March 22, 2017

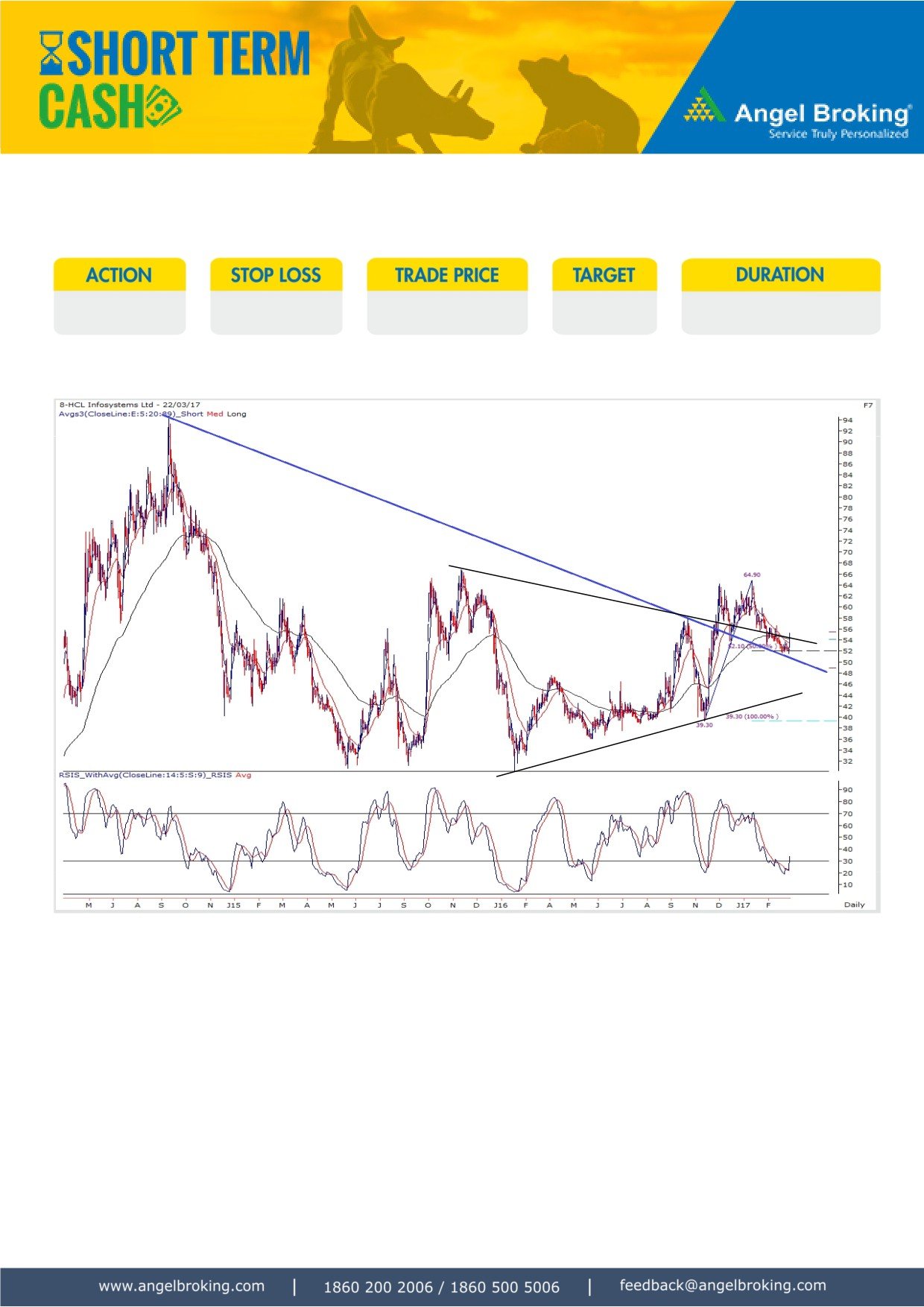

HCL Infosystems (NSE Cash)

BUY

` 50

` 54 - 54.50

` 63

14 - 21 sessions

Daily Chart

Source: Falcon (Time: 09:30 IST)

Justification:

In December 2016, the stock had given a ‘Falling Trendline’ breakout and ‘Symmetrical Traingle’ breakout on daily chart

with good volumes. However, post the breakout, the follow-up move was short livened and the stock has started moving

in a corrective phase. The ongoing correction should halt at current levels as the stock is rebounding after taking a

support around the ‘Falling Trendline’, which coincides with the ‘200 DEMA’ and 50% retracement levels of the previous

up move. Today, the stock is showing some strength in initial trade with decent volumes. The ‘RSI-Smoothened’ on daily

chart has given positive crossover with its average from oversold territory, indicating reversal on the cards. Looking at this

development, we expect the stock prices to resume its upward movement. With an anticipation of this move, we advise

traders to buy this stock at current levels to a decline up to `54 for a target of `63 over the next 14 to 21 sessions.

The stop loss should be fixed at `50.

Jay Kumar Purohit

022-3935 7600 Extn: 6844

1

March 22, 2017

Last 14 recommendations

Date

Stocks

Recom. Buying/Selling Range CMP

Target 1

Target 2

Stop-loss

Status

20-03-17

Mindtree

BUY

477 - 479

475

509

-

464

Active

16-03-17

SRF

BUY

1605-1615

1612

1725

-

1550

Active

16-03-17

Tata Global

BUY

144-145

144.5

158

-

138

Active

15-03-17

Union Bank

BUY

150 - 151

150

163

-

143.50

Active

14-03-17

BHEL

BUY

160 - 161.50

-

174

-

154

Profit Booked at 169

10-03-17

ICICI Bank

BUY

269-271

267

298

-

254.50

Active

07-03-17

UPL

BUY

690 - 694

724

740

-

688

SL Revised to 705

06-03-17

Bajaj Auto

BUY

2840 - 2855

2879

3030

-

2748

Active

01-03-17

Sintex

BUY

98-99

98

109

-

91

Active

28-02-17

OBC

BUY

125-126.50

-

137

-

120

Target Achieved

27-02-17

Wockhardt

BUY

725 - 732

737

808

-

688

Active

20-02-17

PNB

BUY

140 - 141

139.5

155

-

132.75

Active

13-02-17

Siemens

BUY

1190 - 1200

1234

1290

-

1148

Active

09-02-17

PTC Ind

BUY

88 - 89

88.25

106

-

80

Active

Source: Angel Research

Research Team Tel: 022 - 4000 3600 (Extn. 6552)

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

2