Derivatives Rollover Report | June 01, 2018

The Nifty rallied towards the 10900 mark in the midst of May series, which was clearly on cards seeing the long rollovers in

the April series (due to anticipation of a favorable outcome from the Karnataka assembly election). However, strong bout of

selling got attracted as BJP failed to form government in Karnataka. Subsequently, we saw good amount of short formation

in index futures that dragged index towards the support zone of 10400-10450 levels. In last couple of days, we witnessed

decent short covering which resulted into low rollovers figures for Nifty.

Rollover for Nifty stood at 62.62%, below its 3-month average of 67.89%; in fact, the outstanding contracts have also

plunged to the 3-month low. Stronger hands continued curbing liquidity as they sold equities worth Rs. 11,658 crores last

month. At the same time, they formed good amount of shorts in index futures segment and also rolled over few of them,

resulting their ‘Long Short Ratio’ declining to 44% from 54% MoM. At current juncture, index seem to have an immediate

support of 10600-10650 levels; whereas, 10900-10950 should act as a sturdy hurdle. Considering the above data points,

we expect index to remain in the mentioned range for the initial part of June series and hence, traders are advised to prefer

stock centric approach for a time being.

BankNifty Rollovers is at 75.06%, slightly lower to the 3-month average of 77.62%. However, we saw open interest surging

36.69% series on series, hinting good amount of longs have been carried forward. The banking giant, HDFCBANK showed

spectacular run of 4.45% on the news, SEBI opens trading window for FIIs on Friday. Whereas, other counters like

KOTAKBANK, AXISBANK and INDUSINDBK also contributed in the rally seen in BankNifty.

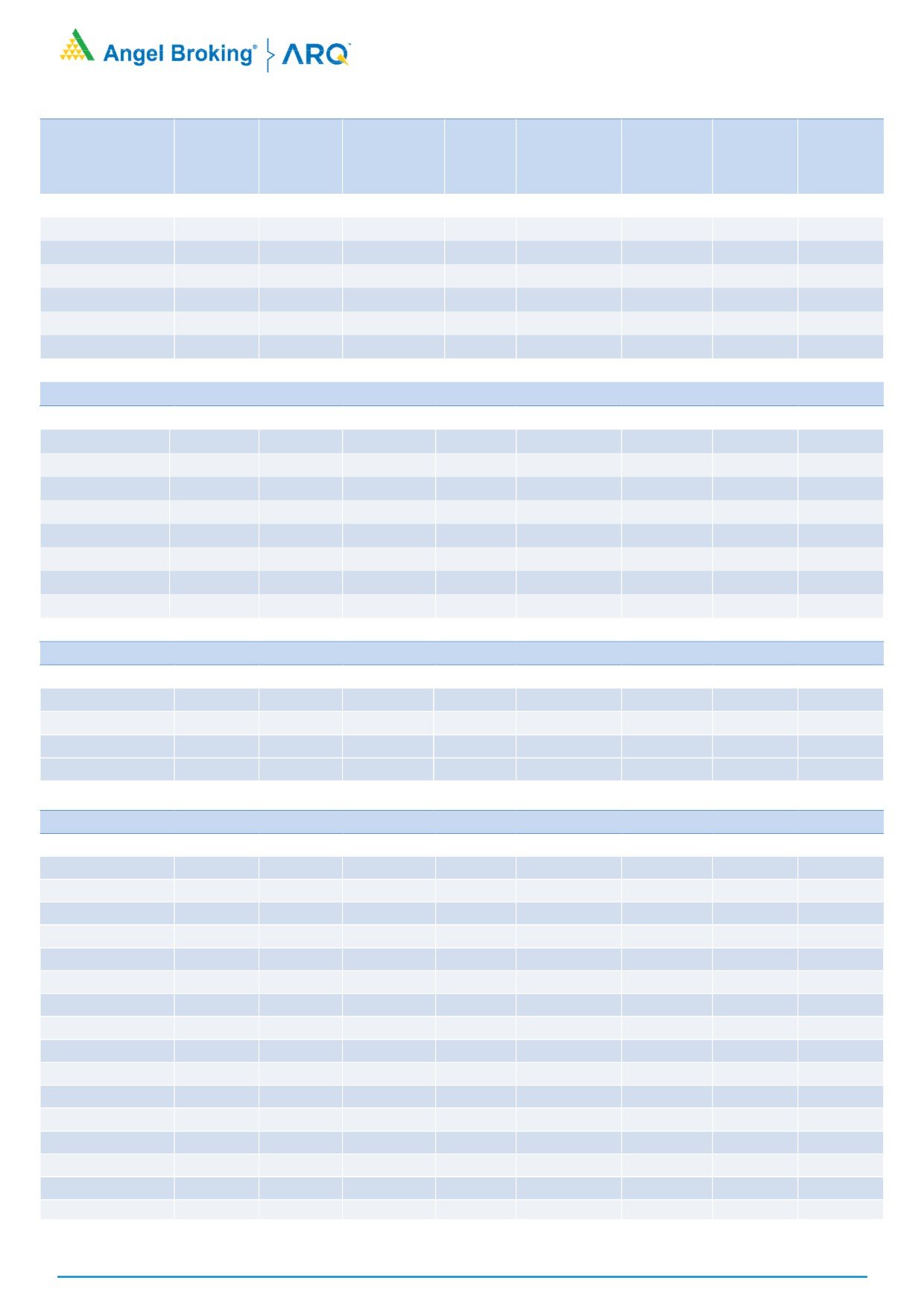

Indices Change

NIFTY & PCR Graph

Price

Change

3 month

INDEX

Price

(%)

Rollover

avg.

NIFTY

10617.80

4.73

72.32

67.80

BANKNIFTY

25010.90

2.80

82.59

74.36

NIFTYIT

14026.65

10.19

86.94

67.02

NIFTYMID50

5371.90

8.04

99.97

99.92

NIFTYINFRA

3440.70

3.43

-

-

Monthly Gainers

Monthly Losers

Price

Ol

Price

Ol

Change Open

Change

Change Open

Change

Scrip

Price

(%)

Interest

(%)

Scrip

Price

(%)

Interest

(%)

JUSTDIAL

582.20

30.58

2002000

(55.07)

STAR

404.10

(37.21)

2499600

30.47

SBIN

269.05

14.78

71943000

(15.39)

HCC

15.00

(34.92)

41439000

6.71

MCX

862.80

12.32

3254300

(15.70)

JETAIRWAYS

415.55

(33.46)

6267600

(10.27)

ASIANPAINT

1306.05

12.30

4969200

16.50

PCJEWELLER

166.80

(30.17)

6573000

(48.76)

KPIT

279.35

12.14

7726500

(4.24)

AJANTPHARM

965.95

(29.29)

893000

21.83

Note: Stocks which have more than 1000 contract in Futures OI.

Note: Stocks which have more than 1000 contract in Futures OI.

For Private Circulation Only

1

Derivatives Rollover Report

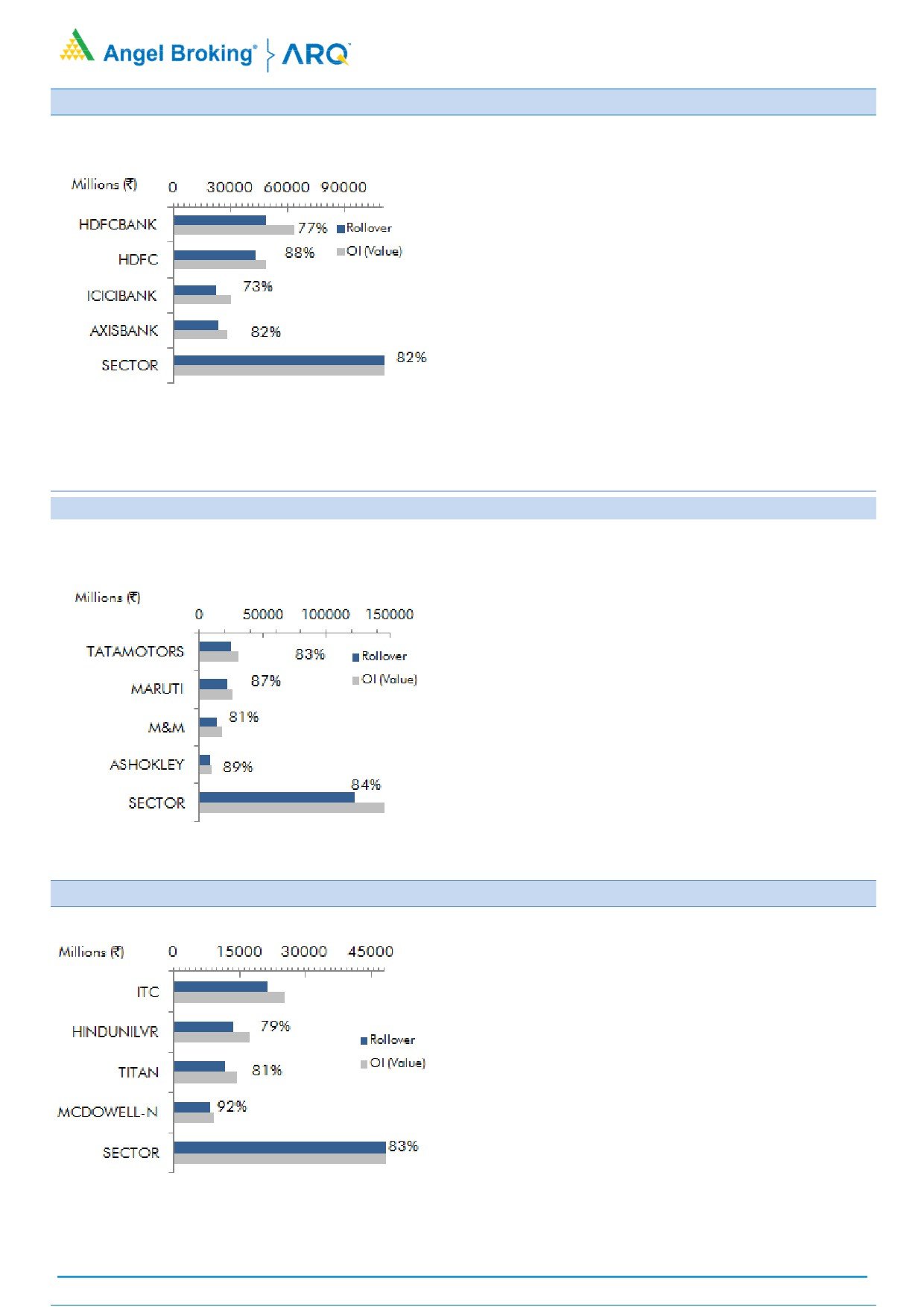

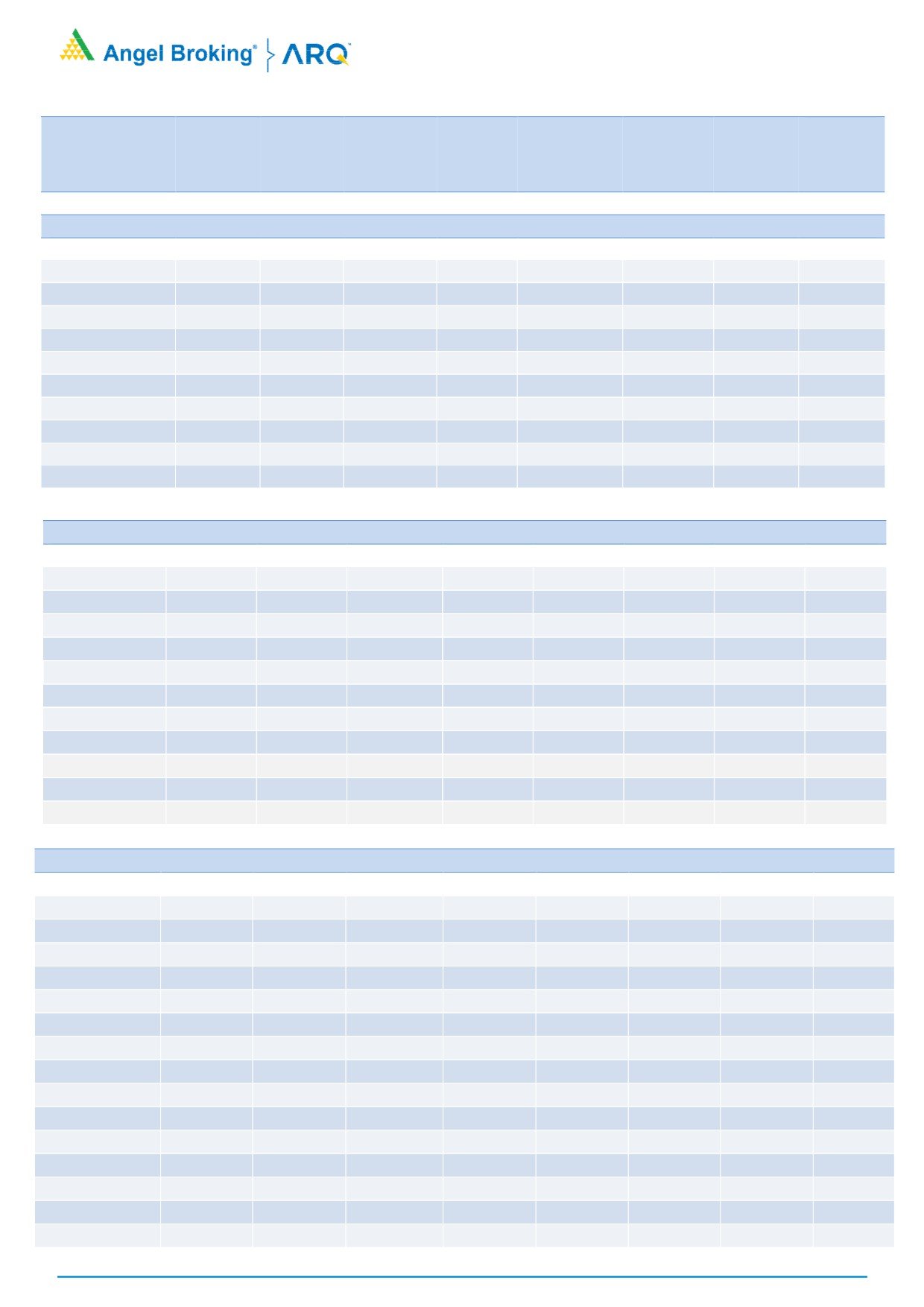

Banking and Financials

KOTAKBANK (74.90%) rallied 11% with decent long

formation. Rollover remains slightly

low in

percentage; but, in terms of OI is on the higher side.

Hence, any dips towards Rs. 1270-1290 shall be an

opportunity to re-enter this stock.

HDFC (88.19%) corrected from Rs. 1900 plus levels

mainly due to short formation. We did saw some

short covering bounce from the strong support zone

of Rs. 1780-1785 levels but decent shorts are still

intact. We expect extension of this move going

ahead.

CHOLAFIN (81.29%) open interest surged 76%

last series, which was mainly due to short

formation. Any move beyond Rs. 1555-1560 will

lead to decent short covering rally towards

Rs. 1620-1630 levels.

Auto & Auto Ancillaries

MARUTI (87.37%) has been under pressure from

9350 mark and also had huge shorts. We saw decent

short covering move from the support zone of

Rs. 8250-8270 levels. We believe any move above

8800 levels shall be an opportunity to add fresh long

positions.

TATAMOTORS (88.20%) extended its loss to touch the

important support of Rs. 280-285 levels. we also saw

decent shorts getting rolled to June series. Thus,

traders who are long shall keep a strict stop loss at

Rs.280.

M&M (80.67%) outperformed this space and also

added decent longs position. Rollovers are also

above averages, hinting longs are still intact. Traders

should hold on to their longs if any.

Consumer Goods & FMCG

COLPAL (70.32%) continued to attract fresh longs

even at its all-time high prices. However, the rollovers

were below average and thus, we may not see

significant upmove from here in near term. Hence,

traders with long positions can look to book profits at

current levels.

We saw long formation in ASIANPAINT

(73.58%)

during the series but rollovers are less than average.

Since last few days’ prices have traded in the range of

Rs. 1260-1335. Existing long positions should be

protected with a stoploss below the lower end of the

mentioned range.

During the series, TATAGLOBAL (84.35%) corrected

with significant fall in open interest indicating long

unwinding. Hence, traders are advised to avoid buying

in this counter from a short-term perspective.

For Private Circulation Only

2

Derivatives Rollover Report

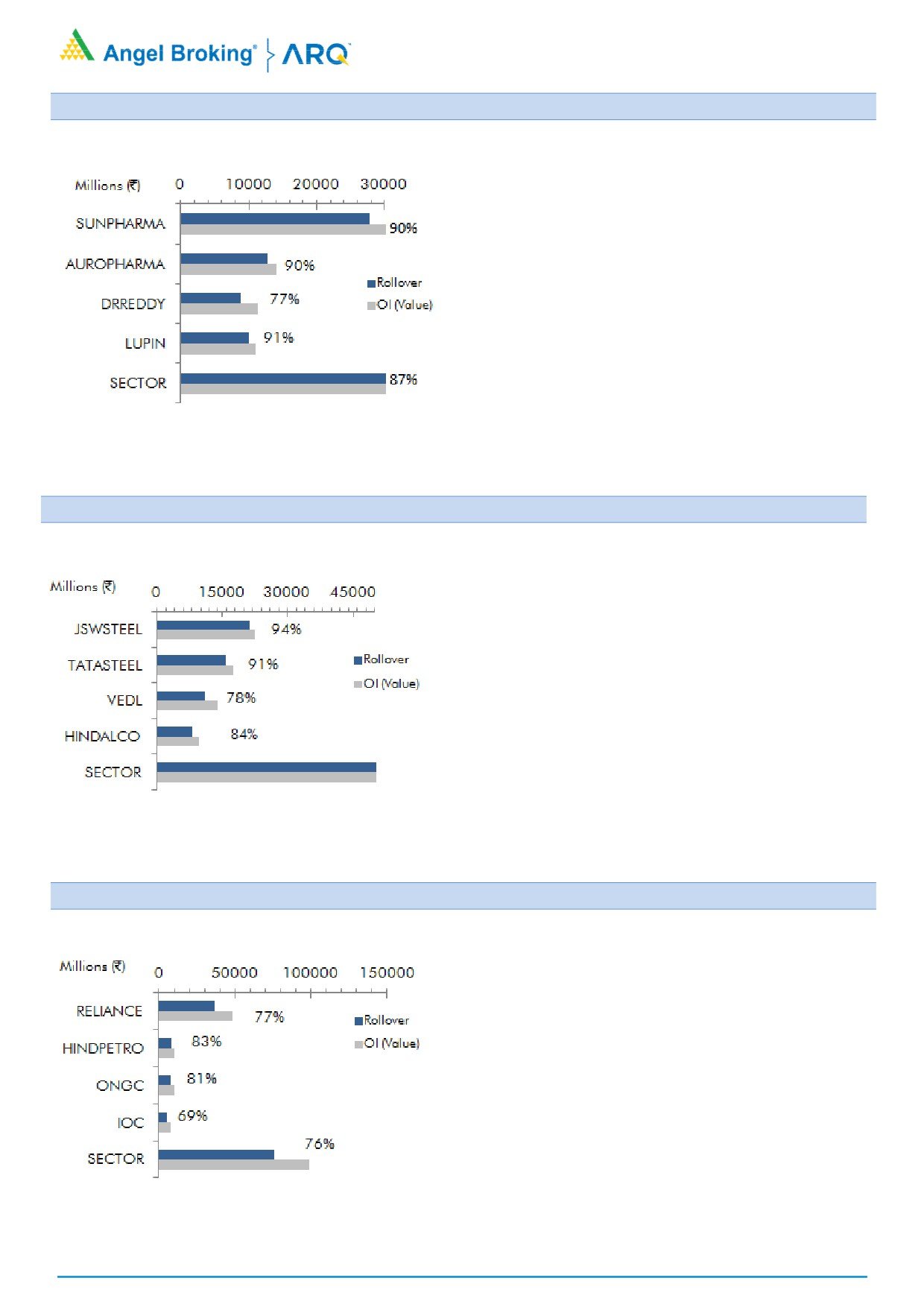

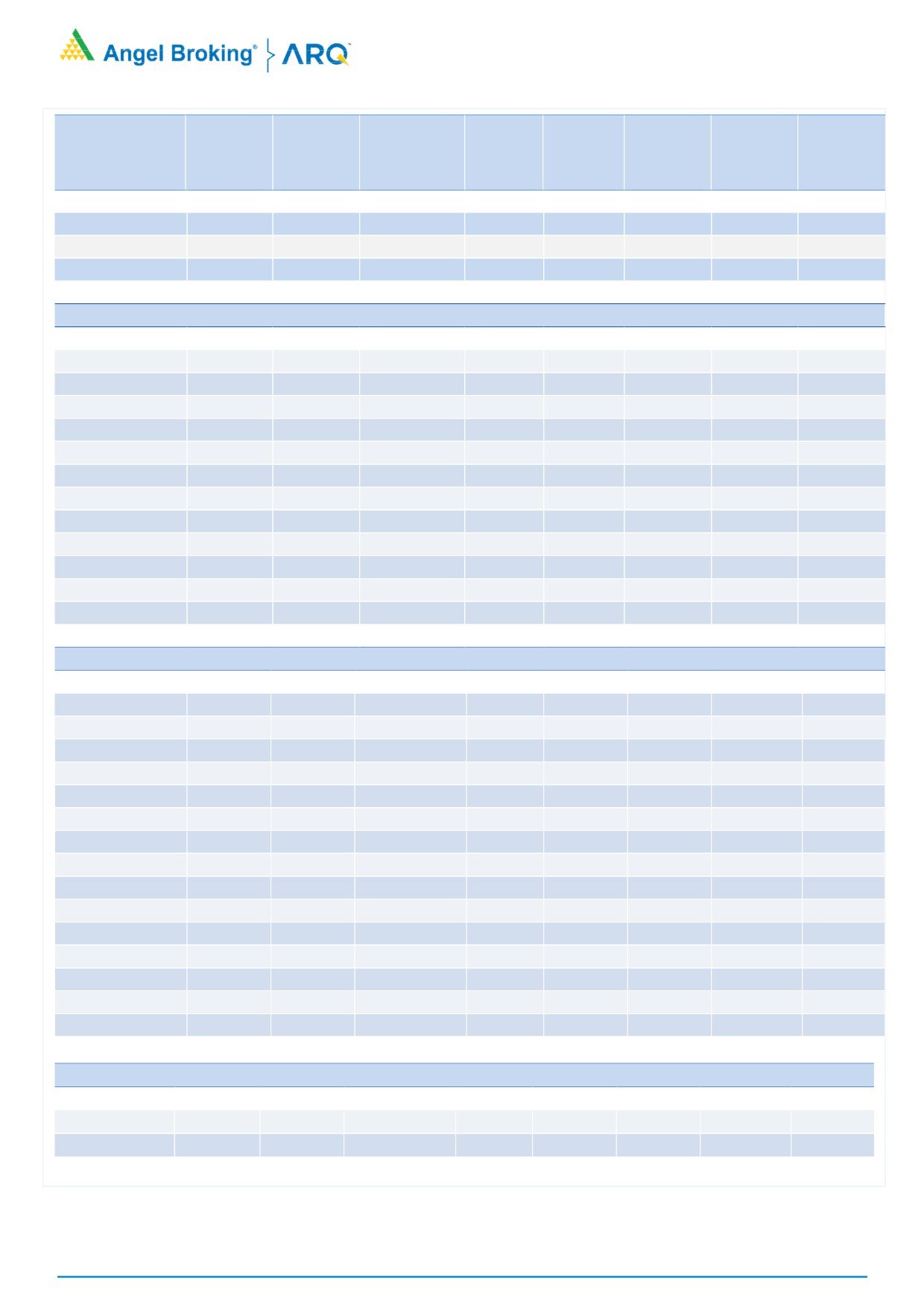

Pharmaceutical

CIPLA (83.71%) formed decent shorts during the

series and majority of them have been rolled too.

Hence, we may see further correction in the stock in

short-term.

During the series, DIVISLAB (78.88%) corrected with

decent short formation and they have been rolled

too. Hence, prices could remain under pressure and

the stock could approach its support zone of

Rs. 975-1000.

We saw massive correction in prices in STAR (75.79%)

along with rise in open interest. The short positions

have been rolled and hence, traders should avoid

any bottom fishing.

Metal & Mining

HINDALCO

(83.72%) concluded the series with

marginal cut; however, we saw good amount of fall

in open interest. At present, this counter is light in

terms of open interest. Hence, fresh build-up shall

decide the upcoming trend for this counter.

TATASTEEL (90.83%) corrected from 636 levels and

also added decent shorts. The open interest has

surged 35% series on series and we believe these are

shorts that are still in system. Now, Rs. 585-590 is a

sturdy hurdle for this counter. Unless we don’t see

any up move above this levels. One should avoid any

kind of bottom fishing.

Some of the counters having low rollovers are

NATIONALUM

(73.10%), VEDL

(78.15%) and

COALINDIA (82.11%).

Oil & Gas

ONGC (80.72%)- During the second half of May

series, the prices had corrected sharply with rise in OI

which indicates formation of short positions. Decent

amount of short positions have been rolled too which

indicates that the stock could continue to remain

under pressure in near term.

RELIANCE (76.59%) corrected during last series due

to long unwinding. The stock is currently trading near

its support of Rs. 900-910. Traders should watch for

fresh OI build up in this counter which would direct

the near-term momentum.

All the OMC's witnessed short covering during the

series. The rollovers were also below average and

thus, we could see some consolidation phase in near

term.

For Private Circulation Only

3

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

767.30

(8.93)

1545600

55.82

-50.86

1.05

70.59

78.27

APOLLOTYRE

270.30

(5.61)

8643000

(6.46)

4.84

0.56

79.74

78.91

ASHOKLEY

149.00

(8.59)

57714000

16.98

8.36

0.51

88.53

86.00

BAJAJ-AUTO

2770.40

(4.57)

2114000

(4.56)

9.53

0.44

86.84

85.08

BALKRISIND

1139.50

(10.87)

1020800

18.48

5.63

0.77

81.17

76.53

BHARATFORG

654.95

(15.60)

8714400

3.61

8.51

0.79

89.30

92.10

BOSCHLTD

18284.75

(7.53)

129400

(15.27)

-5.87

0.00

84.29

76.51

CASTROLIND

171.55

(11.48)

10175200

(15.37)

4.96

0.90

84.57

89.59

CEATLTD

1369.45

(11.83)

1506400

4.62

7.27

0.32

84.19

86.14

EICHERMOT

30615.30

(2.47)

179825

(10.63)

-7.00

0.33

83.53

81.99

ESCORTS

937.05

(2.89)

4343900

27.22

6.43

0.40

87.89

87.86

EXIDEIND

261.35

6.74

6864000

(16.37)

8.28

0.33

78.00

85.85

HEROMOTOCO

3562.25

(5.54)

1318200

(12.68)

6.38

0.41

82.86

79.03

M&M

919.10

7.29

15292000

9.76

-5.44

0.59

80.67

80.15

MARUTI

8585.35

(4.66)

2644875

(1.45)

7.35

0.24

87.37

87.30

MOTHERSUMI

312.10

(12.07)

13025600

0.51

8.20

0.80

91.47

88.47

MRF

76094.45

(1.23)

27600

(14.74)

6.20

0.00

87.00

86.92

TATAMOTORS

284.40

(14.43)

89673000

21.88

8.77

0.34

82.66

85.72

TATAMTRDVR

170.00

(8.72)

27465700

4.38

9.66

0.85

65.49

82.90

TVSMOTOR

582.80

(10.89)

4423000

(5.61)

-10.10

0.64

84.81

84.24

BANKING & FINANCIALS

ALBK

41.15

(13.37)

14880000

8.22

-20.27

0.74

87.63

80.91

ANDHRABANK

36.60

(2.79)

19380000

(12.86)

5.36

1.16

83.64

83.71

AXISBANK

541.15

8.94

43718400

(4.72)

-11.34

0.78

82.00

81.43

BAJAJFINSV

6003.00

11.69

662875

(4.57)

-8.47

0.29

83.50

74.14

BAJFINANCE

2121.00

11.19

4698500

2.69

6.86

0.41

84.44

86.20

BANKBARODA

137.50

(0.47)

53924000

4.46

6.19

1.00

90.43

89.13

BANKINDIA

99.15

0.05

24642000

(1.11)

7.27

0.70

79.76

85.07

BHARATFIN

1175.85

2.44

5615000

9.88

7.75

0.44

96.71

90.72

CANBK

258.50

1.23

12942400

27.27

6.84

0.59

86.52

86.58

CANFINHOME

380.80

(13.51)

4365000

(23.37)

6.71

0.99

83.36

84.19

CAPF

569.85

(9.17)

8562400

24.82

-2.06

0.64

91.28

91.90

CHOLAFIN

1541.60

(9.31)

982000

76.30

11.00

0.55

81.29

72.28

DCBBANK

186.35

(5.04)

7038000

(5.67)

8.09

0.71

82.93

82.33

DHFL

617.10

(1.48)

24195000

7.31

8.40

1.43

85.65

86.41

EQUITAS

164.85

8.85

21182400

7.29

6.76

0.54

92.60

94.95

FEDERALBNK

85.30

(12.83)

75922000

27.90

7.69

0.82

86.77

88.18

HDFC

1837.70

(1.34)

23469000

29.39

3.34

0.36

88.19

85.14

HDFCBANK

2116.00

9.77

22969000

13.26

-14.29

0.34

76.66

78.71

For Private Circulation Only

4

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

IBULHSGFIN

1251.10

(4.48)

14044400

20.40

8.81

0.40

82.34

87.73

ICICIBANK

286.45

2.43

77924000

(3.14)

2.96

0.45

73.00

80.82

ICICIPRULI

422.20

(2.72)

4278300

(9.16)

-0.93

0.31

82.23

79.44

IDBI

66.00

(1.71)

54540000

7.51

13.97

1.01

81.04

80.88

IDFC

51.10

(8.34)

150427200

(3.27)

11.58

0.77

92.80

93.48

IDFCBANK

41.25

(13.16)

190133000

3.40

17.62

0.87

76.48

87.08

IFCI

17.85

(10.08)

65374000

(5.81)

11.05

0.81

87.95

87.85

INDIANB

327.70

4.16

2686000

(11.24)

-50.29

0.75

76.48

80.67

INDUSINDBK

1915.75

2.71

7481700

19.04

-26.47

0.57

78.18

77.16

KOTAKBANK

1319.60

11.37

15765600

27.97

-14.65

0.62

74.99

78.58

KTKBANK

120.70

2.59

21303200

(14.52)

8.15

0.87

91.95

90.21

L&TFH

170.70

2.74

28219500

(18.89)

6.52

1.04

85.86

90.17

LICHSGFIN

477.60

(13.02)

13757700

13.79

6.72

0.56

87.55

91.50

M&MFIN

484.50

(5.87)

8673750

(0.56)

-8.42

0.21

87.90

87.95

MANAPPURAM

108.35

(10.01)

18420000

16.91

7.87

0.70

88.27

87.10

MFSL

493.35

(3.27)

2838800

14.24

8.64

5.00

91.40

90.27

MUTHOOTFIN

392.05

(12.24)

2067000

35.36

8.03

10.00

77.20

82.37

ORIENTBANK

81.10

(8.41)

13572000

(8.16)

2.42

0.88

83.93

83.68

PFC

81.20

(2.87)

95088000

28.80

10.52

0.60

79.19

83.84

PNB

84.10

(7.99)

67032500

(1.16)

7.01

0.68

87.07

86.86

RBLBANK

514.00

(1.66)

3839400

(12.40)

-4.80

0.63

80.00

83.15

RECLTD

118.80

(5.94)

34512000

(4.25)

7.17

1.07

82.42

85.35

RELCAPITAL

420.30

(2.13)

9438000

(21.59)

8.43

0.94

88.86

90.03

REPCOHOME

592.10

(1.22)

551700

(27.88)

3.75

3.00

82.61

78.28

SBIN

269.05

14.78

71943000

(15.39)

-2.42

0.89

77.11

81.35

SOUTHBANK

24.20

(7.81)

154901034

9.72

8.13

0.73

90.41

90.25

SREINFRA

77.55

(15.93)

16723000

9.44

8.46

1.13

89.41

86.42

SRTRANSFIN

1464.70

(11.17)

3445200

1.13

9.32

0.88

91.01

92.79

SYNDIBANK

49.45

(7.14)

25371000

(16.18)

10.63

0.77

88.84

88.09

UJJIVAN

393.15

(3.24)

5856000

19.30

5.83

0.68

88.75

89.44

UNIONBANK

91.00

(0.22)

29176000

(2.00)

4.31

0.84

89.97

88.90

YESBANK

343.75

(2.95)

45946250

(23.56)

-9.23

0.58

81.59

84.82

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

394.00

(1.12)

12705000

(11.29)

6.15

1.05

55.50

75.93

BEML

930.55

(11.28)

1835500

(13.87)

7.61

0.25

83.30

88.37

BHEL

83.35

(4.09)

46342500

28.73

-4.68

0.49

86.11

84.40

CGPOWER

61.60

(25.15)

18396000

(4.07)

2.12

0.32

83.45

83.84

ENGINERSIN

132.10

(15.46)

9908500

13.29

5.95

0.85

82.13

79.06

GMRINFRA

18.20

(11.00)

262260000

(7.95)

3.59

0.98

89.22

91.80

HAVELLS

547.65

(0.10)

4534000

(27.78)

8.38

0.58

86.39

87.21

HCC

15.00

(34.92)

41439000

6.71

17.62

1.13

87.24

84.07

IRB

232.20

(11.93)

18672500

1.48

9.61

0.83

84.88

88.52

For Private Circulation Only

5

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

JPASSOCIAT

15.30

(20.93)

176358000

(16.88)

12.91

0.92

91.29

89.29

LT

1366.50

1.01

12698250

(6.18)

-3.71

0.39

82.02

75.77

NBCC

92.35

(12.21)

18234000

3.30

3.54

0.83

82.25

85.41

RELINFRA

436.10

(1.83)

6068400

(25.41)

4.05

0.56

84.69

89.46

SIEMENS

1051.20

(3.98)

1166500

(9.99)

7.23

0.54

78.76

85.74

VOLTAS

543.25

(14.33)

2705000

(24.02)

7.97

0.44

72.08

80.17

CEMENT

ACC

1363.10

(11.46)

3753600

150.17

8.18

0.55

63.71

72.31

AMBUJACEM

206.80

(15.28)

16287500

90.78

8.89

0.54

89.15

73.14

DALMIABHA

2741.65

(9.21)

543300

(21.60)

7.29

0.55

88.47

87.46

GRASIM

1045.95

(2.57)

5151750

(23.51)

7.71

1.96

80.06

80.94

INDIACEM

130.80

(10.44)

23149000

(6.96)

8.53

0.48

85.91

88.37

RAMCOCEM

774.80

(4.97)

842400

(28.76)

2.11

4.00

80.57

77.03

SHREECEM

16920.10

(2.38)

58800

(28.38)

3.05

0.00

84.79

82.87

ULTRACEMCO

3734.40

(8.86)

2040000

(0.21)

-3.65

0.62

87.74

87.77

CHEMICALS & FERTILIZERS

GSFC

117.15

(9.71)

15858000

(6.67)

10.09

0.89

90.57

89.18

PIDILITIND

1147.60

5.82

3127000

161.02

-11.26

0.63

63.45

69.03

TATACHEM

744.20

2.82

4299000

(24.28)

4.92

0.76

85.81

85.84

UPL

707.95

(6.34)

10064400

(9.89)

0.64

0.61

77.08

85.93

CONSUMER GOODS & FMCG

ASIANPAINT

1306.05

12.30

4969200

16.50

1.40

0.82

73.53

79.21

BERGEPAINT

295.15

8.89

2050400

19.64

-13.33

0.33

74.98

73.84

BRITANNIA

5903.45

9.17

780200

(7.49)

-4.51

0.57

89.84

90.62

COLPAL

1239.50

11.92

1754900

26.87

-20.90

0.58

70.32

78.90

DABUR

386.25

7.56

13642500

21.24

10.03

0.38

90.83

91.34

GODFRYPHLP

758.35

(13.77)

530400

(16.34)

8.74

0.54

82.82

86.95

GODREJCP

1146.90

2.89

2144000

(8.22)

8.87

0.27

85.98

83.74

HINDUNILVR

1608.45

7.85

8504400

(10.01)

-2.43

0.47

79.10

85.61

ITC

272.60

(0.93)

78093600

(5.73)

4.56

0.73

84.13

83.83

JUBLFOOD

2521.25

(0.72)

2495500

23.02

6.57

0.44

88.49

83.73

MARICO

323.85

0.67

4841200

(24.25)

8.10

0.04

85.81

82.06

MCDOWELL-N

3364.75

(4.83)

2435750

17.80

8.25

0.58

91.66

92.00

NESTLEIND

9709.20

7.00

267600

(2.90)

7.45

0.22

86.60

87.63

TATAGLOBAL

265.80

(9.17)

16256250

(35.24)

-16.46

0.72

84.35

86.62

TITAN

906.40

(7.14)

12952500

4.39

9.12

0.83

81.24

75.80

UBL

1176.30

3.36

1239000

71.01

6.46

0.46

78.95

83.40

For Private Circulation Only

6

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

METALS & MINING

COALINDIA

293.80

1.36

17778200

2.85

-10.78

0.74

82.11

79.19

HINDALCO

234.75

(0.17)

35070000

(25.06)

3.06

0.63

83.72

85.16

HINDZINC

297.90

(7.56)

15564800

33.96

6.82

0.36

86.95

88.02

JINDALSTEL

230.45

(8.97)

29769750

(10.49)

5.11

0.84

86.35

87.53

JSWSTEEL

333.90

1.43

63357000

(3.29)

7.86

0.51

94.14

95.29

NATIONALUM

70.70

(11.68)

38856000

(20.59)

4.63

0.58

73.10

81.77

NMDC

118.40

(4.75)

25884000

1.41

10.54

0.78

83.48

83.46

SAIL

76.45

(0.13)

90984000

4.48

8.58

0.68

85.26

85.72

TATASTEEL

579.30

(0.46)

27363190

35.52

8.27

0.66

90.86

80.76

VEDL

250.35

(14.31)

43690500

12.59

10.76

0.74

78.15

81.23

INFORMATION TECHNOLOGY

HCLTECH

914.00

(15.32)

11303600

21.38

5.23

0.75

86.65

84.27

HEXAWARE

437.55

2.41

4500000

11.69

-4.60

0.28

75.59

78.09

INFY

1207.60

2.69

31402800

(25.90)

-25.61

0.55

83.67

87.54

KPIT

279.35

12.14

7726500

(4.24)

10.58

0.36

79.97

80.88

MINDTREE

1014.45

(3.09)

2992800

(2.88)

8.41

0.34

74.09

69.63

NIITTECH

1124.80

0.39

1236000

(33.12)

8.99

0.20

80.47

72.57

OFSS

3900.25

(7.47)

72750

(21.27)

-14.10

0.00

32.88

53.16

TATAELXSI

1241.55

1.40

1684800

(18.05)

4.69

0.35

80.29

82.83

TCS

1752.25

(0.90)

11133000

(19.48)

8.39

0.53

76.07

74.33

TECHM

708.40

1.88

13417200

4.85

-7.23

0.40

82.69

83.94

WIPRO

263.60

(6.74)

28255200

(11.83)

8.46

0.27

85.98

87.94

MISCELLANIOUS

ADANIENT

121.90

(13.73)

11432000

(9.04)

9.70

0.41

83.28

84.44

APOLLOHOSP

956.85

(11.76)

1121000

63.53

8.92

0.45

84.03

83.07

BALRAMCHIN

71.90

10.79

12873000

(8.67)

8.21

0.34

76.43

78.74

BATAINDIA

782.55

(0.52)

2250600

(10.07)

5.10

0.13

80.97

85.08

BEL

115.20

(12.73)

33016500

12.29

9.12

1.13

87.37

84.45

CONCOR

1367.35

5.06

1444375

28.67

-11.06

0.23

54.17

75.34

CUMMINSIND

708.10

(5.66)

687100

(17.26)

12.55

0.80

75.28

73.29

GODREJIND

593.40

(1.10)

1894500

(24.33)

-7.21

0.58

66.51

79.90

INDIGO

1207.10

(18.81)

3946200

46.55

-12.99

0.72

64.24

72.23

INFIBEAM

165.10

(2.02)

33896000

5.73

-38.32

0.22

90.07

90.63

JETAIRWAYS

415.55

(33.46)

6267600

(10.27)

8.53

0.59

87.87

88.93

JISLJALEQS

104.30

(10.01)

36783000

2.61

9.44

1.58

90.48

86.58

JUSTDIAL

582.20

30.58

2002000

(55.07)

-7.68

0.76

58.49

75.74

KAJARIACER

554.00

1.47

1484600

(7.81)

11.51

0.05

79.83

81.83

KSCL

538.40

0.77

2086500

(4.20)

5.96

0.51

79.67

84.00

For Private Circulation Only

7

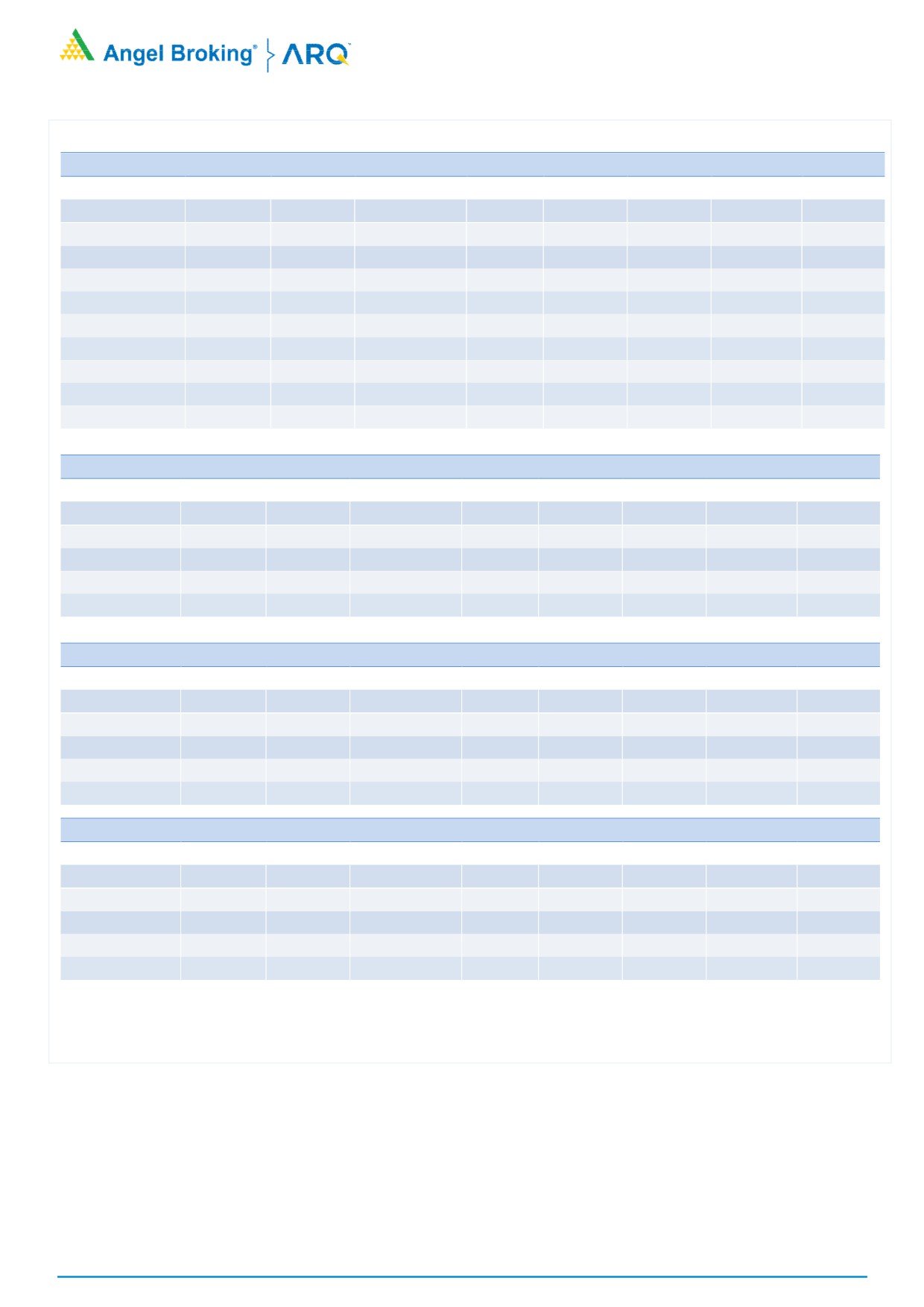

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

MCX

862.80

12.32

3254300

(15.70)

9.90

0.44

88.11

92.22

PCJEWELLER

166.80

(30.17)

6573000

(48.76)

7.86

0.44

72.96

80.36

VGUARD

214.10

(10.34)

3141000

10.09

-39.56

0.00

84.71

84.48

OIL & GAS

BPCL

401.60

3.63

7767000

(49.37)

-7.58

0.53

63.98

74.35

CHENNPETRO

285.30

(11.45)

2962500

0.25

8.74

1.71

85.28

88.24

GAIL

350.40

7.09

13860399

9.97

-1.86

1.04

77.19

81.46

HINDPETRO

311.30

4.48

26808075

(15.45)

-2.30

0.63

82.69

80.84

IGL

264.60

(10.89)

7658750

71.91

-1.97

0.50

80.40

83.25

IOC

173.00

6.72

31692000

(23.45)

-8.24

0.38

68.86

79.48

MGL

820.75

(8.57)

2055000

(39.98)

2.87

0.67

85.35

82.60

MRPL

93.00

(15.22)

5382000

3.64

2.81

1.17

80.65

80.03

OIL

217.15

(6.24)

2443881

(18.30)

7.85

0.81

74.82

73.21

ONGC

176.45

(2.62)

45510000

19.68

-10.62

0.55

80.72

82.85

PETRONET

220.10

(3.89)

17322000

(13.64)

2.67

0.56

79.22

88.94

RELIANCE

922.45

(5.81)

39859000

(20.64)

1.56

0.61

76.59

82.57

PHARMACEUTICAL

AJANTPHARM

965.95

(29.29)

893000

21.83

4.88

3.46

75.36

80.02

AUROPHARMA

559.30

(11.62)

22654200

8.59

7.03

0.46

89.60

89.05

BIOCON

670.00

0.56

9296100

23.20

9.01

0.31

86.36

87.56

CADILAHC

363.80

(11.69)

9411200

32.45

9.02

0.34

84.77

88.32

CIPLA

526.45

(12.06)

10820000

41.85

4.10

0.74

83.71

85.46

DIVISLAB

1054.55

(10.60)

3221600

55.54

8.84

0.51

78.88

81.68

DRREDDY

1948.95

(6.74)

4495500

(1.74)

8.31

0.75

76.93

85.09

GLENMARK

533.40

(6.49)

4906400

(1.74)

-6.20

1.04

87.22

90.87

GRANULES

78.90

(27.18)

15970000

8.49

8.31

0.94

85.38

86.43

LUPIN

772.40

(3.22)

12993000

(6.05)

3.47

0.54

91.31

91.83

PEL

2388.70

(8.26)

2204298

17.44

9.48

0.30

89.33

92.22

STAR

404.10

(37.21)

2499600

30.47

7.46

0.44

85.79

87.28

SUNPHARMA

483.65

(6.18)

57453000

1.04

8.96

0.55

89.56

92.08

TORNTPHARM

1413.85

1.25

403500

2.93

2.17

1.00

69.27

79.59

WOCKPHARMA

686.65

(14.27)

2833200

(13.82)

6.01

0.56

85.08

88.68

REAL ESTATE

DLF

210.80

(4.36)

33792500

(22.10)

5.59

0.96

86.50

88.13

NCC

121.05

(5.02)

34832000

25.40

11.95

0.38

87.48

86.24

For Private Circulation Only

8

Derivatives Rollover Report

POWER

ADANIPOWER

20.35

(17.11)

101240000

8.53

12.94

0.84

89.29

89.64

CESC

1025.40

(4.40)

5676550

(8.66)

7.80

0.32

93.73

91.73

NHPC

26.70

(4.13)

27432000

(11.81)

9.84

0.72

87.14

76.45

NTPC

167.20

(3.07)

42892000

18.07

-2.72

0.42

76.96

82.20

POWERGRID

204.10

(2.02)

47748000

57.44

-33.30

0.64

63.19

77.27

PTC

85.50

(2.95)

21408000

1.94

6.90

1.03

84.84

88.72

RPOWER

36.45

0.55

49595000

(24.69)

1.79

0.48

83.04

85.02

SUZLON

8.85

(18.06)

290410000

(10.20)

14.90

0.41

86.39

86.71

TATAPOWER

81.45

(5.57)

40275000

(13.93)

2.41

0.89

77.61

83.74

TORNTPOWER

252.60

5.85

2625000

(35.14)

-48.21

0.67

42.05

65.91

TELECOM

BHARTIARTL

375.85

(8.39)

46772100

(18.31)

7.85

0.84

85.98

90.59

IDEA

61.70

(10.38)

135604000

1.72

4.24

0.40

89.94

90.28

INFRATEL

298.10

(4.61)

6160800

(15.05)

-2.40

0.49

65.70

73.78

RCOM

18.75

10.62

72604000

(33.51)

6.99

0.58

82.11

84.32

TATACOMM

620.10

(0.68)

3904000

(33.92)

5.81

0.82

65.83

83.82

TEXTILES

ARVIND

392.00

(6.79)

7554000

63.37

12.93

0.60

85.53

85.58

CENTURYTEX

953.65

(22.44)

6330500

0.36

8.95

0.70

89.27

92.31

PAGEIND

25353.95

5.26

53300

16.89

6.83

0.00

84.34

78.74

RAYMOND

987.35

(11.89)

4854400

(0.70)

7.90

0.52

88.90

90.44

SRF

1937.75

(16.35)

418000

(13.28)

3.74

1.00

64.06

75.16

MEDIA

DISHTV

73.50

(2.26)

46039000

9.76

8.93

1.88

80.94

88.34

PVR

1332.75

(5.25)

1131200

37.41

9.66

0.46

90.50

88.93

SUNTV

924.00

4.92

5486000

(6.00)

9.09

0.34

81.91

86.44

TV18BRDCST

56.40

(13.30)

76729500

(2.33)

10.48

0.52

91.26

90.32

ZEEL

559.55

(4.21)

7003100

(13.78)

8.21

0.90

69.12

81.09

For Private Circulation Only

9

Derivatives Rollover Report

Research Team Tel: 022 - 39357800 Extn-6824

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor.

Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations,

2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other

regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.

Derivative Research Team

For Private Circulation Only

10