Derivatives

Rollover Report

March 31, 2017

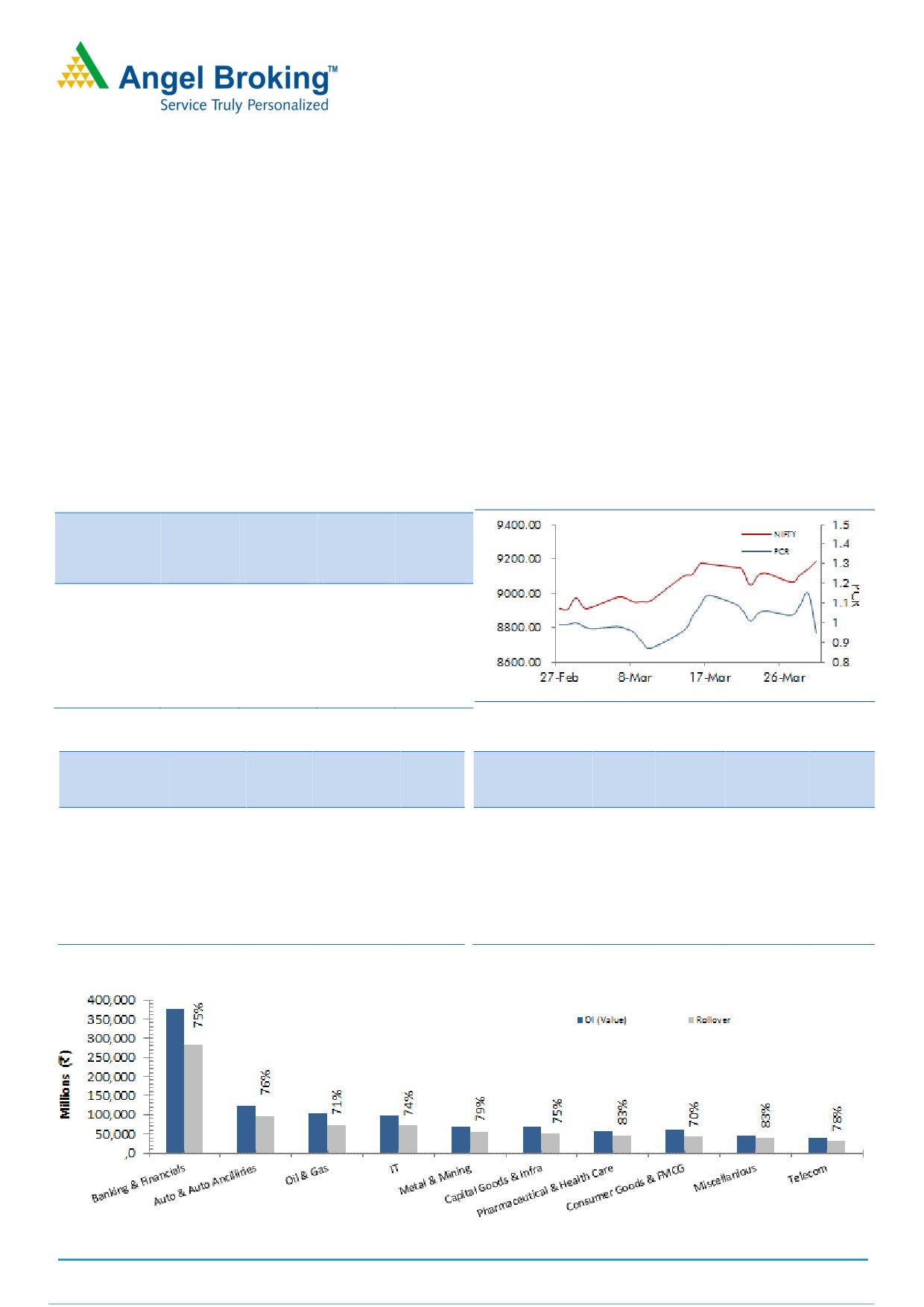

March series is the historical one for our market as the Nifty ended the F&O expiry above 9000 mark for the first time.

Despite being the eventful month (elections in four states), the March series began with healthy positions and kept on adding

further open interest during the month. The rollover is low in percentage terms; while it’s high in terms of OI. This is the

fourth consecutive month, when Nifty ended the series on a positive note (Month on Month basis) and FIIs too participated

heavily in this up move. FIIs added decent amount of long positions in index futures; however, they also added some short

positions in last few sessions, which resulted into decreasing the ‘Long Short Ratio’ from 82.90% to 76.70%. As far as their

activity in cash segment is concerned (in March series), we witnessed huge buying interest from FIIs’ desk after many years.

They bought equities worth more than `28,000 crores (including couple of block deals). It clearly depicts buying by stronger

hands, which certainly augurs well for our market with a directional perspective. In options segment, highest OI in April

series is placed at 9500 and 9200 call option; while in put option, it is placed at 9000 put option. Considering all these

data points, we believe that ongoing optimism should continue in the forthcoming series too.

Rollover in BANKNIFTY is marginally lower in terms of open interest; whiles it’s above its quarterly average in percentage

terms. Rollover data is hinting that majority of the longs formed have been rolled too. Some Midcap PSU Banks like

ORIENTBANK (81.73), BANKINDIA (81.25%) and UNIONBANK (72.56%) has seen decent rally in last series; but, their open

interest data is not so encouraging. While, some NBFCs like IBULHSGFIN (86.42%), DHFL (87.33%), RELCAPITAL (81.65%),

M&MFIN (76.54%) and L&TFH (81.95%) had seen decent rally in March series along with formation of long positions. The

overall data of BANKNIFTY is positive and thus we may see further rally in the banking space.

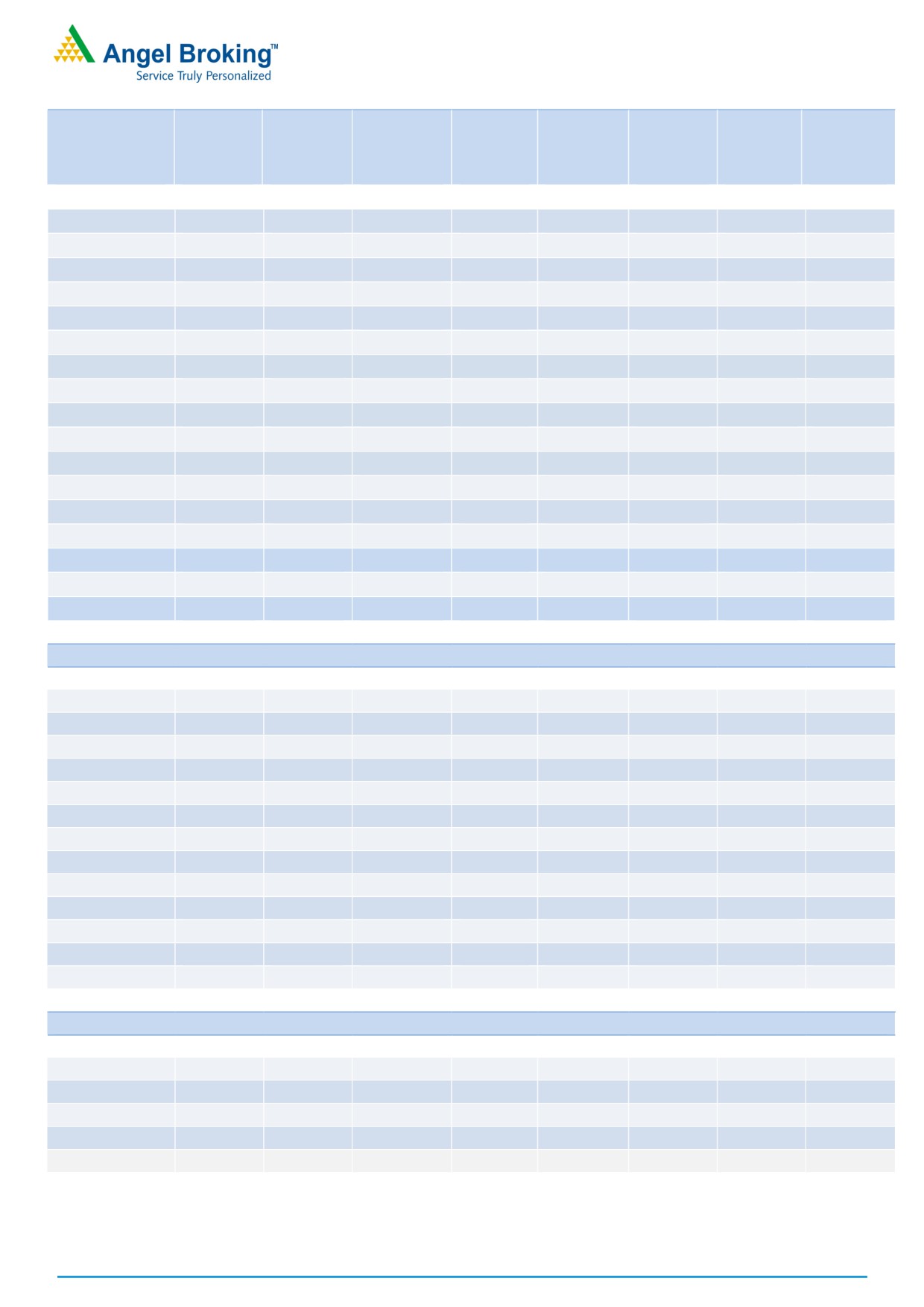

Indices Change

NIFTY & PCR Graph

Price

Change

3 month

INDEX

Price

(%)

Rollover

avg.

NIFTY

9189.50

2.61

67.66

71.36

BANKNIFTY

21545.45

3.19

67.57

62.78

NIFTYIT

10732.00

0.08

77.86

82.16

NIFTYMID50

3981.70

7.58

-

-

NIFTYINFRA

2940.90

7.64

-

-

Monthly Gainers

Monthly Losers

Price

Ol

Price

Ol

Change Open

Change

Change Open

Change

Scrip

Price

(%)

Interest

(%)

Scrip

Price

(%)

Interest

(%)

JETAIRWAYS

535.50

25.96

5705000

4.58

IDEA

87.65

(26.65)

92295000

29.71

ICIL

197.20

22.60

9338000

134.45

DIVISLAB

626.80

(16.68)

10145400

100.84

HDIL

82.25

19.64

20336000

(22.71)

APOLLOHOSP

1163.80

(12.35)

1513200

138.22

KSCL

545.90

19.18

2883000

(0.41)

DRREDDY

2628.85

(9.50)

3425000

29.31

RECLTD

180.20

18.98

26790000

(12.49)

IDBI

75.05

(8.64)

38368000

58.13

Note: Stocks which have more than 1000 contract in Futures OI.

Note: Stocks which have more than 1000 contract in Futures OI.

SEBI Registration No: INB 010996539

1

Derivatives Rollover Report

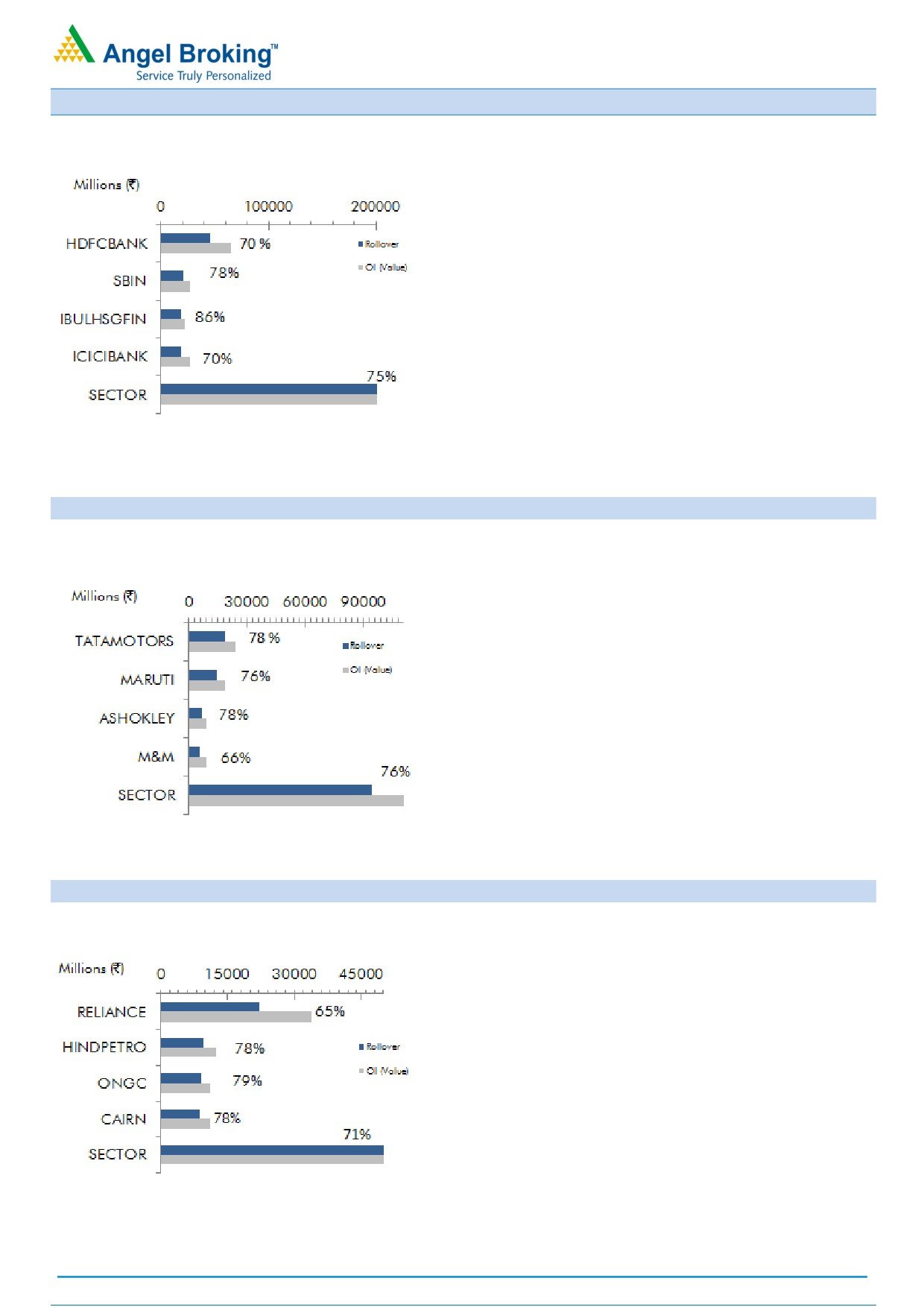

Banking and Financials

SBIN (78.14%) traded in a narrow range of `270 -

`280 for major part of the series; wherein, we

witnessed formation of mixed positions. However, the

stock rallied in last three sessions and closed above

its strong resistance of `280 - `285 along with long

build-up. The stock may continue its upward

momentum and should be traded with positive bias.

BANKBARODA (82.22%) remained under pressure

for first three weeks of the series and added some

short positions. However, strong rally was seen in last

week with formation of long positions. Rollover is

above its quarterly average. The stock has strong

support at `168 - `170 and any dips for upto that

zone should be used as a buying opportunity.

Some NBFCs like IBULHSGFIN

(86.42%), DHFL

(87.33%), RELCAPITAL (81.65%), M&MFIN (76.54%)

and L&TFH (81.95%) had seen decent rally in March

series along with formation of long positions. These

stocks can be traded with positive bias.

Auto & Auto Ancillaries

BAJAJ-AUTO (78.31%) remained flat on M-o-M basis

and has added good amount of positions. These

positions are blend of both long and short. Rollovers

are also in-line with its average. The stock has strong

support at `2765 - `2785 zone and traders may

look for buying around the same.

M&M (65.56%) ended the series with marginal loss

over its previous month’s expiry. In March series, we

witnessed huge open interest addition in the stock

and most of them are on short side and the same got

rolled too. Thus, traders are suggested to stay light

unless we see any positive development in data.

MRF (82.43%) was the biggest gainer in this space

and added decent amount of long formation. The

long positions got rolled to the next series. Traders

having long positions in the counter can continue to

hold the same. But, fresh buying is not advisable at

current levels.

Oil & Gas

RELIANCE (65.31%) was the biggest gainer in this

space. But, surprisingly, the up move was not

supported by long positions and we also some

witnessed some short formation in corrective moves.

Rollover is much below its average and thus indicates

that the shorts are now out of the system. Meaningful

fresh build-up will decide the further move in the stock.

CAIRN (79.98%) ended the March series with M-o-M

gains of 4.89% with huge open interest build-up. From

first sight, it seems long positions; but, considering its

daily activity, we can figure out that it’s a blend of both

long and short. The stock has good support at `292 -

`295 levels and long can be formed around the same.

ONGC (79.31%) remained under pressure in last

series along with formation of short positions.

Rollovers are also above its average. The stock has

also breached its crucial support of `188 - `190 zone.

Traders should refrain bottom fishing in the counter.

For Private Circulation Only

SEBI Registration No: INB 010996539

2

Derivatives Rollover Report

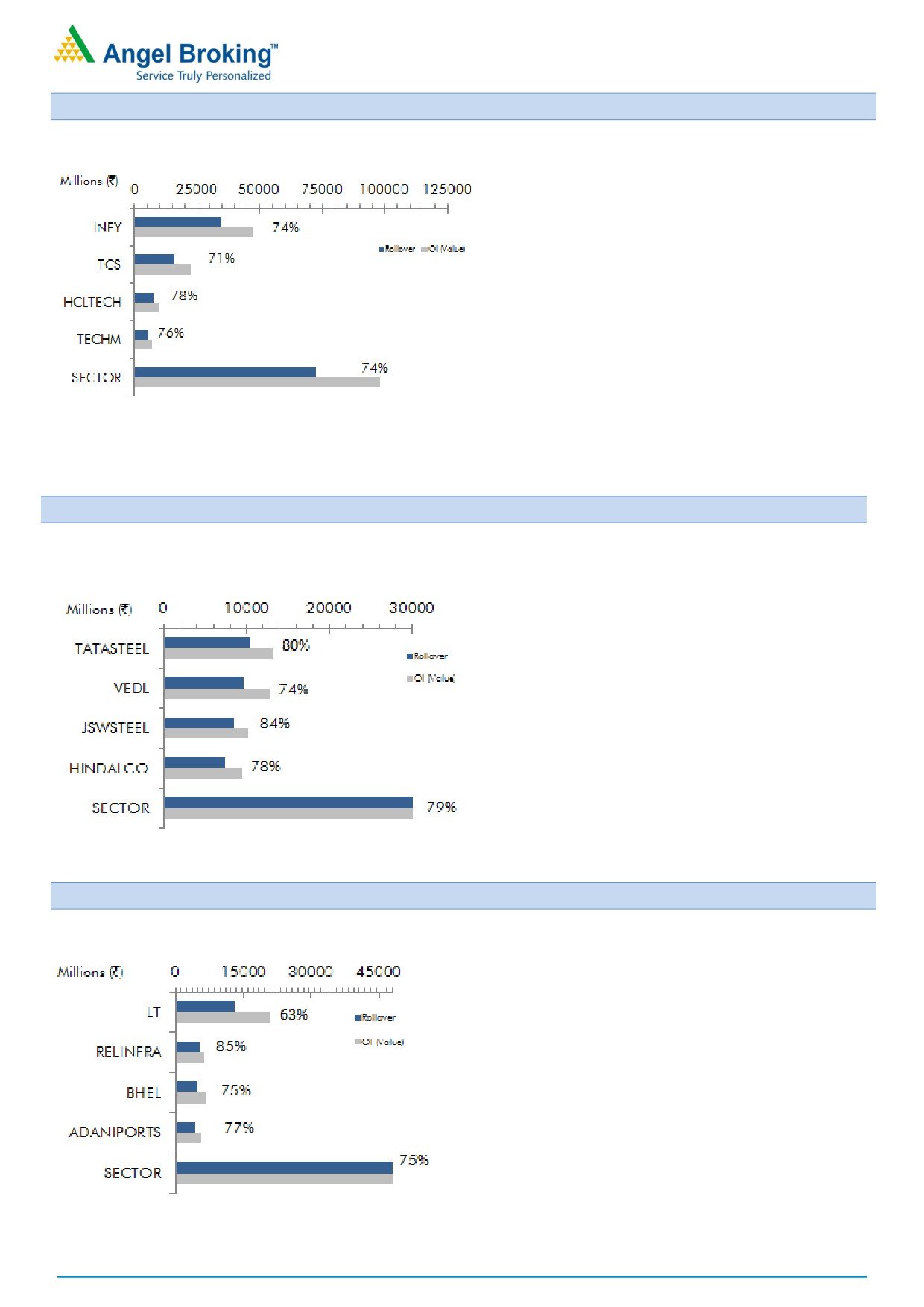

IT

Wipro (70.80%) out-performed its peers last series.

We witnessed good amount of long formation in this

counter as it bounced from `455 levels. Rollover in

percentage is below average but is high in open

interest term. We believe longs formed during last

series are still intact. Hence, one can go long at dips.

Infy (73.87%) is hardly up by 1.45% series on series,

but surprisingly we witnessed huge open interest

additions during last few trading sessions. We believe

these are mixed positions formed. Trades are

suggested to avoid forming any directional trade and

prefer long straddle/ strangle strategy in this counter.

TECHM (76.14%) plunged more than 8% series on

series with good amount of open interest additions.

Short positions formed in last series also got rolled in

April series. This counter has immediate support

around `445 - `450 levels, one can expect some

short covering bounced from these levels, trade

accordingly.

Metal & Mining

COALINDIA (77.42%) has been under pressure since

start of March series. We witnessed huge short

formation in this fall, due to which open interest has

doubled series on series. While, rollovers are also

above its averages, suggesting shorts formed are still

in system. Hence, this counter may remain under-

pressure. Thus, trades are suggested to avoid forming

long at current levels.

TATASTEEL (80.42%) has been consistently attracting

shorts between `500 - `505 levels. Last series, this

counter traded in range of `470 - `505 levels. We

witnessed good amount of short addition last series

and these positions got rolled too. At present, this

counter is trading at the lower side of the range.

Thus, traders can buy this stock on dips, as we expect

some short covering bounce which may bring near

`500 - `505 levels.

Capital Goods & Infra

BHEL (74.63%) continued the Feb month’s rally in last

series too with formation of long positions. Rollover is

also inline with its average, which indicates that longs

has been rolled to April series. The stock has good

support at `157 - `160 zone and traders can use

declines to initiate fresh longs in the counter.

LT (62.96%) has the lowest rollover in this space. The

stock has added good amount of positions and most

of them are on long side. The stock has managed to

sustain above its major resistance of `1512 and

`1545. Traders are advised to trade this counter with

positive bias.

VOLTAS (74.15%) outperformed the Capital Goods

sector with huge open interest addition, indicating

long build-up in the stock. The long positions have

been rolled to April series also. Traders should hold

their long positions in the stock.

For Private Circulation Only

SEBI Registration No: INB 010996539

3

Derivatives Rollover Report

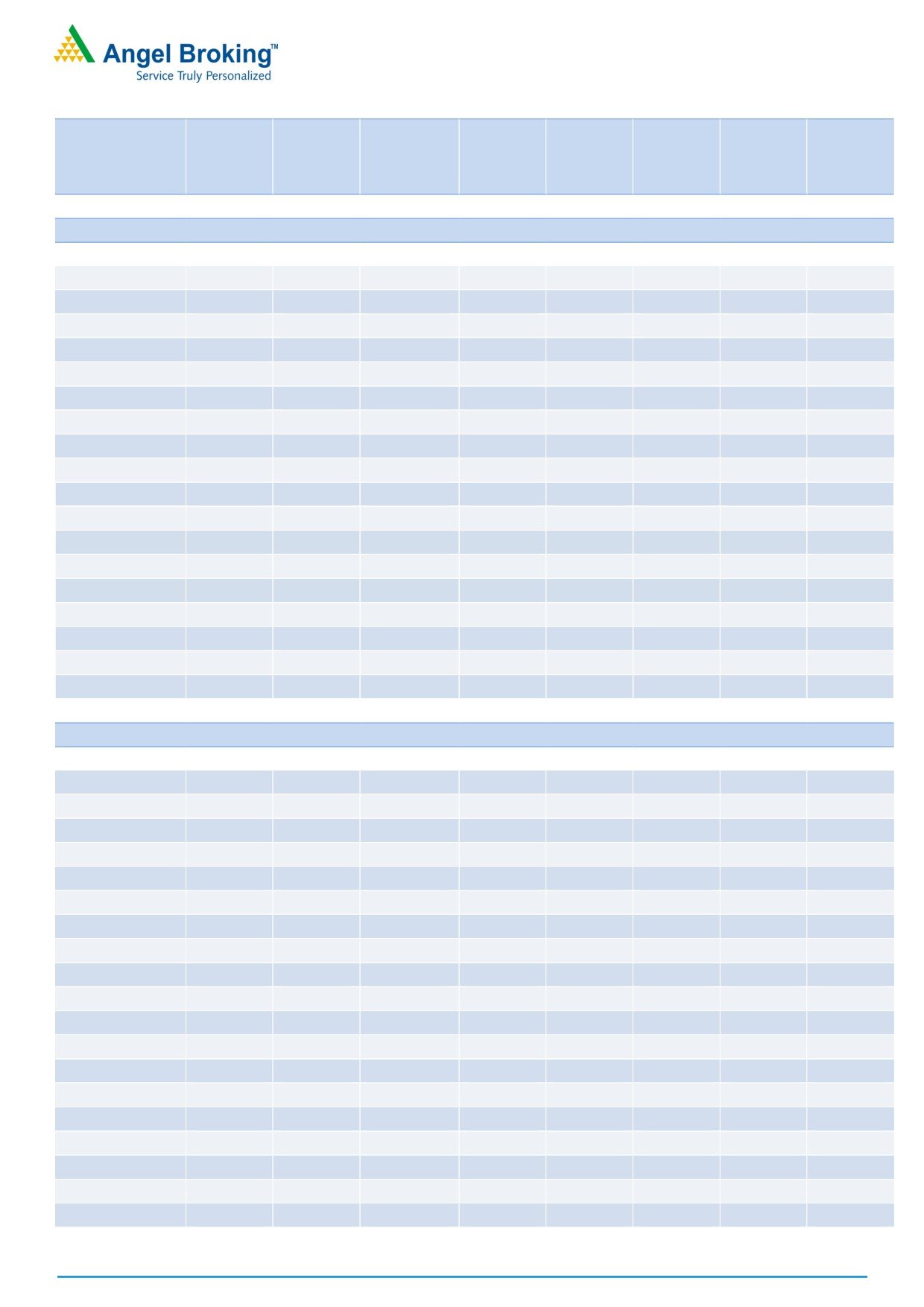

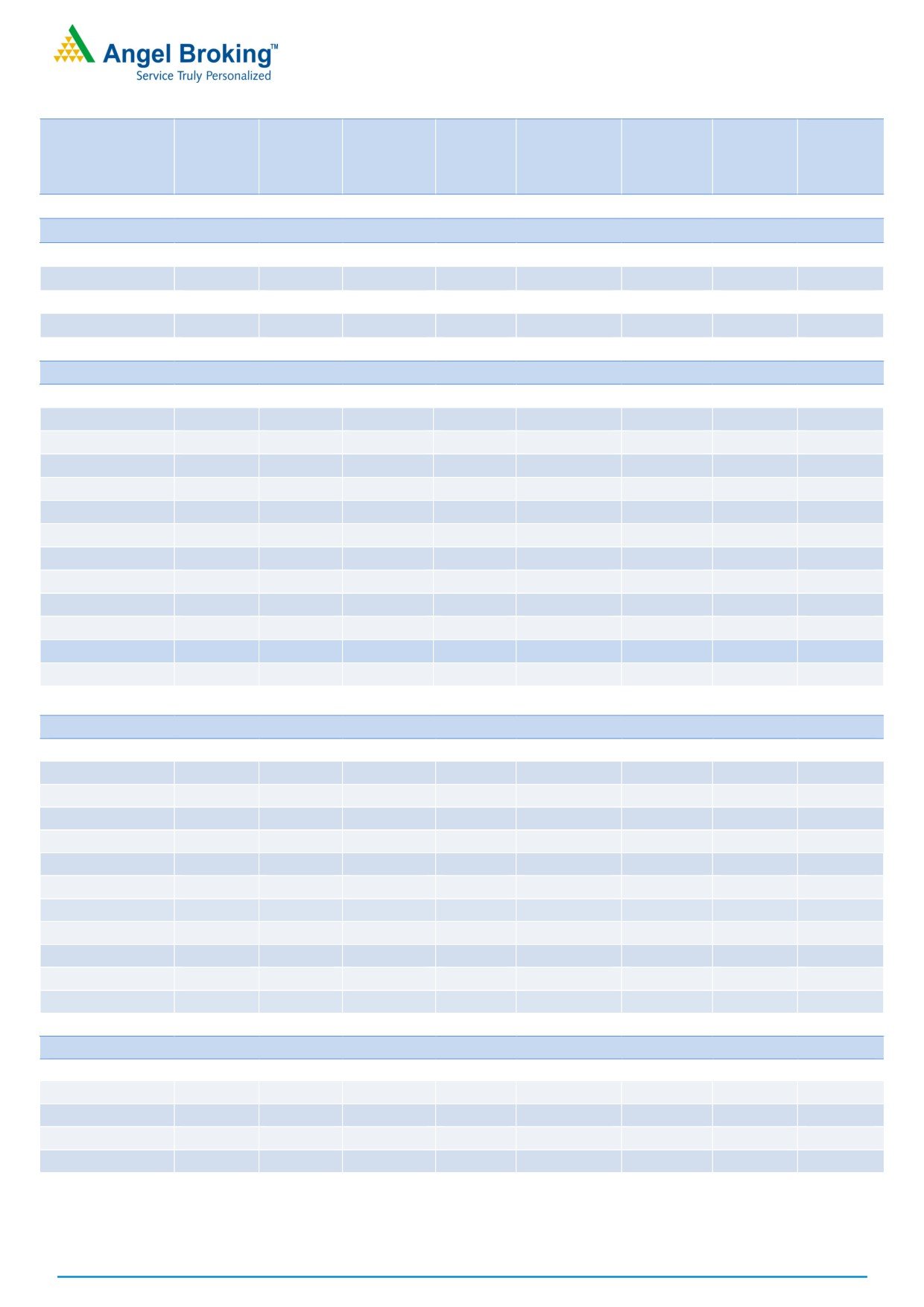

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

876.50

3.02

1835400

25.57

9.29

0.84

70.06

74.70

APOLLOTYRE

209.20

12.75

14031000

(10.71)

8.15

0.73

88.68

89.39

ASHOKLEY

83.60

(8.28)

83244000

36.88

9.42

0.47

78.31

86.28

BAJAJ-AUTO

2836.20

0.76

1585250

31.88

6.16

0.53

75.62

76.02

BHARATFORG

1033.90

(3.99)

4226400

45.48

8.95

0.54

78.20

79.95

BOSCHLTD

22737.50

2.84

90300

20.40

7.93

0.00

74.66

77.32

CASTROLIND

431.90

3.31

8603000

(1.82)

8.66

0.25

90.34

90.65

CEATLTD

1322.25

13.37

1838900

9.37

8.38

0.23

83.21

81.36

EICHERMOT

25764.80

3.31

183525

26.96

5.40

0.54

67.85

73.35

EXIDEIND

221.25

3.44

16580000

3.32

4.14

0.26

87.45

89.95

HEROMOTOCO

3248.60

1.93

1503200

7.74

6.84

1.05

73.72

75.33

M&M

1287.50

(1.57)

4516000

44.54

7.79

0.82

65.56

70.97

MARUTI

5978.35

(1.42)

2400450

6.04

4.76

0.46

76.07

78.62

MOTHERSUMI

380.15

8.32

7975000

(13.64)

5.34

0.56

64.28

76.55

MRF

59983.20

15.86

52635

13.52

3.48

0.00

82.43

87.80

TATAMOTORS

469.30

1.16

40204500

13.19

2.50

0.80

77.56

70.31

TATAMTRDVR

283.55

0.37

19796700

6.45

9.03

1.09

77.11

82.99

TVSMOTOR

433.70

1.40

4202000

(31.25)

-6.58

0.73

67.43

77.78

BANKING & FINANCIALS

ALBK

73.40

(0.20)

13370000

(0.82)

9.84

0.38

82.89

72.78

ANDHRABANK

58.10

4.31

20160000

13.51

19.35

0.44

58.45

63.08

AXISBANK

500.60

(5.41)

31698000

20.51

3.52

0.64

74.66

76.25

BAJFINANCE

1182.15

9.97

4268000

2.06

1.21

0.46

85.45

79.24

BANKBARODA

174.50

3.32

53637500

32.33

6.38

0.67

82.22

77.01

BANKINDIA

139.35

9.12

24498000

12.23

8.00

0.42

81.25

82.92

BHARATFIN

813.10

(7.13)

17880000

79.88

9.37

0.57

86.41

84.96

CANBK

303.85

5.56

15009828

10.66

3.01

0.55

90.10

86.86

DCBBANK

169.20

9.59

4423500

14.30

6.58

1.06

72.65

77.18

DHFL

366.90

10.18

19458000

11.39

9.66

1.27

87.33

88.75

FEDERALBNK

91.15

7.74

53944000

(11.45)

5.75

0.57

81.76

83.37

HDFC

1524.10

9.54

9984000

(6.57)

3.56

0.50

52.02

66.49

HDFCBANK

1447.70

4.24

31518500

(5.36)

-16.45

0.53

69.86

73.25

IBULHSGFIN

992.15

14.67

19446400

35.08

2.04

0.28

86.42

85.13

ICICIBANK

281.95

(1.12)

68207500

5.83

2.78

0.80

70.18

70.78

IDBI

75.05

(8.64)

38368000

58.13

9.62

0.78

83.03

83.13

IDFCBANK

60.05

(4.83)

76888000

38.17

8.74

0.69

87.15

90.29

IDFC

54.90

3.10

99237600

23.92

9.57

0.72

81.72

88.96

IFCI

30.20

1.17

59950000

4.65

13.08

0.35

82.85

82.22

For Private Circulation Only

SEBI Registration No: INB 010996539

4

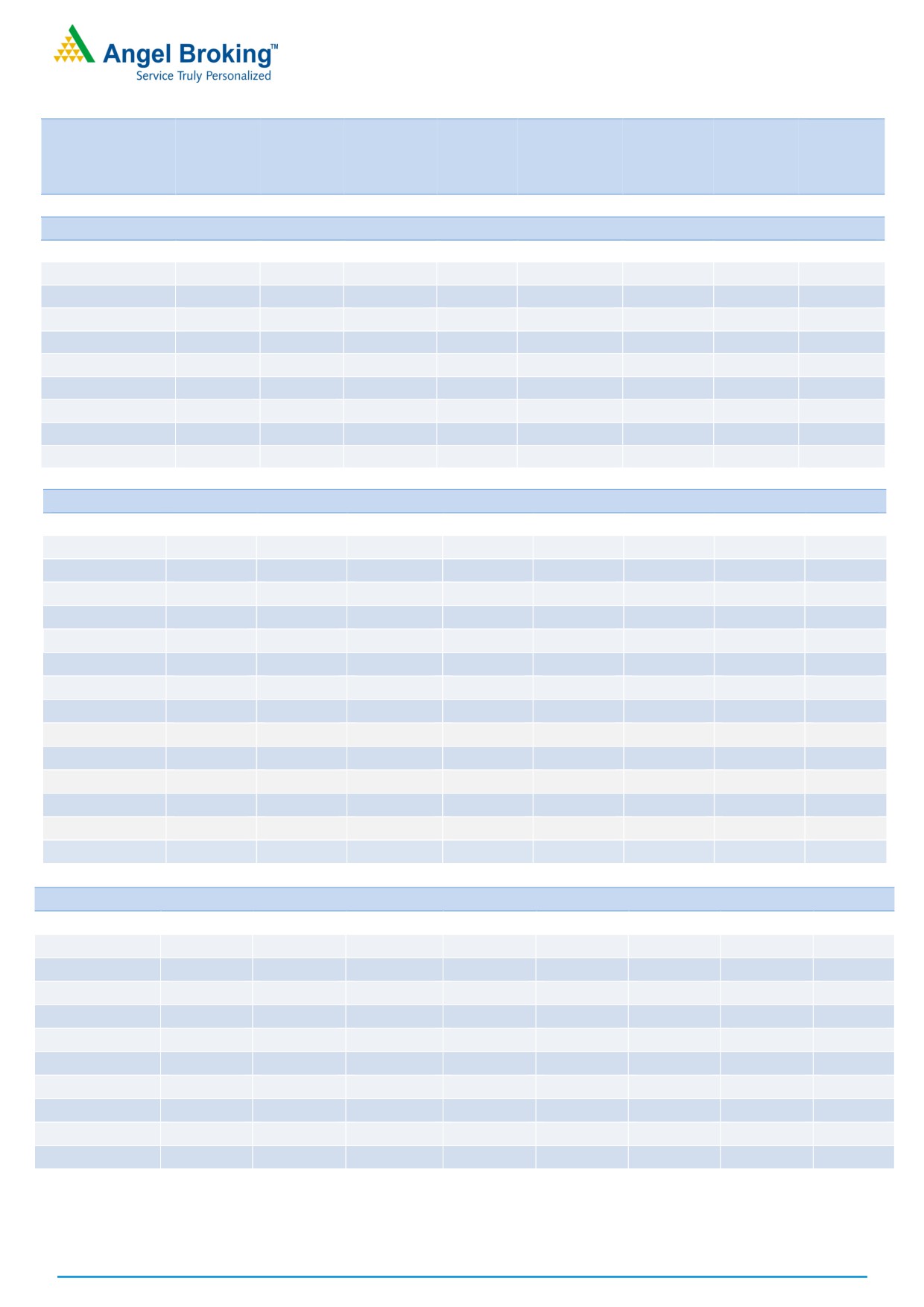

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

INDUSINDBK

1425.20

5.84

7827000

33.60

2.66

0.57

71.43

69.76

KOTAKBANK

866.45

6.89

9700000

(1.73)

1.96

0.63

67.17

70.70

KTKBANK

141.15

7.95

27951250

(2.29)

9.77

0.48

75.77

83.56

L&TFH

124.15

6.25

21006000

25.01

7.92

0.43

81.95

79.67

LICHSGFIN

624.70

9.81

5051200

(41.72)

4.82

0.58

77.55

77.98

M&MFIN

316.40

8.02

13855000

9.37

6.21

0.80

76.54

75.63

ORIENTBANK

138.50

10.45

12318000

(7.56)

-44.54

0.80

81.73

84.98

PFC

143.50

6.89

31722000

16.63

7.31

0.86

77.10

74.07

PNB

149.40

6.33

51863000

11.43

-32.33

0.79

82.13

80.71

RECLTD

180.20

18.98

26790000

(12.49)

-14.66

0.54

67.74

74.69

RELCAPITAL

612.20

17.21

11232000

8.10

10.30

0.68

81.65

87.10

SBIN

291.55

7.29

72918000

(9.08)

2.24

0.69

78.14

76.05

SOUTHBANK

20.40

(1.92)

80830899

38.03

9.66

1.16

90.64

90.01

SRTRANSFIN

1055.90

12.52

1989600

(44.61)

3.96

0.19

55.39

75.89

SYNDIBANK

71.20

1.50

13149000

(6.76)

8.29

0.33

81.48

77.21

UNIONBANK

155.70

8.92

17428000

(21.11)

5.04

0.37

72.56

79.22

YESBANK

1555.60

7.14

7508200

(0.87)

2.90

1.13

73.29

75.31

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

340.20

13.89

12857500

(0.16)

3.46

0.59

76.85

77.44

BEML

1319.15

(0.89)

2130600

5.18

7.50

1.39

71.52

81.35

BHEL

165.60

7.39

29955000

30.81

9.12

0.55

74.63

74.51

CGPOWER

77.15

13.29

17556000

(8.45)

5.94

0.20

80.52

82.89

ENGINERSIN

144.85

(2.23)

26180000

18.35

9.98

1.10

81.50

79.23

GMRINFRA

16.55

9.97

207180000

17.06

15.95

0.44

88.90

87.12

HAVELLS

469.15

13.98

4212000

(11.74)

-5.12

0.32

76.03

77.42

IRB

238.20

2.45

16130000

63.59

9.93

0.49

89.08

88.59

JPASSOCIAT

14.15

(5.03)

150960000

0.77

18.69

0.30

89.55

88.33

LT

1563.15

4.65

8346500

8.93

4.77

0.44

62.96

73.37

RELINFRA

567.80

1.43

9623900

51.08

9.13

0.52

84.63

88.80

SIEMENS

1258.20

4.06

914500

2.64

7.29

0.41

74.99

79.24

VOLTAS

416.15

16.95

5634000

25.48

8.83

0.27

74.15

76.22

CEMENT

ACC

1426.80

(0.86)

1825200

68.94

7.21

0.36

81.05

79.82

AMBUJACEM

234.20

1.19

10912500

10.76

1.11

0.17

72.48

75.28

GRASIM

1069.45

4.14

6052500

20.72

1.46

0.75

74.39

70.53

INDIACEM

161.70

(3.46)

22848000

25.56

9.75

0.58

82.39

85.46

ULTRACEMCO

3996.90

5.28

2386000

16.81

2.76

0.69

77.43

76.84

For Private Circulation Only

SEBI Registration No: INB 010996539

5

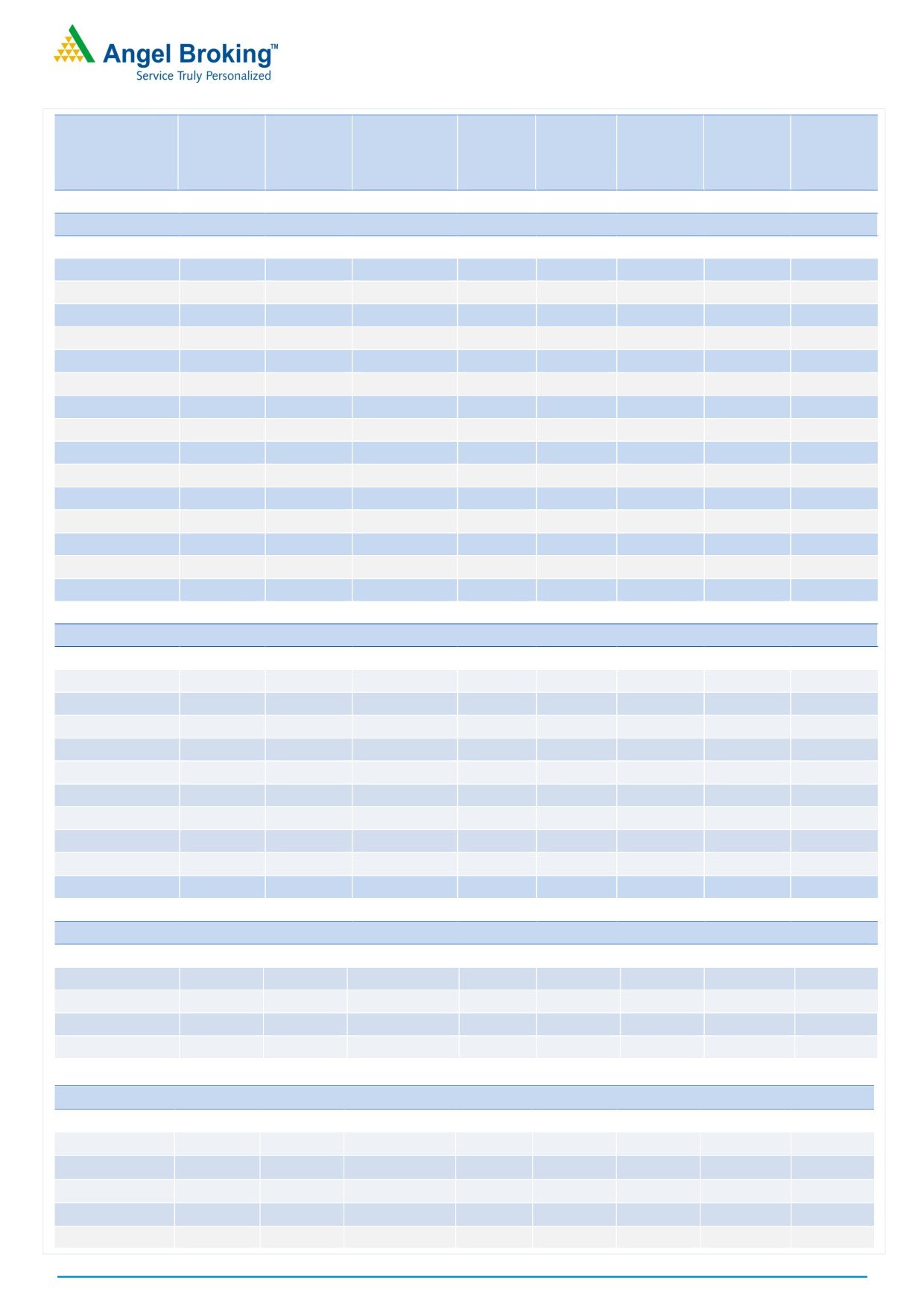

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

CHEMICAL & FERTILIZERS

PIDILITIND

694.60

0.33

1632000

11.86

6.89

0.39

79.30

80.95

TATACHEM

596.85

2.98

3823500

20.18

5.04

0.49

87.20

83.88

UPL

716.60

(0.65)

5030400

(11.56)

3.83

0.75

67.66

81.81

CONSUMER GOODS & FMCG

ASIANPAINT

1074.75

6.09

4222200

(9.52)

5.66

0.41

74.77

80.73

BRITANNIA

3406.75

5.03

337600

(71.53)

4.45

0.45

42.39

68.89

COLPAL

1007.25

12.02

877100

(36.59)

-1.10

0.38

63.60

77.72

DABUR

275.40

1.70

11920000

(6.38)

5.94

0.46

81.19

86.53

GODREJCP

1668.95

(0.30)

348400

(16.09)

5.49

0.50

67.83

64.30

HINDUNILVR

921.00

6.74

7116600

4.62

2.55

0.37

73.43

79.06

ITC

284.00

6.33

50956800

10.31

5.76

1.25

67.13

73.59

JUBLFOOD

1114.25

10.74

1840500

(12.75)

-3.73

0.43

57.16

69.83

MARICO

296.80

9.95

4526600

(2.68)

1.32

1.00

75.24

76.57

TATAGLOBAL

150.95

7.71

31810500

9.63

6.95

0.30

90.11

92.66

TITAN

459.60

5.63

4617000

(29.24)

6.56

0.54

66.34

71.35

UBL

784.65

(0.66)

1017800

(9.01)

9.20

0.44

61.98

74.41

INFORMATION TECHNOLOGY

HCLTECH

871.40

3.03

8373400

29.78

-6.62

0.87

78.36

79.71

HEXAWARE

219.70

(0.54)

3603000

(16.25)

6.26

0.57

81.98

81.57

INFY

1027.20

1.45

33820500

56.69

2.16

0.71

73.87

73.11

KPIT

131.35

(5.74)

5012000

32.45

6.98

2.79

76.26

80.03

MINDTREE

453.45

(4.10)

2887200

(3.88)

0.72

0.62

71.29

83.54

NIITTECH

421.35

(0.70)

592500

(18.39)

4.03

1.00

57.08

73.62

OFSS

3625.35

(2.46)

239850

(4.14)

-54.09

0.00

74.86

75.87

TATAELXSI

1485.15

0.30

1220000

19.56

9.33

0.78

78.87

80.83

TCS

2450.90

(1.45)

6400250

20.43

5.29

2.59

70.58

71.54

TECHM

462.95

(8.31)

11420200

43.20

4.95

0.68

76.14

74.01

WIPRO

517.15

6.08

6992400

38.47

3.03

0.82

70.80

75.93

MEDIA

DISHTV

108.75

15.88

25585000

(7.59)

2.40

0.34

78.96

83.78

SUNTV

792.25

11.73

6878000

(4.82)

6.62

0.33

86.17

85.30

TV18BRDCST

42.40

5.47

89998000

3.54

10.85

0.82

92.25

91.91

ZEEL

535.10

2.67

7616700

6.78

6.61

0.48

74.35

78.63

For Private Circulation Only

SEBI Registration No: INB 010996539

6

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

METALS & MINING

COALINDIA

291.35

(6.44)

20366000

100.13

8.33

0.68

77.42

71.03

HINDALCO

191.50

4.70

38650500

(12.37)

8.22

0.99

78.41

82.10

HINDZINC

287.80

(4.97)

10112000

27.83

9.12

0.41

76.44

76.78

JINDALSTEL

120.05

2.43

32184000

(13.12)

11.50

0.49

77.34

84.53

JSWSTEEL

186.10

(0.67)

45633000

6.47

4.92

0.70

83.73

85.04

NMDC

132.90

(6.51)

27582000

52.52

7.89

0.65

84.19

80.08

SAIL

61.40

1.57

52584000

8.41

7.47

0.80

85.79

84.80

TATASTEEL

480.40

(1.27)

21936000

13.87

7.92

0.79

80.42

80.69

VEDL

253.70

(3.50)

37884000

9.78

-98.78

0.40

74.22

77.22

MISCELLANIOUS

ABIRLANUVO

1540.55

2.80

3250400

24.08

8.95

0.90

87.31

90.29

ADANIENT

106.60

9.61

19640000

(7.18)

9.86

0.34

81.18

84.79

BATAINDIA

571.35

14.54

4185500

59.54

4.35

0.10

86.40

84.27

BEL

154.55

2.10

31806000

(10.67)

9.34

0.52

81.40

86.24

CONCOR

1269.20

7.24

964500

(24.59)

1.44

0.60

75.53

78.85

CUMMINSIND

947.15

6.70

621600

(0.67)

9.36

0.67

74.37

77.91

GODREJIND

505.90

(0.50)

1941000

110.41

8.95

1.21

76.03

74.35

JETAIRWAYS

535.50

25.96

5705000

4.58

7.84

0.33

77.85

77.75

JISLJALEQS

93.75

(0.58)

37269000

(1.73)

10.51

0.72

85.26

86.22

JUSTDIAL

544.85

4.77

2498400

(4.93)

4.80

0.54

72.29

74.31

KSCL

545.90

19.18

2883000

(0.41)

9.14

1.88

74.35

80.82

MCDOWELL-N

2206.15

(5.96)

3552000

32.22

7.16

0.38

88.97

91.10

PCJEWELLER

419.25

10.62

861000

(5.12)

9.24

0.46

64.35

70.57

SINTEX

106.20

13.04

37897875

12.52

9.89

0.60

85.86

89.09

OIL & GAS

BPCL

644.85

(7.87)

10959600

6.84

8.55

0.56

75.92

77.91

CAIRN

301.65

4.89

29046500

13.90

7.17

0.52

78.30

84.65

GAIL

377.95

(1.24)

15790000

10.51

-3.61

0.57

54.85

68.99

HINDPETRO

519.20

(5.39)

18549300

8.90

4.79

0.33

77.60

78.04

IGL

1010.30

(2.98)

2352900

52.46

9.42

1.95

78.29

78.77

IOC

375.25

(3.11)

16356000

8.91

-5.36

0.53

70.53

72.65

OIL

328.45

0.09

1930632

(17.52)

-0.99

0.53

62.60

74.73

ONGC

185.10

(5.75)

48052500

25.75

8.51

0.51

79.31

75.80

PETRONET

402.70

0.32

3940500

(33.09)

7.98

0.54

82.64

81.13

RELIANCE

1274.20

7.19

17377000

(9.10)

3.64

0.50

65.31

77.53

For Private Circulation Only

SEBI Registration No: INB 010996539

7

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

PHARMACEUTICAL

AJANTPHARM

1767.10

2.96

578400

18.33

9.44

1.19

70.09

80.00

APOLLOHOSP

1163.80

(12.35)

1513200

138.22

9.08

0.96

83.33

83.47

AUROPHARMA

675.25

0.72

14450100

3.20

6.89

0.84

81.18

83.21

BIOCON

1145.65

2.65

2896800

24.34

7.55

0.59

79.03

86.01

CADILAHC

451.65

4.66

3016000

(0.89)

3.62

0.28

80.56

81.12

CIPLA

600.50

0.99

6357000

(4.68)

4.68

0.65

76.47

80.54

DIVISLAB

626.80

(16.68)

10145400

100.84

8.06

0.34

90.10

83.57

DRREDDY

2628.85

(9.50)

3425000

29.31

7.78

0.69

79.40

78.23

GLENMARK

867.90

(7.31)

3604300

58.77

8.62

1.15

87.52

85.55

GRANULES

140.05

8.31

12955000

(5.30)

8.90

0.73

85.74

86.77

LUPIN

1452.80

(0.40)

8691600

22.53

5.27

0.91

75.24

77.90

STAR

1111.45

(5.60)

1996500

47.02

9.03

0.80

80.80

77.50

SUNPHARMA

690.70

2.02

28576800

(0.08)

6.93

0.76

78.19

81.73

TORNTPHARM

1488.10

14.63

179200

(39.05)

-7.88

0.33

71.45

76.06

WOCKPHARMA

731.70

3.19

3162000

(1.22)

9.33

0.79

83.76

86.97

POWER

ADANIPOWER

40.20

4.55

125940000

(2.16)

9.80

0.29

88.33

90.73

CESC

846.00

(1.76)

4348300

34.41

3.55

0.83

83.52

86.40

JSWENERGY

63.20

0.08

57608000

38.08

8.30

0.72

85.47

88.82

NHPC

31.90

4.76

21276000

(13.12)

8.22

0.52

74.90

72.17

NTPC

164.05

(1.35)

23884000

10.25

7.59

0.79

70.75

74.76

POWERGRID

196.60

(1.87)

31544000

63.98

7.67

0.49

73.24

77.50

PTC

92.30

2.56

15280000

(8.31)

5.67

0.84

78.15

83.91

RPOWER

48.15

3.88

55656000

2.29

10.92

0.43

87.13

89.97

TATAPOWER

90.25

7.44

28341000

1.19

5.08

0.40

80.07

83.89

TORNTPOWER

231.25

14.51

3654000

10.93

-28.94

0.50

88.26

88.77

REAL ESTATE

DLF

150.50

0.77

31120000

7.40

10.92

0.54

83.29

79.56

HDIL

82.25

19.64

20336000

(22.71)

3.97

0.23

72.82

79.17

IBREALEST

87.90

12.48

31470000

(1.07)

9.71

0.32

86.08

88.15

NCC

81.25

(1.04)

30576000

7.57

7.26

1.00

81.06

82.82

TELECOM

BHARTIARTL

348.60

(5.04)

36247400

(7.54)

-9.65

0.38

78.89

77.11

IDEA

87.65

(26.65)

92295000

29.71

8.98

0.61

76.09

72.35

INFRATEL

325.65

8.77

8086400

5.47

-42.78

0.45

64.06

74.56

RCOM

38.35

2.95

89928000

(10.75)

3.41

0.39

79.86

85.04

TATACOMM

718.60

(3.75)

6582800

16.85

8.77

0.56

90.58

88.95

For Private Circulation Only

SEBI Registration No: INB 010996539

8

Derivatives Rollover Report

TEXTILES

ARVIND

393.05

5.14

6802000

(0.15)

7.34

0.72

80.17

82.14

CENTURYTEX

1055.30

10.93

7991500

(0.47)

9.27

0.38

88.75

90.88

ICIL

197.20

22.60

9338000

134.45

8.99

0.27

81.64

86.93

PAGEIND

14824.05

5.12

31650

(2.01)

10.22

0.00

78.63

76.04

SRF

1614.75

3.29

802500

9.71

8.65

1.18

77.87

77.79

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager with SEBI. It

also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in

terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates including its relatives/analyst

do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not

received any compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market

making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as

they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume,

as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to

be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only.

Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the

information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update

on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in

the stocks recommended in this report.

Derivative Research Team

For Private Circulation Only

SEBI Registration No: INB 010996539

9