Derivatives Rollover Report | October 27, 2017

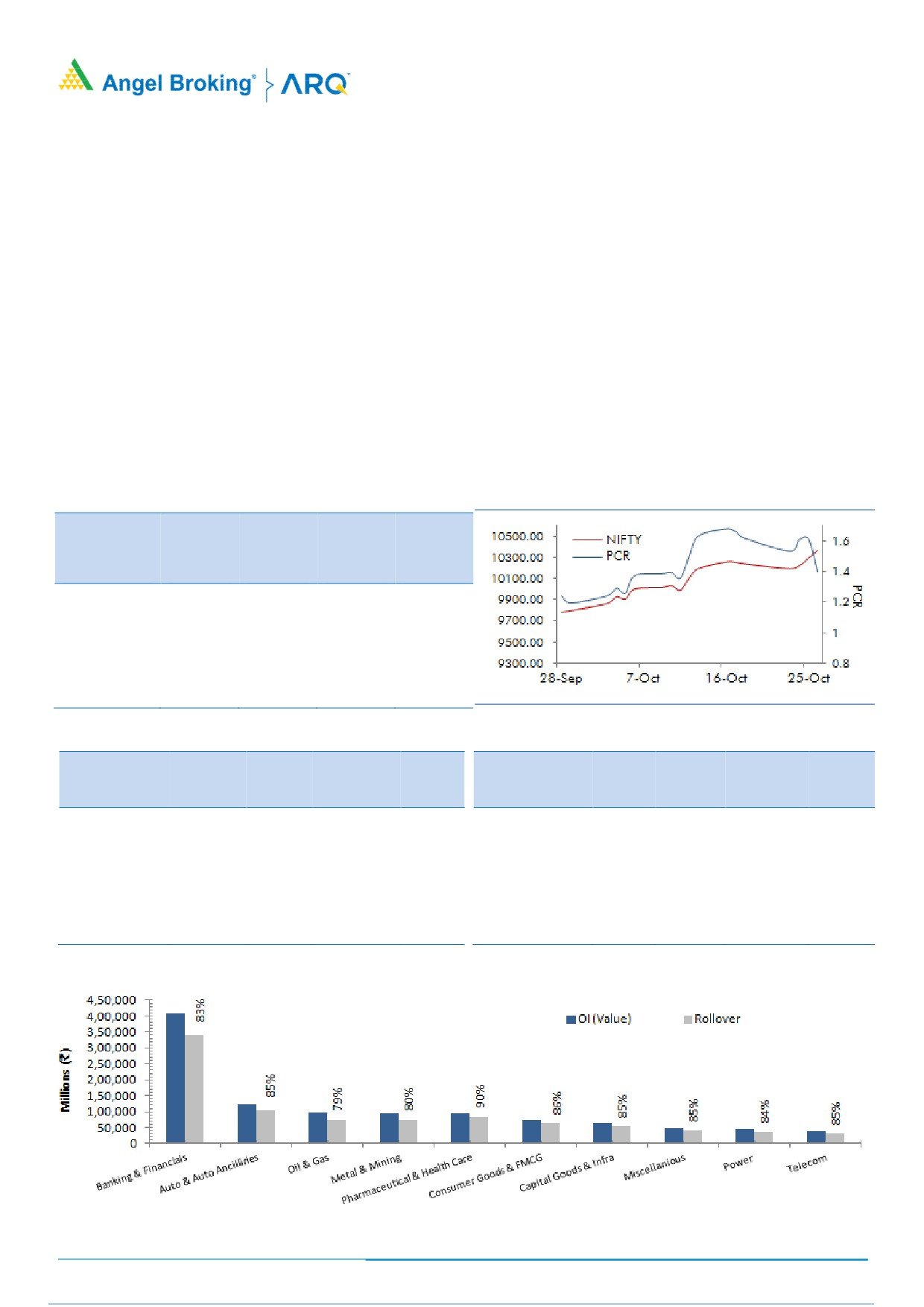

October series was indeed a Diwali bonanza for our markets as the benchmark index registered a fresh record high

and achieved yet another milestone of 10350. Finally, post consolidation seen in last two series index gained

momentum and we also witnessed decent amount of long formation in index futures segment. Now, Nifty Rollovers is

at 72.69% which is above its 3 month average of 65% and in terms of open interest as well it’s on the higher side.

Historically, there has been a trend whenever FIIs start selling in equities, markets tends to take it negatively; but, this

time, history is not getting replicated. In fact, this entire selling has been completely overshadowed by the enormous

and relentless buying from domestic institutions (DIIs). However, FIIs did participate in the recent rally by forming good

amount of longs in index and stock futures. In addition, they also rolled majority of these positions; resulting their

Index Futures ‘Long Short Ratio’ surging back to 70%. At current juncture, 10500 call option is attracting traders

attention; while, maximum concentration of open interest in puts is placed at 10000 followed by 10200 strike.

Considering above data, we expect continuation of ongoing momentum in November series.

BANKNIFTTY (68.63%) rollover in terms of percentage is on the higher side; but, open interest has dropped series on

series. Post huge short rollovers in October series, we witnessed a healthy rally in PSU banks on the back of

recapitalization plan announced by government. Now, BankNifty as well as majority of the PSU bank are light in terms

of open interest. Hence, traders are advised to wait for fresh build-up before initiating any aggressive positions.

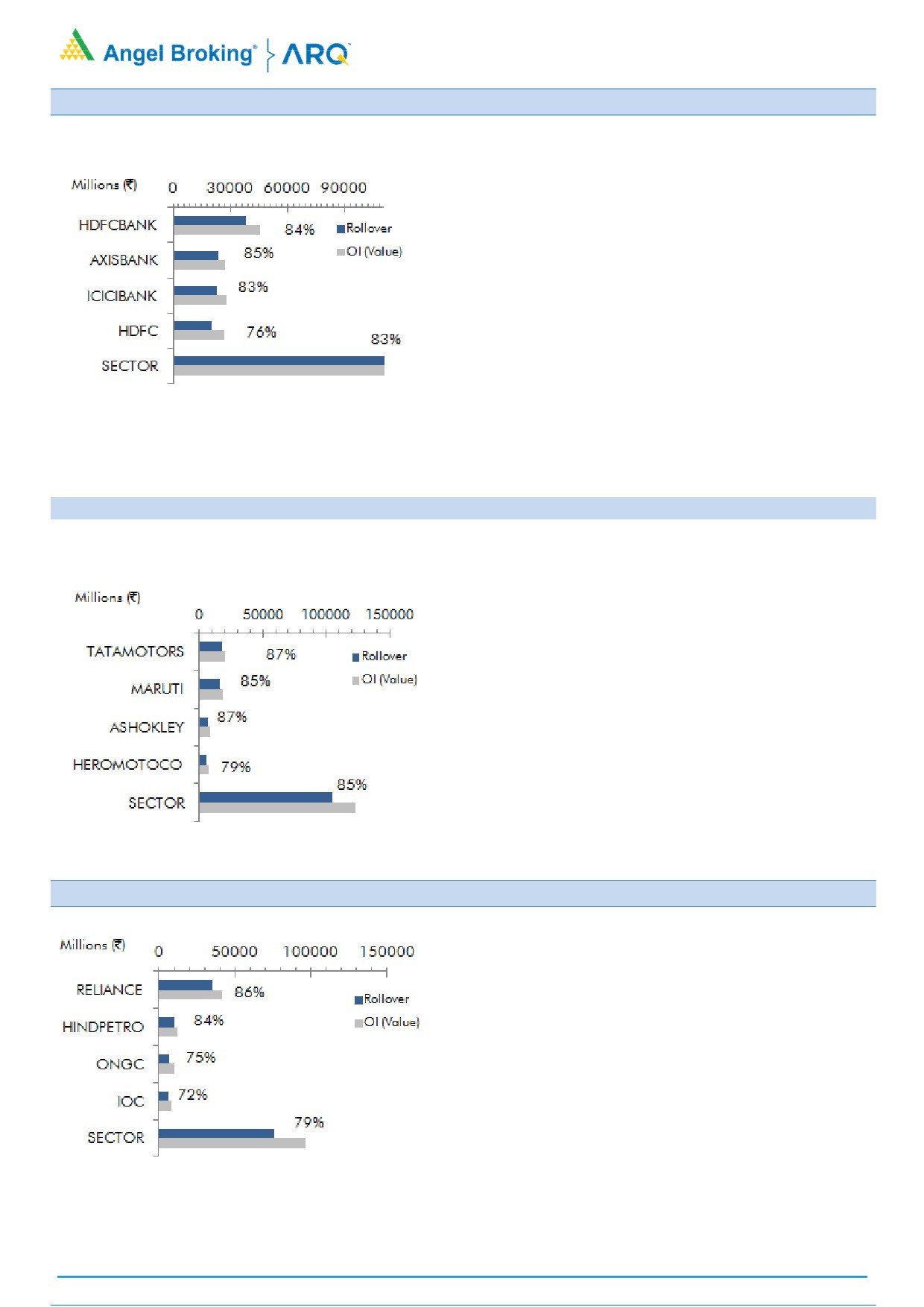

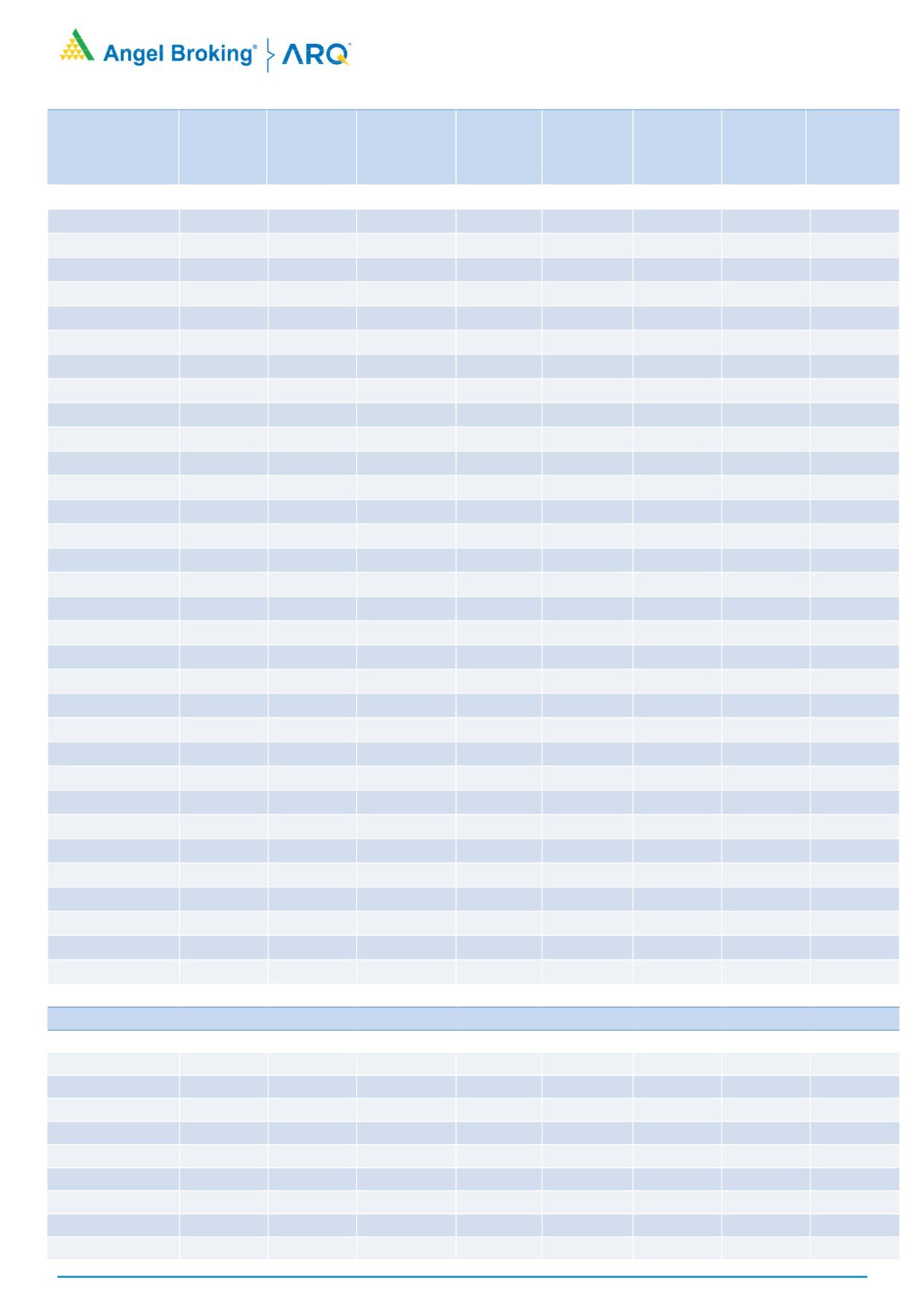

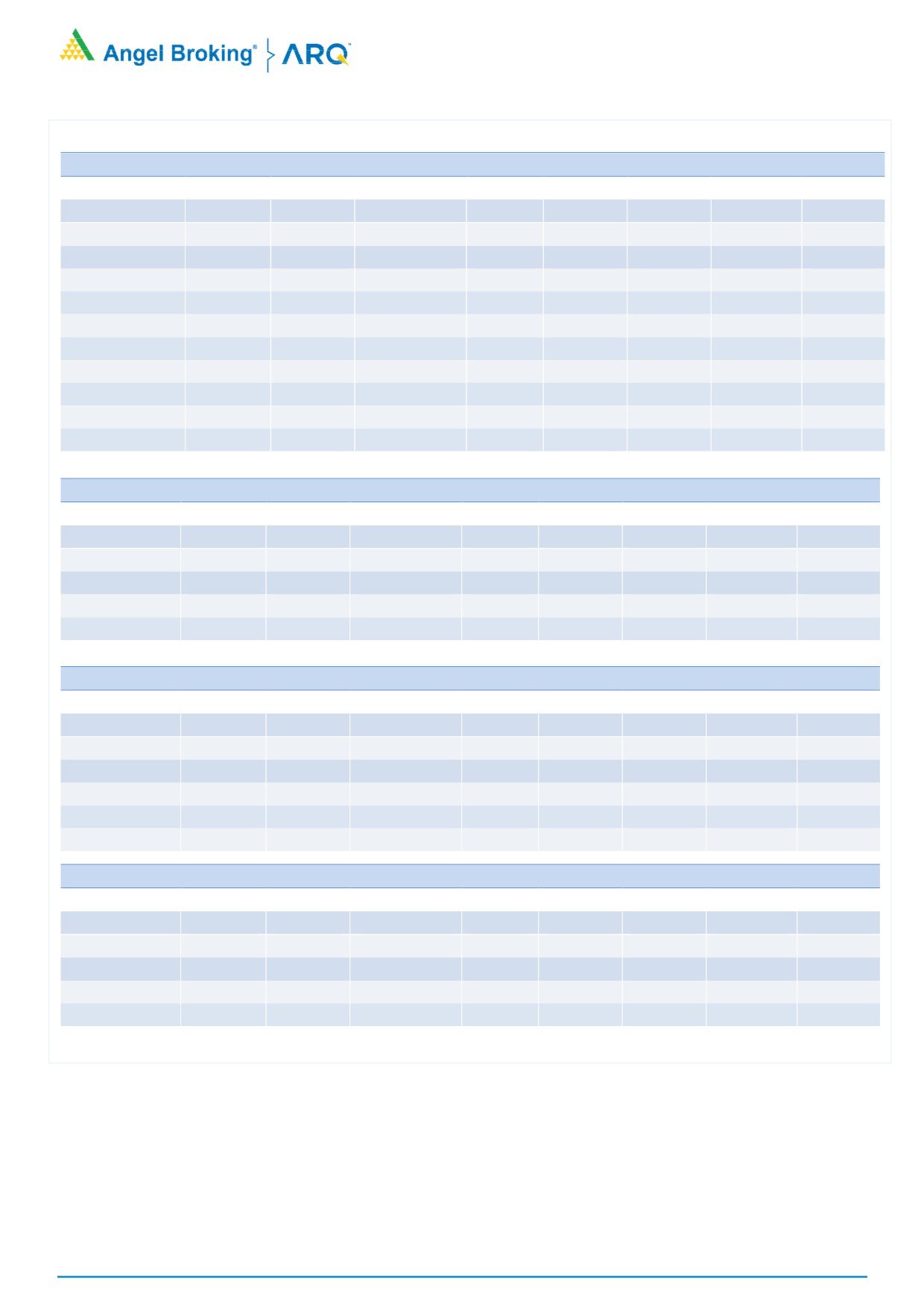

Indices Change

NIFTY & PCR Graph

Price

Change

3 month

INDEX

Price

(%)

Rollover

avg.

NIFTY

10360.55

5.86

72.69

66.84

BANKNIFTY

25080.65

4.36

68.63

67.18

NIFTYIT

10886.00

3.19

76.46

73.45

NIFTYMID50

5084.55

8.62

-

-

NIFTYINFRA

3601.55

11.63

-

-

Monthly Gainers

Monthly Losers

Price

Ol

Price

Ol

Change Open

Change

Change Open

Change

Scrip

Price

(%)

Interest

(%)

Scrip

Price

(%)

Interest

(%)

PNB

207.65

57.79

30320500

16.61

RCOM

15.95

(21.04)

111594000

0.15

UNIONBANK

187.05

44.55

15608000

(17.84)

STAR

842.25

(5.59)

4277500

99.05

SAIL

76.65

42.87

64152000

(5.81)

RELCAPITAL

571.05

(5.46)

11937000

33.14

BANKINDIA

193.15

38.46

13764000

(15.44)

YESBANK

333.55

(5.42)

52407250

39.15

CANBK

426.35

34.16

6164916

(37.08)

AXISBANK

485.70

(5.40)

48296400

53.32

Note: Stocks which have more than 1000 contract in Futures OI.

Note: Stocks which have more than 1000 contract in Futures OI.

For Private Circulation Only

1

Derivatives Rollover Report

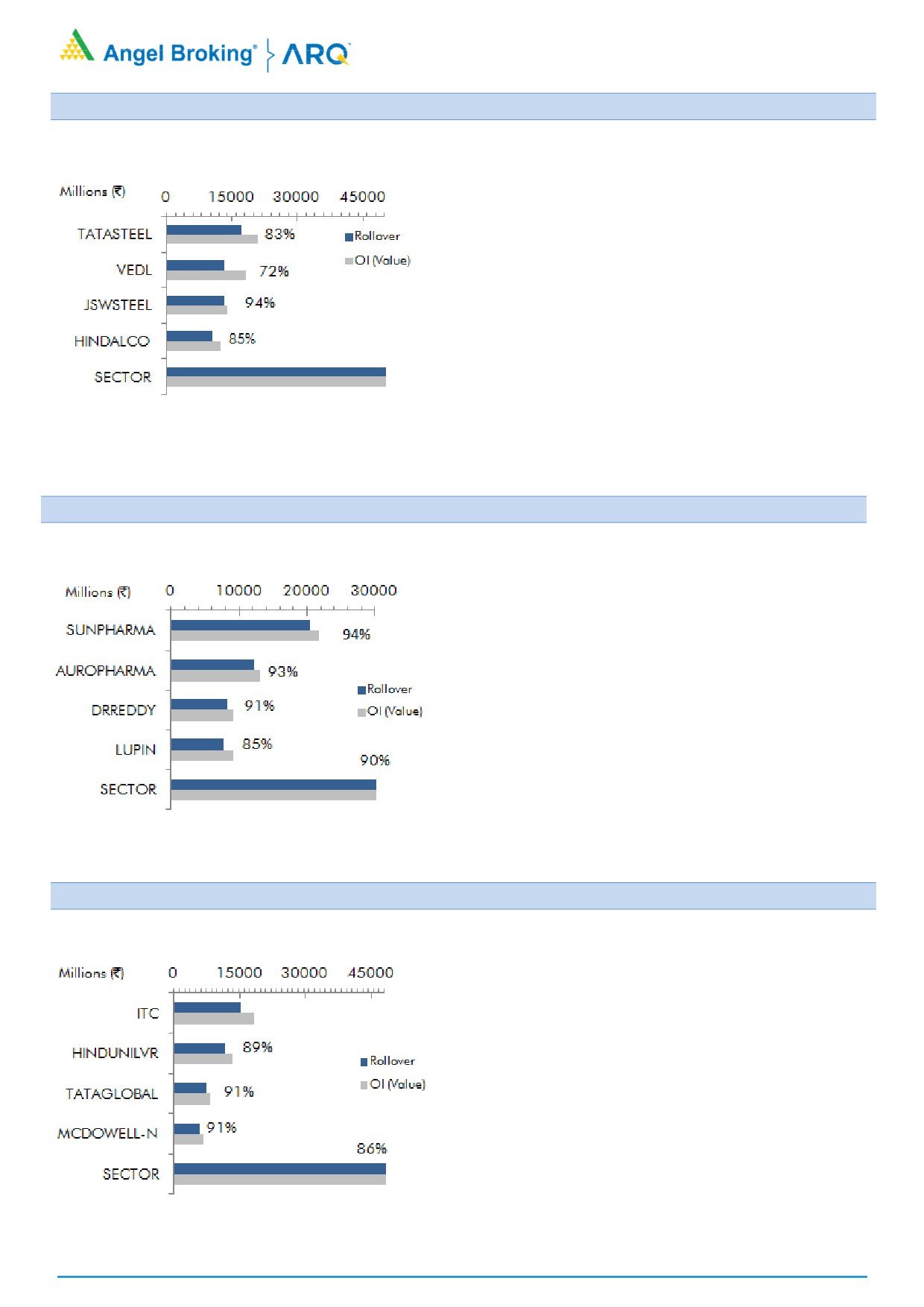

Banking and Financials

HDFCBANK (84.34%) closed on a flat note last

series; but, added good amount of long position. At

the same time, rollover is above its averages. Thus,

any bounce back above immediate hurdle of

Rs. 1810-1830 levels shall be an opportunity to buy.

ICICIBANK (82.81%) rallied 8% series on series which

was mainly due to short covering. Though, rollovers

are above average; OI remains light. At present,

Rs. 280-283 is an immediate support; one shall look

for fresh longs at current levels.

FEDERALBNK (83.79%) started October series on a

light note; however, we saw meaningful long

formation last series. Open interest is up 36% series

on series, indicating longs formed in last series are

still intact. At present, this counter is hovering

around the support zone of Rs. 118-120; traders

are advised to add fresh longs.

Auto & Auto Ancillaries

Last series, APOLLOTYRES (75.10%) traded in a very

narrow range but added huge positions. Open

interest surged 46% series on series, we believe

majority of the positions formed are on short side. At

present, this stock is taking strong support around

Rs. 236-238 levels. Traders are suggested to go

long, once stock surpasses Rs. 242-243.

CASTROLIND (95.22%) has highest rollover in this

space. This counter added huge longs due to which

open interest jumped up to 52.42% series on series.

Thus, we believe this counter may continue its

momentum going ahead; buy on dips.

TATAMOTORS (87.18%) rallied 4.65% MoM with

good amount of long positions. Rollovers are also

above averages, indicating we may see some

strength going forward.

Oil & Gas

GAIL

(67.50%) rallied

16% last series with good

amount of long formation. Rollover figure in

percentage terms is on the lower side but open-interest

wise its inline. Thus, any dip towards Rs. 457-460

shall be an opportunity to buy.

BPCL (65.49%) has lowest rollovers in this space. Post

some correction in September series, this counter

resumed its major trend and was up 15% last series.

However, this move was mainly due to short covering.

Thus, traders are suggested to exit from long if any.

Similar to BPCL, HINDPETRO (84.46%) rallied 15% in

October series due to short covering. At present, open

interest is lowest in last two series. Those, traders with

longs shall look to exit and one who wishes to take

new positions shall wait for fresh build-up.

For Private Circulation Only

2

Derivatives Rollover Report

Metal & Mining

HINDALCO (84.56%) extended its gains last series

and registered a fresh record high. We witnessed

huge long formation and rollover figure suggests

these positions have been rolled too. Thus, this

counter remains buy on dips for us.

JSWSTEEL (94.32%) has highest rollovers in this

space. This counter traded in a narrow range for

major part of October series. We saw some longs

and good amount of short covering. Now, this

counter has strong support at Rs. 256-258 levels. We

expect fresh buying coming in soon. Thus, traders are

advised to go long and fix stop loss of Rs. 255/-

Other stocks wherein we saw long rollovers are

NATIONALUM (90.96%), HINDZINC (82.62%) and

NMDC (84.09%).

Pharmaceutical

AUROPHARMA (93.09%) rallied 11% MoM; but, this

move was mainly due to short covering. However, the

momentum is very strong in this counter. Thus,

traders are advised to hold on to their existing longs.

DRREDDY (90.74%) traded in a narrow range for the

entire October series. However, we believe majority

of the shorts formed in July and August series have

been lightened; this is a positive sign for bulls. Thus,

we expect fresh buying attracting in this counter.

SUNPAHRMA (93.74%) rallied nearly 7% and also

added fresh longs. As rollovers are on the higher

side, we believe majority of these long positions have

been rolled over. Traders are advised to hold on to

their longs.

Consumer Goods & FMCG

Last series, ITC (80.07%) consolidated in a range and

formed mixed positions. However, the earlier shorts

are still in the system. Any positive trigger could lead

to some short covering and the prices could bounce

upto its resistance around Rs. 284/-.

UBL (91.90%) formed significant long positions which

have been rolled over to the November series.

Traders with long positions are advised to continue

holding their positions for a probable target of

around Rs. 1050-1160.

Rally in JUBLFOOD (81.50%) was supported by short

covering as well as fresh long build-up. The long

positions seem to have been rolled and hence, the

stock could continue its uptrend. Traders should

adopt buy on dips strategy for this counter

For Private Circulation Only

3

Derivatives Rollover Report

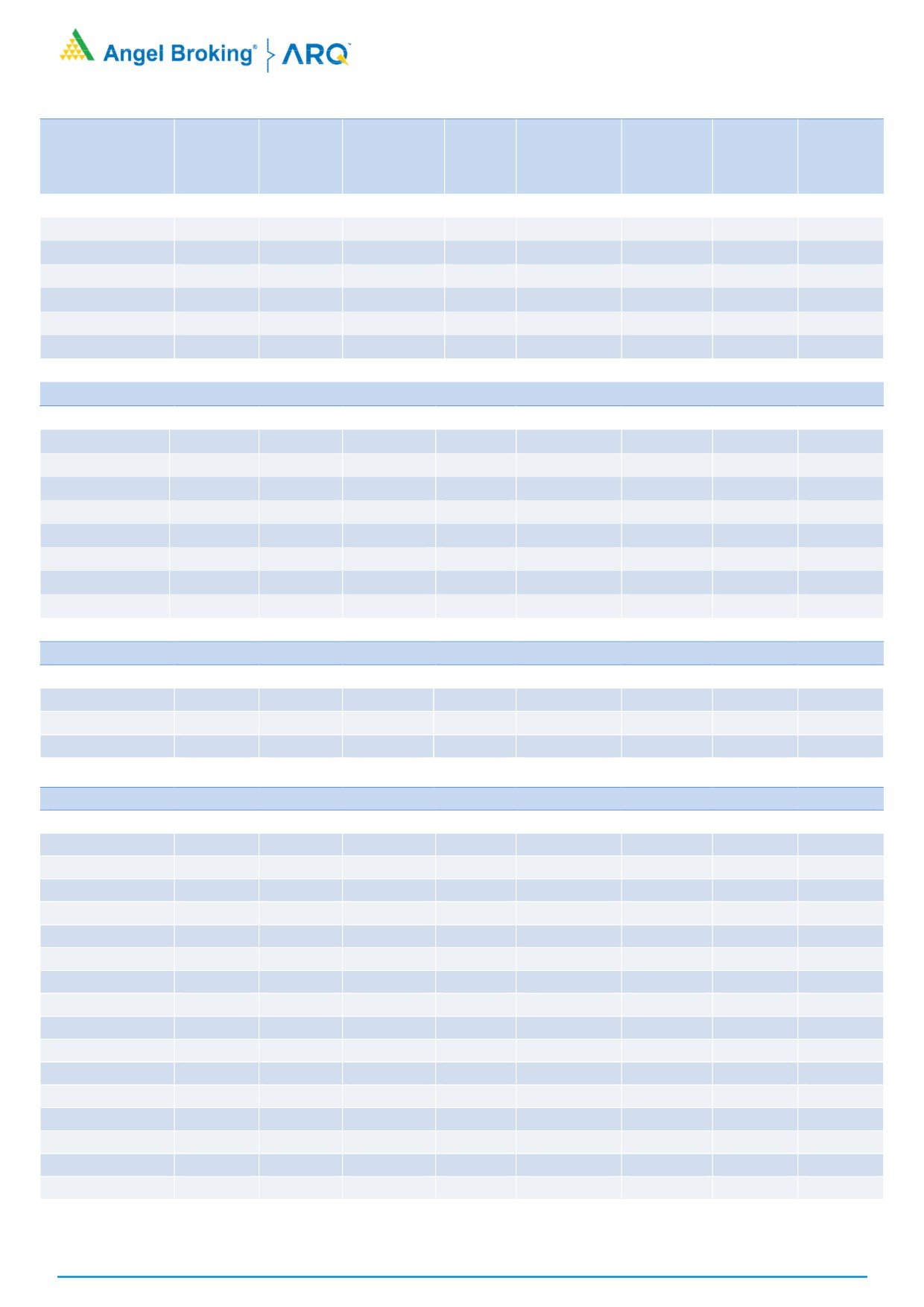

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

695.80

(2.48)

2245200

40.36

8.23

1.54

84.89

83.38

APOLLOTYRE

240.50

(1.31)

14574000

46.15

8.30

1.11

75.10

80.68

ASHOKLEY

132.20

12.32

53935000

(0.10)

8.35

0.44

86.50

86.78

BAJAJ-AUTO

3298.10

7.82

1696500

12.78

4.67

0.70

85.66

84.34

BALKRISIND

1644.15

(4.11)

601600

30.56

8.79

1.38

70.54

80.74

BHARATFORG

664.35

10.52

6446400

(17.65)

3.94

0.24

85.23

85.14

BOSCHLTD

21174.50

1.98

103075

(1.10)

7.09

1.25

85.56

85.30

CASTROLIND

402.10

11.22

14039200

52.42

6.92

0.12

95.22

91.21

CEATLTD

1688.05

(0.93)

1659700

3.99

10.51

0.67

80.67

82.12

EICHERMOT

31712.65

4.53

142750

3.97

3.14

0.20

84.98

82.15

ESCORTS

727.95

13.67

2271500

(38.30)

8.59

0.48

80.44

84.05

EXIDEIND

206.30

0.90

15936000

22.17

-2.52

0.64

79.32

85.26

HEROMOTOCO

3773.35

0.52

1617600

(4.85)

6.26

0.56

78.87

81.06

M&M

1377.70

11.38

3899000

(19.52)

3.61

0.98

83.22

81.58

MARUTI

8113.30

2.27

1920450

9.79

5.85

0.44

85.15

84.71

MOTHERSUMI

358.00

5.22

11996250

28.53

8.22

0.42

88.37

86.19

MRF

63710.20

2.37

46305

(10.70)

9.15

0.00

88.71

87.53

TATAMOTORS

421.85

4.65

42399000

19.21

6.09

0.65

87.18

83.92

TATAMTRDVR

232.20

4.10

25886700

13.32

8.38

0.97

94.00

87.08

TVSMOTOR

713.60

10.66

5390000

14.44

-11.99

0.62

78.92

82.90

BANKING & FINANCIALS

ALBK

85.10

27.20

12770000

8.96

6.16

0.63

80.16

80.61

ANDHRABANK

70.20

22.51

20020000

(2.29)

5.23

0.39

83.38

81.06

AXISBANK

485.70

(5.40)

48296400

53.32

3.01

0.65

84.94

82.09

BAJAJFINSV

5017.05

(1.21)

768875

14.76

7.34

0.29

92.52

90.72

BAJFINANCE

1760.60

(4.69)

6128000

30.81

8.27

0.68

87.59

84.04

BANKBARODA

186.65

33.75

35868000

(37.41)

5.34

0.77

80.68

83.59

BANKINDIA

193.15

38.46

13764000

(15.44)

1.08

0.75

73.88

77.04

BHARATFIN

980.75

3.54

12781000

6.53

0.53

0.82

88.10

88.42

CANBK

426.35

34.16

6164916

(37.08)

5.53

0.92

74.42

79.28

CANFINHOME

502.80

(5.19)

4081250

27.69

8.89

0.34

88.89

87.79

CAPF

718.85

(0.73)

2830400

(6.75)

8.04

1.42

89.46

86.14

CHOLAFIN

1123.05

3.13

393500

(11.87)

8.71

0.00

83.99

82.01

DCBBANK

179.50

(0.61)

6372000

4.81

10.27

0.43

81.10

83.02

DHFL

607.95

12.77

25854000

8.66

7.43

0.36

88.01

90.38

EQUITAS

146.90

(4.05)

13872000

21.70

5.71

0.42

83.72

80.74

FEDERALBNK

120.35

7.41

69674000

36.04

7.86

0.60

83.79

84.26

HDFC

1702.10

(2.74)

11868000

34.83

6.01

0.71

75.54

76.16

HDFCBANK

1799.35

0.50

21454500

11.37

2.32

0.61

84.34

79.98

For Private Circulation Only

4

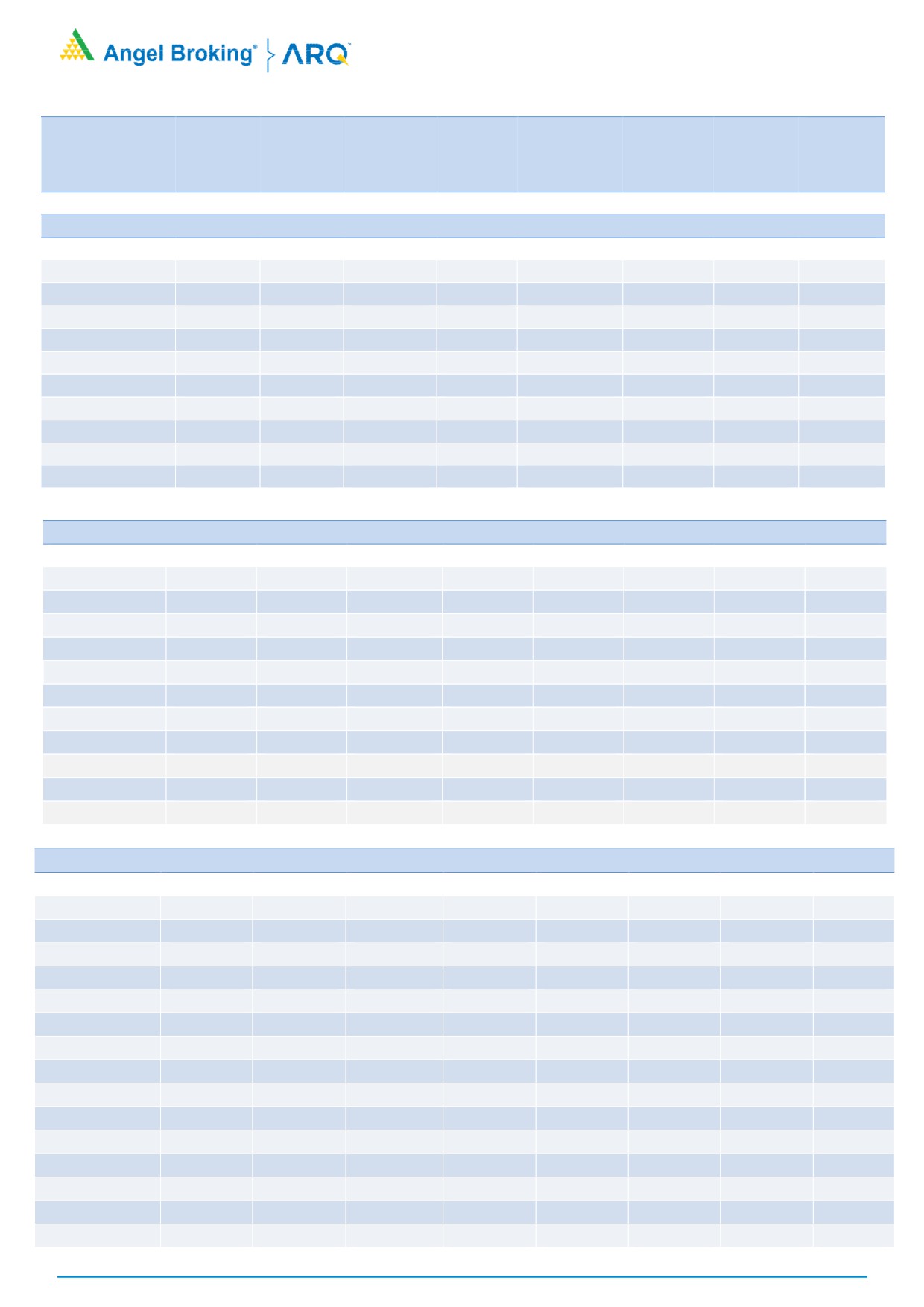

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

IBULHSGFIN

1248.20

2.56

7149600

14.90

-0.04

0.96

86.49

81.75

ICICIBANK

299.15

8.05

77907500

(7.61)

-0.35

0.77

82.81

79.99

ICICIPRULI

387.60

0.91

6280300

10.57

0.13

0.74

91.25

87.26

IDBI

68.40

29.18

19640000

(34.53)

6.91

0.47

80.36

84.85

IDFC

66.45

11.21

129439200

(10.46)

2.36

0.61

79.52

82.30

IDFCBANK

57.55

1.50

113454000

18.50

7.30

0.59

92.77

90.10

IFCI

26.00

13.04

78012000

8.14

10.12

0.30

89.19

89.44

INDIANB

321.50

23.46

3640000

(7.47)

7.19

0.60

84.57

83.49

INDUSINDBK

1628.30

(3.38)

5512800

35.68

6.90

0.68

83.94

75.34

KOTAKBANK

1022.20

1.56

7992800

(6.13)

3.38

0.33

78.27

72.14

KTKBANK

156.95

11.39

23677800

5.47

6.69

0.73

88.89

87.07

L&TFH

197.75

3.29

33322500

42.90

8.24

0.56

90.87

86.47

LICHSGFIN

620.10

(0.75)

11214500

13.11

8.22

0.83

90.53

87.42

M&MFIN

419.70

4.09

9832500

79.59

7.63

0.32

87.81

81.06

MANAPPURAM

98.85

3.13

30354000

(9.03)

5.83

0.79

84.30

88.10

MFSL

576.75

(1.95)

4228000

(6.73)

5.18

0.60

87.36

88.21

MUTHOOTFIN

489.35

5.90

1737000

(21.54)

6.22

0.57

69.55

80.11

ORIENTBANK

147.15

22.07

13584000

0.53

7.14

0.51

81.56

78.14

PFC

141.05

14.91

44736000

81.81

-18.88

0.39

81.20

80.83

PNB

207.65

57.79

30320500

16.61

-29.05

1.60

70.67

74.20

RBLBANK

534.70

5.73

6132000

45.27

8.16

0.41

90.58

75.49

RECLTD

167.80

10.29

38430000

(7.56)

4.68

0.51

73.89

83.92

RELCAPITAL

571.05

(5.46)

11937000

33.14

8.56

0.43

90.53

84.09

REPCOHOME

621.75

0.27

785400

(10.95)

6.33

17.75

85.19

82.72

SBIN

321.00

26.50

60531000

(31.00)

1.63

0.79

75.23

80.03

SOUTHBANK

31.55

12.08

169516215

27.81

10.01

0.43

91.03

87.52

SREINFRA

118.25

14.25

10030000

10.83

8.89

0.40

89.87

86.53

SRTRANSFIN

1121.75

6.16

3172800

(7.44)

2.75

0.53

85.91

83.93

SYNDIBANK

82.50

31.26

18333000

8.52

7.64

0.34

80.80

79.71

UJJIVAN

325.15

2.46

6628800

9.30

9.87

0.43

90.17

88.70

UNIONBANK

187.05

44.55

15608000

(17.84)

3.64

1.01

75.90

81.40

YESBANK

333.55

(5.42)

52407250

39.15

7.40

0.43

89.47

86.03

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

416.90

11.65

7122500

3.49

6.54

0.59

81.26

80.43

BEML

1703.15

2.81

2365200

(3.83)

1.26

0.71

88.39

84.48

BHEL

97.25

17.03

47040000

(5.95)

7.56

0.53

85.06

84.78

CGPOWER

82.85

7.46

27132000

5.07

8.89

0.81

89.72

83.68

ENGINERSIN

169.90

13.42

12498500

20.07

3.08

0.35

81.01

84.32

GMRINFRA

18.65

15.84

291645000

(0.31)

11.30

0.34

91.28

89.74

HAVELLS

488.25

2.80

5720000

88.90

8.72

0.52

83.58

82.65

HCC

39.35

19.42

25104000

(2.33)

9.36

0.69

85.74

83.80

IRB

238.20

7.35

15347500

(2.21)

1.10

0.47

79.59

78.61

For Private Circulation Only

5

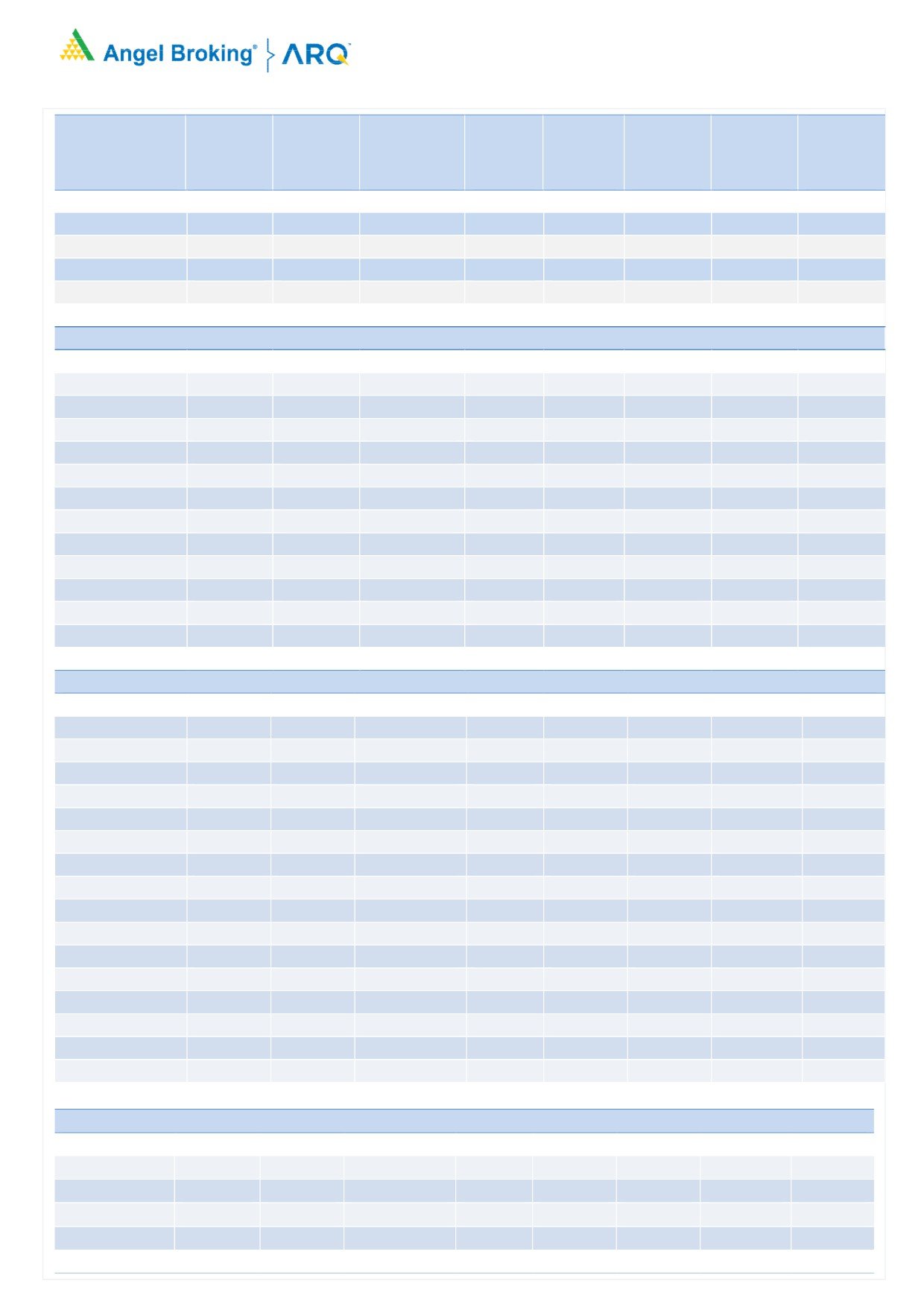

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

JPASSOCIAT

18.35

9.55

163064000

(0.37)

8.59

0.80

88.91

88.50

LT

1224.95

7.59

10757250

9.58

1.24

0.61

80.62

83.12

NBCC

258.15

21.74

4560000

53.54

7.53

0.51

86.27

83.33

RELINFRA

494.75

6.17

10779600

1.69

8.39

0.70

91.84

89.81

SIEMENS

1266.40

5.81

926500

2.77

7.59

0.62

87.61

82.92

VOLTAS

538.30

6.68

2304000

(3.76)

8.10

0.46

81.76

74.72

CEMENT

ACC

1793.70

8.24

1409200

(30.79)

6.58

0.59

79.56

77.68

AMBUJACEM

278.20

3.36

10202500

(12.84)

6.60

0.45

79.41

77.64

DALMIABHA

2847.60

11.24

540900

(7.44)

7.02

1.36

83.78

86.47

GRASIM

1201.15

5.90

3421500

(5.29)

6.68

0.80

91.29

86.78

INDIACEM

197.50

15.80

25718000

10.23

8.25

0.53

92.21

89.33

RAMCOCEM

728.35

6.91

496800

38.31

7.57

0.75

80.34

75.91

SHREECEM

19316.55

5.84

30800

1.65

8.60

0.00

88.76

81.55

ULTRACEMCO

4494.10

15.70

1289000

9.52

2.37

1.33

83.67

86.56

CHEMICALS & FERTILIZERS

PIDILITIND

795.05

1.65

1325000

22.46

9.06

0.43

80.79

78.93

TATACHEM

763.60

19.40

6304500

28.61

7.98

0.58

86.66

81.91

UPL

816.70

6.16

7976400

0.21

4.75

0.73

89.21

85.20

CONSUMER GOODS & FMCG

ASIANPAINT

1195.35

5.21

2866200

(1.22)

3.68

0.63

75.11

77.13

BERGEPAINT

273.20

12.87

1155000

(41.14)

8.08

0.09

78.59

81.33

BRITANNIA

4636.80

6.29

732600

45.01

7.28

0.15

92.64

84.99

COLPAL

1061.35

(1.32)

1494500

(0.14)

6.63

1.80

83.20

81.22

DABUR

322.90

3.49

11110000

(9.93)

0.32

0.32

89.11

89.67

GODFRYPHLP

1013.60

0.31

495500

1.23

9.66

0.60

80.63

77.61

GODREJCP

929.50

2.72

1716000

6.82

7.29

0.86

89.64

85.28

HINDUNILVR

1270.50

5.79

9301800

2.49

-2.62

0.24

88.79

86.98

ITC

269.60

2.65

55996800

2.14

4.66

0.64

82.52

79.86

JUBLFOOD

1654.70

19.64

1892500

5.23

7.65

0.50

81.50

79.40

MARICO

314.75

0.51

4648800

3.59

4.33

0.49

73.91

80.29

MCDOWELL-N

2597.05

7.37

2291500

24.28

9.07

0.29

90.98

88.50

NESTLEIND

7188.45

0.16

93400

7.85

6.36

2.00

80.94

81.64

TATAGLOBAL

211.25

3.23

34992000

27.48

7.21

0.46

90.69

90.11

TITAN

589.20

1.68

5421000

24.41

8.12

0.70

86.19

80.63

UBL

947.40

10.69

1227100

55.13

6.37

0.44

82.22

78.12

For Private Circulation Only

6

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

METALS & MINING

COALINDIA

290.90

8.63

15546500

(26.95)

-8.71

0.32

67.36

77.77

HINDALCO

274.10

14.59

38108000

31.80

4.59

0.56

84.56

77.38

HINDZINC

317.70

8.08

9129600

10.97

1.81

0.40

82.62

79.57

JINDALSTEL

169.15

24.51

31666500

(9.47)

6.20

0.63

81.32

85.53

JSWSTEEL

262.20

8.89

50106000

(4.43)

9.03

0.73

94.32

92.73

NATIONALUM

91.75

19.62

23192000

21.45

0.57

0.15

90.96

87.78

NMDC

128.00

8.80

31368000

5.40

6.15

0.63

84.09

85.92

SAIL

76.65

42.87

64152000

(5.81)

-4.07

0.66

86.98

87.41

TATASTEEL

734.45

12.39

23528000

9.87

7.51

0.88

82.84

80.86

VEDL

344.20

10.71

38297000

(14.60)

4.11

0.44

72.35

79.65

INFORMATION TECHNOLOGY

HCLTECH

872.45

(0.19)

8142400

25.10

4.08

0.48

88.38

83.60

HEXAWARE

285.30

6.36

1722000

3.05

2.93

1.33

74.35

73.94

INFY

927.85

3.26

35215500

(7.96)

-21.47

0.47

74.26

80.73

KPIT

138.65

13.65

11032000

5.15

9.49

0.39

92.55

87.81

MINDTREE

486.40

4.64

3290400

(4.63)

-0.21

0.35

87.63

84.91

NIITTECH

614.70

11.43

649500

(8.46)

9.59

0.16

73.64

74.52

OFSS

3550.80

(1.74)

45150

(6.81)

9.63

0.00

76.98

78.19

TATAELXSI

846.05

4.05

1725600

21.04

7.26

0.83

85.22

82.42

TCS

2554.10

3.25

5789250

(0.95)

6.26

0.74

83.50

85.34

TECHM

479.65

5.42

10891100

(1.80)

5.24

0.56

83.84

83.31

WIPRO

300.85

5.39

33033600

6.69

-5.00

0.39

87.62

86.44

MISCELLANIOUS

ADANIENT

132.10

13.83

30248000

14.82

8.76

0.67

89.15

86.02

APOLLOHOSP

1029.30

3.12

1677000

18.27

6.32

1.60

87.55

85.85

BALRAMCHIN

159.75

0.73

15456000

29.58

8.89

0.47

83.59

82.12

BATAINDIA

777.35

11.60

1353000

(20.54)

2.49

0.37

64.98

75.48

BEL

171.15

4.07

14795550

1.12

7.98

0.42

84.67

84.72

CONCOR

1377.05

5.15

1200625

(2.49)

6.75

1.43

83.12

81.10

CUMMINSIND

914.15

1.71

534000

9.61

7.41

0.47

83.88

78.95

GODREJIND

575.80

(0.60)

3309000

7.77

9.32

0.81

79.41

85.09

INDIGO

1178.10

8.49

2098200

(12.42)

8.39

1.10

91.19

81.94

INFIBEAM

131.85

1.35

45220000

0.52

8.77

0.00

84.10

84.52

JETAIRWAYS

534.35

10.96

4952400

15.80

10.15

0.65

88.51

83.96

JISLJALEQS

95.80

1.86

46341000

18.97

8.78

0.47

88.75

89.81

JUSTDIAL

409.40

9.58

4203600

9.09

7.57

0.42

82.42

74.24

KAJARIACER

698.65

(1.38)

873600

12.81

8.27

0.92

79.30

76.93

KSCL

580.95

11.69

4195500

8.88

7.69

0.20

90.28

88.58

For Private Circulation Only

7

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

MCX

1063.90

3.28

1721000

64.45

10.85

1.15

86.59

84.01

PCJEWELLER

343.70

7.42

9813000

15.38

8.87

0.47

78.97

83.46

RNAVAL

52.90

0.19

12312000

5.23

9.95

0.46

88.95

84.92

VGUARD

209.40

15.56

1551000

(18.45)

8.79

0.58

75.04

72.52

OIL & GAS

BPCL

536.50

15.38

9635400

(30.56)

0.10

0.39

65.49

78.77

CHENNPETRO

444.80

12.95

1482000

(34.66)

6.61

0.33

78.54

82.81

GAIL

461.05

15.83

11916000

13.08

-9.53

0.60

67.50

80.04

HINDPETRO

479.10

15.00

21067200

(15.38)

-4.55

0.38

84.46

83.27

IGL

1604.45

9.47

947650

(0.92)

8.72

0.76

80.40

81.35

IOC

434.75

9.17

13251000

(17.45)

-4.18

0.48

71.63

79.93

MGL

1190.25

9.07

665400

(7.35)

8.44

0.53

78.10

82.87

MRPL

135.30

10.09

7636500

27.40

6.98

0.43

83.68

82.32

OIL

347.35

0.81

2449546

2.46

-13.04

0.59

70.01

74.74

ONGC

175.30

1.83

41463750

(5.28)

-12.05

0.46

74.71

81.73

PETRONET

260.40

15.71

9531000

(22.89)

8.07

0.42

83.32

80.72

RELIANCE

952.75

20.79

37311000

0.14

5.89

0.65

86.16

81.89

PHARMACEUTICAL

AJANTPHARM

1181.00

2.59

954000

14.33

9.13

1.22

92.05

85.95

AUROPHARMA

753.35

10.94

16233600

(7.15)

6.06

0.65

93.09

90.99

BIOCON

363.75

9.53

9286200

1.70

-12.74

0.39

80.71

84.52

CADILAHC

486.65

3.79

2764800

(15.25)

5.60

1.81

80.04

83.57

CIPLA

616.20

5.62

7562000

7.16

8.02

0.28

86.02

81.04

DIVISLAB

865.10

0.82

3995200

(35.16)

7.89

0.67

82.98

85.19

DRREDDY

2359.55

(0.71)

3528000

(1.42)

6.76

0.61

90.74

85.51

FORTIS

147.10

0.68

41631300

7.09

9.30

0.41

95.28

92.98

GLENMARK

601.25

0.43

6880300

14.66

4.62

0.64

86.33

88.72

GRANULES

139.05

23.00

16250000

16.53

8.70

0.18

88.24

83.19

LUPIN

1001.05

(0.67)

7799200

16.46

8.45

1.08

84.78

83.38

PEL

2645.80

2.21

1463100

27.80

6.38

0.39

89.18

87.03

STAR

842.25

(5.59)

4277500

99.05

8.99

0.54

91.54

90.80

SUNPHARMA

534.20

6.62

38179200

2.37

7.97

0.52

93.74

90.59

TORNTPHARM

1257.05

2.19

512400

125.53

7.44

0.42

91.24

80.40

WOCKPHARMA

630.05

3.10

2904000

5.71

6.58

0.55

87.11

88.53

REAL ESTATE

DLF

183.50

12.37

43920000

12.85

8.31

0.79

88.23

84.96

HDIL

58.10

3.29

31520000

(0.56)

9.05

0.34

85.84

85.76

IBREALEST

209.45

0.19

43840000

13.46

12.60

0.38

96.37

94.95

NCC

109.40

32.69

21504000

(10.19)

4.79

0.51

82.99

84.60

For Private Circulation Only

8

Derivatives Rollover Report

POWER

ADANIPOWER

32.95

11.51

103360000

5.75

11.20

0.43

93.59

91.91

CESC

1038.40

5.09

4944500

(0.82)

8.25

0.56

88.73

85.59

JSWENERGY

84.50

14.27

62781000

7.23

9.97

0.94

95.83

93.93

NHPC

28.25

4.82

36504000

17.98

9.31

0.37

84.71

83.48

NTPC

183.45

10.21

23332000

1.82

-6.78

0.21

69.61

69.77

POWERGRID

212.65

1.50

12340000

5.98

3.20

0.84

61.30

65.95

PTC

120.05

(2.16)

16832000

32.41

8.76

0.80

88.74

84.47

RPOWER

40.35

(2.30)

62172000

14.90

9.13

0.55

90.64

88.69

SUZLON

16.00

2.89

430020000

(0.26)

9.87

0.53

89.28

85.25

TATAPOWER

82.80

6.29

32148000

(11.85)

8.25

0.41

85.56

80.54

TORNTPOWER

266.90

26.94

5055000

(23.34)

7.28

0.59

73.55

81.79

TELECOM

BHARTIARTL

513.60

33.63

30627200

26.89

4.69

1.08

86.79

87.98

IDEA

97.25

27.88

55706000

0.03

5.93

0.67

76.48

76.69

INFRATEL

458.55

16.34

8938600

52.27

7.21

0.97

82.95

74.42

RCOM

15.95

(21.04)

111594000

0.15

9.90

0.88

88.68

88.84

TATACOMM

682.20

0.79

7852600

5.87

10.03

0.42

88.71

88.55

TEXTILES

ARVIND

399.15

7.79

5182000

(20.64)

7.50

0.39

85.46

76.81

CENTURYTEX

1360.45

10.96

7200050

0.93

8.50

0.86

91.58

91.89

ICIL

121.65

17.88

10101000

(5.31)

7.77

0.40

87.14

86.34

PAGEIND

20011.80

7.83

17650

(7.59)

5.34

0.00

75.59

71.59

RAYMOND

880.75

7.85

4184800

32.33

8.48

0.07

90.47

89.39

SRF

1657.35

7.15

734500

22.62

9.49

1.05

78.22

82.54

MEDIA

DISHTV

77.15

1.05

21490000

48.67

4.07

0.34

85.18

81.32

PVR

1428.40

18.94

491200

(31.40)

5.10

0.25

74.61

77.89

SUNTV

820.85

11.23

5391000

(4.90)

6.33

0.51

87.12

84.89

TV18BRDCST

43.45

11.70

91511000

6.81

8.47

0.46

93.86

91.07

ZEEL

534.40

2.42

7581600

39.19

5.69

0.71

86.08

85.49

For Private Circulation Only

9

Derivatives Rollover Report

Research Team Tel: 022 - 39357800 Extn-6824

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor.

Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations,

2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other

regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.

Derivative Research Team

For Private Circulation Only

10