FPO Note | Steel

March 21, 2013

SAIL

AVOID

Issue Open: March 22, 2013

Expensive valuation

Issue Close: March 22, 2013

Company background: Incorporated in 1973, SAIL is one of the leading

Issue Details

steel-making companies in India with an annual saleable steel production

capacity of 12.4mn tonne. Major plants owned by SAIL are located at Bhilai,

Face Value: `10

Bokaro, Durgapur, Rourkela, Burnpur and Salem. The company’s steel plants are

Present Eq. Paid-up Capital: `4,130cr

fully backed by captive iron ore mines. SAIL has a Navratna status; thus, it enjoys

Offer Size: 24.03cr Shares

significant operational and financial autonomy.

Post Eq. Paid-up Capital: `4,130cr

Slow progress on capacity continues: SAIL is increasing its saleable steel

production capacity from 12.4mn tonne to 20.2mn tonne by FY2015 at a capex

Issue size (amount): `1,514cr

of `72,000cr. We expect robust profitability from these plants, with captive iron

OFS Floor Price: `63

ore backing the upcoming steel expansion. Also, we expect SAIL's older

Post-issue implied mkt cap: `26,022cr

loss-making plants to be modernized as part of its modernization program.

Promoters holding Pre-Issue: 85.8%

However, the company has reported delays in its expansion projects over the last

few quarters. Going forward, we do not rule out further delays and cost over-runs

Promoters holding Post-Issue: 80.0%

in its expansion plans.

Sales volumes continue to disappoint: SAIL reported disappointing sales

Post Issue Shareholding Pattern

volumes for 9MFY2013 in the midst of lower steel demand. Lower-than-expected

Promoters Group

80.0

volumes reflect lower demand in India as well as lack of focus on marketing by

MF/Banks/Indian

SAIL, in our view. Given the slowdown in steel demand in India, and rising

FIs/FIIs/Public &

Others

20.0

imports from FTA countries (which attract lower import duty), we remain skeptical

over SAIL’s sales volume growth during FY2014.

Outlook and valuation: We expect SAIL’s operational and financial

performance to remain weak during FY2014 due to its:

1) inability to

maintain/raise sales volumes amidst slower steel demand in India; 2) higher fixed

costs, and 3) delays/cost overruns in its brownfield expansion projects. SAIL is on

the verge of expanding its saleable steel production capacity from 12.5mn tonne

to 24.0mn tonne by FY2015. However, we believe that there is still time to play

the volume growth story of SAIL. Moreover, it is expensively valued at the

offer-for-sale (OFS) floor price of `63 (7.2x FY2015E EV/EBITDA). Hence, we

recommend investors to Avoid subscribing to SAIL OFS.

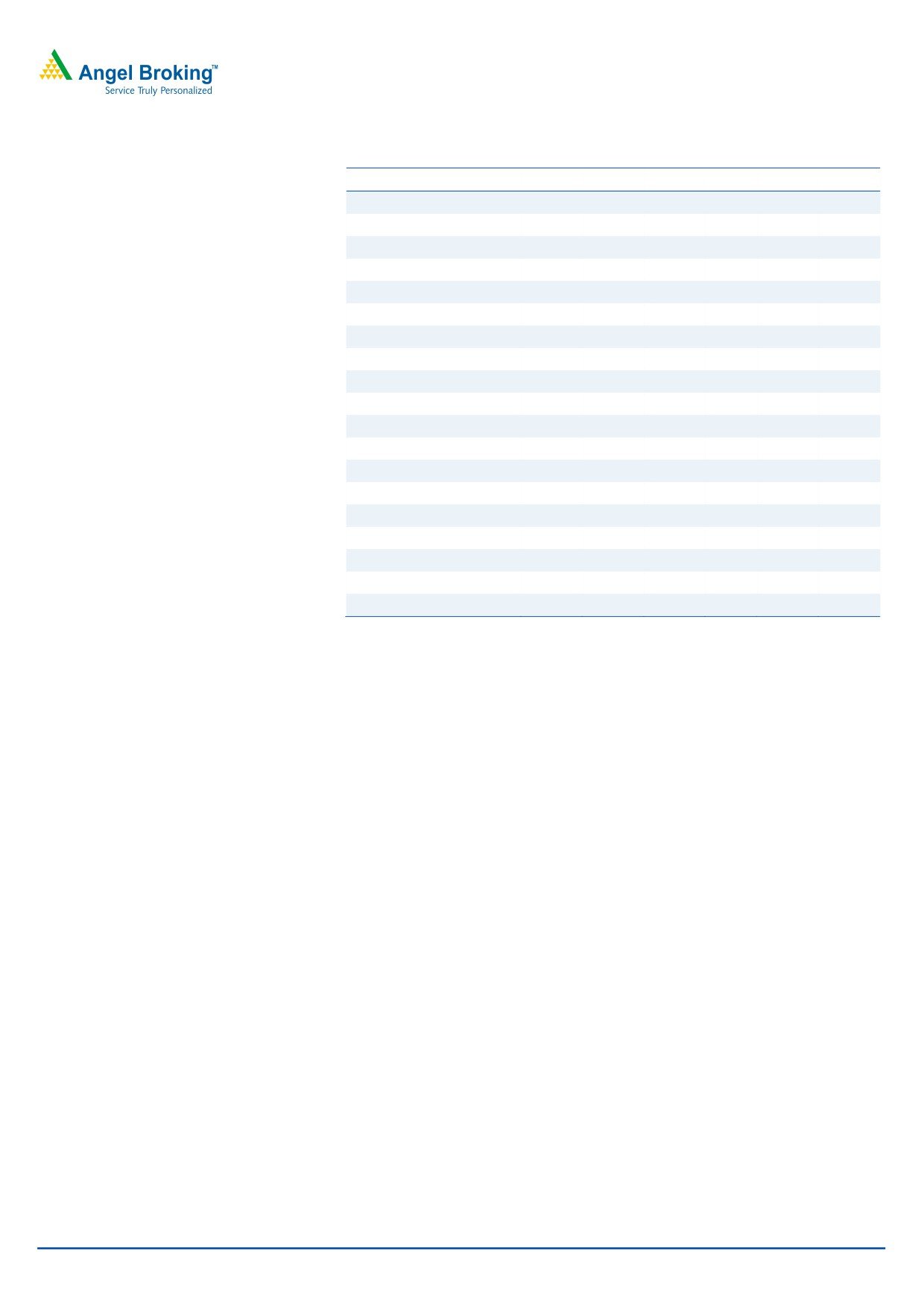

Key financials (Standalone)

Y/E March (` cr)

FY12

FY13E

FY14E

FY15E

Net sales

45,665

43,438

53,685

63,235

% chg

6.8

(4.9)

23.6

17.8

Net profit

3,545

2,695

2,260

2,939

% chg

(28.2)

(24.0)

(16.1)

30.0

FDEPS (`)

8.6

6.5

5.5

7.1

OPM (%)

13.3

12.0

9.3

11.3

Bhavesh Chauhan

P/E (x)

6.8

9.7

11.5

8.9

Tel: 022- 39357600 Ext: 6821

P/BV (x)

0.7

0.6

0.6

0.6

RoE (%)

9.2

6.6

5.4

6.7

RoCE (%)

7.8

5.9

4.6

6.8

Vinay Rachh

EV/Sales (x)

0.8

0.7

0.8

0.8

Tel: 022- 39357600 Ext: 6841

EV/EBITDA (x)

5.8

6.1

8.3

7.2

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

SAIL | FPO Note

Company Background

Incorporated in 1973, SAIL is one of the leading steel-making companies in India

with an annual saleable steel production capacity of 12.4mn tonne. SAIL’s major

plants are located at Bhilai, Bokaro, Durgapur, Rourkela, Burnpur and Salem. The

company’s steel plants are fully backed by captive iron ore mines. SAIL has a

Navratna status; thus, it enjoys significant operational and financial autonomy.

During February 2011, SAIL received clearances for Chiria iron ore mines, which

have proven reserves of 1.8bn tonne.

Issue Details

The Promoter (Government of India), proposes to sell 24,03,96,572 equity shares

of face value of `10 each representing 5.8% of the total paid up equity share

capital of the company.

SAIL has fixed the OFS floor price at `63 per share (at a

1.4% discount to its closing price as on March 21, 2013).

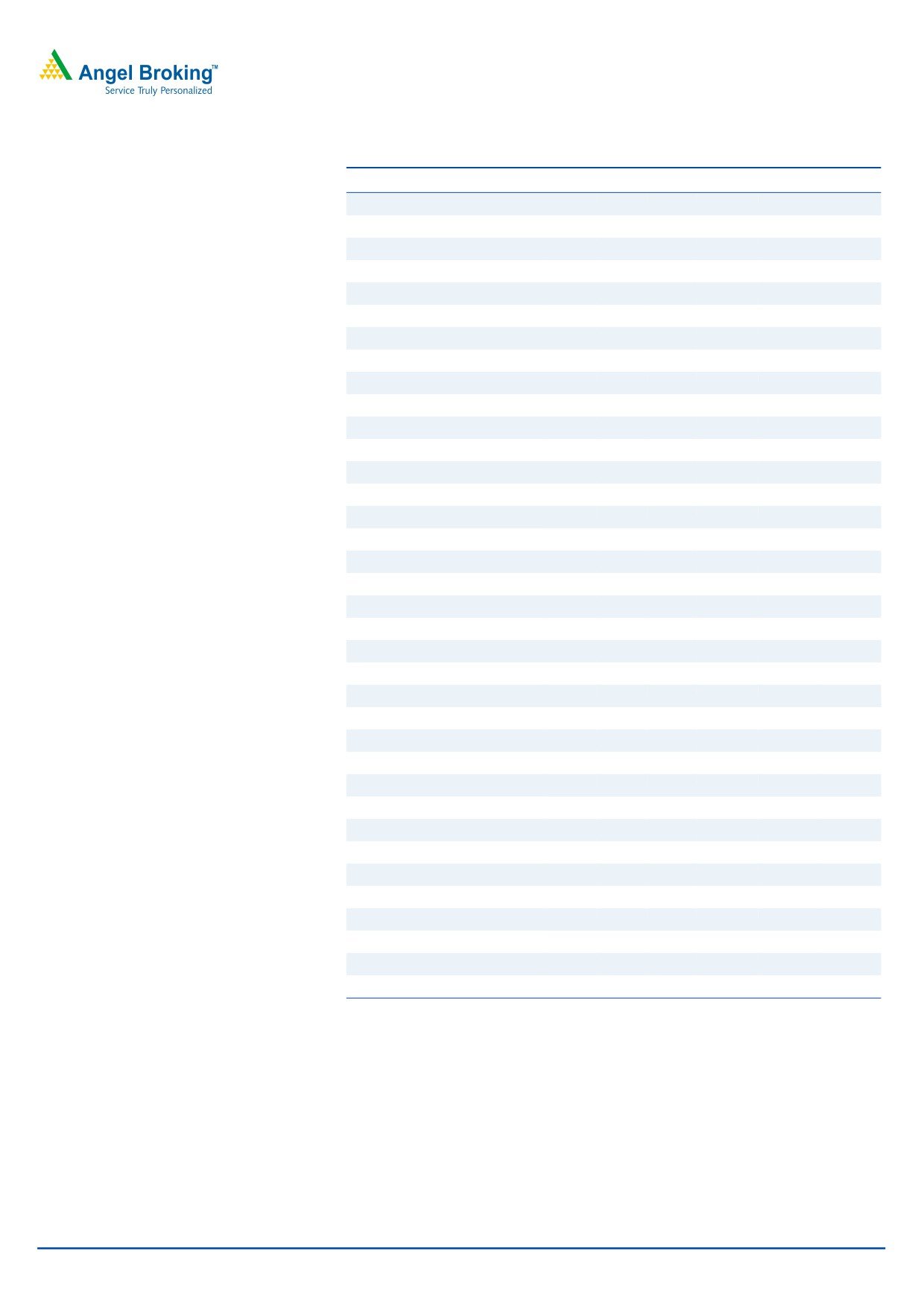

Exhibit 1: Shareholding Pattern

Pre-Issue

Post-Issue

Particulars

No. of shares

(%)

No. of shares

(%)

Promoter and promoter group

3,54,48,16,803

85.8

3,30,44,20,231

80.0

Total public holding

58,57,08,486

14.2

82,61,05,058

20.0

Total

4,13,05,25,289

100

4,13,05,25,289

100

Source: Company, Angel Research

March 21, 2013

2

SAIL | FPO Note

Investment rationale

Slow progress on capacity continues

SAIL is increasing its saleable steel production capacity from 12.4mn tonne to

20.2mn tonne by FY2015 at a capex of `72,000cr. We expect robust profitability

from these plants, with captive iron ore backing the upcoming steel capacity

expansion. Also, we expect SAIL's older loss-making plants to be modernized as

part of its modernization program. However, the company has reported delays in

its expansion projects over the last few quarters. Going forward, we do not rule out

further delays and cost over-runs in expansion plans.

Sales volumes continue to disappoint

SAIL reported disappointing sales volumes for 9MFY2013 in the midst of lower

steel demand. Lower-than-expected volumes reflect lower demand in India as well

as lack of focus on marketing by SAIL, in our view. Given the slowdown in steel

demand in India, and rising imports from FTA countries (which attract lower import

duty), we remain skeptical over SAIL’s sales volume growth during FY2014.

Outlook and valuation

We expect SAIL’s operational and financial performance to remain weak during

FY2014 due to its: 1) inability to maintain/raise sales volumes amidst slower steel

demand in India; 2) higher fixed costs, and 3) delays/cost overruns in brownfield

expansion projects. SAIL is on the verge of expanding its saleable steel production

capacity from 12.5mn tonne to 24.0mn tonne by FY2015. However, we believe

that there is still time to play the volume growth story of SAIL. Moreover, it is

expensively valued at the OFS floor price of `63 (7.2x FY2015E EV/EBITDA).

Hence, we recommend investors to avoid subscribing to SAIL OFS.

March 21, 2013

3

SAIL | FPO Note

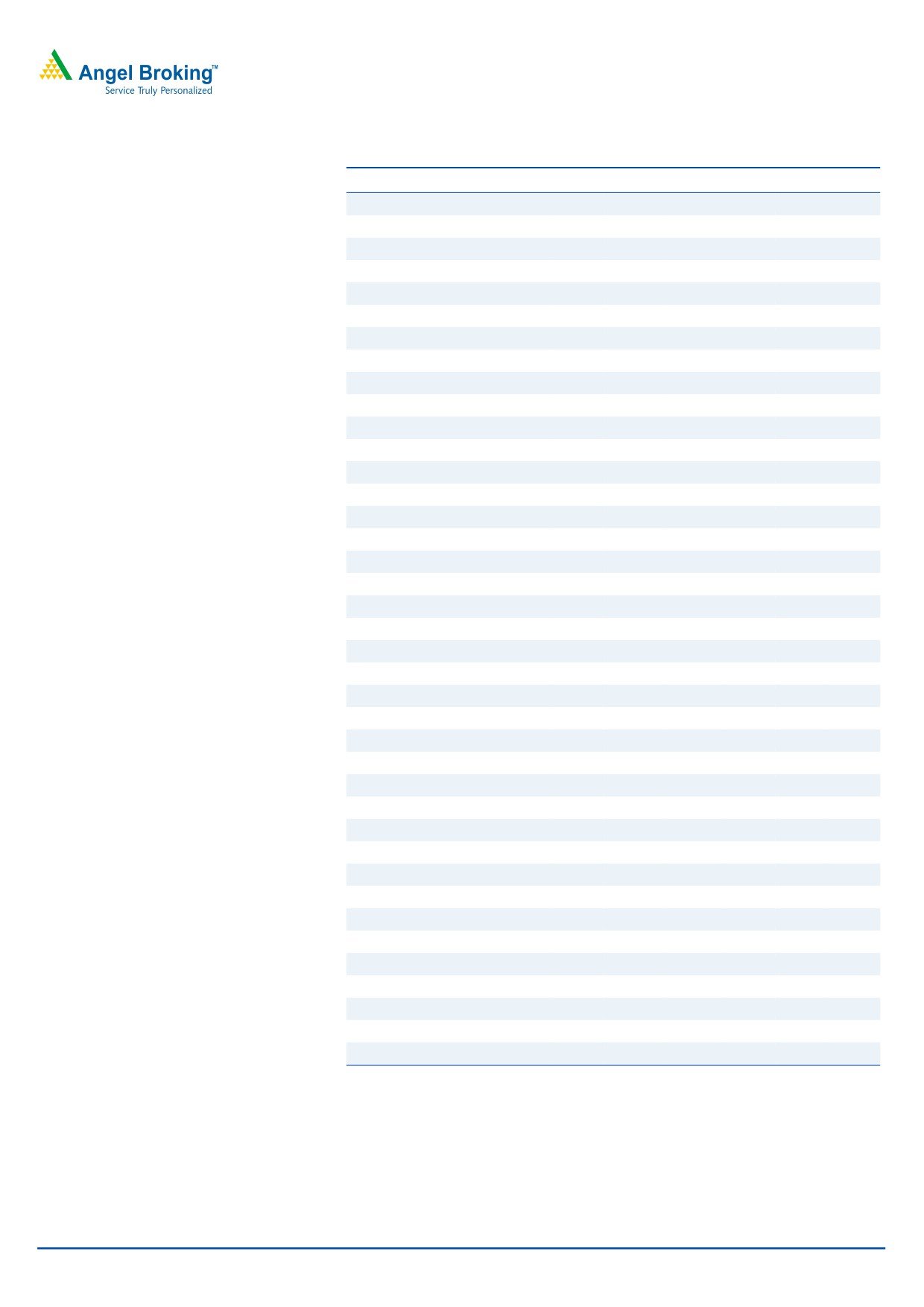

Profit & loss statement (Standalone)

Y/E March (` cr)

FY10

FY11

FY12

FY13E

FY14E

FY15E

Gross sales

44,002

47,103

50,361

47,905

59,206

69,737

Less: excise duty

3,425

4,353

4,696

4,467

5,521

6,503

Net sales

40,551

42,750

45,665

43,438

53,685

63,235

Other operating income

0

590

688

625

368

386

Total operating income

40,551

43,339

46,353

44,063

54,053

63,621

% chg

(7.2)

6.9

7.0

(4.9)

22.7

17.7

Total expenditure

31,157

35,742

40,267

38,866

49,070

56,489

Net raw materials

18,601

18,686

21,662

19,145

26,314

30,869

Other mfg costs

6,305

3,720

4,470

7,254

8,965

10,560

Personnel

5,527

7,678

7,936

8,253

8,583

8,926

Other

3,619

5,657

6,199

4,213

5,207

6,134

EBITDA

9,395

7,598

6,086

5,198

4,983

7,132

% chg

10.1

(19.1)

(19.9)

(14.6)

(4.1)

43.1

(% of net sales)

23.2

17.8

13.3

12.0

9.3

11.3

Depreciation

1,430

1,488

1,567

1,629

1,879

2,213

EBIT

7,965

6,109

4,518

3,569

3,104

4,918

% chg

9.9

(23.3)

(26.0)

(21.0)

(13.0)

58.5

(% of net sales)

19.6

14.3

9.9

8.2

5.8

7.8

Interest expenses

474

475

678

732

805

1,594

Other income

2,782

1,481

1,576

970

894

827

(% of PBT)

27.1

20.8

29.1

25.5

28.0

19.9

Share in profit of associates

-

-

-

-

-

-

Recurring PBT

10,273

7,115

5,416

3,806

3,193

4,152

% chg

9.3

(30.7)

(23.9)

(29.7)

(16.1)

30.0

Extraordinary inc/(expense)

-

125

(262)

-

-

-

PBT (reported)

10,299

7,240

5,154

3,806

3,193

4,152

Tax

3,448

2,302

1,609

1,111

932

1,212

(% of PBT)

33.5

31.8

31.2

29.2

29.2

29.2

PAT (reported)

6,851

4,938

3,545

2,695

2,260

2,939

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest

-

-

-

-

-

-

Extraordinary expense/(inc.)

-

-

-

-

-

-

Net income (reported)

6,851

4,938

3,545

2,695

2,260

2,939

Adj. PAT

6,851

4,812

3,807

2,695

2,260

2,939

% chg

10.9

(29.8)

(20.9)

(29.2)

(16.1)

30.0

(% of net sales)

16.9

11.3

8.3

6.2

4.2

4.6

Basic EPS (`)

16.6

12.0

8.6

6.5

5.5

7.1

FDEPS (`)

16.6

12.0

8.6

6.5

5.5

7.1

% chg

10.9

(27.9)

(28.2)

(24.0)

(16.1)

30.0

March 21, 2013

4

SAIL | FPO Note

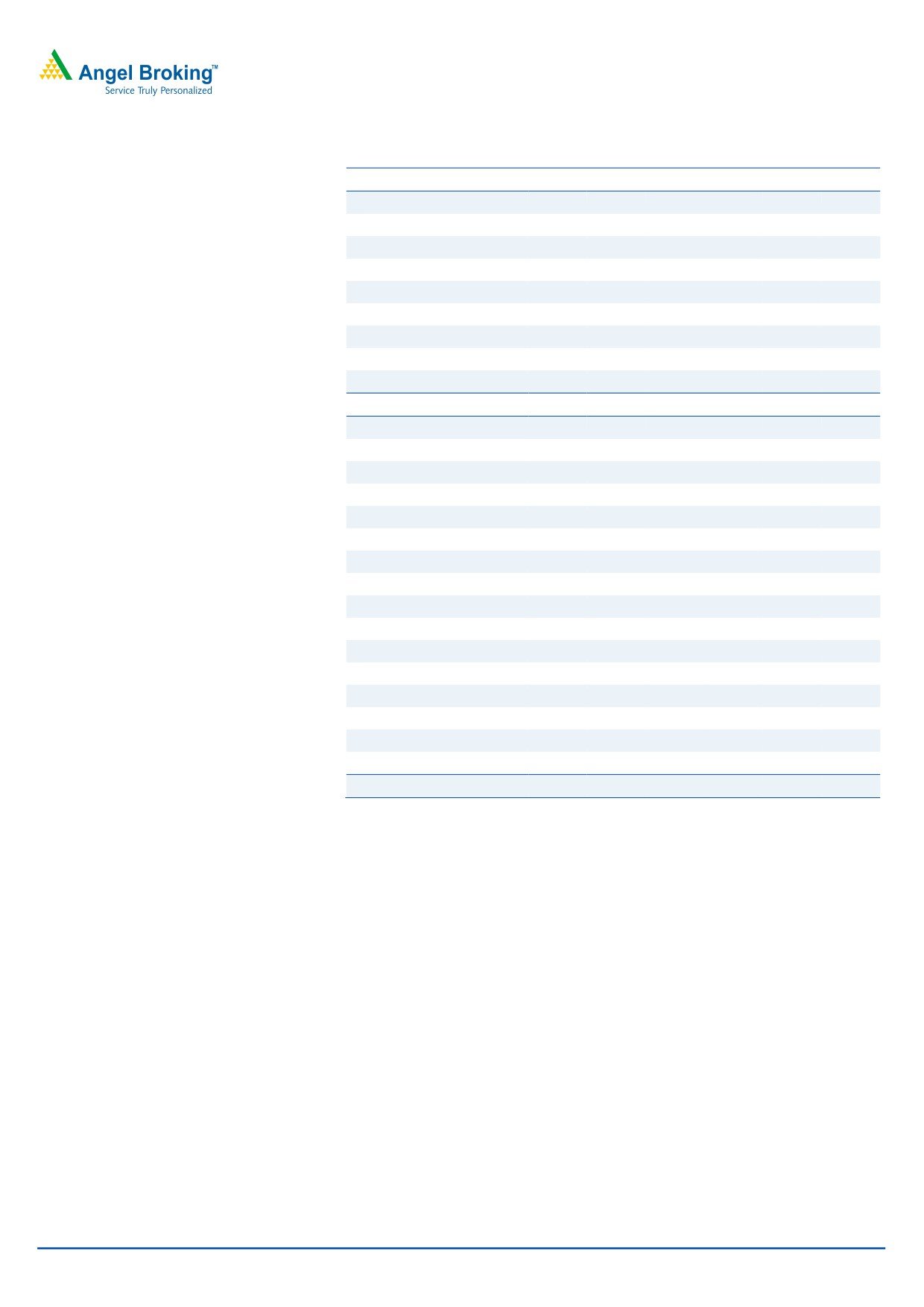

Balance sheet (Standalone)

Y/E March (` cr)

FY10

FY11

FY12

FY13E

FY14E

FY15E

SOURCES OF FUNDS

Equity Share Capital

4,130

4,130

4,130

4,130

4,130

4,130

Reserves & Surplus

29,613

32,939

35,681

37,410

38,705

40,679

Shareholders Funds

33,743

37,069

39,811

41,541

42,835

44,809

Minority Interest

1

-

-

-

-

-

Total Loans

17,638

19,056

16,097

21,097

25,097

29,097

Deferred Tax Liability

1,430

1,491

1,644

1,644

1,644

1,644

Other Long term liabilities

-

1,097

1,090

1,090

1,090

1,090

Long Term Provisions

-

3,192

3,513

3,513

3,513

3,513

Total Liabilities

52,812

61,905

62,156

68,886

74,180

80,154

APPLICATION OF FUNDS

Gross Block

37,419

38,077

41,728

53,728

71,228

93,728

Less: Acc. Depreciation

22,310

23,018

24,601

26,230

28,109

30,322

Net Block

15,109

15,059

17,127

27,498

43,119

63,406

Capital Work-in-Progress

15,309

22,075

28,049

24,549

17,049

6,549

Goodwill

-

-

-

-

-

-

Investments

45

684

685

685

685

685

Long Term loans and adv.

-

1,692

2,003

2,003

2,003

2,003

Other non- current assets

-

30

41

41

41

41

Current Assets

40,035

36,544

28,431

32,490

31,683

29,152

Cash

22,719

17,480

6,416

14,511

8,838

2,938

Loans & Advances

3,736

1,246

1,386

1,386

1,386

1,386

Other

13,580

17,817

20,630

16,593

21,459

24,829

Current liabilities

17,686

14,178

14,181

18,381

20,400

21,682

Net Current Assets

22,350

22,365

14,250

14,109

11,283

7,470

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

52,812

61,905

62,156

68,886

74,180

80,154

March 21, 2013

5

SAIL | FPO Note

Cash flow statement (Standalone)

Y/E March (` cr)

FY10

FY11

FY12

FY13E FY14E FY15E

Profit before tax

10,299

7,194

5,151

3,806

3,193

4,152

Depreciation

1,426

1,483

1,574

1,629

1,879

2,213

Change in Working Capital

1,427

(3,263)

(3,086)

8,237

(2,848)

(2,087)

Less: Other income

(4,435)

(1,043)

(656)

-

-

-

Direct taxes paid

3,619

2,215

1,456

1,111

932

1,212

Cash Flow from Operations

5,097

2,157

1,170

12,561

1,292

3,065

(Inc.)/ Dec. in Fixed Assets

(10,371)

(10,621)

(9,487)

(8,500)

(10,000)

(12,000)

(Inc.)/ Dec. in Investments

15

(9)

5

-

-

-

(Inc.)/ Dec. in loans and adv.

-

-

-

-

-

-

Other income

(2,112))

(1,697)

(1,948)

-

-

-

Cash Flow from Investing

(8,257)

8,933

(7,535)

(8,500)

(10,000)

(12,000)

Issue of Equity

45

159

-

-

-

Inc./(Dec.) in loans

8,886

3,641

(3,086)

5,000

4,000

4,000

Dividend Paid (Incl. Tax)

1,402

1,395

1,152

965

965

965

Others

169.4

429

620

-

-

-

Cash Flow from Financing

7,359

1,818

4,699

4,035

3,035

3,035

Inc./(Dec.) in Cash

4,199

12,908

(11,064)

8,096

(5,674)

(5,900)

Opening Cash balances

18,522

22,439

17,480

6,416

14,512

8,838

Closing Cash balances

22,721

17,480

6,416

14,512

8,838

2,938

March 21, 2013

6

SAIL | FPO Note

Key ratios

Y/E March

FY10

FY11

FY12

FY13E

FY14E

FY15E

Valuation Ratio (x)

P/E (on FDEPS)

3.8

5.4

6.8

9.7

11.5

8.9

P/CEPS

3.1

4.0

5.1

6.0

6.3

5.1

P/BV

0.8

0.7

0.7

0.6

0.6

0.6

Dividend yield (%)

5.2

4.1

1.6

3.2

3.2

3.2

EV/Sales

0.5

0.6

0.8

0.7

0.8

0.8

EV/EBITDA

2.2

3.5

5.8

6.1

8.3

7.2

EV / Total Assets

0.4

0.4

0.6

0.5

0.6

0.6

Per Share Data (`)

EPS (Basic)

16.6

11.7

9.2

6.5

5.5

7.1

EPS (fully diluted)

16.6

11.7

9.2

6.5

5.5

7.1

Cash EPS

20.0

15.6

12.4

10.5

10.0

12.5

DPS

3.3

2.6

1.0

2.0

2.0

2.0

Book Value

81.7

89.7

96.4

100.6

103.7

108.5

Dupont Analysis

EBIT margin

19.6

14.3

9.9

8.2

5.8

7.8

Tax retention ratio (%)

66.5

68.2

68.8

70.8

70.8

70.8

Asset turnover (x)

1.7

1.2

1.0

0.9

1.0

1.0

ROIC (Post-tax)

22.1

12.2

7.0

5.1

4.1

5.3

Cost of Debt (Post Tax)

-

1.7

2.9

2.5

2.3

3.9

Leverage (x)

-

0.0

0.2

0.1

0.4

0.6

Operating RoE

22.1

12.4

7.9

5.5

4.7

6.1

Returns (%)

RoCE (Pre-tax)

17.8

11.1

7.8

5.9

4.6

6.8

Angel RoIC (Pre-tax)

60.9

38.0

22.7

15.2

9.2

9.1

RoE

22.2

13.9

9.2

6.6

5.4

6.7

Turnover ratios (x)

Asset Turnover (Gross Block)

1.2

1.1

1.2

0.9

0.9

0.8

Inventory / Sales (days)

180

225

194

200

200

200

Receivables (days)

33

36

33

33

33

33

Payables (days)

122

119

103

103

103

103

WC cycle (ex-cash) (days)

70

69

77

78

71

75

Solvency ratios (x)

Net debt to equity

(0.2)

0.0

0.2

0.1

0.4

0.6

Net debt to EBITDA

(0.5)

0.1

1.5

1.1

3.1

3.6

Interest Coverage (EBIT / Int.)

16.8

12.9

6.7

4.9

3.9

3.1

March 21, 2013

7

SAIL | FPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

SAIL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below `1 lakh for Angel, its Group companies and Directors

March 21, 2013

8

SAIL | FPO Note

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Viral Shah

Sr. Analyst (Infrastructure)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, Power, FMCG)

Yaresh Kothari

Analyst (Automobile)

Ankita Somani

Analyst (IT, Telecom)

Sourabh Taparia

Analyst (Banking)

Bhupali Gursale

Economist

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Tejas Vahalia

Research Editor

Dilip Patel

Production Incharge

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP /

March 21, 2013

9