Please refer to important disclosures at the end of this report

1

S.J.S. Enterprises Limited (SJS) is one of the leading players in the Indian decorative

aesthetics industry in terms of revenue as on FY21 and offer the widest range of

aesthetics products in India (CRISIL Report). They are a “design-to-delivery”

aesthetics solutions provider catering to requirements of the two-wheeler,

passenger vehicle, commercial vehicle, consumer appliance, medical devices, farm

equipment and sanitary ware industries. They have an established relationship with

reputed OEMs and tier-1 suppliers and their relationship with 10 largest customers

averaged 15 years. The share of exports currently stands at ~17.6% as on

Q1FY22, up from 9.8% in FY19. The current capacity stands at ~50% providing

ample scope to cater to growing industry demand.

Positives: (a) Leading aesthetics solution provider with an extensive suite of

premium products in a growing industry. (b) Well diversified product portfolio and

long-standing relationship with customers that enables cross-sell and increase in

wallet share. (c) Potential to scale up utilization and drive operating leverage. (d)

Strong margins and net-debt free position with healthy cash generation.

Investment concerns: (a) Significant dependence on top 10 customers (~87% of

FY21 revenues) and the automotive segment (~75% of FY21 revenues). (b) High

dependence on the two-wheeler industry (~58% of FY21 revenues). (c) Increased

competition, lack of firm long term commitment agreements with customers or

suppliers (d) Continuing impact of the COVID-19.

Outlook & Valuation: As per the industry trends, higher preference for premium

and technologically advanced products is leading to growing content per vehicle or

appliances thus benefitting companies like SJS. The company has demonstrated its

ability to scale up its client relationships across geographies on the back of its

strong design and product development capabilities. It commands higher margins

which can be supported due to operating leverage benefits and SJS has a strong

financial profile (net debt free and healthy cash generation). At `542, the P/E

based on FY21 EPS is ~35x and ~32x considering the Exotech financials which

was acquired in April-22. Given the moderate scale of operations and after

considering better than industry level growth rates, issue appears rightly priced

based on Sep-23 EPS. We have a “NEUTRAL” rating on the issue.

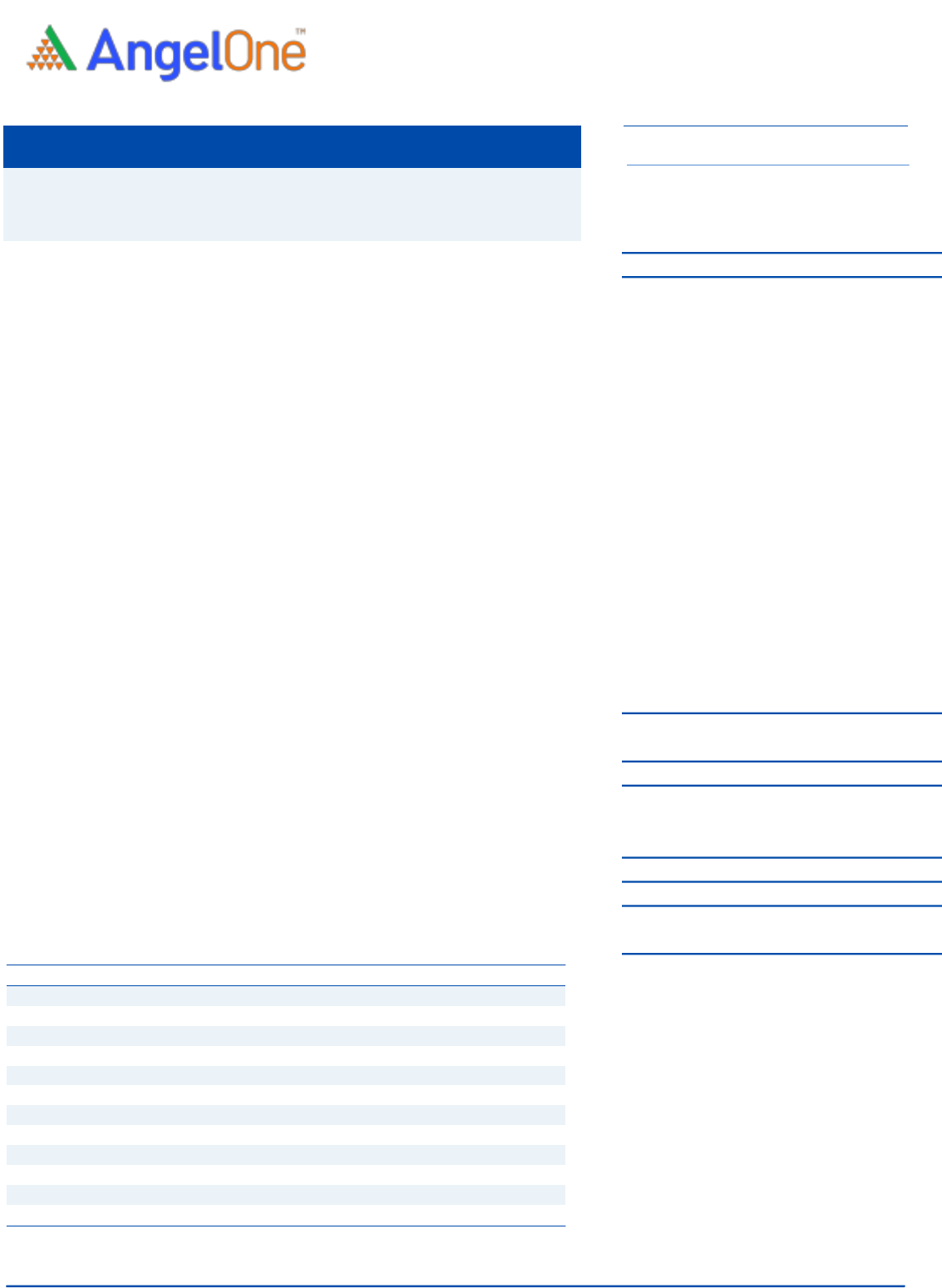

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Net Sales

237

216

252

74

% chg

--

-8.9

16.4

--

Reported Net Profit

38

41

48

9

% chg

--

9.8

15.7

--

EBITDA (%)

28.7

29.4

30.3

23.6

EPS (`)

12.4

13.6

15.7

3.1

P/E (x)

43.9

40.0

34.5

--

P/BV (x)

6.9

5.9

5.2

--

ROE (%)

36.3

15.9

16.1

--

ROCE (%)

33.6

15.5

15.8

--

EV/EBITDA

23.7

24.8

20.2

--

EV/Sales

6.8

7.3

6.1

--

Source: Company, Angel Research; Note: Valuation ratios at upper price band.

NEUTRAL

Issue Open: Nov 01, 2021

Issue Close: Nov 03, 2021

Offer for Sale: `800 cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 50.4%

Others 49.6%

Fresh issue: NA

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `30.4 cr

Post Issue Shareholding Pa ttern

Post Eq. Paid up Capital: `30.4cr

Issue size (amount): `800 cr

Price Band: `531-542

Lot Size: 27 shares and in multiple thereafter

Post-issue mkt. cap: * `1,616 cr - ** `1,650 cr

Promoters holding Pre-Issue: 98.86%

Promoters holding Post-Issue: 50.37%

*Calculated on lower price band

** Calculated on upper price band

Book Building

S.J.S. ENTERPRISES LIMITED

IPO NOTE S.J.S. ENTERPRISES LTD.

October 29, 2021

S.J.S. Enterprises Ltd | IPO Note

Oct 29, 2021

2

Company background

SJS is one of the leading players in the Indian decorative aesthetics industry

offering a wide range of aesthetic products. It is a “design-to-delivery” aesthetics

solutions provider with the ability to design, develop and manufacture a diverse

product portfolio for a wide range of customers primarily in the automotive and

consumer appliance industries. Apart from catering to the requirements for two-

wheeler, passenger vehicle and consumer appliance industries, it also caters to

requirements of requirements of the commercial vehicles, medical devices, farm

equipment and sanitary ware industries.

The Company supplied over 115 million parts with more than 6,000 SKUs in Fiscal

2021 to around 170 customers in approximately 90 cities across 20 countries. Its

product offerings include decals and body graphics, 2D appliques and dials, 3D

appliques and dials, 3D lux badges, domes, overlays, aluminium badges, In-

mould label, or decoration parts (IML/IMD(s)), lens mask assembly and chrome-

plated, printed, and painted injection moulded plastic parts. As of Q1FY22, SJS’

relationship with its 10 largest customers in terms of revenue averaged

approximately 15 years. As on FY21, its sales of products and services to two-

wheeler OEMs and Tier-1 suppliers contributed 58%, to passenger vehicle OEMs

and Tier-1 suppliers contributed 16.6% and majority of the balance being

contributed by sales to consumer appliance manufacturers. Exports accounted for

16% of revenue from operations in FY21, up from 9.8% in FY19

Issue details

The IPO is made up of offer for sale of ` 800 Cr shares by selling shareholders.

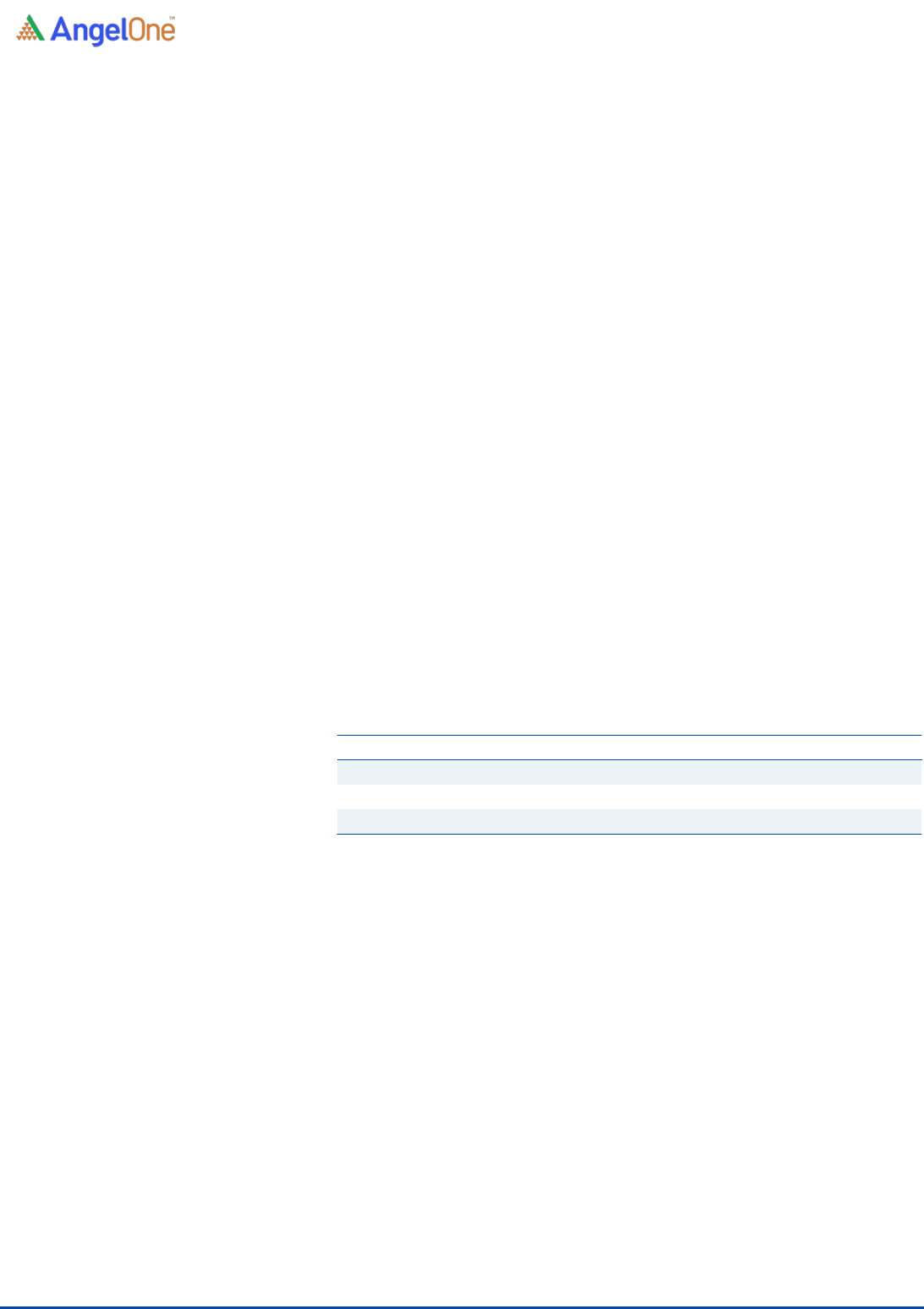

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

3,00,91,960

98.86

1,53,31,812

50.37

Public

3,45,944

1.14

1,51,06,092

49.63

Total

3,04,37,904

100.00

3,04,37,904

100.00

Source: Company, Angel Research & RHP.

Objectives of the Offer

To achieve the benefits of listing the Equity Shares on the Stock Exchanges.

Key Management Personnel

K.A. Joseph is the Managing Director and one of the Promoters and co-founders.

He holds a bachelor’s degree in science from the Bangalore University and a post

graduate diploma in business administration. He has more than 34 years of

experience in the aesthetics printing business.

Sanjay Thapar is an Executive Director and CEO having over 30 years of

experience in the automotive industry. He holds bachelor’s degree in science

(mechanical engineering) from the Delhi College of Engineering. He leads the

strategy, business development and finance functions.

Amit Kumar Garg is the CFO of the Company. He holds a bachelor’s degree in

commerce from the University of Delhi and a master’s degree in business

administration from the Massachusetts Institute of Technology.

S.J.S. Enterprises Ltd | IPO Note

Oct 29, 2021

3

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` Cr)

FY2019

FY2020

FY2021

Q1FY2022

Total operating income

237

216

252

74

% chg

--

-8.9

16.4

Total Expenditure

169

153

175

57

Cost of materials consumed

95

84

99

32

Power and fuel

0

(2)

(2)

(1)

Employee benefits expense

32

33

36

12

Other expenses

42

37

42

14

EBITDA

68

64

76

18

% chg

--

-6.8

19.9

--

(% of Net Sales)

28.7

29.4

30.3

23.6

Depreciation& Amortization

10

13

15

5

EBIT

58

51

61

12

% chg

--

-13.2

21.0

--

(% of Net Sales)

24.6

23.5

24.4

16.8

Finance costs

2

1

1

1

Other income

4

5

4

1

(% of Sales)

1.5

2.4

1.4

1.4

Recurring PBT

57

49

61

12

% chg

--

-13.2

23.1

-80.6

Exceptional item

7

-

-

-

Tax

15

13

16

3

PAT (reported)

38

41

48

9

% chg

--

9.8

15.7

-80.1

(% of Net Sales)

15.8

19.1

19.0

12.8

Basic & Fully Diluted EPS (Rs)

12.4

13.6

15.7

3.1

Source: Company, Angel Research

S.J.S. Enterprises Ltd | IPO Note

Oct 29, 2021

4

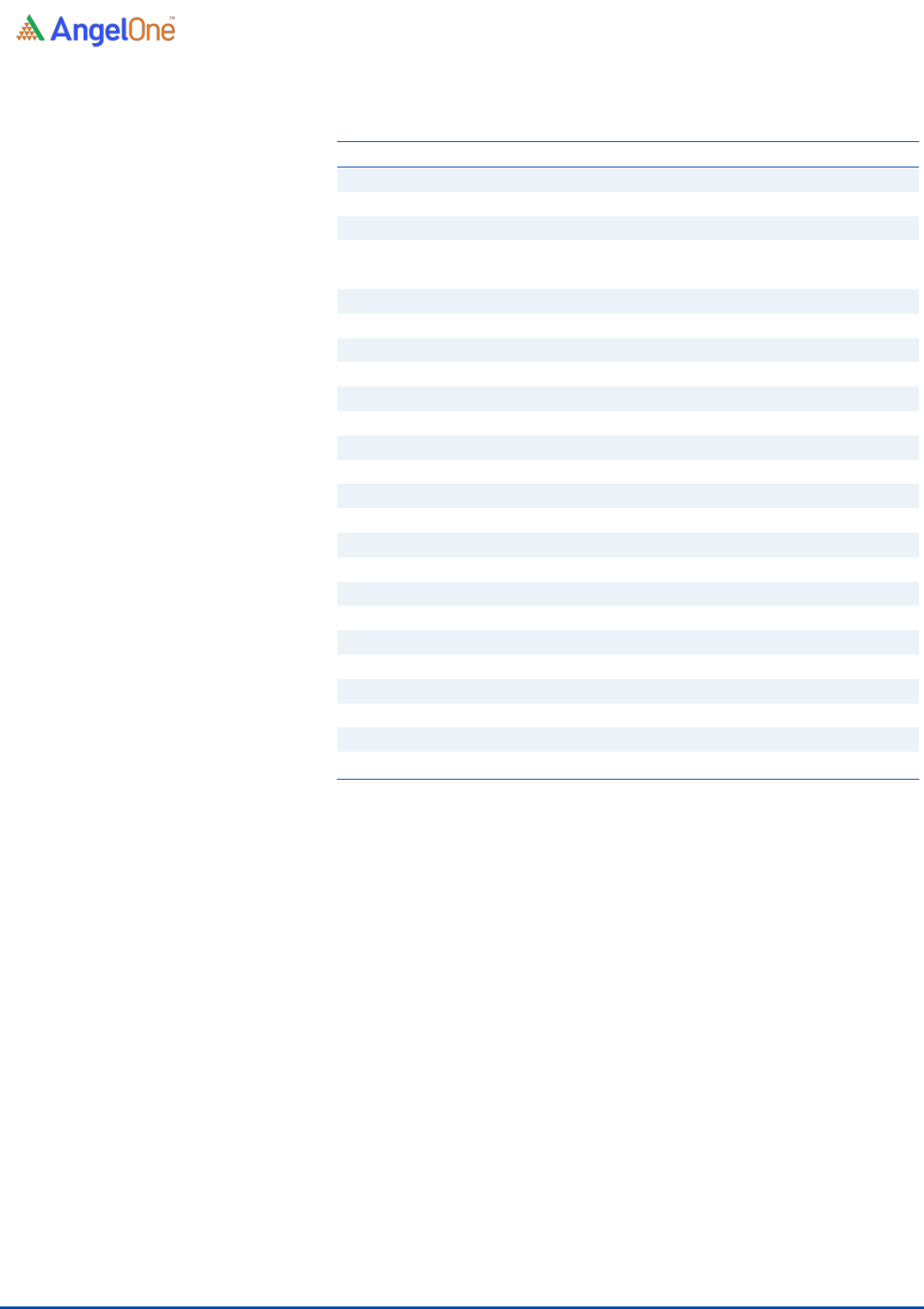

Exhibit 2: Consolidated Balance Sheet

Y/E March (` Cr)

FY2019

FY2020

FY2021

Q1FY2022

SOURCES OF FUNDS

Equity Share Capital

30

30

30

30

Other equity

208

249

285

289

Shareholders’ Funds

239

280

315

320

Total Loans (incl. lease liabilities)

23

6

9

26

Other liabilities

13

12

9

9

Total Liabilities

274

298

334

355

APPLICATION OF FUNDS

Property, Plant and Equipment

145

149

141

154

Right-of-use assets

4

4

8

20

Capital work-in-progress

0

0

4

4

Intangible assets

9

8

7

35

Non-Current Investments

-

-

-

-

Other Non-Current Asset

15

14

6

8

Current Assets

131

157

219

195

Inventories

25

28

33

45

Investments

55

70

81

41

Trade receivables

46

45

60

61

Cash and Cash equivalents

3

11

38

36

Loans & Other Financial Assets

0

0

1

2

Other current assets

2

4

6

10

Current Liability

30

35

50

62

Net Current Assets

101

123

169

133

Total Assets

274

298

334

355

Source: Company, Angel Research

S.J.S. Enterprises Ltd | IPO Note

Oct 29, 2021

5

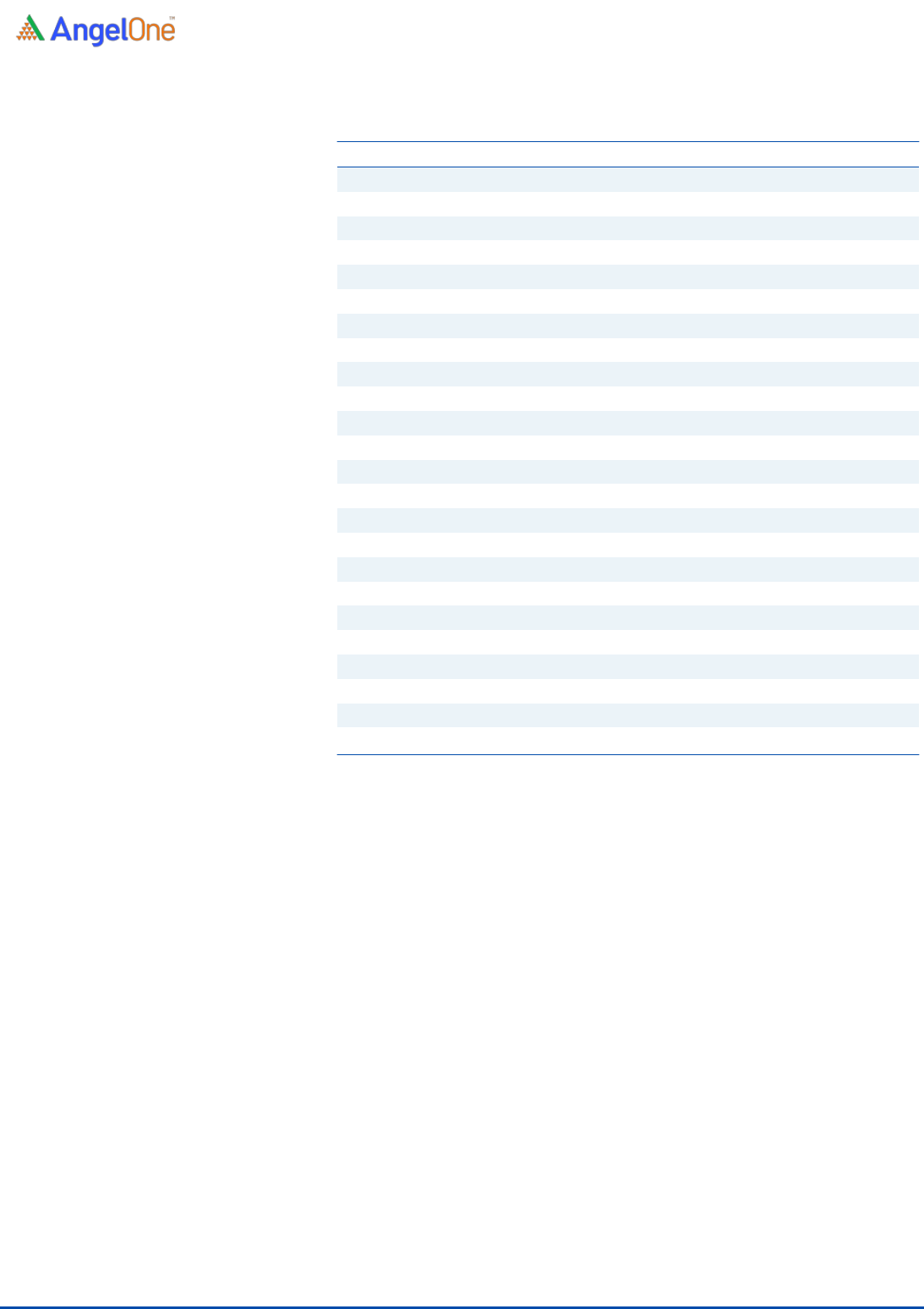

Exhibit 3: Consolidated Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021

Q1FY2022

Operating profit

53

54

64

13

Net changes in working capital

(8)

3

(5)

8

Cash generated from operations

9

11

14

5

Direct taxes paid (net of refunds)

(19)

(10)

(15)

(4)

Net cash flow from operating activities

36

58

58

22

Purchase of Assets

(48)

(21)

(13)

(66)

Interest received

0

0

0

0

Others

4

(11)

(25)

41

Cash Flow from Investing

(44)

(32)

(37)

(25)

Repayment (long term borrowings)

-

-

-

(0)

Repayment (short term borrowings)

8

(17)

3

(5)

Proceeds from Issue of Shares

2

-

-

-

Interest paid

(1)

(1)

(0)

(0)

Payment of Lease liabilities

-

-

-

(1)

Dividend Paid

-

-

(12)

(5)

Cash Flow from Financing

9

(18)

(10)

(12)

Inc./(Dec.) in Cash incl. forex fluctuation

0

8

11

(15)

Cash from acquired co.

-

-

-

11

Opening Cash balances

3

3

11

22

Closing Cash balances

3

11

22

18

Source: Company, Angel Research

S.J.S. Enterprises Ltd | IPO Note

Oct 29, 2021

6

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

43.9

40.0

34.5

P/CEPS

34.9

30.5

26.4

P/BV

6.9

5.9

5.2

EV/Sales

6.8

7.3

6.1

EV/EBITDA

23.7

24.8

20.2

Per Share Data (Rs)

EPS (Basic)

12.4

13.6

15.7

EPS (fully diluted)

12.4

13.6

15.7

Cash EPS

16

18

21

Book Value

78

92

104

Returns (%)

ROE

36.3

15.9

16.1

ROCE

33.6

15.5

15.8

Turnover ratios (x)

Receivables (days)

70

76

87

Inventory (days)

53

66

69

Payables (days)

23

51

53

Working capital cycle (days)

101

91

103

Source: Company, Angel Research

S.J.S. Enterprises Ltd | IPO Note

Oct 29, 2021

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.