Please refer to important disclosures at the end of this report

1

RateGain Travel Technologies Limited (RateGain) is among the leading distribution

technology companies globally and is the largest Software as a Service (SaaS)

company in the travel & hospitality (T&H) industry in India. RateGain offers suite of

inter-connected products which enable its clients to drive efficiencies in guest

acquisition, retention and maximize their margins by leveraging on RateGain’s A.I

powered products and its large data lake. It offers its solutions through its SaaS

platform and its products are classified into Data as a Service (DaaS, 37% of FY21

revenue), Distribution (49% of revenue) and, Marketing Technology (MarTech). Its

business. RateGain’s customer base has grown over the years and stood at 1,462

customers which include eight Global Fortune 500 companies, 25 out of the top 30

online travel agents (OTAs), 23 of the top 30 hotel chains among others (Sep’21).

Positives: (a) One of the largest aggregators of data points in the world for the T&H

industry with diverse and comprehensive portfolio of revenue maximization and

business critical solutions. (b) Marquee global customers with long-term

relationships. (c) Strong balance sheet and cash generation. (d) Successful track

record of growth through strategic acquisitions and strong management.

Investment concerns: (a) High concentration of revenue from contracts in relation to

distribution products and high dependence on single industry (~50% of overall

revenues for distribution products and almost entire revenue is derived from Travel

& Hospitality Industry). (b) High client concentration can pose as a risk as Gross

Retention Rate is averaging ~93%. (c) There are contingent liabilities of `68 Cr. (d)

Continuing impact of the COVID-19 on the Travel & Hospitality industry.

Outlook & Valuation: RateGain being a vertical specific platform company stands

to benefit from rapidly growing addressable market with key positives being tough

to replicate inter-operable products that leverages data. Its revenues are recurring

in nature with subscription/hybrid model forming a large part of its revenues. Its

growing customer base (from 1,274 in FY19 to 1,337/1,462 in FY21/5MFY22)

and stable gross revenue retention during the pandemic not only highlight the

importance of digital transformation in T&H industry but also speaks volumes

about the “business critical” nature of RateGain’s products. At `425 per share,

RateGain is commanding FY21/TTM Price/Sales multiple of 18.1x/16.3x

respectively. We recommend NEUTRAL as the listing gains might be minimal in the

current environment, but long-term prospects are bright for RateGain.

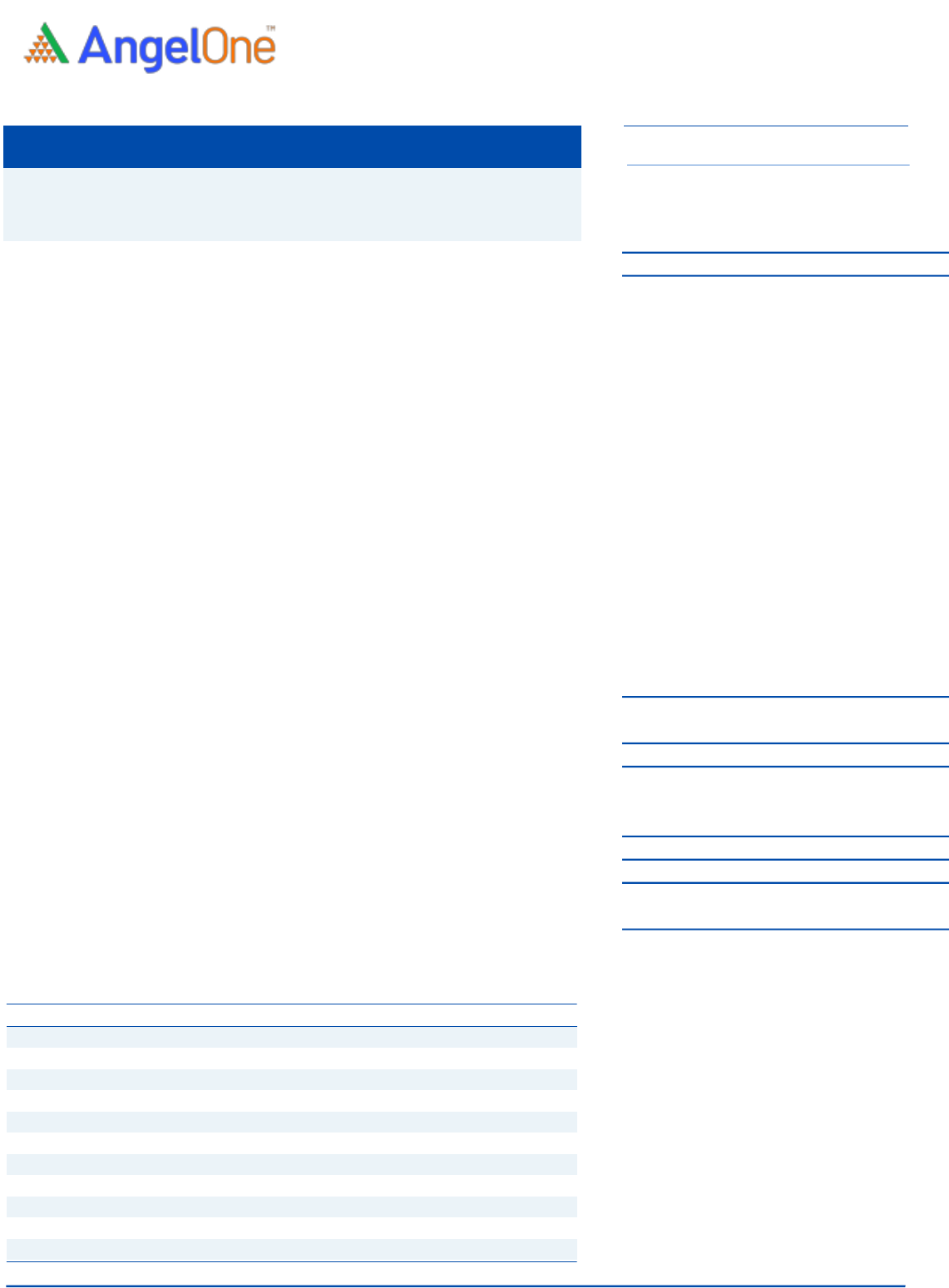

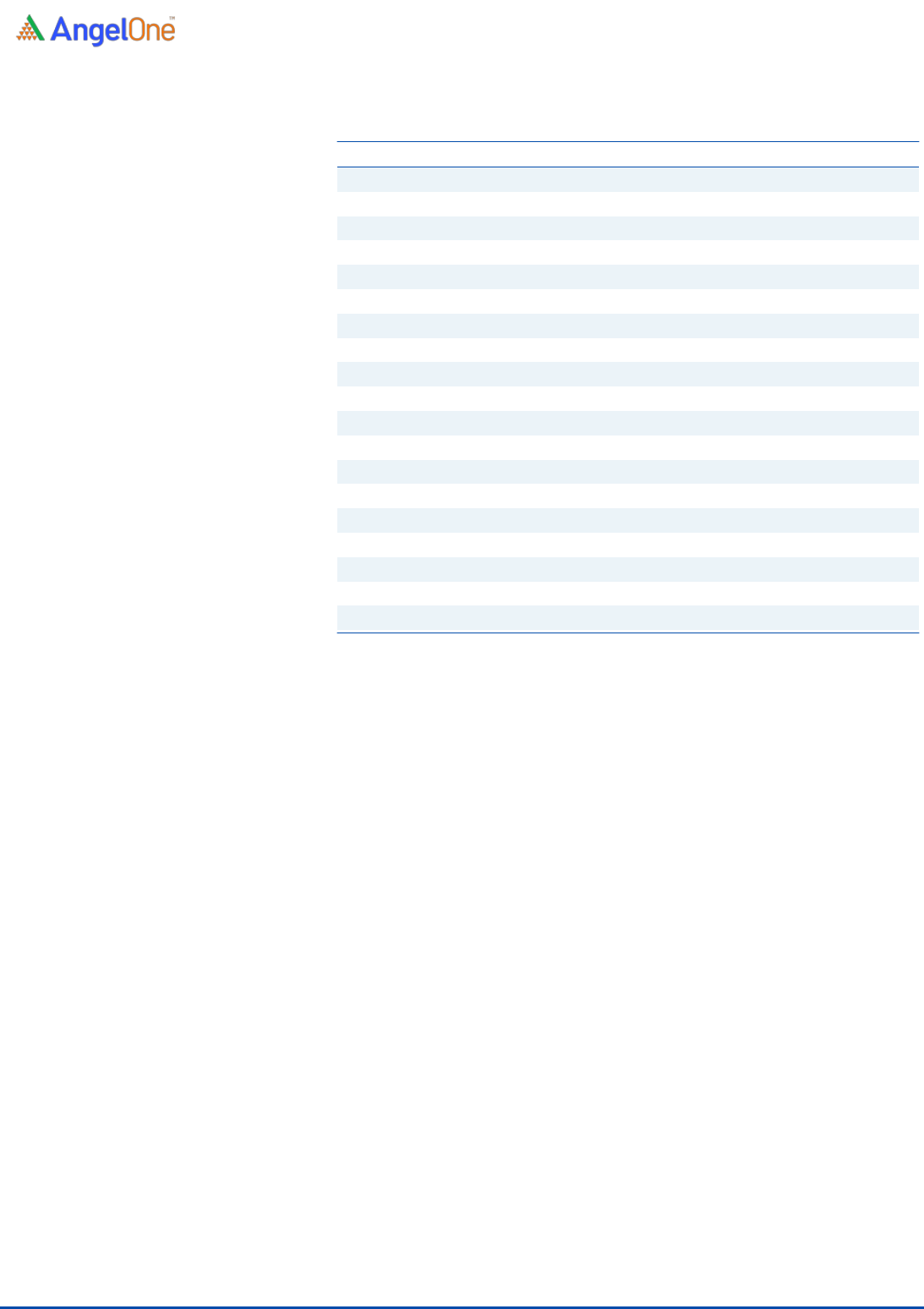

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

FY2021

Q1FY22

Net Sales

262

399

251

98

125

% chg

--

52.4

(37.1)

--

28.0

Reported Net Profit

11

(20)

(29)

(8)

(4)

% chg

--

(282.2)

(42.1)

--

54.1

EBITDA (%)

8.3

7.2

2.5

9.4

3.6

EPS (`)

1.0

(1.9)

(2.7)

(0.7)

(0.8)

P/E (x)

411.2

(225.7)

(158.8)

--

--

P/BV (x)

31.7

32.9

18.5

--

--

ROE (%)

15.4

(14.3)

(14.9)

--

--

ROCE (%)

8.3

12.2

(3.3)

--

--

EV/Sales

411.2

(225.7)

(158.8)

--

--

Source: Company, Angel Research; Note: Ratios calc. at upper price band & on post money basis

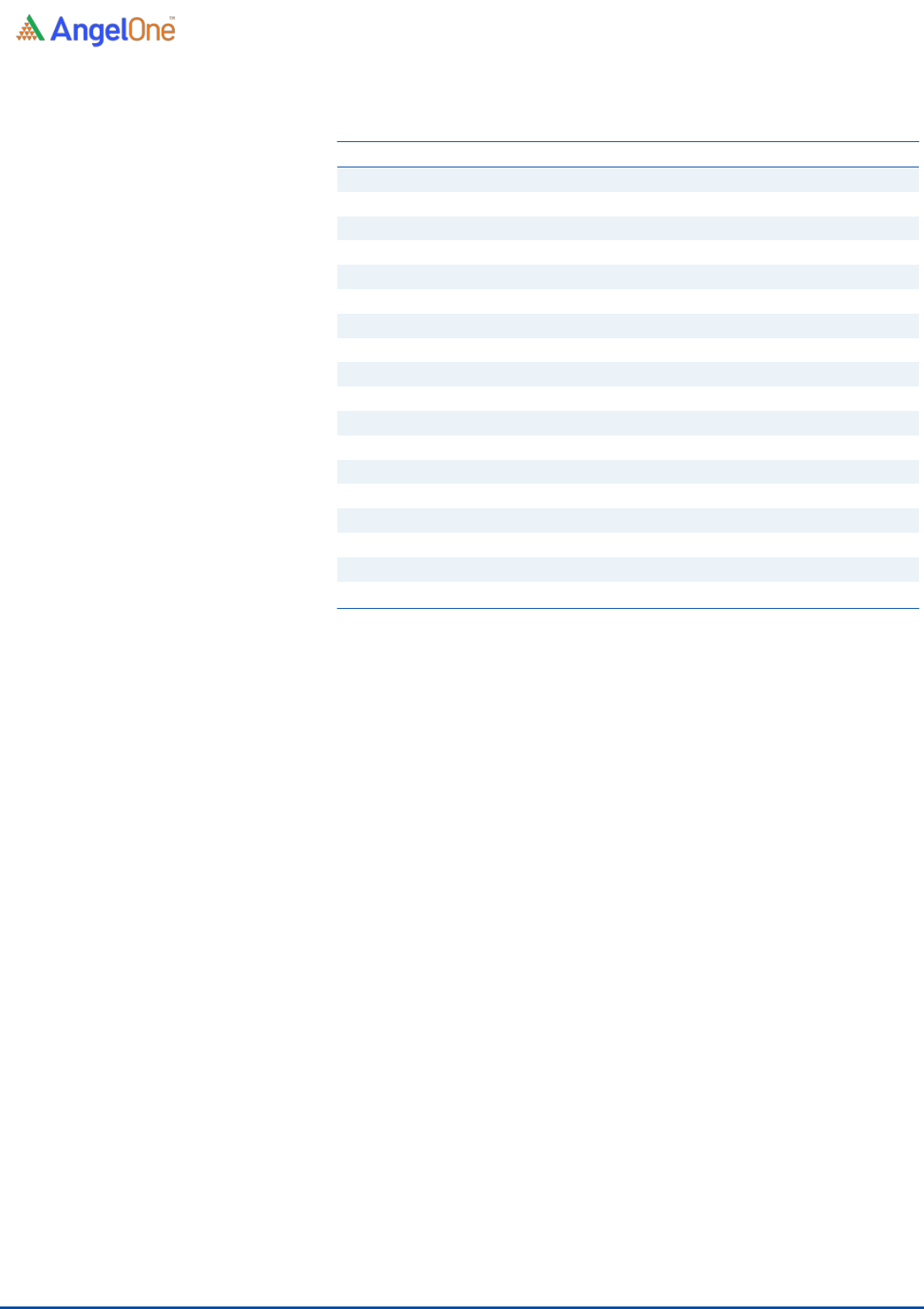

NEUTRAL

Issue Open: Dec 07, 2021

Issue Close: Dec 09, 2021

Offer for Sale: `961 cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 56.6%

Others 43.4%

Fresh issue: `375

Issue Details

Face Value: `1

Present Eq. Paid up Capital: `9.79 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `10.67cr

Issue size (amount): `1,336 cr

Price Band: `405-425

Lot Size: 35 shares and in multiple thereafter

Post-issue mkt. cap: * `4,341 cr - ** `4,537 cr

Promoters holding Pre-Issue: 67.29%

Promoters holding Post-Issue: 56.58%

*Calculated on lower price band

** Calculated on upper price band

Book Building

RATEGAIN TRAVEL TECHNOLOGIES LIMITED

IPO NOTE | RATEGAIN TRAVEL

TECHNOLOGIES LTD.

December 6, 2021

Dec 06, 2021

2

RateGain Travel Technologies Ltd | IPO Note

Company background

RateGain Travel Technologies Limited (RateGain) is among the leading distribution

technology companies globally and is the largest Software as a Service (SaaS)

company in the travel & hospitality (T&H) industry in India. It offers solutions to

hotels, airlines, online travel agents (OTAs), meta-search companies, vacation

rentals, package providers, car rentals, rail, travel management companies,

cruises, and ferries. RateGain’s solutions help T&H companies find the right guest,

decide the right price, distribute it to the preferred channel of the guest and once

converted, helps them have an exceptional experience by leveraging on

RateGain’s A.I powered products and its large data lake. It offers its solutions

through its SaaS platform and its products are classified into Data as a Service

(DaaS, 37% of FY21 revenue), Distribution (49% of revenue) and, Marketing

Technology (MarTech). Its business. RateGain’s customer base has grown over the

years and stood at 1,462 customers which include eight Global Fortune 500

companies, 25 out of the top 30 OTAs, 23 of the top 30 hotel chains among

others as on Sep’21. The Gross retention revenue as on Aug’21 was 95-99%

across the three above mentioned business units and revenues from top 10

customers were ~40%. Seven of the top 10 customers have been with the

company for over 10 years.

Issue details

The IPO is made up of offer for sale of 2.26Cr Equity Shares and fresh issue of

`375 Cr aggregating to `1,336 Cr at the upper end of the price band.

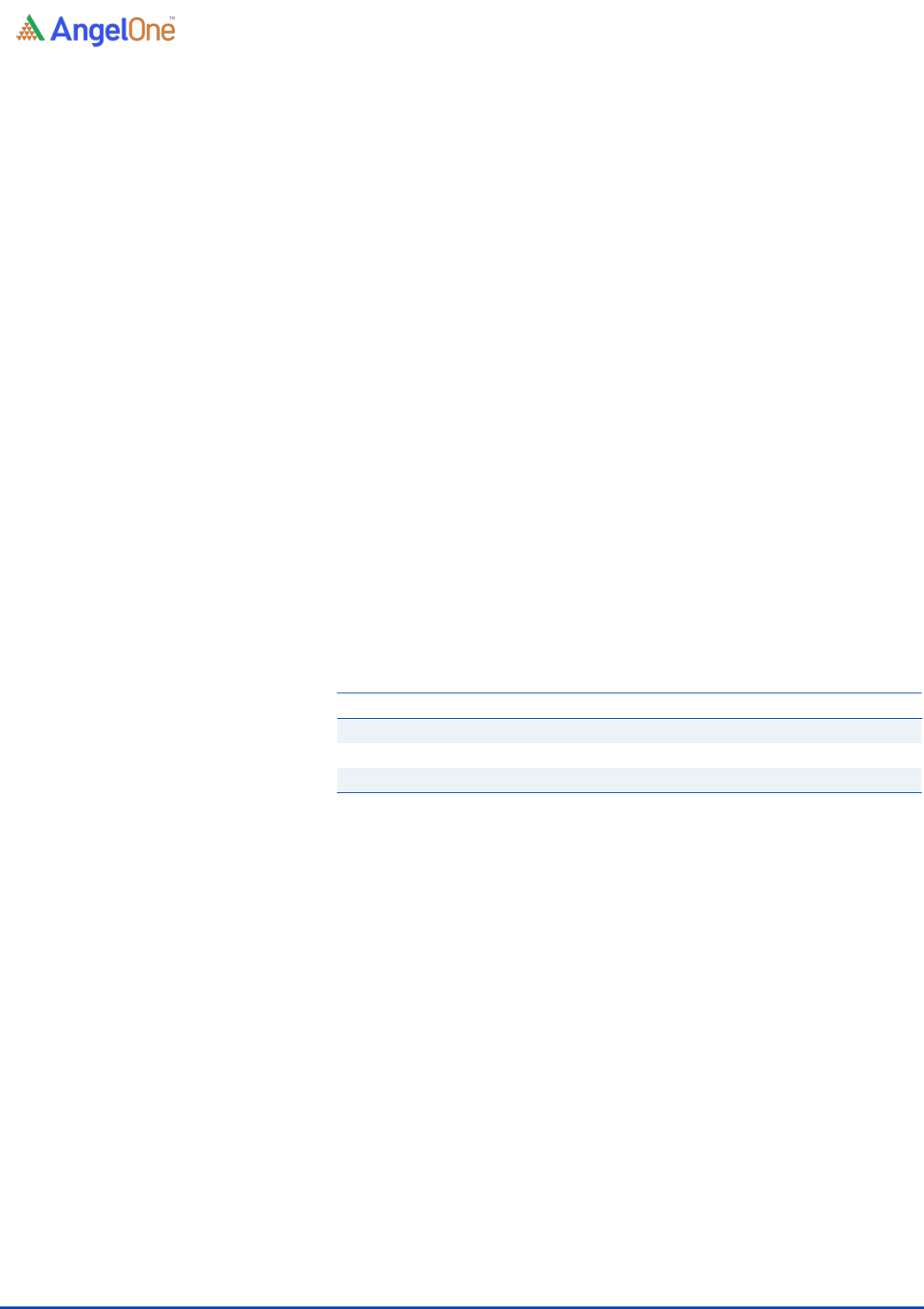

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

6,58,92,480

67.29

6,04,01,440

56.58

Public

3,20,29,880

32.71

4,63,44,449

43.42

Total

9,79,22,360

100.00

10,67,45,889

100.00

Source: Company, Angel Research & RHP.

Objectives of the Offer

1) ~`85 Cr towards repayment/prepayment of indebtedness availed by one of

its subsidiaries, RateGain UK. 2) ~`25 Cr towards payment of deferred

consideration for acquisition of DHISCO. 3) `80 Cr for strategic investments,

acquisitions, and inorganic growth. 4) `50 Cr for investment in technology

innovation, A.I. and other organic growth initiatives. 5) ~`41Cr for purchase

of certain capital equipment for their Data Center.

Key Management Personnel

Bhanu Chopra is the Chairman and Managing Director and one of the Promoters

and co-founders. He is an entrepreneur with experience of over 15 years and

holds a bachelor’s degree of science in business from Indiana University

Harmeet Singh is the group CEO and he holds bachelor’s degree in science from

California State University, Northridge. Prior to joining RateGain he served as the

President - J2 Cloud Services.

Tanmaya Das is the CFO and has been associated with RateGain since August 20,

2015. He holds a bachelor’s degree in commerce from Utkal University,

Bhubaneswar and is a member of the Institute of Chartered Accountants of India.

Dec 06, 2021

3

RateGain Travel Technologies Ltd | IPO Note

Exhibit 1: Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

5MFY21

5MFY22

Total operating income

262

399

251

98

125

% chg

--

52.4

(37.1)

--

28.0

Total Expenditure

240

370

245

89

121

Employee benefits expense

121

206

151

49

76

Other expenses

119

164

93

39

45

EBITDA

22

29

6

9

5

% chg

--

31.9

(78.5)

--

(50.6)

(% of Net Sales)

8.3

7.2

2.5

9.4

3.6

Depreciation& Amortization

20

43

36

19

13

EBIT

2

(14)

(30)

(10)

(8)

% chg

--

(1,011.0)

(112.4)

--

13.7

(% of Net Sales)

0.6

(3.5)

(11.9)

(10.0)

(6.7)

Finance costs

3

9

8

4

2

Other income

11

59

13

8

6

(% of Sales)

4.3

14.8

5.3

8.2

4.8

Recurring PBT

(2)

(23)

(38)

(14)

(11)

% chg

--

(1,298.4)

(65.5)

--

25.4

Exceptional item

-

54

-

-

-

Tax

(2)

2

4

2

(1)

PAT (reported)

11

(20)

(29)

(8)

(4)

% chg

--

(282.2)

(42.1)

--

54.1

(% of Net Sales)

4.2

(5.0)

(11.4)

(8.0)

(2.9)

Basic & Fully Diluted EPS (`)

1.0

(1.9)

(2.7)

(0.7)

(0.8)

Source: Company, Angel Research

Dec 06, 2021

4

RateGain Travel Technologies Ltd | IPO Note

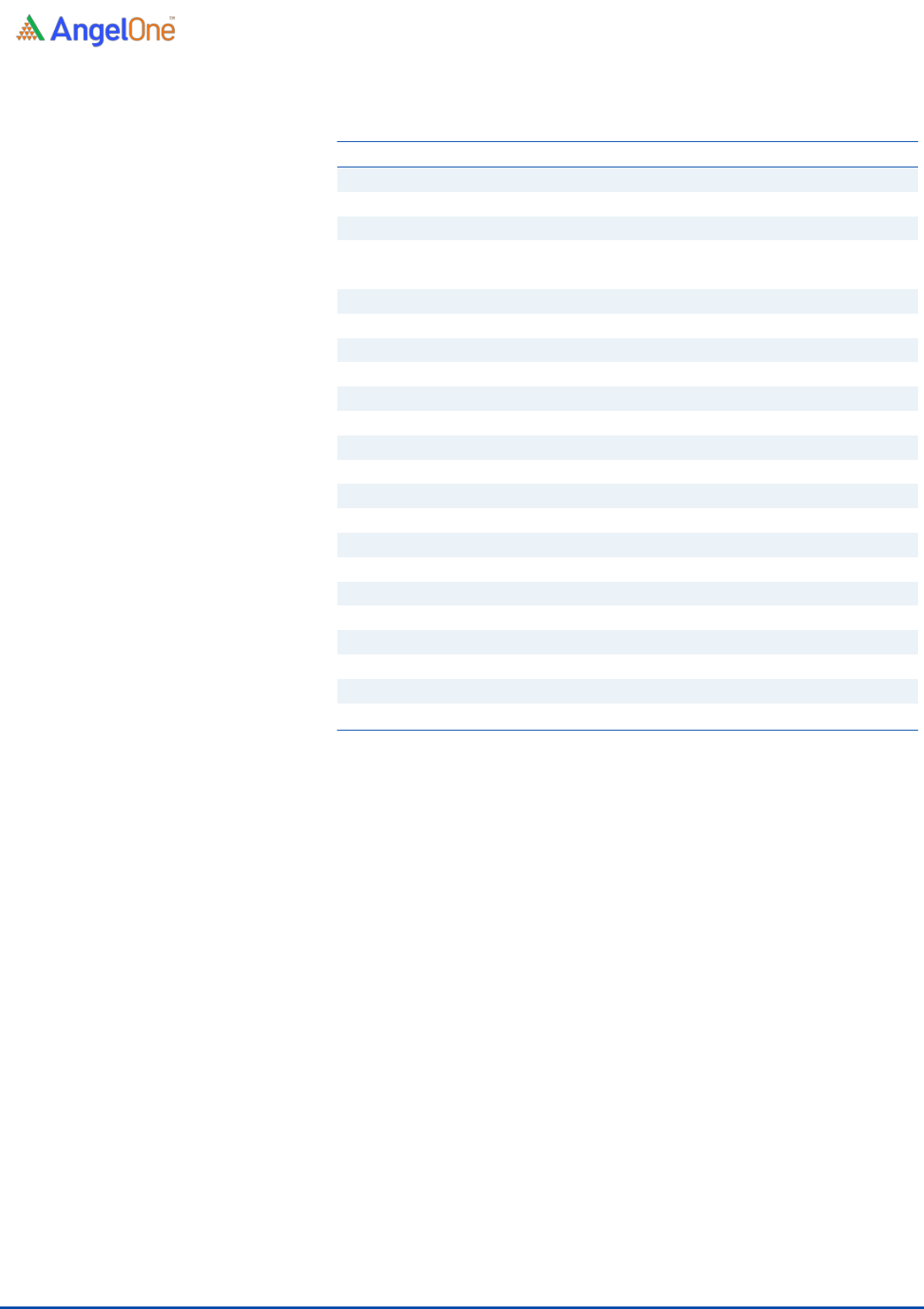

Exhibit 2: Balance Sheet

Y/E March (` Cr)

FY2019

FY2020

FY2021

5MFY21

5MFY22

SOURCES OF FUNDS

Equity Share Capital

1

1

1

1

8

Other equity

143

137

244

189

236

Shareholders’ Funds

143

138

245

190

244

Total Loans

54

144

117

120

112

Other liabilities

(0)

20

0

(0)

(1)

Total Liabilities

197

301

362

309

355

APPLICATION OF FUNDS

Property, Plant and Equipment

17

13

8

10

6

Right-of-use assets

22

20

5

6

2

Intangible assets

67

183

155

169

145

Non-Current Investments

-

-

-

-

-

Other Non-Current Asset

8

7

2

3

2

Current Assets

168

171

267

198

269

Investments

41

45

129

21

131

Trade receivables

63

78

67

69

64

Cash and Cash equivalents

45

24

57

92

59

Loans & Other Financial Asssets

1

0

0

0

0

Other current assets

18

24

14

16

14

Current Liability

84

92

74

76

69

Net Current Assets

84

79

193

122

200

Total Assets

197

301

362

309

355

Source: Company, Angel Research

Dec 06, 2021

5

RateGain Travel Technologies Ltd | IPO Note

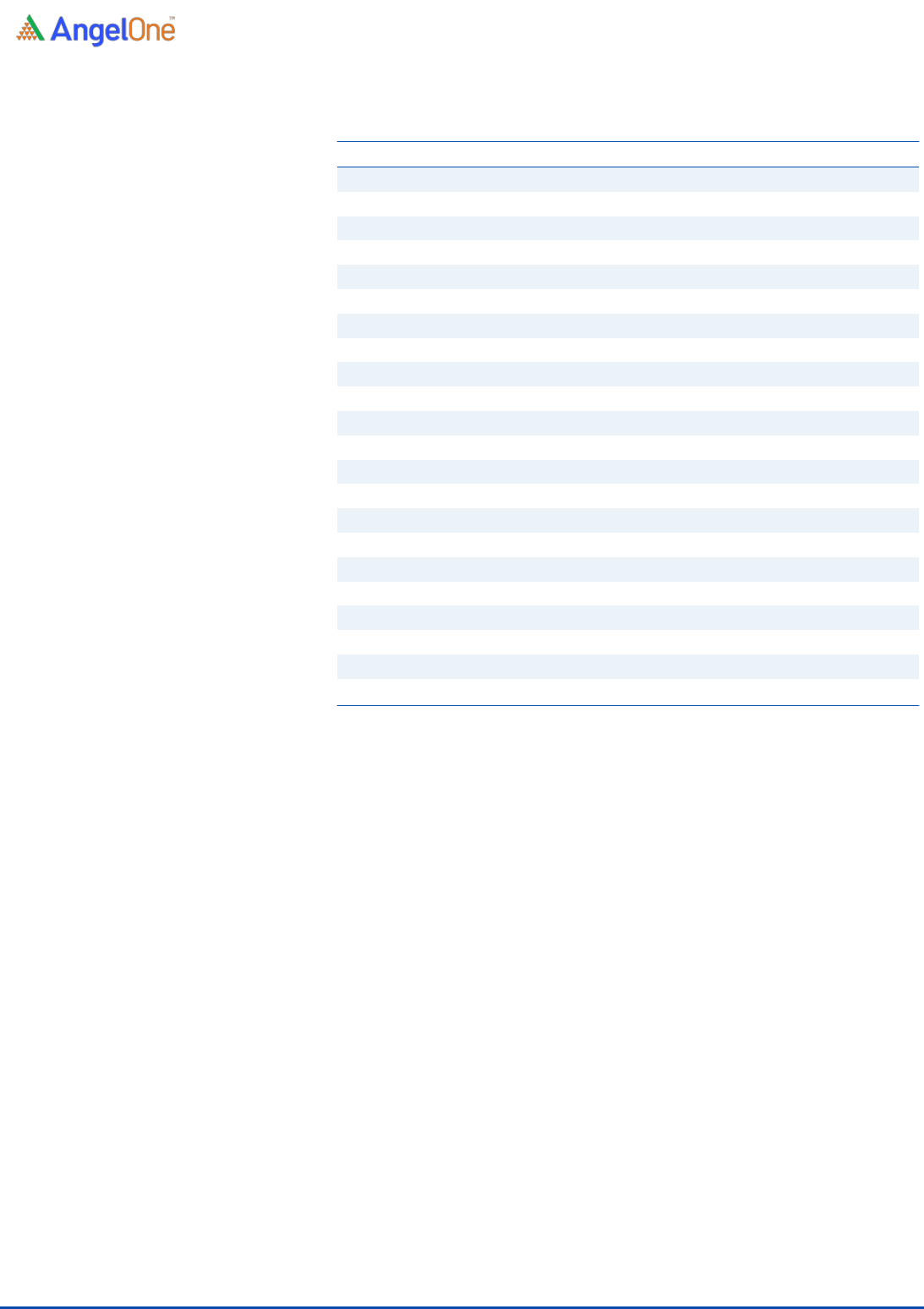

Exhibit 3: Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021

5MFY21

5MFY22

Operating profit

9

(18)

(25)

(6)

(9)

Net changes in working capital

10

(26)

(6)

(4)

(7)

Cash generated from operations

19

66

54

23

24

Direct taxes paid (net of refunds)

(2)

(4)

(2)

(0)

(1)

Net cash flow from operating activities

36

19

21

13

7

Purchase of Assets

(77)

(113)

(1)

(0)

(0)

Interest received

0

0

0

0

0

Others

74

0

(81)

25

0

Cash Flow from Investing

(3)

(112)

(82)

25

(0)

Repayment/Proceeds (borrowings)

-

86

(2)

(1)

(2)

Issue of Preference share Capital

-

-

111

35

-

Share issue expenses

-

-

(7)

-

-

Interest paid

(2)

(6)

(7)

(5)

(2)

Interest/Principal Payment on Lease liab.

(4)

(7)

(2)

(0)

(1)

Cash Flow from Financing

(6)

73

93

29

(5)

Inc./(Dec.) in Cash

27

(20)

32

67

2

Acquisition

-

-

-

-

-

Opening Cash balances

13

40

21

21

54

Closing Cash balances

40

21

54

88

55

Source: Company, Angel Research

Dec 06, 2021

6

RateGain Travel Technologies Ltd | IPO Note

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/Sales

17.3

11.4

18.1

P/E (on FDEPS)

411.2

(225.7)

(158.8)

P/CEPS

145.1

59.4

621.0

P/BV

31.7

32.9

18.5

EV/Sales

17.2

11.6

17.8

Per Share Data (Rs)

EPS (Basic)

1.0

(1.9)

(2.7)

EPS (fully diluted)

1.0

(1.9)

(2.7)

Cash EPS

2.9

7.2

0.7

Book Value

13.4

12.9

22.9

Returns (%)

ROE

15.4

(14.3)

(14.9)

ROCE

8.3

12.2

(3.3)

Turnover ratios (x)

Receivables (days)

88

71

97

Payables (days)

29

38

36

Working capital cycle (days)

59

33

61

Source: Company, Angel Research

Dec 06, 2021

7

RateGain Travel Technologies Ltd | IPO Note

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the

subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its

associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the

report or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market

making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has

not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the

subject company. Research analyst has not served as an officer, director or employee of the subject company.