April 18, 2017

Bank of Baroda (NSE Cash)

BUY

` 170.75

` 176 - 178

` 191

14 - 21 sessions

Daily Chart

Source: Falcon (Time: 09.35 IST)

Justification:

In last three weeks, we have witnessed a good catch up rally from the ‘PSU’ banking space. After PNB, OBC, Union Bank

and Canara Bank, this stock has caught our eye considering the overall chart structure on near to medium term charts.

We are witnessing series of breakouts in the recent past as the stock prices seem to have followed a typical pattern.

Today, we can observe a clear price-volume breakout from the consolidation of nearly two weeks from the hurdle of 177

on hourly chart. The volume activity too picked up substantially in the recent up move. In addition, the ‘RSI-Smoothened’

has crossed the 70 mark in the northward direction, which we believe would provide the impetus for the extension of the

ongoing optimism. Thus, we advise traders to buy this stock at current levels to a decline up to `176 for a target of

`191 over the next 14 to 21 sessions. The stop loss should be fixed at `170.75.

Sameet Chavan

022-3935 7600 Extn: 6552

1

April 18, 2017

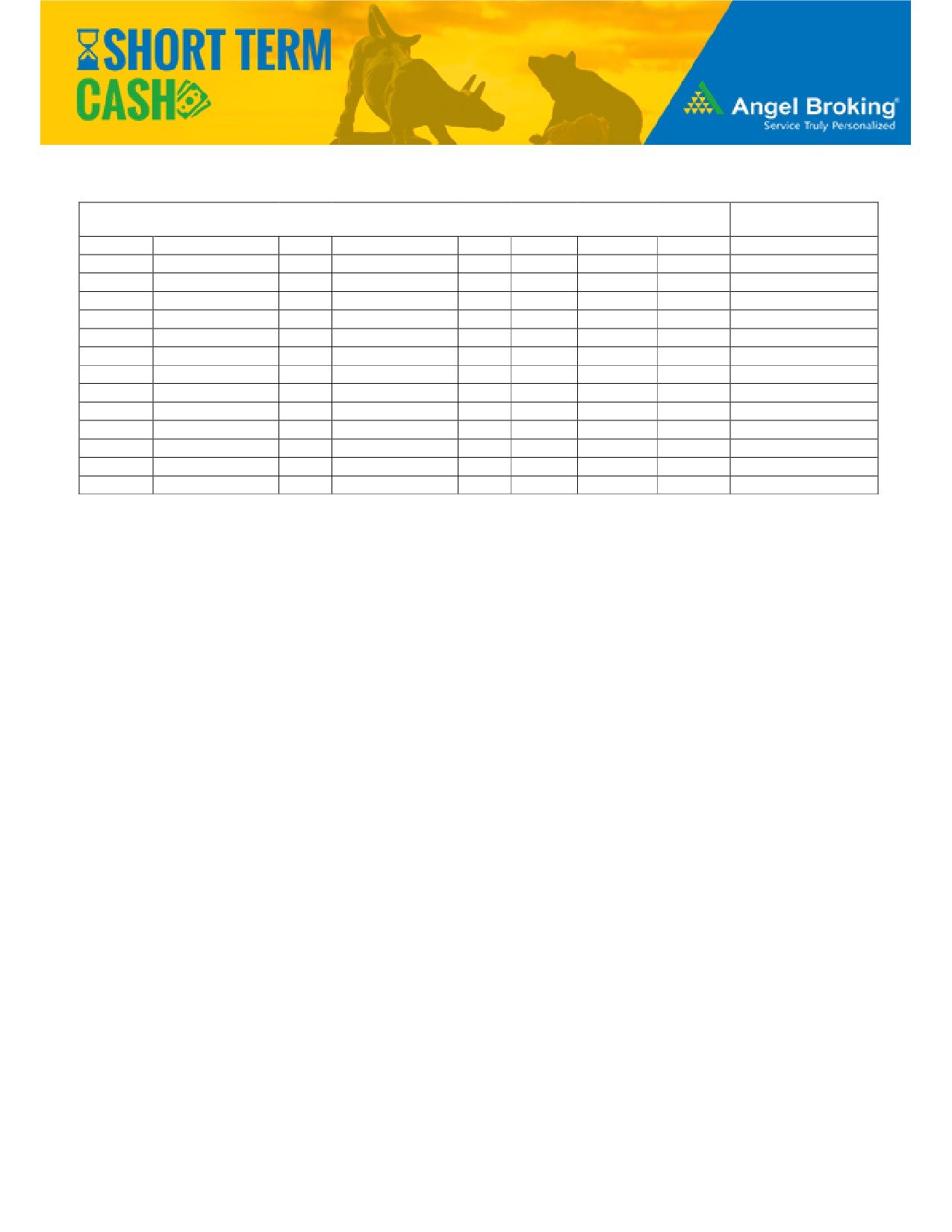

Last 14 recommendations

Buying/Selling

Date

Stocks

Recom.

CMP Target 1 Target 2 Stop-loss

Status

Range

11-04-17

Ambuja Cements

BUY

244 - 246

247

263

-

235

Active

06-04-17

Tata Elexi

BUY

1550 - 1560

1548

1700

-

1480

Active

05-04-17

Canara Bank

BUY

306 - 309

316

330

-

297

Active

05-04-17

Pidilite

BUY

714 - 718

714

760

-

694

Active

03-04-17

Jain Irrigation

BUY

97 - 98

102

108

-

92

Active

03-04-17

SAIL

BUY

62.75-63.25

63

71

-

59

Active

03-04-17

M&M

BUY

1290 - 1300

1264

1378

-

1254

Active

22-03-17

HCL Infosystem

BUY

54-54.50

58

63

-

50

Active

16-03-17

SRF

BUY

1605-1615

1719

1725

-

1550

Book Profits

16-03-17

Tata Global

BUY

144-145

-

158

-

138

Booked at 152.50

10-03-17

ICICI Bank

BUY

269-271

285

298

-

254.50

Active

06-03-17

Bajaj Auto

BUY

2840 - 2855

2850

3030

-

2748

Active

27-02-17

Wockhardt

BUY

725 - 732

764

808

-

688

Active

09-02-17

PTC Ind

BUY

88 - 89

98

106

-

80

Active

Source: Angel Research

Research Team Tel: 022 - 4000 3600

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

2