Derivatives

Rollover Report

November 25, 2016

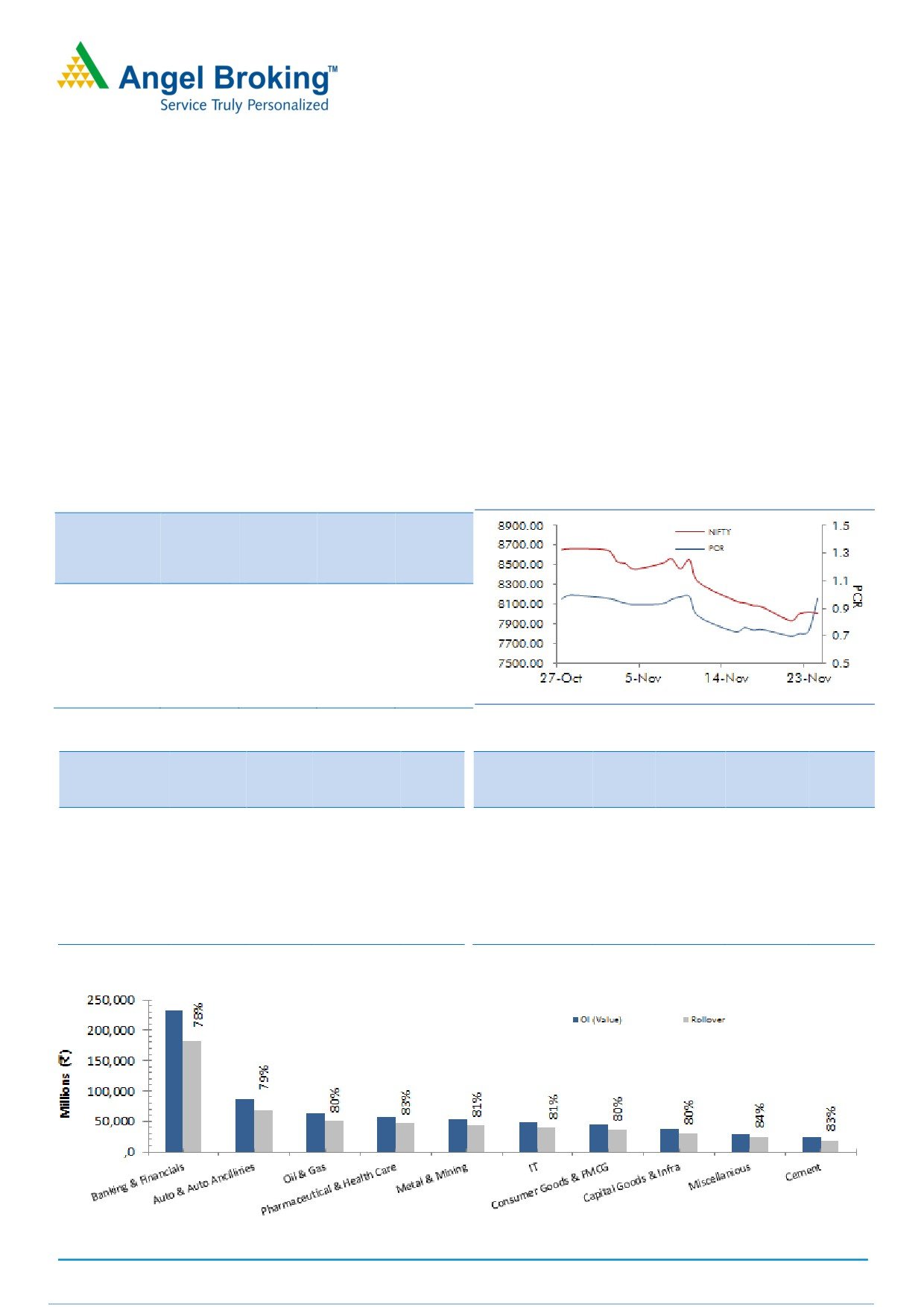

Again, December series is beginning with open interest being light. Rollover in Nifty, both in terms of percentage and

open interest, is below its averages. In first two weeks of November series, we witnessed huge amount of long

unwinding followed by short formation going ahead. FIIs curb liquidity for more than eighteen thousand crore in

November series, which was seen for the first time after March 2016. While in Index Futures, they have exited most of

their longs and formed mixed positions in last week of November series; as a result, the Long/Short ratio fell from

79.20% to 48.90%. Currently, FIIs open positions in index futures are lowest in the last two years, as they have exited

around one third of their total positions in last series. As far as Options data is concerned, 8000 & 8500 call and

8000 put options are attracting trader’s attention. At the current juncture, 7900-8000 seems to be an immediate

support zone for Nifty. Considering above data, we are unable to retrieve any clear directional hints; thus, we would

like to wait for fresh build-up before forming any directional view. Traders are advised to remain light unless we see

any meaningful activity in either direction.

As far as Rollover in BankNifty is concerned, it is below average in terms percentage; but is higher in terms of open

interest. Private Banking heavyweights were the major draggers in November series and they also added some short

positions. Now, 18850-18900 can be seen as a strong support for BankNifty; while resistance is placed at 19000-

19150 zones.

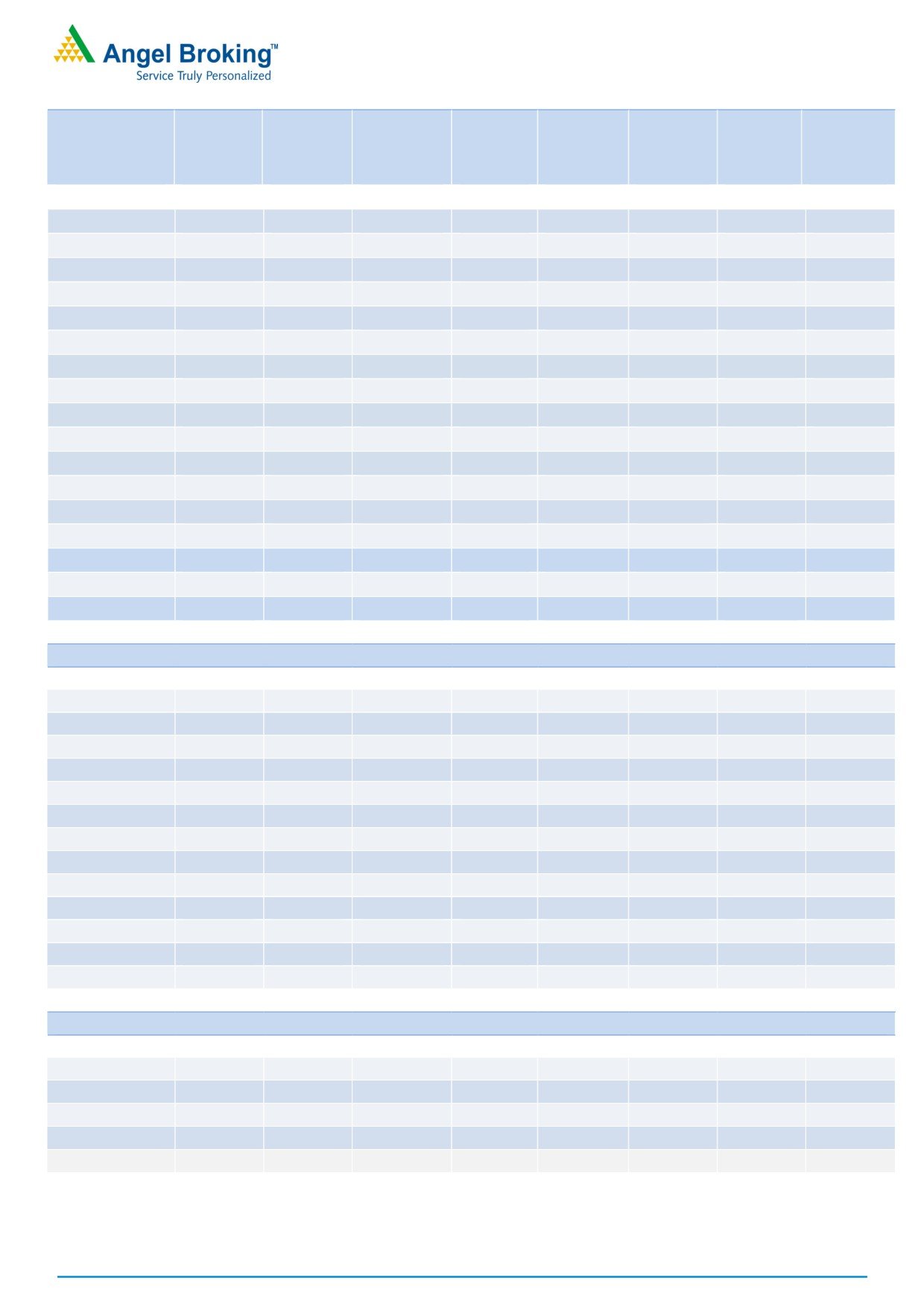

Indices Change

NIFTY & PCR Graph

Price

Change

3 month

INDEX

Price

(%)

Rollover

avg.

NIFTY

8013.10

(7.42)

63.10

66.22

BANKNIFTY

18392.25

(6.13)

61.49

64.76

NIFTYIT

9714.00

(3.95)

73.60

65.65

NIFTYMID50

3924.85

1.99

-

-

NIFTYINFRA

2828.70

(4.04)

-

-

Monthly Gainers

Monthly Losers

Price

Ol

Price

Ol

Change Open

Change

Change Open

Change

Scrip

Price

(%)

Interest

(%)

Scrip

Price

(%)

Interest

(%)

HINDALCO

180.80

21.14

38367000

9.82

JPASSOCIAT

7.15

(35.29)

142392000

(10.70)

STAR

1079.90

14.28

1561000

(34.32)

PCJEWELLER

343.35

(32.64)

727500

13.05

VEDL

222.05

11.75

41142000

13.83

DHFL

228.95

(29.85)

17025000

17.13

TECHM

460.30

10.45

7991500

(10.39)

HDIL

58.20

(27.70)

23776000

1.57

HINDZINC

274.85

9.72

8016000

37.64

INDIACEM

114.85

(26.09)

20167000

(9.69)

Note: Stocks which have more than 1000 contract in Futures OI.

Note: Stocks which have more than 1000 contract in Futures OI.

SEBI Registration No: INB 010996539

1

Derivatives Rollover Report

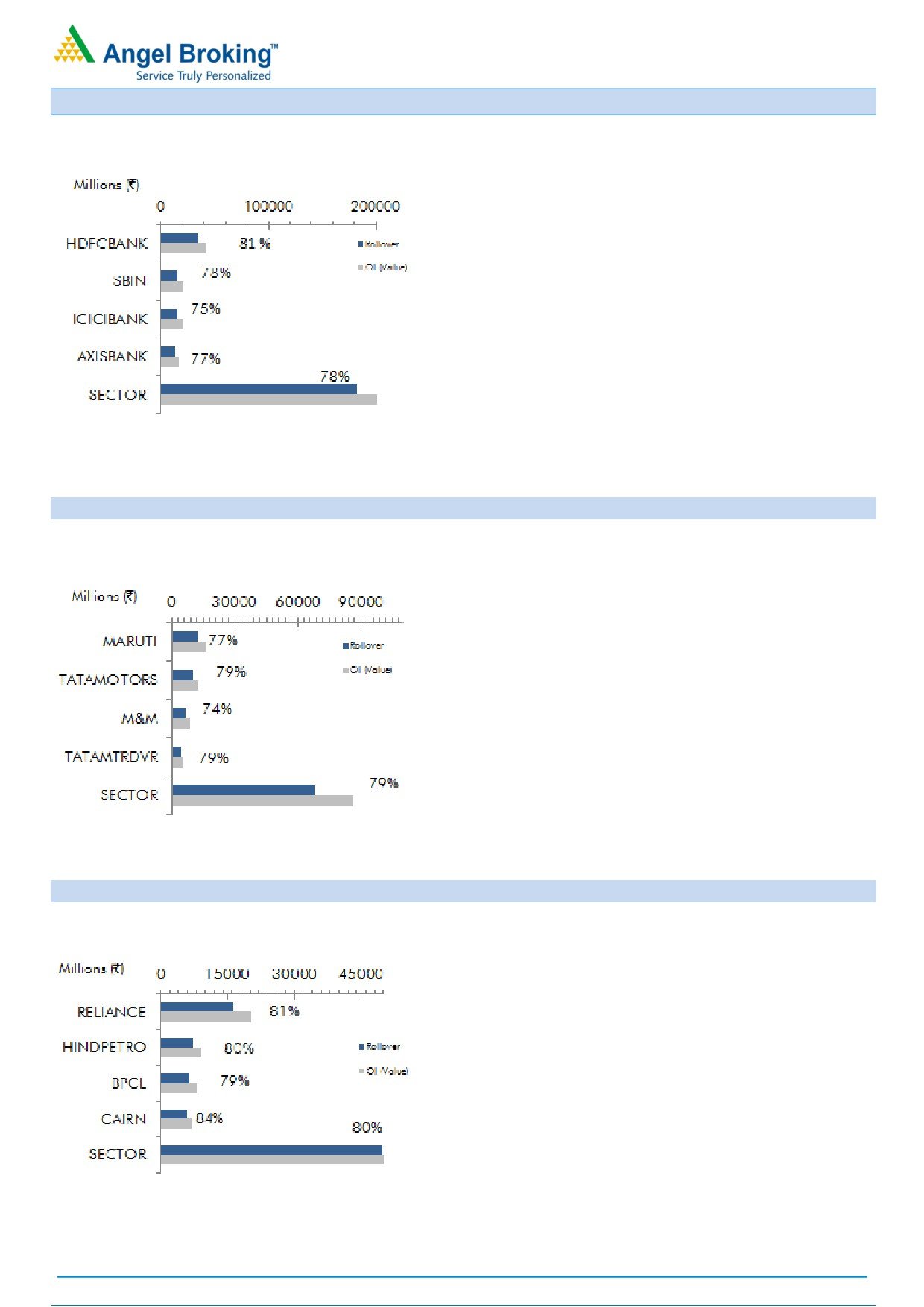

Banking and Financials

ICICIBANK

(75.48%) added huge amount of

positions in last series, most of them are on short

side. Rollover was also above average. Since, there

is no sign of reversals per derivative data; stock

may see further correction towards `240-`242

level.

BANKBARODA (77.70%) was major gainer in

heavyweight PSU banks. In last few days, the stock

added good amount of fresh longs. Stock may

continue to move higher towards its resistance of

`177-`180 zone.

Post the demonetization announcement, DHFL

(84.32%) has corrected sharply along with huge

short formations. Rollovers were also in-line with its

quarterly averages. This counter may remain under

pressure in upcoming sessions too.

Auto & Auto Ancillaries

MARUTI (77.43%) plunged more than 17% series

on series. Most of the longs formed in October

series have been lightened, while huge amount of

fresh short positions were formed in the last few

days. `4650-`4700 is an immediate support in

this counter; traders who are short should look

towards covering their shorts at these level.

BHARATFORG (77.75%) out performed its peer

group. But, this move was mainly due to short

covering and some long formation. We expect

fresh long in this counter going ahead. Thus, it’s a

buy on dip counter for us.

TATAMOTORS (79.22%) corrected nearly 13% but

we hardly saw any meaningful short formation.

`430-`440 is a support zone for this stock and we

don’t expect it to breach, unless we see any

aggressive short formation in near term.

Oil & Gas

CAIRN’s (83.77%) bounced from `225 level with

good amount of long formation. These long

positions have been rolled too. We believe, this

stock may continue to show strength in near term,

which may bring it near `255-`256 level.

RELIANCE (80.58%), since start of November series,

remained under pressure but we hardly saw any

short formation. This stock is light in terms of open

interest and traders should wait for any meaningful

build-up in either direction before entering into

trade.

GAIL (84.37%) corrected from `450 level with good

amount of short formation and these positions have

been rolled too. This counter has a strong support

around `398-`402 level. We expect short covering

bounce in this stock. Hence, one should trade this

counter with a positive bias.

For Private Circulation Only

SEBI Registration No: INB 010996539

2

Derivatives Rollover Report

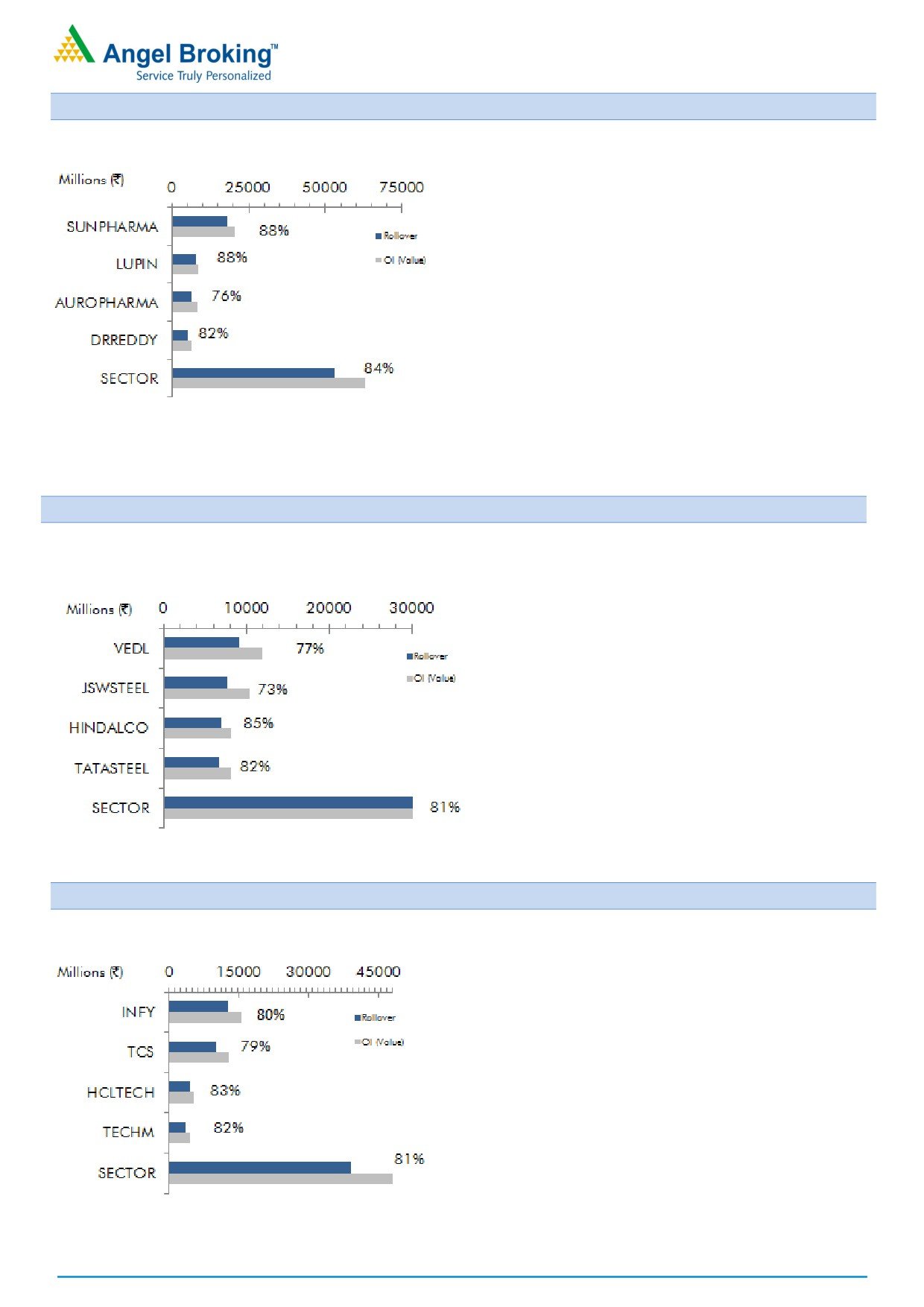

Pharmaceuticals

SUNPHARMA (88.23%) has seen decent correction

in first half of November series with formation of

fresh shorts. However, the stock consolidated in

later half with some unwinding. We may see

further short covering bounce in the counter on a

sustainable move above its resistance at `710-

`715 zones.

AUROPHARMA (75.70%) has corrected sharply in

last series; but we didn’t witness any short

formation in that fall. Currently, the stock is very

light in terms of OI and thus traders are advised to

wait for some fresh build-up before initiating any

positional trade in the counter.

STAR (89.00%) was the top gainer in this space,

but we hardly saw any long formation in last

series. Rollovers are also in-line with averages.

Traders should book profit in longs on rallies.

Metal & Mining

TATASTEEL (82.21%) remained flat on MoM basis.

We witnessed decent amount of unwinding in last

series and as a result, stock is light on positions.

Fresh build-up in next series will decide further

move in the counter.

VEDL (76.77%) is attracting long positions from

last couple of months. Up moves in the counter

was on back of fresh long build-up; while

corrective moves were not supported by fresh

positions. The stock may breach its resistance of

`230-`232 and move higher in near term.

HINDALCO (85.31%) and HINDZINC (83.78%)

were major gainers in this sector with huge OI

build-up. Most of them are on long side and got

rolled too. Traders are advised to trade these

counters with positive bias.

IT

INFY counter corrected from

`1030 level with

decent amount of short positions. Recently, stock

rebounded from lower levels, wherein, we

witnessed short covering and some fresh long

build-up in the stock. We expect some short

covering bounce in this counter which may bring it

near `980-`986 level.

TCS

(78.58%) has added highest positions in

percentage terms in this sector. These positions are

mixed and rolled too. Stock is rebounding from its

support of `2100-`2050 and we may see some

short covering move in upcoming sessions too.

TECHM (81.91%) was the major gainer in this

space. However, the up move was not supported

by significant long positions. Thus, traders should

lighten up their existing longs in the counter.

For Private Circulation Only

SEBI Registration No: INB 010996539

3

Derivatives Rollover Report

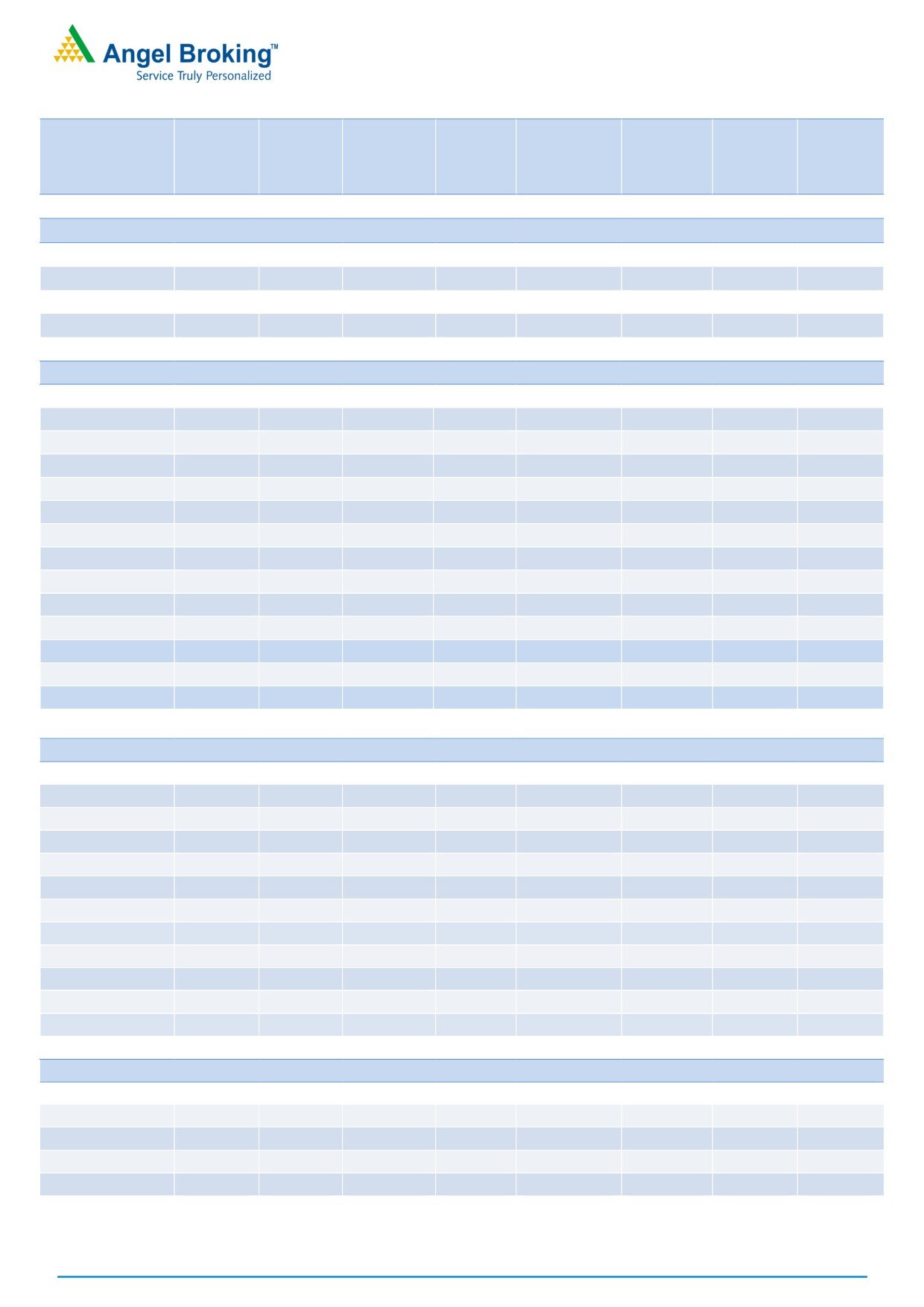

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

917.30

(8.88)

561000

(7.33)

-2.10

0.73

72.26

75.39

APOLLOTYRE

178.90

(10.97)

9396000

(6.79)

4.98

0.48

81.84

80.35

ASHOKLEY

76.10

(10.94)

54754000

(19.58)

6.20

0.54

84.49

81.63

BAJAJ-AUTO

2641.95

(4.87)

1262750

(11.07)

4.38

1.08

71.66

73.61

BHARATFORG

911.30

5.73

3391200

(37.62)

-2.80

0.29

77.75

83.21

BOSCHLTD

18923.60

(15.35)

75350

(22.00)

5.29

0.00

77.80

77.67

CASTROLIND

387.35

(15.88)

11060000

(21.98)

7.18

0.94

87.10

87.79

CEATLTD

1156.80

(4.04)

805700

(35.19)

5.35

0.58

66.80

66.28

EICHERMOT

20443.05

(17.12)

146800

10.38

4.43

0.20

77.59

77.51

EXIDEIND

172.10

(9.85)

16072000

(34.54)

6.40

0.81

88.64

88.96

HEROMOTOCO

3057.90

(8.35)

1172200

(26.60)

2.03

1.29

76.58

77.38

M&M

1170.25

(10.31)

5579000

(18.90)

5.87

1.00

74.01

77.04

MARUTI

4857.60

(17.61)

2631000

22.27

5.93

0.87

77.43

75.50

MOTHERSUMI

296.80

(9.88)

9930000

6.00

2.29

1.05

88.19

79.49

MRF

47334.60

1.35

22980

(53.49)

2.65

0.00

85.59

88.17

TATAMOTORS

455.65

(13.24)

21684000

(23.51)

6.22

0.59

79.22

78.43

TATAMTRDVR

288.75

(15.17)

15201900

(16.49)

8.01

0.58

79.21

80.66

TVSMOTOR

351.00

(14.08)

4978000

(20.63)

-25.93

0.90

69.14

69.99

BANKING & FINANCIALS

ALBK

67.10

(11.01)

12900000

(11.83)

7.04

1.08

78.56

80.48

ANDHRABANK

51.40

(8.21)

18040000

(10.91)

7.15

1.18

82.11

81.66

AXISBANK

471.15

(3.43)

27997200

(20.96)

6.57

0.66

77.13

75.99

BAJFINANCE

824.60

(25.82)

6305750

6.02

4.96

1.13

87.07

87.22

BANKBARODA

167.95

8.99

36396500

(16.51)

5.62

0.59

77.70

81.21

BANKINDIA

120.50

6.03

19788000

(2.54)

3.91

0.77

74.30

82.66

BHARATFIN

688.00

(22.34)

4883000

(27.72)

5.41

0.35

82.01

86.31

CANBK

306.90

(2.73)

6504000

(28.12)

3.24

0.65

72.58

73.68

DCBBANK

106.95

(16.64)

1746000

18.29

6.38

1.63

74.19

-

DHFL

228.95

(29.85)

17025000

17.13

5.96

0.68

84.32

84.14

FEDERALBNK

68.40

(16.74)

54472000

35.45

7.68

0.57

84.23

84.46

HDFC

1224.55

(11.48)

7925000

(19.57)

5.91

0.65

76.19

76.24

HDFCBANK

1175.75

(6.52)

29661000

(0.07)

9.17

0.76

80.89

85.00

IBULHSGFIN

679.80

(19.22)

7780800

13.25

4.78

0.45

82.71

84.68

ICICIBANK

260.95

(8.52)

60737500

32.38

6.64

0.46

75.48

72.56

IDBI

67.00

(10.61)

32640000

0.32

3.12

1.16

83.81

80.82

IDFCBANK

68.55

(11.83)

25168000

0.06

6.12

0.88

78.81

-

IDFC

55.45

(19.23)

58000800

(2.20)

3.78

0.53

91.62

88.03

IFCI

22.85

(12.28)

56474000

(17.14)

-9.05

0.65

67.87

79.21

For Private Circulation Only

SEBI Registration No: INB 010996539

4

Derivatives Rollover Report

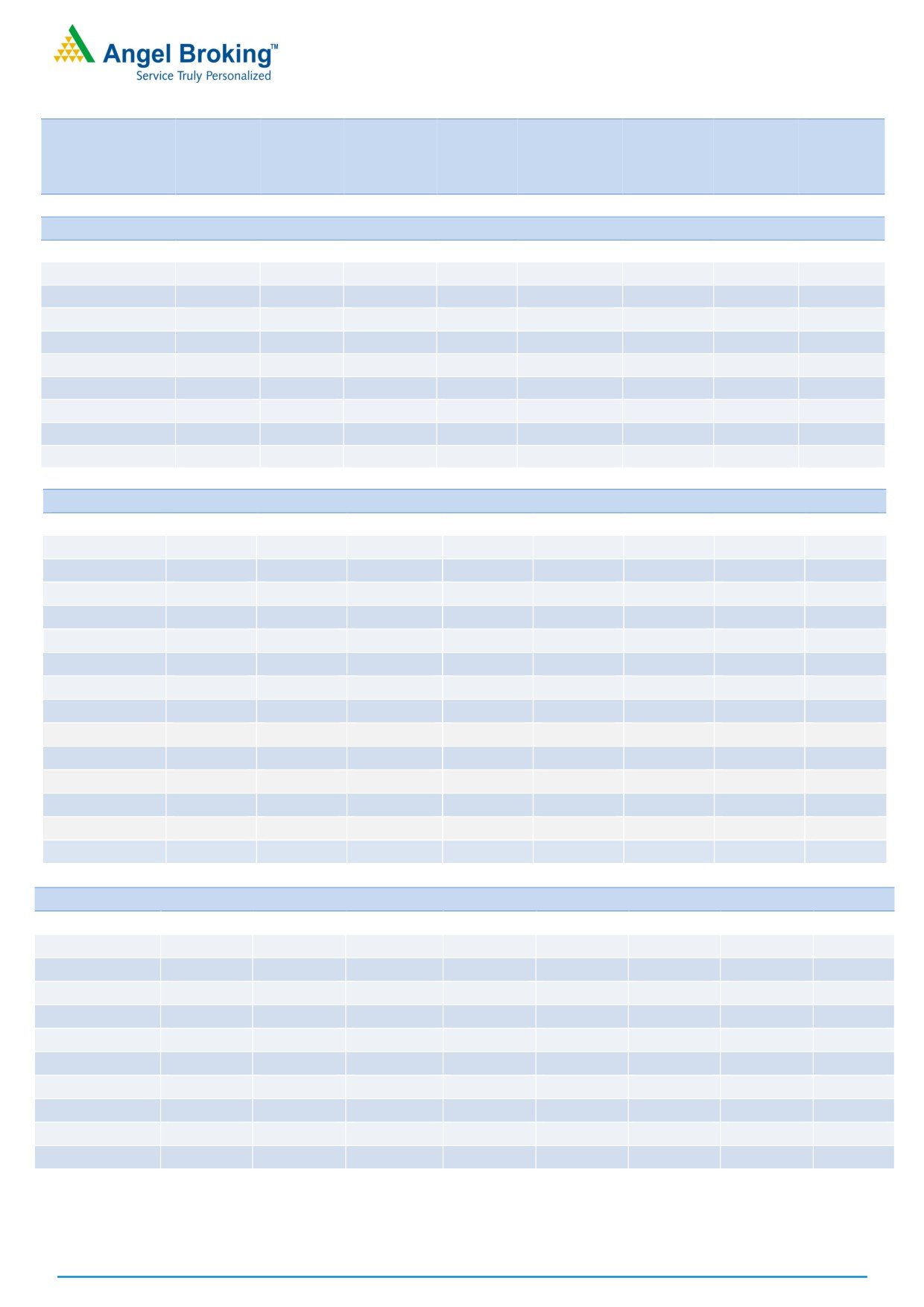

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

INDUSINDBK

1051.35

(11.23)

4873800

22.95

6.94

0.68

74.28

72.10

KOTAKBANK

747.10

(7.63)

7619200

0.12

7.03

0.65

68.16

72.66

KTKBANK

101.80

(16.11)

16166000

(0.23)

3.60

0.63

87.79

85.04

L&TFH

83.40

(21.62)

28098000

(23.85)

6.29

0.64

84.15

83.93

LICHSGFIN

521.90

(11.35)

6284300

(15.90)

3.71

0.60

78.21

78.22

M&MFIN

278.60

(24.16)

7810000

(39.59)

4.70

1.06

74.58

79.15

ORIENTBANK

120.00

(8.85)

12048000

20.17

0.43

0.97

73.15

79.22

PFC

127.10

1.60

8742000

(52.34)

-1.64

0.25

43.82

65.17

PNB

138.50

(2.98)

34405000

(15.05)

4.92

0.64

84.81

84.05

RECLTD

133.05

(2.28)

26454000

(9.65)

4.72

0.40

85.55

85.98

RELCAPITAL

425.60

(18.24)

11002500

(11.91)

6.04

0.75

84.56

80.49

SBIN

263.05

2.37

60822000

(1.69)

5.18

0.58

77.97

79.39

SOUTHBANK

20.65

(12.68)

38100000

(12.41)

7.63

0.31

84.95

86.37

SRTRANSFIN

877.55

(19.82)

3172800

(5.08)

7.06

0.25

75.51

79.60

SYNDIBANK

66.30

(10.53)

15075000

(14.06)

3.95

0.37

82.80

77.23

UNIONBANK

150.85

4.18

10604000

(20.84)

-4.47

0.72

80.68

84.45

YESBANK

1125.75

(10.78)

7606200

(6.38)

5.49

0.59

72.73

73.96

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

258.85

(15.71)

12497500

(31.73)

4.65

0.62

79.00

78.52

BEML

789.25

(14.92)

671300

(34.06)

3.91

0.52

84.25

87.23

BHEL

125.05

(10.17)

33100000

(7.63)

5.45

0.68

73.01

80.60

CROMPGREAV

75.05

0.87

6192000

(42.73)

3.49

0.67

62.55

72.21

ENGINERSIN

278.10

3.17

4648000

(52.02)

2.82

0.43

79.28

83.59

GMRINFRA

11.15

(18.61)

166590000

(11.41)

9.44

1.08

87.64

87.77

HAVELLS

335.70

(18.05)

2996000

(17.10)

3.12

0.83

75.89

75.04

IRB

186.00

(21.09)

9735000

(3.42)

-1.12

0.56

83.44

80.82

JPASSOCIAT

7.15

(35.29)

142392000

(10.70)

7.34

0.64

87.21

84.74

LT

1357.60

(8.39)

6596000

1.61

6.14

0.75

79.74

78.28

RELINFRA

453.25

(17.03)

8312200

(30.27)

6.13

0.81

82.77

82.12

SIEMENS

1052.95

(11.00)

823500

(0.78)

5.63

0.60

83.31

82.74

VOLTAS

297.55

(22.39)

3154000

(9.00)

-8.00

1.15

70.72

77.45

CEMENT

ACC

1329.65

(13.37)

1125600

(7.22)

3.54

1.60

80.35

78.81

AMBUJACEM

201.90

(17.54)

15685000

48.46

3.37

0.43

78.50

76.35

GRASIM

814.90

(15.52)

7679250

(12.63)

5.98

5.82

86.19

86.13

INDIACEM

114.85

(26.09)

20167000

(9.69)

6.40

0.72

83.58

85.42

ULTRACEMCO

3473.70

(12.21)

1585400

82.94

-3.01

1.98

81.69

73.73

For Private Circulation Only

SEBI Registration No: INB 010996539

5

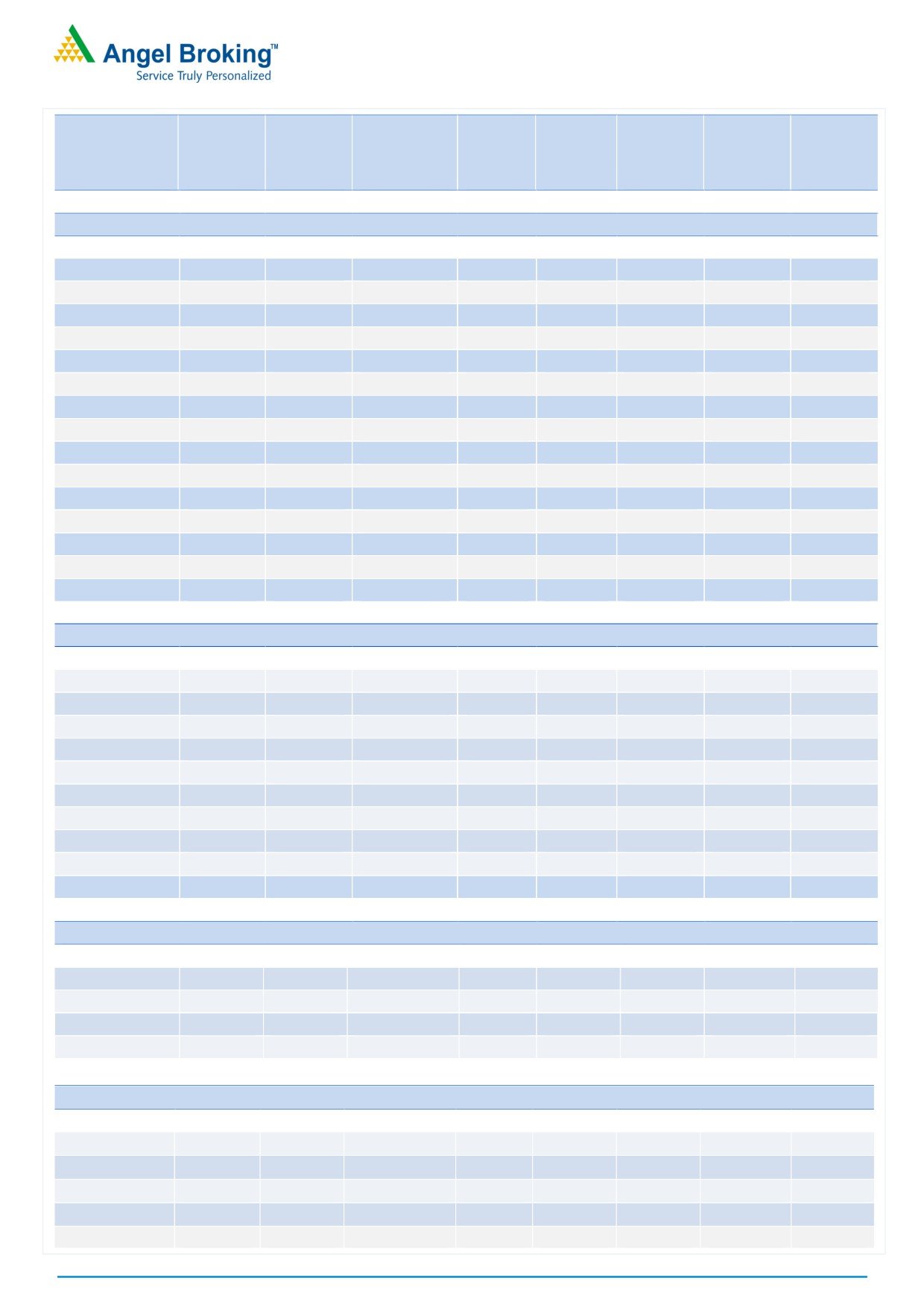

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

CHEMICAL & FERTILIZERS

PIDILITIND

614.55

(13.89)

1238000

(35.25)

4.17

0.75

73.21

80.49

TATACHEM

456.50

(15.81)

5044500

(28.06)

-3.19

1.48

81.92

87.58

UPL

612.35

(13.83)

4804800

(14.21)

5.31

0.94

81.93

85.56

CONSUMER GOODS & FMCG

ASIANPAINT

939.95

(13.84)

4148400

(9.95)

4.29

0.74

67.91

74.44

BRITANNIA

2957.90

(8.40)

973400

(3.49)

5.44

1.00

88.75

88.25

COLPAL

929.70

(1.16)

434000

(45.66)

-5.52

1.50

75.98

70.26

DABUR

276.90

(4.37)

12140000

85.27

2.45

0.44

88.08

86.95

GODREJCP

1438.60

(9.31)

427600

39.01

2.69

-

73.07

75.65

HINDUNILVR

829.45

(0.90)

4557600

(24.35)

5.24

0.69

76.21

76.36

ITC

224.75

(7.98)

41112000

3.17

5.83

0.81

76.07

73.61

JUBLFOOD

855.70

(14.40)

1875000

(8.56)

0.06

0.87

83.78

83.23

MARICO

251.50

(10.29)

7662200

(11.77)

5.21

3.67

88.26

90.75

MCLEODRUSS

147.10

(13.32)

4326000

(27.39)

7.14

1.10

77.03

80.54

TATAGLOBAL

115.80

(16.48)

28984500

(9.84)

6.34

1.09

89.38

89.50

TITAN

309.00

(16.88)

9721500

1.71

4.92

0.90

86.10

89.25

UBL

864.60

(1.31)

1060500

(7.68)

3.02

0.82

71.46

77.74

INFORMATION TECHNOLOGY

HCLTECH

771.70

(1.00)

5844300

2.18

5.30

0.61

83.08

78.54

HEXAWARE

191.15

(4.90)

4044000

(34.69)

6.59

0.44

80.94

83.31

INFY

935.85

(7.39)

13375500

5.46

6.22

0.66

79.83

76.09

KPIT

126.90

(12.90)

3712000

(15.41)

3.71

1.70

83.60

81.57

MINDTREE

464.70

5.45

3002400

(8.86)

4.17

1.08

85.06

84.97

NIITTECH

402.20

(2.39)

603500

(37.72)

5.47

2.50

88.30

84.04

OFSS

2976.95

(7.17)

208350

(8.98)

6.40

0.00

86.01

83.60

TATAELXSI

1163.30

(6.78)

1949800

(4.13)

4.77

0.25

87.67

85.14

TCS

2198.80

(9.32)

4605500

5.56

4.93

0.82

78.58

75.43

TECHM

460.30

10.45

7991500

(10.39)

3.75

0.67

81.91

80.44

WIPRO

453.20

(2.40)

5601200

(17.23)

5.67

1.36

75.31

75.36

MEDIA

DISHTV

82.20

(14.46)

36393000

15.76

6.38

0.60

86.74

84.74

SUNTV

446.90

(17.02)

7340000

(18.41)

5.87

0.92

87.26

87.63

TV18BRDCST

35.80

(19.37)

76534000

(4.15)

8.81

1.10

91.78

91.21

ZEEL

441.50

(13.06)

9075300

(17.20)

5.70

0.98

79.27

79.73

For Private Circulation Only

SEBI Registration No: INB 010996539

6

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

METALS & MINING

COALINDIA

302.10

(5.09)

11621200

(9.13)

6.08

1.48

79.43

77.93

HINDALCO

180.80

21.14

38367000

9.82

2.02

0.90

85.31

80.21

HINDZINC

274.85

9.72

8016000

37.64

5.72

0.50

83.78

73.97

JINDALSTEL

65.00

(15.53)

43641000

(7.13)

4.84

0.47

90.70

92.11

JSWSTEEL

1622.90

(1.56)

4694100

(25.79)

5.26

0.71

73.43

80.42

NMDC

120.25

(2.87)

17376000

36.54

5.23

0.74

87.33

85.43

SAIL

47.80

(4.59)

51192000

(23.36)

-19.27

0.66

85.00

87.49

TATASTEEL

399.30

(0.14)

16744000

(16.20)

3.01

0.58

82.21

80.58

VEDL

222.05

11.75

41142000

13.83

1.18

0.77

76.99

79.52

MISCELLANIOUS

ABIRLANUVO

1178.05

(14.65)

3405400

(23.29)

4.40

3.62

86.78

85.86

ADANIENT

62.00

(7.81)

15512000

(14.96)

5.92

0.70

83.87

85.05

BATAINDIA

403.60

(15.46)

3478200

10.87

2.72

0.93

83.81

81.87

BEL

1306.45

3.04

1152450

19.90

6.38

1.00

84.72

72.78

CONCOR

1182.10

(13.43)

541000

6.60

-2.29

0.28

76.96

67.98

CUMMINSIND

778.10

(9.11)

503400

(11.22)

2.69

0.87

85.35

82.55

GODREJIND

369.20

(16.56)

1383000

(5.73)

5.97

2.00

81.45

81.37

JETAIRWAYS

356.05

(22.22)

5134000

(22.11)

6.19

0.52

86.53

87.12

JISLJALEQS

84.25

(21.48)

35505000

(10.58)

4.35

0.75

88.67

86.95

JUSTDIAL

352.00

(14.80)

3848800

(5.72)

-46.15

1.02

84.61

80.83

KSCL

384.90

(10.71)

2316000

4.39

-1.89

0.21

75.21

79.21

MCDOWELL-N

1859.20

(18.61)

2828750

(17.08)

4.54

1.26

84.88

85.69

PCJEWELLER

343.35

(32.64)

727500

13.05

-85.21

1.00

49.90

63.37

SINTEX

72.55

(15.79)

28478625

(19.55)

6.51

0.62

85.19

87.61

OIL & GAS

BPCL

637.40

(5.81)

10050000

(23.53)

-1.14

0.87

78.87

83.44

CAIRN

245.70

9.13

23443000

31.36

6.19

0.50

83.77

82.07

GAIL

404.40

(7.62)

6598500

20.85

4.79

0.70

84.37

78.10

HINDPETRO

450.55

(0.85)

16134300

(20.51)

-3.69

0.64

79.80

87.28

IGL

830.85

(2.18)

904200

(41.41)

-5.87

1.11

70.68

74.16

IOC

295.10

(6.35)

16284000

(29.72)

4.08

0.46

78.72

80.12

OIL

439.90

6.06

834700

(50.05)

1.31

0.86

76.36

73.32

ONGC

278.90

(3.04)

14380000

(21.60)

6.21

0.50

79.22

76.01

PETRONET

371.35

(3.13)

4090500

(35.62)

3.24

0.59

72.03

78.44

RELIANCE

992.85

(5.87)

16396000

(24.64)

5.81

0.60

80.58

81.18

For Private Circulation Only

SEBI Registration No: INB 010996539

7

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

PHARMACEUTICAL

AJANTPHARM

1785.10

(9.93)

312800

(28.13)

5.67

0.92

78.67

80.22

APOLLOHOSP

1229.40

(8.20)

434800

(15.47)

-2.71

0.63

69.95

81.28

AUROPHARMA

713.85

(12.09)

8842400

(25.65)

6.17

0.70

75.70

82.16

BIOCON

861.10

(7.07)

2381300

(48.76)

7.07

0.97

80.75

84.52

CADILAHC

397.95

0.10

2892800

15.97

4.47

0.33

84.17

88.15

CIPLA

555.40

(5.41)

5823000

0.94

3.30

0.61

81.20

80.82

DIVISLAB

1153.75

(10.18)

1129200

(12.59)

5.54

1.00

80.36

74.73

DRREDDY

3121.15

(6.54)

1680000

17.25

3.17

0.84

81.66

76.44

GLENMARK

893.95

(1.66)

2020900

(6.99)

5.45

1.04

83.78

85.12

GRANULES

105.15

(13.95)

9470000

(32.33)

8.00

0.23

88.80

88.99

LUPIN

1466.65

(1.58)

5276400

(18.98)

5.83

0.65

88.05

84.53

STAR

1079.90

14.28

1561000

(34.32)

4.75

0.35

89.00

87.45

SUNPHARMA

686.20

(8.49)

26382300

3.05

5.65

0.70

88.23

84.94

TORNTPHARM

1347.85

(6.14)

214000

(42.16)

0.70

1.50

77.09

75.45

WOCKPHARMA

672.65

(21.70)

3120000

(11.46)

0.93

1.18

86.14

84.12

POWER

ADANIPOWER

24.25

(10.19)

103040000

(18.57)

8.67

0.62

86.60

80.33

CESC

570.70

(7.62)

1961300

14.59

4.22

2.60

73.95

75.75

JSWENERGY

55.15

(15.80)

24152000

(4.82)

6.66

1.21

88.98

86.59

NHPC

26.50

2.51

18144000

(2.04)

5.94

0.47

74.92

74.50

NTPC

157.85

3.44

14648000

6.70

5.65

0.33

81.74

75.22

POWERGRID

186.10

5.47

16868000

5.69

5.92

0.33

73.52

72.99

PTC

70.85

(3.80)

14728000

(0.81)

2.21

0.88

78.37

85.58

RPOWER

38.85

(17.52)

53544000

(9.77)

5.40

0.56

85.84

86.50

TATAPOWER

69.60

(13.05)

19809000

(7.83)

3.01

1.16

74.84

76.71

TORNTPOWER

172.35

(0.40)

1977000

2.49

5.17

0.13

85.25

-

REAL ESTATE

DLF

113.70

(24.05)

29805000

(29.71)

6.00

0.89

83.08

84.47

HDIL

58.20

(27.70)

23776000

1.57

6.31

0.92

82.88

81.70

IBREALEST

66.80

(24.09)

26380000

(28.53)

7.07

0.43

78.63

83.45

NCC

73.45

(19.77)

14560000

(49.92)

8.59

1.11

83.91

86.18

TELECOM

BHARTIARTL

301.75

(6.55)

23584900

1.80

-2.24

1.12

84.35

81.21

IDEA

71.70

(8.02)

56862000

(14.30)

3.65

0.65

84.76

82.59

INFRATEL

362.30

1.70

2843400

(18.79)

5.50

0.22

68.38

69.88

RCOM

34.70

(24.97)

86372000

(17.12)

6.05

0.49

88.00

82.97

TATACOMM

636.95

0.70

4501000

(26.01)

5.76

0.89

83.20

85.53

For Private Circulation Only

SEBI Registration No: INB 010996539

8

Derivatives Rollover Report

TEXTILES

ARVIND

347.15

(16.76)

4570000

(36.70)

3.31

0.83

78.98

79.83

CENTURYTEX

742.75

(17.12)

6400900

(14.69)

4.87

0.56

89.77

90.54

ICIL

137.30

(13.79)

3081000

(20.14)

3.81

0

78.46

82.33

PAGEIND

12496.05

(24.15)

34300

(4.19)

1.27

0.00

76.31

82.35

SRF

1456.15

(20.13)

344500

(28.53)

2.98

1.52

70.38

74.21

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager with SEBI. It

also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in

terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates including its relatives/analyst

do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not

received any compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market

making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as

they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume,

as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to

be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only.

Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the

information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update

on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in

the stocks recommended in this report.

Derivative Research Team

For Private Circulation Only

SEBI Registration No: INB 010996539

9