IPO Note | Auto Ancillary

April 30, 2012

SMFL

AVOID

Issue Open: May 02, 2012

Stretched Valuations

Issue Close: May 04, 2012

Samvardhana Motherson Finance Ltd. (SMFL) is the principal holding company of

Issue Details

the Samvardhana Motherson group with 18 subsidiaries, 19 Joint Ventures and

86 other consolidated entities catering to the domestic and global automotive

Face Value: `10

industry. The principal investments of SMFL constitute a 36.1% stake in Motherson

Present Eq. Paid-up Capital: `473.6cr

Sumi Systems (MSSL), 49% stake in Samvardhana Motherson Reflectec Group

Holdings Ltd. (SMR, erstwhile Visiocorp) and

49% stake in Samvardhana

Offer Size*: 14.7cr shares

Motherson Polymers Ltd. (SMPL). Together the three companies accounted for

~94% of the consolidated revenues in 9MFY2012.

Post Eq. Paid-up Capital: `592.5cr

MSSL: MSSL is the flagship company of the group and is the market leader in the

Issue size (amount): `1,665cr

domestic wiring harness segment with a market share of ~65%.

Price Band: `113-118

SMR: SMR, acquired in March 2009, is the world’s second largest exterior rear

Post-issue implied market cap**: `6,696cr -

6,933cr

view mirror manufacturer with ~22% global market share.

Promoters holding Pre-Issue: 90.4%

SMPL: SMPL is engaged in the business of high quality plastic components and

assemblies for exterior and interior trims for passenger vehicles through Peguform

Promoters holding Post-Issue*: 67.4%

companies acquired in November 2011.

Note:* At the lower price band, **At the lower and

upper price band, respectively

SMFL’s major customers include the Volkswagen group, BMW, Daimler, Renault

Nissan, Ford India Private Limited, Volvo Car Corporation, Maruti Suzuki, Tata

Book Building

Motors, Honda Siel Cars India Limited, Toyota Kirloskar Motor Private Limited and

Fiat India Automobiles Limited.

QIBs

Up to 50%

Outlook and valuation: We value SMFL’s 36.1% stake in MSSL based on our

Non-Institutional

At least 15%

target price for the company

(`216 based on

15x FY2014E consolidated

Retail

At least 35%

earnings). We value SMFL’s stake in SMR and SMPL on an EV/Sales basis instead

of earnings based multiples as current earnings of these companies’ do not reflect

their true potential. Currently the profitability at SMR and SMPL has been

Post Issue Shareholding Pattern

impacted due to significant start up costs in relation to new manufacturing

facilities and due to one-time costs related to the acquisition and refinancing of

Promoters Group

67.4

Peguform Group.

MF/Banks/Indian

FIs/FIIs/Public & Others

32.6

Based on our SOTP methodology we arrive at a value of `97/share against the

IPO price band of `113-`118. Management expects to turnaround the financial

performances of SMR and SMPL over the medium term. However, we believe that

it is early to factor in the anticipated turnaround in these two subsidiaries and

valuations in our view are not providing sufficient margin of safety to investors

considering the execution risks involved in the turnaround process. Hence we

recommend Avoid on the issue.

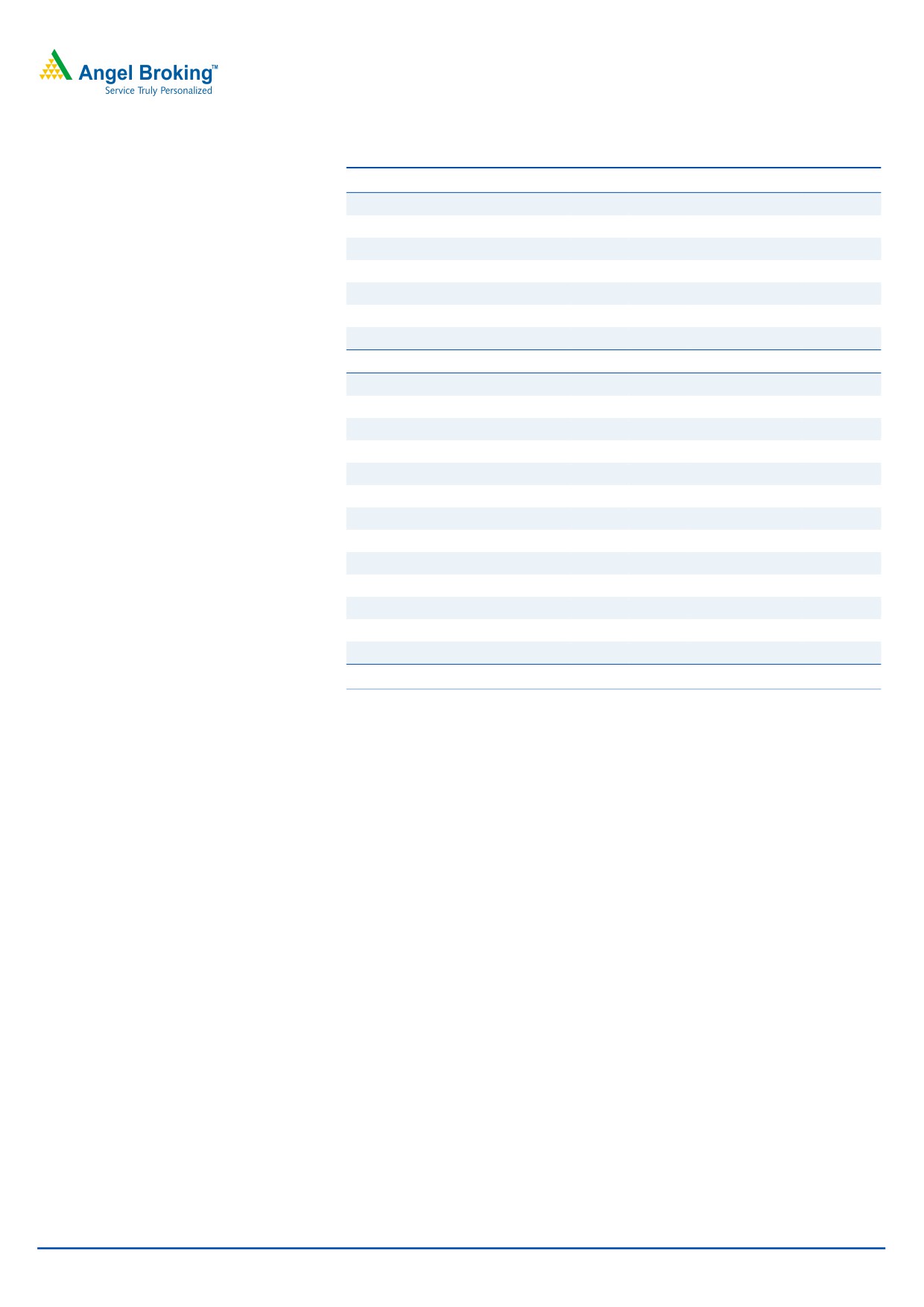

Key financials (Consolidated)

Y/E March (` cr)

FY2009

FY2010

FY2011 9MFY2012

Net Sales

843

4,914

5,635

5,957

% chg

67.3

483.0

14.7

5.7

Net Profit

57

70

140

(91)

% chg

76.3

23.6

100.1

-

EBITDA Margin (%)

5.3

4.7

7.5

3.3

EPS (`)

1.6

1.3

3.0

(1.9)

P/E (x) Lower End

69.3

87.2

37.8

-

Yaresh Kothari

P/E (x) Upper End

72.3

91.0

39.5

-

022 - 39357800 Ext: 6844

RoE (%)

7.0

6.0

10.1

(6.3)

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

SMFL | IPO Note

Company background

Samvardhana Motherson Finance Ltd. (SMFL), a principal holding company with

18 subsidiaries, 19 Joint Ventures and 86 other consolidated entities is an

integrated design and manufacturing company providing full system solutions to

diverse industries. The principal focus of the company is the domestic and global

automotive industry and is catered through Motherson Sumi Systems Ltd. (MSSL),

Samvardhana Motherson Reflectec Group Holdings Ltd. (SMR) and Samvardhana

Motherson Polymers Ltd. (SMPL). As of December 31, 2011, SMFL has a 36.1%

stake in MSSL - listed on domestic stock exchanges, 49% stake in SMR and 49%

stake in SMPL.

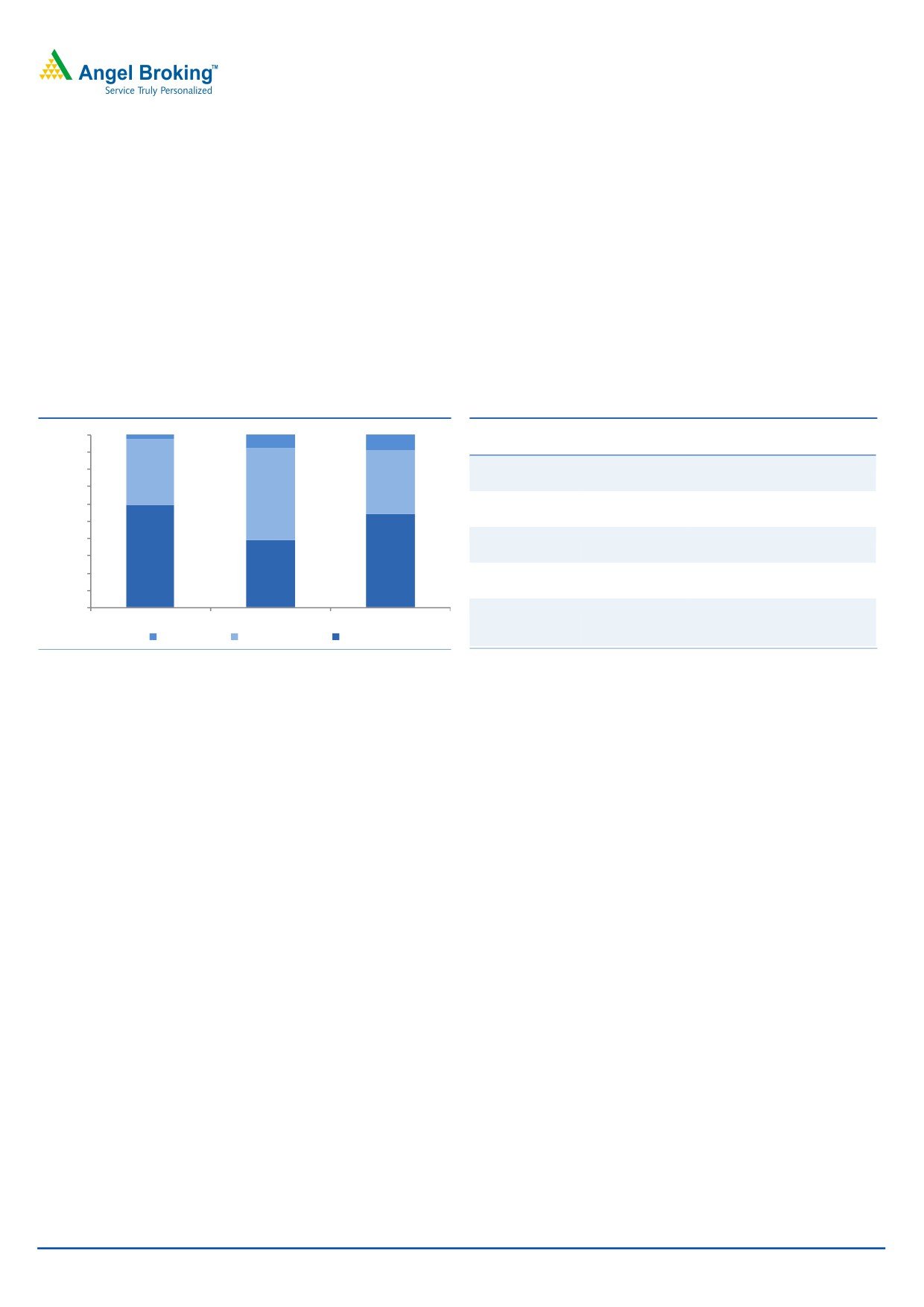

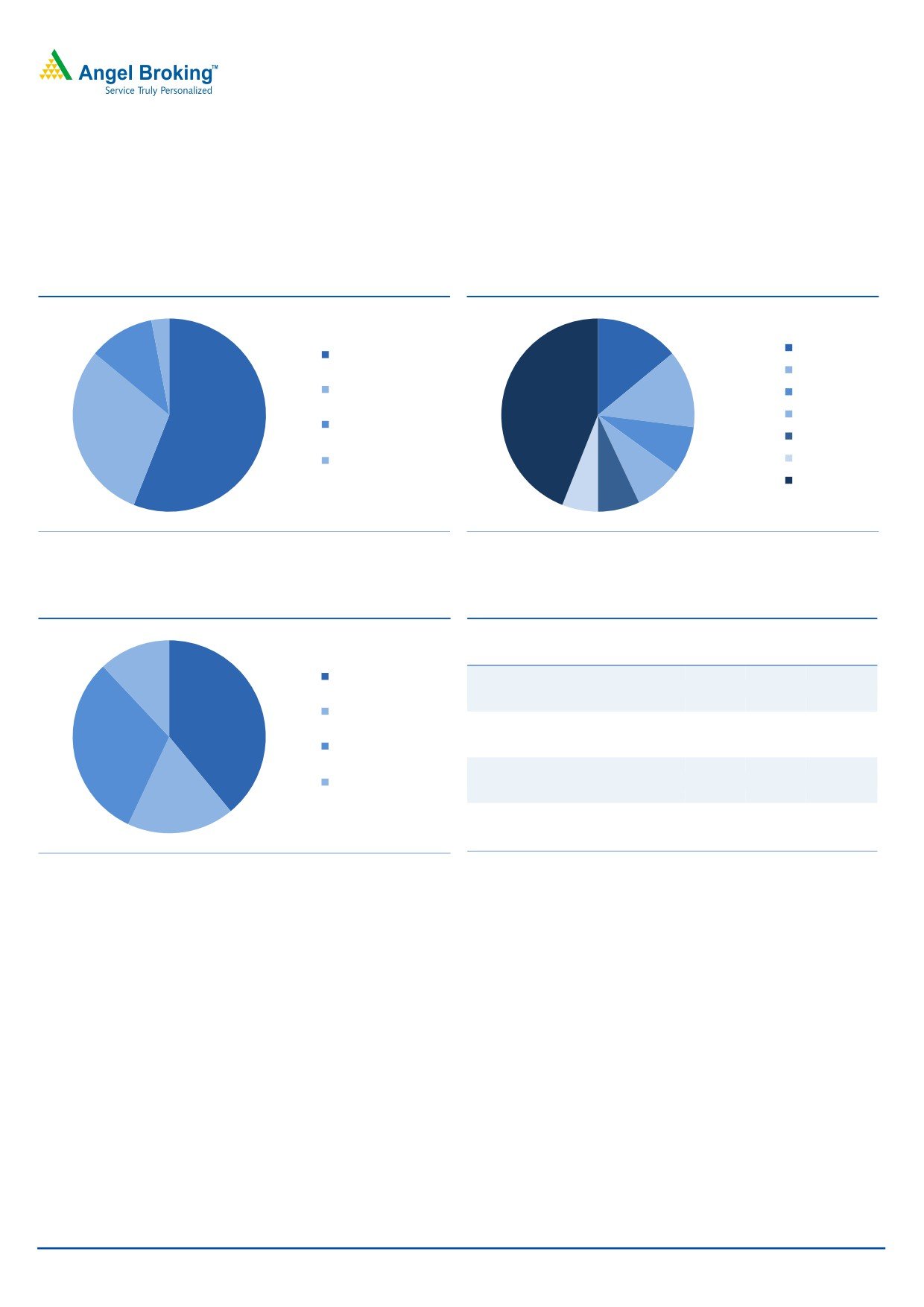

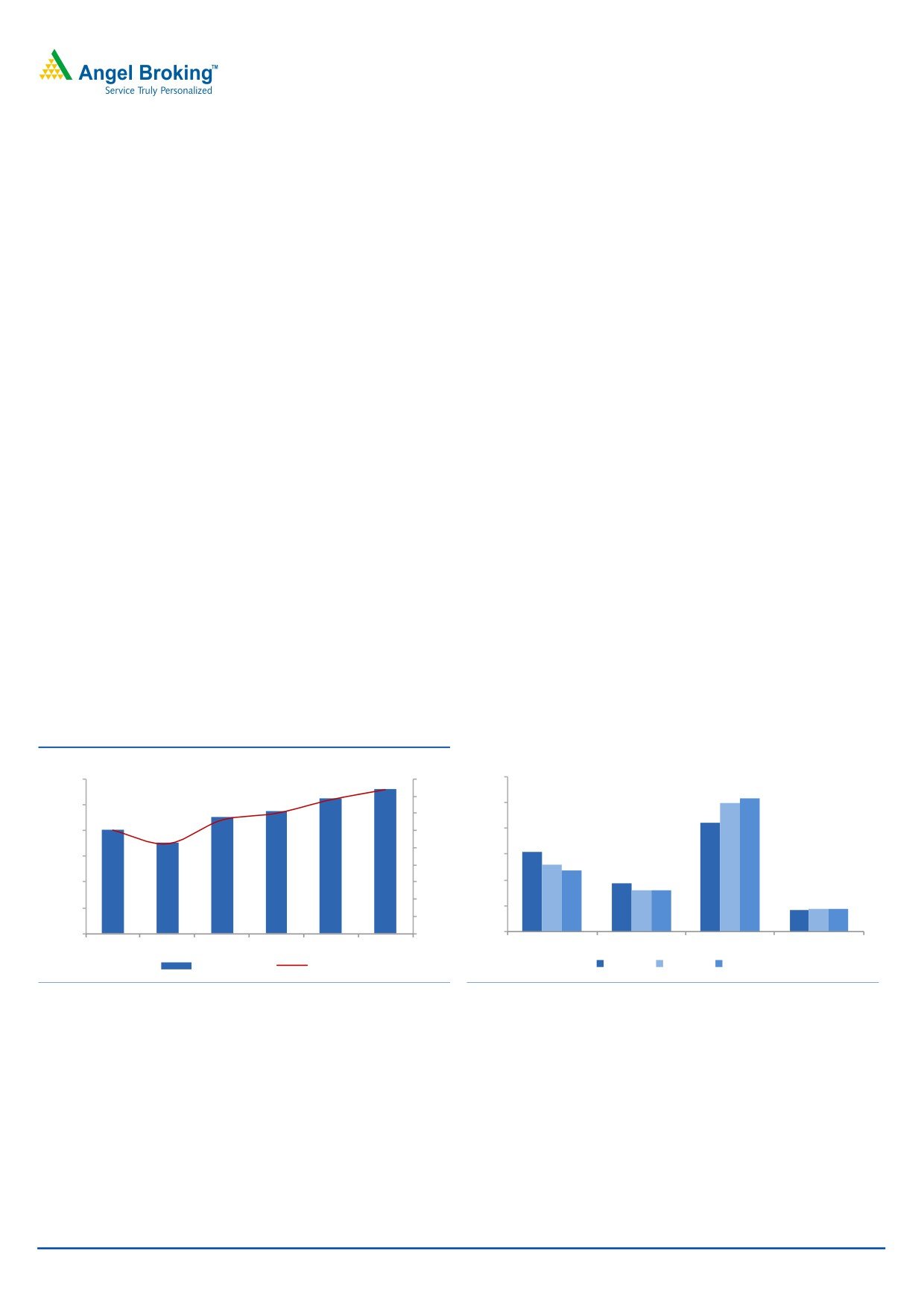

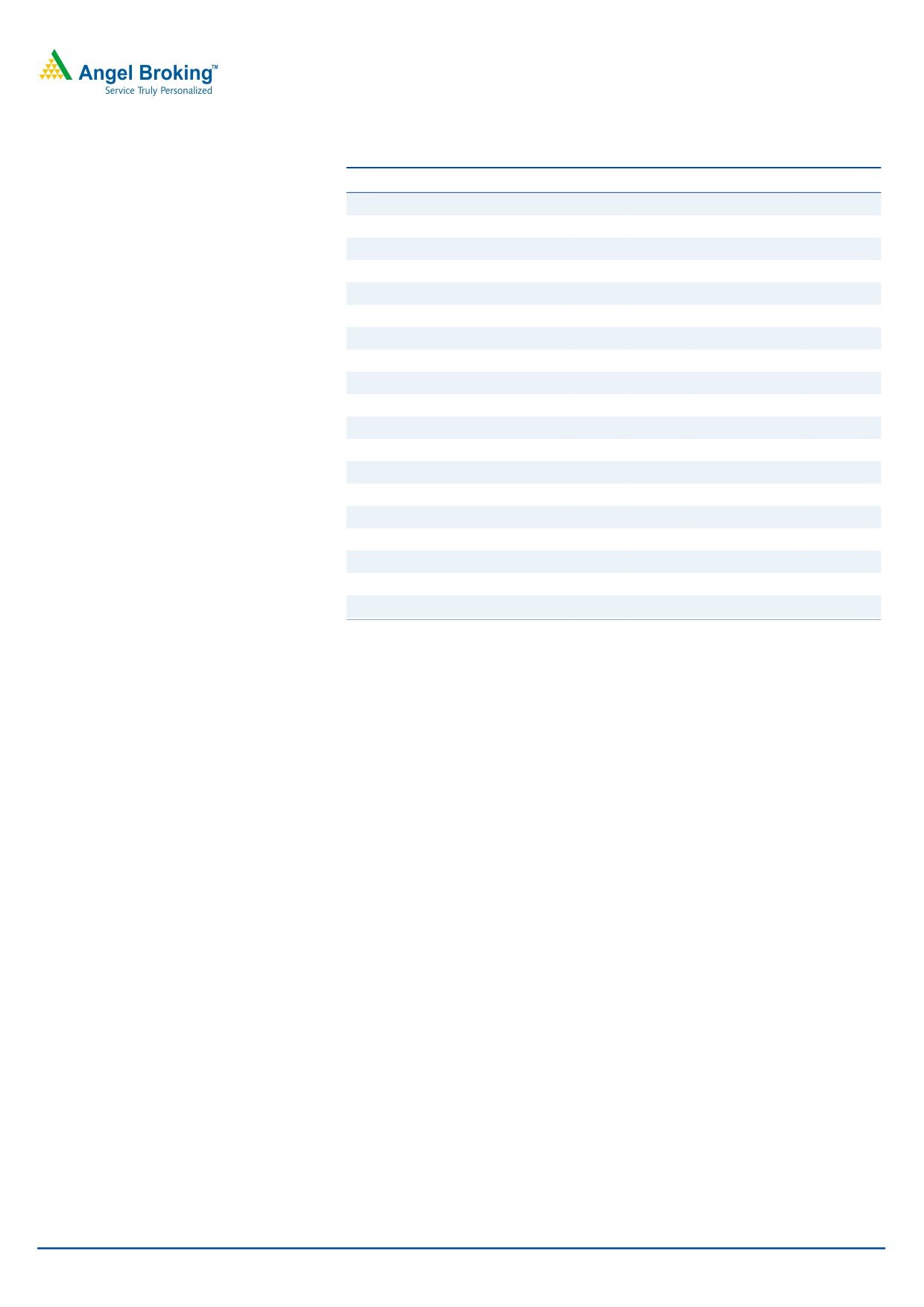

Exhibit 1: Consolidated revenue-mix

Exhibit 2: Product portfolio

Other Subsidiaries and Joint

100.0%

MSSL

SMR

Ventures

99.0%

Wiring harness

Rear view vision

Automotive lighting products

98.0%

3.8

3.7

systems

97.0%

5.3

Polymer

Bus and other commercial

96.0%

processing

vehicles HVAC system

95.0%

94.0%

Elastomer

Cabins for off-highway vehicle

93.0%

95.9

95.4

92.0%

93.9

Metal working

Refrigeration system

91.0%

90.0%

Car HVAC system

Manufatcuring support

FY2010

FY2011

9M FY2012

Information technology and

Unallocated

Non automotive

Automotive

design engineering

Source: RHP, Angel Research

Source: RHP, Angel Research

Through a combination of organic growth and acquisitions, SMFL is now a

multinational company with 120 manufacturing facilities and presence in

25

countries across the world. The company is in the process of establishing new

manufacturing facilities in India, Brazil, Mexico, Spain and Thailand. SMFL’s major

customers include the Volkswagen group, BMW, Daimler, Renault Nissan, Ford

India Private Limited, Volvo Car Corporation, Maruti Suzuki, Tata Motors, Honda

Siel Cars India Limited, Toyota Kirloskar Motor Private Limited and Fiat India

Automobiles Limited.

April 30, 2012

2

SMFL | IPO Note

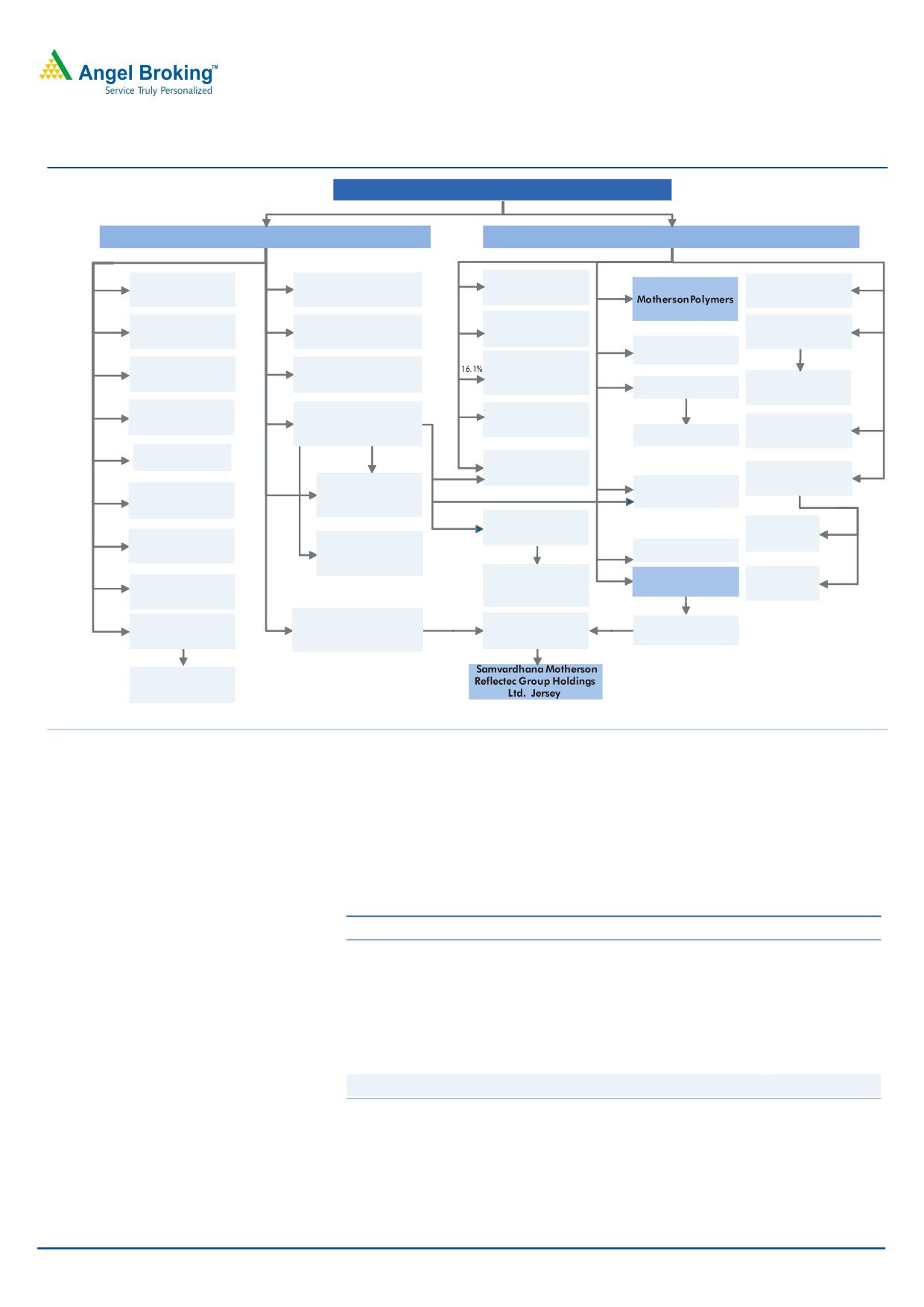

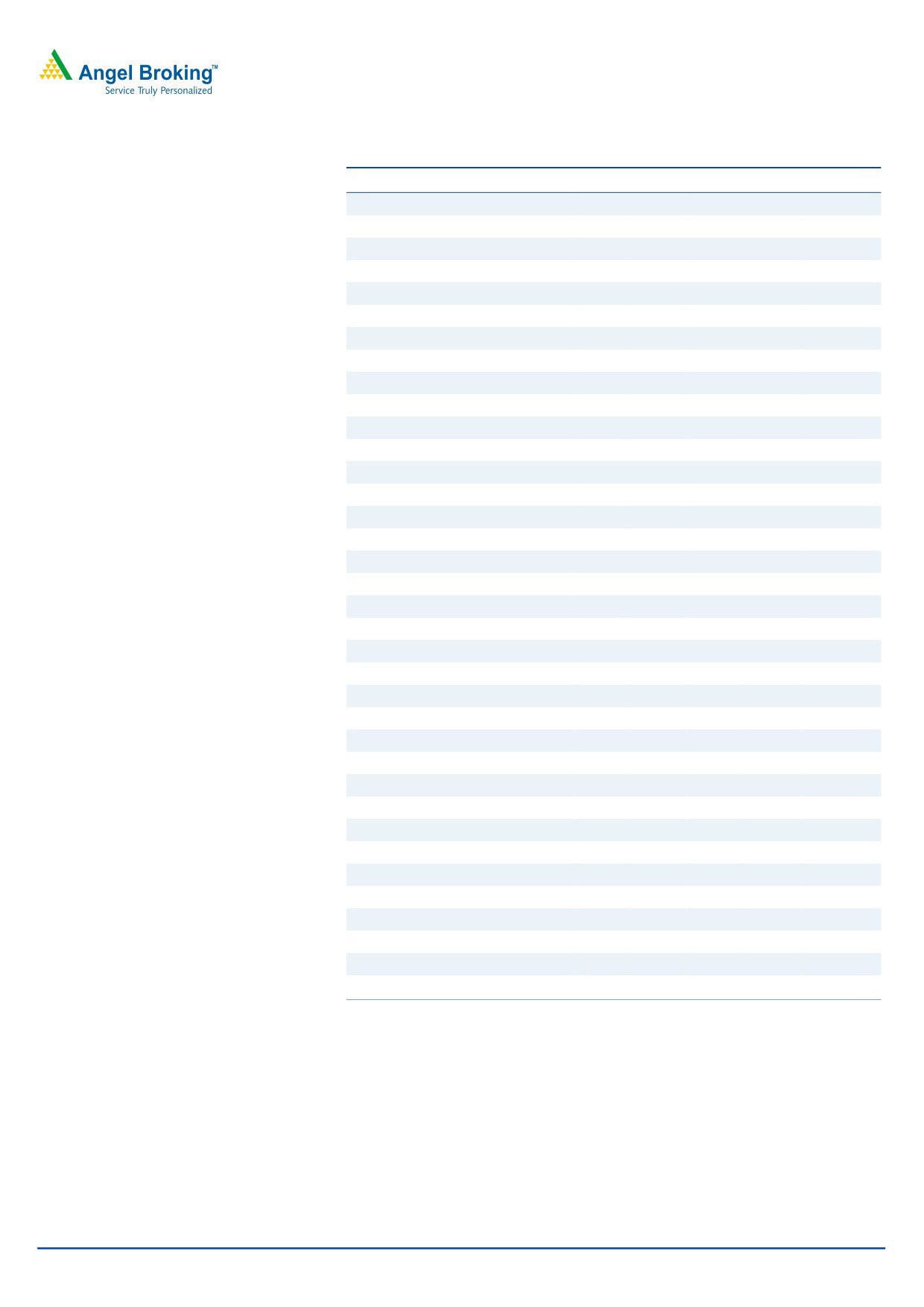

Exhibit 3: SMFL group structure

Samvardhana Motherson Finance Limited (SMFL)

Subsidiary

/ JV with Majority Holding

Other Joint Ventures / Associates

49%

100%

Motherson Climate

100%

Tigers Connect Travel

Spheros Motherson

Nachi Motherson

49%

49%

Samvardhana

System Ltd.

Systems and Solutions Ltd.

Thermal Systems Ltd.

Precision Ltd.

Ltd

Samvardhana

49%

100%

100%

Motherson Machinery and

Anest Iwata Coating

Motherson Techno

14.3%

Motherson Virtual

Automations Ltd.

Equipment Ltd.

Tools Ltd.

Analysis Ltd.

26%

AES (India)

Engineering Ltd.

100%

Sumi Motherson

100%

Motherson Advanced

51%

Motherson Molds and

Innovative Engineering

49%

Tooling Solutions Ltd.

Diecasting Ltd.

Anest Iwata Motherson

Motherson Techno

Ltd.

Ltd.

Tools Mideast (FZE)

100%

Motherson

100%

Samvardhana Motherson

41%

100%

Auto Engineering

CTM India Ltd.

43.3%

Finance Services

Motherson Air Travel

Service Ltd.

Cyprus Ltd.

Air Factory Energy Ltd.

Agencies Ltd.

100%

MSID USA

23.8%

0.8%

Fritzmeier Motherson

Cabin Engineering Ltd.

Systematic Conscom

Motherson

0.5%

26.3%

49.2%

Nissin Advanced

Ltd.

74%

Nachi Motherson Tool

Zanotti Refrigeration

Coating Indo Co.Ltd.

Technology Ltd.

System Ltd.

48.5%

50%

Magneti Marelli

Motherson Holding

SCCL Global

100%

66%

Motherson Auto

Samvardhana

India B.V.

50%

Project (FZE)

Matsui Technologies

Solutions Ltd.

Motherson Finance

100%

India Ltd.

100%

Services Inc.

Magneti Marelli

36.1%

Motherson Sumi

SCCL Infra

100%

58.1%

SAKS Ancillaries

Motherson Auto

Systems Ltd.

Projects Ltd.

Ltd.

System Ltd.

100%

Motherson Sumi

100%

Samvardhana Motherson

Samvardhana

53.6%

49%

51%

MSSL Mauritius

Infotech &

Holding (M) Pvt. Ltd.

Motherson Global

Holdings Ltd

Designs Ltd.

Mauritius

Holdings Ltd. Cyprus

51%

93.6%

Motherson

Bergstrom HVAC

Solutions Pvt. Ltd.

Source: Company, Angel Research

Details of the issue

SMFL intends to raise `1,665cr through the IPO which comprises a fresh equity

issue of `1,344cr and an offer for sale of `321cr by promoter group entity, Radha

Rani Holdings Pte Ltd.

Exhibit 4: Objects of the issue

Particulars

Amount (` cr)

Funding pre-payment and repayment of debt facilities

338.5

Funding strategic investments in SMPL

627.5

Funding investments in rear-view vision systems business

156.0

General corporate purposes

222.0

Total

1,344.0

Offer for sale by Radha Rani Investments

321.0

Total issue size

1,665.0

Source: RHP, Angel Research

April 30, 2012

3

SMFL | IPO Note

Investment arguments

Globally diversified business presence across automotive sector

SMFL has a strong presence across the automotive value chain and provides end

to end solutions to its customer’s right from designing to analysis, prototyping,

manufacturing, assembling to supply of integrated modules to the customers.

SMFL undertakes wiring harnesses business through MSSL and its subsidiaries,

joint ventures and associate companies. The rear view vision systems and the

polymer processing business is undertaken through SMR and SMPL (Peguform

Group companies), respectively.

Rear view vision systems business: SMFL undertakes the rear view vision systems

business through SMR which was acquired from Visiocorp Plc. in March 2009 at a

consideration of €26.5mn. Though SMR was a loss making entity when acquired,

SMFL along with MSSL turned it around and the company turned profitable in

3QFY2011 registering a PAT (before minority interest) of `25.4cr as against loss of

`9.2cr in 3QFY2010. Nearly 80% of SMR’s revenue comes from the exterior mirror

sales and 15% from the interior mirrors.

SMR caters to the requirements of the top ten OEMs globally and has

manufacturing facilities in India, China, Korea, Japan and Mexico. The company

has set up new facilities in Hungary and Brazil which has recently commenced

production. While the management expects SMR margins to return back to 6-7%

levels once the new plants ramp-up, there could be possible delays on account of

delays in launch of new models by customers or demand slowdown.

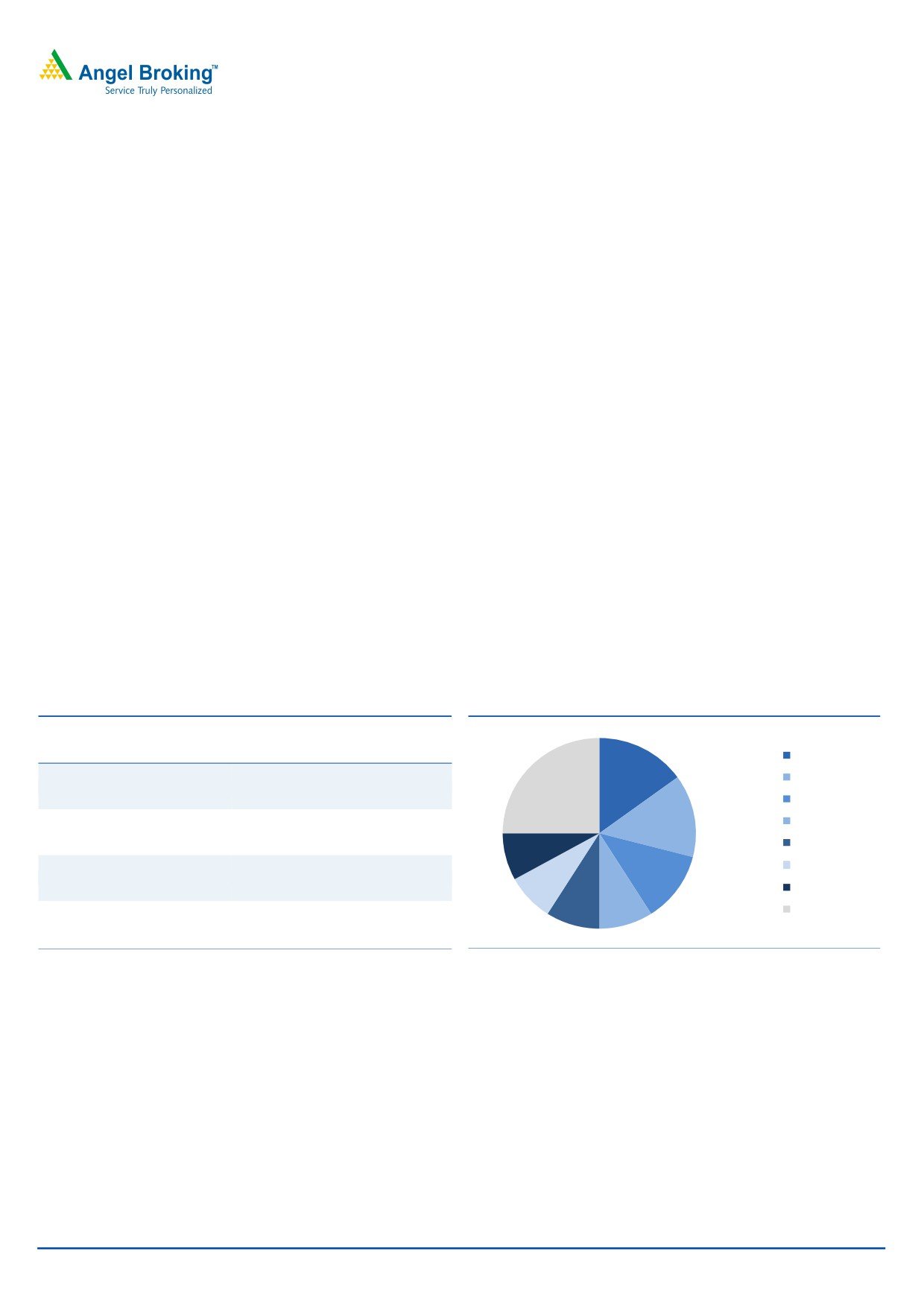

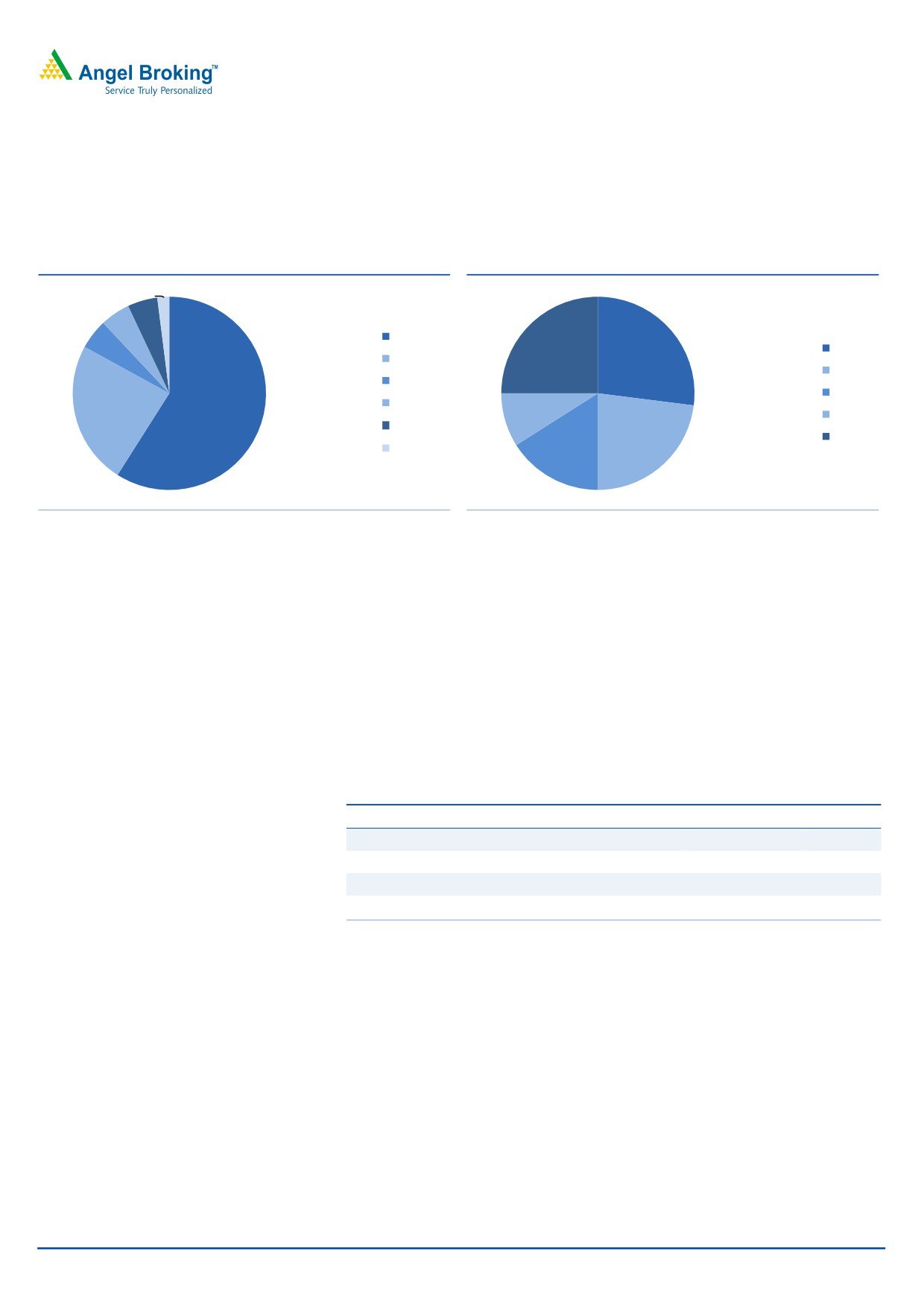

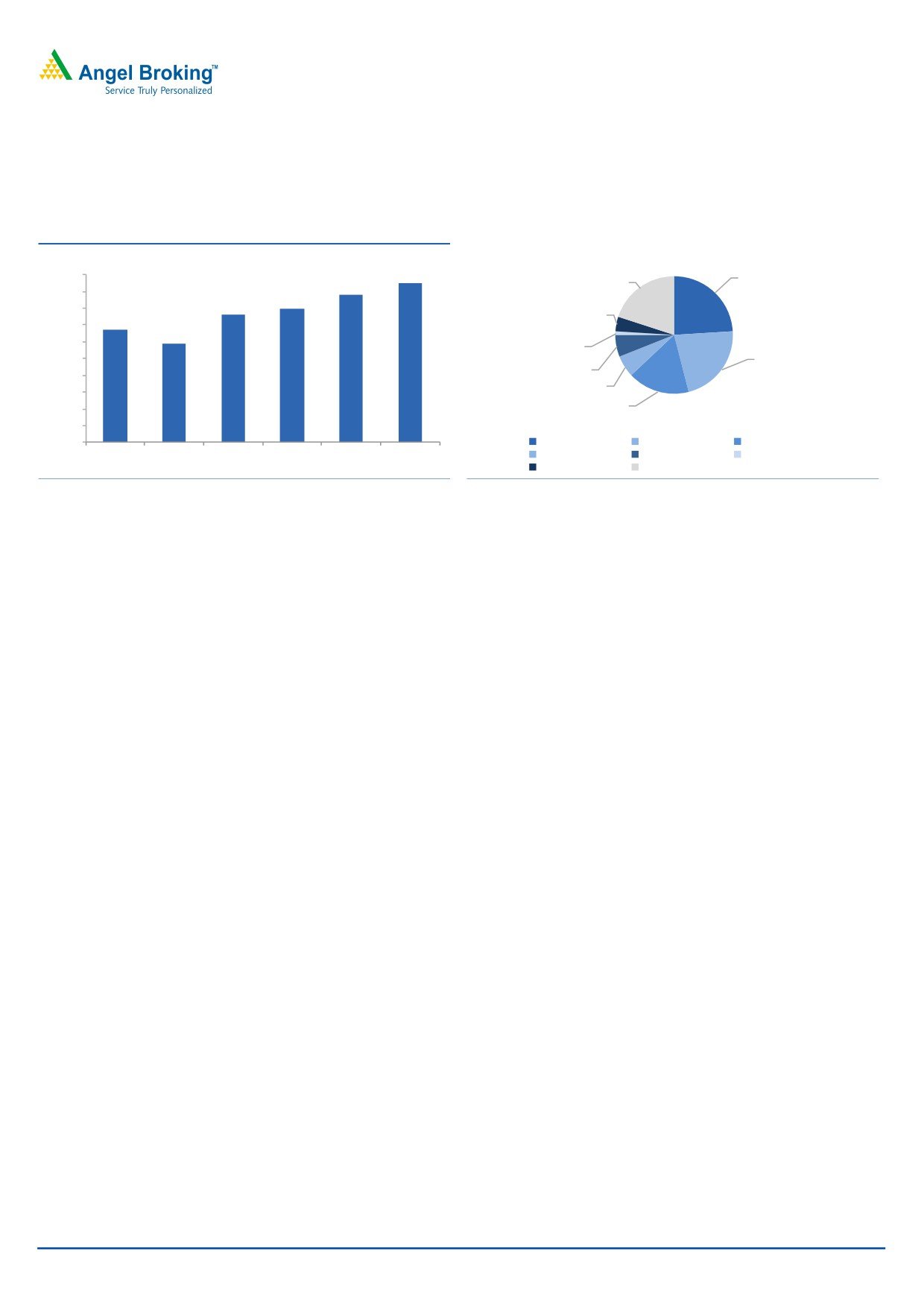

Exhibit 5: SMR - Brief financial summary

Exhibit 6: SMR - Customer wise sales

(` cr)

FY2010

FY2011

9MFY2012

Hyundai Group

15%

VW

25%

Net sales

4,159

4,547

4,082

GM Group

14%

Renault Nissan

EBITDA

236

314

180

Ford Group

8%

Kia Motors

Ebitda margin (%)

5.7

6.9

4.4

12%

8%

Volvo

Others

9%

9%

PAT

6

48

(6)

Source: Company, Angel Research

Source: Company, Angel Research

SMR is the world’s second-largest exterior rear view mirror manufacturer with a

global market share of ~22% in 2010. The company is the leading player in the

European exterior rear view vision systems market with a market share of ~34%,

and enjoys a leading position in the North America and Asia Pacific regions with a

market share of ~25% and ~17%, respectively. SMFL is also the leading player in

the domestic exterior rear view vision systems market with a 57% market share.

Wiring harnesses business: SMFL operates in the wiring harnesses segment

through Motherson Sumi Systems Ltd (MSSL). MSSL with its technological

partnership with Sumitomo Wiring Systems, Japan (holds 25% in MSSL) is India’s

largest supplier of wire harnesses with 65% of the domestic market share. The

April 30, 2012

4

SMFL | IPO Note

company also has strong global presence in wire harnessing especially in

European two-wheeler and material handling equipment markets. The wiring

harness division contributed ~30% of company’s revenues on a consolidated basis

and registered a growth of 38% and 62% on consolidated and standalone basis

respectively in FY2011.

Exhibit 7: MSSL - Segment wise revenue

Exhibit 8: MSSL - Customer wise sales

3%

11%

14%

Maruti Suzuki

Mirrors

Hyundai

Wiring Harness

VW

44%

13%

Ford

Polymer components

30%

56%

Renault Nissan

8%

Rubber/Metal

GM

machined components

8%

Others

6%

7%

Source: Company, Angel Research

Source: Company, Angel Research

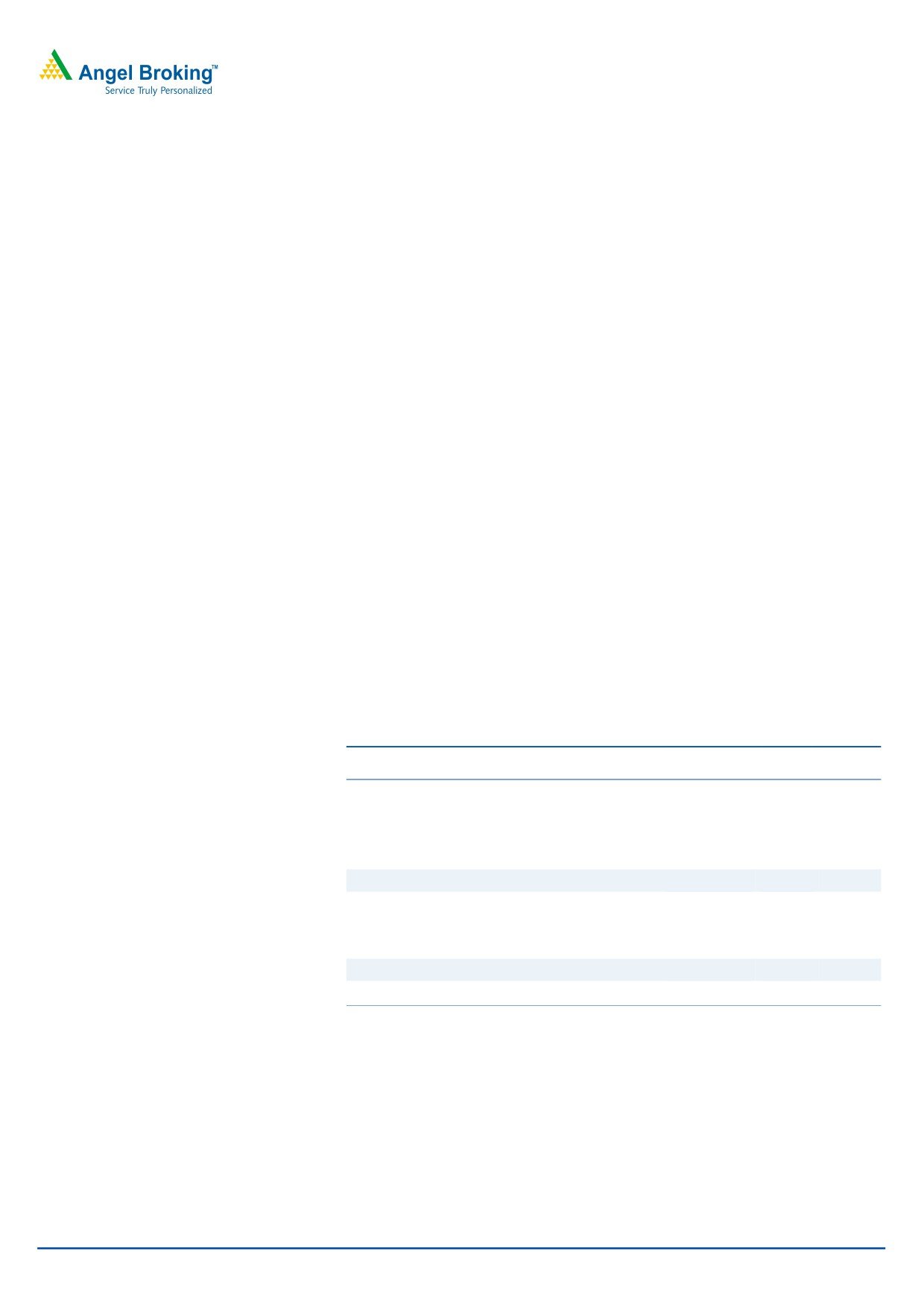

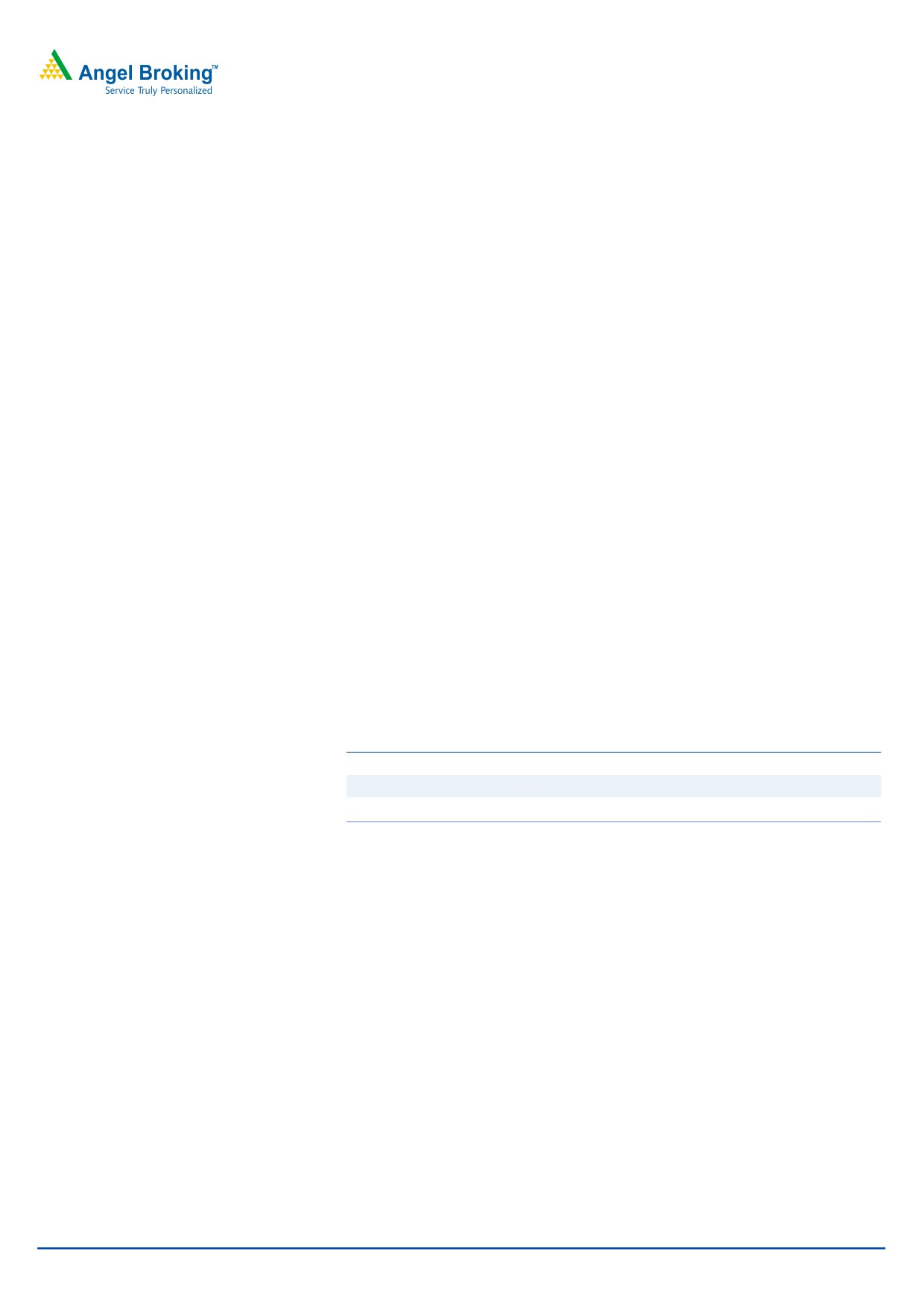

Exhibit 9: MSSL - Geography wise sales

Exhibit 10: MSSL - Brief financial summary

Consolidated (` cr)

FY2010

FY2011

FY2012E

12%

India

Net sales

6,924

8,371

9,830

39%

Australia - Asia Pacific

(excl. India)

EBITDA

549

888

813

31%

Europe

America

Ebitda margin (%)

7.9

10.6

8.3

18%

PAT

243

391

240

Source: Company, Angel Research

Source: Company, Angel Research

MSSL operates over 25 manufacturing facilities and seven design centers for the

wire harness segment. The company has been aggressively expanding its

manufacturing capacity to take advantage of the increased demand from

automotive manufacturers in India and abroad.

Polymer processing and tool manufacturing

SMFL along with MSSL has acquired 80% stake in a Peguform GmbH and

Peguform lberica, SL and 50% stake in Wethje Entwicklungs GmbH and Wethje

Carbon Composite GmbH with from Cross Industries AG to strengthen its

presence in high quality plastic components and assemblies for exterior and

interior trims for passenger vehicles.

Peguform has a strong presence in Europe catering to major German brands. The

company is the second largest supplier of door panels and the third largest

supplier of instrument panels in Germany. The company is also one of the market

leaders of bumpers in Germany and holds a leading position in cockpit assemblies

April 30, 2012

5

SMFL | IPO Note

in Spain. Peguform has 17 production sites and 5 module centers across Europe,

Mexico, Brazil and China. Major customers of the company include the

Volkswagen group (which includes brands such as Volkswagen, Audi, Porsche and

SEAT), Daimler and BMW.

Exhibit 11: Peguform - Geographical revenue-mix

Exhibit 12: Peguform - Customer-mix

2%

5%

5%

Germany

25%

5%

27%

VW

Spain

Audi

China

Seat

Portugal

24%

9%

BMW

59%

Brazil

Others

Mexico

23%

16%

Source: Company, Angel Research

Source: Company, Angel Research

Although Peguform has revenues of EUR1.4bn (CY2010), the EBITDA margins of

the company are lower at ~5% compared to 6.9% for SMR (FY2011) and 7.5% for

the SMFL’s consolidated business. According to the management, some of

Peguform’s plants are operating at significantly higher margins which offer high

scope for margin improvement going ahead. Further

~50% of Peguform’s

revenues are from bought out components translating into ~EUR680mn, of which

~50% is being manufactured across different plants within the Samvardhana

Motherson group. SMFL intends to seize upon the opportunity on offer by cost

effectively sourcing the components from the group companies and improve the

overall operational synergies.

Exhibit 13: Peguform - Brief financial summary

(` cr)

CY2008

CY2009

CY2010 1HCY2011

Net sales

9,749

8,140

8,365

5,119

EBITDA

336

440

400

NA

Ebitda margin (%)

3.4

5.4

4.8

NA

PAT

(477)

(170)

41

(75)

Source: Company, Annual Reports, Angel Research

Joint Venture specialist

Over the years, SMFL has evolved as a JV specialist, having collaborations with

global technology leaders including Sumitomo Wiring Systems Limited, Nachi

Fujikoshi Corporation, Magneti Marelli Holding S.P.A., Calsonic Kansei

Corporation, the Woco Franz Josef Holding GmbH and Woco Industrietechnik

GmbH, Kyungshin Industrial Company Limited, Spheros GmbH, F Holding GmbH,

Austria and Zanotti S.P.A. These long standing relationships give them access to

world-class technology which has helped the company leverage its competencies

in existing areas to create products fulfilling the emerging technical needs of its

customers.

April 30, 2012

6

SMFL | IPO Note

SMFL’s major customers include the five largest automotive OEM manufacturers in

the world, as well as the largest automotive OEM manufacturer in India. Further,

SMFL’s strong ties with its major OEM customers enable it to communicate and

coordinate with them and seek to establish or acquire manufacturing facilities in

areas that they propose to target for growth. The trust and confidence of customers

as also its JV partners has played a pivotal role in the growth of SMFL.

Synergies through horizontal and vertical integration

SMFL has been able to harness synergies through horizontal and vertical

integration across its different product and service segments. For example, wiring

harnesses are used in the manufacture of rear view mirrors, enabling SMR to

source these wiring harnesses from MSSL, while MSSL’s wiring harness

manufacturing activities are supported by the group’s existing polymer processing

and tool manufacturing capabilities. SMFL’s wiring harnesses business produces all

the major components required in-house, ranging from wires to connectors.

These synergies extend across various businesses of the group, enhancing its

ability to become an integrated full-system solutions provider. Further, SMFL is able

to coordinate manufacturing activities across its subsidiaries, joint ventures and

associate companies through its integrated supply chain and inventory

management, engineering, design and information technology functions.

The horizontal and vertical synergies provide SMFL with a significant operational

advantage and helps reduce its dependence on third party suppliers providing

economies of scale. Additionally, SMFL also intends to achieve operational

synergies through the horizontal and vertical integration of the Peguform Group’s

operations and products, by sourcing raw materials from its subsidiaries, Joint

Ventures and other consolidated entities where possible.

April 30, 2012

7

SMFL | IPO Note

Key concerns

Lower global GDP growth may impact operating performance

An external shock in the global economy or recession fears can derail the global

GDP growth, leading to reduced automotive demand. The high share of the

automotive segment to the total consolidated revenues (~94% in FY2011) makes it

highly vulnerable to economic cycles. A slowdown in global economic growth

could lead to a significant decline in revenues at SMR and Peguform.

Dependent on Joint Ventures

The company has entered into several joint ventures to gain access to technology.

As a result significant portion of the company’s revenues are derived from the JV

companies. Any compromise in performance of its JV may adversely affect its

business prospects and therefore the cash flows.

Foreign currency fluctuation risk

As SMFL’s overseas revenue constitutes ~75% of its consolidated revenue there is a

significant risk arising out of currency fluctuation for the company.

April 30, 2012

8

SMFL | IPO Note

Outlook and valuation

SMFL has posted a

123.6% and

63.4% CAGR in revenues and earnings,

respectively over FY2008-11 driven largely by the acquisition of SMR. SMFL is the

market leader in the domestic wiring harness (65% market share) and rear-view

mirror markets (53% market share) and has a 22% share in the global exterior

rear view mirrors segment. Further, acquisition of Peguform is expected to enrich

its product portfolio and consolidate its in-house design, development and tooling

capabilities.

We value SMFL’s 36.1% stake in MSSL based on our target price for the company

(`216 based on 15x FY2014E consolidated earnings). We value SMFL’s stake in

SMR and SMPL on an EV/Sales basis instead of earnings based multiples as

current earnings of these companies’ do not reflect their true potential. Currently

the profitability at SMR and SMPL has been impacted due to significant start up

costs in relation to new manufacturing facilities and due to one-time costs related

to the acquisition and refinancing of Peguform Group. We have assigned EV/Sales

multiple of 0.5x based on our analysis of SMFL’s global as well domestic peers.

Based on our SOTP methodology we arrive at a value of `97/share against the

IPO price band of `113-`118. Management expects to turnaround the financial

performances of SMR and SMPL over the medium term. However, we believe that it

is early to factor in the anticipated turnaround in these two subsidiaries and

valuations in our view are not providing sufficient margin of safety to investors

considering the execution risks involved in the turnaround process. Hence we

recommend Avoid on the issue.

Exhibit 14: SOTP valuation

Equity value

% Value

(` cr)

holding

(` cr)

MSSL (based on 15x FY2014E EPS)

8,370.0

36.1

3,023

SMR (based on EV/Sales of 0.5x FY2012E)

2,251.5

49.0

1,103

SMPL (based on EV/Sales of 0.5x CY2011E)

2,704.7

49.0

1,325

Value of other investments (Book value)

234

Total Equity value

5,686

Holding company discount (%)

20.0

4,549

Net debt post issue (Standalone)

(1,196)

Final value (` cr)

5,745

Value (`/share)

97.0

Source: Company, Angel Research

April 30, 2012

9

SMFL | IPO Note

Exhibit 15: Peer comparison

CMP

Market-cap

P/E

P/B

EV/Sales

(`)

(` cr)

TTM

FY13E

TTM

FY13E

TTM

FY13E

Domestic

Motherson Sumi Systems

179.0

6,934

17.7

21.4

4.3

4.0

1.2

0.8

Bharat Forge

321.5

7,453

25.8

17.7

3.8

3.2

2.0

1.5

International

Magna International*

44.9

10,475

10.4

9.5

1.3

1.2

0.2

0.3

Denso Corp&

2,609.0

2,307

23.5

12.5

1.0

1.0

0.6

0.5

Johnson Controls^

32.3

21,984

12.8

11.9

1.9

1.7

0.7

0.6

Source: Bloomberg, Angel Research; Note: * Calendar year end, CMP in US$, Mcap - US$ mn; & CMP in JPY, Mcap in JPY bn; ^September year end,

CMP in US$, Mcap in US$ mn

April 30, 2012

10

SMFL | IPO Note

Industry Overview

The global automotive components market

The automotive components market is influenced largely by the trends in the global

automotive industry. As with the broader automotive market, the components market

is mature and capital intensive and is characterized by high entry barriers. OEMs

have extremely close working relationships with automotive component vendors as

product development time is in the range of 3-5 years.

The year CY2009 was challenging for all automotive component manufacturers.

Most of the prominent automotive component manufacturers witnessed low capacity

utilization and made losses. The OE automotive components market is expected to

grow at a rate of ~8.2% during the period CY2010 to CY2013E in tandem with the

growth in vehicle production. The overall revenues of the top 50 automotive

component suppliers are expected to reach ~ €472.4bn in CY2013E, which is likely

to account for ~60% of the total automotive components market revenues.

Global OE rear view mirror market

The automotive rear view mirrors industry can be segmented into two main

categories - exterior rear view mirrors and interior rear view mirrors. The key

participants within the overall rear view mirrors market are Magna Mirrors, SMR,

Ficosa, Murakami, Ichikoh and Gentex. While Gentex is strong in the interior mirror

market, all other participants are present in both the exterior and interior rear view

mirrors markets. Magna Mirrors and SMR have strongest presence in the exterior

rear view mirror market while the interior rear view mirror market is dominated by

Magna Mirrors, Ficosa and Gentex.

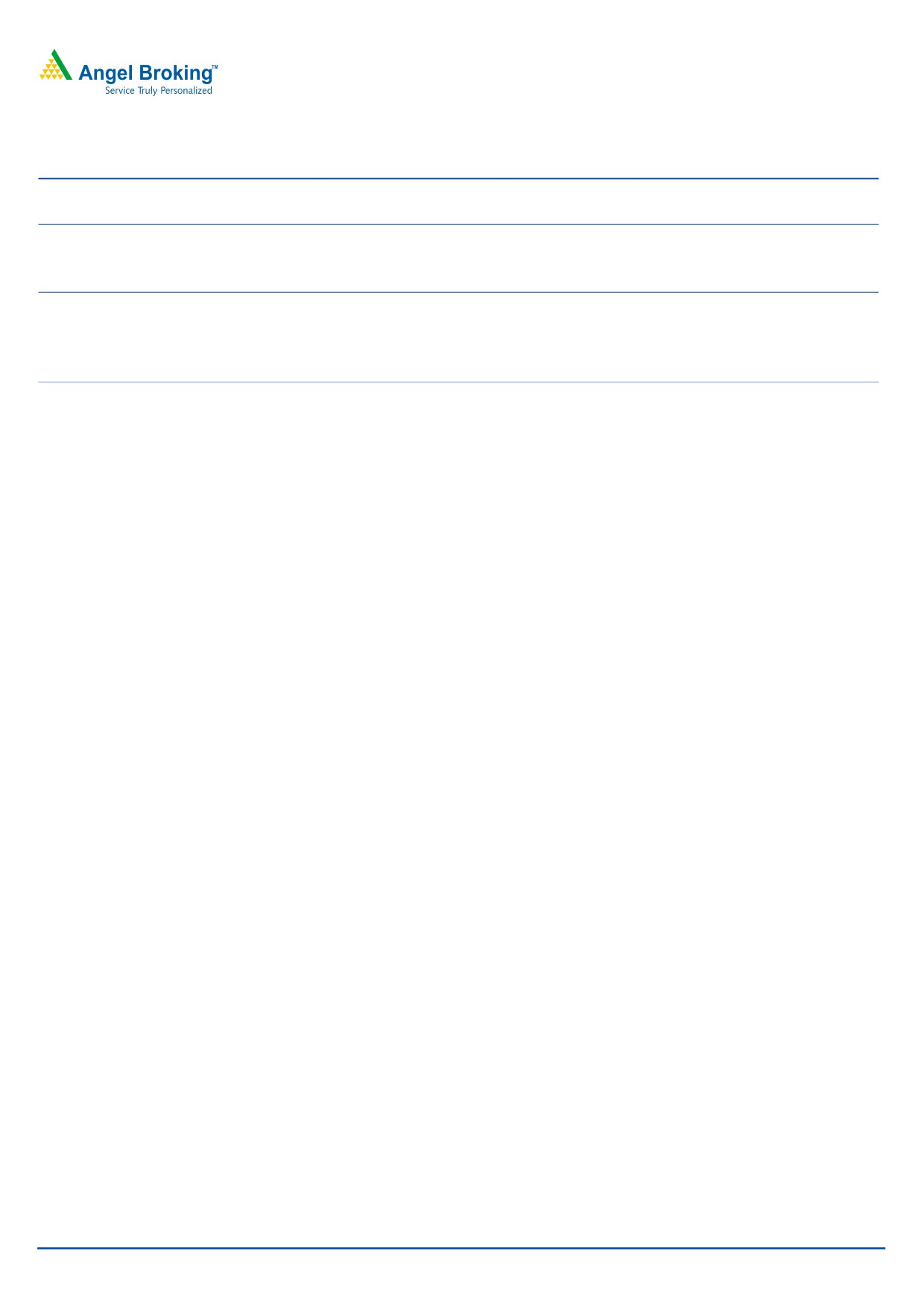

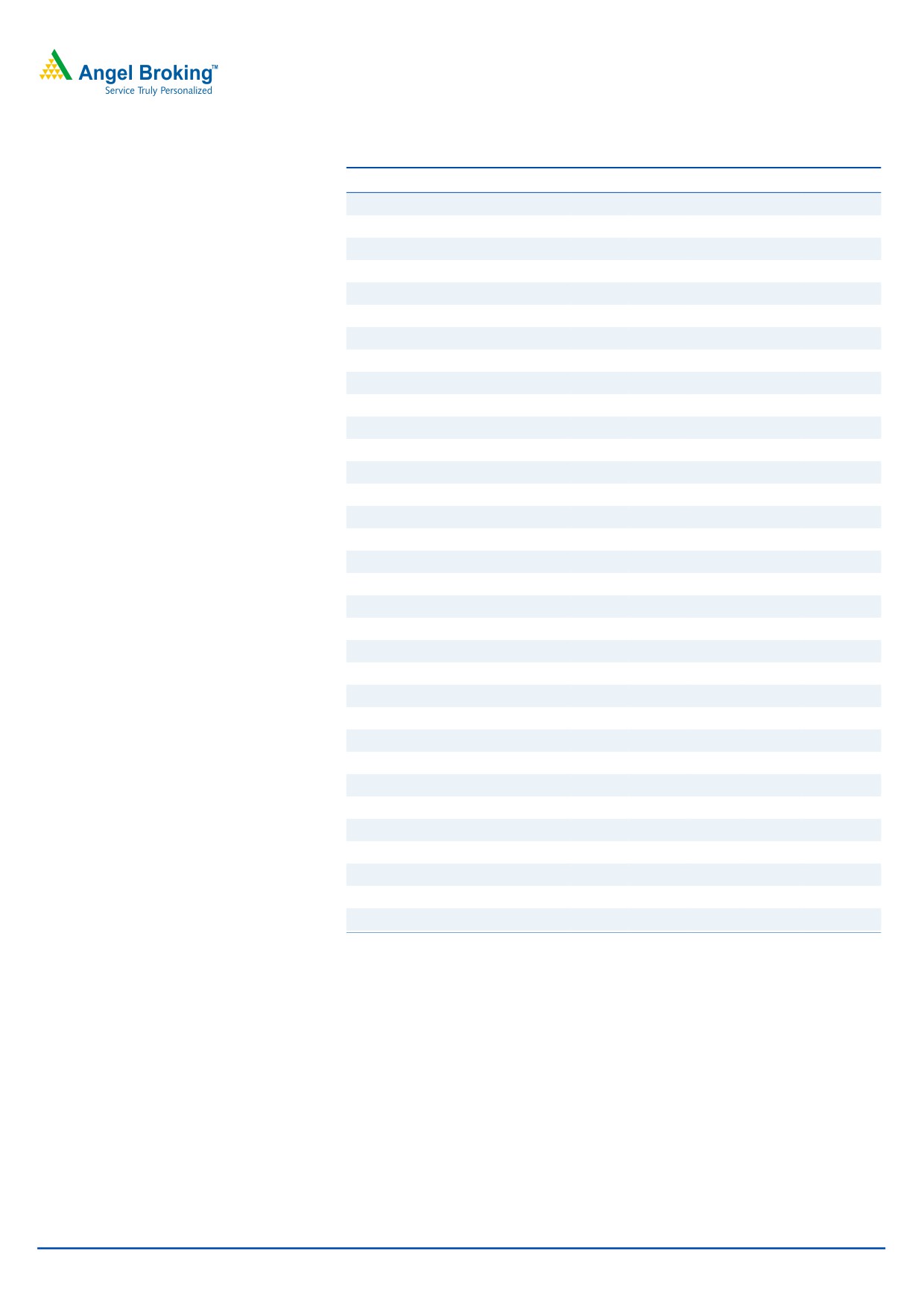

Exhibit 16: Global OE rear view mirror market

Exhibit 17: OE rear view mirror geographical market trend

(mn

units)

(EUR bn)

(%)

4.2

60.0

300.0

3.9

4.5

51.6

49.6

3.5

4.0

250.0

3.3

50.0

3.0

3.5

41.9

200.0

2.6

3.0

40.0

31.0

2.5

30.0

25.9

150.0

23.5

2.0

18.7

15.916.0

100.0

1.5

20.0

1.0

8.4 8.6 8.9

50.0

10.0

0.5

0.0

0.0

0.0

CY2008

CY2009

CY2010

CY2011

CY2012E CY2013E

European Union North America

Asia Pacific

Rest of World

Total volumes

Total revenues

CY2008

CY2010

CY2013E

Source: RHP, Angel Research

Source: RHP, Angel Research

Exterior OE rear view mirror market

The global sales of OE exterior rear view mirrors for LV increased from ~133.8mn

units in 2008 to ~151.9mn units in 2010 at a CAGR of 6.5%, including a small

percentage around 2-3% of mirror volumes that are typically required as spares or

replacement parts. Global revenues increased from ~€2.2 billion in 2008 to €2.5

billion in 2010, at an average annual rate of 5.2%.

Exterior rear view mirrors are playing an increasingly important role in providing

safety, aesthetics and convenience to a LV. These mirrors incorporate various styling

April 30, 2012

11

SMFL | IPO Note

elements such as high gloss surfaces and LED turn signal lamps. Future innovations

are likely to include additional safety features such as warning lamps of lane change

assist systems.

Exhibit 18: Global exterior rear view mirror volumes

Exhibit 19: Global market share of exterior rear view mirrors

(mn units)

200.0

189.2

24%

176.3

20%

180.0

159.5

151.9

160.0

4%

133.8

140.0

117.9

120.0

1%

100.0

22%

6%

80.0

6%

60.0

17%

40.0

20.0

0.0

Magna Mirrors

SMR

Ficosa

CY2008

CY2009

CY2010

CY2011

CY2012E CY2013E

Murakami

Ichikoh

Honda lock

Metagal

Others

Source: RHP, Angel Research

Source: RHP, Angel Research

There are three major players active in the exterior rear view mirror market. Magna

Mirrors leads the market with a share of ~24.0% (2009: 23%) closely followed by

SMR at ~22.0% (2009: 22%) and Ficosa at ~17.0% (2009: 16%) in 2010. The

market share of SMR for exterior rear view mirrors is ~25% (2009: 25 %) in 2010

when light commercial vehicle segments are excluded.

Interior OE rear view mirror market

Global sales of interior rear view mirrors increased from ~67.5mn units in 2008 to

~74.3mn units in 2010, at a CAGR of 4.9% which was in line with the increase in

global LV production volumes. Global revenues increased from ~€740.1mn in 2008

to ~€865.1mn in 2010 at a CAGR of 8.1% mainly due to an increase in the average

price of interior rear view mirrors. In 2010, APAC had a market share of ~49.6% of

the interior rear view mirror market in volume terms. European Union and North

American respectively had a share of ~25.9% and ~15.9% while ROW contributed

~8.6%.

According to Frost & Sullivan by 2013, the North American market is expected to

remain at ~16.0% of the overall interior rear view mirrors market in volume terms,

Europe’s contribution is likely to settle at ~23.5%, Asia Pacific’s share would increase

to ~51.6% and ROW share is expected to be ~8.9%.

There are six major participants in the global interior rear view mirrors market. These

are Magna Mirrors, SMR, Ficosa, Tokai Rika, Murakami and Gentex. The basic

interior rear view mirror segment is dominated by Magna Mirrors, SMR, and Ficosa.

Magna Mirrors is the market leader with ~60.0% (2009: 54.0%) market share,

followed by SMR with a share of ~10.0% (2009: 12.0%) and Ficosa at an share of

~3.0% (2009: 5.0%) in 2010. The auto-dimming interior rear view mirror market is

dominated by Gentex, which held ~82.0% (2009: 82.0%) share of the global

market in 2010. Magna Mirrors with a market share of ~14.0% (2009: 14.0%) is

the other leading player in this segment.

April 30, 2012

12

SMFL | IPO Note

Indian automotive components market

The domestic automotive components industry consists mostly of unorganized

players, who are largely small and medium enterprises. However, it is the organized

segment that contributes about 72% of the industry’s total revenues.

According to CRISIL Research, the domestic automotive components production is

estimated to have risen by 25% yoy in FY2011 to `1,573bn, led by an improvement

in domestic automobile production. Strong volume growth across segments like cars

and utility vehicles (28%), commercial vehicles (33%), two-wheelers (27%) and

tractors (24%) translated into a 32% yoy growth in sales to OEMs. Further, average

realizations of the industry are estimated to have improved by 3.0-3.5% in FY2011

to partially offset an increase in raw material prices. Capacity utilization for most

automotive components players are also expected to have improved significantly

during the year and some segments also faced capacity constraints during the year.

As per CRISIL Research, domestic automotive component production is set to reach

`3,100 - `3,200bn in FY2016, registering a CAGR of 14-16% over FY2011. This is

expected to be led by a healthy demand from OEMs, especially for cars and utility

vehicles and commercial vehicles, constituting 75-76% of the total demand from

OEMs. Further, an increasing focus on cost-efficiency will lead to international OEMs

sourcing automotive components from low-cost countries like India. CRISIL Research

also anticipates increased utilization of commercially vehicles, shortening

replacement cycles and boosting demand for replacements.

Exhibit 20: Outlook on size of domestic automotive component industry

FY2011

FY2016

Domestic Consumption

Size (` bn)

% of total

Size (` bn)

% of total

OEM

1,131

69.0

2,245

73.4

Replacement

507

31.0

812

26.6

Total Consumption

1,638

3,058

Source: RHP, Angel Research

April 30, 2012

13

SMFL | IPO Note

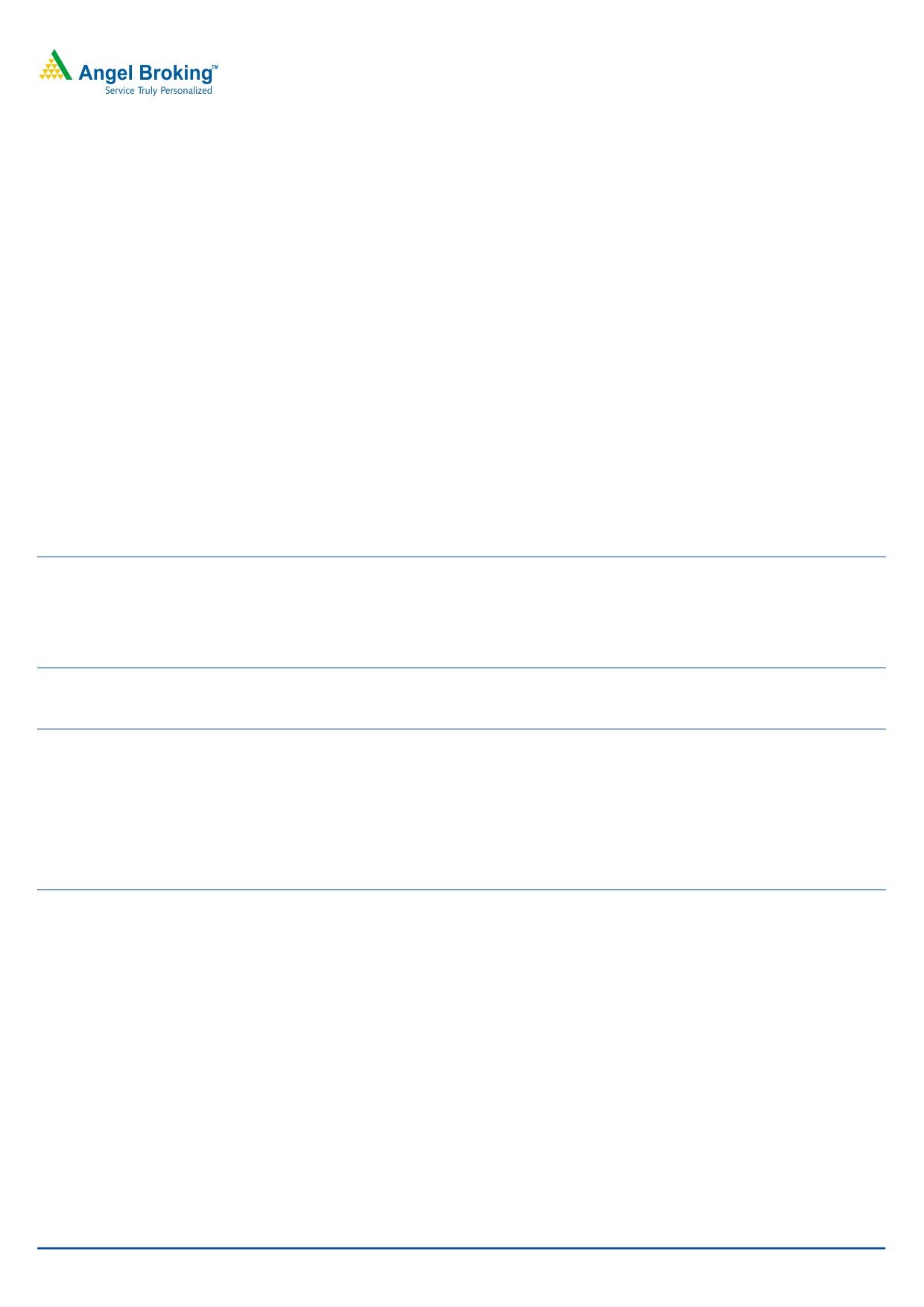

Profit and Loss Statement (Consolidated)

Y/E March (` cr)

FY2008

FY2009

FY2010

FY2011

YTDFY2012

Net sales

492

828

4,841

5,512

5,862

Other operating income

12

15

73

122

96

Total operating income

504

843

4,914

5,635

5,957

% chg

646.7

67.3

483.0

14.7

5.7

Total expenditure

441

798

4,683

5,213

5,761

Net raw material expenses

274

505

3,044

3,500

3,776

Other manufacturing expenses

102

163

685

743

957

Employee expense

66

130

955

970

1,028

EBITDA

62

45

231

422

197

% chg

589.5

(28.1)

414.1

82.5

(53.3)

(% of total operating income)

12.4

5.3

4.7

7.5

3.3

Depreciation & Amortization

24

37

190

170

168

EBIT

38

8

41

251

28

% chg

518.2

(79.1)

405.5

517.8

(88.7)

(% of total operating income)

7.6

1.0

0.8

4.5

0.5

Interest & other charges

6

21

62

62

129

Other income

11

93

147

82

67

(% of PBT)

24.7

116.3

117.3

30.3

(199.9)

Recurring PBT

43

80

125

271

(34)

% chg

560.9

84.4

56.3

116.5

-

PBT (reported)

43

80

125

271

(34)

Tax

13

12

51

103

95

(% of PBT)

31.0

15.1

40.5

38.1

-

PAT (reported)

30

68

74

168

(129)

Add: Share of earnings of associate

1

1

1

1

1

Less: Minority interest (MI)

(1)

12

6

29

(37)

PAT after MI (reported)

32

57

70

140

(91)

ADJ. PAT

32

57

70

140

(91)

% chg

598.0

76.3

23.6

100.1

-

(% of total operating income)

6.4

6.7

1.4

2.5

(1.5)

Adj. Basic EPS (`)

1.1

1.6

1.3

3.0

(1.9)

Adj. Fully Diluted EPS (`)

1.1

1.6

1.3

3.0

(1.9)

% chg

(81.3)

52.5

(20.5)

130.6

-

April 30, 2012

14

SMFL | IPO Note

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2008 FY2009 FY2010 FY2011 YTDFY2012

SOURCES OF FUNDS

Equity share capital

300

347

540

468

474

Reserves & surplus

283

696

754

1,009

965

Total shareholders’ funds

583

1,043

1,294

1,477

1,439

Minority interest

18

101

158

174

485

Total loans

168

693

868

1,095

3,918

Deferred tax liability

1

12

(4)

(12)

33

Total Liabilities

769

1,849

2,315

2,735

5,875

APPLICATION OF FUNDS

Gross block

663

2,646

3,026

3,381

7,748

Less: Acc. depreciation

95

1,146

1,323

1,531

3,662

Net block

568

1,500

1,703

1,849

4,086

Capital work-in-progress

13

77

122

286

430

Investments

13

55

99

48

109

Current assets

292

1,358

1,511

1,889

4,552

Cash

88

255

255

276

596

Loans & advances

46

298

246

276

554

Other

158

804

1,010

1,338

3,401

Current liabilities and provisions

126

1,150

1,120

1,338

3,306

Net current assets

166

208

390

552

1,245

Mis. exp. not written off

9

9

1

0

5

Total Assets

769

1,849

2,315

2,735

5,875

April 30, 2012

15

SMFL | IPO Note

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2008 FY2009 FY2010 FY2011 YTDFY2012

Profit before tax

44

70

127

284

(46)

Depreciation

24

37

190

170

168

Change in working capital

(14)

(63)

(138)

(133)

(65)

Direct taxes paid

(13)

(18)

(74)

(89)

(74)

Others

7

(42)

52

25

207

Cash flow from Operations

49

(16)

158

257

191

Inc./ (Dec.) in fixed assets

(65)

(118)

(277)

(462)

(552)

Inc./ (Dec.) in investments

(3)

(2)

(54)

55

(17)

Others

0

(425)

(187)

(14)

(811)

Cash flow from Investing

(68)

(545)

(518)

(421)

(1,379)

Issue of equity

0

334

148

0

26

Inc./(Dec.) in loans

64

350

260

152

1,256

Dividend paid (incl. tax)

(1)

(2)

(4)

(4)

(9)

Others

9

(29)

(44)

39

70

Cash Flow from Financing

71

653

360

186

1,343

Inc./(Dec.) in cash

52

92

(0)

22

155

Opening cash balance

36

88

255

255

276

Net adjustments

(0)

75

(0)

(1)

165

Closing cash balance

88

255

255

276

596

April 30, 2012

16

SMFL | IPO Note

Key Ratios

Y/E March

FY2008

FY2009

FY2010

FY2011

YTDFY2012

Valuation ratio (x)

P/E (on FDEPS)

105.6

69.3

87.2

37.8

-

P/CEPS

60.4

41.9

23.4

17.1

69.3

P/BV

5.8

3.8

4.7

3.6

3.7

Dividend yield (%)

0.0

0.0

0.0

0.0

0.0

EV/Sales

7.0

5.2

1.4

1.1

1.5

EV/EBITDA

55.4

95.8

28.6

14.4

43.5

EV/Total Assets

4.5

2.3

2.9

2.2

1.5

Per share data (`)

EPS (Basic)

1.1

1.6

1.3

3.0

(1.9)

EPS (fully diluted)

1.1

1.6

1.3

3.0

(1.9)

Cash EPS

1.9

2.7

4.8

6.6

1.6

DPS

0.0

0.0

0.0

0.0

0.0

Book Value

19.4

30.0

24.0

31.5

30.4

Dupont analysis

EBIT margin

7.6

1.0

0.8

4.5

0.5

Tax retention ratio (%)

69.0

84.9

59.5

61.9

383.9

Asset turnover (x)

0.8

0.7

2.7

2.5

1.5

RoIC (Post-tax)

4.1

0.6

1.3

6.9

2.8

Cost of Debt (Post Tax)

2.9

4.2

4.7

3.9

19.8

Leverage (x)

0.1

0.4

0.4

0.5

2.2

Operating RoE

4.2

(0.7)

(0.0)

8.4

(35.0)

Returns (%)

RoCE (Pre-tax)

5.4

0.6

2.0

9.9

0.7

Angel RoIC (Pre-tax)

6.0

0.7

2.4

12.2

0.8

RoE

5.7

7.0

6.0

10.1

(6.3)

Turnover ratios (x)

Asset Turnover (Gross Block)

0.8

0.5

1.7

1.8

1.1

Inventory (days)

44

100

31

36

72

Receivable (days)

55

109

36

40

73

Payable (days)

57

195

62

65

110

Working capital cycle (ex-cash) (days)

51

7

3

13

28

Solvency ratios (x)

Net debt to equity

0.1

0.4

0.4

0.5

2.2

Net debt to EBITDA

1.1

8.5

2.2

1.8

16.3

Interest Coverage (EBIT / Interest)

6.7

0.4

0.7

4.0

0.2

Note: Valued at lower price band of `113

April 30, 2012

17

SMFL | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

April 30, 2012

18

SMFL | IPO Note

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, Power, FMCG)

Yaresh Kothari

Analyst (Automobile)

Nitin Arora

Analyst (Infra, Cap Goods)

Ankita Somani

Analyst (IT, Telecom)

Varun Varma

Analyst (Banking)

Saurabh Taparia

Analyst (Cement, Power, Media)

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Simran Kaur

Research Editor

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

April 30, 2012

19