Derivatives Rollover Report | April 27, 2018

It was indeed a good start for the financial year 2018-2019, as we saw a smart recovery post last two series correction. The

benchmark Nifty rallied near about 5% with decent long formation in futures segment. Rollovers in Nifty shot up to 72.32%

for April series, which is above the 3-month average of 68%. Similarly, for BankNifty also stood on the higher side at

82.59%. This certainly hints positive sentiments ahead of the Karnataka Legislative Assembly election, to be slated in the mid

of May series.

In the series gone by, FIIs chose to participate in the recent rally as there added good amount of long positions in index and

as well as in stock futures segment. In fact, their index futures ‘Long Short Ratio’ climbed higher to reclaim 50% from 18%

seen in the initial days of April series. At the same time, they sold equities to the tune of Rs. 8476 crores last month. Now, the

are heading into the new series with INDIAVIX below 12%, this is again an indication of some strength. Meanwhile, the

options activity too points out the trading range shifting higher as the maximum concentration of OI is now placed at 11000

followed by 10800 call strike and in case of put options, is visible in 10500 followed by 10400 strike. Considering the above

data point, we may see a bit of extension of the ongoing momentum in the near term.

BankNifty Rollovers in terms of percentage as well as open interest are on the higher side. In fact, we haven’t seen such high

rollover figure for last 10 years. During the series, private heavy weights like YESBANK and KOTAKBANK rallied 16%-12%

and supported the index; whereas, public sector bank remained under pressure. Looking at the quantum of short rollovers in

PSU names, it seems we may soon see decent short covering rally in individual counters.

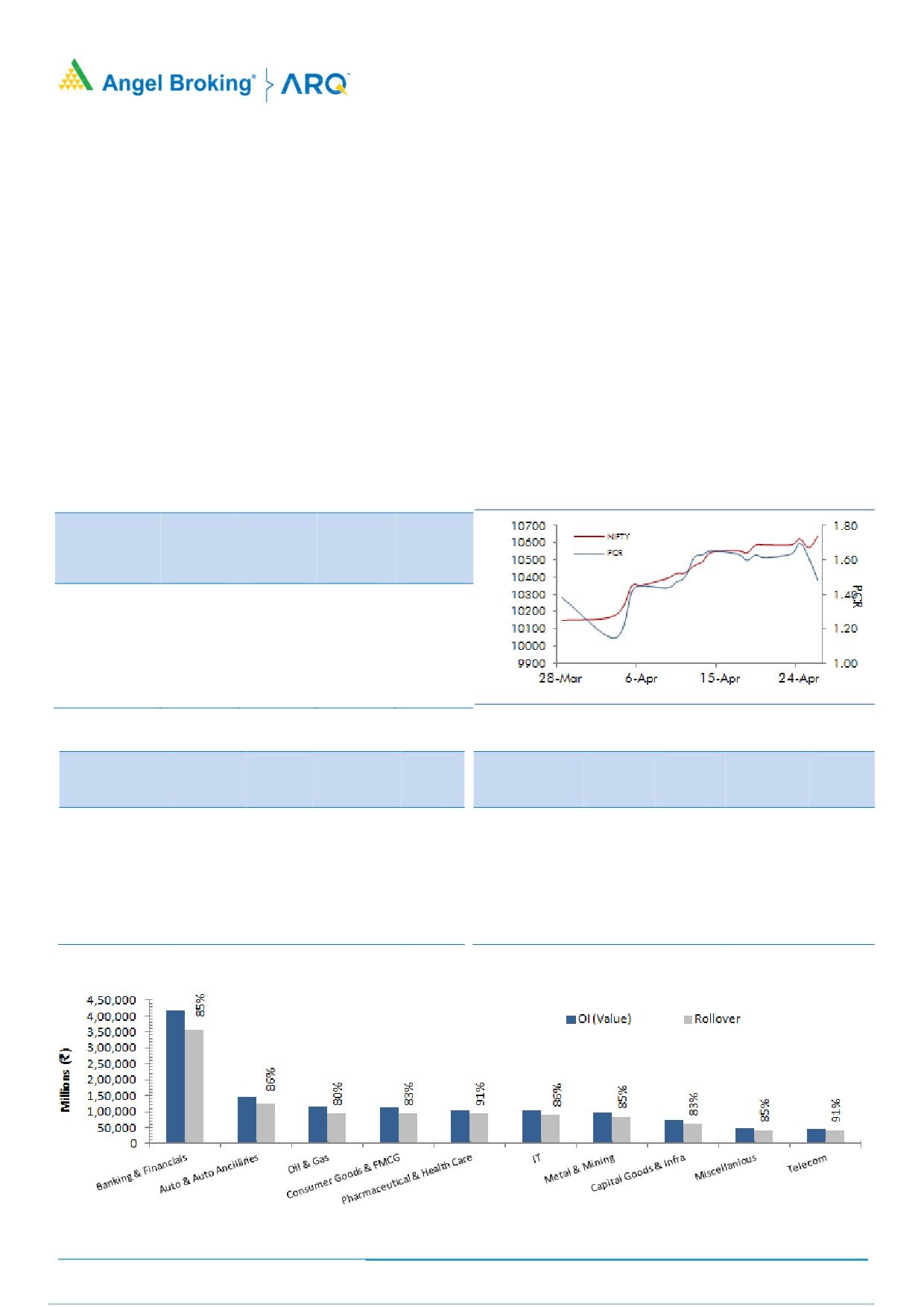

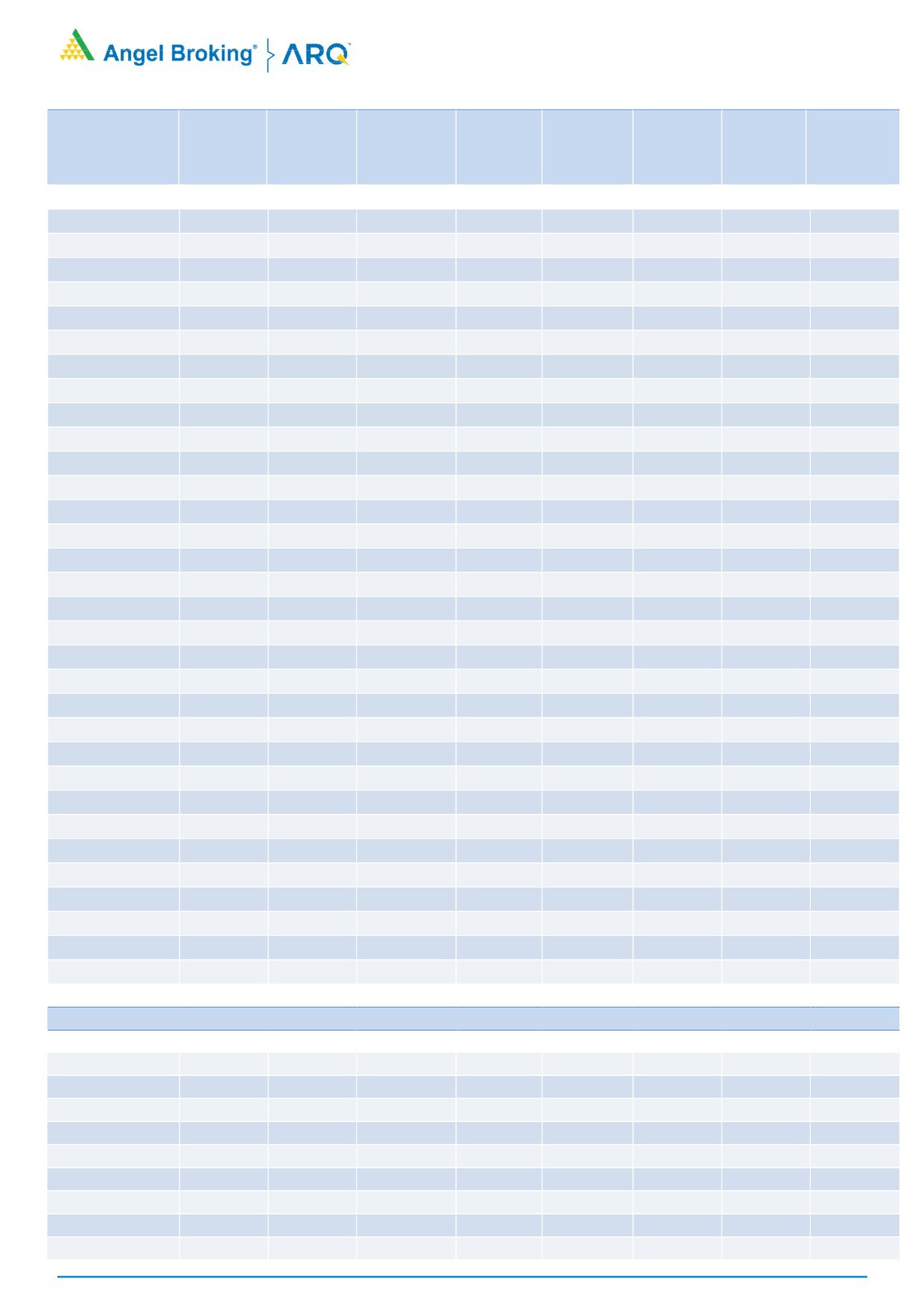

Indices Change

NIFTY & PCR Graph

Price

Change

3 month

INDEX

Price

(%)

Rollover

avg.

NIFTY

10617.80

4.73

72.32

67.80

BANKNIFTY

25010.90

2.80

82.59

74.36

NIFTYIT

14026.65

10.19

86.94

67.02

NIFTYMID50

5371.90

8.04

99.97

99.92

NIFTYINFRA

3440.70

3.43

-

-

Monthly Gainers

Monthly Losers

Price

Ol

Price

Ol

Change Open

Change

Change Open

Change

Scrip

Price

(%)

Interest

(%)

Scrip

Price

(%)

Interest

(%)

MINDTREE

1046.80

34.96

3081600

85.15

RNAVAL

19.50

(29.22)

40077000

1.53

NIITTECH

1120.45

28.65

1848000

17.45

PCJEWELLER

238.85

(25.85)

12828000

91.02

SREINFRA

92.25

25.00

15280000

12.48

RCOM

16.95

(22.60)

109200000

24.60

RAYMOND

1120.65

24.06

4888800

5.78

BALRAMCHIN

64.90

(14.89)

14094500

(2.47)

TATAELXSI

1224.35

23.65

2056000

28.76

HINDPETRO

297.95

(13.81)

31707900

27.11

Note: Stocks which have more than 1000 contract in Futures OI.

Note: Stocks which have more than 1000 contract in Futures OI.

For Private Circulation Only

1

Derivatives Rollover Report

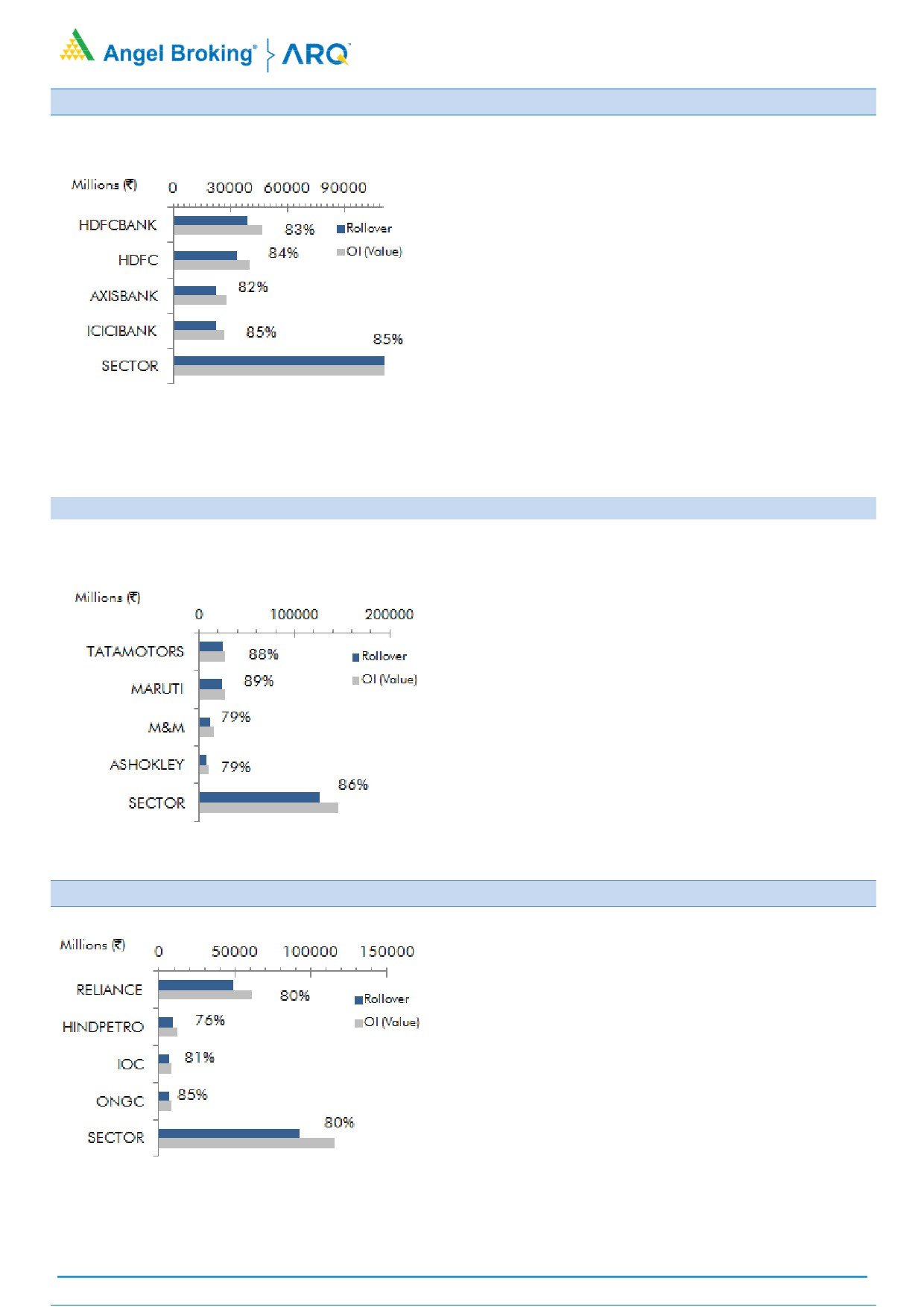

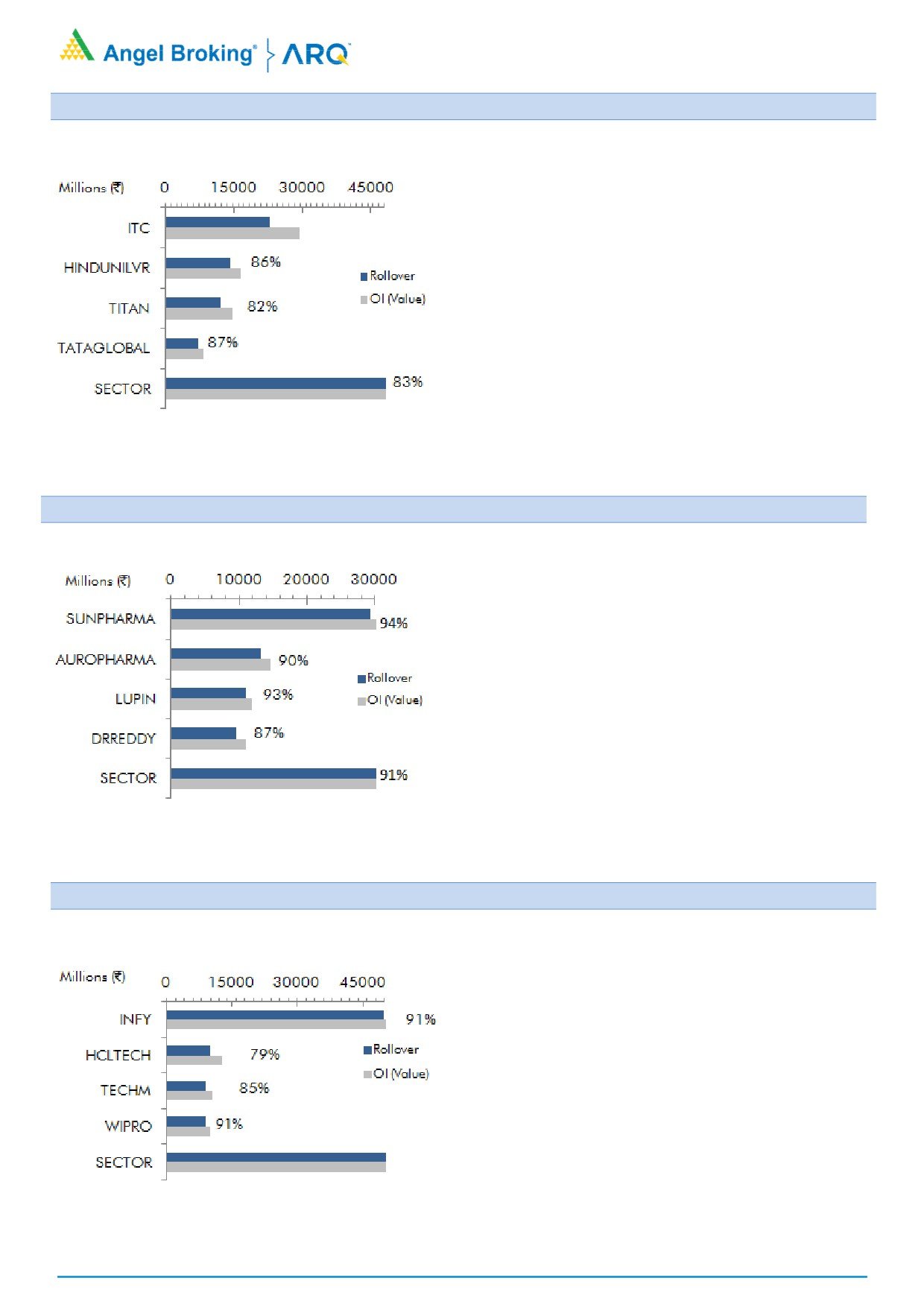

Banking and Financials

SBIN (82.20%) corrected 6.69% with decent short

formation. Rollover remains slightly low for this

counter but decent amount of shorts are still intact.

This counter has a strong support around

Rs.

230-232 levels and we expect some short

covering move going ahead.

LICHSGFIN (84.58%) is merely up 2% series on series

and we hardly saw any relevant open interest activity

for the entire April series. This counter is now light in

terms of open interest and has been taking support

near Rs. 536-540 levels. Any fresh buying may lead

to rally towards Rs. 570-572 levels.

As anticipated in the beginning of April series,

M&MFIN (84.44%) tested 500 plus levels along

with decent longs. But, these positions were not

rolled to next series. Thus, traders should lighten

up their positions for time being.

Auto & Auto Ancillaries

ASHOKLEY (90.42%) extended its upmove in the

latter half of April series and rallied nearly 12% last

series. However, this move was mainly due to short

covering. Unless we don’t see any fresh buying

interest one should avoid forming aggressive longs.

TATAMOTORS (88.20%) rallied towards 370 levels

but due to lack of momentum again corrected to

conclude the series with marginal gains. During the

recent fall, we witnessed decent short formation and

we believe these positions are still intact. Now, this

counter is trading near the support zone of

Rs.

324-327 levels and hence, we expect short

covering move soon.

Other stocks wherein we saw long rollovers are

TVSMOTOR (85.70%), BHARATFORG (94.45%) and

HEROMOTOCO (81.56%).

Oil & Gas

We did saw strong buying interest once RELIANCE

(80.27%) surpassed the hurdle of 900-910 levels. This

move was mainly due to short covering and if we see

fresh longs above 1000 mark, once can add-on fresh

longs.

HINDPETRO (75.83%) underperformed this space. We

witnessed huge shorts last series but good amount of

shorts were rolled too. This counter has any immediate

support around 285-290 zone; thus, we expect some

fresh buying and short covering which may bring it

towards Rs. 330-335 levels.

BPCL

(79.60%) corrected nearly

10% along with

meaningful short formation. These positions have

been rolled too and it also has a strong hurdle around

Rs. 400-405 levels. Unless we don’t see strong move

above these levels; one should avoid bottom fishing.

For Private Circulation Only

2

Derivatives Rollover Report

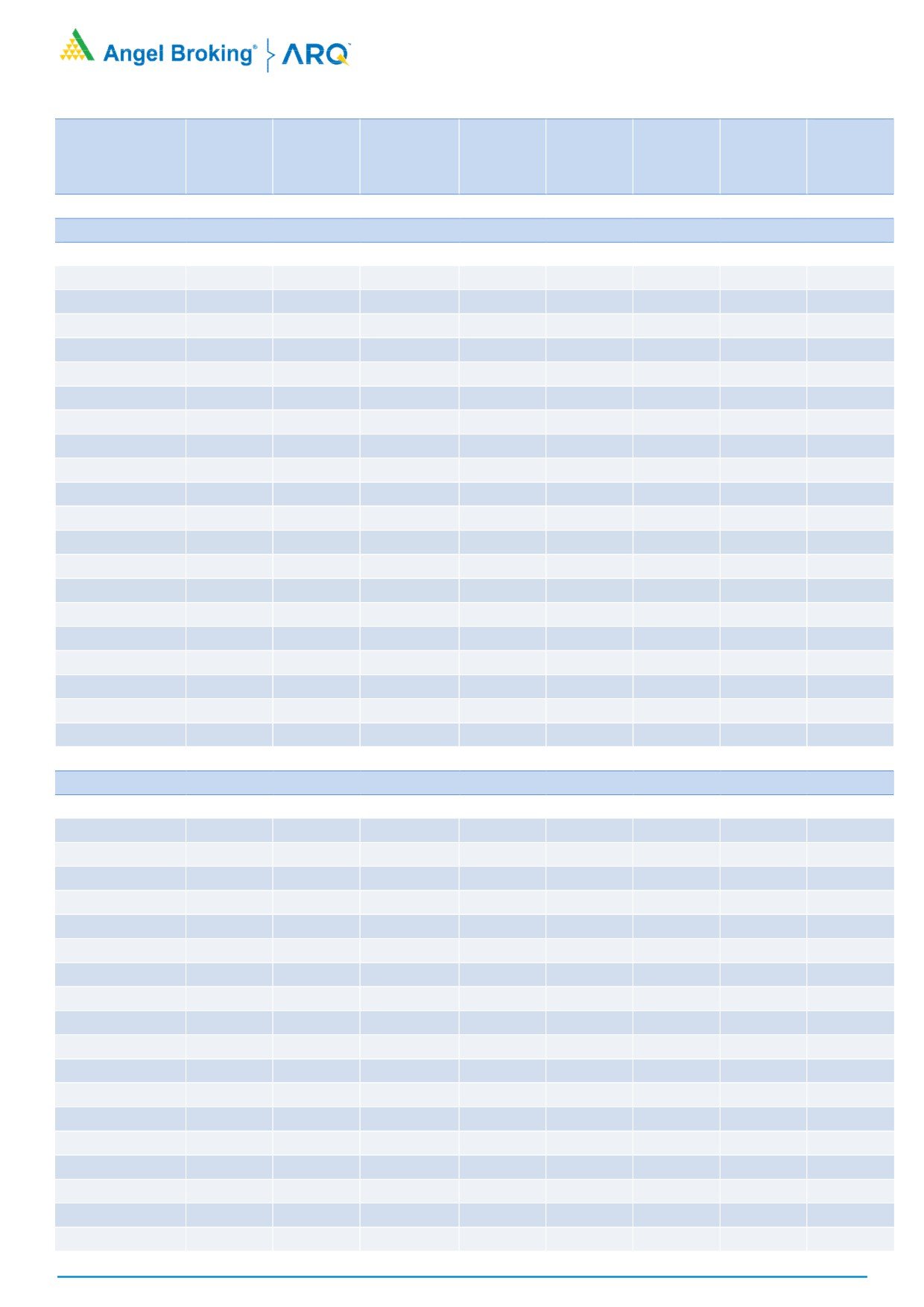

Consumer Goods & FMCG

UBL (83.87%) outperformed the FMGS space. As

anticipated we achieved the target of Rs. 1000 due to

massive shorts covering. Now, the rollovers in terms

of percentage as well as open interest are on the

lower side as we hardly saw any relevant longs.

Unless we don’t see any fresh buying one should

avoid forming aggressive positions.

HINDUNILVR (85.69%) in last series surpassed the

important hurdle of Rs.

1400-1410 levels.

Meanwhile, we also witnessed decent long formation

but these positions are now out of the system. Thus,

would advise traders to book their profit now.

Other stocks wherein we saw long rollovers are

BERGEPAINT (73.77%), JUBLFOOD (84.82%) and

TATAGLOBAL (87.17%).

Pharmaceutical

BIOCON (89.15%) hits a fresh record high and

closed at the highest point ever. We did saw decent

long formations and these positions are still intact.

Those traders who are long shall hold on their

positions.

Although SUNPHARMA (94.42%) concluded the April

series on the positive note but we hardly saw any

relevant change in OI series on series. Now, this

counter is light in terms of OI, any move above

immediate hurdle of 522-524 shall lead to fresh

buying.

There were few stock that rallied mainly because of

short covering are TORNTPHARM (82.53%), CIPLA

(84.70%) and DIVISLAB (83.14%).

Information Technology

April series this time belonged to the IT pack, as 8 out

of

11 stocks gave returns between

35%-11%.

Courtesy to the appreciating home currency. We

witnessed decent long addition in the entire space.

MINDTREE

(62.18%) outperformed this space by

rallying 35% and OI surged 85% series on series.

These hints long are still intact; hence, dips shall be

utilized to add fresh longs.

INFY (90.83%) was up merely 3% but decent amount

of longs were formed last series and these positions

got rolled too. At present, 1200 call options has

highest OI concentration, which means an immediate

hurdle at these levels. Any relevant unwinding in

above call may lead to stock hinting fresh record

highs.

For Private Circulation Only

3

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

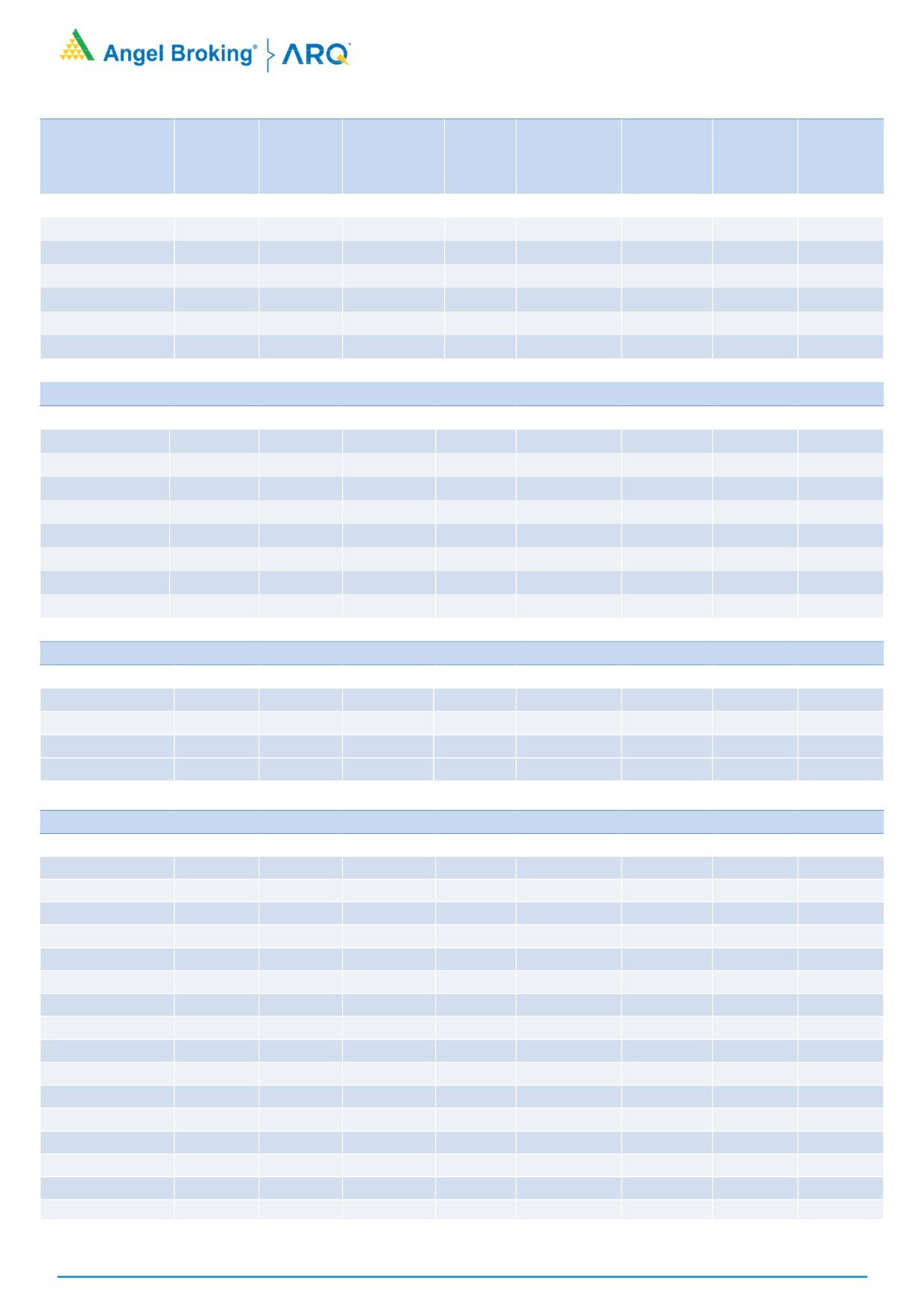

AUTO & AUTO ANCILLARIES

AMARAJABAT

842.55

5.54

991900

(13.44)

3.58

1.18

83.85

80.34

APOLLOTYRE

286.35

4.58

9240000

(11.62)

1.50

0.79

78.43

81.30

ASHOKLEY

163.00

11.80

49336000

(3.73)

2.31

0.45

79.05

85.89

BAJAJ-AUTO

2903.00

5.15

2215000

6.84

6.72

0.50

83.96

81.11

BALKRISIND

1278.45

19.51

861600

2.47

7.14

0.37

79.13

76.58

BHARATFORG

776.05

10.35

8410800

21.62

6.33

0.26

94.45

90.61

BOSCHLTD

19774.25

9.12

152725

(4.99)

6.96

0.00

81.92

75.52

CASTROLIND

193.80

(3.82)

12023200

10.41

7.81

0.35

90.04

89.32

CEATLTD

1553.25

2.83

1439900

38.52

7.17

0.70

87.03

83.73

EICHERMOT

31391.55

10.17

201225

6.81

6.41

0.10

84.77

81.93

ESCORTS

964.95

17.17

3414400

9.92

5.09

0.46

87.66

87.36

EXIDEIND

244.85

9.77

8208000

(4.42)

6.40

0.32

87.65

88.08

HEROMOTOCO

3771.10

6.86

1509600

15.17

2.64

0.79

81.56

77.12

M&M

856.65

15.36

13932000

2.03

-1.88

0.84

79.01

78.93

MARUTI

9004.60

1.12

2683875

23.49

6.98

0.23

88.96

85.46

MOTHERSUMI

354.95

13.66

12960000

(9.36)

3.19

0.48

91.38

86.87

MRF

77042.95

5.98

32370

(7.14)

7.49

0.00

85.06

87.03

TATAMOTORS

332.35

1.26

73573500

11.45

6.83

0.61

88.20

86.37

TATAMTRDVR

186.25

1.14

26312500

(8.08)

7.55

1.01

93.04

91.56

TVSMOTOR

654.00

5.67

4686000

46.48

8.35

0.62

85.70

79.02

BANKING & FINANCIALS

ALBK

47.50

(2.36)

13750000

1.85

7.97

0.65

81.55

78.73

ANDHRABANK

37.65

(10.04)

22240000

9.13

7.18

1.09

81.61

83.77

AXISBANK

496.75

(2.85)

45882000

18.42

6.52

0.80

81.92

82.86

BAJAJFINSV

5374.50

3.76

694625

13.43

7.09

0.72

86.50

76.36

BAJFINANCE

1907.55

7.26

4575500

(3.94)

8.77

0.66

84.53

86.57

BANKBARODA

138.15

(3.15)

51624000

0.26

6.25

1.00

90.96

88.17

BANKINDIA

99.10

(4.89)

24918000

1.54

7.64

0.73

87.43

86.57

BHARATFIN

1147.85

4.09

5110000

19.39

6.16

0.48

89.26

84.37

CANBK

255.35

(3.84)

10169600

(15.42)

7.19

0.61

84.86

85.28

CANFINHOME

440.30

(9.77)

5696250

(5.48)

6.75

1.10

85.23

85.62

CAPF

627.40

1.14

6860000

(9.90)

7.41

0.72

91.11

91.75

CHOLAFIN

1699.80

16.67

557000

75.43

6.86

0.81

84.84

67.95

DCBBANK

196.25

20.99

7461000

76.95

3.02

0.20

80.92

81.73

DHFL

626.40

22.05

22546500

(16.49)

8.55

0.45

81.25

87.28

EQUITAS

151.45

4.74

19744000

11.35

4.63

0.48

97.30

94.78

FEDERALBNK

97.85

8.96

59361500

11.03

8.29

0.79

88.94

88.09

HDFC

1862.65

1.53

18138000

17.07

7.08

0.35

83.55

79.57

HDFCBANK

1927.70

1.97

20280000

34.59

-1.42

0.31

83.07

75.07

For Private Circulation Only

4

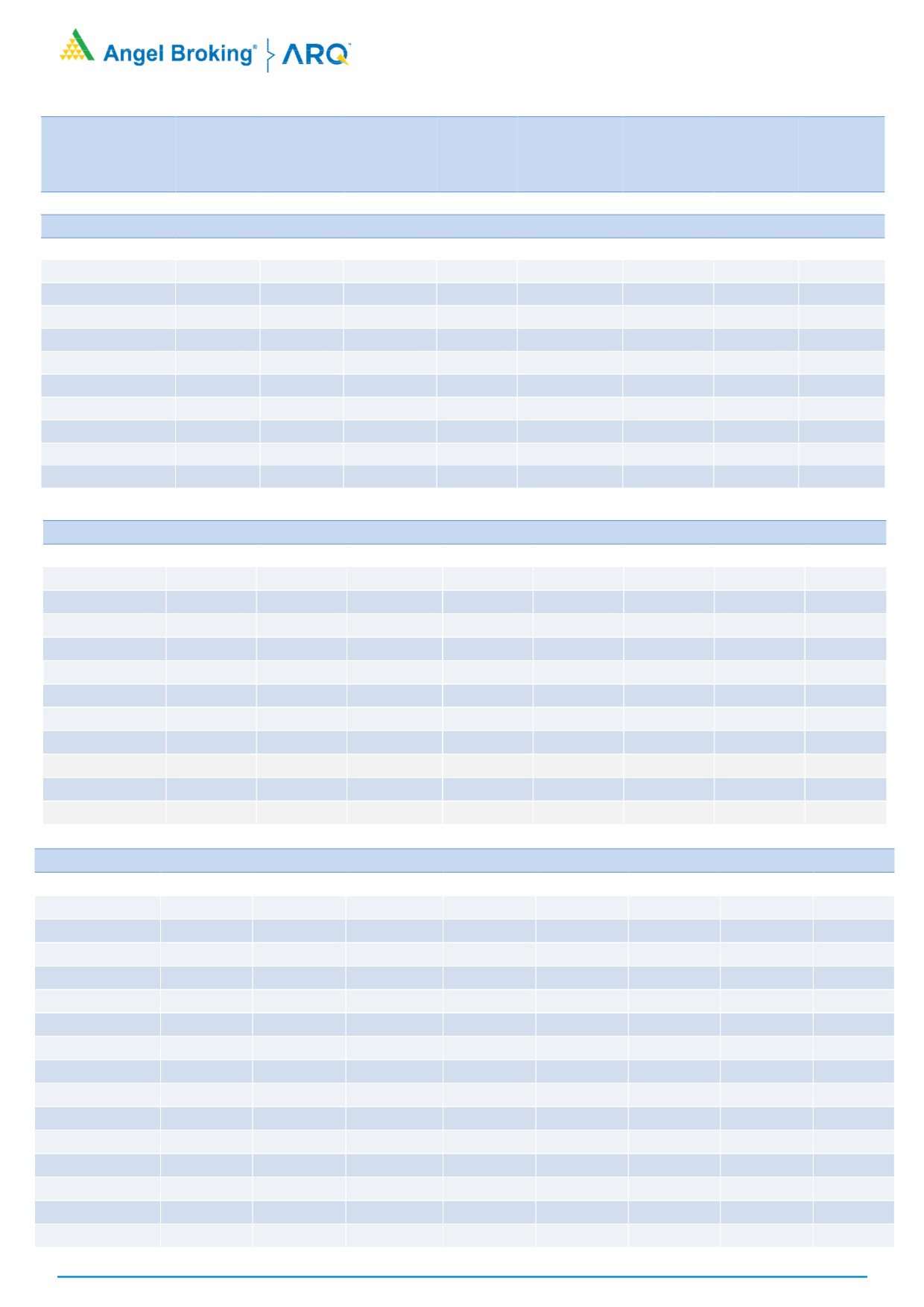

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

IBULHSGFIN

1309.75

5.37

11665200

(24.62)

-0.57

0.70

93.59

90.49

ICICIBANK

279.65

(0.04)

80451250

(12.88)

3.08

0.78

84.77

78.69

ICICIPRULI

434.00

11.21

4709900

13.11

7.35

0.41

75.32

81.49

IDBI

67.15

(7.51)

50730000

32.87

8.87

0.69

87.89

81.94

IDFC

55.75

14.01

155509200

(5.41)

6.78

0.57

94.32

94.10

IDFCBANK

47.50

(0.42)

183888000

0.46

6.82

0.79

91.08

92.09

IFCI

19.85

0.76

69410000

(0.94)

8.17

0.72

89.76

87.17

INDIANB

314.60

4.34

3026000

(8.36)

9.12

0.33

76.49

83.31

INDUSINDBK

1865.20

4.51

6285000

17.55

-9.53

0.88

73.60

74.58

KOTAKBANK

1184.85

12.46

12320000

26.43

-0.77

0.34

79.41

75.97

KTKBANK

117.65

1.77

24920400

2.82

8.28

1.11

87.85

88.27

L&TFH

166.15

5.29

34789500

13.42

7.15

0.85

93.44

89.31

LICHSGFIN

549.10

2.15

12090100

(2.84)

7.78

0.66

94.58

91.89

M&MFIN

514.70

10.97

8722500

17.71

4.82

0.26

84.44

87.23

MANAPPURAM

120.40

9.70

15756000

(12.35)

4.03

0.36

83.10

86.81

MFSL

510.05

12.28

2485000

(8.71)

6.78

0.53

92.69

90.50

MUTHOOTFIN

446.75

9.67

1527000

(10.62)

7.99

0.32

82.03

84.74

ORIENTBANK

88.55

(3.85)

14778000

9.42

6.71

0.81

83.35

81.40

PFC

83.60

(2.90)

73824000

4.85

8.41

0.77

87.29

86.48

PNB

91.40

(4.69)

67820000

(7.07)

4.72

0.81

85.63

85.24

RBLBANK

522.70

9.48

4383000

2.86

4.85

0.35

83.11

86.76

RECLTD

126.30

0.76

36042000

(0.65)

6.84

1.01

85.13

86.25

RELCAPITAL

429.45

0.85

12036000

(7.27)

7.30

0.64

90.75

90.22

REPCOHOME

599.40

8.48

765000

(16.99)

7.39

0.67

79.44

79.81

SBIN

234.40

(6.69)

85032000

10.69

5.52

0.73

82.20

80.99

SOUTHBANK

26.25

14.13

141180660

(6.99)

10.32

0.60

90.18

89.09

SREINFRA

92.25

25.00

15280000

12.48

7.03

0.81

89.59

86.54

SRTRANSFIN

1648.85

14.12

3406800

39.82

6.45

0.13

93.47

92.63

SYNDIBANK

53.25

(4.66)

30267000

(2.10)

8.13

0.75

85.33

88.59

UJJIVAN

406.30

16.90

4908800

5.28

5.04

0.27

88.39

88.34

UNIONBANK

91.20

(3.49)

29772000

(2.46)

7.71

0.97

90.15

87.11

YESBANK

354.20

15.45

60107250

28.06

5.48

0.98

89.91

85.43

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

398.45

11.85

14322500

3.39

3.65

0.67

86.31

84.13

BEML

1048.85

(0.04)

2131200

(10.37)

7.73

0.93

90.86

88.07

BHEL

86.90

6.23

36000000

(25.79)

6.84

1.00

79.88

84.29

CGPOWER

82.30

5.85

19176000

(10.33)

5.90

0.67

77.99

83.56

ENGINERSIN

156.25

(1.01)

8746500

27.37

7.96

0.44

71.28

75.32

GMRINFRA

20.45

19.94

284895000

(0.78)

7.93

0.44

94.55

92.00

HAVELLS

548.20

11.72

6278000

38.71

6.30

0.78

89.56

86.70

HCC

23.05

2.90

38835000

(5.75)

7.03

1.34

81.34

83.01

IRB

263.65

17.62

18400000

24.09

6.14

0.27

92.74

89.34

For Private Circulation Only

5

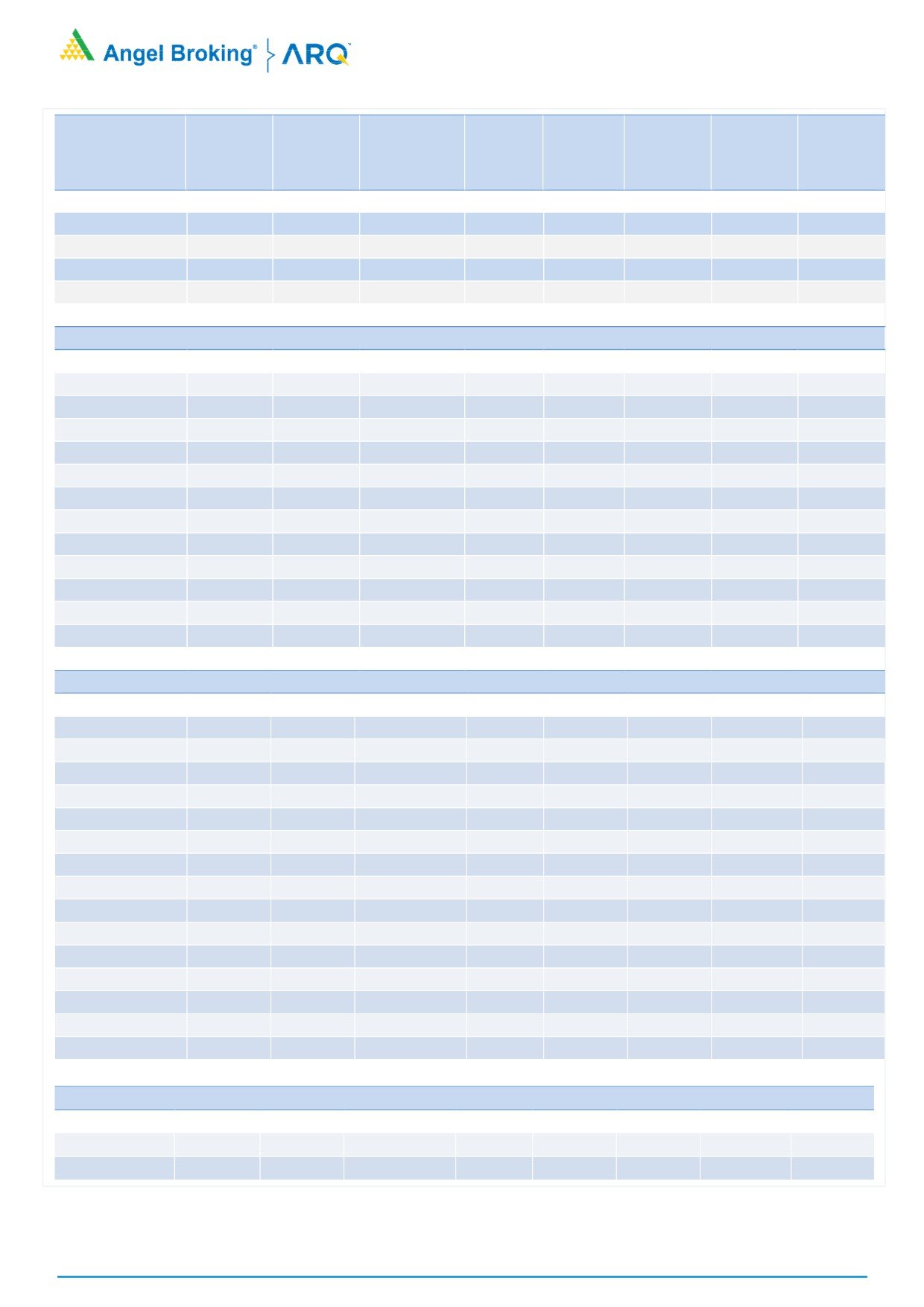

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

JPASSOCIAT

19.35

1.57

212160000

9.44

8.39

0.46

88.55

89.14

LT

1352.85

2.62

13535250

20.74

4.50

0.61

74.00

73.01

NBCC

105.20

9.90

17652000

218.57

5.64

0.83

86.58

85.08

RELINFRA

444.25

3.86

8135400

(14.72)

7.05

0.60

92.12

89.87

SIEMENS

1094.75

1.41

1296000

73.49

5.97

0.40

91.56

84.22

VOLTAS

634.10

1.63

3560000

41.21

7.24

0.42

84.28

81.62

CEMENT

ACC

1539.50

1.84

1500400

32.97

-4.10

0.38

89.22

74.83

AMBUJACEM

244.10

4.90

8537500

(23.89)

7.08

0.65

77.51

68.68

DALMIABHA

3019.90

5.52

693000

21.26

5.09

0.61

89.99

88.59

GRASIM

1073.50

1.66

6735000

25.12

4.32

0.81

89.56

83.20

INDIACEM

146.05

2.53

24881500

9.08

7.77

0.75

88.93

88.07

RAMCOCEM

815.30

12.00

1182400

31.03

6.82

0.14

86.28

76.51

SHREECEM

17332.25

6.32

82100

48.87

6.54

0.00

91.07

82.67

ULTRACEMCO

4097.35

3.46

2044200

14.30

4.71

0.68

87.43

86.53

CHEMICALS & FERTILIZERS

GSFC

129.75

12.97

16992000

(6.28)

6.66

0.61

92.10

87.45

PIDILITIND

1084.50

17.56

1198000

(16.86)

-1.24

0.57

65.72

73.89

TATACHEM

723.80

6.28

5677500

8.95

1.56

0.95

82.26

87.20

UPL

755.85

3.12

11168400

2.67

8.01

0.43

89.95

88.78

CONSUMER GOODS & FMCG

ASIANPAINT

1162.95

3.31

4265400

0.67

6.73

0.40

76.03

78.90

BERGEPAINT

271.05

6.92

1713800

56.74

-21.92

0.14

73.77

70.57

BRITANNIA

5407.65

8.81

843400

(0.80)

6.84

0.23

94.53

89.11

COLPAL

1107.50

5.05

1383200

2.38

4.38

0.14

87.90

80.32

DABUR

359.10

9.32

11252500

(17.89)

6.01

0.41

92.67

92.55

GODFRYPHLP

879.50

6.49

634000

8.01

7.87

0.33

87.57

84.21

GODREJCP

1114.70

1.39

2336000

(3.18)

2.17

0.67

76.06

85.42

HINDUNILVR

1491.35

11.34

9450600

16.26

0.07

0.57

85.69

84.72

ITC

275.15

7.10

82836000

(3.72)

-11.96

0.55

77.42

80.89

JUBLFOOD

2539.65

8.77

2028500

16.25

5.89

0.86

84.82

81.55

MARICO

321.70

(1.89)

6390800

31.87

7.56

0.26

71.45

82.50

MCDOWELL-N

3535.40

12.41

2067750

(3.95)

6.06

0.54

90.28

91.64

NESTLEIND

9074.00

10.11

275600

28.01

3.69

0.19

83.34

86.52

TATAGLOBAL

292.65

12.54

25101000

12.60

5.35

0.46

87.17

87.18

TITAN

976.10

3.52

12408000

28.47

7.31

0.43

82.20

78.54

UBL

1138.05

19.49

724500

(36.15)

1.13

1.86

83.87

80.49

For Private Circulation Only

6

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

METALS & MINING

COALINDIA

289.85

2.86

17285400

2.89

-3.51

0.32

86.55

72.84

HINDALCO

235.15

9.55

46795000

13.78

5.28

0.59

86.81

85.61

HINDZINC

322.25

6.41

11619200

(21.37)

7.55

0.64

87.83

82.39

JINDALSTEL

253.15

14.99

33259500

6.36

6.61

0.49

90.68

88.71

JSWSTEEL

329.20

13.67

65511000

(0.78)

4.91

0.72

96.67

93.47

NATIONALUM

80.05

19.93

48928000

32.81

8.11

0.48

90.39

86.61

NMDC

124.30

4.23

25524000

(10.91)

8.27

0.83

79.00

82.55

SAIL

76.55

8.35

87084000

(4.73)

8.48

0.84

89.03

86.67

TATASTEEL

582.00

1.49

20191891

(7.09)

7.06

0.64

81.07

79.20

VEDL

292.15

4.60

38806250

14.85

6.84

0.63

82.61

78.35

INFORMATION TECHNOLOGY

HCLTECH

1079.35

11.17

9312800

(5.07)

2.04

0.71

78.58

81.38

HEXAWARE

427.25

14.85

4029000

18.64

-4.13

0.44

82.95

77.28

INFY

1175.95

3.44

42378000

21.26

-0.46

0.54

90.83

87.81

KPIT

249.10

14.40

8068500

(3.45)

6.50

0.45

83.05

83.42

MINDTREE

1046.80

34.96

3081600

85.15

-23.87

0.62

62.18

70.66

NIITTECH

1120.45

28.65

1848000

17.45

-27.49

0.48

55.02

70.91

OFSS

4215.25

12.36

92400

67.85

6.78

0.00

80.73

68.81

TATAELXSI

1224.35

23.65

2056000

28.76

6.17

0.25

85.07

82.51

TCS

3536.25

23.44

6913500

(18.92)

-0.91

1.21

66.08

76.10

TECHM

695.30

9.18

12796800

11.86

6.52

0.36

85.03

84.00

WIPRO

282.65

0.02

32047200

9.34

4.96

0.44

91.39

87.07

MISCELLANIOUS

ADANIENT

141.30

(10.23)

12568000

(32.86)

5.73

0.60

82.32

83.85

APOLLOHOSP

1084.40

1.68

685500

(5.06)

7.48

1.50

83.96

80.87

BALRAMCHIN

64.90

(14.89)

14094500

(2.47)

7.50

0.57

80.98

80.55

BATAINDIA

786.65

7.12

2502500

9.74

7.84

0.18

84.23

85.34

BEL

132.00

(7.14)

29403000

14.89

7.78

0.85

83.03

83.05

CONCOR

1301.50

5.18

1122500

23.95

6.85

0.61

88.39

80.91

CUMMINSIND

750.60

9.99

830400

(61.49)

6.76

2.31

55.21

71.53

GODREJIND

600.00

8.65

2503500

35.58

3.95

1.00

83.87

84.98

INDIGO

1486.85

15.88

2692800

(11.15)

-8.42

0.39

79.65

75.75

INFIBEAM

168.50

14.70

32060000

(18.99)

8.02

0.32

89.04

91.52

JETAIRWAYS

624.50

1.97

6985200

17.60

7.62

0.87

89.82

88.72

JISLJALEQS

115.90

8.22

35847000

3.16

6.99

0.99

84.65

85.90

JUSTDIAL

445.85

0.04

4456200

20.29

6.66

0.86

88.71

84.09

KAJARIACER

545.95

(4.43)

1610400

36.29

9.42

0.03

87.14

83.71

KSCL

534.30

9.92

2178000

4.09

4.34

0.28

86.02

86.68

For Private Circulation Only

7

Derivatives Rollover Report

Average

Price

OI

Rollover

Change

Change

Rollover

(3month)

Scrip

Price

(%)

OI Futures

(%)

COC (%)

PCR-OI

(%)

(%)

MCX

672.05

(10.48)

3428500

2.07

8.86

0.68

94.01

90.65

PCJEWELLER

322.10

(2.23)

6715500

(3.37)

7.47

0.27

82.53

77.68

RNAVAL

27.55

(32.64)

39474000

19.71

6.89

0.28

84.23

85.09

VGUARD

222.75

0.25

2022000

(32.60)

3.12

5.67

84.78

82.85

OIL & GAS

BPCL

387.55

(9.79)

15341400

46.87

5.71

0.63

79.60

78.02

CHENNPETRO

322.20

(2.14)

2955000

17.47

8.73

1.96

90.87

87.47

GAIL

327.20

(0.97)

12604242

(10.37)

6.10

0.60

83.90

80.67

HINDPETRO

297.95

(13.81)

31707900

27.11

5.80

0.60

75.83

81.29

IGL

296.95

5.66

4455000

(18.39)

5.82

0.60

83.68

83.81

IOC

162.10

(8.26)

41403000

4.58

6.33

0.86

81.16

75.22

MGL

897.65

(6.86)

3423600

284.76

8.07

1.27

78.19

81.93

MRPL

109.70

(0.68)

5193000

18.97

5.90

0.80

75.18

79.24

OIL

231.60

7.10

2991120

(3.51)

-16.21

0.52

68.43

70.80

ONGC

181.20

1.46

38025000

25.62

2.38

0.48

84.97

80.98

PETRONET

229.00

(0.97)

20058000

24.34

4.94

0.62

93.13

92.59

RELIANCE

979.40

10.40

50224000

(7.63)

4.46

0.55

80.27

83.83

PHARMACEUTICAL

AJANTPHARM

1366.10

(2.36)

733000

42.33

6.20

0.72

83.92

82.50

AUROPHARMA

632.80

12.83

20862400

(7.11)

5.97

0.59

90.18

89.36

BIOCON

666.30

11.71

7545600

6.18

4.53

0.35

89.15

87.00

CADILAHC

411.95

8.55

7105600

33.16

7.21

0.51

92.58

83.50

CIPLA

598.65

9.93

7628000

(13.06)

-2.33

0.54

84.70

83.96

DIVISLAB

1179.65

7.54

2071200

(9.35)

7.70

0.60

83.14

84.42

DRREDDY

2089.85

(0.15)

4575000

14.56

6.72

0.94

86.80

87.20

GLENMARK

570.45

7.89

4993200

(2.58)

7.39

0.32

93.02

91.92

GRANULES

108.35

4.13

14720000

1.38

7.48

0.64

89.00

86.14

LUPIN

798.10

7.85

13829400

(1.75)

7.31

1.22

93.08

90.76

PEL

2603.75

6.39

1876930

7.86

8.50

0.19

94.10

93.05

STAR

643.60

(4.49)

1915800

(41.25)

4.69

0.62

85.06

86.72

SUNPHARMA

515.50

3.63

56861200

1.35

6.07

0.47

94.42

92.64

TORNTPHARM

1396.45

11.34

392000

(38.85)

0.58

1.00

82.53

84.65

WOCKPHARMA

800.95

9.69

3287700

(2.92)

8.37

0.39

89.12

90.11

REAL ESTATE

DLF

220.40

8.87

43380000

(6.48)

6.37

0.85

86.91

88.53

NCC

127.45

8.01

27776000

11.00

9.35

0.44

87.72

86.22

For Private Circulation Only

8

Derivatives Rollover Report

POWER

ADANIPOWER

24.55

2.72

93280000

(2.35)

11.04

0.96

88.82

89.04

CESC

1072.55

10.61

6214450

8.49

7.71

0.02

95.55

88.78

NHPC

27.85

0.00

31104000

1.86

9.72

0.50

74.37

70.78

NTPC

172.50

2.37

36328000

22.75

3.12

0.50

84.78

81.72

POWERGRID

208.30

7.21

30328000

42.79

6.74

0.63

84.54

82.03

PTC

88.10

0.34

21000000

(4.48)

8.60

1.40

90.92

90.09

RPOWER

36.25

(0.14)

65858000

5.17

8.96

0.58

86.14

87.07

SUZLON

10.80

0.00

323400000

(6.21)

15.12

0.66

84.62

86.50

TATAPOWER

86.25

8.83

46791000

(12.68)

2.50

0.47

90.51

86.59

TORNTPOWER

238.65

3.85

4047000

0.67

4.52

0.59

76.30

78.94

TELECOM

BHARTIARTL

410.25

2.55

57256000

5.22

2.75

0.59

91.80

92.06

IDEA

68.85

(9.88)

133308000

28.77

7.06

0.76

90.85

90.10

INFRATEL

312.50

(6.60)

7252200

35.56

-12.23

0.32

78.40

77.98

RCOM

16.95

(22.60)

109200000

24.60

9.59

0.48

85.26

85.37

TATACOMM

624.35

0.10

5908000

3.00

7.36

0.78

93.22

90.76

TEXTILES

ARVIND

420.55

9.11

4624000

(14.21)

7.32

0.59

83.95

84.72

CENTURYTEX

1229.50

7.25

6307950

7.42

7.87

0.60

94.15

93.14

PAGEIND

24087.85

7.21

45600

82.40

6.53

0.00

77.82

74.53

RAYMOND

1120.65

24.06

4888800

5.78

9.57

0.30

89.84

91.10

SRF

2316.45

18.26

482000

(24.15)

-1.09

0.65

81.28

74.75

MEDIA

DISHTV

75.20

5.03

41944000

(11.14)

6.46

3.12

93.26

90.48

PVR

1406.60

15.04

823200

32.95

6.72

0.69

89.32

85.37

SUNTV

880.70

3.35

5836000

37.90

6.56

0.29

91.79

88.63

TV18BRDCST

65.05

(3.70)

78557000

(5.60)

9.15

0.66

91.09

87.03

ZEEL

584.15

0.98

8122400

14.66

5.54

0.25

87.96

83.75

For Private Circulation Only

9

Derivatives Rollover Report

Research Team Tel: 022 - 39357800 Extn-6824

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited, Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor.

Angel Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations,

2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other

regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.

Derivative Research Team

For Private Circulation Only

10