Please refer to important disclosures at the end of this report

1

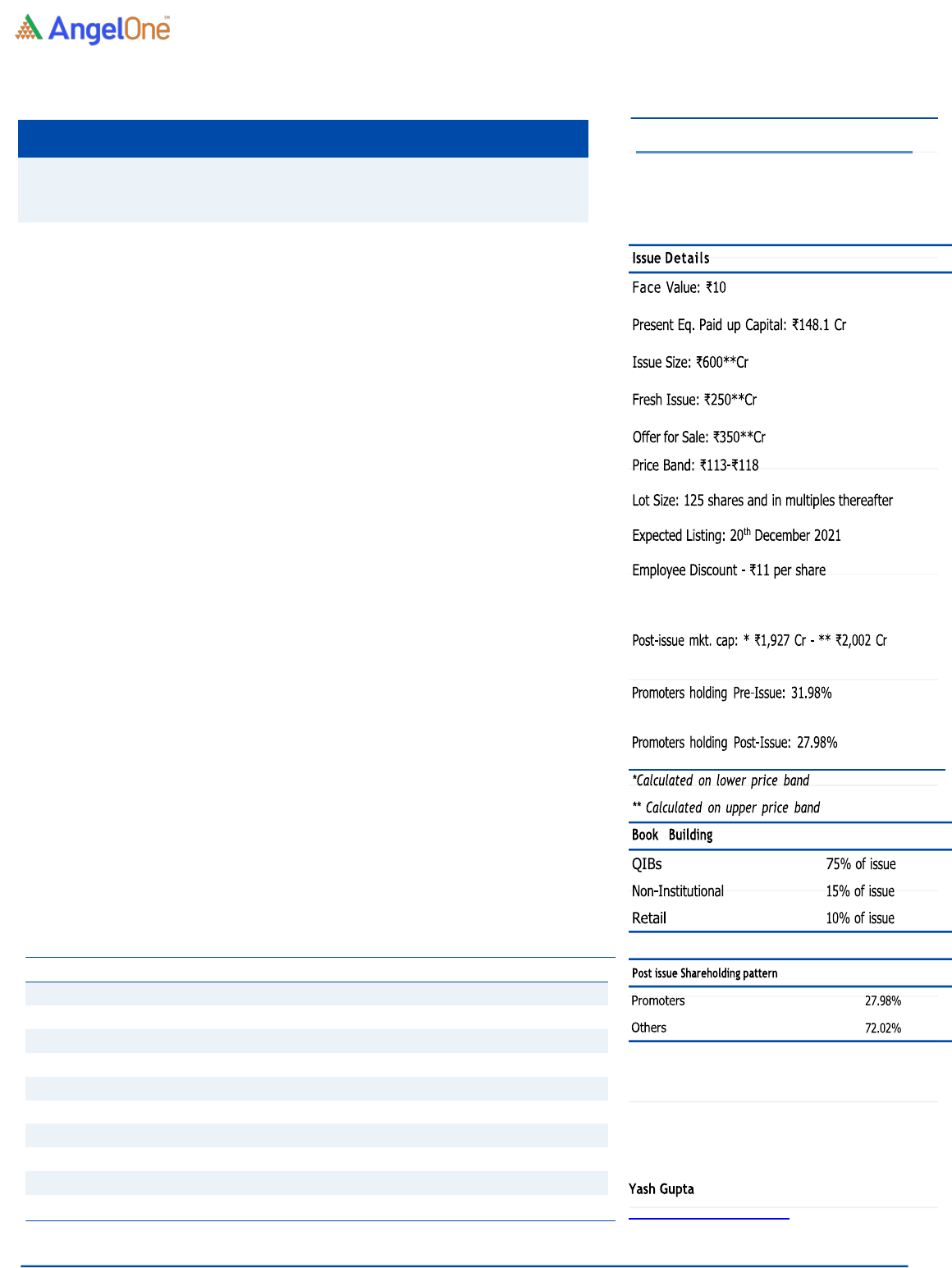

Shriram Properties Limited

IPO NOTE Shriram Properties Limited

December 07, 2021

Shriram Properties Limited was incorporated in 2000, company is a group

company of Shriram Group. Shriram Properties Limited is one of the leading

residential real estate development companies in South India, primarily focused

on the mid-market and affordable housing categories. Shriram Properties is

among the Top-5 residential real estate developers in South India in terms of the

number of units launched since 2015. Company focus markets are Bengaluru and

Chennai, along with this company has a presence in Kolkata and Hyderabad.

Positives

(a) Good Launch Pipeline – Company having a saleable area of 26.3

msf(million square feet) under ongoing projects and 8.27 msf project under

development. (b). The company is part of the Shriram Group and backed by

marquee investors like TPG, Tata Opportunities Fund, Walton Street. (c).

Company having a strong execution track record of completing the project and

delivering the project on time.

Investment concerns: (a) Increase in competition, Bangalore market is the key

market for Shriram Properties Ltd and we have seen an increase in competition in

the Bangalore market. (b) Company not have much completed inventory, so

upcoming sales will be dependent on the new launch of projects and it will take

time to launch new projects. (c) Out of 26 ongoing projects, 18 projects are based

in Bangalore market, any change in rule and regulation will impact the company.

Outlook & Valuation: Based on H1FY2022 numbers, the IPO is priced at a Price to

Book value of 2.28 times at the upper price band of the IPO, which is in line with

the listed peer group. Company is one of the leading residential real-estate

developers in south India and focuses on mid-market and affordable housing

categories. We believe that the company has strong track record of delivering the

project on time and can maintain strong execution which will get reflected in the

pre-sales numbers going ahead. Hence, we are assigning a “SUBSCRIBE”

recommendation to the Shriram Properties Limited IPO.

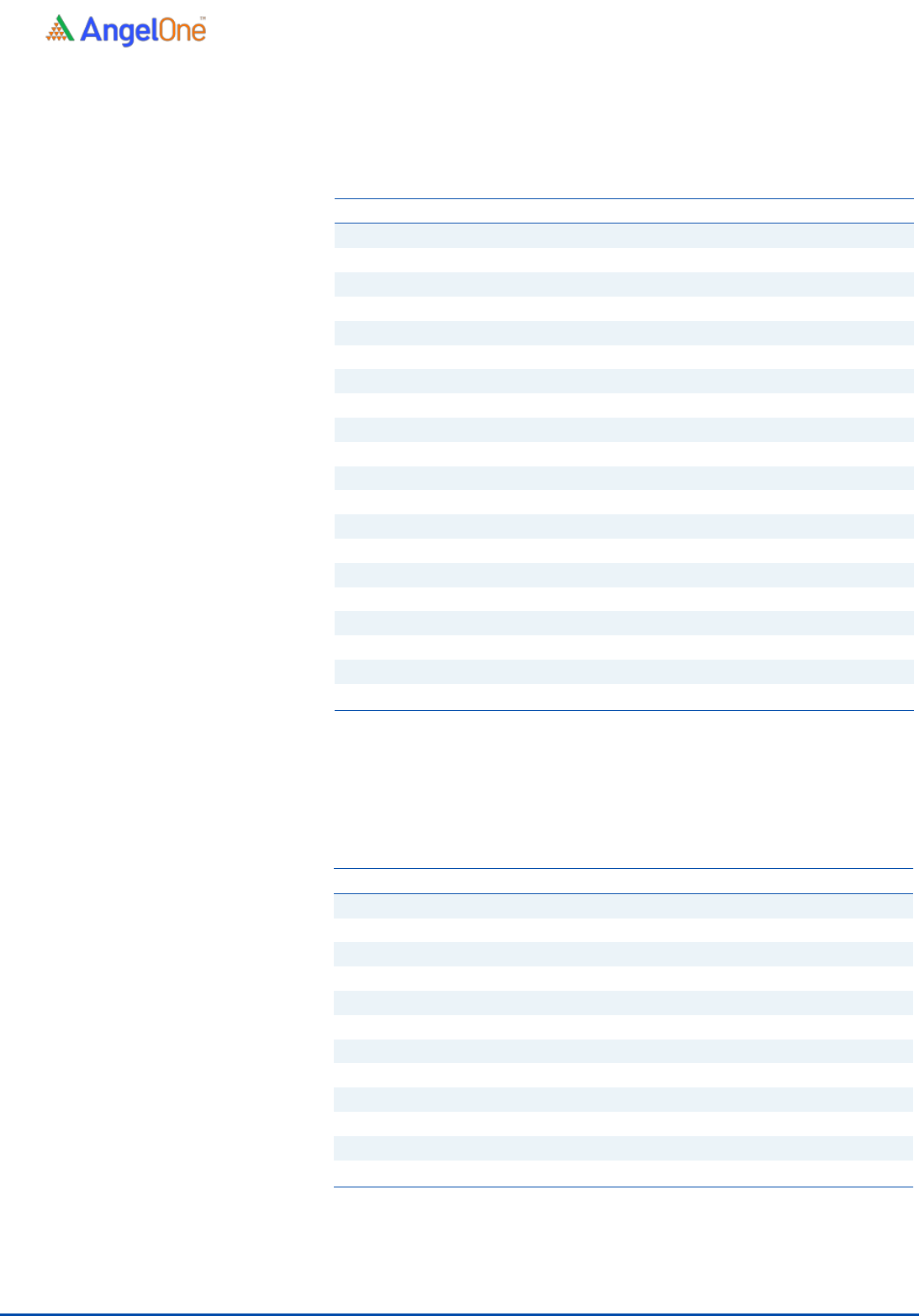

Key Financials

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

Net Sales

650.1

571.9

431.4

118.1

% chg

-

(12)

(24.6)

-

Net Profit

48.9

(86)

(67.8)

-59.9

% chg

-

(276)

(21.2)

-

EBITDA (%)

12.3

15.8

28.1

31.3

EPS (as stated)

3.4

(5.8)

(4.6)

(4.6)

P/E (x)

34.9

-

-

-

P/BV (x)

1.8

2.0

2.1

2.3

EV/EBITDA

24.4

20.5

14.6

24.4

EV/Sales

3.0

3.2

4.1

7.6

Source: Company, Angel Research

SUBSCRIBE

Issue Open: December 08, 2021

Issue Close: December 10, 2021

Shriram Properties Limited | IPO Note

December 07, 2021

2

Company Background

Shriram Properties Limited was incorporated in 2000, company is a group

company of Shriram Group. Shriram Properties Limited is one of the leading

residential real estate development companies in South India, primarily

focused on the mid-market and affordable housing categories.

Shriram Properties is among the Top-5 residential real estate developers in

South India in terms of the number of units launched after 2015. The

company commenced operations in Bengaluru in the year 2000 and have

since expanded their presence to other cities in South India, i.e., Chennai,

Coimbatore and Visakhapatnam.

Company focus markets are Bengaluru and Chennai, along with this company

has a presence in Kolkata and Hyderabad markets. The Company holds 197

acres of land parcel in Kolkata with a development potential of 21 Msf (Million

square feet).

As of H1FY2022, the company has 29 Completed Projects, representing 16.76

million square feet of Saleable Area, out of which 24 Completed Projects are in

Bengaluru and Chennai market, which accounts for 90.56% of Saleable Area.

Companies 83.69% of the total Saleable Area for Completed Projects were in

the mid-market category and affordable housing category (with mid-market

and affordable categories accounting for 51.44% and 32.25% respectively),

and the remainder in the commercial and office space and luxury housing

categories, as of September 30, 2021.

Issue Details –

The issue comprises of new issue of ₹250 crores and offer for sale of

₹350Cr. With the IPO price band of ₹113-₹118.

Pre & Post Shareholding

(Pre-issue)

(Post-issue)

Particular

No of shares

%

No of shares

%

Promoter

4,74,58,070

31.98%

4,74,58,070

28.0%

Public – Investor Selling Shareholders

9,96,45,055

67.14%

5,21,82,915

41.3%

Public - Other

13,08,323

0.88%

6,99,84,039

30.8%

Total

14,84,11,448

100.0%

16,96,24,024

100.0%

Source: Company, Angel Research

Shriram Properties Limited | IPO Note

December 07, 2021

3

Objectives of the Offer

Repayment of certain borrowings availed by the company or subsidiaries.

General Corporate Purposes.

Key Management Personnel

M Murali is the Chairman and Managing Director and individual Promoter of

the company. He has over 17 years of work experience with the company and

was first appointed as a Director of the company on March 30, 2003.

S Natarajan is the Non-Executive Director of the company. He is on the board

of various other companies, such as Binny Mills Ltd, Calcom Credit and

Holdings Pvt Ltd, Envestor Ventures Ltd, Integrated Enterprises (India) Pvt

Ltd, Sipping Spirits Pvt Ltd etc. He has been associated with the Shriram

group for over 17 years and has been a Director of the company since March

30, 2003.

Raphael Dawson is a Non-Executive Nominee Director of the company. He has

more than 15 years of work experience and is currently a Principal with

Walton Street Capital, LLC. He has been a Director of the company since

March 14, 2014.

Gopalakrishnan J is the Executive Director and Group CFO of the company. He

has more than 28 years of experience in the field of finance, mergers and

acquisitions, corporate restructuring, debt and equity, capital markets

financing and debt financing. He joined the company on April 2, 2018.

K.R Ramesh is the Executive Director – Operations of the company. He has

many years of experience in the field of accounting and finance. He joined the

company on August 8, 2007.

Krishna Veeraraghavan is the Director – Operations & Chief Operating Officer

(Bangalore) of the company. He has more than 30 years of experience in the

field of construction, engineering and construction management. He has been

working with the company since June 12, 2014.

Shriram Properties Limited | IPO Note

December 07, 2021

4

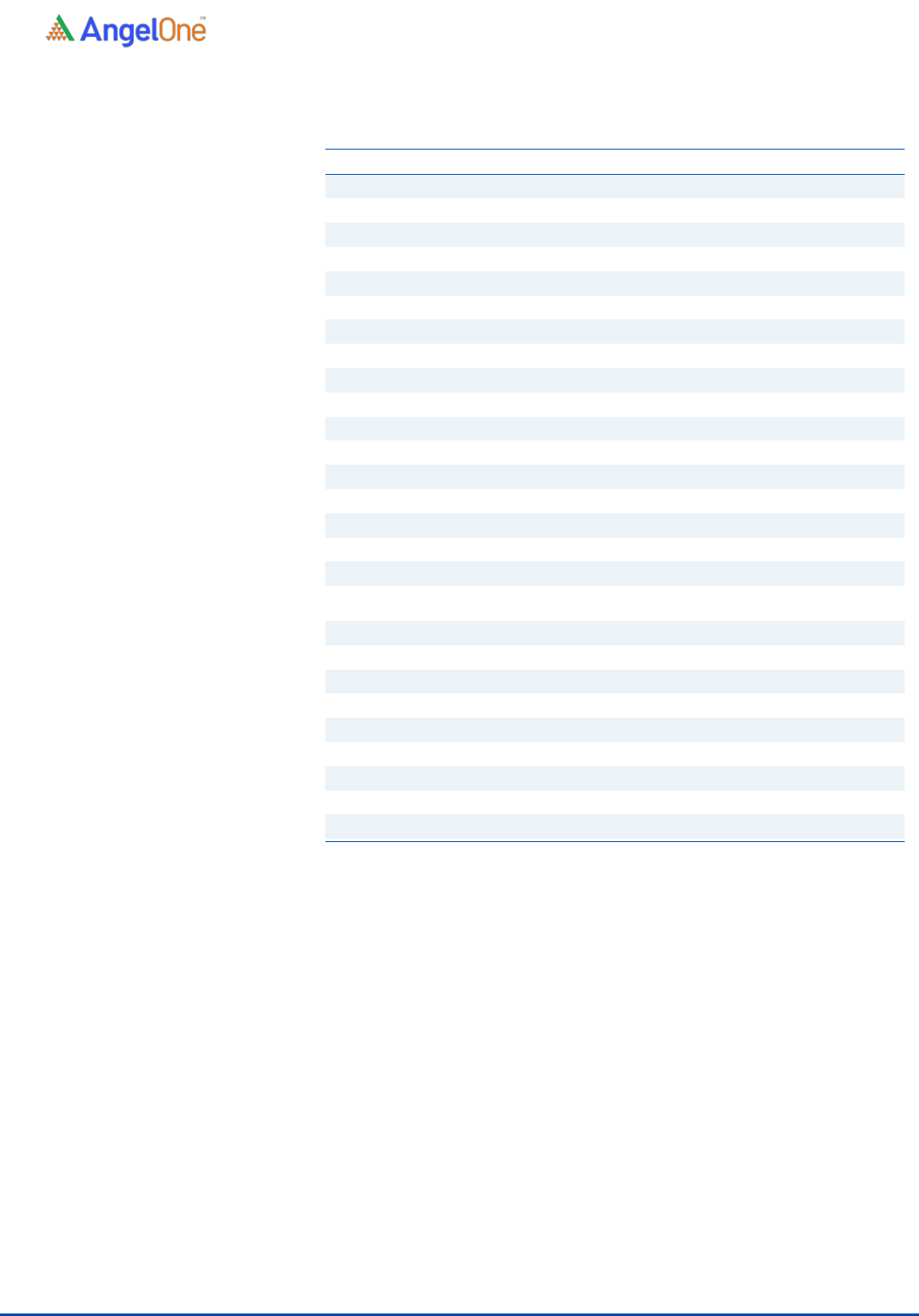

Consolidated Profit & Loss account

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

Total operating income

650.1

571.9

431.4

118.1

% chg

-

(12)

(24.6)

-

Total Expenditure

644

541

380

118

Land & Material cost

485

352

239

60

Employee Benefit Expense

78

85

64

35

Other Expenses

80

104

78

23

EBITDA

6

31

51

0

% chg

-

378

67

-

(% of Net Sales)

1.0

5.4

11.9

0.1

Depreciation& Amortisation

5.2

6.4

6.5

3.4

EBIT

1.2

24.4

44.8

(3.3)

% chg

-

1,868

84

-

(% of Net Sales)

0.2

4.3

10.4

-

Interest & other Charges

105

123

125

64

Other Income

73.6

59.8

69.8

36.9

(% of Sales)

11.3

10.5

16.2

31.2

Exceptional items

122.3

(1.5)

(1.1)

(3.9)

Profit /(loss) before tax and share of

loss in joint ventures

92

(40.4)

(11.8)

(34.2)

Share of loss of joint ventures

(9.0)

(40.9)

(33.1)

(18.4)

PBT

83.0

(81.3)

(44.9)

(52.6)

(% of Net Sales)

12.8

(14.2)

(10.4)

(44.5)

Tax

34.1

4.7

22.9

7.3

PAT (reported)

48.9

(86.0)

(67.8)

(59.9)

% chg

-

-

(21.2)

(11.7)

(% of Net Sales)

7.5

(15.0)

(15.7)

(50.7)

EPS (as stated)

3.38

(5.8)

(4.6)

(4.6)

% chg

-

-

(20.7)

-

Source: Company, Angel Research

Shriram Properties Limited | IPO Note

December 07, 2021

5

Consolidated Balance Sheet

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

SOURCES OF FUNDS

Equity Share Capital

148

148

148

148

Other equity

822

746

679

619

Shareholders Funds

970

894

827

767

Total Loans

259

154

97

97

Other liabities

3.7

4.4

4.4

4.9

Total Liabilities

1,233

1,053

929

869

APPLICATION OF FUNDS

Net Block

68

81

75

73

Current Assets

2,849

2,884

2,838

2,900

Sundry Debtors

210

165

132

108

Cash &Bank Balance

56

44

81

42

Other Assets

203

209

275

310

Current liabilities

2,133

2,364

2,370

2,424

Net Current Assets

716

520

468

476

Other Non Current Asset

448

451

385

319

Total Assets

1233

1053

929

869

Source: Company, Angel Research

Shriram Properties Limited | IPO Note

December 07, 2021

6

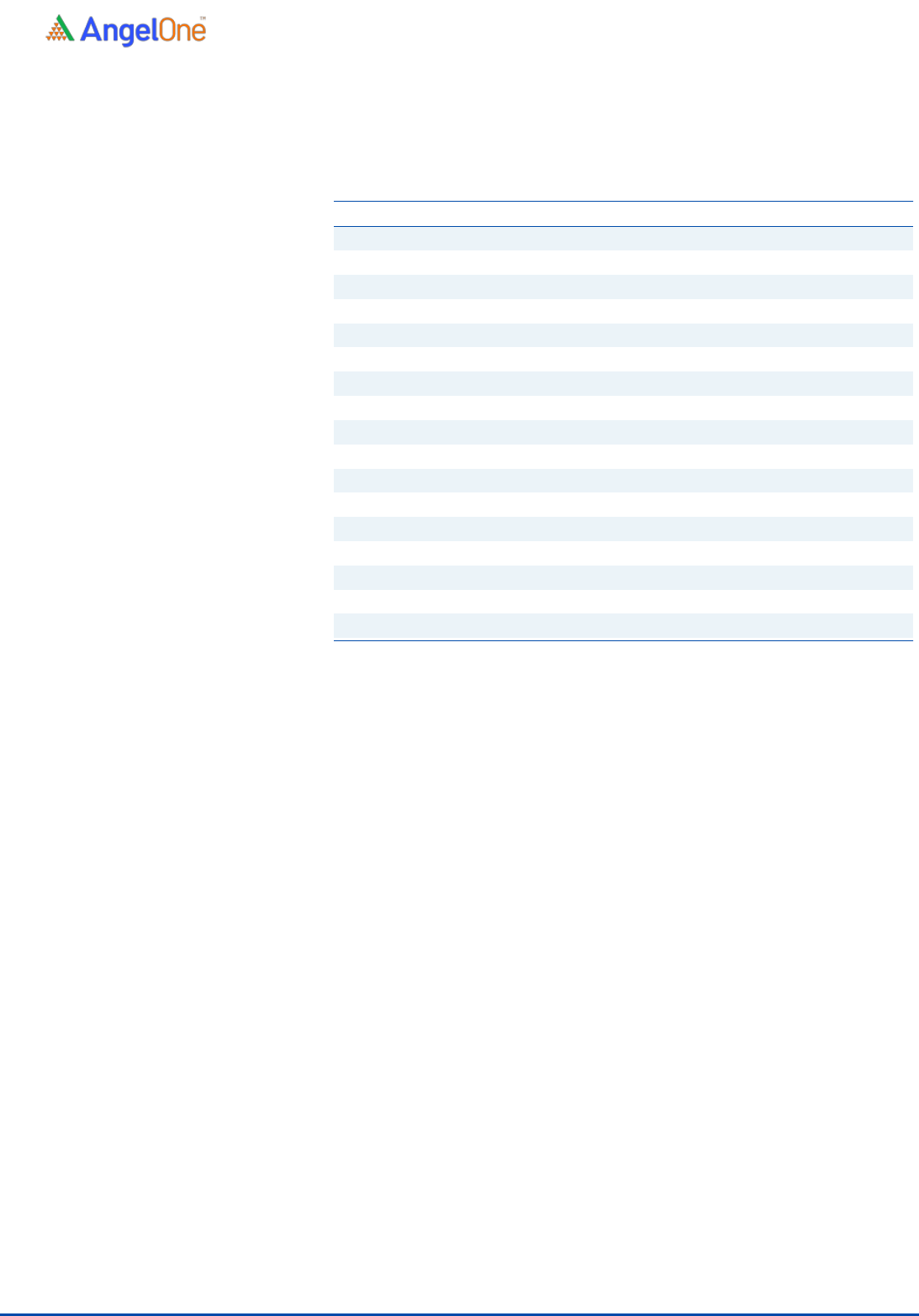

Key Ratios

Y/E March

FY19

FY20

FY21

H1FY22

Valuation Ratio (x)

P/E (on FDEPS)

34.9

(20.3)

(25.7)

(25.7)

P/CEPS

32.3

(21.9)

(28.5)

(30.9)

P/BV

1.8

2.0

2.1

2.3

EV/Sales

3.0

3.2

4.1

7.6

EV/EBITDA

24.4

20.5

14.6

24.4

Per Share Data (Rs)

EPS (fully diluted )

3.38

(5.8)

(4.6)

(4.6)

Cash EPS

3.7

(5.4)

(4.1)

(3.8)

Book Value

65.5

60.4

55.9

51.8

DPS

-

-

-

Number of share

14.81

14.81

14.81

14.81

Source: Company, Angel Research

Consolidated Cash Flow Statement

Y/E March (₹ cr)

FY19

FY20

FY21

H1FY22

Restated Profit before tax

82.9

(81.6)

(45.2)

(52.7)

Depreciation

5.2

6.4

6.5

3.4

Change in Working Capital

(34.2)

7.5

126.3

(34.0)

Interest Expense

105.1

123.1

125.3

63.9

Direct Tax Paid

(24.4)

(9.9)

(1.1)

0.2

Others

(57.0)

147.2

117.1

58.9

Cash Flow from Operations

(179.2)

129.1

147.6

54.9

(Inc.)/ Dec. in Fixed Assets

(40.2)

(16.5)

(0.8)

(0.0)

Loans given to joint ventures

(69.1)

(28.8)

(33.3)

(7.4)

Mutual Fund

129.3

157.4

41.4

0.2

Interest received

1.1

1.1

0.67

0.24

Other

152.8

(20.4)

(0.5)

(0.2)

Cash Flow from Investing

173.9

92.8

7.5

(7.2)

Proceeds from Long Term Borrowing

105.4

(181.8)

(18.2)

(34.2)

Dividend paid on equity shares

(113.4)

(105.4)

(73.8)

(52.7)

Others

1.3

59.9

(26.3)

(0.2)

Cash Flow from Financing

(6.7)

(227.3)

(118.3)

(87.1)

Inc./(Dec.) in Cash

(12.2)

(5.4)

36.8

(39.3)

Opening Cash balances

49.6

41.0

42.7

79.2

Closing Cash balances

41.0

42.7

79.2

39.8

Source: Company, Angel Research

Shriram Properties Limited | IPO Note

December 07, 2021

7

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund

Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst)

Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI

or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment

in the securities of the companies referred to in this document (including the merits and risks involved), and should consult

their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities

of the subject company at the end of the month immediately preceding the date of publication of the research report.

Neither Angel or its associates nor Research Analysts or his relative has any material conflict of interest at the time of

publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings,

corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business. Angel or its associates did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with the research report. Neither Angel nor

its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding

positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a

report on a company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports

available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as

such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not

be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. Angel Broking Limited has not independently verified all the information contained within this

document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel Broking Limited endeavors to update on a reasonable basis

the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing

so.

This document is being supplied to you solely for your information, and its contents, information or data may not be

reproduced, redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information. Angel or its associates or Research Analyst or his relative might have

financial interest in the subject company. Research analyst has not served as an officer, director or employee of the subject

company.