Initiating Coverage | Textile

July 11, 2012

S. Kumars Nationwide

BUY

CMP

`34

Changing consumer preferences to drive growth

Target Price

`45

S. Kumars Nationwide Ltd. (SKNL) is one of the leading textile and apparel

Investment Period

12 Months

companies in India catering to various segments ranging from economy to

premium. The company has also extended its presence globally by acquiring

Stock Info

Leggiuno in Italy and Hart Schaffner Marx (HMX) in the U.S. In addition, it has

Sector

Textile

entered an 80:20 JV with Louis Vuitton (LVMH) in U.K., thereby creating a strong

Market Cap (` cr)

1,008

Beta

1.5

portfolio with 45 owned and licensed brands. SKNL has a 74.4% stake in its

52 Week High / Low

60 / 22

subsidiary, Reid & Taylor (valued at `3,514cr in 2008 by GIC), whose IPO, if hits

Avg. Daily Volume

469,551

the market, may prove to be a re-rating trigger for the stock. We initiate coverage

Face Value (`)

10

on SKNL with a Buy recommendation.

BSE Sensex

17,489

Investment rationale

Nifty

5,306

Strong historical growth - Foundation for a stable future: Over the past five years

Reuters Code

SKNL.BO

(FY2008-12), SKNL (consolidated) reported a revenue CAGR of

38.1%,

Bloomberg Code

SKNL IN

substantially higher than its peers. This was mainly on the back of changing

consumer preferences from the unorganized market towards the branded market

Shareholding Pattern (%)

and from textile to ready-to-wear. Further, we expect the company’s revenue to

Promoters

48.6

normalize and post a CAGR of 14.2% over FY2012-14E to `8,290cr.

MF / Banks / Indian Fls

12.0

It’s all about brand show: SKNL follows a strong brand ambassador-led strategy,

FII / NRIs / OCBs

26.2

as part of which its major domestic brands are endorsed by big celebrities

Indian Public / Others

13.2

such as Amitabh Bachchan (Reid & Taylor), Shahrukh Khan (Belmonte) and

Sachin Tendulkar (World Player). In FY2011, the company spent `110cr on

advertisement (including conferences, publicity and business promotion activities). This

Abs.(%)

3m 1yr

3yr

rigorous spending has helped the company in positioning itself as a strong brand. We

Sensex

2.2

(6.0)

30.5

expect the company’s advertising spend to increase to `176cr by FY2014E.

SKNL

0.7

(37.3)

(6.4)

International acquisitions - Long-term growth drivers: With overseas acquisitions

(Leggiuno and HMX) and an 80:20 JV between its wholly owned U.K. subsidiary,

SKNL (U.K.) Ltd., and LVMH group, SKNL has expanded its presence across the

globe, thus creating a strong portfolio of 45 owned and licensed brands. We

expect revenue from the international business to post a CAGR of 14.5% over

FY2012-14E to `1,747cr.

Outlook and valuation

We expect SKNL’s consolidated revenue to post a 14.2% CAGR to `8,290cr and

profit to post a 15.2% CAGR to `524cr over FY2012-14E. We initiate coverage

on SKNL with a Buy rating and an SOTP target price of `45.

SOTP valuation

Value of SKNL's stake in Reid & Taylor (discounted by 70%) (` cr)

784

Expected value of SKNL standalone (target PE of 2x for FY2014E) (` cr)

549

Net value of the company (SKNL standalone + Reid & Taylor) (` cr)

1,334

Existing no. of shares (cr)

30

Expected CMP (`)

45

Source: Company, Angel Research

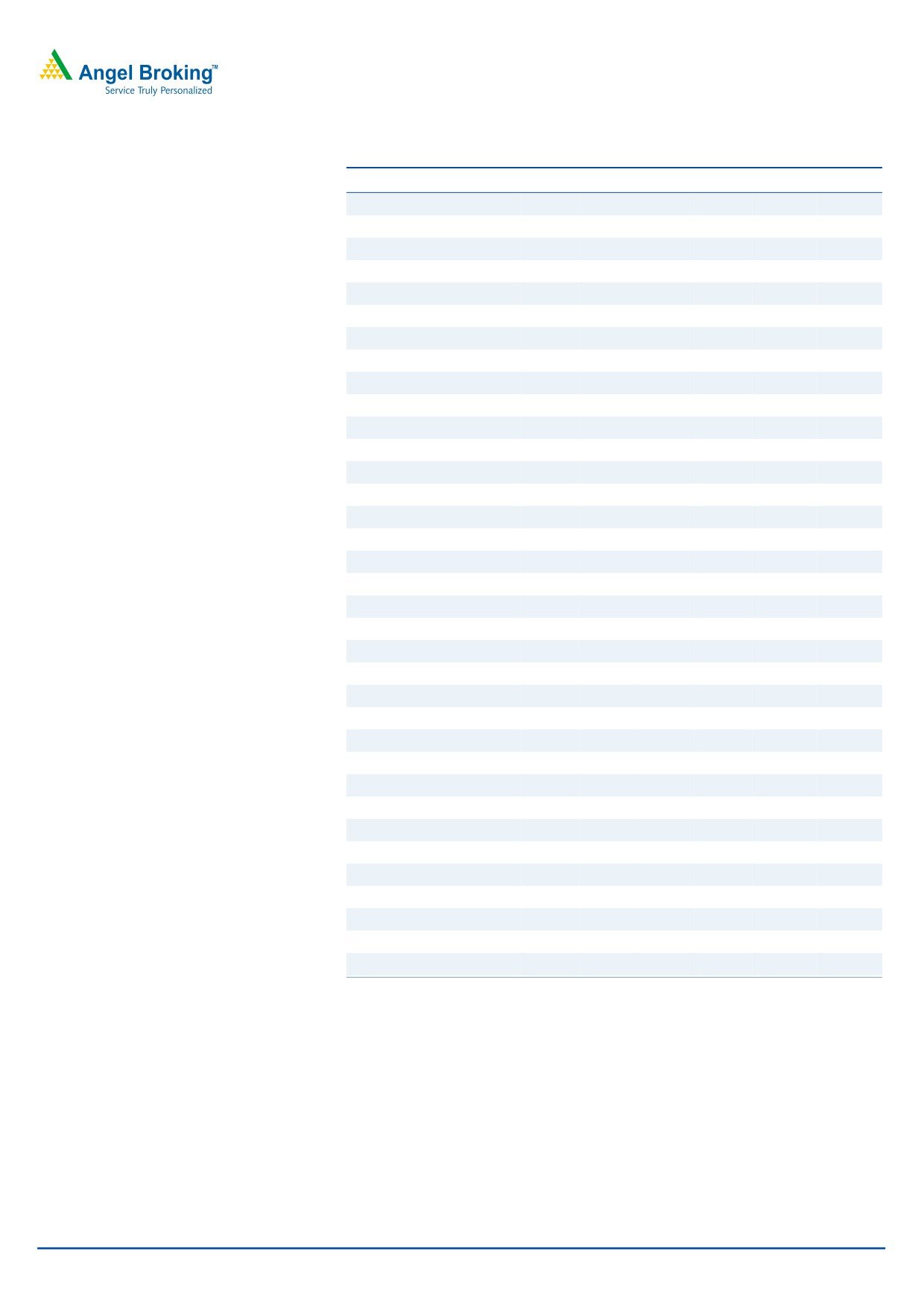

Key financials (Consolidated)

Sales

OPM PAT EPS RoE P/E P/BV

EV/

EV/

Year

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

Sales (x) EBITDA (x)

Tejashwini Kumari

FY2013E

7,279

21.0

447

15.0

13.7

2.3

0.3

0.7

3.4

022-39357800 Ext: 6856

FY2014E

8,290

21.0

524

17.6

13.9

1.9

0.2

0.7

3.2

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

S. Kumars Nationwide | Initiating Coverage

Investment arguments

It’s all about brand show

SKNL, being a multi-brand company, is very clear about differentiating its brands

across segments so that brands do not end up cannibalizing each other.

The company follows a strong brand ambassador-led strategy, as part of

which its major domestic brands are endorsed by big celebrities such as Amitabh

Bachchan, Shahrukh Khan and Sachin Tendulkar.

Exhibit 1: Strong brand show

Brand

Ambassador

Reid & Taylor

Amitabh Bachchan

Belmonte

Shahrukh Khan

World Player

Sachin Tendulkar

Source: Company, Angel Research

The company has been spending rigorously on advertising for the recognition of its

brands. In FY2011, the company spent `110cr on advertisement (including

conferences, publicity and business promotion activities). This rigorous spending

has helped the company in positioning itself as a strong brand. We expect the

company’s advertising spend to increase to `176cr by FY2014E.

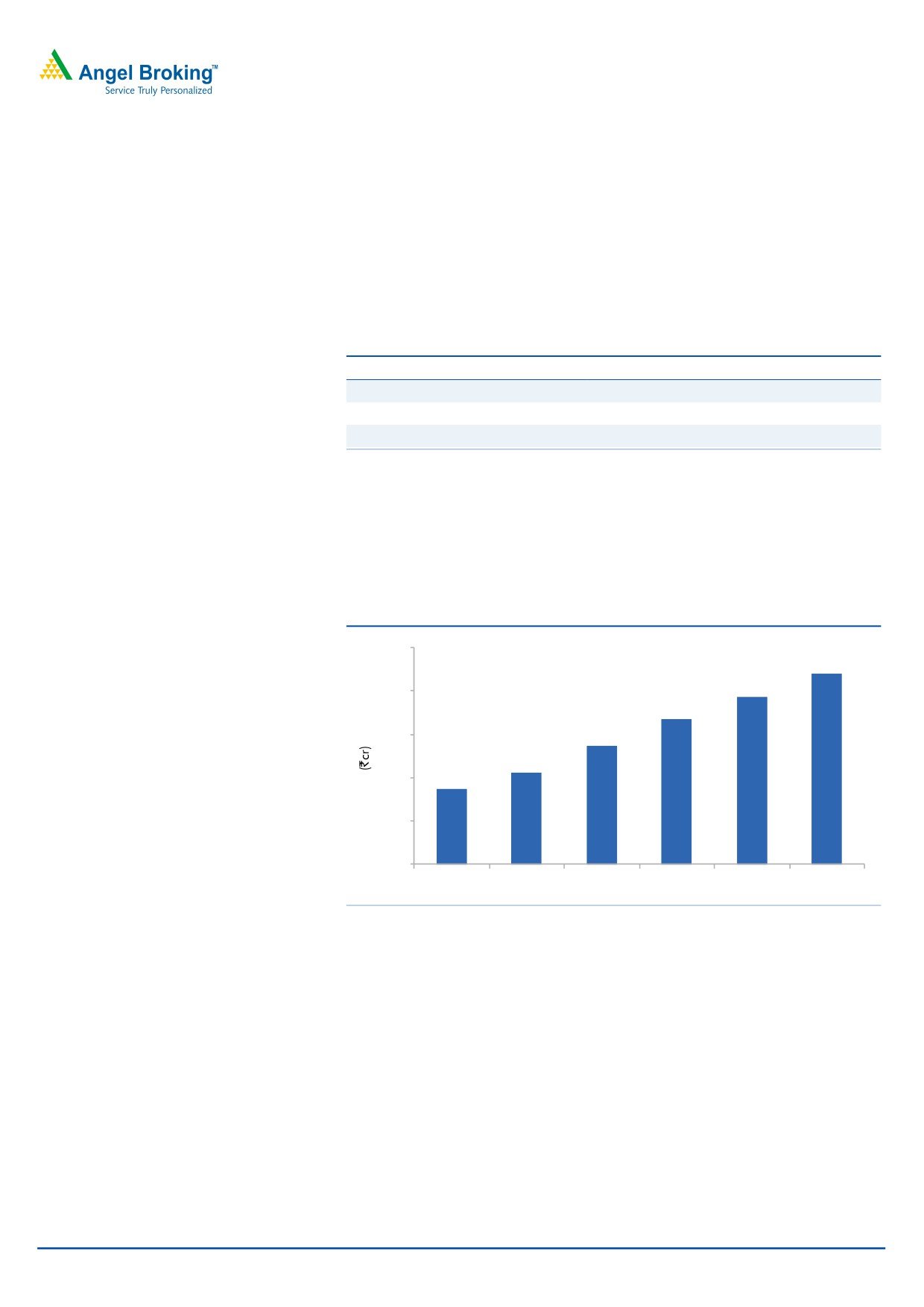

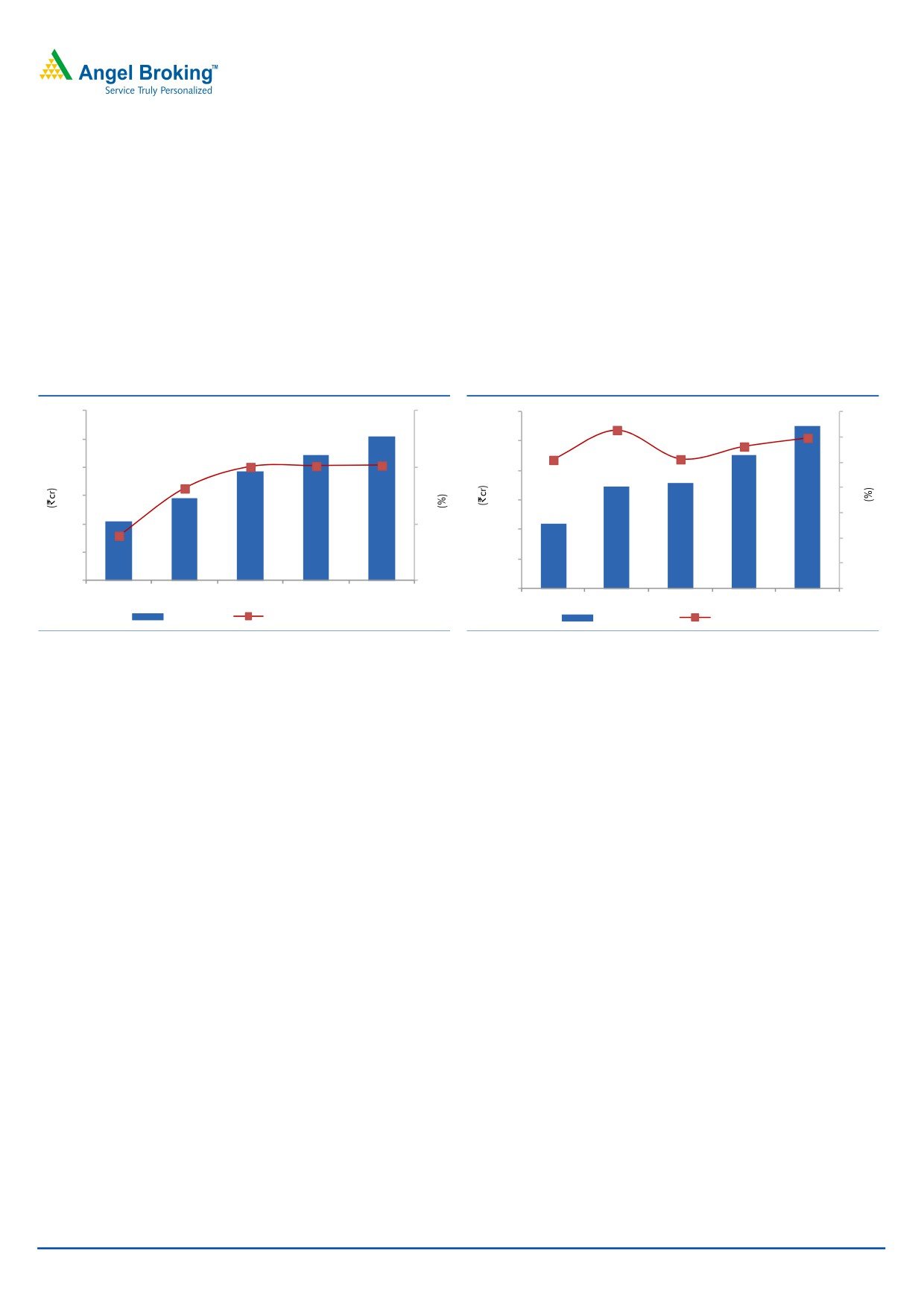

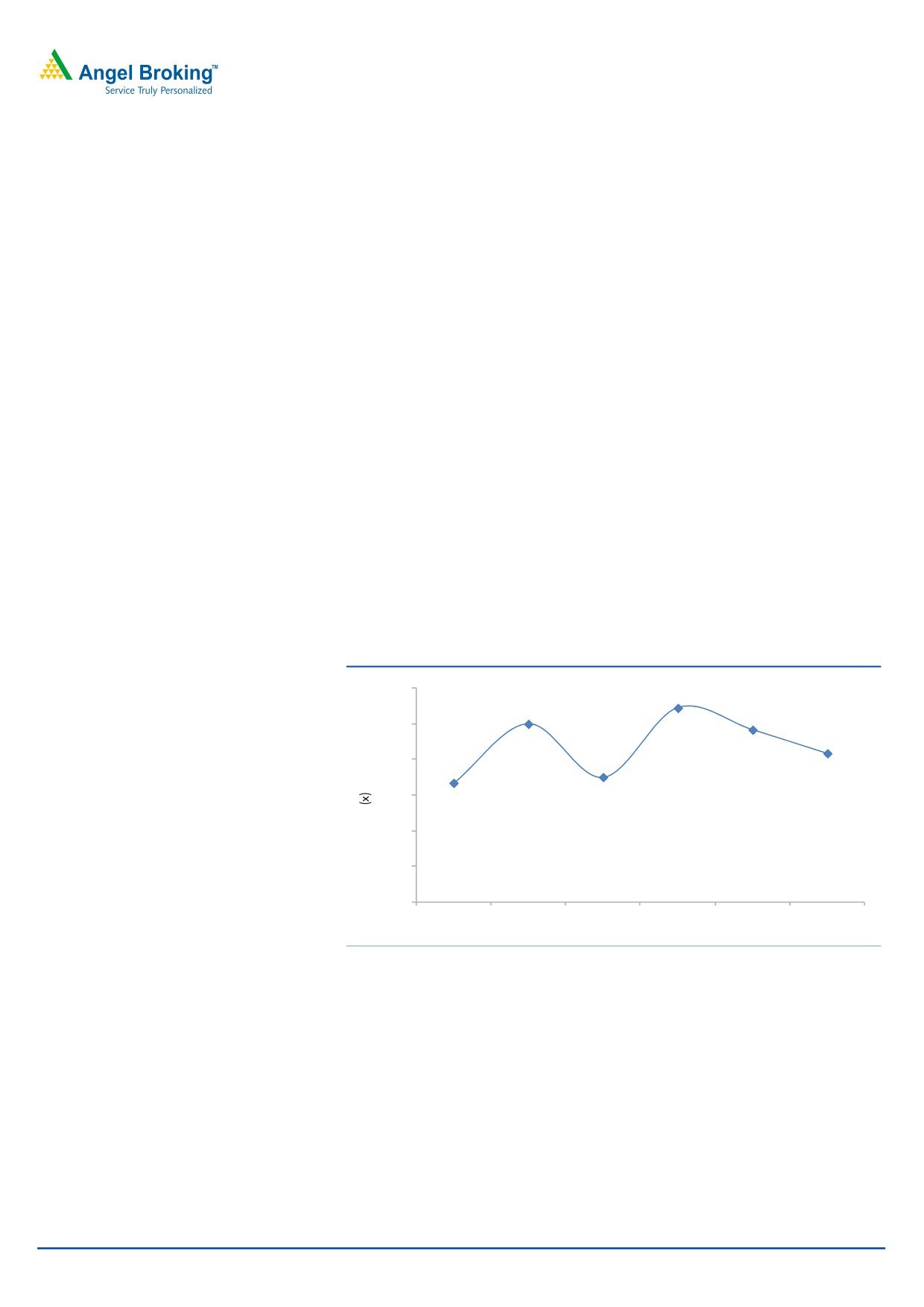

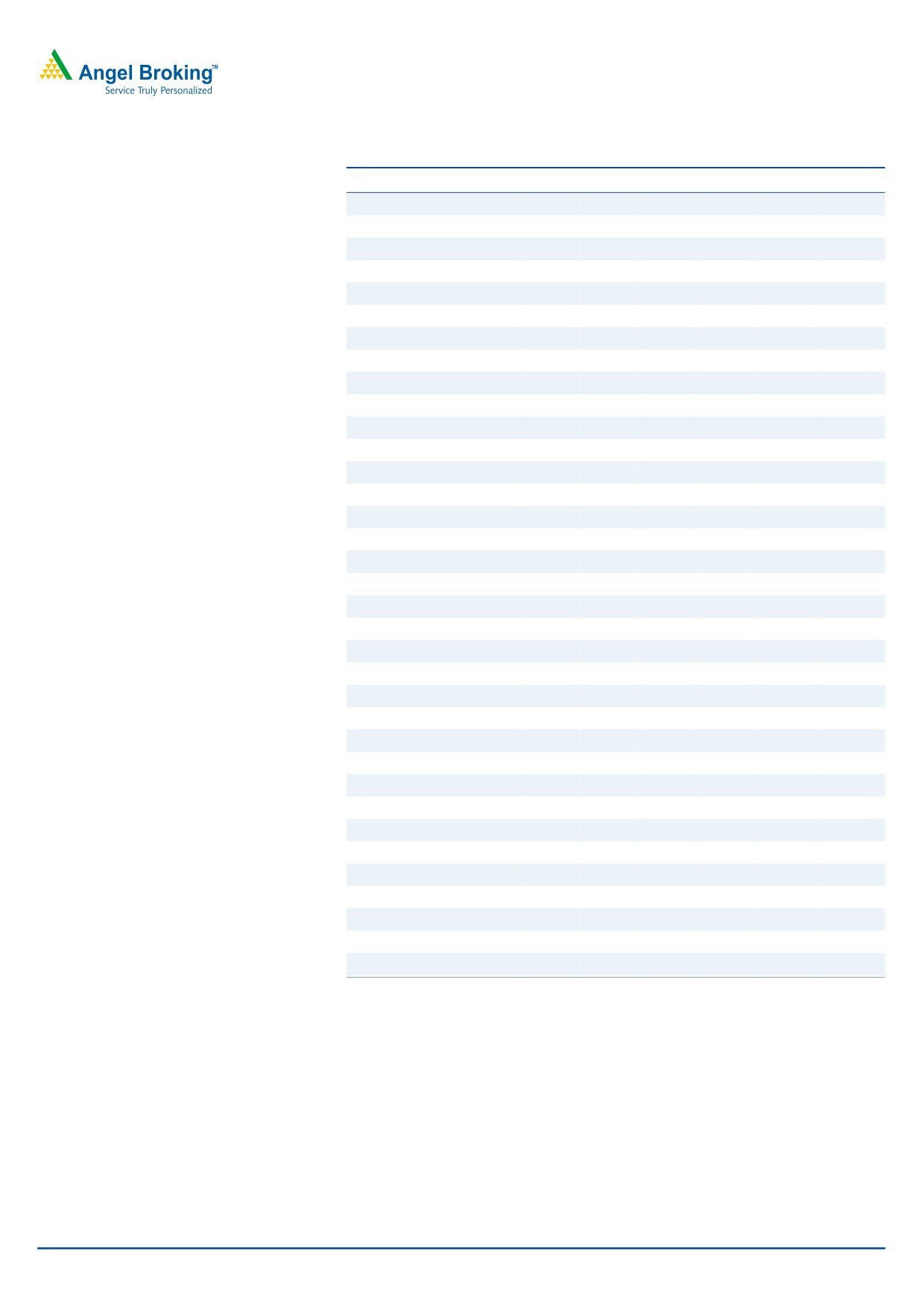

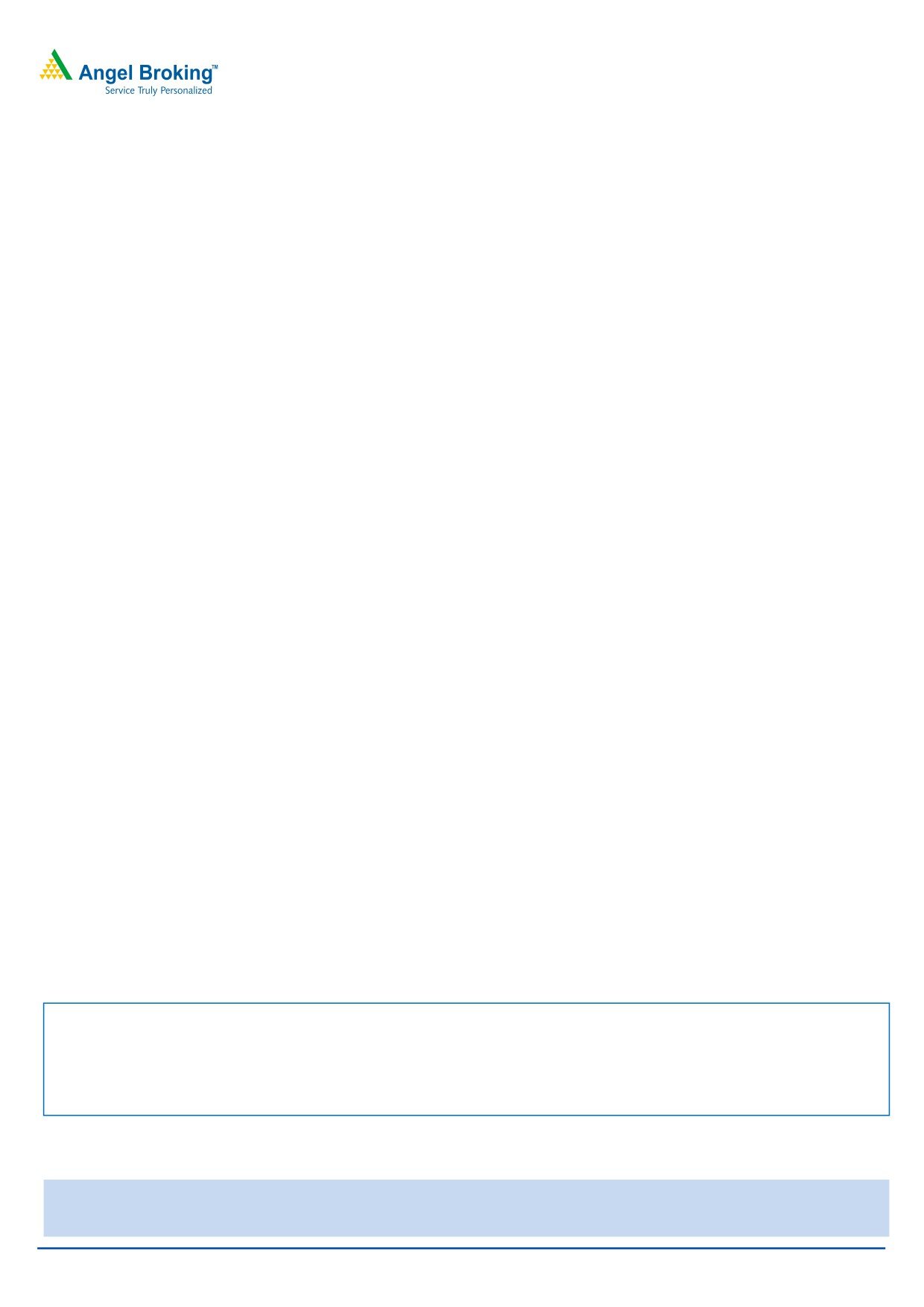

Exhibit 2: Rigorous ad spend for strong brand positioning

200

176

154

160

135

120

110

85

80

70

40

0

FY2009

FY2010

FY2011

FY2012E FY2013E FY2014E

Source: Company, Angel Research, Note: Ad spend includes publicity and promotional activities

The company is also gearing up for the launch of its premium casual brand,

Kruger, which is expected to be in a price band of `999-4,999, competing with

brands such as Tommy Hilfiger (Arvind Ltd. JV) and ColorPlus (Raymond).

International acquisitions - Long-term growth drivers

SKNL extended its presence overseas to European and North American markets by

expanding its brand portfolio to 45 leading brands, catering to various price

points. SKNL acquired Leggiuno in Italy (October 2008) and HMX in the U.S. (May

2009). The company has also signed an 80:20 JV between its wholly owned U.K.

subsidiary, SKNL (U.K.) Ltd., and Louis Vuitton (LVMH) group for the global

menswear license for DKNY brand.

July 11, 2012

2

S. Kumars Nationwide | Initiating Coverage

Acquisition of Leggiuno was a strategic move by SKNL to provide its domestically

produced HVFC fabric an access to leading international brands in the high-end

market along with better sales price realization and higher margins through

Leggiuno, which is a manufacturer of HVFC fabrics. The Indian HVFC plant

currently caters to 30-35% of Leggiuno’s high-value fabric requirement and aims

at supplying 50% in the near future.

HMX is the largest men’s formal wear clothing company in the U.S. and a leading

American producer of luxury apparel. The company is the largest manufacturer

and marketer of men’s suits and coats in the U.S. The company’s brands include

HMX, Hickey Freeman, Misook, Coppley, Austin Reed, Claiborne and Pierre Cardin,

among others. HMX has a broad distribution network of speciality and leading

department stores, value-oriented retailers and direct mail catalogues.

The JV between SKNL’s wholly owned U.K. subsidiary SKNL (U.K.) Ltd. and (80%)

DKNY (20%) gives SKNL the right to design, manufacture/outsource and wholesale

the brand across the globe (except Japan). It also allows SKNL to open its own

retail outlets in countries where there is no existing retail partner.

Exhibit 3: International brands across segments

Segment

Brands

Luxury

Hickey Freeman, Leggiuno

Accessible luxury

HMX, Bobby Jones, JAG Jeans, Exclusively Misook, Coppley, Monarchy

Moderate

Jack Nicklaus Golf, Pierre Cardin, Palm Beach, Sansabelt

Source: Company, Angel Research

All these acquisitions along with the JV were strategic steps taken by SKNL at the

right time, which helped SKNL to get them at a lower cost. With these acquisitions,

SKNL has an access to the global distribution network, which helps it in catering to

customers in the U.S. and Europe. So far, SKNL has been successful in turning

around the business by discontinuing brands that were not able to sustain on their

own. Currently, only HMX, Misook and Hickey Freeman are manufactured in the

U.S. and the remaining are outsourced. Also, SKNL has successfully lowered its

selling and administration expenses for international businesses from US$150mn

at the time of acquisition to US$90mn currently. In FY2012, revenue from the

international business stood at `1,334cr, with EBITDA margin at 4.7%. We expect

revenue from the international business to post a 14.5% CAGR over FY2012-14E

to `1,747cr.

Reid & Taylor IPO - A potential re-rating trigger

SKNL had filed Draft Red Herring Prospectus (DRHP) with SEBI on December 9,

2010, for the listing of Reid & Taylor (74.4% subsidiary) for an expected issue size

of ~`1,000cr. However, the IPO for the same didn’t materialized due to the

unfavorable and volatile market. If going forward, the IPO hits the market; we

expect it to command a premium over SKNL’s valuation because of its strong

brand name, supported by healthy financial and operational efficiency.

July 11, 2012

3

S. Kumars Nationwide | Initiating Coverage

Well-diversified portfolio

SKNL deals in branded products across various price segments, ranging from the

mass level to premium category. The company’s product portfolio ranges from

fabric to ready-to-wear. SKNL is also present in the home textile segment. This

positioning allows the company to capitalize on the consumption patterns of all

segments domestically. In addition, with its overseas acquisitions, the company is

expanding its presence across the globe. The company has a strong brand

portfolio of 45 owned and licensed brands, such as Reid & Taylor, Belmonte,

S Kumars and Carmichael House and international names such as HMX, Hickey

Freeman, Exclusively Misook, Austin Reed, Jag Jeans, Bobby Jones and DKNY.

Exhibit 4: SKNL's diversified portfolio is present across all segments

Fabric

Home textile

Ready-to-wear

Premium

Reid & Taylor/ Baruche Carmichael House Reid & Taylor/ Kruger

Mid-price

Belmonte

-

Belmonte

Economy

S Kumars

-

World Player

Source: Company

Strong historical growth - Foundation for a stable future

Over the past five years (FY2008-12), SKNL (consolidated) has posted a revenue

CAGR of 38.1%, substantially higher than its peers. This was mainly on the back of

changing consumer preferences from the unorganized market towards the

branded market and from textile to ready-to-wear. This shift is providing a major

opportunity (in terms of increasing penetration) to players in the textile industry.

The consumer textile/Belmonte division, a major contributor to the company’s

revenue, witnessed a 28.2% CAGR over FY2008-12. For the same period, the

luxury textile segment posted a 28.5% CAGR and ready-to-wear posted a 51.9%

CAGR. Going forward, we expect growth to normalize with consumer textile, luxury

textile and ready-to-war segments posting a revenue CAGR of 12.9%, 13.7% and

15.6%, respectively, over FY2012-14E.

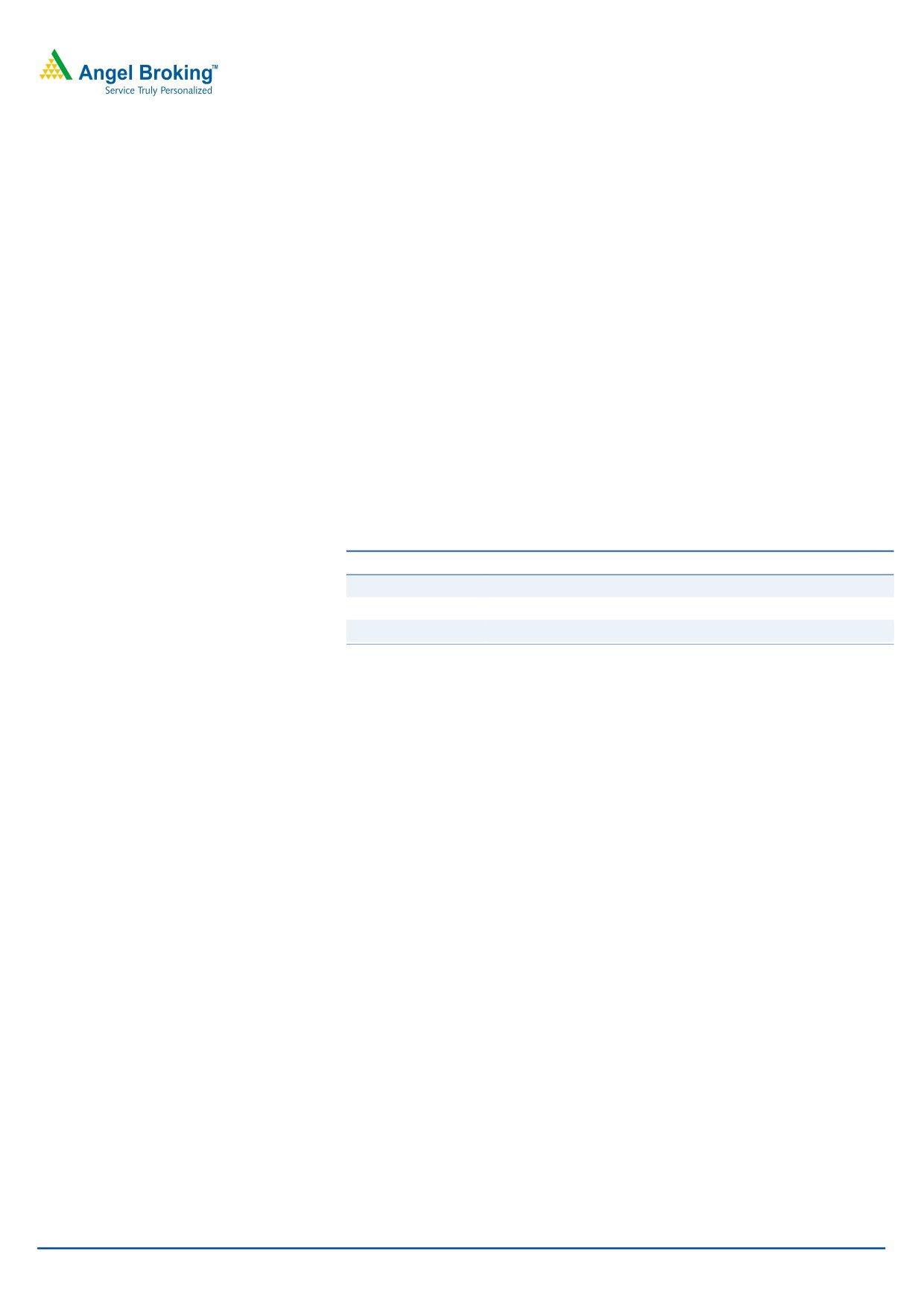

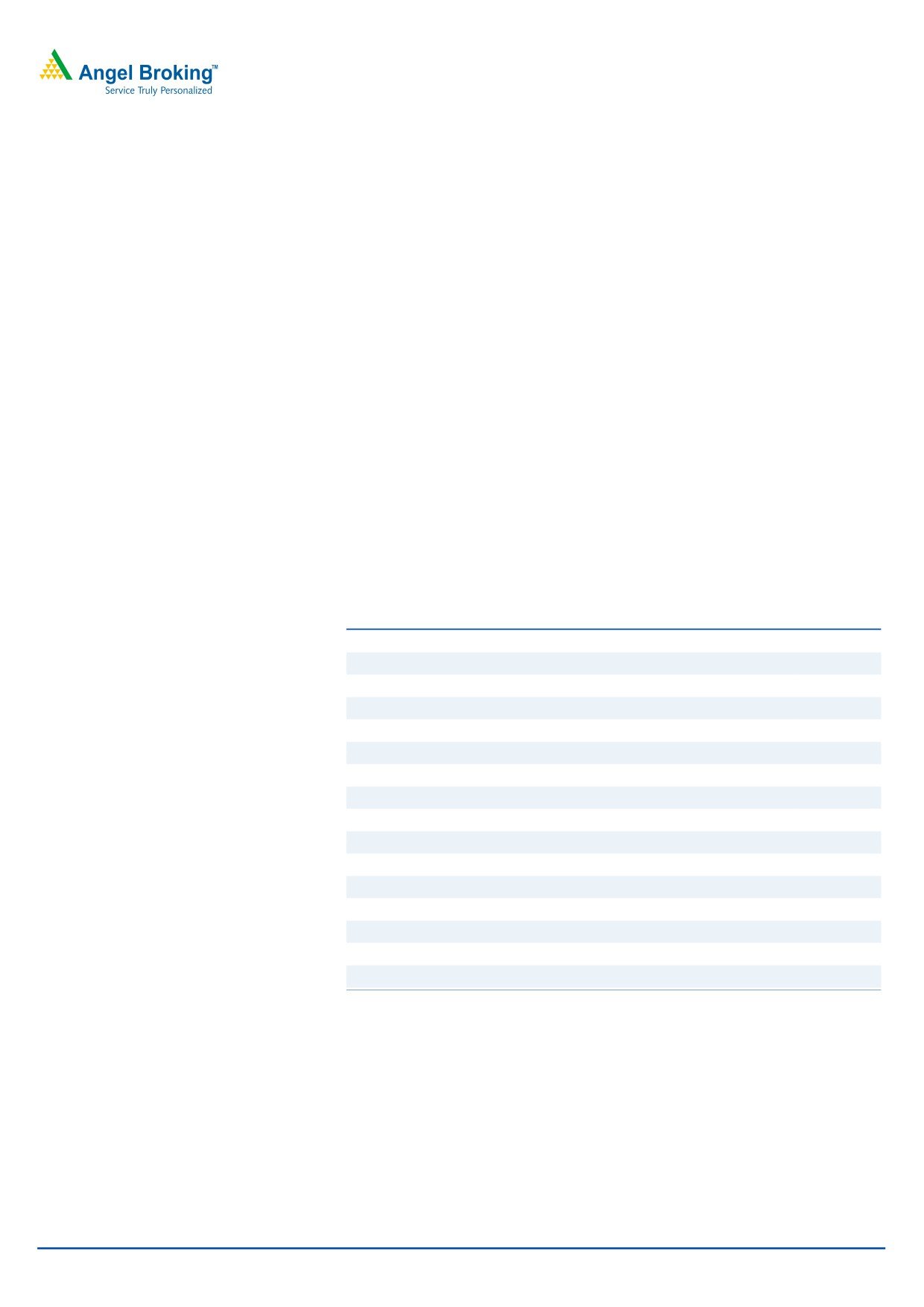

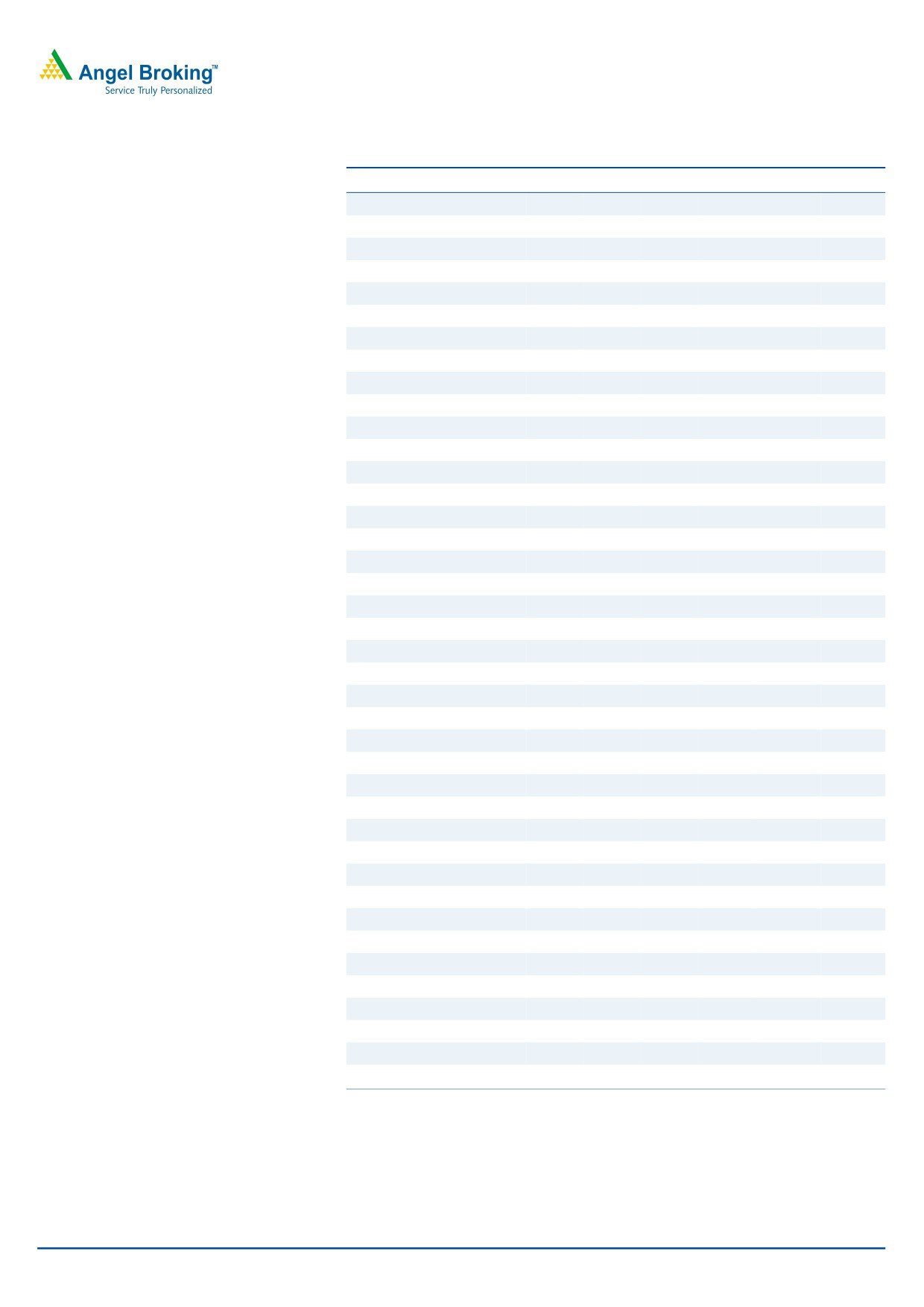

Exhibit 5: Segmental growth

70

60

50

46

40

30

24

20

19

10

0

FY2008

FY2009

FY2010

FY2011

FY2012

Consumer Textiles/Belmonte

Luxury Textiles

Ready to wear

Source: Company, Angel Research

We expect the company’s revenue to normalize and post a CAGR of 14.2% over

FY2012-14E to `8,290cr, aided by changing consumer preferences and the

company’s strong brand positioning. Also, SKNL has maintained its EBITDA margin

at 19.5-22.5% from FY2008 to FY2012. Going ahead, we factor in the same kind of

consistent performance on the margin front and expect it to be 21.0% in FY2014E.

July 11, 2012

4

S. Kumars Nationwide | Initiating Coverage

Conversion of warrants at premium demonstrates confidence

The promoter group company, Sansar Exim Private Limited, which held

1,24,25,000 numbers of equity share warrants allotted on preferential basis issued

on 15th June, 2010 converted the warrants into equity shares at `63.5, at a

premium of

109% from the market price

(`30.4) on

13th Dec,2011, thus

increasing the promoter’s stake by 1.7% yoy in FY2012. This is a positive signal for

investors, as it demonstrates the confidence of promoters in the company’s future

growth outlook.

July 11, 2012

5

S. Kumars Nationwide | Initiating Coverage

Financials

SKNL’s financials (Standalone)

Exhibit 6: Key assumptions

2013E

2014E

Average volume growth (%)

10.2

10.2

Average realization growth (%)

4.1

3.9

Source: Company, Angel Research

Demand for branded fabrics and readymade garments to drive revenue

We expect demand for branded fabrics and apparels to grow in future,

as consumers’ preference has shifted from the unorganized market towards the

branded market and from textile to ready-to-wear. Also the company’s strong

brand positioning and its strategically planned growth strategy, which includes -

1) rollout of additional exclusive brand outlets for Reid & Taylor (~160 stores),

Kruger and Belmonte to expand their distribution and franchisee networks,

2) set up a shirts factory to improve margins by offering readymade products,

3) scale up capacity utilization at BSFC and 4) capacity expansion in the luxury and

mid-premium textile segments, are expected to be the company’s growth drivers.

We expect SKNL’s (standalone) revenue to normalize and post a decent CAGR of

14.6% over FY2012-14E from `3,511cr in FY2012 to `4,609cr in FY2014E.

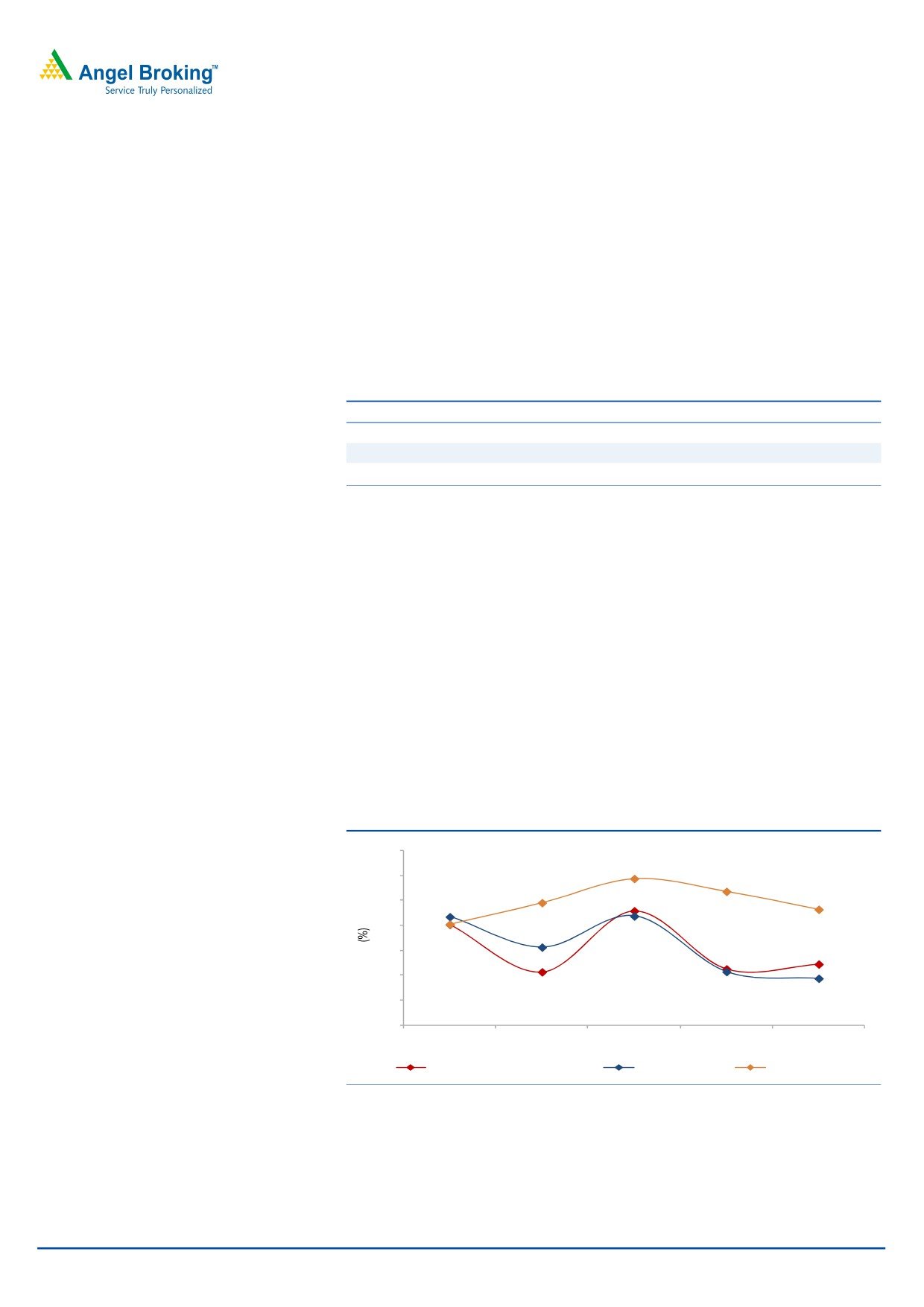

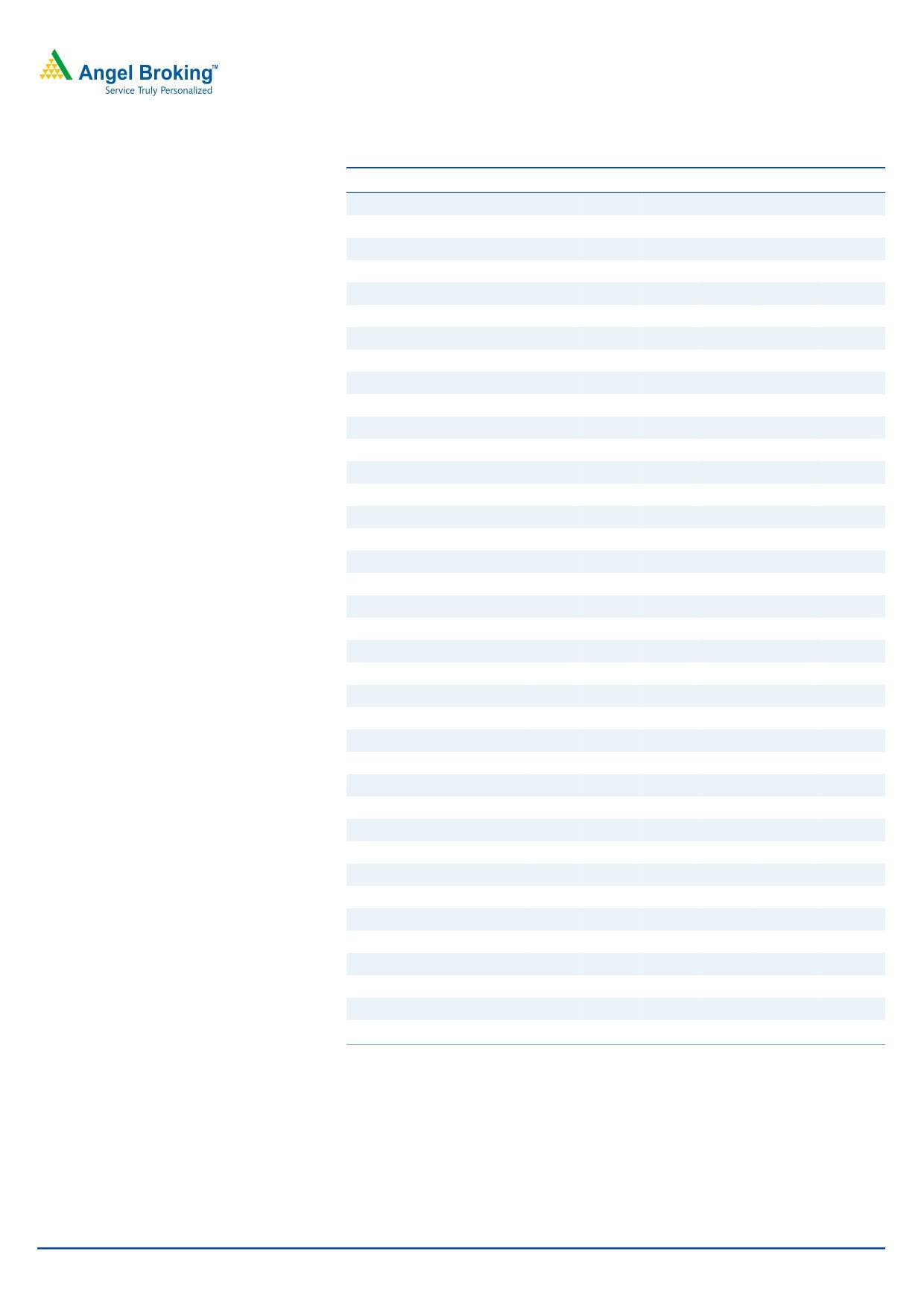

Exhibit 7: Changing consumer preferences and growth strategies to drive revenue

5,000

4,609

50

4,027

4,000

40

39.0

3,511

3,000

2,757

30

2,155

28.0

27.3

2,000

14.7

20

1,000

14.5

10

-

0

FY2010

FY2011

FY2012

FY2013E

FY2014E

Revenue (LHS)

Revenue growth (RHS)

Source: Company, Angel Research

July 11, 2012

6

S. Kumars Nationwide | Initiating Coverage

We expect the company’s operating margin to remain flat over FY2012-14E at

22.1%. Going forward, the relative increase in interest outgo for the company is

expected to come down substantially to ~10% as compared to ~29% in last two

years, assuming the interest rate to be stable at 16.6% and debt to increase by

10%, each for FY2013E and FY2014E. Bottom-line growth on a yoy basis was

muted in FY2012 at 3.9%, mainly because of higher tax outgo, as the company

lost the MAT credit entitlement in FY2012. The effective tax rate for FY2012 was

35.7%, which we expect would come down to the normal level of 33.0% in the

coming years. Aided by the above-mentioned factors, we expect SKNL’s profit to

post a 23.7% CAGR over FY2012-14E to `275cr.

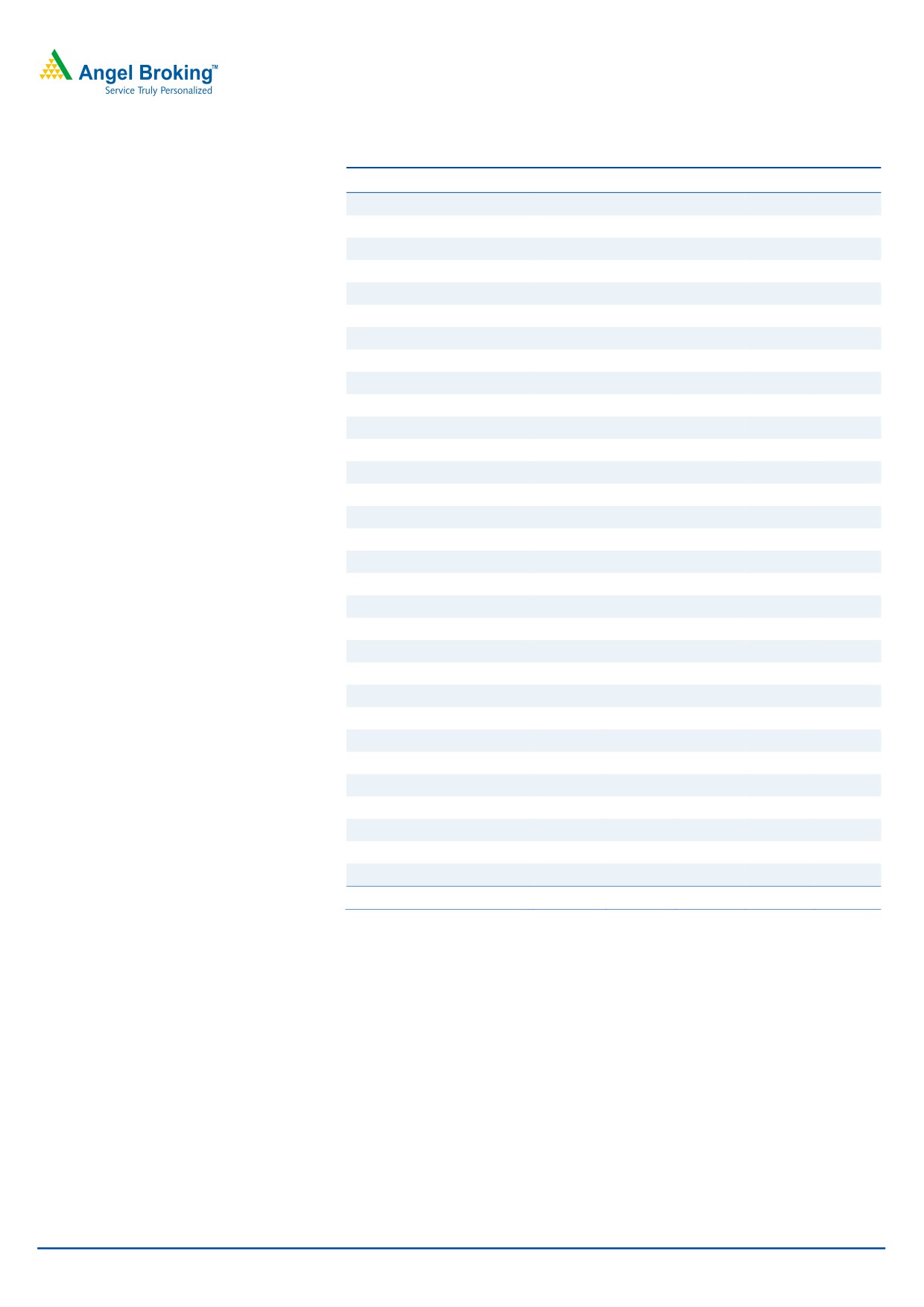

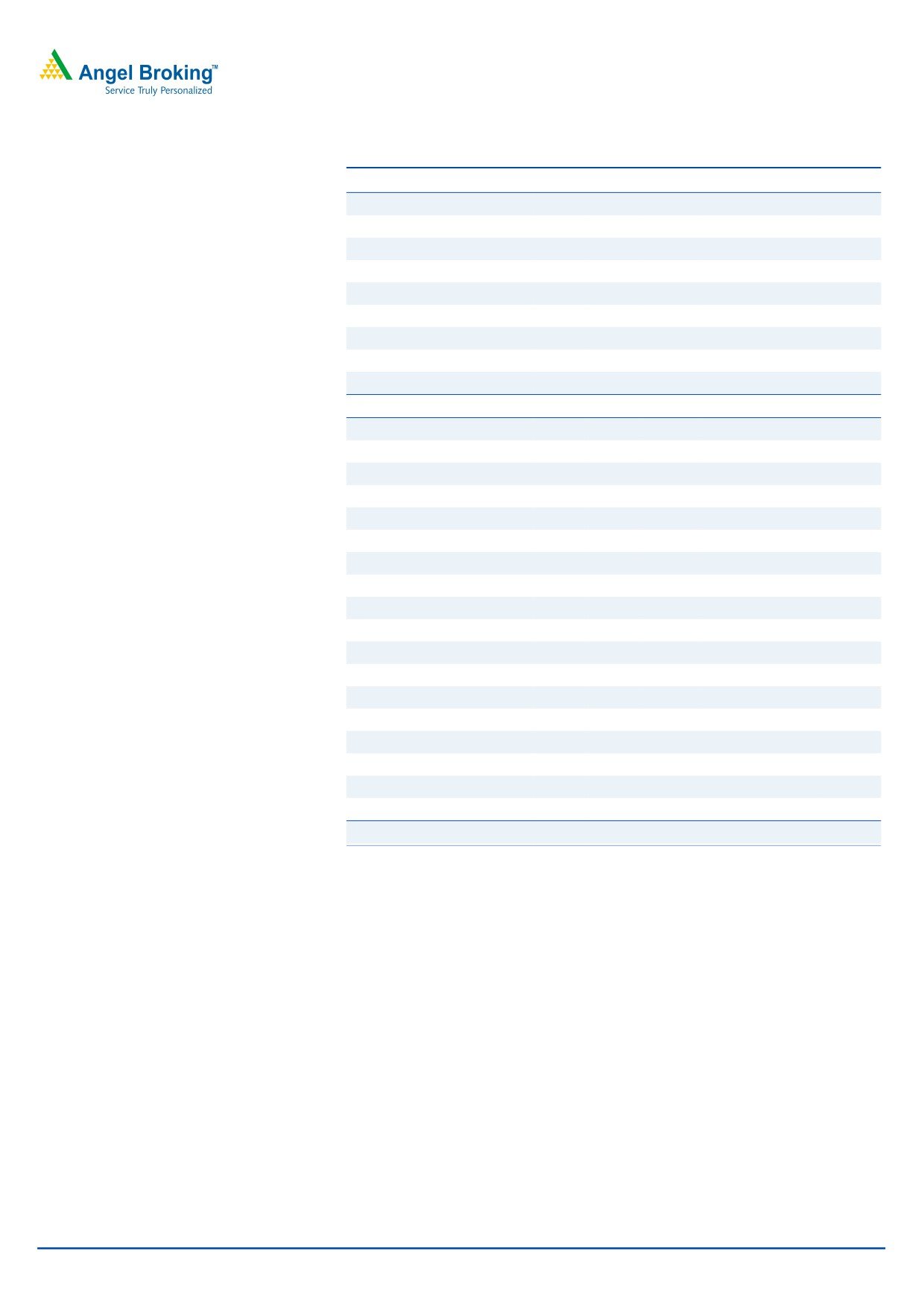

Exhibit 8: EBITDA margin to remain flat

Exhibit 9: PAT margin to improve

1,200

24

300

7

6.3

275

1,017

5.6

6

1,000

888

250

5.1

6.0

773

5.1

5

800

22

200

226

586

173

180

22.0

22.1

22.1

4

600

150

422

21.3

110

3

400

20

100

2

200

19.6

50

1

0

18

0

0

FY2010

FY2011

FY2012

FY2013E

FY2014E

FY2010

FY2011

FY2012

FY2013E

FY2014E

EBITDA (LHS)

EBITDA Margin (RHS)

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Reid & Taylor’s financials

We expect Reid & Taylor’s revenue to post a 15.2% CAGR to `1,911cr over

FY2011-14E, driven by strong brand name and increasing demand for branded

apparel in the urban market. Operating margin is expected to be flat at 32.7% for

FY2014E. In FY2012, the tax outgo was lower on account of excess provision for

tax in earlier years, which was a one-time benefit for the company. We expect the

company’s profit to register a 9.7% CAGR over FY2011-14E to `320cr.

Consolidated financials of SKNL

We expect SKNL (consolidated) to post a revenue CAGR of 14.2% to `8,290cr over

FY2012-14E, with an operating margin of

21.0% in FY2014E. The major

contributor to the revenue is the consumer textile segment (`3,084cr), followed by

the international business (`1,747cr) and the luxury textile segment (`1,426cr).

We expect the company to report profit of `524cr, registering a 15.2% CAGR over

FY2012-14E.

July 11, 2012

7

S. Kumars Nationwide | Initiating Coverage

Exhibit 10: SBU’s contribution to consolidated results

SBUs

FY2010

FY2011

FY2012

FY2013E

FY2014E

Consumer textiles/Belmonte

Net Sales

1,585

1,942

2,418

2,730

3,084

% chng

45.9

22.6

262.1

12.9

13.0

EBITDA

329

436

555

628

709

EBITDA margin

20.8

22.5

23.0

23.0

23.0

Luxury textiles

Net Sales

765

929

1,103

1,252

1,426

% chng

43.8

21.5

255.5

13.5

13.9

EBITDA

281

355

421

478

544

EBITDA margin

36.7

38.2

38.2

38.2

38.2

Ready-to-wear

Net Sales

397

610

894

1,034

1,194

% chng

58.8

53.7

234.8

15.6

15.5

EBITDA

84

129

183

209

240

EBITDA margin

21.1

21.2

20.5

20.2

20.1

Home textiles

Net Sales

386

426

462

524

590

% chng

13.4

10.5

259.1

13.6

12.6

EBITDA

69

72

80

90

101

EBITDA margin

17.9

16.8

17.2

17.2

17.2

Luxury cotton

Net Sales

16

111

183

226

249

% chng

607.8

258.3

23.6

10.2

EBITDA

1

21

46

56

62

EBITDA margin

3.3

18.8

25.0

25.0

25.0

International business

Net Sales

714

1,328

1,334

1,514

1,747

% chng

85.9

350.3

13.5

15.4

EBITDA

10

44

62

70

82

EBITDA margin

1.4

3.3

4.7

4.7

4.7

Intercompany

(1.8)

(124.1)

(28.7)

-

-

Total

3,861

5,223

6,364

7,279

8,290

Source: Company, Angel Research

July 11, 2012

8

S. Kumars Nationwide | Initiating Coverage

Outlook and valuation

SKNL has a well-planned growth strategy, following which it has set up a suit

factory at Bangalore, which commenced operations at the end of 3QFY2012.

The company further plans to - 1) rollout additional exclusive brand outlets for

Reid & Taylor (~160 stores), Kruger and Belmonte to expand its distribution and

franchisee networks, 2) set up a shirts factory to improve margins by offering

readymade products, 3) scale up capacity utilization at BSFC and 4) capacity

expansion in the luxury and mid-premium textile segments. Considering all these

factors, we expect SKNL’s consolidated revenue to post a 14.2% CAGR to `8,290cr

and profit to post a 15.2% CAGR to `524cr over FY2012-14E.

GIC had invested `900cr in Reid & Taylor in July 2008 for a 25.6% stake, which

gives a value of `2,614cr for the 74.4% stake of SKNL. On a conservative basis,

discounting SKNL’s stake in Reid & Taylor by 70%, its value in Reid & Taylor would

be `784cr. Assuming PE of 2x for SKNL (standalone) for FY2014E, we get a value

of

`549cr. Thus, the net value of SKNL would be

`1,334cr, including

Reid & Taylor’s stake, while the company currently has a market cap of `1,008cr.

Currently, at

`34, SKNL (standalone) is trading at PE of

3.7x; and on a

consolidated basis, it is trading at 1.9x for FY2014E. We initiate coverage on SKNL

with a Buy recommendation and an SOTP target price of `45.

Exhibit 11: Valuation

GIC investment in Reid & Taylor (` cr) (in 2008)

900

GIC's stake (%)

25.6

SKNL's stake in Reid & Taylor (%)

74.4

Value of SKNL's stake in Reid & Taylor (` cr)

2,614

Value after discounting stake by 70% (`cr)

784

SKNL's standalone PAT (FY2014E) (` cr)

275

Target PE (x)

2

Expected mcap (` cr)

549

Net value of the company (SKNL standalone + Reid & Taylor value)

1,334

Existing no. of shares (cr)

30

SKNL's current Mcap (`cr)

1,008

CMP

34

Expected CMP (`)

45

Upside (%)

32

Source: Company, Angel Research

July 11, 2012

9

S. Kumars Nationwide | Initiating Coverage

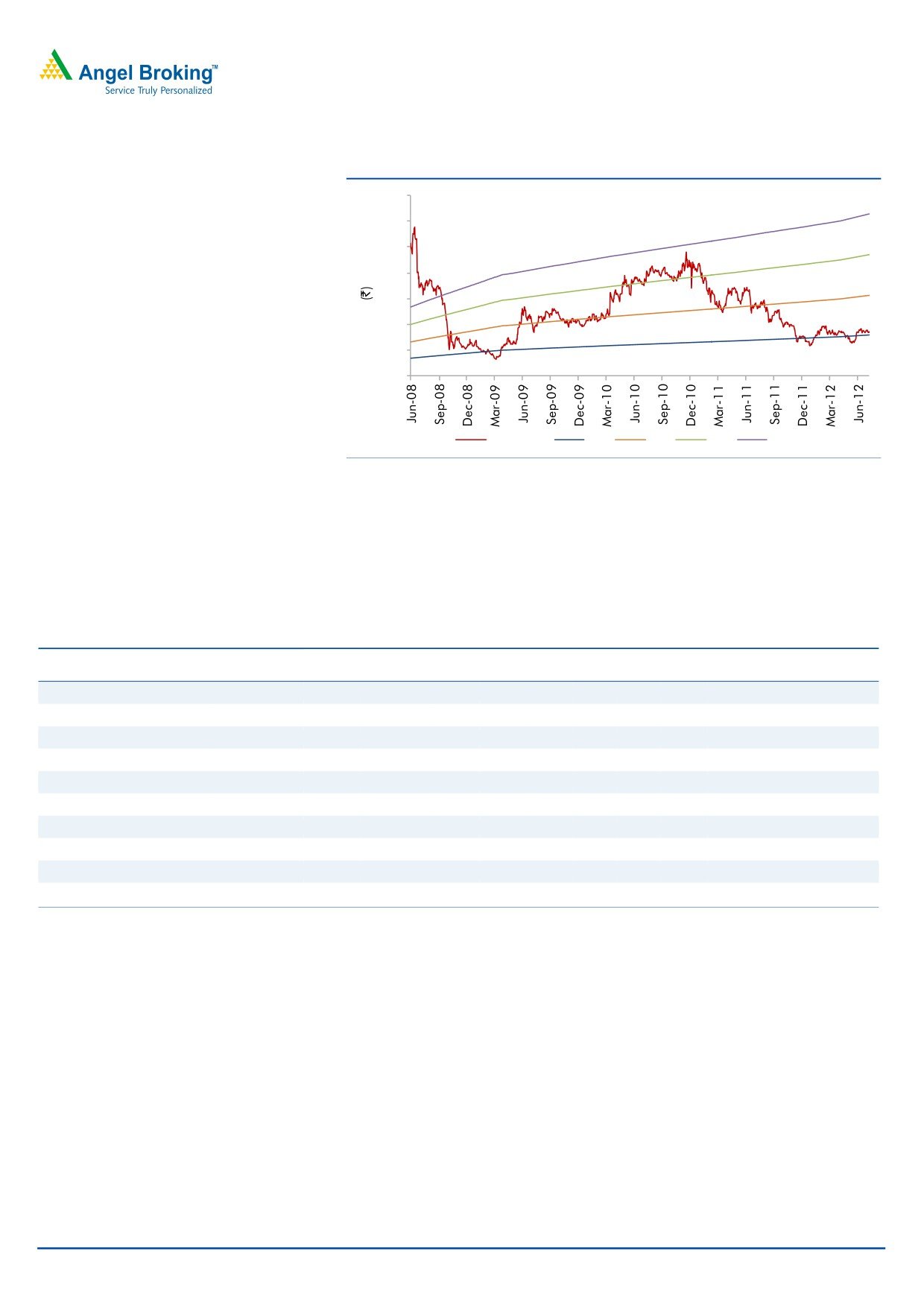

Exhibit 12: One-year forward PE band

140

120

100

80

60

40

20

0

Price (`)

2x

4x

6x

8x

Source: Company, Angel Research

Peer comparison on various parameters

On FY2014E basis, SKNL (consolidated) is trading at PE of 1.9x, which looks

attractive vis-à-vis its peers. The operating margin of the company is expected to

be 21.0% for FY2014E, which is higher than the operating margin of Arvind Ltd.

and Raymond.

Exhibit 13: SKNL trading at a discount vs. domestic textile industries

Mcap

Sales

OPM

PAT

EPS

RoE

P/E

P/BV

EV/Sales

EV/EBITDA

Company

Year

(` cr)

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

SKNL - Standalone

FY2013E

1,008

4,027

22.1

226

7.6

13.7

4.5

0.6

0.8

3.5

FY2014E

1,008

4,609

22.1

275

9.2

14.8

3.7

0.5

0.7

3.3

SKNL - Consolidated

FY2013E

1,008

7,279

21.0

447

15.0

13.7

2.3

0.3

0.7

3.4

FY2014E

1,008

8,290

21.0

524

17.6

13.9

1.9

0.2

0.7

3.2

Alok Industries*

FY2013E

1,458

11,218

25.0

479

5.8

16.4

3.0

0.4

1.1

4.4

FY2014E

1,458

12,342

25.2

665

8.0

17.4

2.2

0.4

1.0

3.9

Arvind Ltd.*

FY2013E

1,977

5,372

12.9

294

11.6

13.2

6.7

0.9

0.7

5.6

FY2014E

1,977

5,968

13.5

393

15.4

15.3

5.0

0.7

0.7

4.8

Raymond*

FY2013E

2,455

4,077

10.8

189

30.8

13.1

13.0

1.6

0.9

6.3

FY2014E

2,455

4,630

11.4

236

38.4

14.6

10.4

1.4

0.8

5.5

Source: Company, Angel Research; Note: * Bloomberg estimates

In the ready-to-wear segment, SKNL faces competition from branded competitors

such as Arvind Mills (Arrow), Aditya Birla Nuvo Brands (Louis Philippe, Allen Solly

and Van Heusen) and Raymond Apparel (Park Avenue).

July 11, 2012

10

S. Kumars Nationwide | Initiating Coverage

Concerns

Economic slowdown

According to industry reports, the current size of the domestic textile and apparel

market is US$77bn (2010). The market is expected to post a CAGR of 11% to

UD$220bn over FY2010-20E, mainly driven by increasing disposable income and

awareness in the mass market (i.e. rural India) about branded fabrics and

garments. However, any slowdown in the economy may adversely affect demand

and, hence, the company’s revenue.

Further postponement of Reid & Taylor IPO

SKNL had filed DRHP with SEBI on December 9, 2010, for the listing of

Reid & Taylor. However, the IPO for the same didn’t materialized due to the

unfavorable and volatile market. If the IPO is delayed further, it may be a concern

for the company as Reid & Taylor’s IPO is a major re-rating trigger for SKNL.

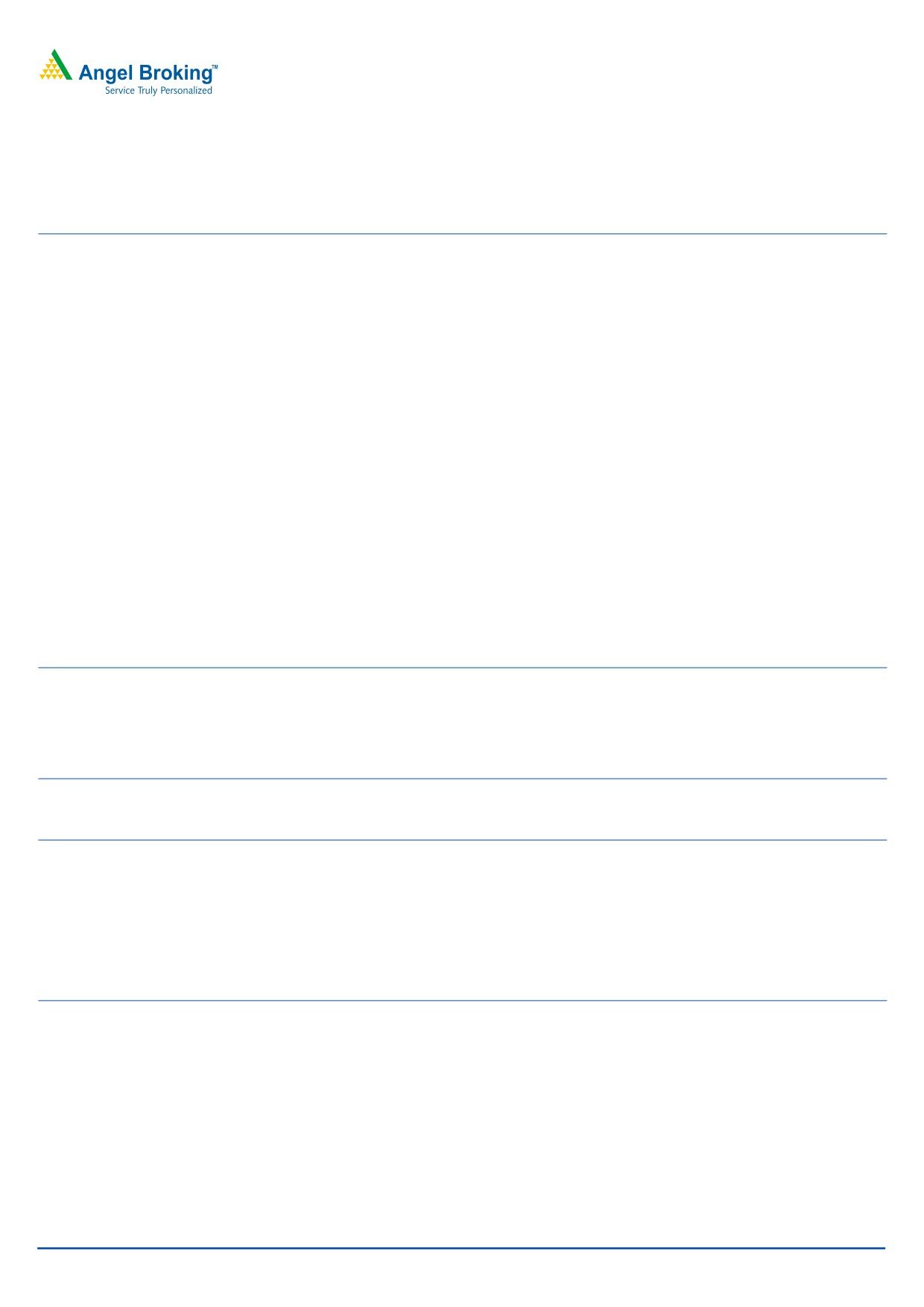

High net debt to equity level

Owing to the acquisitions and expansion activities, the net debt to equity for SKNL

(consolidated) has been at high levels in previous years. However, the

management expects the debt level to come down in the coming years as the

investments start yielding profits. However, if that doesn’t happen, it may be a

concern for the company going forward.

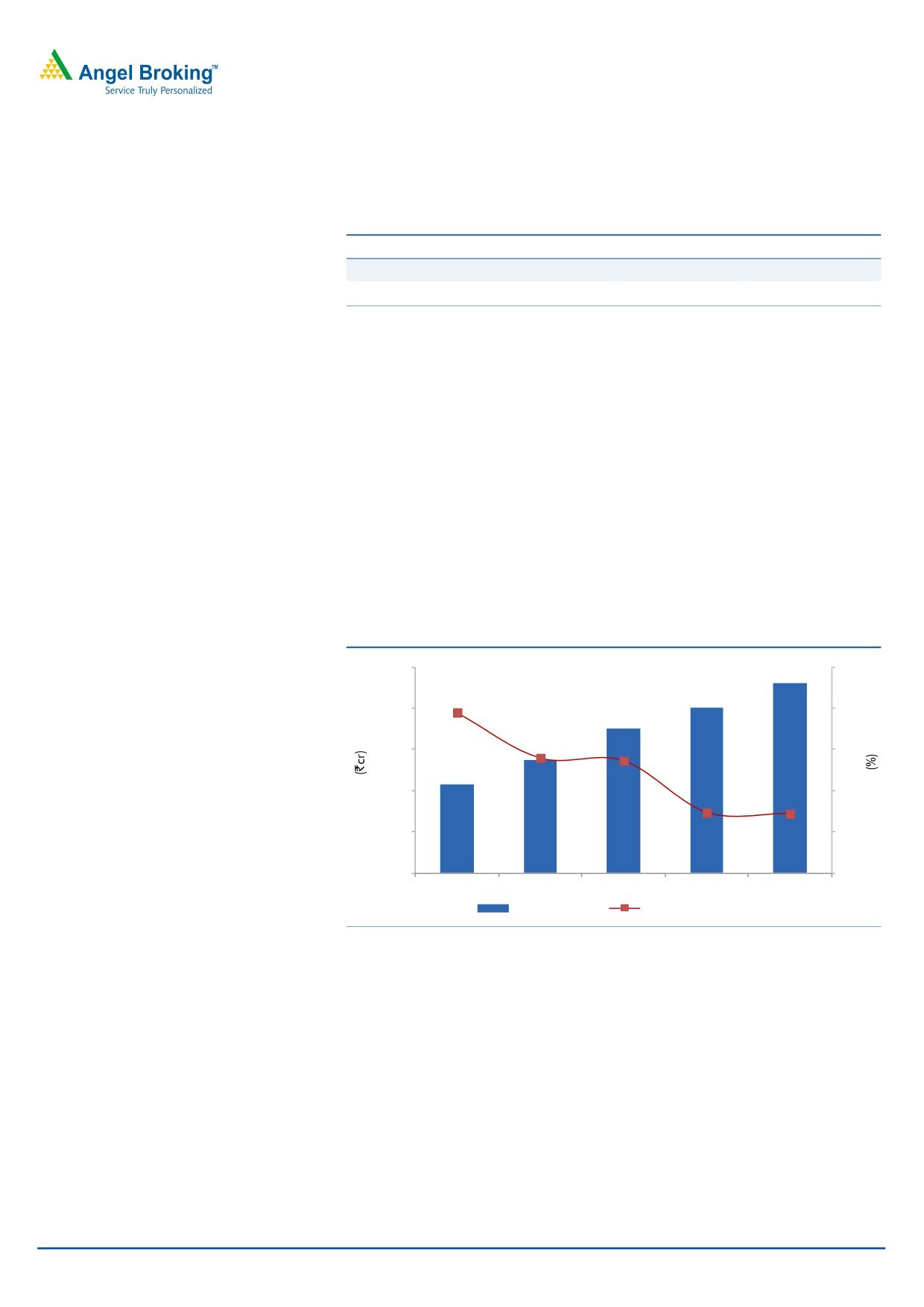

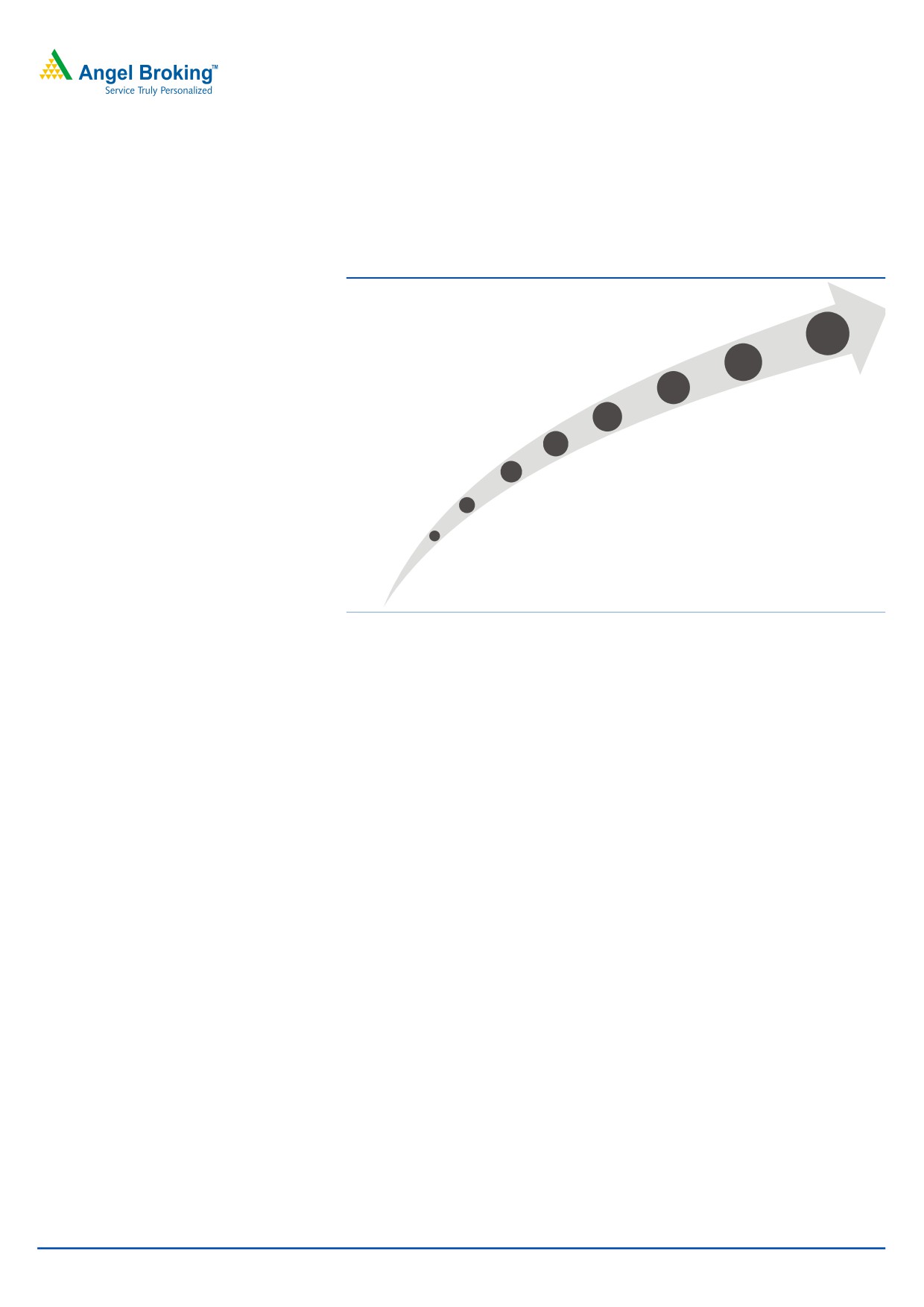

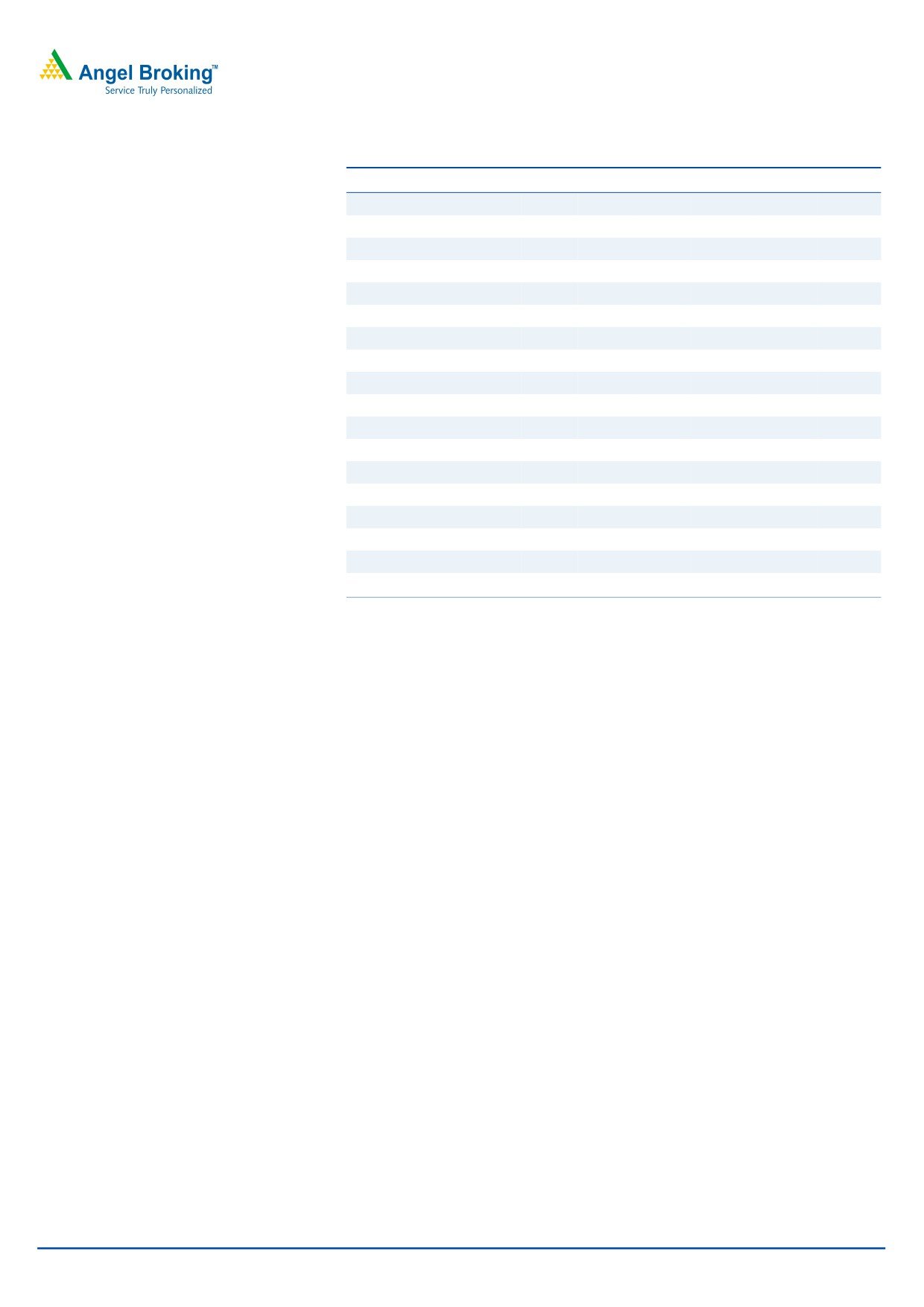

Exhibit 14: Net debt to equity level (consolidated)

1.30

1.24

1.20

1.20

1.12

1.18

1.10

1.00

1.05

1.03

0.90

0.80

0.70

FY2009

FY2010

FY2011

FY2012E FY2013E FY2014E

Source: Company, Angel Research

July 11, 2012

11

S. Kumars Nationwide | Initiating Coverage

Company background

S. Kumars Nationwide Ltd.

SKNL is one of the leading textile and apparel companies in India, which is

involved in the manufacturing, marketing and distribution of polyester blended

suitings, worsted suitings, workwear fabric, home textiles and ready-to-wear

garments. The company’s main growth drivers include its strong brand positioning,

diverse product portfolio that caters to all socioeconomic segments, vertically

integrated business model, presence across the value chain and contemporary

product offerings. SKNL is a market leader in the uniforms segment, with a 30%

market share. In addition, the company is the second largest player in the worsted

suiting segment. Further, SKNL is one of the largest institutional suppliers of textiles

to defense and police forces in India. The company is also a leader in the formal

wear segment in North America with popular brands, Coppley, HMX and Hickey

Freeman.

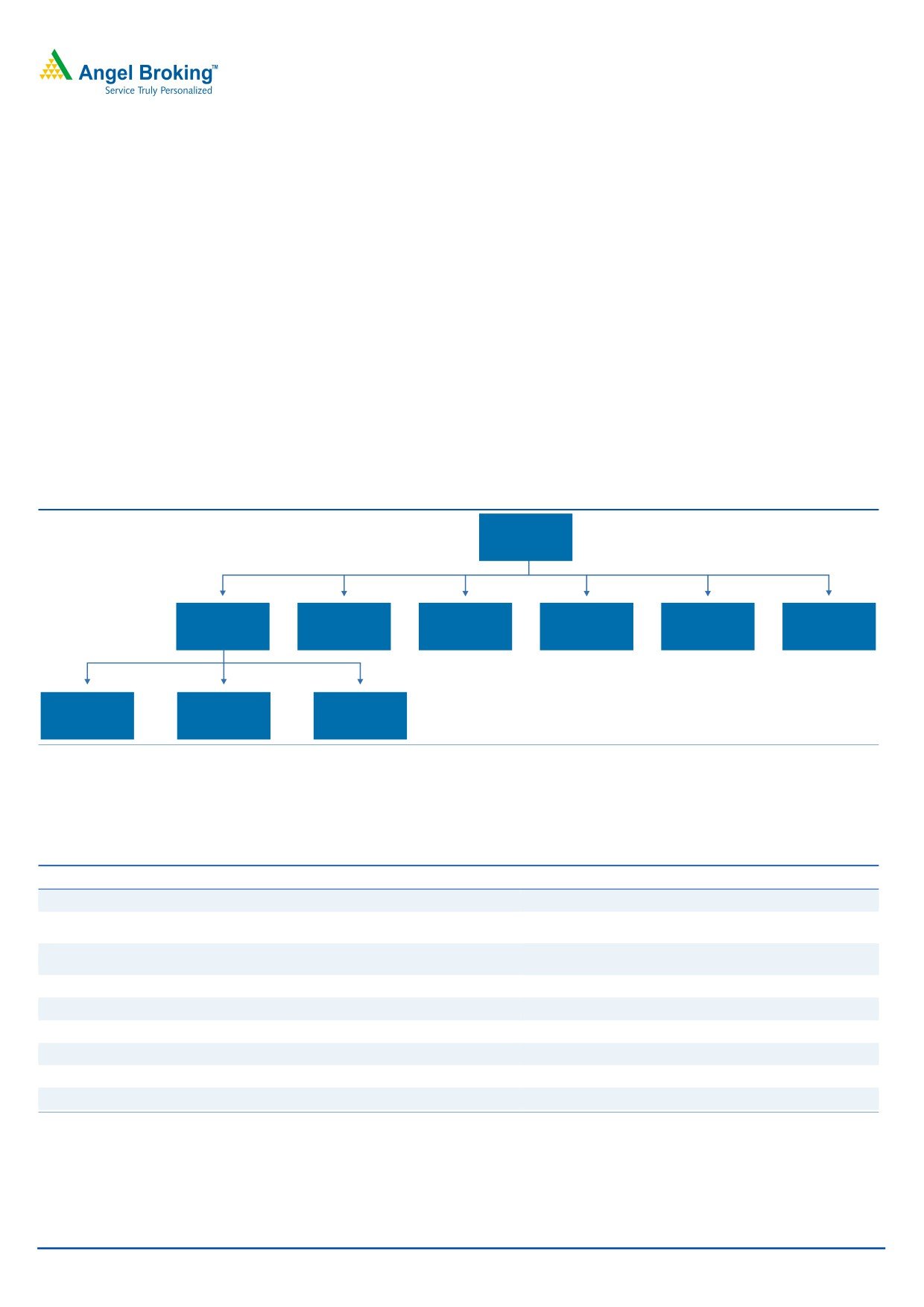

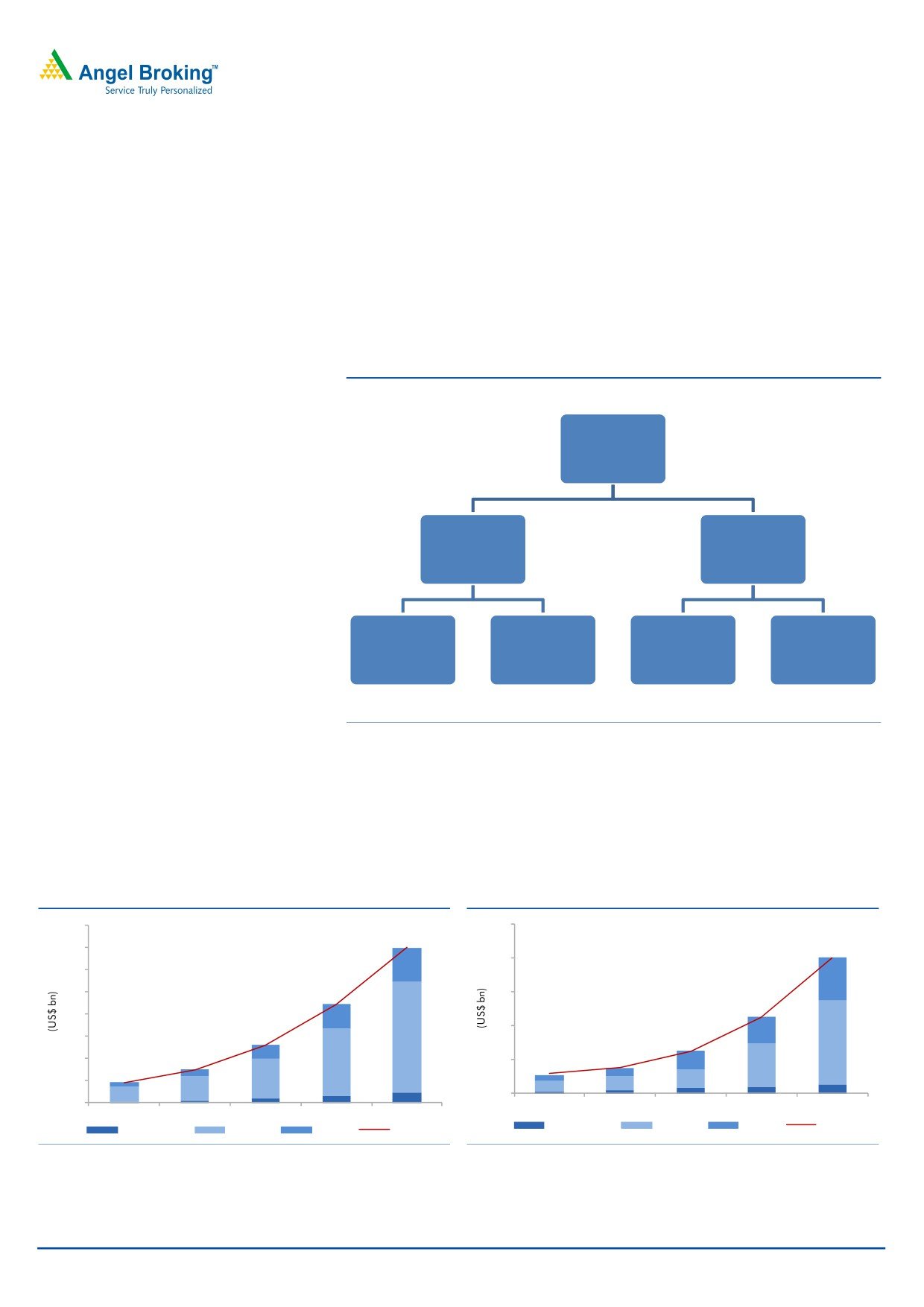

Exhibit 15: Corporate structure

SKNL

100%

100%

100%

100%

100%

74.4%^

SKNL

Total

Luxury

Home

Reid & Taylor

Belmonte

International

Wardrobe

Cotton

Textile

100%

100%

80%*

Leggiuno

HMX

SKNL

Italy

USA

U.K.

Source: Company, Angel Research; Note: ^ 25.6% owned by GIC; * 20% owned by LVMH

The company has manufacturing units located in India, Italy, U.K., U.S. and

Canada with cost-effective outsourcing.

Exhibit 16: SKNL's manufacturing units

Plant and location

Location

Products

Reid & Taylor Suiting Unit

Mysore, Karnataka

Worsted Suiting, Premium P/V Blended Suiting

Uniforms, Work Wear Fabrics, Polyester & Polyester -

S. Kumars Suiting Unit

Dewas, Madhya Pradesh

Viscose Blended Suitings

Polyester Blended Yarn, Grey Fabrics(PV,PC,100% Cotton)

Home Textile Chamunda Standard Mills

Dewas, Madhya Pradesh

Medium Value Cotton

Total Wardrobe Solutions

Bengaluru, Karnataka

Shirts, Trousers, Blazers, Suits & Other Accessories

Home Textiles

Jhagadia, Gujarat

Home Textiles

HVFC

Jhagadia, Gujarat

High Value Fine Cotton Shirting

Leggiuno

Italy & U.K.

Luxury Cotton Shirting & Woolen Fabrics

HMX

Illinois & New York, U.S.

Tailored Products

Coppley

Hamilton, Canada

Tailored Products

Source: Company, Angel Research

July 11, 2012

12

S. Kumars Nationwide | Initiating Coverage

SKNL’s SBUs

SKNL operated under six SBUs, Consumer textile, Luxury textile, Ready-to-wear,

Home textile, luxury cotton and international business.

1. Consumer Textiles/Belmonte

The consumer textile division addresses to the economy and mid-price strata of the

society and deals in fabrics for work wear, uniforms and daily wear. This division is

the major contributor to the company’s overall growth over years and is improving

with further market penetration.

Uniformity, the work wear division of Belmonte, is the market leader in the uniform

segment with a 30% market share and is one of the largest institutional suppliers

of textiles to defense and paramilitary forces in India.

2. Luxury textiles

The luxury textiles division primarily comprises Reid & Taylor, which targets the

premium segment of the Indian fabric market. The luxury textiles segment

continues to be a prime revenue driver, reporting consistent growth over time.

Being a premium segment caterer, this segment is the last to get affected with any

rise in raw-material prices and has seen good growth on the back

of expanding volumes and better realizations in polyester-wool as well as

polyester-viscose fabrics.

3. Ready-to-wear

Ready-to-wear consists of garments/apparel represented by Reid & Taylor,

Belmonte and World Player. Ready-to-wear is the fastest growing segment in the

textile and apparel market because of changing consumer preferences. The

company also plans to launch brand ‘Kruger’ under premium category to capture

high margins.

4. Home textiles / Carmichael House / Total Home Expression

This segment manufactures and markets home textiles, such as bed sheets and

sheeting fabrics. The segment is witnessing a rise in demand because of increasing

disposable income and consumers’ shift towards luxury brands.

5. Luxury cotton / HVFC (High Value Fine Cotton)

This segment focuses on the HVFC market for shirting, bottoms and home textiles.

This division operates the 12.8mn meters per year state-of-the-art HVFC facility at

Bharuch, Gujarat (operating at

70% capacity utilization

- 4QFY2012).

The segment is represented by the premium category brand, Baruche.

6. International business

SKNL has expanded its global footprints by acquiring HMX in the U.S. and

Leggiuno in Italy. The company has also signed an 80:20 JV between its wholly

owned U.K. subsidiary, SKNL (U.K.) Ltd., and LVMH group, for the global

menswear license for DKNY brand.

July 11, 2012

13

S. Kumars Nationwide | Initiating Coverage

Vertically integrated system and strong distribution channel

SKNL operates through a vertically integrated operational system, which facilitates

its presence across the value chain and captures higher margin. The company’s

presence across the supply chain allows it to operate in a more systematic way.

Exhibit 17: Presence across the supply chain

Retail

Wholesale

Garmenting

Finishing

Weaving

Spinning

Preparatory

Processes

Procurement

of Taw Fibre

Source: Company, Angel Research

In addition, SKNL has a well-entrenched distribution channel, which gives it an

edge over other players in terms of reach. The company has an extensive

distribution network consisting of multi-brand outlets (more than 30,000 retailers

serviced by a network of over 400 wholesalers), exclusive brand outlets and large

format stores. The company is further focused on expanding its distribution

franchisee networks by adding more exclusive brand outlets for Reid & Taylor,

Kruger and Belmonte as part of its growth strategy.

World Player - New card in the product portfolio deck

World Player, SKNL’s economy brand under SKumars’ apparel segment, is a total

wardrobe solution, ranging from shirts, trousers, jeans to knitwear. The company

has chosen Sachin Tendulkar as its brand ambassador. The company has currently

launched it in four states of Southern India and plans to extend its presence across

India by having it in 650 districts. Through this brand, SKNL is poised to access the

mass market of India, which is a huge market in terms of volume and is

increasingly becoming brand conscious. The average selling price of shirts under

this brand ranges from `270 to `500.

July 11, 2012

14

S. Kumars Nationwide | Initiating Coverage

Reid & Taylor

Reid & Taylor, a 74.4% subsidiary of SKNL, is the flagship brand of the company.

The remaining 25.6% is owned by the Government of Singapore Investment

Corporation (Ventures) Pte. Ltd. (GIC). In July 2008, GIC invested `900cr in

Reid & Taylor for its stake, which gives a value of `2,614cr to SKNL’s stake.

Reid & Taylor covers premium and super premium fabrics, such as worsted, all-

wool and wool polyester blended suitings, which cater to the premium and

super premium markets, as well as ready-to-wear garments that focus on the

formal wear part of the premium segment. The apparel range includes formal

and casual daywear suits, jackets, trousers, ties and other accessories along with a

wide range of t-shirts, jeans and other weekend wear. According to CARE

Research, Reid & Taylor has a ~24% share (in 2010) of the worsted fabrics

market in India.

July 11, 2012

15

S. Kumars Nationwide | Initiating Coverage

Textile and apparel industry in India

The Indian textile industry is one of the leading textile industries in the world,

contributing ~4% to India’s GDP and 17% to forex earnings. This industry is one of

the most important sectors of the economy in terms of investment, revenue, trade

and employment generation the world over.

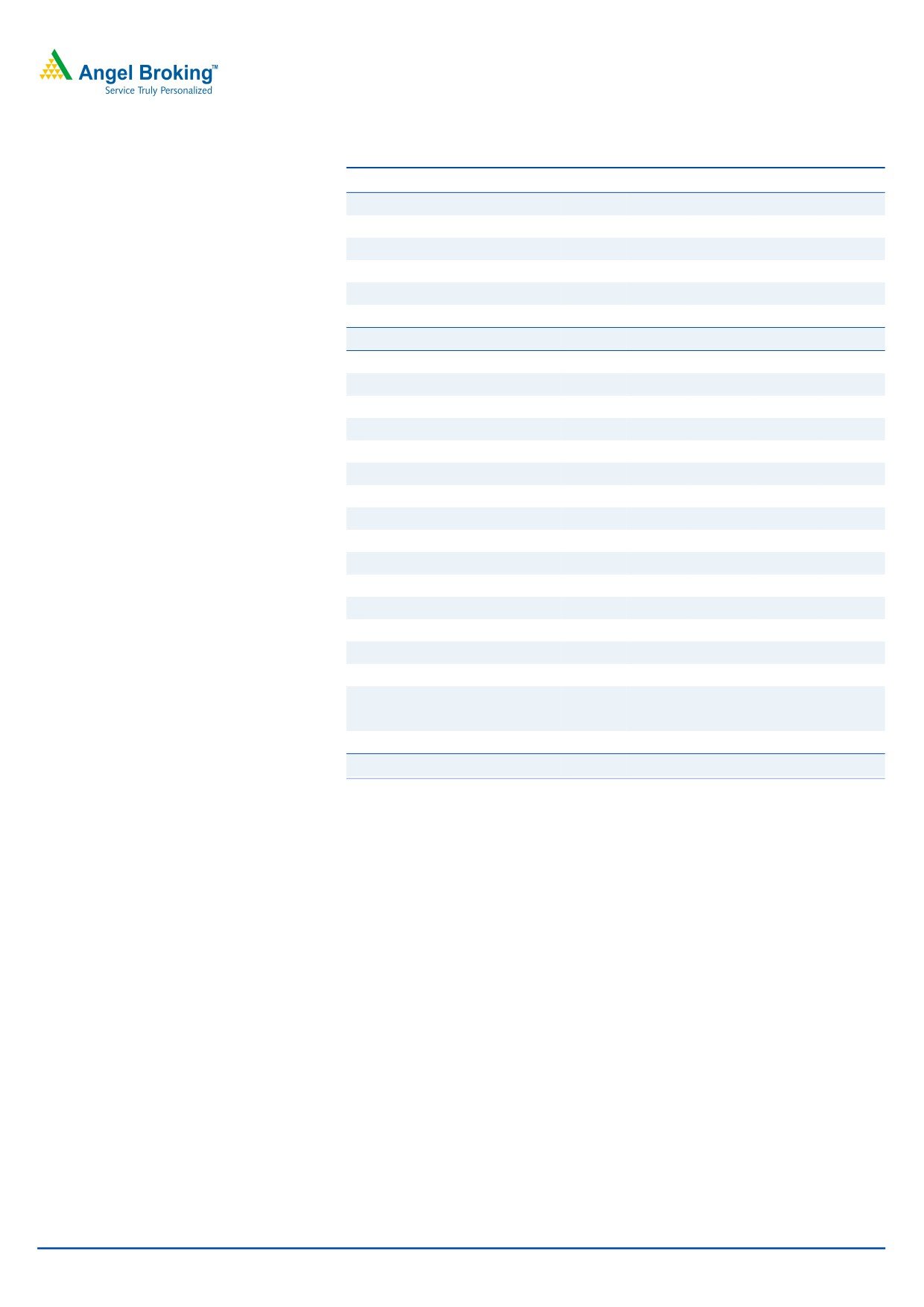

According to Technopak’s analysis, the current size of the domestic textile and

apparel market is US$77bn (2010). The market is expected to post a CAGR of

11% to US$220bn over FY2010-20E.

Exhibit 18: Indian textile and apparel market (2010)

Indian Textile

and Apparel

Market

(US$77bn)

Domestic market

Export market

(US$52bn)

(US$25bn)

Textiles

Apparel

Textiles

Apparel

(US$12bn)

(US$36bn)

(US$11bn)

(US$11bn)

Source: Technopak analysis

Of the total domestic textile market, apparels are expected to post a CAGR of 11%

over FY2010-20E to US$100bn, surpassing the other segments such as home

textile (CAGR 8%) and technical textile (CAGR 10%). The export market is

estimated to post a 12% CAGR in this decade and the market size will reach

US$80bn by FY2020E.

Exhibit 19: Domestic textile & apparel market (US$bn)

Exhibit 20: Indian textile & apparel export (US$bn)

100

160

140

80

140

80

120

100

89

60

45

80

40

60

52

25

30

15

40

20

11

18

20

0

0

2000

2005

2010

2015E

2020E

2000

2005

2010

2015E

2020E

Home textile

Apparel

Textile

Total

Home textile

Apparel

Textile

Total

Source: Technopak Analysis

Source: Technopak Analysis

July 11, 2012

16

S. Kumars Nationwide | Initiating Coverage

Profit and Loss (Standalone)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

Gross sales

1,550

2,155

2,757

3,511

4,027

4,609

Less: Excise duty

0

0

0

-

-

-

Net Sales

1,550

2,155

2,757

3,511

4,027

4,609

Other operating income

-

-

-

-

-

-

Total operating income

1,550

2,155

2,757

3,511

4,027

4,609

% chg

(3.4)

39.0

28.0

27.3

14.7

14.5

Net Raw Materials

1,165

1,547

1,930

2,456

2,814

3,207

% chg

8.7

32.8

24.7

27.3

14.6

14.0

Other Mfg costs

24

31

58

63

72

88

% chg

(44.1)

29.9

88.1

9.0

14.7

20.8

Personnel

29

41

54

88

101

120

% chg

(21.6)

43.0

30.8

64.8

14.7

18.1

Other

86

113

130

131

151

177

% chg

(28.3)

31.9

14.4

0.7

15.6

17.5

Total Expenditure

1,304

1,733

2,171

2,738

3,139

3,592

EBITDA

247

422

586

773

888

1,017

% chg

(26.4)

71.2

38.9

31.9

14.9

14.5

(% of Net Sales)

15.9

19.6

21.3

22.0

22.1

22.1

Depreciation & Amortisation

27

42

74

92

109

122

EBIT

220

380

512

681

779

895

% chg

(26.5)

72.9

34.7

32.9

14.4

14.9

(% of Net Sales)

14.2

17.7

18.6

19.4

19.3

19.4

Interest & other Charges

139

244

314

404

443

487

Other Income

61

5

4

2

2

3

(% of Net Sales)

3.9

0.2

0.1

0.1

0.1

0.1

Recurring PBT

81

137

198

277

336

408

% chg

(61.3)

69.2

44.9

39.9

21.0

21.5

PBT (reported)

142

142

202

279

338

410

Tax

82

36

29

100

112

136

(% of PBT)

57.7

25.2

14.5

35.7

33.0

33.0

PAT (reported)

60

106

173

180

226

275

Extraordinary Expense/(Inc.)

50

(4)

(0)

-

-

-

ADJ. PAT

10

110

173

180

226

275

% chg

(94.7)

1,008.2

57.7

3.9

26.0

21.4

(% of Net Sales)

0.6

5.1

6.3

5.1

5.6

6.0

Basic EPS (`)

0.4

4.6

6.1

6.0

7.6

9.2

Fully Diluted EPS (`)

0.4

4.6

6.1

6.0

7.6

9.2

% chg

(95.0)

946.7

30.9

(0.5)

26.0

21.4

July 11, 2012

17

S. Kumars Nationwide | Initiating Coverage

Balance Sheet (Standalone)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

SOURCES OF FUNDS

Equity Share Capital

310

313

337

350

350

350

Reserves& Surplus

602

765

1,175

1,208

1,393

1,627

Shareholder’s Funds

913

1,077

1,512

1,557

1,743

1,977

Total Loans

1,938

2,366

2,226

2,426

2,669

2,936

Deferred Tax (Net)

8

17

27

40

40

40

Total Liabilities

2,858

3,460

3,765

4,023

4,451

4,952

APPLICATION OF FUNDS

Gross Block

682

881

1,068

1,487

1,711

1,882

Less: Acc. Depreciation

193

230

304

396

505

628

Less: Impairment

-

-

-

-

-

-

Net Block

489

651

764

1,091

1,205

1,254

Capital Work-in-Progress

607

564

259

71

171

271

Lease adjustment

-

-

-

-

-

-

Goodwill

-

-

-

-

-

-

Investments

206

426

504

517

517

517

Current Assets

1,838

2,229

3,043

3,486

3,762

4,288

Cash

43

46

21

11

49

49

Loans & Advances

381

427

848

791

805

922

Inventory

578

726

941

1,162

1,340

1,528

Debtors

837

1,030

1,189

1,494

1,539

1,761

Current liabilities

-

-

45

28

28

28

Other current assets

282

409

806

1,143

1,204

1,378

Net Current Assets

1,556

1,819

2,237

2,344

2,558

2,910

Misc. Exp. not written off

-

-

-

-

-

-

Total Assets

2,858

3,460

3,765

4,023

4,451

4,952

July 11, 2012

18

S. Kumars Nationwide | Initiating Coverage

Cash Flow (Standalone)

Y/E March (` cr)

FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E

Profit before tax

142

142

202

279

338

410

Depreciation

27

42

74

92

109

122

Change in Working Capital

(346)

(260)

(444)

(116)

(175)

(353)

Direct taxes paid

(82)

(36)

(29)

(100)

(112)

(136)

Others

66

148

68

(2)

(2)

(3)

Cash Flow from Operations

(193)

36

(129)

154

158

41

(Inc.)/Dec. in Fixed Assets

(278)

(156)

118

(231)

(324)

(271)

(Inc.)/Dec. in Investments

(165)

(219)

(78)

(13)

-

-

Others

(6)

(8)

(258)

2

2

3

Cash Flow from Investing

(449)

(384)

(219)

(242)

(321)

(268)

Issue of Equity

(70)

3

24

12

-

-

Inc./(Dec.) in loans

836

428

(140)

200

243

267

Dividend Paid (Incl. Tax)

-

-

(39)

(41)

(41)

(41)

Others

(90)

(79)

477

(94)

-

-

Cash Flow from Financing

676

351

322

78

202

226

Inc./(Dec.) in Cash

35

3

(25)

(10)

39

(1)

Opening Cash balances

8

43

46

21

11

49

Closing Cash balances

43

46

21

11

49

49

July 11, 2012

19

S. Kumars Nationwide | Initiating Coverage

Key Ratios (Standalone)

Y/E March

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

Valuation Ratio (x)

P/E (on FDEPS)

101.9

9.2

5.8

5.6

4.5

3.7

P/CEPS

27.7

6.7

4.1

3.7

3.0

2.5

P/BV

1.1

0.9

0.7

0.6

0.6

0.5

EV/Net sales

1.7

1.3

1.0

0.8

0.8

0.7

EV/EBITDA

10.9

6.9

4.6

3.8

3.5

3.3

EV / Total Assets

0.9

0.8

0.7

0.7

0.7

0.7

Per Share Data (`)

EPS (Basic)

0.4

4.6

6.1

6.0

7.6

9.2

EPS (fully diluted)

0.4

4.6

6.1

6.0

7.6

9.2

Cash EPS

1.6

6.4

8.7

9.1

11.3

13.3

DPS

-

-

1.0

1.0

1.0

1.0

Book Value

40.9

45.6

53.1

52.4

58.6

66.5

DuPont Analysis

EBIT margin

14.2

17.7

18.6

19.4

19.3

19.4

Tax retention ratio

0.4

0.7

0.9

0.6

0.7

0.7

Asset turnover (x)

0.8

0.9

0.9

1.0

1.1

1.1

ROIC (Post-tax)

4.7

11.8

14.8

12.9

14.2

14.7

Cost of Debt (Post Tax)

3.9

8.5

11.7

11.2

11.6

11.6

Leverage (x)

1.9

1.8

1.1

1.2

1.2

1.2

Operating ROE

6.1

17.7

18.3

15.1

17.3

18.4

Returns (%)

ROCE (Pre-tax)

7.7

11.0

13.7

17.1

17.6

18.2

Angel ROIC (Pre-tax)

11.0

15.8

17.3

20.1

21.2

22.0

ROE

1.1

11.0

13.3

11.7

13.7

14.8

Turnover ratios (x)

Asset TO (Gross Block)

2.7

2.8

2.8

2.7

2.5

2.6

Inventory / Net sales (days)

125

110

110

109

113

114

Receivables (days)

170

158

147

139

139

139

Payables (days)

64

73

102

130

140

140

WC cycle (ex-cash) (days)

316

278

264

236

219

213

Solvency ratios (x)

Net debt to equity

1.9

1.8

1.1

1.2

1.2

1.2

Net debt to EBITDA

6.8

4.5

2.9

2.5

2.4

2.3

Int. Coverage (EBIT/ Int.)

1.6

1.6

1.6

1.7

1.8

1.8

July 11, 2012

20

S. Kumars Nationwide | Initiating Coverage

Profit and Loss (Consolidated)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

Gross sales

2,260

3,838

5,181

6,355

7,279

8,290

Less: Excise duty

0

0

0

-

-

-

Net Sales

2,260

3,838

5,180

6,355

7,279

8,290

Other operating income

-

-

-

-

-

-

Total operating income

2,260

3,838

5,180

6,355

7,279

8,290

% chg

29.3

69.8

35.0

22.7

14.6

13.9

Net Raw Materials

1,461

2,316

2,971

3,738

4,278

4,863

% chg

29.4

58.5

28.3

25.8

14.4

13.7

Other Mfg costs

79

124

187

203

232

265

% chg

49.5

57.6

50.8

8.9

14.1

14.2

Personnel

73

313

506

584

668

770

% chg

73.8

328.4

61.5

15.5

14.5

15.2

Other

183

338

487

492

570

654

% chg

36.4

84.9

44.1

1.0

15.9

14.6

Total Expenditure

1,796

3,091

4,151

5,017

5,748

6,551

EBITDA

465

747

1,029

1,337

1,531

1,738

% chg

18.9

60.7

37.9

29.9

14.5

13.5

(% of Net Sales)

20.6

19.5

19.9

21.0

21.0

21.0

Depreciation & Amortisation

44

81

125

148

188

211

EBIT

420

665

905

1,190

1,343

1,527

% chg

20.7

58.3

36.0

31.5

12.9

13.7

(% of Net Sales)

18.6

17.3

17.5

18.7

18.5

18.4

Interest & other Charges

145

264

390

533

588

647

Other Income

73

23

43

10

11

13

(% of Net Sales)

3.2

0.6

0.8

0.2

0.2

0.2

Recurring PBT

275

401

515

656

755

880

% chg

9.7

45.7

28.4

27.4

15.0

16.6

PBT (reported)

349

425

558

666

766

893

Tax

153

147

165

195

246

286

(% of PBT)

44.0

34.7

29.6

29.3

32.1

32.1

PAT (reported)

195

277

392

471

520

606

Minority interest

19

48

62

76

73

82

PAT after MI

177

229

331

395

447

524

Extraordinary Expense/(Inc.)

43

(3)

(1)

-

-

-

ADJ. PAT

134

232

332

395

447

524

% chg

(37.3)

73.5

43.0

19.1

13.1

17.3

(% of Net Sales)

5.9

6.0

6.4

6.2

6.1

6.3

Basic EPS (`)

6.0

9.8

11.6

13.3

15.0

17.6

Fully Diluted EPS (`)

6.0

9.8

11.6

13.3

15.0

17.6

% chg

(41.1)

63.8

18.7

14.1

13.1

17.3

July 11, 2012

21

S. Kumars Nationwide | Initiating Coverage

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

SOURCES OF FUNDS

Equity Share Capital

310

313

337

350

350

350

Reserves& Surplus

1,325

1,855

2,401

2,674

3,148

3,708

Equity Share Warrants

-

13

33

-

-

-

Equity Application Money

-

6

6

-

-

-

Shareholders’ Funds

1,636

2,188

2,777

3,023

3,498

4,058

Minority Interest

230

337

411

487

508

590

Total Loans

1,804

2,759

3,000

3,796

4,197

4,617

Deferred Tax (Net)

11

150

75

103

103

103

Total Liabilities

3,681

5,434

6,263

7,408

8,306

9,368

APPLICATION OF FUNDS

Gross Block

852

1,573

1,839

2,615

3,005

3,345

Less: Acc. Depreciation

217

376

490

638

826

1,037

Less: Impairment

-

-

-

-

-

-

Net Block

634

1,196

1,349

1,977

2,179

2,308

Capital Work-in-Progress

666

783

284

297

597

797

Lease adjustment

-

-

-

-

-

-

Goodwill

101

125

125

125

125

125

Investments

4

1

1

1

1

1

Current Assets

2,756

4,077

5,664

6,659

7,094

8,051

Cash

109

132

82

32

57

81

Loans & Advances

634

921

1,976

2,107

2,257

2,570

Inventory

808

1,307

1,586

2,023

2,223

2,485

Debtors

1,204

1,717

1,968

2,459

2,518

2,876

Other current assets

-

-

53

39

39

39

Current liabilities

480

748

1,160

1,650

1,689

1,914

Net Current Assets

2,276

3,329

4,504

5,009

5,404

6,137

Misc. Exp. not written off

-

-

0

0

0

0

Total Assets

3,681

5,434

6,263

7,408

8,306

9,368

July 11, 2012

22

S. Kumars Nationwide | Initiating Coverage

Cash Flow (Consolidated)

Y/E March (` cr)

FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E

Profit before tax

349

425

558

666

766

893

Depreciation

44

81

125

148

188

211

Change in Working Capital

(727)

(1,029)

(1,226)

(555)

(370)

(708)

Direct taxes paid

(153)

(147)

(165)

(195)

(246)

(286)

Others

114

550

443

(10)

(11)

(13)

Cash Flow from Operations

(374)

(120)

(266)

54

326

97

(Inc.)/Dec. in Fixed Assets

(517)

(862)

232

(788)

(690)

(540)

(Inc.)/Dec. in Investments

(2)

2

0

(0)

-

-

Others

60

389

(626)

(159)

11

13

Cash Flow from Investing

(459)

(470)

(394)

(947)

(679)

(528)

Issue of Equity

(70)

3

24

12

-

-

Inc./(Dec.) in loans

409

955

242

795

402

420

Dividend Paid (Incl. Tax)

-

-

(39)

(41)

(41)

(41)

Others

591

(344)

383

76

17

77

Cash Flow from Financing

931

613

610

843

378

456

Inc./(Dec.) in Cash

98

23

(50)

(50)

25

25

Opening Cash balances

11

109

132

82

32

57

Closing Cash balances

109

132

82

32

57

81

July 11, 2012

23

S. Kumars Nationwide | Initiating Coverage

Key Ratios (Consolidated)

Y/E March

FY2009

FY2010

FY2011

FY2012

FY2013E

FY2014E

Valuation Ratio (x)

P/E (on FDEPS)

7.5

4.3

3.0

2.6

2.3

1.9

P/CEPS

5.7

3.2

2.2

1.9

1.6

1.4

P/BV

0.6

0.5

0.4

0.3

0.3

0.2

EV/Net sales

1.2

0.9

0.8

0.8

0.7

0.7

EV/EBITDA

5.8

4.9

3.8

3.6

3.4

3.2

EV / Total Assets

0.7

0.7

0.6

0.7

0.6

0.6

Per Share Data (`)

EPS (Basic)

6.0

9.8

11.6

13.3

15.0

17.6

EPS (fully diluted)

6.0

9.8

11.6

13.3

15.0

17.6

Cash EPS

8.0

13.2

16.0

18.2

21.4

24.7

DPS

-

-

1.0

1.0

1.0

1.0

Book Value

73.2

92.5

97.4

101.7

117.6

136.5

DuPont Analysis

EBIT margin

18.6

17.3

17.5

18.7

18.5

18.4

Tax retention ratio

0.6

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

0.8

0.9

0.9

0.9

1.0

1.0

ROIC (Post-tax)

8.4

10.2

11.2

12.3

12.3

12.6

Cost of Debt (Post Tax)

5.1

7.6

9.5

11.1

10.0

10.0

Leverage (x)

1.0

1.2

1.1

1.2

1.2

1.1

Operating ROE

11.9

13.5

12.9

13.7

15.0

15.4

Returns (%)

ROCE (Pre-tax)

11.5

12.6

14.6

16.3

16.4

16.5

Angel ROIC (Pre-tax)

15.1

15.7

15.9

17.4

18.1

18.5

ROE

10.2

12.1

13.4

13.6

13.7

13.9

Turnover ratios (x)

Asset TO (Gross Block)

3.2

3.2

3.0

2.9

2.6

2.6

Inventory / Net sales (days)

112

101

102

104

106

104

Receivables (days)

162

139

130

127

125

119

Payables (days)

72

72

84

102

106

100

WC cycle (ex-cash) (days)

350

304

312

286

268

267

Solvency ratios (x)

Net debt to equity

1.0

1.2

1.1

1.2

1.2

1.1

Net debt to EBITDA

3.6

3.5

2.8

2.8

2.7

2.6

Int. Coverage (EBIT/ Int.)

2.9

2.5

2.3

2.2

2.3

2.4

July 11, 2012

24

S. Kumars Nationwide | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and

its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

SKNL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

Yes

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to 15%)

Sell (< -15%)

July 11, 2012

25

S. Kumars Nationwide | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, Power, FMCG)

Yaresh Kothari

Analyst (Automobile)

Nitin Arora

Analyst (Infra)

Ankita Somani

Analyst (IT, Telecom)

Varun Varma

Analyst (Banking)

Saurabh Taparia

Analyst (Banking)

Rahul Kaul

Analyst (Cap Goods, Real Estate)

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Simran Kaur

Research Editor

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

July 11, 2012

26