Please refer to important disclosures at the end of this report

1

Servalakshmi Paper (SPL), part of the Servall Group, was incorporated in

November 2005. SPL manufactures printing and writing paper and newsprint.

The company’s plant is situated in Tamil Nadu and has total installed capacity o

f

90,000mn tonnes per annum, which makes it one of the largest single-location

plants in India.

SPL is tapping the IPO market with an issue size of `60cr in the price band o

f

`27–29/share, thus resulting in a public issue of 2.2cr and 2.1cr equity shares at

the upper and lower price bands, respectively, of face value `10, resulting in a

dilution of 49.7% and 47.9% stake.

SPL has embarked upon setting up an integrated paper mill with a capacity o

f

90,000mn tonnes per annum along with a 15MW captive power plant at a single

location. The total investment is estimated to be `340cr and the entire project is to

be completed in two phases. Phase-1 of the project has already been completed

and the company’s plant has commenced commercial operations from April

2010. Money raised through the IPO would be used for Phase-II, under which SPL

plans to add balancing equipment for improving productivity and manufacturing

value-added products. Funds would also be utilised for working capital needs.

The Indian paper industry is highly fragmented with nearly 700 manufacturing

units spread across the country, with capacity ranging from 5 tonnes per day to

over 1,000 tonnes per day. Total installed capacity is estimated to be at 9.18mn

tonnes, with production of 8.60mn tonnes. The industry has grown at a 6% CAG

R

over the last few years and is estimated to grow at a 7.6% CAGR over the next

2–3 years, showing strong correlation with India’s GDP growth. Nearly 600,000

tonnes of new capacity is estimated to have been added in 2008 and 2009.

Industry estimates 500,000 tonnes of capacity addition over the next few years.

Outlook and valuations

Given that the best players in the industry have RoE of 14–16%, with cost of equit

y

for the top Sensex companies in a similar range, we believe investors should

approach investment in such a sector cautiously. SPL’s plant has started its

operations recently, thus the company will take some time to make profits.

Further, given the nature of the industry, any sort of price correction in pape

r

prices would lead to delay in profitability.

At the end of 6MFY2011, SPL had net worth of `40cr, while it plans to raise `60c

r

through 50% dilution, which would value the company at `120cr, i.e., P/B o

f

1.2x. Even at the lower price band of `27, SPL would trade at a P/B multiple o

f

1.20x (1.24x at upper band), while its peers, which are profit-making and have

longer history of operations, are currently trading at an average P/B of 1.2x

–

thus placing the stock relatively expensive. Hence, we recommend Avoid on the

IPO.

A

VOID

Issue open: April 27, 2011

Issue close: April 29, 2011

Issue details

Face value:

`

10

Present eq. paid-up capital:

`

22.4cr

Offer Size: 2.1cr-2.2cr Shares*

Post eq. paid up capital*:

`

44.6cr-43.1cr

Issue size (amount):

`

60cr

Price band:

`

27-29

Promoters holding pre-issue: 100%

Promoters holding post-issue: 52-50%

Note:*At lower and upper price bands, respectively

Book building

QIBs At least 50%

Non-Institutional At least 15%

Retail At least 35%

Post issue shareholding pattern

Promoters Group 50.23%

MF/Banks/Indian

FIs/FIIs/Public & Others 49.77%

Sageraj Bariya

022-39357800 Extn: 6815

Servalakshmi Paper

Paper Dreams

IPO Note

|

Pape

r

April 27, 2011

Servalakshmi Paper

|

IPO Note

A

pril 27, 2011

2

Company background

SPL is part of the Servall Group. Servall Group has a strong goodwill in the paper

industry due to its long presence in the industry, spanning over four decades.

The group is present across all industry verticals such as machinery manufacturing,

paper manufacturing, project consultancy and turnkey project implementations.

Servall Group manufactures a wide spectrum of papers such as printing and

writing paper, newsprints, industrial paper and specialty papers. The group is

proficient in handling turnkey projects, design, consultancy, erection and

commissioning of paper machinery, machine rebuilding, unit equipment and

spares. The group has built and supplied 35 paper machines of various capacities

of up to 300 tonnes per day to paper mills in India. Servall Group has a client

base of more than 300 paper mills in Asia, Europe, Africa and Gulf Countries.

SPL was incorporated in November 2005. The company manufactures printing

and writing paper and newsprint. The company’s plant is situated in Tamil Nadu

and has total installed capacity of 90,000mn tonnes per annum, which makes it

one of the largest single-location plants in India. The plant also ranks among the

top 15 plants in the country. SPL’s plant has a co-generation power plant with a

capacity of 15MW for uninterrupted power and steam supply for the paper plant.

Issue details

SPL is tapping the IPO market with an issue size of `60cr in the price band of

`27–29/share, thus resulting in a public issue of 2.2cr and 2.1cr equity shares at

the upper and lower price bands, respectively, of face value `10, resulting in a

dilution of 49.7% and 47.9% stake. The company plans to use the IPO proceeds

for investment in capital equipment, meet working capital requirements,

repayment of loans and funding the subsidiaries for prepayment/repayment of

their loans.

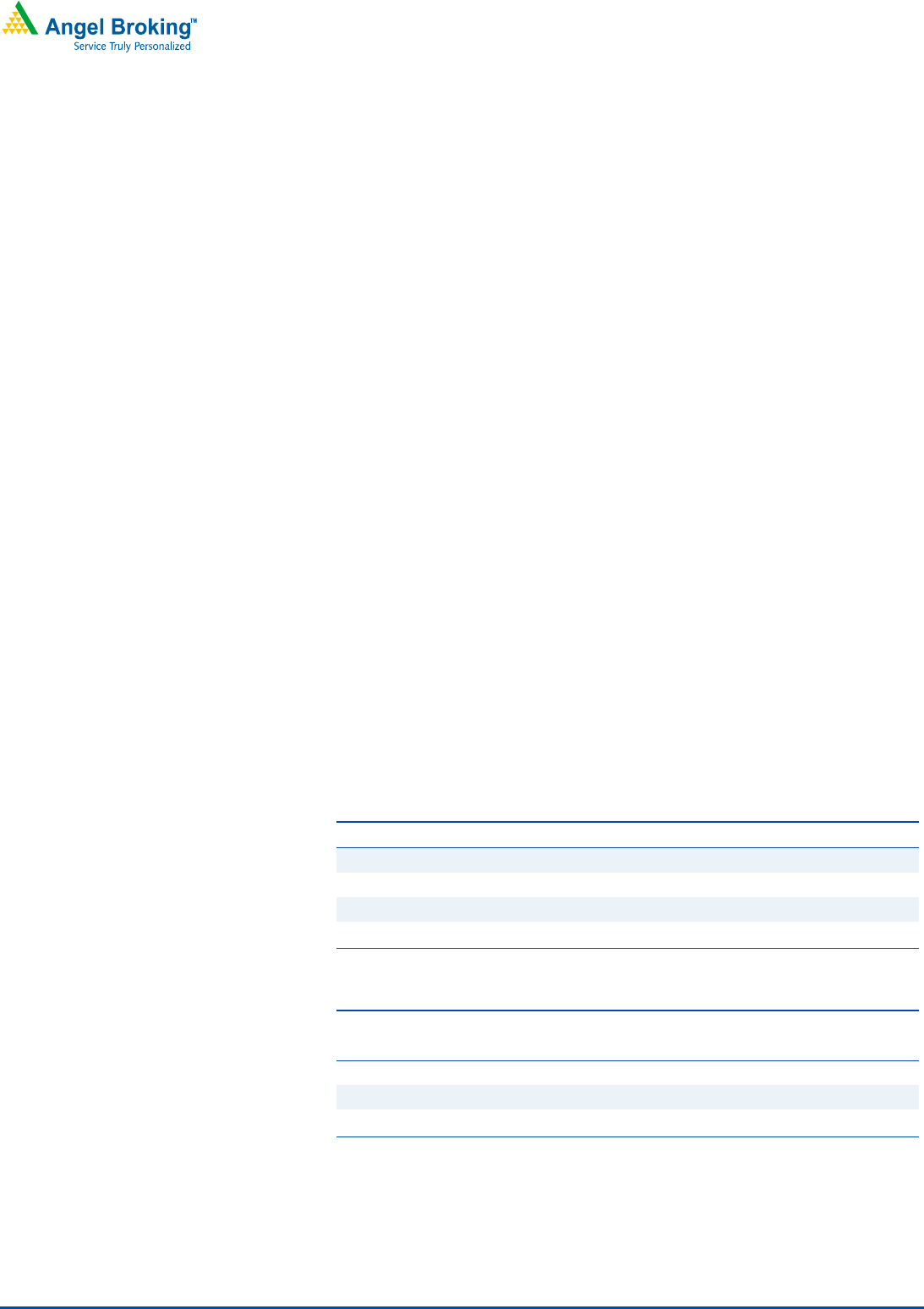

Exhibit 1: Objects of the issue

Particulars Amount (` cr)

Purchase of equipment for value-added products 25

Long-term working capital requirement 30

Preliminary and pre-operative expenses including expenses for the IPO 5

Total cost of Phase-II 60

Source: Company, Angel Research

Exhibit 2: Shareholding Pattern

Pre-issue Post issue

Shareholding pattern No of shares

% No. of shares

%

Promoter and promoter group

22,424,000

100 22,424,000

50

Public -

- 22,222,222

50

Total 22,424,000

100 44,646,222

100

Source: Company, Angel Research

SPL has embarked upon setting up an integrated paper mill with a capacity of

90,000mn tonnes per annum along with a 15MW captive power plant at a single

location. The total investment is estimated to be `340cr and the entire project is to

Servalakshmi Paper

|

IPO Note

A

pril 27, 2011

3

be completed in two phases. Phase-1 of the project has already been completed

and the company’s plant has commenced commercial operations from April 2010.

Money raised through the IPO would be used for Phase-II, under which SPL plans

to add balancing equipment for improving productivity and manufacturing

value-added products. Funds would also be utilised for working capital needs.

About the industry

The global paper industry is estimated to be worth USD$500bn. Global

consumption of paper and boards has grown from 169mn tonnes in 1981 to

253mn tonnes in 1993, 352mn tonnes in 2005 and 390mn tonnes currently.

The global paper industry is estimated to have been growing at a rate of 2.5–2.8%

per annum.

The paper industry is very capital-intensive and cyclical in nature. Currently, the

industry is highly dominated by North American and European producers.

It is estimated that North America consumes over 100mn tonnes of paper and

boards, while Asia consumes about 140mn tonnes of paper. Europe’s share

stands at 102mn tonnes. China is one of the fastest growing consumers of paper,

with growth of 9.3% in recent times, which is expected to slow down to 7.1% going

ahead. India currently consumes 8.5mn tonnes per annum of paper and is one of

the fastest growing markets, with a growth rate of 7.4% per annum.

The Indian paper industry is highly fragmented with nearly 700 manufacturing

units spread across the country, with capacity ranging from 5 tonnes per day to

over 1,000 tonnes per day. Total installed capacity is estimated to be at 9.18mn

tonnes, with production of 8.60mn tonnes. The industry has grown at a 6% CAGR

over the last few years and is estimated to grow at a 7.6% CAGR over the next

2–3 years, showing strong correlation with India’s GDP growth. Nearly 600,000

tonnes of new capacity is estimated to have been added in 2008 and 2009.

Industry estimates 500,000 tonnes of capacity addition over the next few years.

Servalakshmi Paper

|

IPO Note

A

pril 27, 2011

4

Key strengths

Strong expertise: Given Servall Group’s strong know-how in the paper industry due

to its long experience spanning across four decades, SPL has been able to set up

its plant at a lower cost compared to competitors. The project in totality would be

handled by promoter Group Company M/s. Servall Engineering Works (P) Ltd., an

expert in paper machinery design, engineering and manufacturing. As per

management and project consultant, total project cost as per industry norms was

estimated at ~`400cr, but, in actual, it came to `295cr, an approximate saving of

`100cr. SPL plans to further expand its capacity by 100,000 tonnes per annum.

Strong execution ability: The successful completion and implementation of Phase-1

of the project, without any hiccups or any over-run of cost, shows management’s

strong execution capability.

Logistical advantages: SPL’s paper mill is in close vicinity to Tuticorin Port (72km),

with the National Highway NH7 just 5km away. This enables faster transportation

of raw materials and finished products.

Risks and concerns

Promoter Group in a competing business: SPL’s promoters have group

concerns/entities that are also engaged in the manufacturing of paper.

Commodity nature of the business: The paper industry is highly commoditised

and lacks pricing power.

Servalakshmi Paper

|

IPO Note

A

pril 27, 2011

5

Outlook and valuation

Low per capita consumption and low penetration of key products

India constitutes 16.5% of the world’s total population; however, it consumes only

1.53% of the world’s total paper production. Per capita paper consumption is

estimated to stand at 8kgs, as against global average of 50kgs (Japan – 250kg;

Korea – 165/kg; and China – 42kg). An increase of 1kg in consumption on a per

capita basis will increase demand by 1mn tonnes. Coated paper forms only 10%

of India’s total consumption under the writing and printing paper category,

as against 40–50% in developed countries.

Currently, SPL is making losses as the plant has recently started its operations.

As the plant stabilises and its operations and utilisation start ramping up,

profitability should follow. However, we are not bullish on the sector and the

company due to the following reasons:

1) Commodity nature of the business: This leads to lack of pricing power.

2) Growth by capex only: The business requires continuous capex for growth, due

to absence of pricing power; price-led growth is limited and short-lived.

3) Perennially low RoE business: We have analysed the paper sector and

companies across the sector. As per our understanding of the sector, the best

players in the sector have RoE of 14–16%.

4) Industry running below capacity: Total installed capacity is estimated to be at

9.18mn tonnes with production of 8.60mn tonnes, indicating that the industry

is running below capacity. Hence, capacity ramp-up for SPL would be difficult,

given such a scenario.

Given that the best players in the industry have RoE of 14–16%, with cost of equity

for the top Sensex companies in a similar range, we believe investors should

approach investment in such a sector cautiously. SPL’s plant has started its

operations recently, thus the company will take some time to make profits.

Further, given the nature of the industry, any sort of price correction in paper prices

would lead to delay in profitability.

At the end of 6MFY2011, SPL had net worth of `40cr, while it plans to raise `60cr

through 50% dilution, which would value the company at `120cr, i.e., P/B of 1.2x.

Even at the lower price band of `27, SPL would trade at a P/B multiple of 1.20x

(1.24x at upper band), while its peers, which are profit-making and have longer

history of operations, are currently trading at an average P/B of 1.2x – thus

placing the stock relatively expensive. Hence, we recommend Avoid on the IPO.

Exhibit 3: Peer comparison

Company TTM P/B

BILT 1.5

TNPL 1.2

West Coast 1.1

J K 0.9

Average 1.2

Source: Company, Bloomberg

Servalakshmi Paper

|

IPO Note

A

pril 27, 2011

6

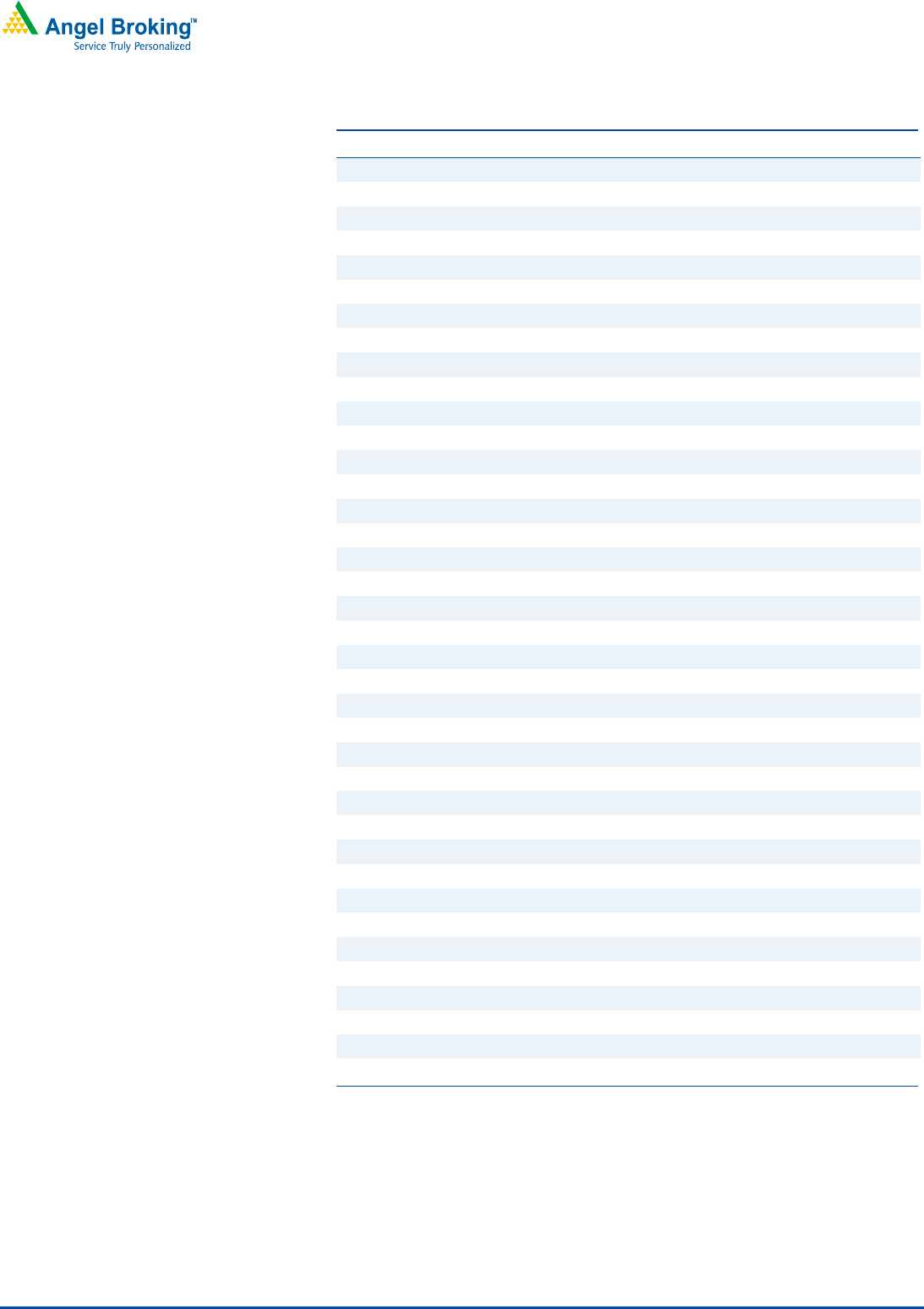

Profit & loss statement

Y/E March (` cr) FY07

FY08 FY09 FY10

6MFY11

Gross sales -

- - -

39

Less: Excise duty -

- - -

-

Net Sales -

- - -

39

Other operating income -

- - -

-

Total operating income -

- - -

39

% chg -

- - -

-

Total Expenditure -

0 0 0

37

Net Raw Materials -

- - -

15

Other Mfg costs -

- - -

18

Personnel -

- - -

3

Other -

0 0 0

1

EBITDA -

(0) (0) (0)

2

% chg -

- - -

-

(% of Net Sales) -

- - -

4.4

Depreciation& Amortisation -

0 0 0

4

EBIT -

(0) (0) (0)

(3)

% chg -

- - -

-

(% of Net Sales) -

- - -

(7.1)

Interest & other Charges -

- 0 0

13

Other Income -

0 0 0

1

(% of PBT) -

(221.1) (168.4) (22.5)

(4.1)

Recurring PBT -

(0) (0) (0)

(15)

% chg -

- - -

-

Extraordinary Expense/(Inc.) -

- - -

-

PBT (reported) -

(0) (0) (0)

(15)

Tax -

0 0 0

-

(% of PBT) -

(34.1) (25.8) (14.3)

-

PAT (reported) -

(0) (0) (0)

(15)

Add: Share of earnings of associate -

- - -

-

Less: Minority interest (MI) 0

0 - -

-

Prior period items -

- - -

-

PAT after MI (reported) (0)

(0) (0) (0)

(15)

ADJ. PAT (0)

(0) (0) (0)

(15)

% chg -

- - -

-

(% of Net Sales) -

- - -

-

Basic EPS (`) -

- - -

-

Fully Diluted EPS (`) -

- - -

-

% chg -

- - -

-

Servalakshmi Paper

|

IPO Note

A

pril 27, 2011

7

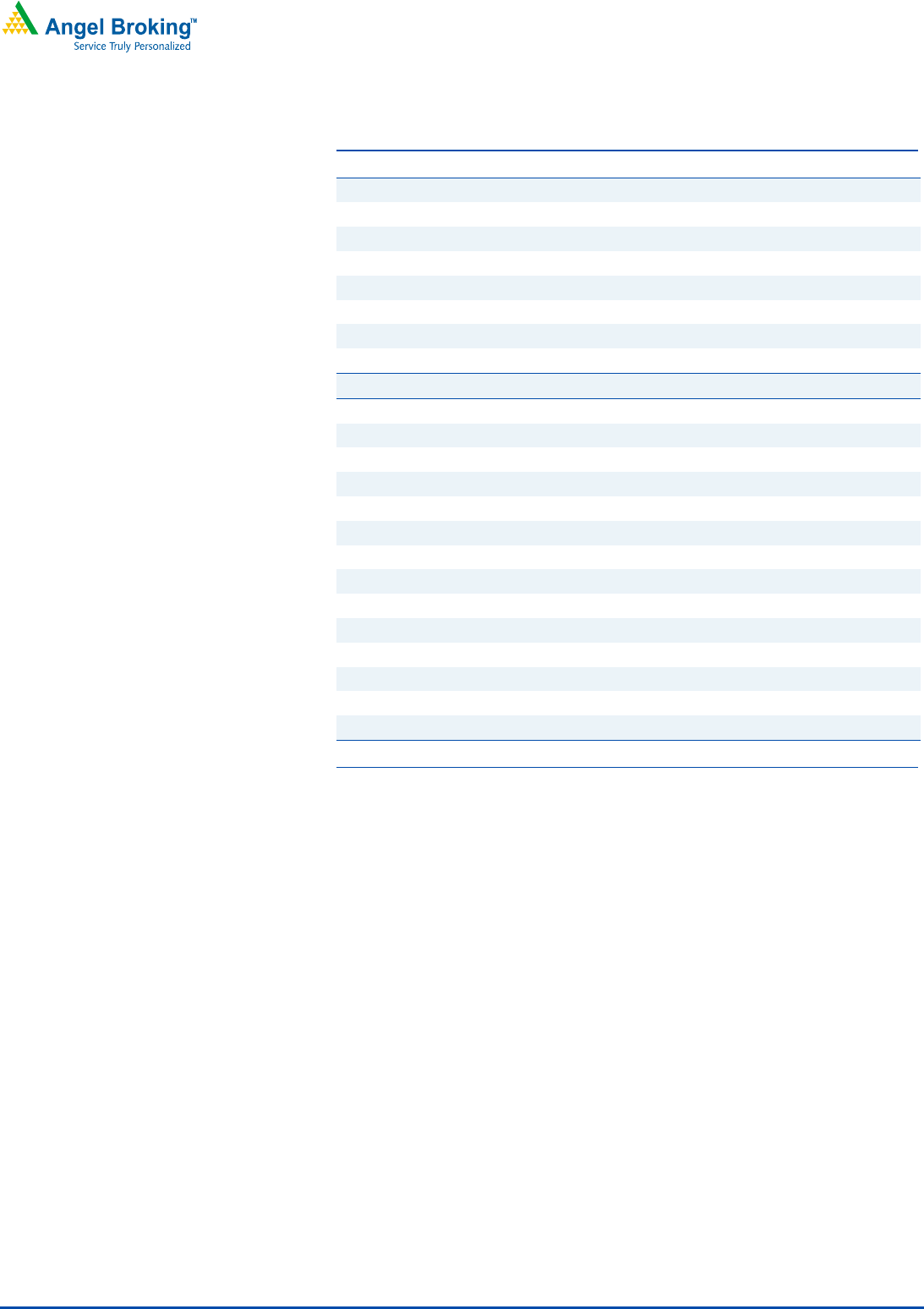

Balance sheet

Y/E March (` cr) FY07

FY08 FY09 FY10

6MFY11

SOURCES OF FUNDS

Equity Share Capital 2

4 8 21

22

Preference Capital 7

2 3 1

-

Reserves& Surplus 8

17 32 32

18

Shareholders’ Funds 17

23 42 54

40

Minority Interest -

- - -

-

Total Loans 0

18 124 231

262

Deferred Tax Liability -

- - -

-

Total Liabilities 17

41 166 284

302

APPLICATION OF FUNDS

Gross Block 2

3 3 4

265

Less: Acc. Depreciation -

0 0 0

5

Net Block 2

3 3 4

261

Capital Work-in-Progress -

24 129 216

-

Goodwill / Intangibles -

- - -

-

Investments -

- - -

-

Current Assets

Cash 5

7 7 3

2

Loans & Advances 10

7 24 19

22

Other 0

(0) - 21

53

Current liabilities 0

0 8 18

41

Net Current Assets 15

13 22 24

36

Others -

- - -

-

Total Assets 17

41 166 284

302

Servalakshmi Paper

|

IPO Note

A

pril 27, 2011

8

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report

.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.