Please refer to important disclosures at the end of this report

1

Incorporated in 2006, Star Health and Allied Insurance Company Ltd (Star

Health) is one of the largest private health insurers in India with a market share

of 15.8% in Fiscal 2021. The company primarily focuses on the retail health

market segment. It offers a range of flexible and comprehensive coverage

options for retail health, group health, personal accident, and overseas travel,

accounting for 87.9%, 10.5%, 1.6%, and 0.01%, respectively, of the total Gross

Written Premium (GWP) in Fiscal 2021. As of September 30, 2021, its network

distribution includes 779 health insurance branches across 25 states and 5 union

territories in India. Star Health has also built one of the largest health insurance

hospital networks in India with more than 11,778 hospitals.

Positives: (a) The largest private health insurance company in India with

leadership in the attractive retail health segment (31.3% market share in FY21).

(b) One of the largest and well spread distribution networks in the health

insurance industry and an integrated ecosystem. (c) The diversified product suite

with a focus on innovative and specialized products Scalable. (d) Experienced

Board and senior management team.

Investment concerns: (a) Further impact of the Covid-19 pandemic could

increase claim (b) Any increase in competition could negatively impact the

company’s profitability.

Outlook & Valuation:

Star Health stands out among other standalone health insurers (SAHI) in terms

of size, strong growth rates (32% Gross Written Premium CAGR over FY18-21)

and better operational performance which is reflected in pre-Covid numbers for

the company (~93% combined ratio). The valuations commanded by Star Health

at ~5.5x FY21 Mcap/GWP, are in-line with recent deals in the SAHI space and

appears fair considering its positioning. Hence, we recommend SUBSCRIBE from

a long-term perspective only.

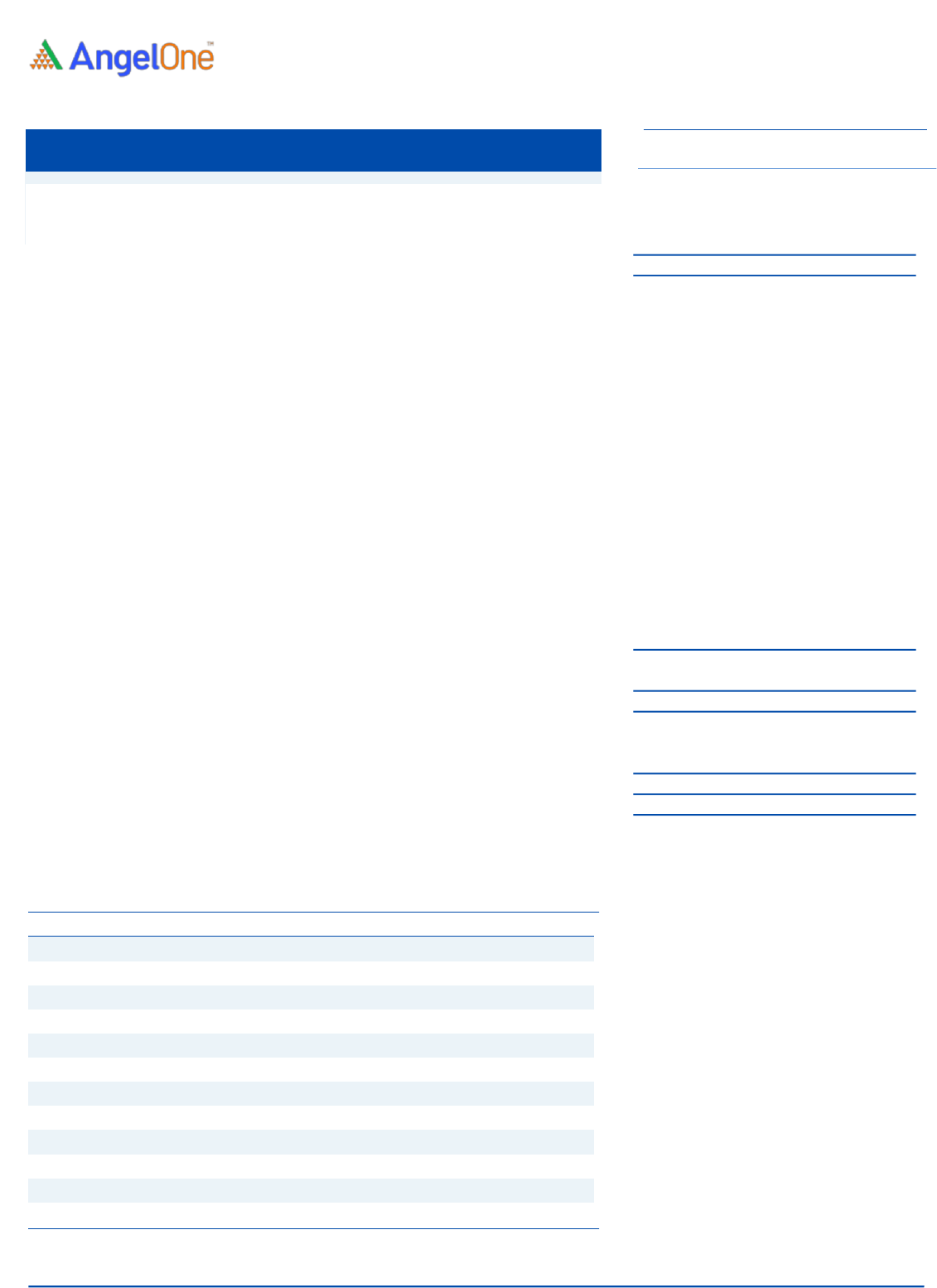

Key Financials

Y/E March (Rs cr)

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Gross Premiums Written

5,415

6,891

9,349

3,967

5,070

% chg

-

27.2

35.7

-

27.8

Premium earned (Net)

3,580

4,693

5,023

2,712

4,660

% chg

-

31.1

7.0

-

71.8

Operating Profit/(Loss)

165

361

(1,071)

271

(662)

% chg

-

119.0

(396.9)

-

(344.4)

Net profit

128

268

(826)

199

(380)

% chg

-

109.0

(408.1)

-

(290.8)

EPS

2.2

4.7

(14.3)

3.5

(6.6)

P/E

404.0

193.3

-

-

-

P/BV (x)

42.6

31.8

14.9

-

-

ROE

10.5

16.5

(23.7)

-

-

Angel Research; Note: Valuation ratios based on post-issue shares and at

`

900 per share.

SUBSCRIBE

Issue Open: Nov 30, 2021

Issue Close: Dec 02, 2021

Offer for Sale: 5.38cr

share

QIBs 75%

Non-Institutional 15%

Retail 10%

Promoters 58.4%

Public 41.6%

Post Issue Shareholding P attern

Post Eq. Paid up Capital: `574.4cr

Issue size (amount): `7,249cr

Price Band: `870-900

Lot Size: 16 shares

Post-issue mkt.cap: `50,146*– 51,806cr**

Promoter holding Pre-Issue: 66.2%

Promoter holding Post-Issue: 58.4%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue:`2,000cr

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `553.3cr

Amarjeet S Maurya

+022 4000 3600, Extn: 6831

amarjeet.maurya@angelbroking.com

Star Health and Allied Insurance Company Ltd

f

IPO Note |Insurance

November 26, 2021

Star Health and Allied Insurance Company Ltd| IPO Note

November 26, 2021

2

Company background

Incorporated in 2006, Star Health and Allied Insurance Company Ltd (Star Health)

is one of the largest private health insurers in India with a market share of 15.8% in

Fiscal 2021. The company primarily focuses on the retail health market segment.

It offers a range of flexible and comprehensive coverage options for retail health,

group health, personal accident, and overseas travel, accounting for 87.9%, 10.5%,

1.6%, and 0.01%, respectively, of the total Gross Written Premium (GWP) in Fiscal

2021. In FY2021 and the 6 months ended September 30, 2021, they had total

Gross Written Premium (GWP) of ₹9,348.95cr and ₹5,069.78cr, respectively.

The company mainly distributes policies through individual agents and also includes

corporate agent banks and other corporate agents. As of September 30, 2021, its

network distribution includes 779 health insurance branches across 25 states and 5

union territories in India. Star Health has also built one of the largest health

insurance hospital networks in India with more than 11,778 hospitals. Their existing

branches are also supplemented by an extensive network of over 562 Sales

Managers Stations (“SMS”) and over 6,892 in house sales managers.

Issue details

Star Health is raising ₹7,294cr through fresh issue (`2,000cr) and Shareholder

are selling equity share 5.83cr through offer for sale in the price band of ₹870-

900.

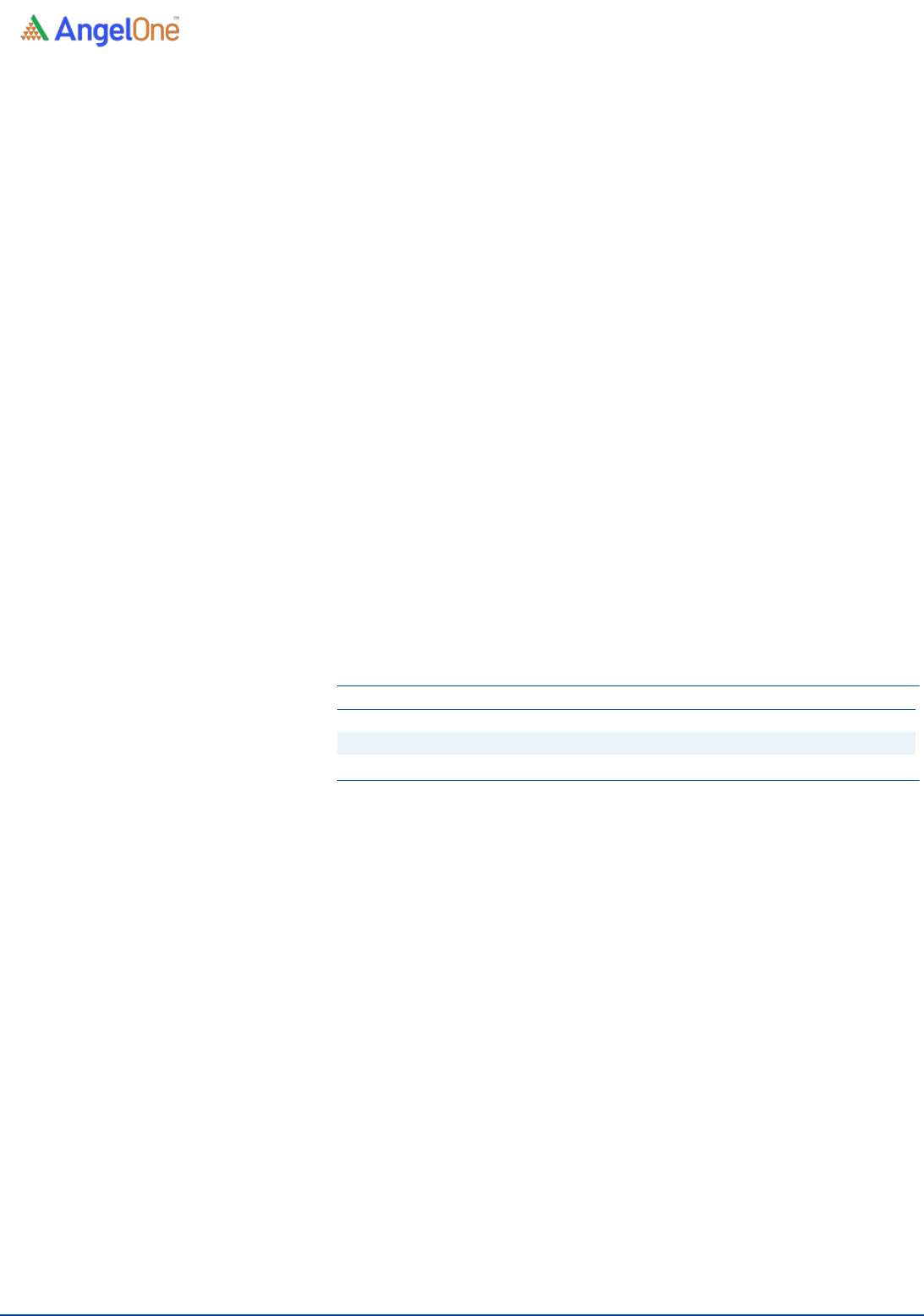

Exhibit 1: Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

366,383,000

66.2%

335,552,113

58.4%

Public

186,906,944

33.8%

238,848,942

41.6%

Total

553,289,944

100.0%

574,401,055

100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

The IPO aims to utilize the net proceed to augment the company's

capital base and insolvency level.

Star Health and Allied Insurance Company Ltd| IPO Note

November 26, 2021

3

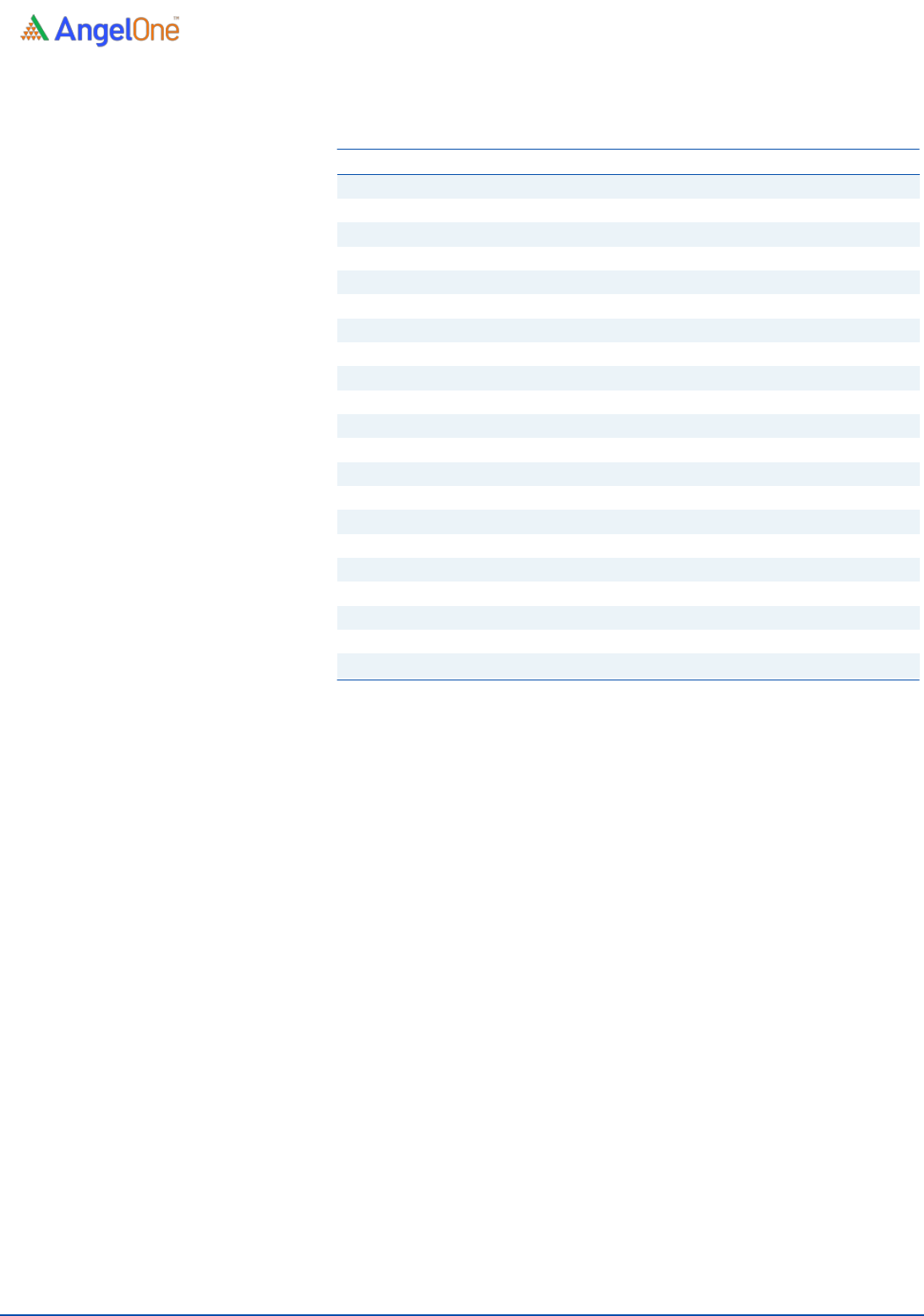

Exhibit 2: Income Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Premium from direct business written

5,415

6,891

9,349

3,967

5,070

% chg

-

27.2

35.7

-

27.8

Premiums earned (Net)

3,580

4,693

5,023

2,712

4,660

% chg

-

31.1

7.0

-

71.8

Other Income

134

192

261

126

270

Total Income

3,714

4,885

5,283

2,838

4,930

Claims Incurred (Net)

2,298

3,087

4,369

1,634

4,111

Commission

264

341

584

302

626

Operating Expenses (Insurance)

987

1,096

1,401

631

854

Operating Profit/(Loss)

165

361

(1,071)

271

(662)

% chg

-

119.0

(396.9)

-

(344.4)

Income from investments

61

101

163

62

160

Other income

0

0

0

2

7

Total Income

226

462

(908)

334

(495)

Provisions (Other than taxation)

4

(3)

34

0

0

Other expenses

40

52

104

18

18

Profit before tax

182

413

(1,046)

317

(513)

Provision for taxation

54

145

(220)

117

(132)

Profit after tax

128

268

(826)

199

(380)

EPS

2.2

4.7

(14.3)

3.5

(6.6)

% chg

-

109.0

(408.1)

-

(290.8)

Source: Company, Angel Research

Star Health and Allied Insurance Company Ltd| IPO Note

November 26, 2021

4

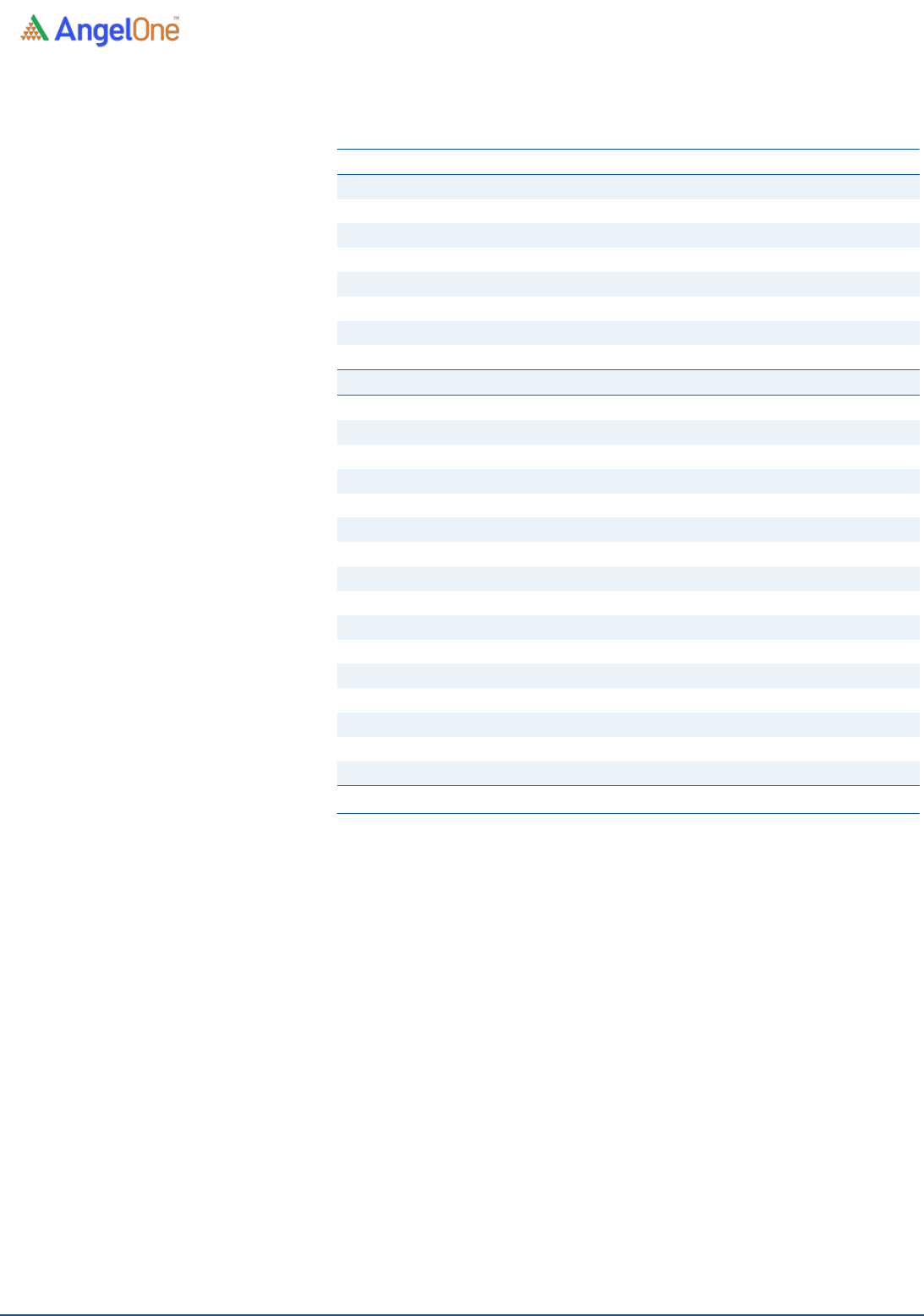

Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Sources Of Funds

Share Capital

456

491

548

491

553

Share Application Money

350

-

-

-

-

Employee Stock Option Outstanding

-

-

0

-

1

Reserves And Surplus

587

1,153

3,676

1,352

3,765

Fair Value Change A/c – Shareholder

-

1

(3)

3

2

Fair Value Change A/C - Policyholder

-

2

(5)

5

4

Borrowings

250

250

250

250

650

Total

1,643

1,897

4,467

2,101

4,975

Application Of Funds

Investments - Shareholders

952

1,478

2,632

1,842

3,200

Investments - Policyholders

2,078

2,812

4,205

3,763

5,403

Loans

-

-

-

-

-

Fixed Assets

98

102

99

93

116

Deferred Tax Asset

142

147

421

74

549

Current Assets

-

-

-

-

-

Cash And Bank Balances

893

611

1,879

606

878

Advances And Other Assets

709

977

1,265

596

616

Sub-Total (A)

1,602

1,588

3,144

1,202

1,494

Current Liabilities

902

1,179

1,564

1,563

1,567

Provisions

2,492

3,051

5,195

3,310

5,325

Sub-Total (B)

3,394

4,230

6,759

4,873

6,892

Net Current Assets (C) = (A - B)

(1,792)

(2,642)

(3,615)

(3,671)

(5,398)

Miscellaneous Expenditure

-

-

-

-

-

Debit Balance In P&L Account

164

-

725

-

1,105

Total

1,643

1,897

4,467

2,101

4,975

Source: Company, Angel Research

Star Health and Allied Insurance Company Ltd| IPO Note

November 26, 2021

5

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Q1FY21

Q1FY22

Valuation Ratio (X)

P/E

404.0

193.3

-

-

-

P/BV

42.6

31.8

14.9

-

-

Per Share Data (Rs)

EPS

2.2

4.7

(14.3)

3.5

(6.6)

Book Value

21.1

28.3

60.5

31.8

55.6

Returns (%)

ROE

10.5

16.5

(23.7)

-

-

ROA

8.5

15.3

(20.4)

-

-

Operating Ratios (X)

Solvency Ratio

1.5

1.5

2.2

1.5

1.5

Loss Ratio

64.2

65.8

87.0

60.3

88.2

Expense Ratio

23.7

20.9

19.6

21.4

17.9

Commission Ratio

6.4

6.5

8.2

10.2

13.1

Combined Ratio

94.3

93.2

114.8

91.9

119.2

Investment Yield

7.5

7.6

7.1

7.3

9.8

Source: Company, Angel Research

Star Health and Allied Insurance Company Ltd| IPO Note

November 26, 2021

6

Research Team Tel: 022 – 40003600 E-mail: research@angelbroking.com Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited

has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.