Derivatives

Rollover Report

January 27, 2017

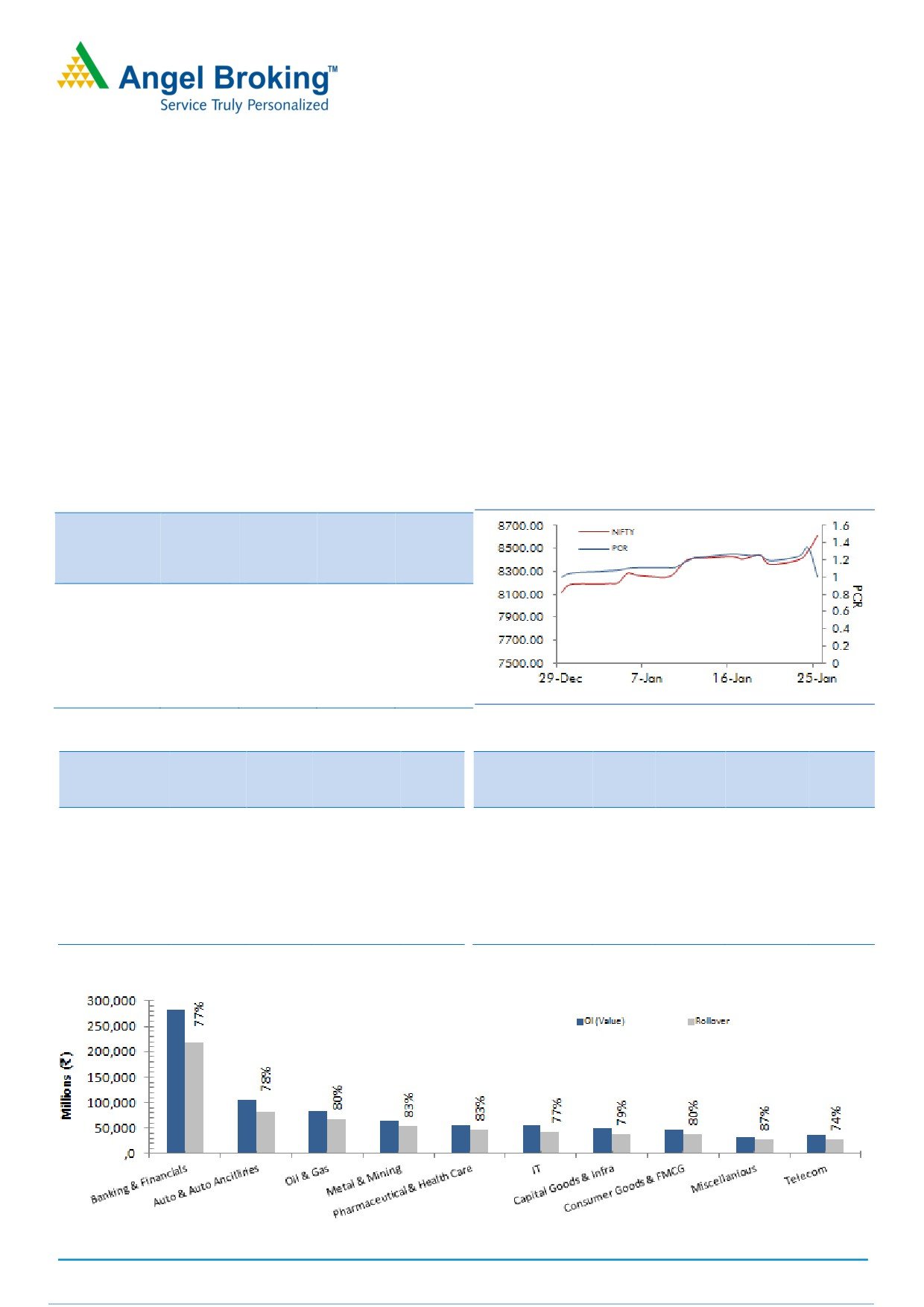

Nifty (73.12%) inaugurated the first series of year 2017 with a constructive move. Rollover in Nifty in terms of

percentage as well as open interest is on the upper side. Nifty rallied nearly 6% MoM with good amount of long

positions and rollover figure suggests that these positions are still intact. FIIs too added significant longs in Index

Futures in recent up move and as a result, their Long-Short ratio in Index future segment jumped from 67% to 82%.

They rolled more than 75% of their longs, which clearly depicts their optimistic stance on our market ahead of ‘Union

Budget’. On options front, being start of new series the overall build-up is quite scattered. However, 8700 & 9000 call

options and 8400 & 8500 put options are attracting trader’s attention. At current juncture, the overall data indicates

continuation in ongoing momentum in near term too. Thus, traders are advised to avoid shorting in index and use

declines as a buying opportunity.

Rollover in BANKNIFTY (60.79%) are below its average in percentage terms; however, its inline in terms of open

interest. We witnessed good amount of longs in the range of 18400 - 19000 and we believe these positions got rolled

too. The overall banking and financial basket (except LICHSGFIN) performed well in January series. At current

juncture, banking index has strong support at 18700-19000 levels. Considering overall data, it’s advisable to trade

banking stocks with positive bias in near term.

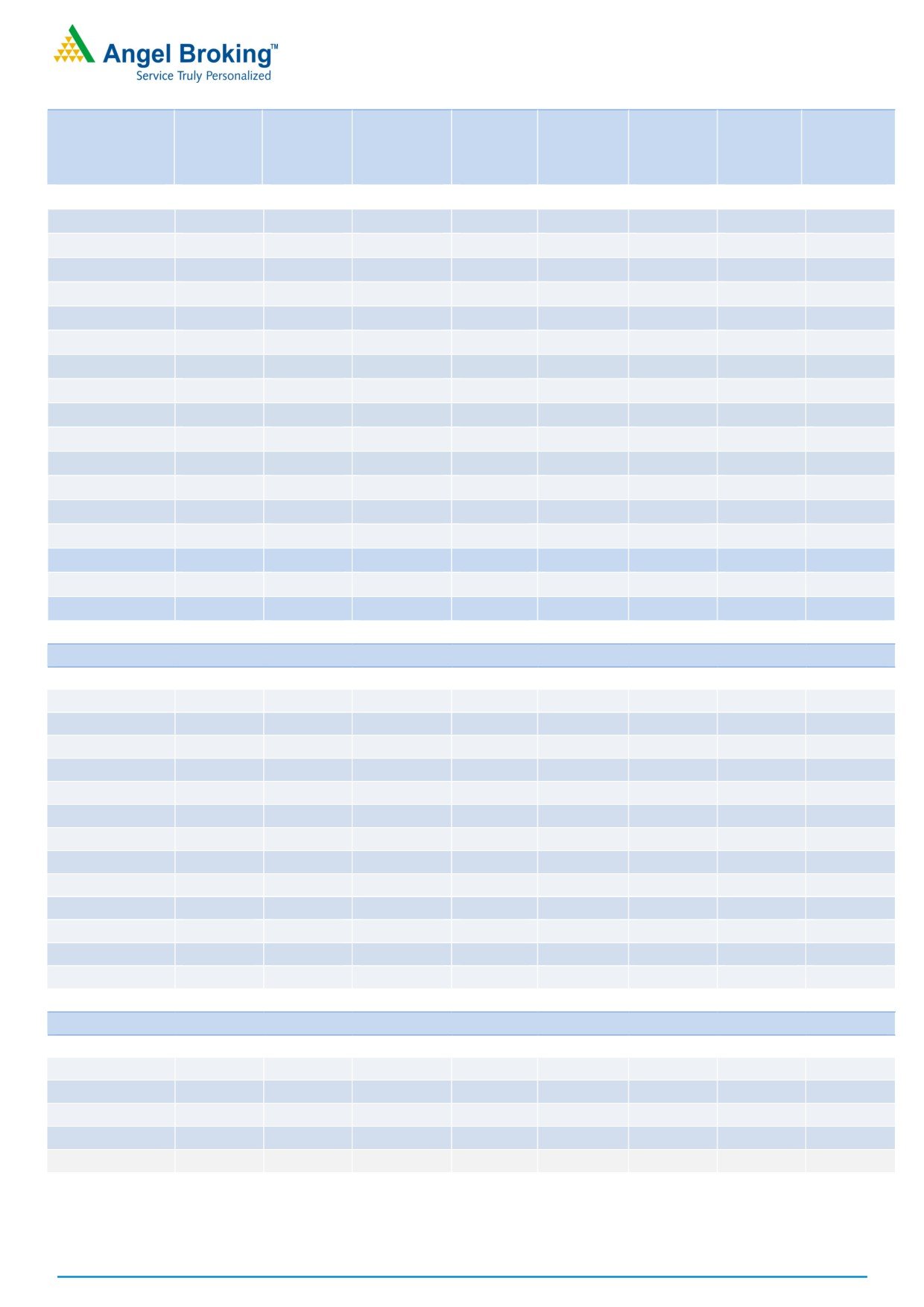

Indices Change

NIFTY & PCR Graph

Price

Change

3 month

INDEX

Price

(%)

Rollover

avg.

NIFTY

8614.85

6.13

73.12

68.57

BANKNIFTY

19509.85

7.95

60.79

63.45

NIFTYIT

10184.00

(1.29)

82.08

80.37

NIFTYMID50

3622.15

(12.13)

-

-

NIFTYINFRA

2713.70

(6.82)

-

-

Monthly Gainers

Monthly Losers

Price

Ol

Price

Ol

Change Open

Change

Change Open

Change

Scrip

Price

(%)

Interest

(%)

Scrip

Price

(%)

Interest

(%)

JPASSOCIAT

10.85

44.67

121516000

1.59

DIVISLAB

677.95

(14.47)

6937800

128.97

HAVELLS

421.85

28.38

4696000

27.61

MINDTREE

464.05

(11.21)

2576400

41.25

INDIACEM

143.85

27.02

22526000

(16.10)

RCOM

31.05

(7.73)

102444000

9.53

SAIL

62.00

26.92

43800000

(11.36)

INFY

940.25

(5.61)

17068000

26.01

DLF

137.85

25.95

28030000

(16.01)

HEXAWARE

197.25

(4.25)

4674000

9.56

Note: Stocks which have more than 1000 contract in Futures OI.

Note: Stocks which have more than 1000 contract in Futures OI.

SEBI Registration No: INB 010996539

1

Derivatives Rollover Report

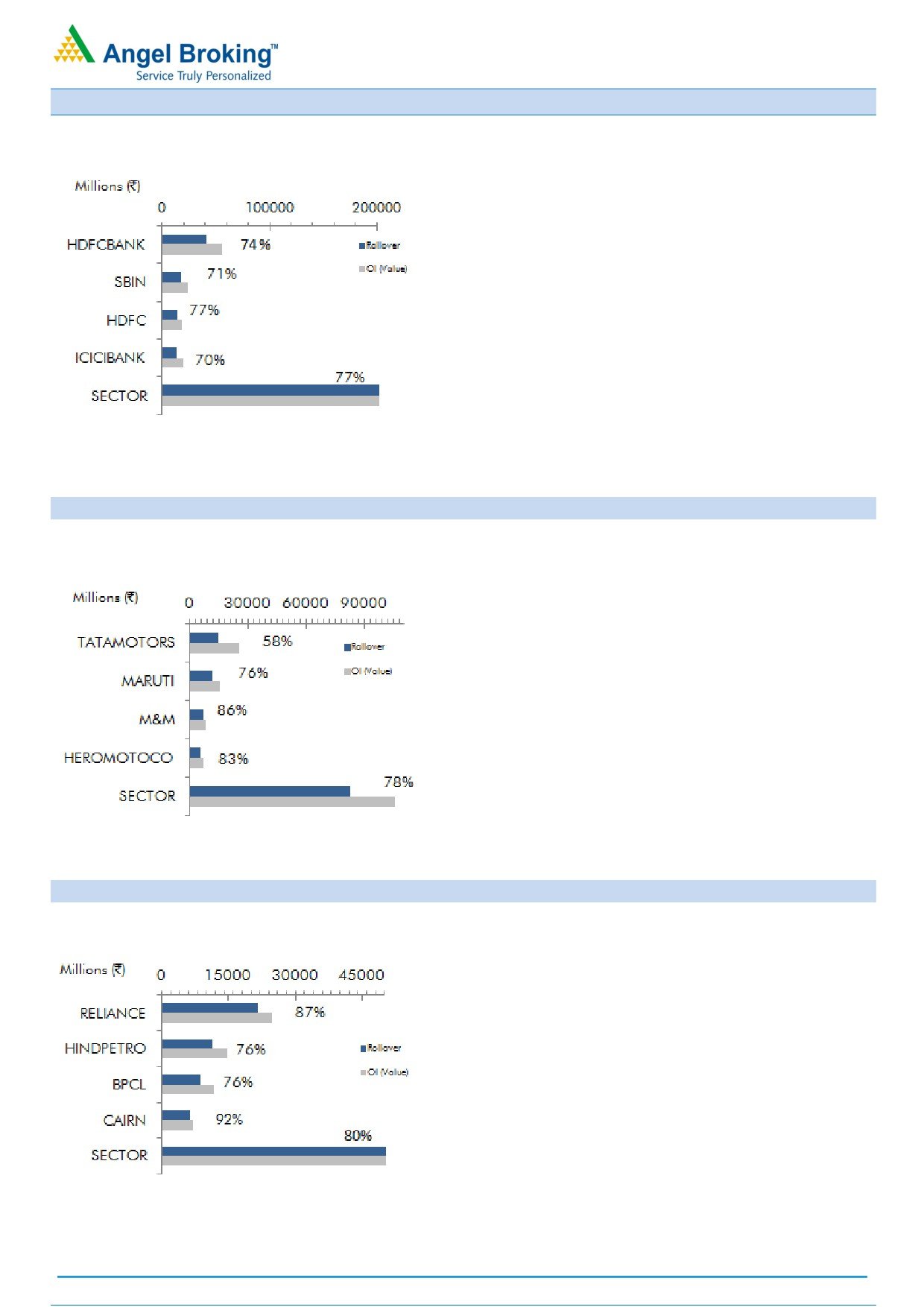

Banking and Financials

HDFCBANK (74.38%) bounced from `1188 levels

last series with good amount of open interest

addition. In terms of percentage the rollover may

seem to be on the lower side but it’s high if open

interest is considered. Thus, any dip near `1250-

`1270 shall be a buying opportunity.

SBIN (70.61%) is nearly 5% up series on series which

was mainly due to short covering. However, we saw

some fresh in last two-three trading session and we

believe these positions are still intact. Thus, one

should form fresh long between `252- `256 levels for

the target of `278.

LICSGFIN (77.24%) is the only counter in this space

that closed in red series on series. We witnessed

significant build-up in correction from `560 to `517

levels. Although, this counter gave decent short

covering bounced, still meaningful short are intact.

Thus, we expect the up move to continue due to

further short covering.

Auto & Auto Ancillaries

TVSMOTORS (85.73%) rallied nearly 10% last series

with good amount of longs. Rollover in this counter is

above its averages both in terms of OI and

percentage. Thus, this counter is a buy on dip for us.

HEROMOTOCO (83.46%) traded in a narrow range

in the start of January series. In last

3 trading

sessions, we witnessed huge long positions when it

bounced from `3058 levels and we believe these

positions have been rolled too. Thus, traders are

suggested to trade with a positive bias.

Rollover in MARUTI (75.51%) is on the lower side.

This counter rallied more than 9% but surprisingly no

relevant longs were visible. Thus, trades should avoid

forming longs at current levels unless we see relevant

fresh longs in system.

Oil & Gas

RELIANCE (86.91%) is the only counter in large cap

We

that underperformed (except some IT stocks).

witness huge short formation in this counter when it

corrected from

`1090-`1092 levels. At present.

RELIANCE is trading near its support zone of Rs.

`1000-`1020 levels. We expect some short covering

bounce which may bring it near `1080-`1082 levels.

GAIL (79.98%) rallied nearly with 70% (MoM) rise in

open interest. Majority of the positions formed were on

long side and these positions got rolled too. Thus, any

dip near

`460-`465 levels shall be a buying

opportunity. One can expect `480-`482 levels in near

term.

Few counters like CAIRN

(91.54%), PETRONET

(87.38%) and IGL (79.02%) has high rollovers in this

space.

For Private Circulation Only

SEBI Registration No: INB 010996539

2

Derivatives Rollover Report

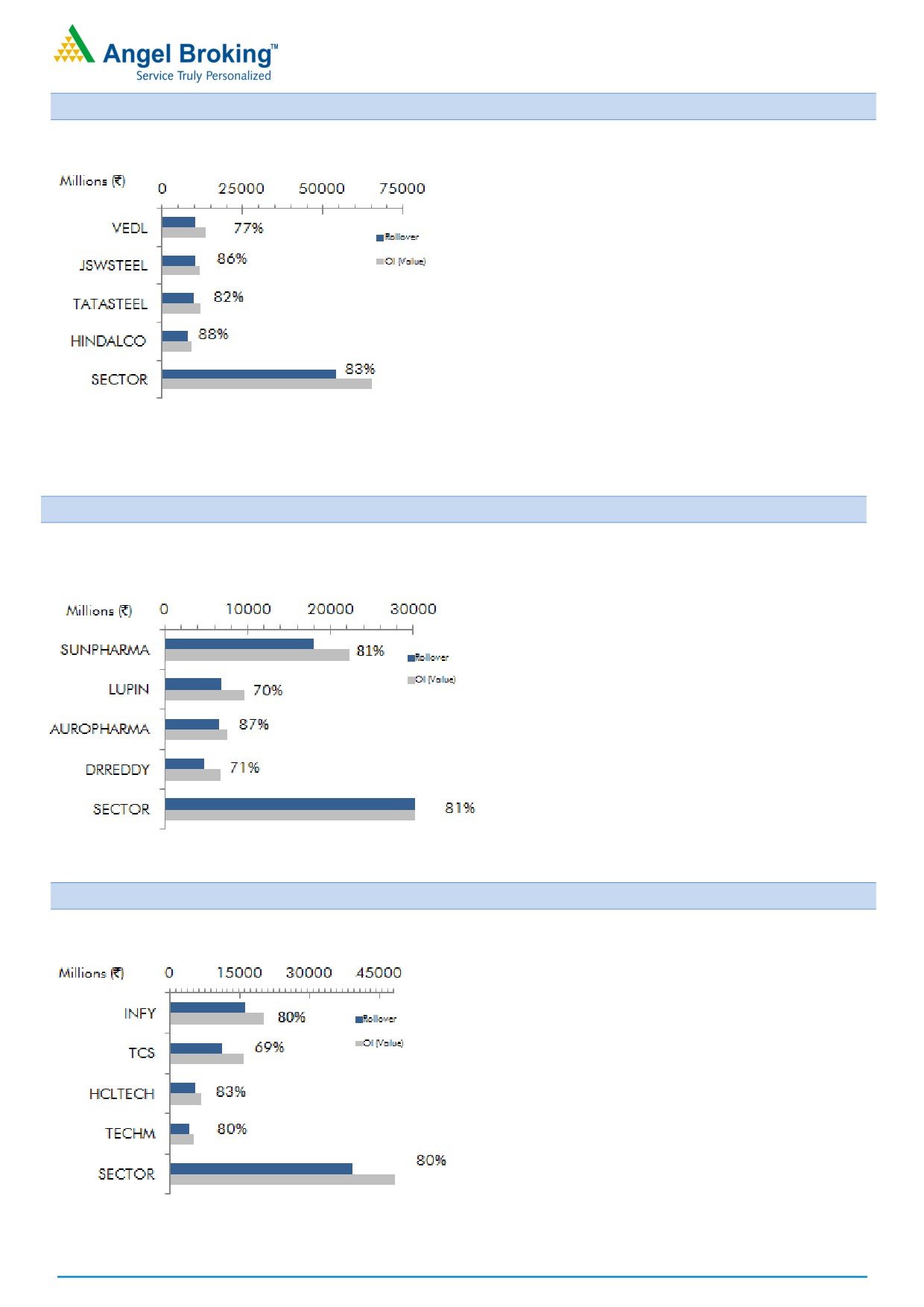

Metal & Mining

HINDALCO (88.28%) was one of the major gainer in

this space. The stock has added good amount of long

positions and the same got rolled too. Stock has

breached its immediate resistance of `180 - `182

and managed to sustain above the same. Stock may

rally further towards `198 - `200 levels. Thus, trade

with positive bias.

VEDL

(76.84%) is continuously attracting long

positions. From last few months, corrections are not

supported by short formations; while, we witnessed

good amount of long build-up in up moves. Traders

should use declines as a buying opportunity.

Some of the liquid counters with high rollovers in this

space are JINDALSTEL (92.11%), JSWSTEEL (86.05%)

and SAIL (85.74%).

Pharmaceuticals

Open Interest of LUPIN (70.42%) remained flat on

Month-on-Month basis and rollovers are also below

its quarterly average. In last few days, we witnessed

long build-up in the stock and any move above its

resistance of `1530 - `1540 may result into decent

rally in the counter.

DIVISLAB (87.60%) was the biggest loser in this space

and added huge amount of short positions in last

series. Shorts positions have got rolled too. Traders

should avoid bottom fishing at current juncture.

Rollover in DRREDDY (70.75%) is below its averages.

Recently, the stock has rebounded from its support

zone of `2900 - `2920 along with formation of fresh

longs. Currently, the stock is light on positions and

further long build-up may lead to an up move

towards `3120 - `3140 levels.

IT

INFY (79.78%) was one of the major Nifty losers in

January series and we also witnessed short

formations in that correction. Most of the shorts are

still intact in the system and thus traders should

refrain forming long positions at current levels.

HCLTECH (82.68%) has added mixed positions in last

series and most of them are still intact. Rollovers are

marginally higher than its average. Currently, the

stock has strong support at `830 levels and resistance

at

`880 levels. Traders should wait for further

development in data before initiating any fresh

position in the counter.

MINDTREE (88.50%) was the major loser in this space

and added highest OI on Month-on-Month basis.

Stock added huge shorts in January series and

rollovers are also above its average. The stock may

continue to correct towards its strong support zone of

`420 - `425.

For Private Circulation Only

SEBI Registration No: INB 010996539

3

Derivatives Rollover Report

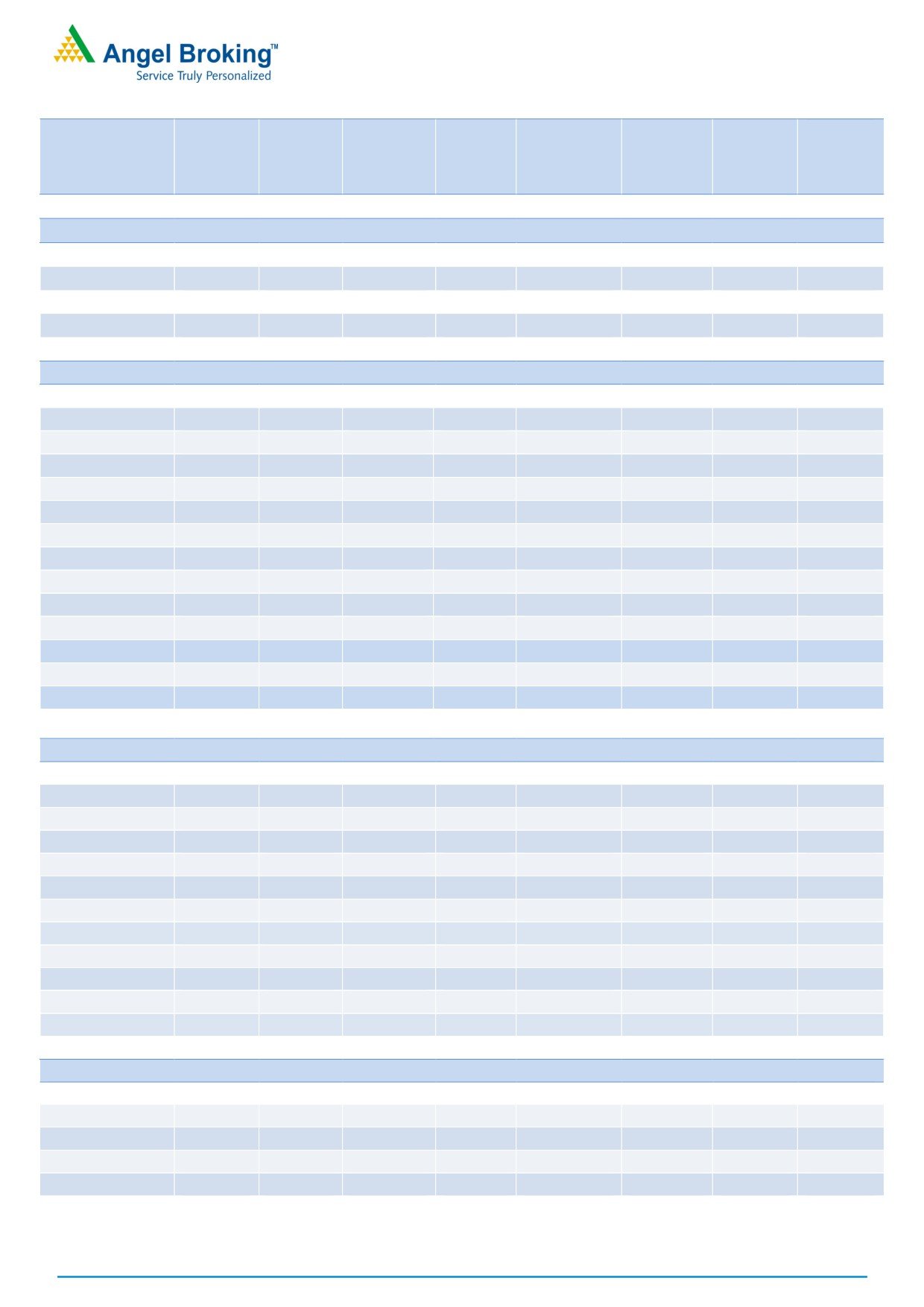

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

891.15

2.04

588600

13.41

7.10

1.12

71.71

74.49

APOLLOTYRE

188.10

0.99

10140000

45.82

9.10

0.51

90.69

85.35

ASHOKLEY

87.05

9.63

62349000

17.18

7.27

0.52

89.38

88.26

BAJAJ-AUTO

2850.85

7.25

1347750

0.71

0.53

0.65

82.07

78.97

BHARATFORG

954.45

4.69

4015200

(13.05)

2.38

0.29

83.08

83.46

BOSCHLTD

22953.90

11.00

73150

5.56

4.18

0.00

77.12

79.87

CASTROLIND

402.10

6.09

9640400

(13.67)

7.72

0.81

92.12

91.12

CEATLTD

1193.15

2.60

1640800

47.33

7.75

0.49

86.05

75.78

EICHERMOT

23118.55

7.46

203950

(3.12)

6.99

0.55

86.84

81.61

EXIDEIND

196.70

9.37

10112000

(5.18)

10.97

0.71

89.90

89.02

HEROMOTOCO

3250.05

6.58

1781800

26.75

1.01

1.30

83.46

80.02

M&M

1248.75

5.87

5401500

7.13

5.01

0.55

86.25

82.16

MARUTI

5828.15

9.38

1962450

(3.80)

5.55

0.61

75.51

77.81

MOTHERSUMI

333.35

1.85

10625000

23.30

7.02

0.76

87.88

88.15

MRF

53390.10

9.39

29730

7.31

7.67

0.00

87.78

85.50

TATAMOTORS

550.05

16.80

26850000

19.08

2.64

0.59

58.38

74.10

TATAMTRDVR

343.65

15.63

15550500

2.05

9.22

0.68

88.48

86.13

TVSMOTOR

391.80

10.07

8294000

30.99

-3.20

0.66

85.73

78.66

BANKING & FINANCIALS

ALBK

66.50

11.30

11950000

(9.40)

0.95

0.84

76.80

81.06

ANDHRABANK

50.15

6.25

19030000

(0.78)

6.31

0.71

73.36

79.04

AXISBANK

464.80

4.31

24571200

(8.30)

3.39

0.57

78.70

79.06

BAJFINANCE

1004.10

20.69

5975000

(26.50)

5.35

0.58

71.21

82.25

BANKBARODA

162.10

6.93

33586000

(0.36)

1.17

1.07

73.82

72.48

BANKINDIA

115.50

10.42

21348000

(10.33)

4.92

0.44

83.62

80.53

BHARATFIN

752.60

25.74

10045000

7.30

5.80

0.59

80.37

84.15

CANBK

276.65

5.94

14028000

4.84

-22.78

0.69

83.51

80.85

DCBBANK

119.10

9.82

3636000

105.08

6.91

0.57

78.52

79.70

DHFL

286.75

16.45

17988000

14.82

7.51

0.59

87.58

88.22

FEDERALBNK

79.20

19.01

50644000

9.54

6.39

0.51

81.36

82.15

HDFC

1341.25

6.28

10684500

19.63

3.62

0.60

76.99

77.75

HDFCBANK

1293.55

7.20

32046500

14.03

2.88

0.50

74.36

80.73

IBULHSGFIN

752.05

16.63

14496800

13.21

-5.66

0.75

92.75

84.08

ICICIBANK

260.80

3.41

52537500

(3.46)

4.12

0.59

69.60

75.03

IDBI

80.35

15.36

20304000

(29.13)

5.51

0.85

82.22

86.21

IDFCBANK

65.85

10.39

48608000

(2.03)

4.80

0.43

92.24

84.22

IDFC

59.65

8.75

60997200

11.06

9.57

0.81

94.40

86.44

IFCI

28.10

0.00

58410000

(5.11)

6.75

0.33

77.88

75.37

For Private Circulation Only

SEBI Registration No: INB 010996539

4

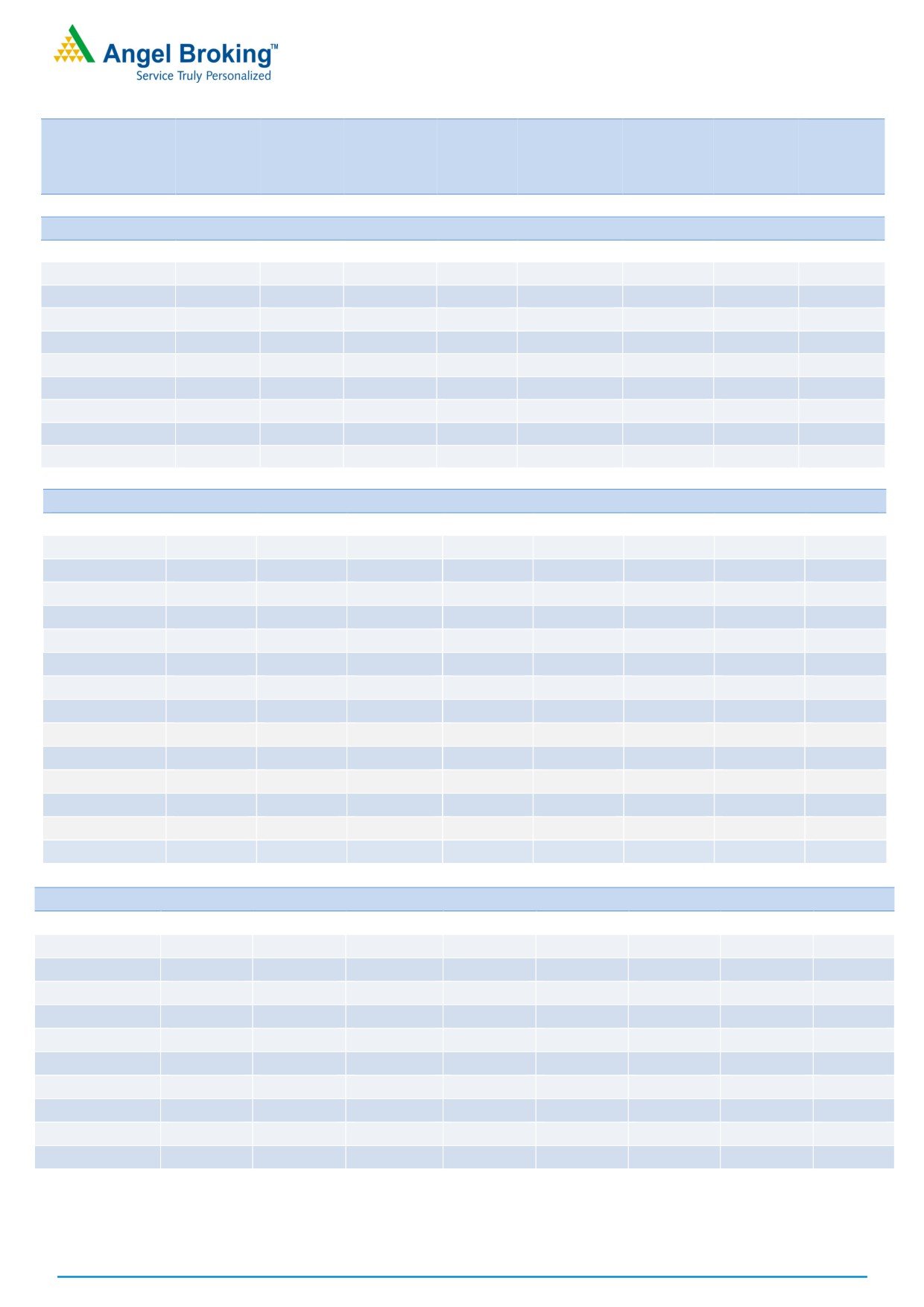

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

INDUSINDBK

1271.25

15.00

4491600

0.75

5.82

0.31

65.87

72.70

KOTAKBANK

796.15

11.14

8432000

7.89

1.50

0.43

75.25

73.78

KTKBANK

114.90

1.91

17360750

24.29

7.71

0.67

83.39

85.11

L&TFH

101.70

19.58

23121000

(9.61)

8.72

0.45

82.66

85.56

LICHSGFIN

548.15

(1.76)

9132200

49.08

4.72

0.61

77.24

81.35

M&MFIN

287.05

7.05

10980000

(8.96)

3.30

0.63

69.43

71.79

ORIENTBANK

116.85

13.34

14220000

0.89

8.68

0.89

87.55

81.36

PFC

136.10

13.70

13128000

(6.77)

-23.59

0.60

60.81

61.36

PNB

131.65

16.09

39067000

(24.06)

-15.11

0.88

75.26

80.67

RECLTD

141.50

16.75

24522000

7.50

-42.13

0.45

77.70

77.02

RELCAPITAL

462.20

8.40

11656500

6.44

8.50

0.70

89.85

87.49

SBIN

259.65

4.89

67032000

1.02

2.19

0.71

70.61

77.94

SOUTHBANK

21.45

9.72

39930000

(4.04)

11.85

0.93

91.48

87.42

SRTRANSFIN

957.00

14.59

3461400

5.74

7.47

0.10

89.26

83.10

SYNDIBANK

68.25

10.71

15831000

15.19

-27.07

0.31

68.66

79.96

UNIONBANK

137.05

13.97

17260000

(8.33)

-44.73

0.77

82.33

84.09

YESBANK

1409.60

22.53

8110200

2.12

2.51

0.71

77.55

77.43

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

305.20

15.06

15222500

2.18

2.27

0.47

87.31

84.55

BEML

1246.85

25.91

1554000

97.11

8.90

0.22

81.60

84.77

BHEL

132.50

11.06

32640000

(9.07)

5.73

0.60

77.84

78.83

CROMPGREAV

65.10

11.09

16908000

(5.88)

8.76

0.45

83.52

75.32

ENGINERSIN

152.55

(3.80)

14364000

(11.67)

4.55

0.88

69.68

72.86

GMRINFRA

12.85

9.83

156195000

(2.66)

9.87

0.58

77.13

84.40

HAVELLS

421.85

28.38

4696000

27.61

-5.94

0.63

78.61

80.82

IRB

228.10

17.09

9145000

7.21

-1.10

0.34

88.21

85.71

JPASSOCIAT

10.85

44.67

121516000

1.59

11.71

0.38

87.60

87.27

LT

1453.55

8.11

8153000

5.13

3.30

0.91

72.28

79.17

RELINFRA

524.20

13.64

5651100

(20.95)

8.46

0.67

91.96

87.66

SIEMENS

1180.20

8.85

783000

9.43

0.11

0.25

84.69

80.03

VOLTAS

326.95

1.93

4374000

15.41

3.47

0.66

83.70

74.83

CEMENT

ACC

1399.30

6.76

1298400

9.37

-0.09

0.96

81.93

83.07

AMBUJACEM

228.25

11.40

13370000

8.96

-4.94

0.39

77.14

77.51

GRASIM

930.20

9.84

7676250

(15.02)

2.85

0.60

71.18

82.37

INDIACEM

143.85

27.02

22526000

(16.10)

8.81

0.80

87.04

87.18

ULTRACEMCO

3684.10

14.47

2505200

(0.69)

1.27

0.97

71.65

79.61

For Private Circulation Only

SEBI Registration No: INB 010996539

5

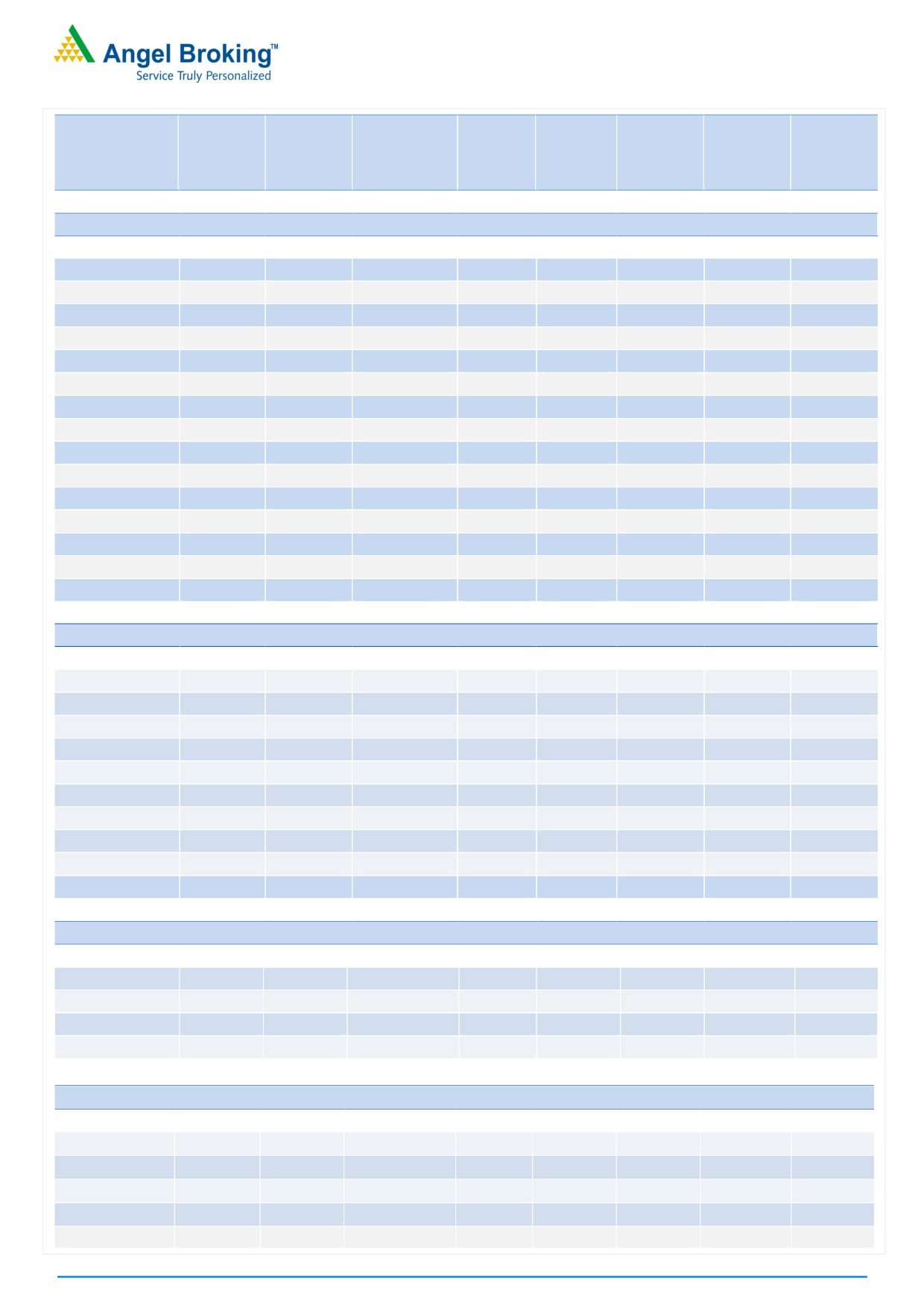

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

CHEMICAL & FERTILIZERS

PIDILITIND

680.30

14.90

1149000

(24.41)

-17.06

0.45

79.13

79.31

TATACHEM

539.55

8.87

4531500

24.63

-4.07

0.51

86.74

84.87

UPL

744.80

16.18

5646000

(1.18)

7.82

0.34

91.55

88.61

CONSUMER GOODS & FMCG

ASIANPAINT

980.35

10.92

4920600

(14.76)

3.41

0.49

83.82

77.96

BRITANNIA

3147.10

8.79

1113000

5.88

4.90

1.22

74.99

85.04

COLPAL

903.10

0.82

694400

24.62

7.92

0.22

85.08

82.81

DABUR

282.35

2.88

10885000

(13.46)

4.92

0.18

89.66

89.90

GODREJCP

1544.55

3.61

455600

(17.58)

2.90

0.37

50.55

72.06

HINDUNILVR

871.40

6.31

5320800

10.79

3.19

0.54

82.72

80.37

ITC

266.30

12.55

38882400

(2.14)

3.79

0.69

78.33

78.30

JUBLFOOD

857.95

4.43

1954000

(11.66)

5.75

0.45

78.11

80.33

MARICO

256.35

1.48

5293600

(34.47)

2.46

0.00

78.43

85.55

MCLEODRUSS

154.80

9.98

3816000

3.25

9.42

0.32

79.25

81.18

TATAGLOBAL

129.25

6.12

26865000

3.06

8.83

0.67

94.76

93.34

TITAN

373.00

15.77

6709500

(28.23)

2.87

0.50

72.61

82.39

UBL

826.85

4.84

994000

2.08

6.12

0.80

85.29

77.34

INFORMATION TECHNOLOGY

HCLTECH

838.95

2.71

6346200

21.69

-3.44

0.22

82.68

80.84

HEXAWARE

197.25

(4.25)

4674000

9.56

5.13

0.44

78.37

80.25

INFY

940.25

(5.61)

17068000

26.01

4.90

0.57

79.78

79.99

KPIT

135.15

0.78

3236000

(8.38)

7.49

5.67

77.19

81.34

MINDTREE

464.05

(11.21)

2576400

41.25

6.54

1.00

88.50

83.21

NIITTECH

438.25

2.84

516000

9.55

6.06

3.00

83.90

81.37

OFSS

3366.40

7.67

186150

(4.61)

6.41

0.00

77.27

85.94

TATAELXSI

1471.45

6.11

1246400

4.95

5.76

0.31

75.91

82.89

TCS

2358.30

0.26

4639750

4.49

2.83

0.70

69.15

76.16

TECHM

468.50

(2.97)

8666900

11.46

7.70

1.74

80.23

83.08

WIPRO

472.00

(0.42)

4138800

(16.87)

-4.52

1.20

76.19

73.30

MEDIA

DISHTV

87.45

4.54

35784000

5.77

9.43

0.87

92.32

90.17

SUNTV

539.25

10.13

9220000

41.11

2.10

0.25

85.80

85.31

TV18BRDCST

36.90

(0.27)

85850000

6.29

8.59

1.17

93.57

93.09

ZEEL

500.15

11.37

8587800

5.39

4.93

0.44

77.34

79.98

For Private Circulation Only

SEBI Registration No: INB 010996539

6

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

METALS & MINING

COALINDIA

310.25

4.67

13542200

40.94

-27.58

0.51

75.72

75.03

HINDALCO

191.20

23.00

41709500

18.27

2.97

0.72

88.28

88.30

HINDZINC

301.50

17.04

7321600

(8.19)

4.40

0.43

80.17

84.83

JINDALSTEL

83.00

18.74

49185000

5.58

12.25

0.24

92.11

92.63

JSWSTEEL

196.80

22.69

51165000

(0.10)

4.17

1.35

86.05

84.43

NMDC

145.60

17.85

19458000

8.28

4.77

0.61

79.29

82.97

SAIL

62.00

26.92

43800000

(11.36)

-1.01

0.36

85.74

86.33

TATASTEEL

471.65

19.91

20414000

0.82

5.76

0.51

81.63

84.65

VEDL

258.40

19.13

39557000

(0.77)

-0.97

0.53

76.84

80.06

MISCELLANIOUS

ABIRLANUVO

1375.15

10.36

3041200

(21.96)

3.44

0.44

92.91

91.69

ADANIENT

80.45

9.60

13912000

2.72

7.08

0.56

88.77

87.82

BATAINDIA

478.75

7.69

2827000

1.58

-1.58

0.45

85.70

80.99

BEL

1520.85

10.97

2051550

30.41

5.32

0.27

86.97

84.92

CONCOR

1181.90

6.25

1108000

50.85

-12.55

0.28

80.58

80.21

CUMMINSIND

839.90

3.32

497400

(12.92)

2.85

0.14

87.17

87.93

GODREJIND

431.05

1.83

1014000

(21.94)

10.30

1.33

72.92

79.43

JETAIRWAYS

419.15

21.90

4162000

(23.37)

7.25

0.53

73.16

83.54

JISLJALEQS

95.05

9.76

38394000

2.08

10.01

0.26

88.69

89.43

JUSTDIAL

361.15

8.94

3066000

(24.14)

-1.57

0.82

80.42

80.36

KSCL

494.45

20.83

2272500

(2.57)

9.23

0.17

85.06

82.69

MCDOWELL-N

2207.75

14.82

2438000

3.01

7.80

0.20

91.96

90.07

PCJEWELLER

387.15

5.08

961500

55.21

-5.66

0.80

75.59

57.78

SINTEX

85.75

16.43

26269875

9.60

8.87

0.38

89.82

89.17

OIL & GAS

BPCL

696.25

9.91

12639600

(7.75)

-26.46

0.51

75.70

77.43

CAIRN

282.30

16.27

22428000

6.18

7.63

0.41

91.54

86.90

GAIL

471.15

11.26

8965500

70.63

-12.56

0.44

79.98

74.99

HINDPETRO

522.15

22.53

21533400

(5.34)

-51.55

0.60

76.31

81.01

IGL

939.45

4.64

1388200

6.77

8.02

1.08

79.02

75.91

IOC

367.40

15.26

15945000

10.89

-42.69

0.43

75.01

76.41

OIL

335.65

2.12

2367970

24.81

-7.64

0.38

78.28

73.80

ONGC

203.15

5.59

27198750

(6.53)

-10.75

0.50

67.74

74.86

PETRONET

376.80

2.54

4860000

54.88

6.89

0.66

85.92

81.07

RELIANCE

1024.15

(4.11)

21105000

44.72

8.47

0.50

87.38

84.41

For Private Circulation Only

SEBI Registration No: INB 010996539

7

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

PHARMACEUTICAL

AJANTPHARM

1720.25

(2.76)

662000

79.70

9.06

0.38

87.06

83.59

APOLLOHOSP

1226.05

5.20

669600

21.83

4.33

1.30

84.89

79.97

AUROPHARMA

709.20

9.11

9233000

(14.88)

6.33

0.66

87.03

83.91

BIOCON

1030.05

9.11

2989200

15.51

9.17

0.54

88.08

85.19

CADILAHC

359.20

2.15

2940800

(6.80)

6.16

2.75

85.25

86.52

CIPLA

585.20

3.47

5678000

(2.17)

-0.97

0.42

84.80

84.14

DIVISLAB

677.95

(14.47)

6937800

128.97

8.69

0.73

87.60

84.15

DRREDDY

3008.70

(2.26)

1578400

1.44

5.21

1.01

70.75

79.10

GLENMARK

879.45

(1.34)

2507400

11.83

7.56

1.11

90.36

87.40

GRANULES

116.20

7.59

9320000

7.87

9.27

0.14

90.71

90.94

LUPIN

1525.50

3.72

4452400

(1.00)

5.18

0.74

70.42

81.09

STAR

1139.50

7.39

1828000

27.30

3.60

0.33

85.74

88.47

SUNPHARMA

639.60

3.56

27988800

(10.30)

7.42

1.06

80.51

86.14

TORNTPHARM

1306.70

1.25

200800

6.81

5.37

6.00

78.19

73.13

WOCKPHARMA

665.45

2.06

3137400

9.74

7.52

1.12

87.11

86.96

POWER

ADANIPOWER

35.65

17.85

125640000

30.77

10.68

0.32

93.05

90.19

CESC

739.95

15.61

3664100

102.86

5.47

0.31

89.04

80.67

JSWENERGY

60.70

1.08

39464000

18.78

8.35

0.88

89.56

89.54

NHPC

28.15

7.03

31401000

5.82

9.01

0.28

71.13

71.38

NTPC

171.60

5.44

17256000

24.97

1.84

0.30

71.64

75.57

POWERGRID

203.45

12.75

11348000

(31.59)

2.17

0.45

74.42

72.01

PTC

84.55

14.88

15176000

10.55

8.24

0.55

84.91

85.28

RPOWER

44.30

9.11

51408000

1.52

8.58

0.38

91.99

89.88

TATAPOWER

80.60

7.18

23571000

9.44

7.86

0.41

85.84

82.26

TORNTPOWER

196.35

10.22

3219000

31.98

10.01

0.30

91.47

87.92

REAL ESTATE

DLF

137.85

25.95

28030000

(16.01)

4.12

0.66

73.76

78.88

HDIL

63.70

13.65

27720000

20.56

8.95

0.36

85.70

83.40

IBREALEST

82.15

16.77

35430000

24.23

10.82

1.26

89.38

84.43

NCC

82.05

1.93

25088000

78.38

10.05

0.38

83.83

85.45

TELECOM

BHARTIARTL

307.95

1.65

34204000

42.83

-13.74

1.22

63.90

77.08

IDEA

74.50

4.49

108906000

48.91

-27.27

0.43

78.56

83.27

INFRATEL

353.60

3.02

5675200

0.08

6.62

0.75

82.47

78.62

RCOM

31.05

(7.73)

102444000

9.53

8.16

0.92

86.78

87.67

TATACOMM

718.80

16.04

5024600

4.57

9.17

0.30

89.08

88.83

For Private Circulation Only

SEBI Registration No: INB 010996539

8

Derivatives Rollover Report

TEXTILES

ARVIND

374.95

11.83

6000000

14.16

7.94

0.60

80.86

80.96

CENTURYTEX

845.70

5.51

7456900

7.89

8.62

0.66

91.03

91.56

ICIL

181.10

10.36

3342500

(1.85)

9.81

0.27

90.09

85.79

PAGEIND

14415.25

6.88

30200

(9.72)

-4.16

0.00

73.04

73.48

SRF

1718.95

12.24

421000

2.31

6.81

0.86

74.71

75.88

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager with SEBI. It

also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in

terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/

suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates including its relatives/analyst

do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not

received any compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market

making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as

they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume,

as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to

be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only.

Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the

information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the

accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the

information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update

on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in

the stocks recommended in this report.

Derivative Research Team

For Private Circulation Only

SEBI Registration No: INB 010996539

9