Initiating Coverage | Auto Ancillary

September 12, 2014

Sterling Tools

BUY

CMP

`332

STL to ride on auto industry recovery

Target Price

`397

Investment Arguments

Investment Period

12 Months

Recovery in Automobile industry would benefit Sterling Tools (STL): The

Stock Info

automobile industry’s performance in the past two consecutive years (FY2013 and

Sector

Auto Ancillary

FY2014) was disappointing. But In YTD FY2015 (April to August), the 2W industry

Market Cap (` cr)

231

has reported a strong growth of ~17% due to recovery in domestic and export

Net Debt (` cr)

54

markets and PVs have also shown an ~4% yoy growth. However, the commercial

Beta

0.6

vehicle (CV) segment is still under pressure due to poor performance of light

52 Week High / Low

341 / 93

commercial vehicles (LCVs), although early signs of recovery are now visible

Avg. Daily Volume

3,117

(since June 2014). Considering overall sales volumes in the past five months, we

Face Value (`)

10

expect growth momentum to continue and expect the Indian automobile industry

BSE Sensex

26,996

to report a healthy ~14% CAGR over FY2014-16E which would benefit auto

Nifty

8,086

ancillary companies like Sterling Tools (STL).

Reuters Code

STTL.BO

Strong customer base would provide revenue visibility for STL: OEMs are a major

Bloomberg Code

STRT@IN

contributor to STL’s revenues

(~81%). STL is among the top

3 fastener

manufacturers in India, supplying to major OEMs like Honda (STL is the largest

Shareholding Pattern (%)

supplier of HT fasteners to the company), Maruti Suzuki India and Tata Motors

(STL is the second-largest supplier of fasteners to the two companies). STL’s other

Promoters

70.2

blue chip customers include Ashok Leyland, Daimler, Fiat, Hero Motocorp,

MF / Banks / Indian Fls

0.3

Mahindra & Mahindra, Volvo, Eicher, TAFE and General Motors. This gives the

FII / NRIs / OCBs

0.0

company a diversified customer base and positions it for strong growth, driven by

Indian Public / Others

29.5

the sharp uptick in volume growth across a range of segments in the industry.

Abs. (%)

3m 1yr

3yr

Outlook and Valuation: We forecast STL to report a Net Sales CAGR of ~14%

Sensex

6.0

35.0

60.1

over FY2014-16E to ~`394cr and net profit CAGR of ~20% during the same

STL

68.1

242.3

204.6

period to `23cr. At the current market price of `332, the stock trades at a PE of

12.1x and 10.0x its FY2015E and FY2016E EPS of `27.4 and `33.1, respectively.

We initiate coverage on the stock with a Buy recommendation and target price of

`397, based on 12x FY2016E EPS, indicating an upside of ~20% from the

current levels.

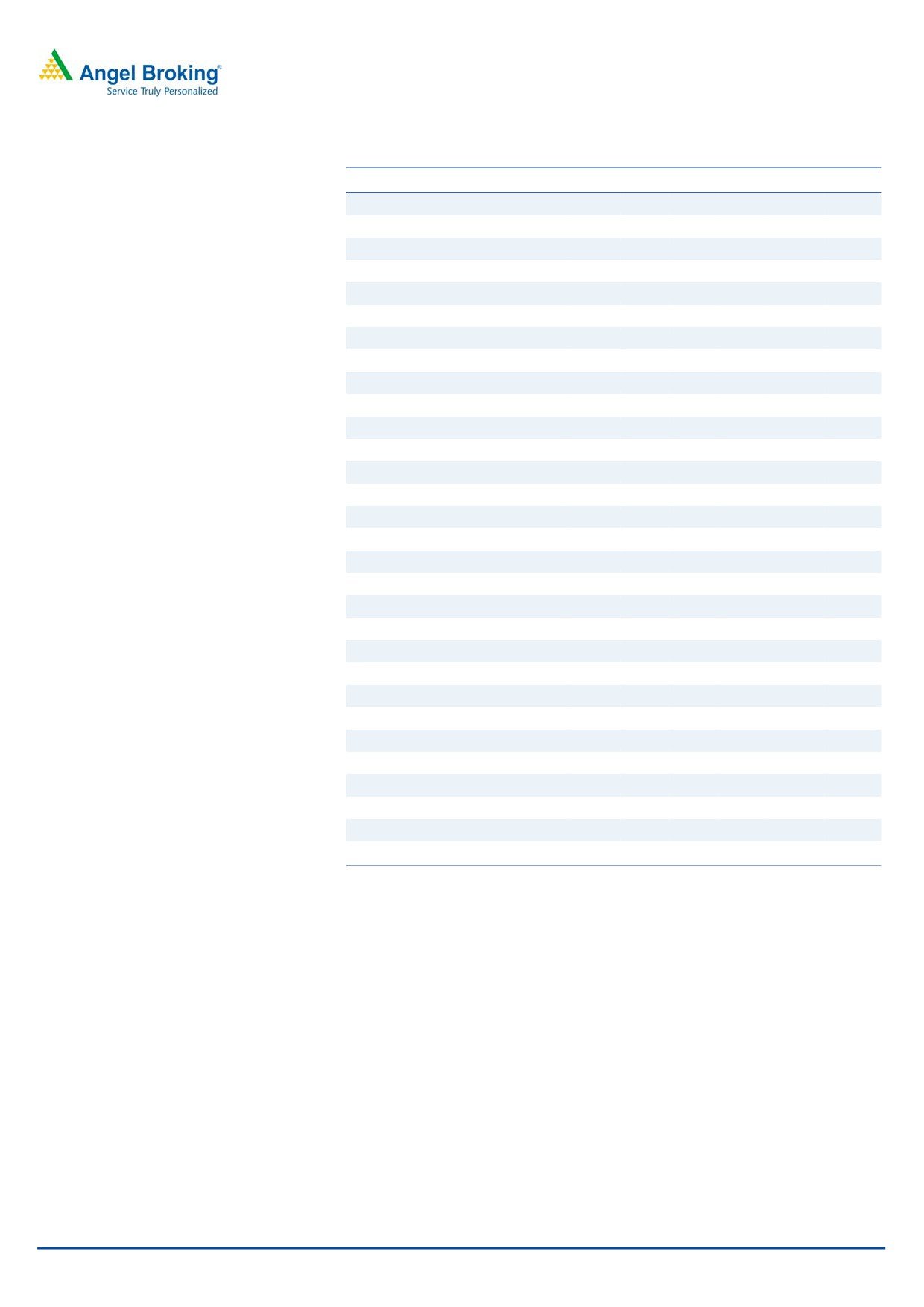

Key financials

Y/E March (` cr)

FY2013

FY2014

FY2015E

FY2016E

Net sales

283

301

342

394

% chg

(4.2)

6.7

13.4

15.4

Net profit

11

16

19

23

% chg

(26.3)

43.6

19.8

20.8

EBITDA margin (%)

12.4

13.9

13.9

13.9

EPS (`)

15.9

22.8

27.4

33.1

P/E (x)

20.8

14.5

12.1

10.0

P/BV (x)

2.5

2.3

2.0

1.7

RoE (%)

12.2

15.5

16.2

16.7

RoCE (%)

15.4

19.5

20.6

21.8

Amarjeet S Maurya

EV/Sales (x)

1.1

0.9

0.8

0.7

022-39357800 Ext: 6831

EV/EBITDA (x)

8.6

6.7

5.8

5.0

Source: Company, Angel Research, Note: CMP as of September 11, 2014

Please refer to important disclosures at the end of this report

1

Sterling Tools | Initiating Coverage

Investment Arguments

Recovery in Automobile industry would benefit STL

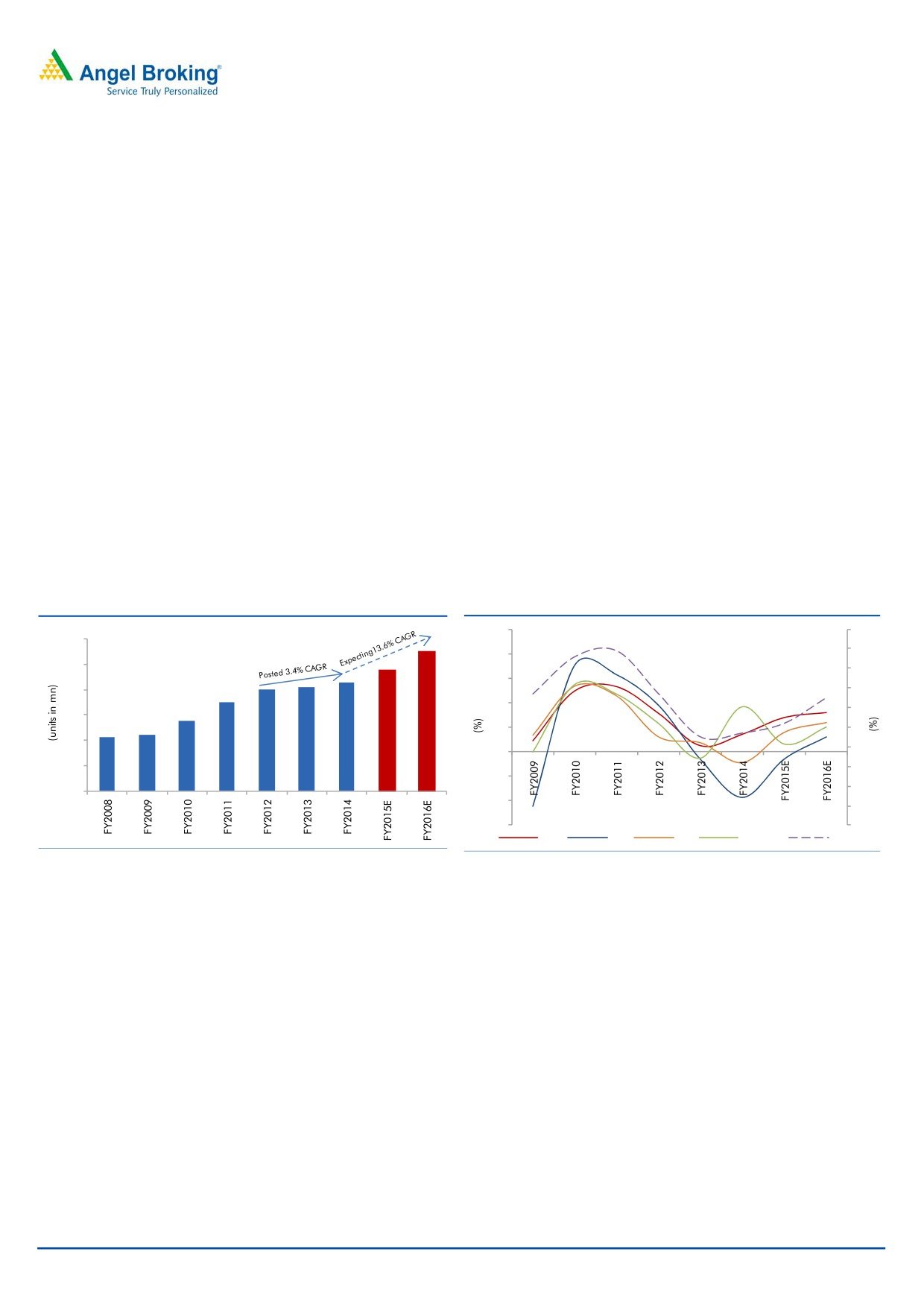

India has been amongst the fastest growing automobile markets in the world in the

last five years. For FY2014, automobile volumes (2W, commercial vehicles [CVs],

passenger vehicles [PVs] and tractors), domestic and exports, stood at ~21.4

During YTD FY2015 (April to August),

million units (a 4.6% yoy growth). The industry has recovered from a subdued

the 2W industry has reported a strong

volume growth in FY2013, which was owing to a slowdown in the domestic

growth of ~17% due to strong recovery

in domestic and export markets

economy, higher inflation and increase in fuel prices. Further, overall automobile

export numbers were also subdued. However, in FY2014, the Indian automobile

industry showed some recovery in domestic and export sales volumes, mainly

driven by the 2W segment.

During YTD FY2015 (April to August), the 2W industry has reported a strong

growth of ~17% (vs 7.2% yoy growth in FY2014). PVs have also shown an ~4%

yoy growth (vs a degrowth of 4.4% in FY2014) due to recovery in domestic and

export markets. However, the CV segment is still under pressure due to poor

performance of LCVs. Nonetheless, the MHCV segment has also started showing

recovery (from June 2014) and going forward we expect CV volumes to be driven

by improvement in the Indian economy.

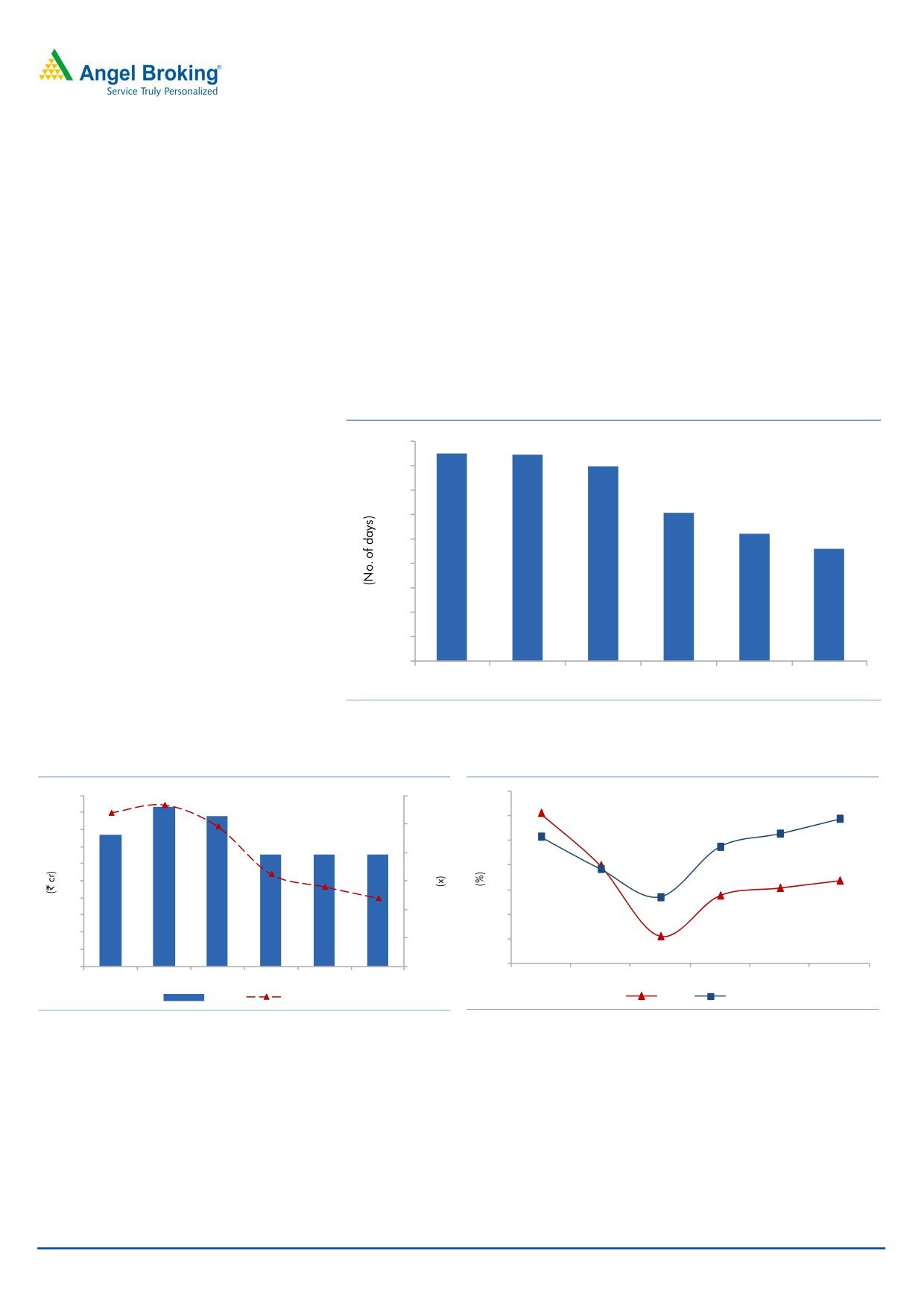

Exhibit 1: Automobile Industry trend

Exhibit 2: GDP & Automobile Industry growth projection

50

10

30

9

40

25

8

30

20

7

20

6

15

10

5

10

4

0

5

3

(10)

2

0

(20)

1

(30)

0

2W

CV

PV

Tractors

GDP

Source: SIAM, Angel Research,

Source: SIAM, Angel Research

# Includes data of Two Wheelers, Commercial Vehicle, Passenger Vehicle and Tractors

Considering the overall improvement in demand in the domestic and export

markets with Indian automobile OEMs expanding presence in new geographical

We expect the Indian automobile

regions in the last three quarters, we expect the Indian automobile industry to

industry to report a healthy

~14%

report a healthy ~14% CAGR over FY2014-16E. Also, with the formation of the

CAGR over FY2014-16E

new government at the centre, we expect inflationary pressures to subside, thus

leading to lower interest rates.

September 12, 2014

2

Sterling Tools | Initiating Coverage

This coupled with the anticipation of an increase in personal disposable incomes

due to recovery in the domestic economy would create a positive sentiment for

Indian consumers, and in turn lead to an improvement in 2W and PV volumes.

Further, we expect improvement in GDP growth (in 1QFY2015 India’s GDP growth

was 5.7%, which is the highest in the last nine quarters) in FY2015 and FY2016;

this would assist growth in the CV segment, mainly in the LCV segment, which is

currently underperforming.

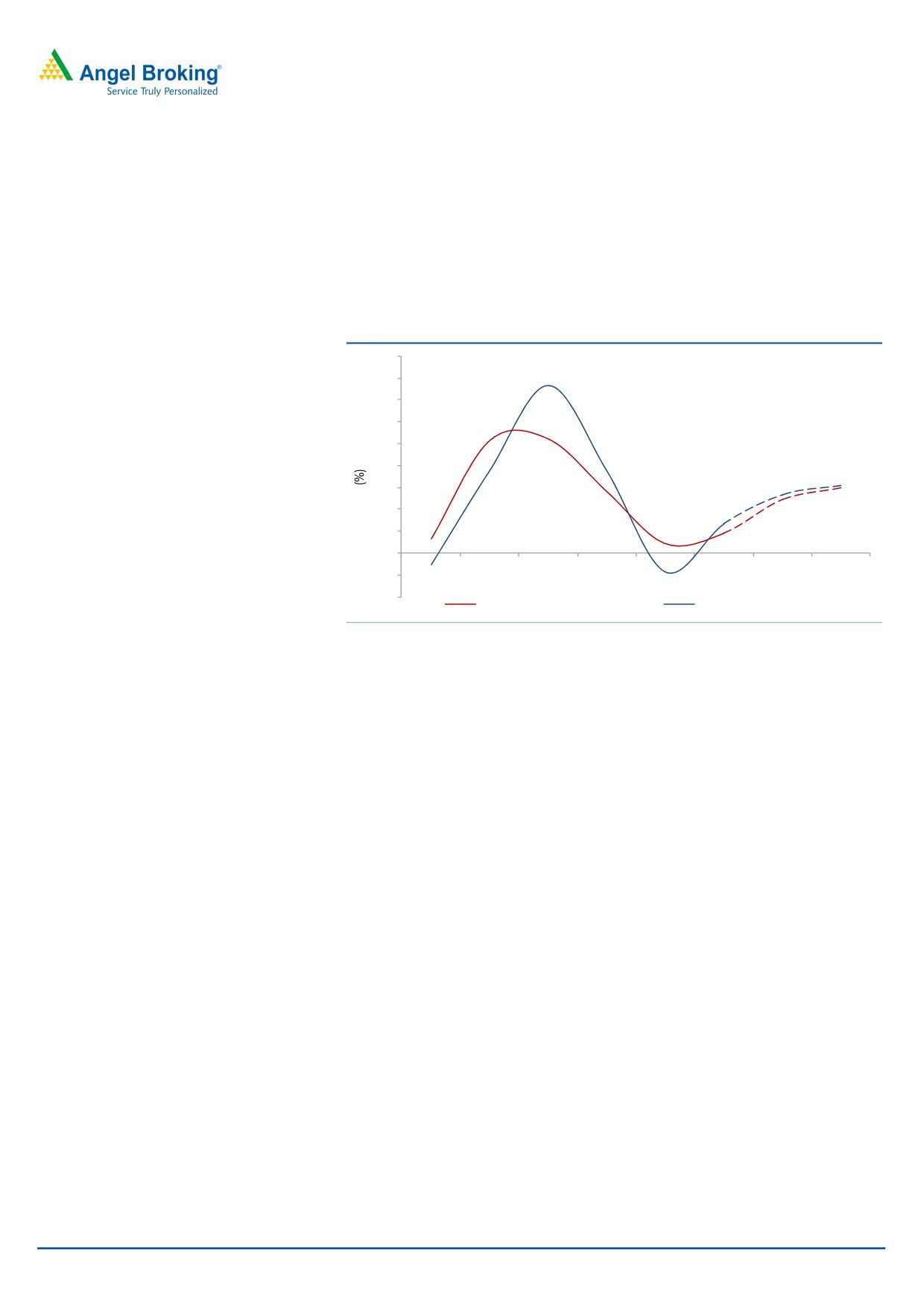

Exhibit 3: Correlation bet. Automobile vol. and STL’s vol. performance

45

40

35

30

25

20

15

10

5

0

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014 FY2015E FY2016E

(5)

(10)

Automobile Industry Volumes

Sterling Tools Volumes

Source: Company, Angel Research

STL caters to all segments of the automobile industry. 2Ws and CVs account for the

2Ws and CVs account for the largest

largest chunk of its sales (21% each), followed by PVs at 11%, farm equipment

chunk of STL’s sales

(21% each),

(tractors) at 10%, replacement at 10% while export account for 9% of total sales.

followed by PVs at

11%, farm

Thus, we believe that STL is best placed to take advantage of an expected recovery

equipment

(tractors)

at

10%,

in the automobile industry.

replacement segment at

10%, while

Moreover, over the last six years, we have witnessed a strong correlation between

exports account for 9% of total sales.

volume growth in the automobile industry and volume growth of STL. We expect

this trend to continue going forward. Thus, in our view, STL would benefit from a

recovery in the automobile industry going forward.

Consistent capacity expansion will trigger top-line growth

STL has undertaken several expansions in the past 8-9 years. Since FY2006, it has

almost doubled its capacity from 21,000 MTPA to 41,600 MTPA (the company has

undergone several periodical upgradations and modernization). Recently the

company has increased its manufacturing capacity in the Fasteners segment from

38,400 MT per annum to 41,600 MT per annum (by the end of FY2014) to cater

Since FY2006, STL has almost doubled

to the increasing demand from the automobile industry. Automobile industry sales

its capacity from

21,000 MTPA to

volumes have started improving owing to improvement in the demand scenario.

41,600 MTPA

Also, the OEMs are increasing their capacity and geographical reach. The

enhancement in capacity by STL will enable it to service the increase in demand.

September 12, 2014

3

Sterling Tools | Initiating Coverage

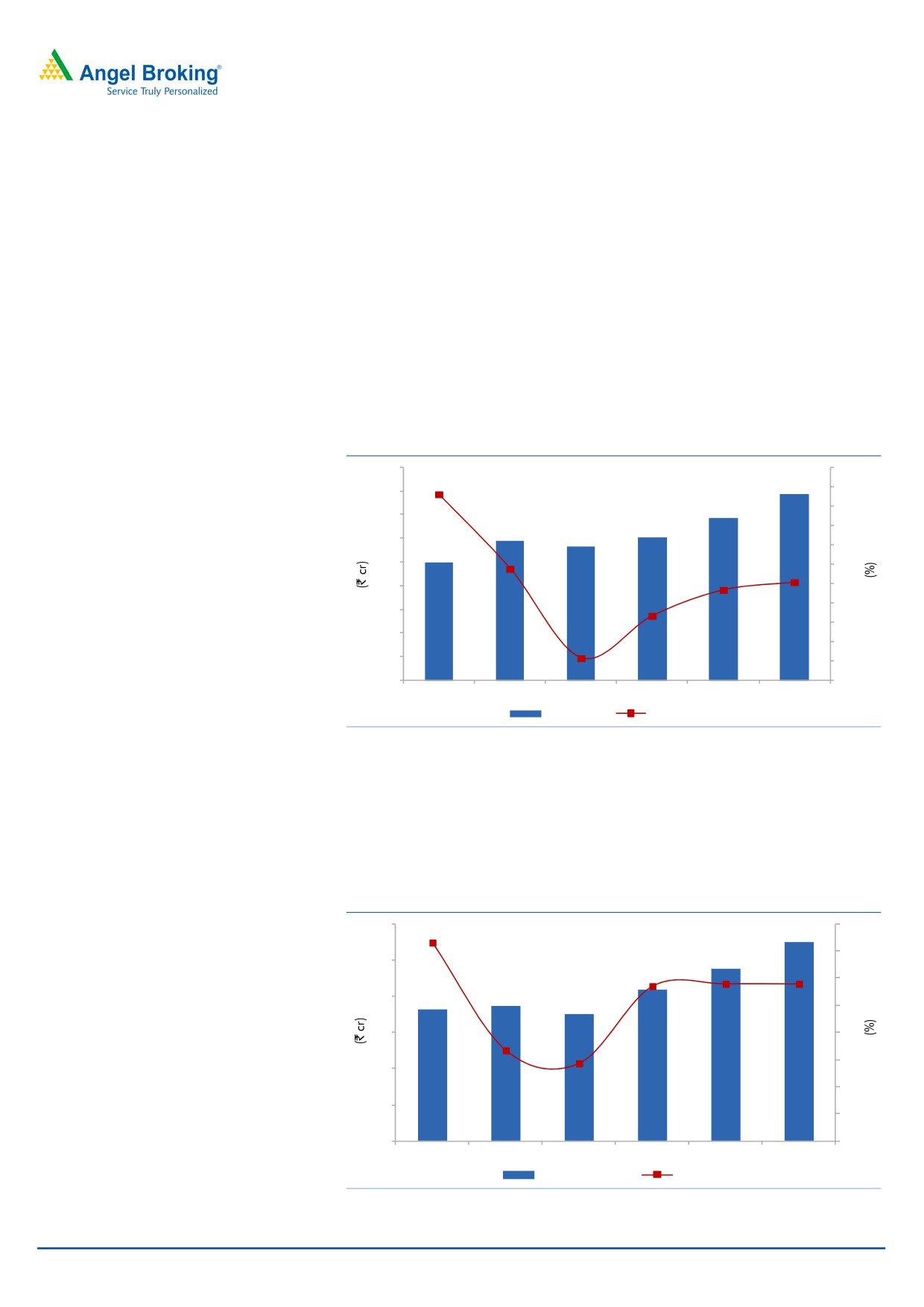

Exhibit 4: Installed Capacity & Utilised Capacity trend

45,000

90

40,000

80

35,000

70

30,000

60

25,000

50

20,000

40

15,000

30

10,000

20

5,000

10

0

0

Capacity

Utilisation (%)

Source: Company, Angel Research

Strong customer base would provide revenue visibility for STL

OEMs are a major contributor to STL’s revenues (~81%). STL is among the top 3

fastener manufacturers in India, supplying to major OEMs like Honda (STL is the

largest supplier of HT fasteners to the company), Maruti Suzuki India and Tata

Motors (STL is the second-largest supplier of fasteners to the two companies). STL’s

The company’s key clients are Honda

other blue chip customers include Ashok Leyland, Daimler, Fiat, Hero Motocorp,

Motorcycle & Scooters India, Maruti

Mahindra & Mahindra, Volvo, Eicher, TAFE and General Motors. This gives the

Suzuki India and Tata Motors

company a diversified customer base and positions it for strong growth, driven by

the sharp uptick in volume growth across a range of segments in the industry.

Exhibit 5: Break-up of Revenue mix

9%

10%

OEMs

Replacement

Exports

81%

Source: Company, Angel Research

September 12, 2014

4

Sterling Tools | Initiating Coverage

Focus on expansion of distribution network

To push replacement market sales, the company is continuously focusing on

increasing dealerships for its products. Currently, the company has more than 60

dealers and the number is growing rapidly. With regional offices in both Chennai

and Pune and residential representatives in places such as Jamshedpur, Mumbai

Currently, the company has more than

and many more cities, STL has been able to interact closely with automobile

60 dealers and the number is growing

dealers, fleet owners and mechanics. This has helped it to gain a better

rapidly

understanding of their needs and enabled it to serve them better. By further

strengthening foothold in this segment, the company intends to make its presence

felt in every part of the country.

Exhibit 6: Domestic Network of STL

Source: Company, Angel Research

September 12, 2014

5

Sterling Tools | Initiating Coverage

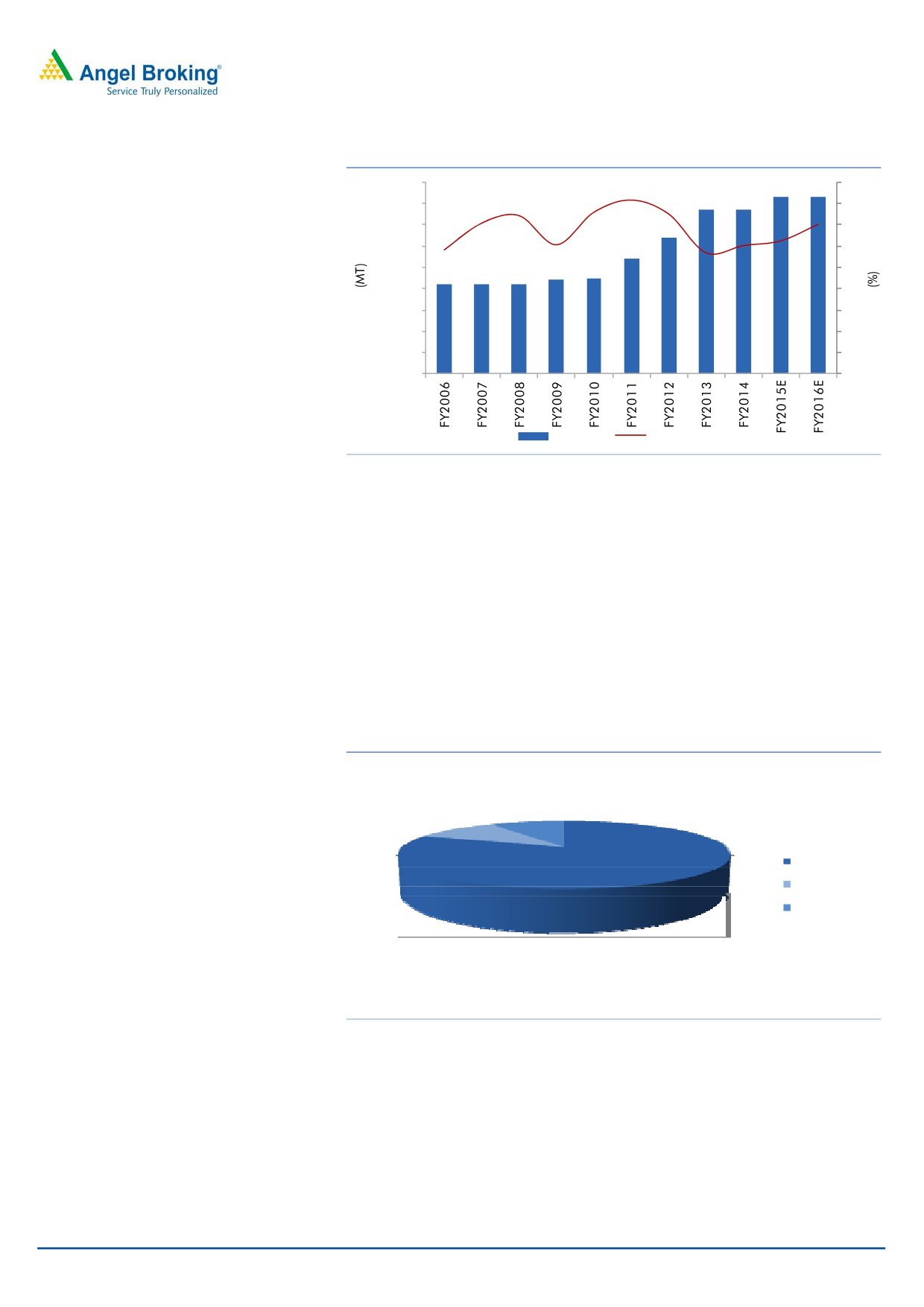

Healthy return ratios, lower D/E and better working capital

The company’s working capital cycle

We expect the company to report improvement in its ROE and ROCE on the back

has reduced from 85 days in FY2011 to

of healthy profitability with strong sales, healthy operating margin due to better

61 days in FY2014

product mix, higher capacity utilization. A decline in interest expenses would also

aid profitability. Further, the company’s working capital cycle has reduced from 85

days in FY2011 to 61 days in FY2014. We expect it to come down further, ie in the

range of 45-50days, owing to improvement in inventory days and receivable days.

Moreover, the company’s debt has reduced from `93cr in FY2012 to `65cr in

FY2014 and we do not expect any significant debt raising by the company due to

absence of any major capex plans in the near term.

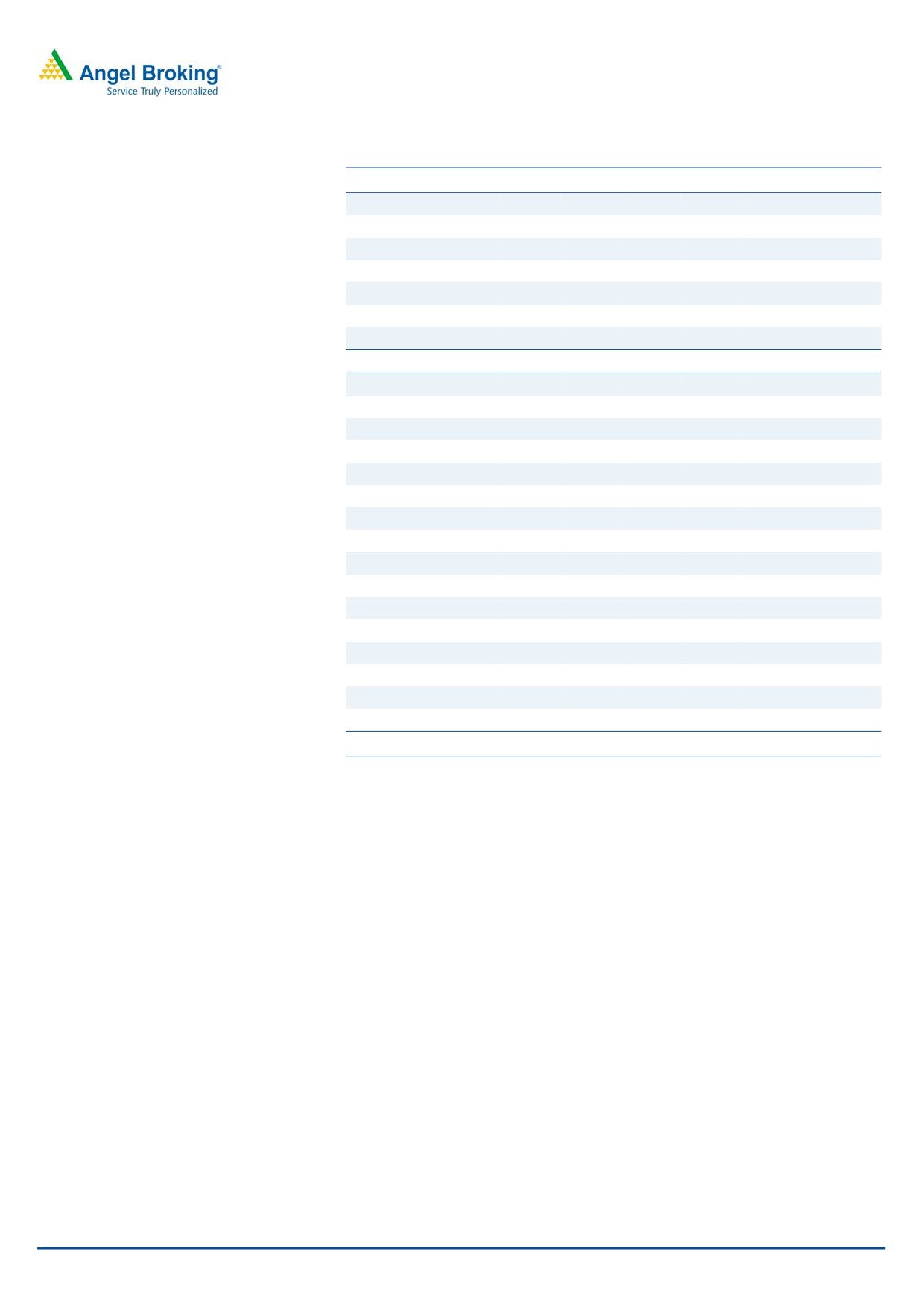

Exhibit 7: Decreasing working capital days

90

85

84

80

80

70

61

60

52

50

46

40

30

20

10

0

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Source: Company, Angel Research

Exhibit 8: Decreasing Debt/Equity ratio

Exhibit 9: Improvement in ROE and ROCE ratios

1.1

24

100

1.1

1.2

21.8

90

1.0

20.3

22

20.6

1.0

80

19.5

20

70

22.2

0.8

17.7

60

0.7

18

0.6

50

0.5

0.6

18.0

15.4

16

40

16.7

16.2

0.4

15.5

14

30

20

0.2

12

10

12.2

77

93

88

65

65

65

0

0.0

10

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Debt

D/E Ratio

ROE

ROCE

Source: Company, Angel Research

Source: Company, Angel Research

September 12, 2014

6

Sterling Tools | Initiating Coverage

Financial outlook

Top-line likely to clock a CAGR of ~14% over FY2014-16E

STL has reported standalone sales CAGR of ~1% over FY2012-14. During

Going forward, we expect STL to

FY2013, the company was unable to perform well due to slowdown in Indian

register a healthy sales CAGR of ~14%

economy and subdued automobile sales volumes, which affected overall OEM

over FY2014-16E

sales performance. Going forward, we expect STL to register healthy net sales

CAGR of ~14% over FY2014-16E supported by healthy sales volume in the

automobile industry owing to recovery in the Indian economy. Further, the

company is also increasing its distribution network which would improve sales from

the replacement markets. Hence, we expect STL’s net sales to grow by ~13% yoy

and ~15% yoy in FY2015 and FY2016, respectively.

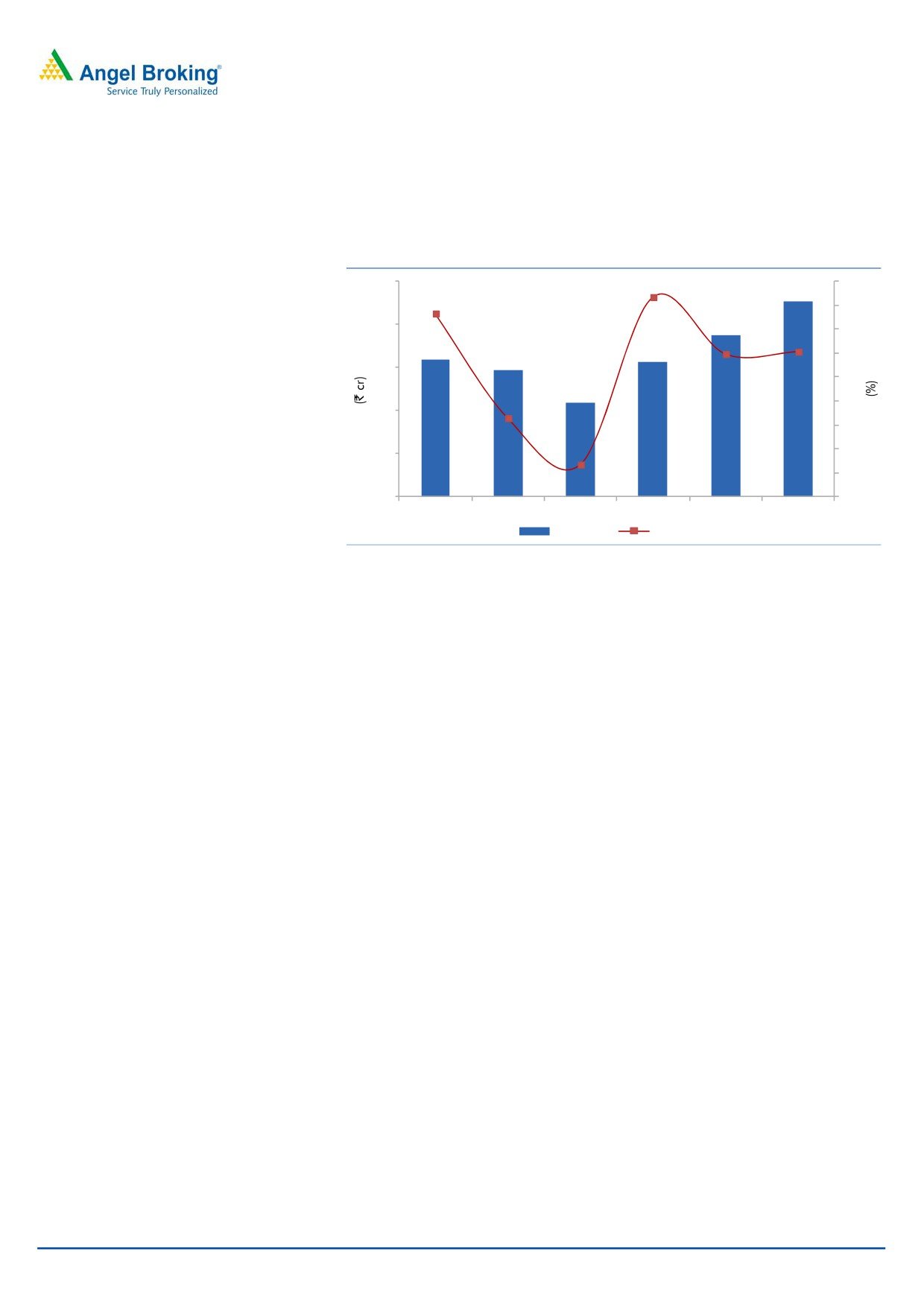

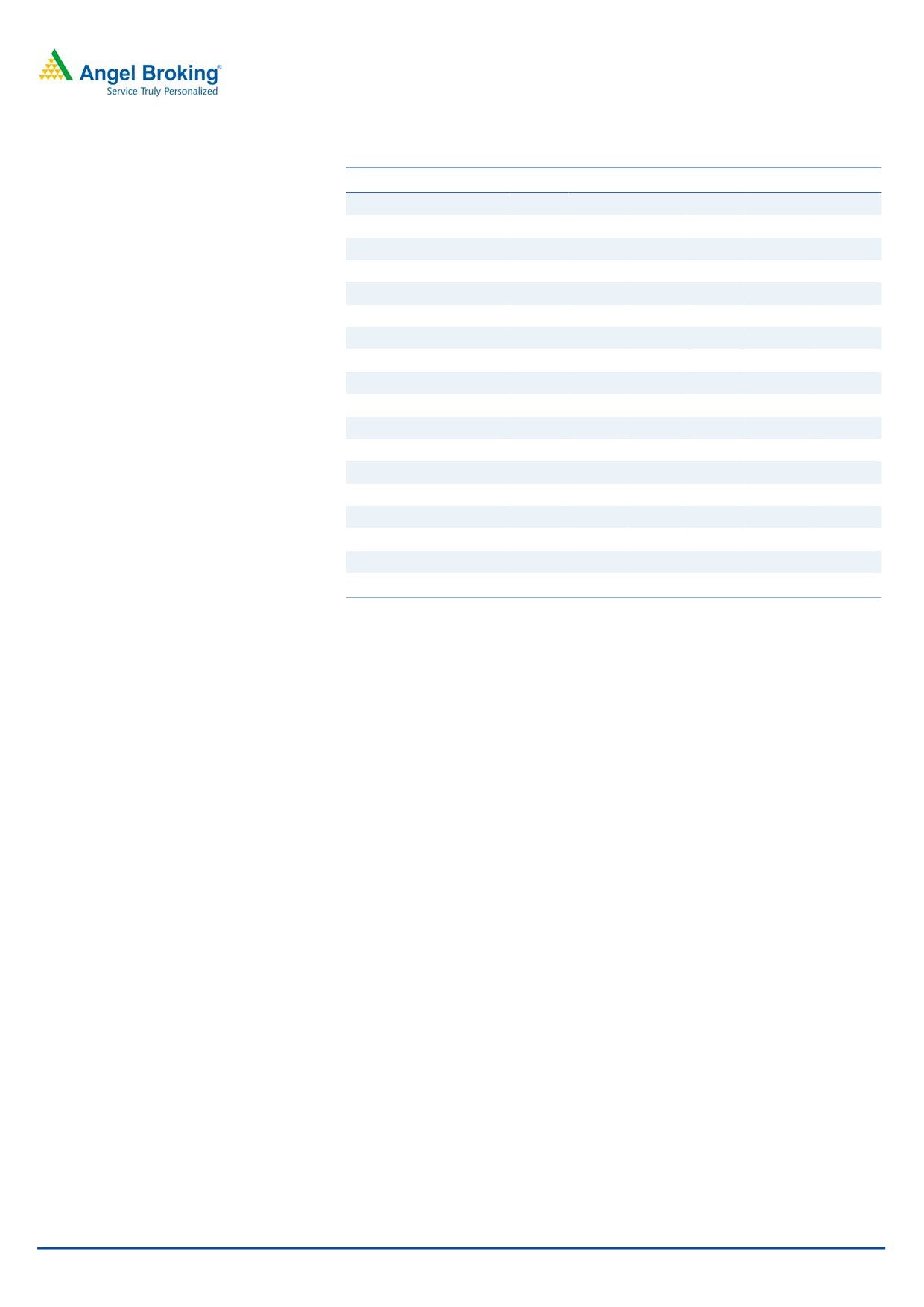

Exhibit 10: Projected Net Sales growth trend

450

45

394

400

40

342

35

350

38.0

295

301

30

283

300

25

248

250

20

200

18.8

15

15.4

10

150

13.4

5

100

6.7

(4.2)

0

50

(5)

0

(10)

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Net Sales

yoy growth (%)

Source: Company, Angel Research

EBITDA to witness a CAGR of ~15% over FY2014-16E

Going forward, we expect the

Going forward, we expect the company’s operating margin to be in the range of

company’s operating margin to be in

13.5-13.9% owing to cost effective management strategy, higher capacity

the range of 13.5-13.9%

utilization, and better product mix.

Exhibit 11: Projected Operating profit growth and margin trend

60

15

55

47

15

50

14.7

42

14

40

36

37

35

13.9

13.9

13.9

14

30

13

13

20

12.7

12.4

12

10

12

0

11

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Operating Profit

Margin (%)

Source: Company, Angel Research

September 12, 2014

7

Sterling Tools | Initiating Coverage

Company to report healthy Net Profit growth

We expect ~20% CAGR in Net Profit

We expect the company to post an ~20% CAGR in net profit over FY2014-16E,

over FY2014-16E

mainly led by strong revenue growth, better margin and lower interest cost.

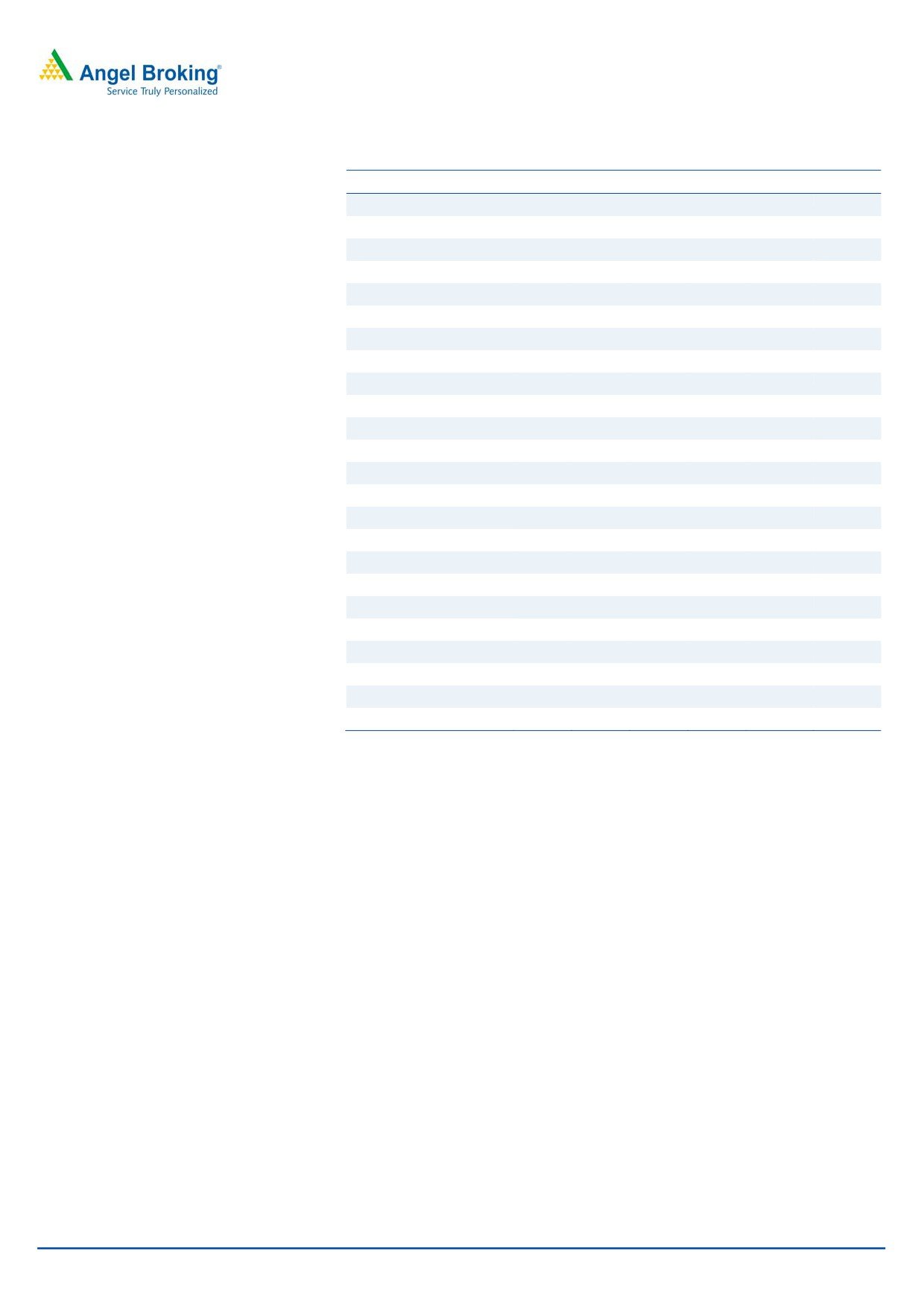

Exhibit 12: Projected Net Profit growth trend

25

43.6

50

23

36.8

40

20

19

30

20.8

16

16

15

20

15

19.8

10

11

(6.9)

0

10

(10)

(20)

5

(26.3)

(30)

0

(40)

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Net Profit

Growth (%)

Source: Company, Angel Research

September 12, 2014

8

Sterling Tools | Initiating Coverage

Outlook and Valuation

Going ahead, we expect STL to report net sales CAGR of ~14% over FY2014-16

to ~`394cr owing to recovery in automobile sales volumes in both domestic as

well as export markets. This will lead to recurring business opportunities for auto

ancillary companies like STL. Going ahead, the company would improve its

volume growth in the fasteners segment driven by healthy volume growth from

OEMs customers like Honda Motorcycle & Scooters India, Maruti Suzuki India, Tata

Motors, Ashok Leyland, Daimler, Fiat, Hero Motocorp, Mahindra & Mahindra,

Volvo, Eicher, TAFE and General Motors.

On the profitability front, we forecast STL to report a net profit CAGR of ~20%

over FY2014-16 to ~`23cr owing to healthy sales and better operating margins

due to better product mix and cost effective management strategy.

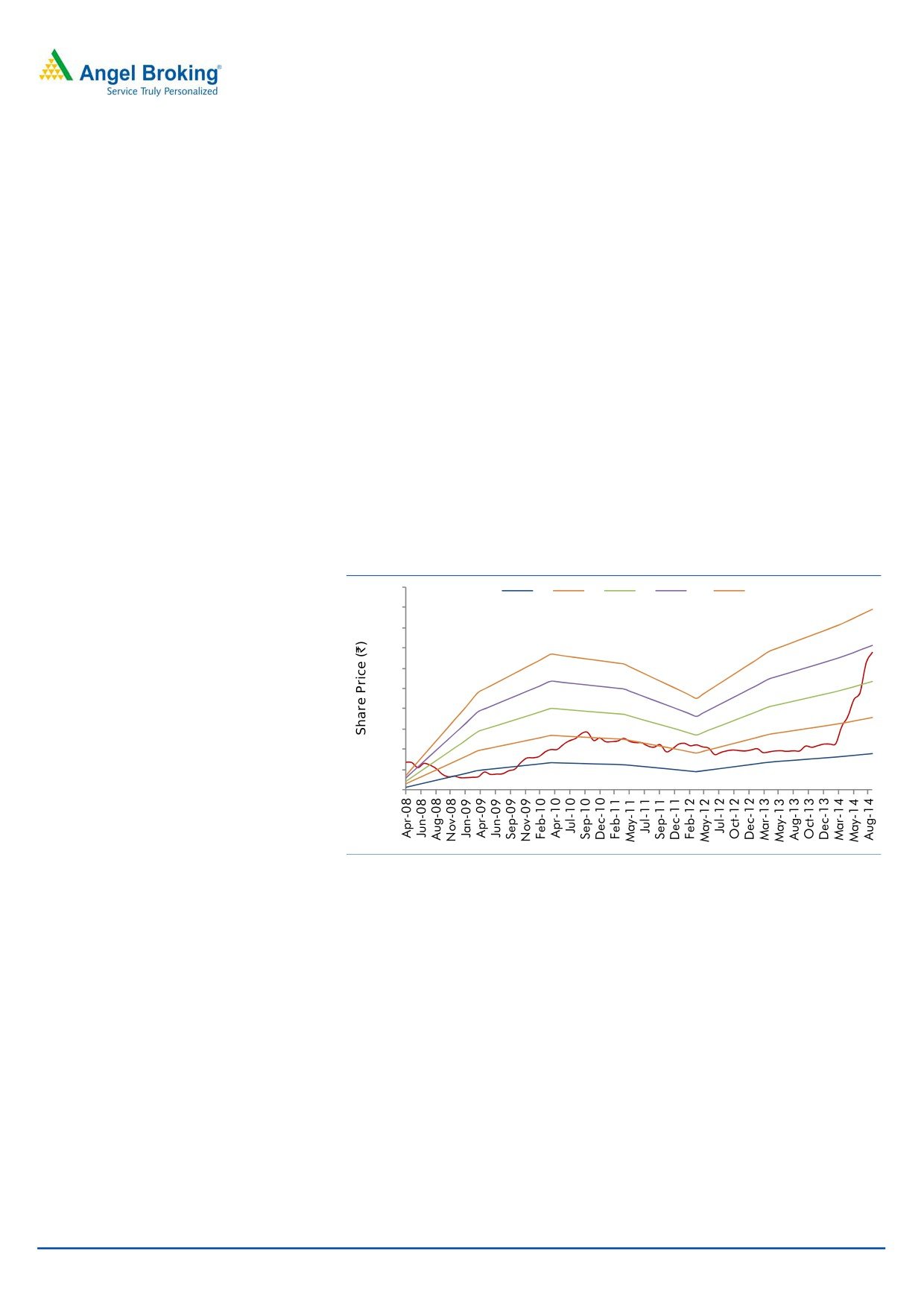

At the current market price of `332, the stock trades at a PE of 12.1x and 10.0x

its FY2015E and FY2016E EPS of `27.4 and `33.1, respectively. We initiate

coverage on the stock with a Buy recommendation and target price of `397, based

on 12x FY2016E EPS, indicating an upside of ~20% from the current levels.

Exhibit 13: One-year forward P/E band

500

3x

6x

9x

12x

15x

450

400

350

300

250

200

150

100

50

0

Source: Company, Angel Research

The downside risks to our estimates include 1) any increase in input costs (ie steel,

iron, etc.) could negatively impact profitability, and 2) downturn in the automobile

industry could affect business growth.

September 12, 2014

9

Sterling Tools | Initiating Coverage

Company Background

Sterling Tools Limited (STL), founded in 1979, engages in manufacturing of high-

tensile (HT) cold forged fasteners mainly for automobiles. The company is one of

the top-3 fastener manufacturers in India and caters to leading automotive

companies in India, Europe, South America and USA-NAFTA. Its product portfolio

includes special fasteners, standard fasteners, surface treatment and coatings,

chassis fasteners and engine fasteners. Its product range includes over 2,000 types

of fasteners ranging from 5mm to 24mm in diameter. The company has three

manufacturing plants in Haryana with a total capacity of 41,600 MT and has over

1,000 employees. STL is the largest supplier of HT fasteners to Honda Motorcycle

& Scooters India and the second largest supplier to Maruti Suzuki India and Tata

Motors. The company’s other blue chip customers include Ashok Leyland, Daimler,

Fiat, Hero Motocorp, Mahindra & Mahindra, Volvo, Eicher, TAFE and General

Motors.

Exhibit 14: Product Profile

Special Fasteners

Standard Fasteners

Chassis Fasteners

Engine Fasteners

Designed specially for unique

Include socket head cap screws,

Include hub/wheel bolts, hub

Include

cylinder

head

customer specifications, available

hexagonal head bolts, studs,

nuts, wheel studs, bolts, rivets

bolts/screws, fly wheel

bolts,

in a variety of surface protection

hexagon nuts and weld nuts

and two wheeler spindles/ wheel

connecting

rod

bolts/nuts,

coatings

axles

balance weight bolts

Source: Company, Angel Research

September 12, 2014

10

Sterling Tools | Initiating Coverage

Profit & Loss Statement

Y/E March (` cr)

FY2011

FY2012 FY2013 FY2014

FY2015E FY2016E

Total operating income

248

295

283

301

342

394

% chg

38.0

18.8

(4.2)

6.7

13.4

15.4

Total Expenditure

212

258

247

260

294

339

Cost of Materials

113

135

130

131

150

175

Personnel

21

24

24

26

30

35

Others

78

99

93

103

114

129

EBITDA

36

37

35

42

47

55

% chg

19.6

2.7

(6.0)

18.8

13.7

15.4

(% of Net Sales)

14.7

12.7

12.4

13.9

13.9

13.9

Depreciation & Amortisation

6

8

9

10

11

12

EBIT

30

29

26

31

36

42

% chg

24.2

(1.8)

(12.6)

22.3

15.2

16.8

(% of Net Sales)

12.1

10.0

9.1

10.4

10.6

10.7

Interest & other Charges

7

10

10

8

8

8

Other Income

0

1

2

1

1

1

(% of PBT)

1.4

3.0

9.2

3.6

3.4

2.8

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

24

20

17

24

29

35

% chg

26.9

(14.1)

(14.9)

39.9

20.8

20.8

Prior Period & Extraordinary Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

24

20

17

24

29

35

Tax

8

6

6

9

11

13

(% of PBT)

33.0

27.4

37.1

35.5

36.0

36.0

PAT (reported)

16

15

11

16

19

23

ADJ. PAT

16

15

11

16

19

23

% chg

36.8

(6.9)

(26.3)

43.6

19.8

20.8

(% of Net Sales)

6.4

5.0

3.9

5.2

5.5

5.7

Basic EPS (`)

23.2

21.6

15.9

22.8

27.4

33.1

Fully Diluted EPS (`)

23.2

21.6

15.9

22.8

27.4

33.1

% chg

36.8

(6.9)

(26.3)

43.6

19.8

20.8

September 12, 2014

11

Sterling Tools | Initiating Coverage

Balance Sheet

Y/E March (` cr)

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

SOURCES OF FUNDS

Equity Share Capital

7

7

7

7

7

7

Reserves& Surplus

64

75

82

94

109

128

Shareholders Funds

71

82

89

101

116

135

Minority Interest

-

-

-

-

-

-

Total Loans

77

93

88

65

65

65

Deferred Tax Liability

10

10

13

13

13

13

Total Liabilities

158

186

190

179

194

213

APPLICATION OF FUNDS

Gross Block

135

155

170

186

206

228

Less: Acc. Depreciation

47

54

64

74

85

98

Net Block

87

101

107

112

121

131

Capital Work-in-Progress

0

1

0

-

-

-

Investments

2

4

4

5

6

7

Current Assets

95

108

99

90

100

113

Inventories

37

47

40

36

37

41

Sundry Debtors

40

41

37

35

37

41

Cash

8

5

8

6

10

12

Loans & Advances

10

8

10

11

13

17

Other Assets

1

7

4

2

2

2

Current liabilities

27

29

21

28

32

37

Net Current Assets

69

79

78

62

67

76

Deferred Tax Asset

1

1

1

-

-

-

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

158

186

190

179

194

213

September 12, 2014

12

Sterling Tools | Initiating Coverage

Cashflow Statement

Y/E March (` cr)

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Profit before tax

24

20

17

24

29

35

Depreciation

6

8

9

10

11

12

Change in Working Capital

(18)

(12)

8

11

(2)

(7)

Interest / Dividend (Net)

6

9

10

7

8

8

Direct taxes paid

(7)

(7)

(4)

(7)

(11)

(13)

Others

(0)

(0)

0

2

0

0

Cash Flow from Operations

11

19

41

49

36

36

(Inc.)/ Dec. in Fixed Assets

(17)

(22)

(15)

(16)

(20)

(22)

(Inc.)/ Dec. in Investments

(2)

(2)

-

(1)

(1)

(1)

Cash Flow from Investing

(18)

(24)

(15)

(17)

(21)

(23)

Issue of Equity

0

0

0

0

0

0

Inc./(Dec.) in loans

30

17

(6)

(22)

(0)

0

Dividend Paid (Incl. Tax)

(2)

(4)

(8)

(4)

(3)

(3)

Interest / Dividend (Net)

(15)

(10)

(10)

(7)

(8)

(8)

Cash Flow from Financing

13

4

(23)

(33)

(12)

(11)

Inc./(Dec.) in Cash

6

(2)

3

(2)

3

2

Opening Cash balances

2

8

5

8

6

10

Closing Cash balances

8

5

8

6

10

12

September 12, 2014

13

Sterling Tools | Initiating Coverage

Key Ratios

Y/E March

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Valuation Ratio (x)

P/E (on FDEPS)

14.3

15.4

20.8

14.5

12.1

10.0

P/CEPS

10.2

10.0

11.2

8.7

7.6

6.5

P/BV

3.2

2.8

2.5

2.3

2.0

1.7

Dividend yield (%)

1.5

1.5

1.5

1.5

1.5

1.5

EV/Sales

1.2

1.1

1.1

0.9

0.8

0.7

EV/EBITDA

8.1

8.3

8.6

6.7

5.8

5.0

EV / Total Assets

1.6

1.4

1.4

1.4

1.2

1.1

Per Share Data (`)

EPS (Basic)

23.2

21.6

15.9

22.8

27.4

33.1

EPS (fully diluted)

23.2

21.6

15.9

22.8

27.4

33.1

Cash EPS

32.6

33.2

29.7

37.9

43.8

51.2

DPS

5.0

5.0

5.0

5.0

5.0

5.0

Book Value

104.2

120.0

130.0

147.0

169.4

197.5

Returns (%)

ROCE

20.3

17.7

15.4

19.5

20.6

21.8

Angel ROIC (Pre-tax)

21.7

18.6

16.5

20.9

22.5

24.0

ROE

22.2

18.0

12.2

15.5

16.2

16.7

Turnover ratios (x)

Asset Turnover (Gross Block)

2.8

2.9

2.6

2.7

2.8

3.0

Inventory / Sales (days)

55

58

52

43

40

38

Receivables (days)

59

50

48

42

40

38

Payables (days)

29

24

20

25

28

30

WC cycle (ex-cash) (days)

85

84

80

61

52

46

September 12, 2014

14

Sterling Tools | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Sterling Tools

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

September 12, 2014

15

Sterling Tools | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Amarjeet Maurya

Analyst

Bharat Gianani

Analyst

Shrenik Gujrathi

Analyst

Umesh Matkar

Analyst

Twinkle Gosar

Analyst

Tejas Vahalia

Research Editor

Technicals and Derivatives:

Siddarth Bhamre

Head - Technical & Derivatives

Sameet Chavan

Technical Analyst

Nagesh Arekar

Executive

Sneha Seth

Associate (Derivatives)

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Production Team:

Dilip Patel

Production Incharge

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 - 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 /

NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

September 12, 2014

16