: Shareholding Pattern

Pre issue

Post issue

Particulars

No of shares

%

No of shares

%

Promoter and promoter group

15,356,780

87.3

13,189,218

75.0

Total public holding

2,228,845

12.7

4,396,407

25.0

Total

17,585,625

100

17,585,625

100

Source: Company, Angel Research

May 20, 2013

2

Styrolution ABS | OFS note

Investment Rationale

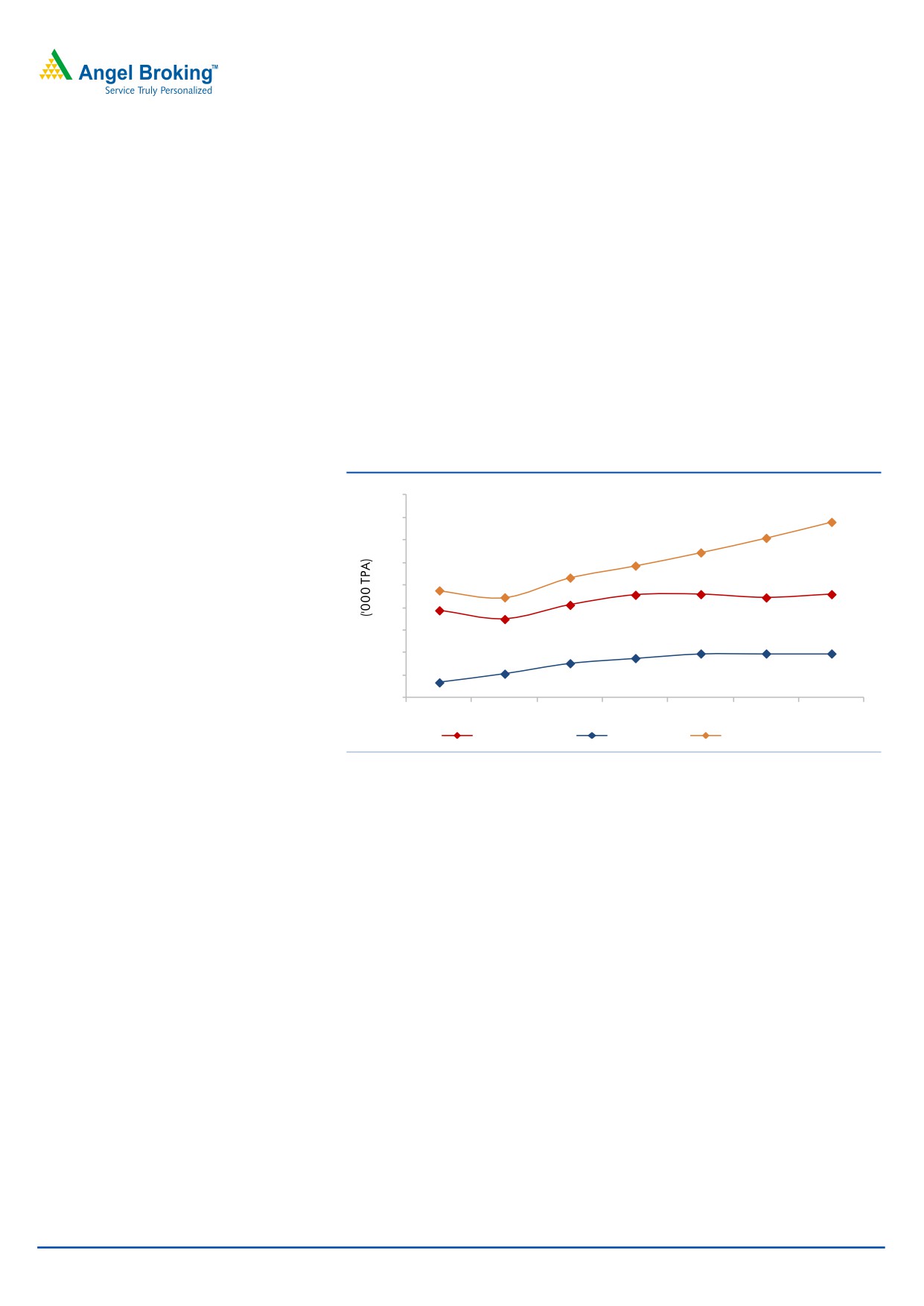

Capacity expansion to compliment unfulfilled ABS demand

The gap between domestic demand for ABS vis-a-vis supply has persisted for long

and the same still continues to exist. The unfulfilled demand is being met by

imports. CRISIL Research estimates that the supply of ABS would grow at 17%

CAGR in order to meet the demand growth of 10% CAGR during CY2010-15E.

Styrolution has expanded its capacity of ABS from

60,000TPA in

2010to

80,000TPA in 2011 and has plans to extend capacity further to 110,000TPA in

CY2013. This extended capacity will enable Styrolution to tap the unfulfilled

demand in the industry. Assuming the market share of Styrolution to remain

constant at 60%, volumes for ABS are likely to grow by ~12% over this period.

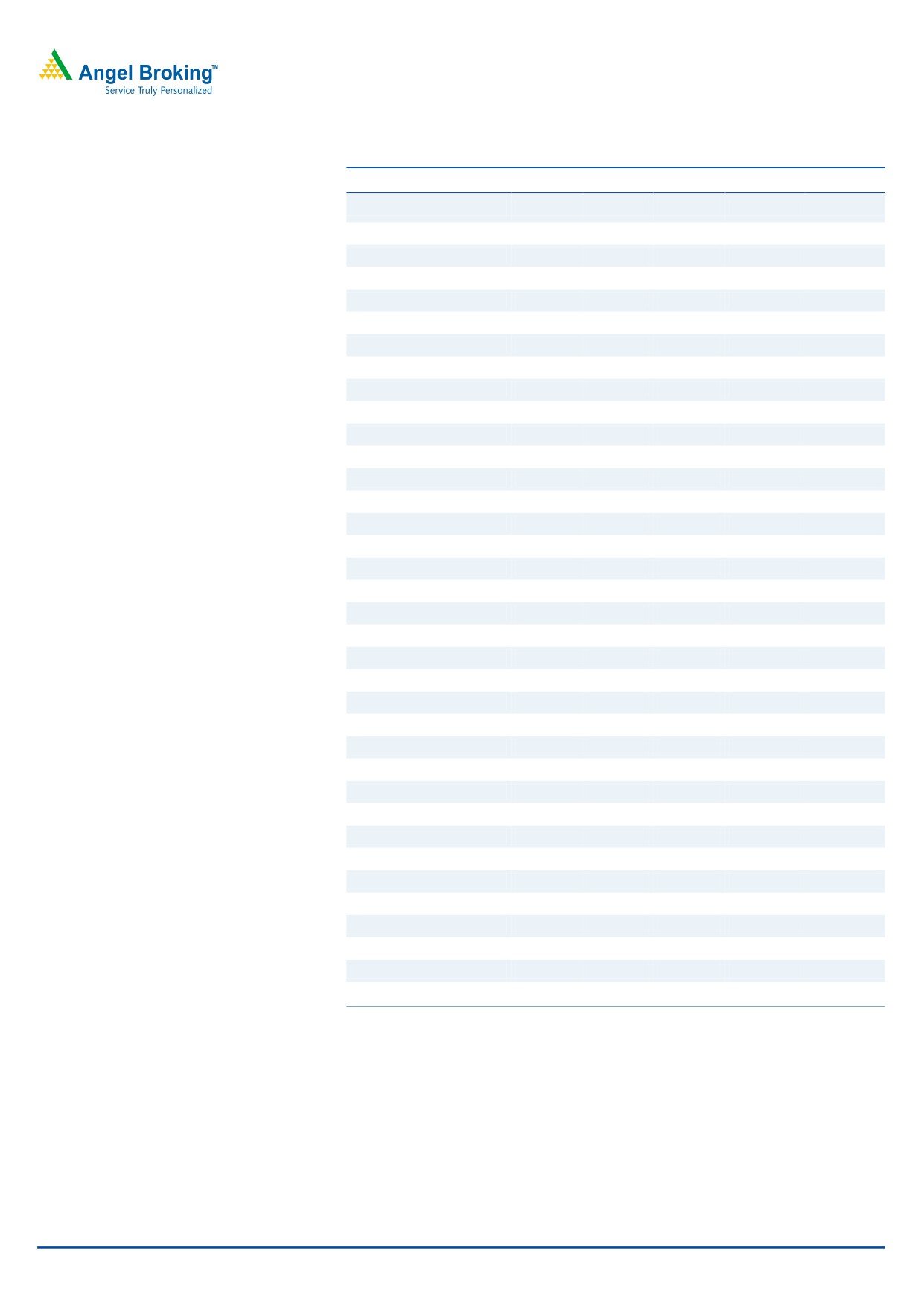

Exhibit 2: Unfulfilled domestic demand owing to demand supply gap

180

160

140

120

100

80

60

40

20

0

CY2008

CY2009

CY2010

CY2011

CY2012

CY2013E CY2014E

ABS Production

ABS import

ABS demand

Source: Company, Angel Research

Debt free and high return ratios

The company has its Debt to Equity at 0.2 times while Net Debt is at almost

negligible level. Moreover, Styrolution has successfully delivered handsome returns

of more than 15% on equity as well as invested capital over last five years, thereby

assuring robust returns.

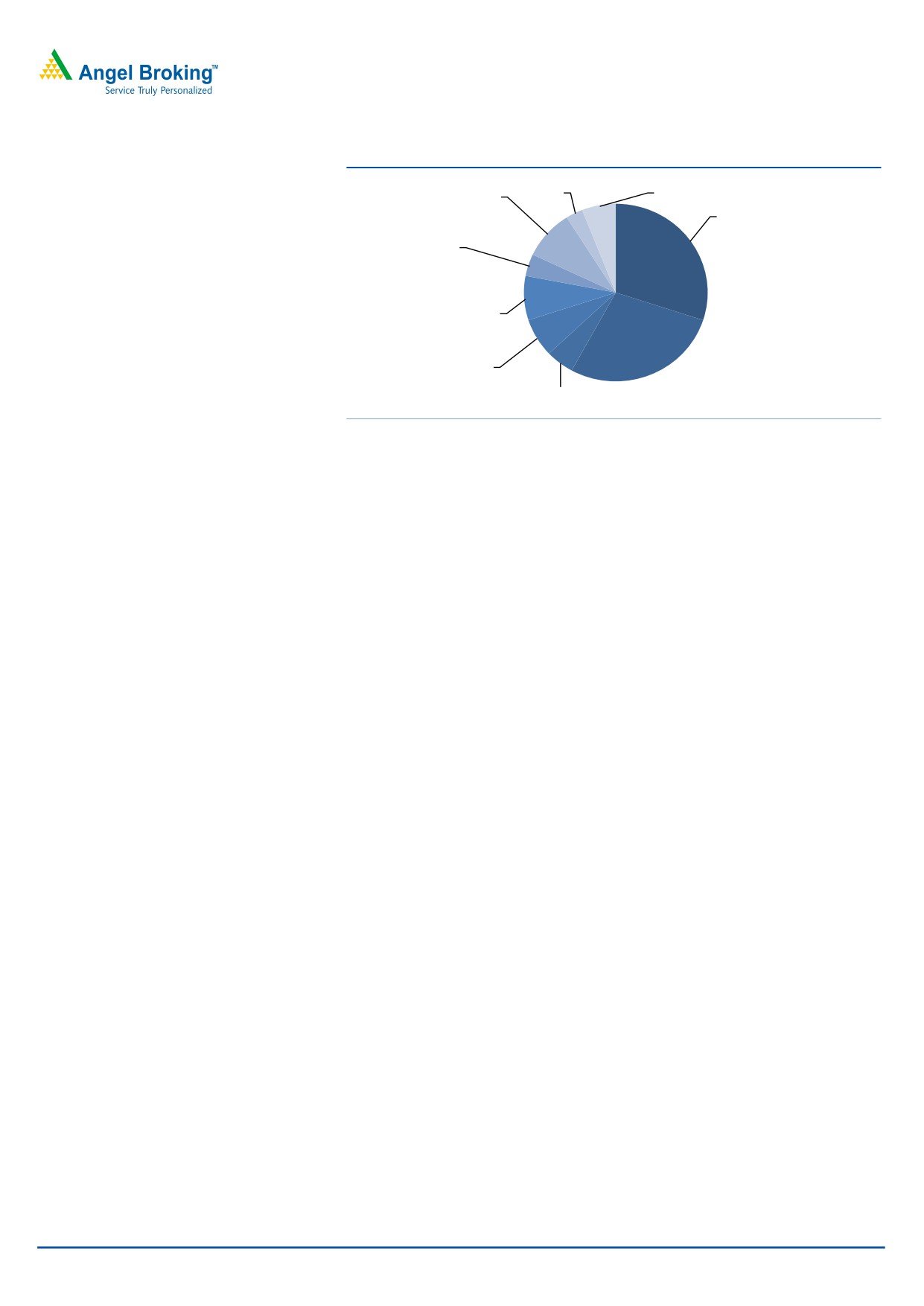

Tailor-made products as per market and consumer demand

Considering the rising demand for polymers in varied industries, Styrolution has

been consistently expanding its capacity and simultaneously co-polymerising ABS

ie, changing polymer composition and blending. The company has come up with

many tailor made products taking advantage of ABS’ flexibility of composition and

structure, which allows its use in diverse applications.

May 20, 2013

3

Styrolution ABS | OFS note

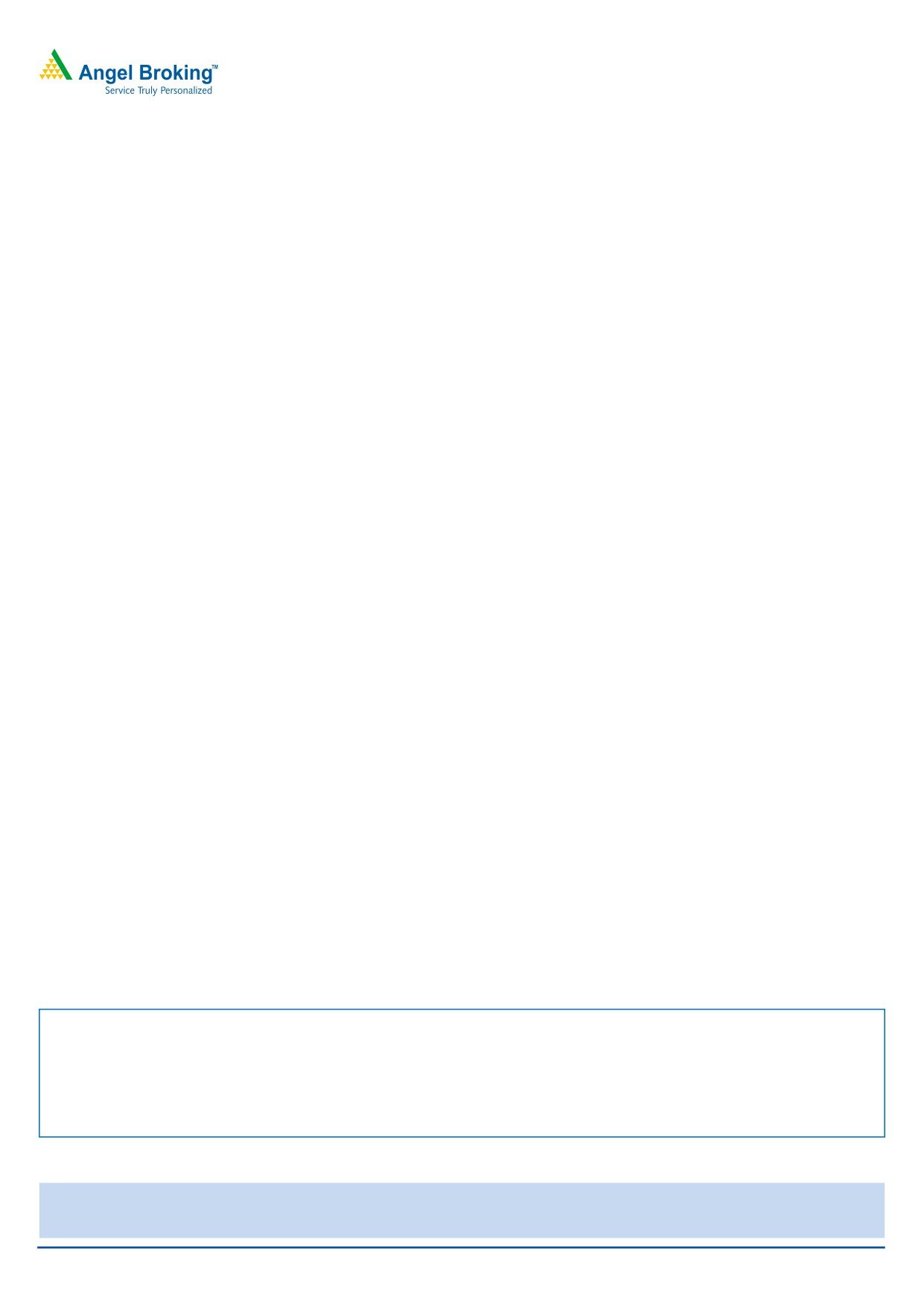

Exhibit 3: Application Industry Composition

Textiles

Others

Stationary/

Home

3%

6%

helmet

Appliances

9%

30%

Luggage & bus

body

4%

Business

machine office

automation

8%

Electrical &

Automobiles

electronics

Telecom

28%

7%

5%

Source: Company

Outlook and valuation

We expect Styrolution’s revenue to post a CAGR of 11.2% to `1,223cr over

CY2012-14E on the back of consistent expansion plans of the company coupled

with revival in user industry. EBITDA is expected to grow at 11.1% CAGR to `117cr

in CY2014E. The rise in manufacturing cost due to high feedstock prices and

currency depreciation is expected to be passed on to the consumers by price hike,

thereby offsetting any negative impact on EBITDA margin. Hence, EBITDA margin

is expected to remain constant at 9.6% in CY2013E and CY2014E. The net profit is

expected to post a CAGR of 11.8% to `78cr in CY2014E while margins are to

remain stable at 6.3% owing to stable operating performance. At OFS floor price,

the stock is attractively valued at 5.2x PE for CY2014E earnings and at 23%

discount to its last traded price (20th May, 2013). Hence, we recommend investors

to Subscribe for Styrolution OFS.

May 20, 2013

4

Styrolution ABS | OFS note

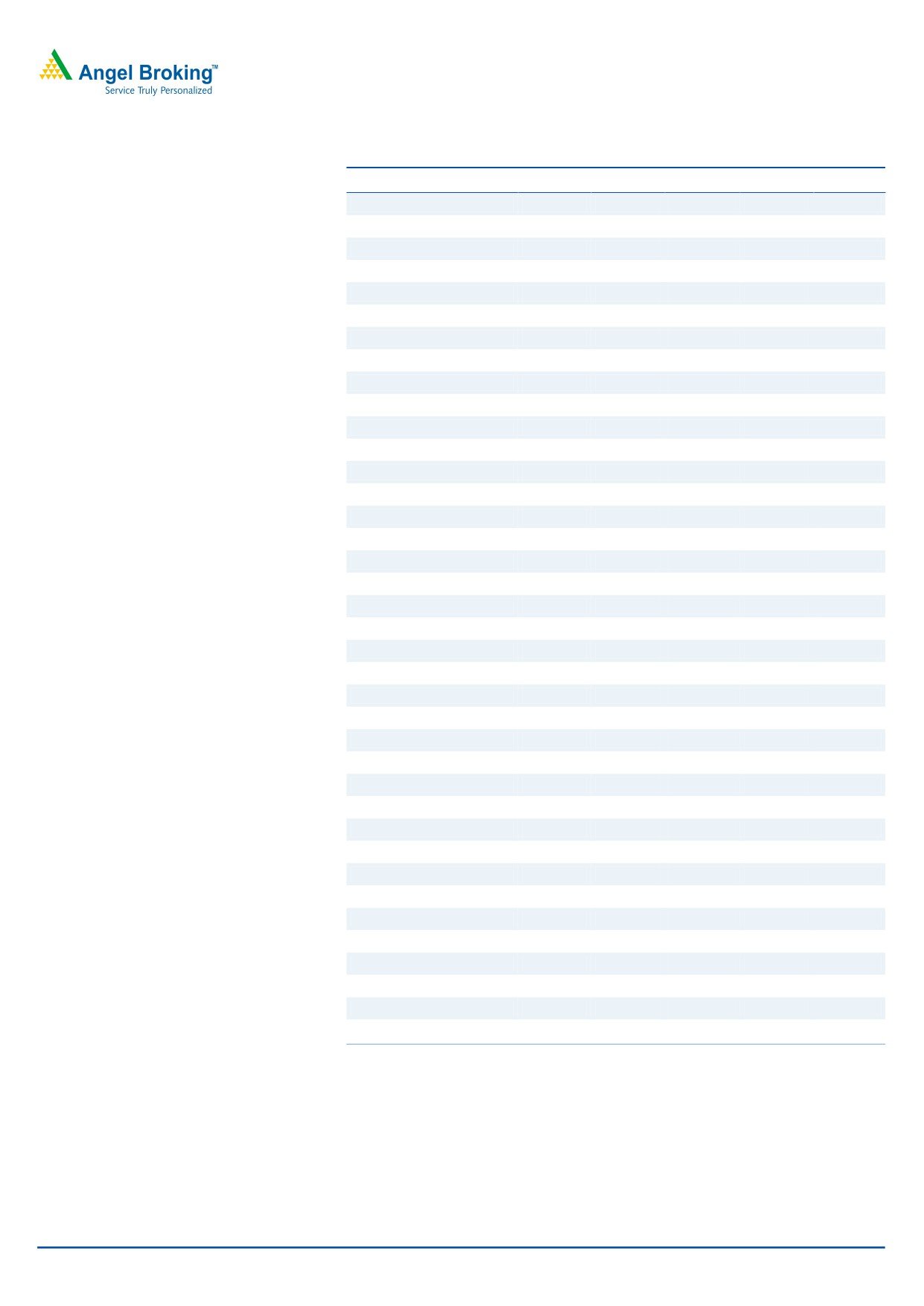

Profit and Loss (Standalone)

Y/E December (` cr)

CY2010

CY2011

CY2012

CY2013E

CY2014E

Gross sales

816

910

1,090

1,178

1,348

Less: Excise duty

74

84

101

109

125

Net Sales

742

825

989

1,068

1,223

Other operating income

-

-

-

-

-

Total operating income

742

825

989

1,068

1,223

% chg

32.8

11.2

19.8

8.1

14.4

Net Raw Materials

522

620

750

814

932

% chg

44.8

18.8

21.0

8.6

14.5

Other Mfg costs

36

41

46

45

52

% chg

5.7

12.9

10.7

(0.6)

14.4

Personnel

20

24

27

30

34

% chg

16.1

16.1

16.2

8.1

14.4

Other

51

59

71

77

88

% chg

(15.9)

15.9

19.8

8.1

14.4

Total Expenditure

629

744

894

965

1,105

EBITDA

113

82

95

103

117

% chg

31.0

(27.6)

16.4

8.2

14.1

EBITDA Margin

15.2

9.9

9.6

9.6

9.6

Depreciation & Amortisation

14

14

14

16

16

EBIT

99

68

82

87

102

% chg

38.0

(31.5)

20.3

7.2

16.0

(% of Net Sales)

13.3

8.2

8.3

8.2

8.3

Interest & other Charges

2

2

1

-

-

Other Income

5

11

11

12

13

(% of Net Sales)

0.7

1.4

1.1

1.1

1.1

Recurring PBT

97

66

81

87

102

% chg

37.9

(31.9)

22.0

8.3

16.0

PBT (reported)

103

78

92

99

115

Tax

33

24

30

32

37

(% of PBT)

31.8

30.3

32.6

32.6

32.6

PAT (reported)

70

54

62

67

78

Extraordinary Expense/(Inc.)

(0)

(0)

-

-

-

ADJ. PAT

70

54

62

67

78

% chg

43.0

(22.9)

14.8

7.9

15.8

(% of Net Sales)

9.4

6.5

6.3

6.3

6.3

Basic EPS (`)

40

31

35

38

44

Fully Diluted EPS (`)

40

31

35

38

44

% chg

43.0

(22.9)

14.8

7.9

15.8

May 20, 2013

5

Styrolution ABS | OFS note

Balance Sheet (Standalone)

Y/E December (` cr)

CY2010

CY2011

CY2012

CY2013E

CY2014E

SOURCES OF FUNDS

Equity Share Capital

18

18

18

18

18

Preference Capital

-

-

-

-

-

Reserves& Surplus

317

362

416

475

544

Shareholders’ Funds

334

380

434

493

562

Minority Interest

-

-

-

-

-

Total Loans

-

131

67

67

67

Deferred Tax Liability (Net)

21

18

17

17

17

Other long term liabilities

-

0

0

0

0

Long term provisions

-

15

15

15

15

Total Liabilities

356

544

533

592

661

APPLICATION OF FUNDS

Gross Block

318

335

362

372

384

Less: Acc. Depreciation

181

195

209

224

240

Net Block

136

140

153

148

144

Capital Work-in-Progress

12

-

-

-

-

Lease adjustment

-

-

-

-

-

Goodwill

-

-

-

-

-

Investments

93

101

17

21

25

Long Term Loans and advances

-

35

28

43

49

Other non-current assets

-

0

0

0

0

Current Assets

281

318

439

492

572

Cash

60

63

31

57

87

Loans & Advances

41

35

136

147

169

Inventory

71

95

95

98

100

Debtor

109

124

175

189

216

Other current assets

-

1

1

1

1

Current liabilities

166

51

104

112

128

Net Current Assets

115

268

335

380

444

Mis. Exp. not written off

-

-

-

-

-

Total Assets

356

544

533

592

661

May 20, 2013

6

Styrolution ABS | OFS note

Cash Flow (Standalone)

Y/E December (` cr)

CY2010

CY2011

CY2012

CY2013E

CY2014E

Profit Before Tax

103

78

92

99

115

Depreciation

14

14

14

16

16

Change in WC

16

(330)

(99)

(20)

(34)

Other income

(5)

(11)

(11)

(12)

(13)

Direct taxes paid

(33)

(24)

(30)

(32)

(37)

Cash Flow from Operations

95

(273)

(34)

51

46

(Incr)/ Decr in Fixed Assets

(8)

(5)

(27)

(11)

(11)

(Incr)/Decr In Investments

(21)

(43)

91

(18)

(10)

Other income

5

11

11

12

13

Cash Flow from Investing

(24)

(37)

75

(17)

(8)

Issue of Equity/Preference

-

0

-

-

-

Incr/(Decr) in Debt

(2)

142

(65)

-

-

Dividend Paid (Incl. Tax)

(7)

(7)

(8)

(8)

(8)

Others

(39)

179

-

-

-

Cash Flow from Financing

(48)

314

(73)

(8)

(8)

Incr/(Decr) In B/S Cash

22

4

(32)

25

30

Opening Cash balance

37

60

63

31

57

Closing cash balance

60

63

31

57

87

May 20, 2013

7

Styrolution ABS | OFS note

Key Ratios (Standalone)

Y/E December

CY2010

CY2011

CY2012

CY2013E

CY2014E

Valuation Ratio (x)

P/E (on FDEPS)

13.1

17.0

14.8

13.7

11.8

P/CEPS

10.9

13.5

12.1

11.1

9.8

P/BV

2.7

2.4

2.1

1.9

1.6

Dividend yield (%)

0.8

0.8

0.9

0.9

0.9

EV/Net sales

1.0

1.1

0.9

0.8

0.7

EV/EBITDA

6.8

10.8

9.8

8.8

7.4

EV / Total Assets

2.1

1.6

1.8

1.5

1.3

Per Share Data (`)

EPS (Basic)

40

31

35

38

44

EPS (fully diluted)

40

31

35

38

44

Cash EPS

48

39

43

47

53

DPS

4

4

4

4

4

Book Value

190

216

247

280

320

DuPont Analysis

EBIT margin

13.3

8.2

8.3

8.2

8.3

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

3.8

2.2

2.0

2.1

2.2

ROIC (Post-tax)

34.6

12.5

11.4

11.5

12.5

Cost of Debt (Post Tax)

-

-

-

-

-

Leverage (x)

(0.5)

(0.1)

0.0

(0.0)

(0.1)

Operating ROE

18.8

11.4

11.9

11.2

11.5

Returns (%)

ROCE (Pre-tax)

27.5

12.5

15.3

14.8

15.4

Angel ROIC (Pre-tax)

50.7

17.9

16.9

17.0

18.5

ROE

23.1

15.1

15.2

14.4

14.7

Turnover ratios (x)

Asset TO (Gross Block)

2.3

2.5

2.7

2.9

3.2

Inventory / Net sales (days)

35

36

36

36

36

Receivables (days)

54

54

54

54

54

Payables (days)

96

92

96

95

94

WC cycle (ex-cash) (days)

27

90

112

110

107

Solvency ratios (x)

Net debt to equity

(0.5)

(0.1)

0.0

(0.0)

(0.1)

Net debt to EBITDA

(1.3)

(0.4)

0.2

(0.1)

(0.4)

Int. Coverage (EBIT/ Int.)

55.0

42.1

102.0

-

-

May 20, 2013

8

Styrolution ABS | OFS note

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Styrolution

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

May 20, 2013

9

Styrolution ABS | OFS note

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Viral Shah

Sr. Analyst (Infrastructure)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, FMCG)

Yaresh Kothari

Analyst (Automobile)

Ankita Somani

Analyst (IT, Telecom)

Sourabh Taparia

Analyst (Banking)

Bhupali Gursale

Economist

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Akshay Narang

Research Associate

Harshal Patkar

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Tejas Vahalia

Research Editor

Dilip Patel

Production Incharge

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 - 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 /

NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

May 20, 2013

10