OFS note | Fertilizer

March 7, 2013

Rashtriya Chemicals & Fertilisers

SUBSCRIBE

CMP

`44

Recommend SUBSCRIBE

OFS floor price

`45

The Government of India is divesting 68,961,012 shares (12.5% stake) in Rashtriya

Chemicals & Fertilisers (RCF) out of its shareholding of 92.5% in the domestic

market through Offer for Sale (OFS). We recommend investors to SUBSCRIBE the

RCF issue.

Investment Arguments

New Urea Investment Policy to boost expansion plan

The recently approved New Urea Policy is likely to encourage fertilizer companies

to set up new plants and expand existing capacities, thereby reducing dependence

on imports. India currently imports ~30% of its urea requirement. The new policy

provides moderate upside to companies as the government plans to give 12-20%

post-tax returns (earlier, returns were less than 12%) on fresh capital infused by

manufacturers for both - setting new urea plants, and for the expansion or

modernisation of the existing plants. The government plans to facilitate this by

providing subsidy on gas prices (the main feedstock of urea, accounting for ~80%

of the cost) subject to its price remaining at or below the level of US$14/mmbtu.

The company is geared up with a capacity expansion plan of urea at Thal by

12.7lakh MT p.a. to be completed in the next three years with a capex of

~`4,112cr, which the company plans to fund through a mix of equity, debt and

internal funding. The project has been cleared by pre-Public Investment Board (PIB)

and the company is now seeking PIB’s and CCEA’s approval.

Great distribution network and high brand recall

RCF has ~6,314 dealers across the county as well as over 500 co-operative

marketing societies that facilitate its pan-India reach. The company enjoys a high

brand recall with brands like Ujjwala (urea); Suphala 15:15:15 and Suphala 20:20:20

(NPK); Biola (bio-fertilizers); Microla (micro nutrients) and Sujala (water soluble

fertilizers). Further, given the high brand recall, RCF enjoys a market share of 10.7% in

the urea market, 5.5% in the NPK market and 7.3% in the MOP market.

Projects under consideration may provide upside in future

In addition to the expansion plan at the Thal unit, the company is working on other

projects for capacity expansion, which are also expected to be completed in a span

of next three to four years. These include -

1) Coal gasification based fertilizer & chemical complex at Talcher (12.7lakh MT

urea, 3.3lakh MT ammonium nitrate and 2.8lakh MT nitric acid) on a JV basis with

Coal India and Fertilizer Corporation, with a capex of ~`9,126cr.

2) Fertilizer project in Ghana (12.7lakh MT urea) on a JV basis with a capex of

~`7,121cr.

3) Granulated Single Super Phosphate project at Thal with a capex of ~`307cr.

Tejashwini Kumari

However, none of these projects are near their zero dates, while they also have a

022-39357800 Ext: 6856

long gestation period.

Please refer to important disclosures at the end of this report

1

OFS note | RCF

Company overview

RCF is a Miniratna PSU incorporated in 1978 as a chemical manufacturer. The

Government of India’s shareholding in the company stands at 92.5%. RCF is in the

business of manufacturing and marketing of various fertilizers and chemicals and

is among the leading players in its industry segment. Its products enjoy high brand

recall. It is the fourth largest producer of urea (sold under the brand name Ujjwala)

with a market share of 10.7% and total capacity of ~23lakh MT p.a. in India. The

company has two operating units at Trombay and Thal in Maharashtra. RCF has

expanded its revenue stream and product portfolio through sale of imported

diammonium phosphate (DAP) and muriate of potash (MOP).

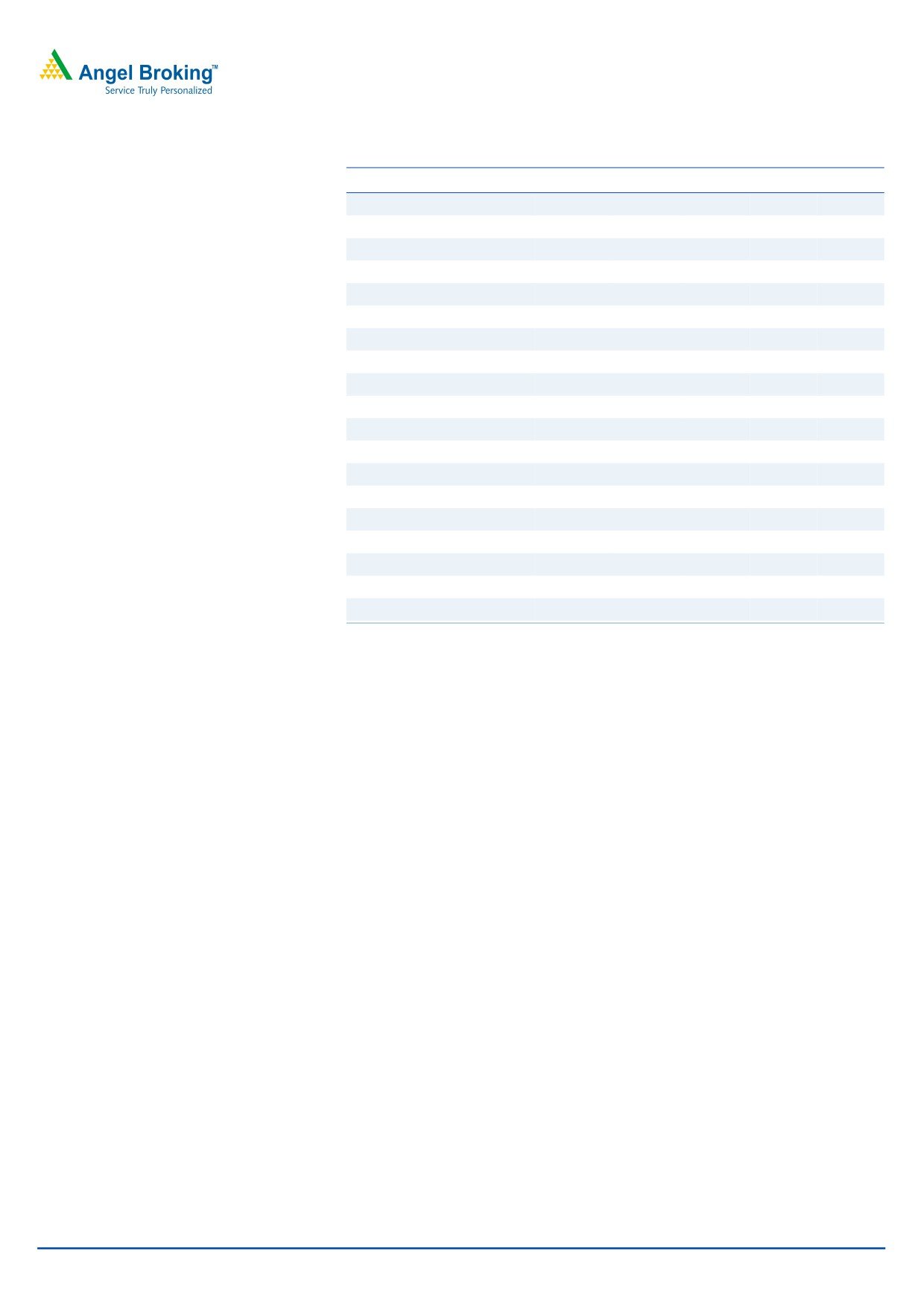

Exhibit 1: Business Structure

Segments

Products

Sales*

EBITDA*

Nitrogenous Fertilizers

Urea - Manufactured & Imported

50%

P&K Fertilizers

Complex Fertilizers

- Suphala 15:15:15

62%

36%

- ANP 20:20:0

- DAP, MOP, Complexes Imported

Industrial Chemicals

Used in various Industries like Pharmaceuticals, Drugs, dyes,

13%

pesticides etc

Specialty Nutrients

Bio Fertilizers

38%

Micro Nutrients

1%

Water Soluble Fertilizers

Source: Company Presentation, Angel Research, *contribution in FY2012

Industry

The Indian fertilizer industry is one of the most regulated sectors in the country. The

urea sector (which accounts for around 50% of the fertilizer consumption) is

completely regulated where retail prices are fixed and subsidy is variable in order

to ensure cost plus return (12% post tax RoE). On the contrary, the non-urea sector

(DAP and NPK fertilizers) functions under a fixed subsidy. A variable retail price

framework is followed with considerable pricing freedom being granted since April

2011.

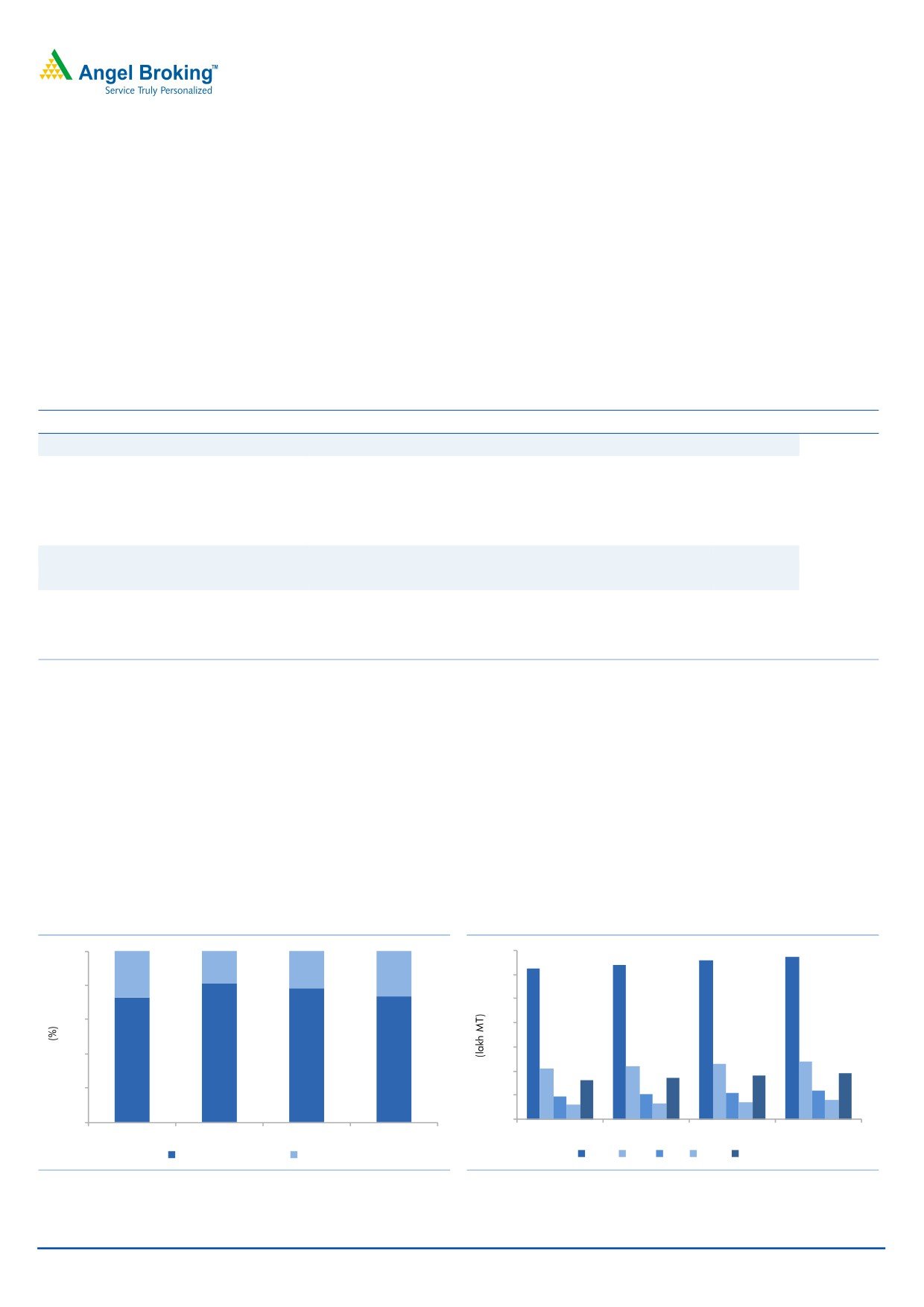

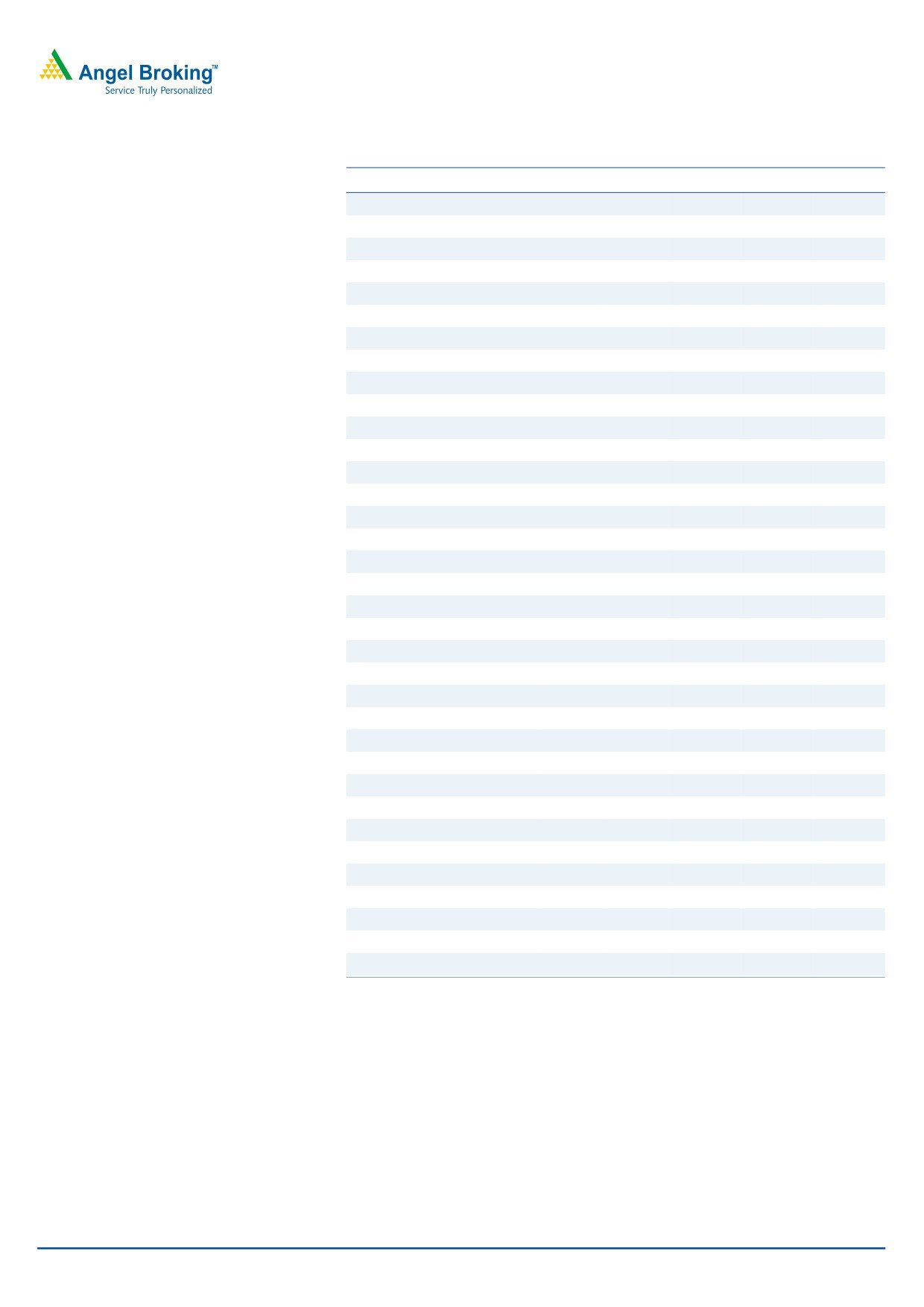

Exhibit 2: Demand fulfilment - Domestic vs. imports

Exhibit 3: Fertilizer demand forecasts in India

100.0

350

320

329

337

312

19.2

21.4

26.9

26.7

300

80.0

250

60.0

200

150

120

40.0

105

110

115

85

90

95

100

80

51

55

60

47

40

20.0

30

33

36

50

73.1

80.8

78.6

73.3

0.0

0

FY2009

FY2010

FY2011

FY2012

FY2014

FY2015

FY2016

FY2017

Domestic production

Import

Urea DAP SSP MOP NPK

Source: Company, Angel Research

Source: Company, Angel Research

March 7, 2013

2

OFS note | RCF

The growth in overall demand for fertilizers has remained at ~5% over the period

FY2005-12. However, the production has remained largely stagnant during the

same period, mainly because of lack of capacity addition due to various policy

related issues and limited availability of raw materials. Hence, India’s dependence

on fertilizer imports has increased to the current level of ~27% for urea and 68%

for DAP.

However, with the New Urea Policy coming in, we expect the scenario to improve

and dependence on imports to reduce in coming years.

Exhibit 4: Major players producing Urea in India

Company

Urea Capacity* (lakh MT)

Other Products

IFFCO

42.4

NPK, DAP, Phosphates, Complex

NFL

32.3

-

KRIBHCO

25.9

-

RCF

23.3

Nitro Phosphate, Ammonium Nitrate Phosphate

Chambal Fertilizers & Chemicals Ltd.

17.3

-

Nagarjuna Fertilizers & Chemicals Ltd.

15.2

-

Source: Company, Angel Research, * as on November 2012

Risks and concerns

Fluctuations in global raw material & natural gas prices

Policy related issues and stringent terms in gas supply and transportation

contracts and their operability

Adverse movements in exchange rate

Adverse agro-climatic conditions may impact the performance of the company

Recession in international chemical market leading to un-remunerative

domestic prices

Outlook and valuation

The new urea investment policy and capacity expansion plans provide the

company a healthy outlook but being a public sector company in a highly

regulated industry, the implementation of projects as well as the policies might get

delayed, which may pose a risk to the company’s future.

The company has fixed a floor price of `45, which is at a premium of 2.6% from

its current market price (CMP) `44. At the CMP, the stock is trading at a PE of 8.7x

on TTM basis and at the floor price of the issue of `45, it is trading at 9.0x on TTM

basis. We recommend investors to SUBSCRIBE the RCF issue as it is fairly valued

and the successful completion of projects in pipeline will provide upside to the

stock in the future.

March 7, 2013

3

OFS note | RCF

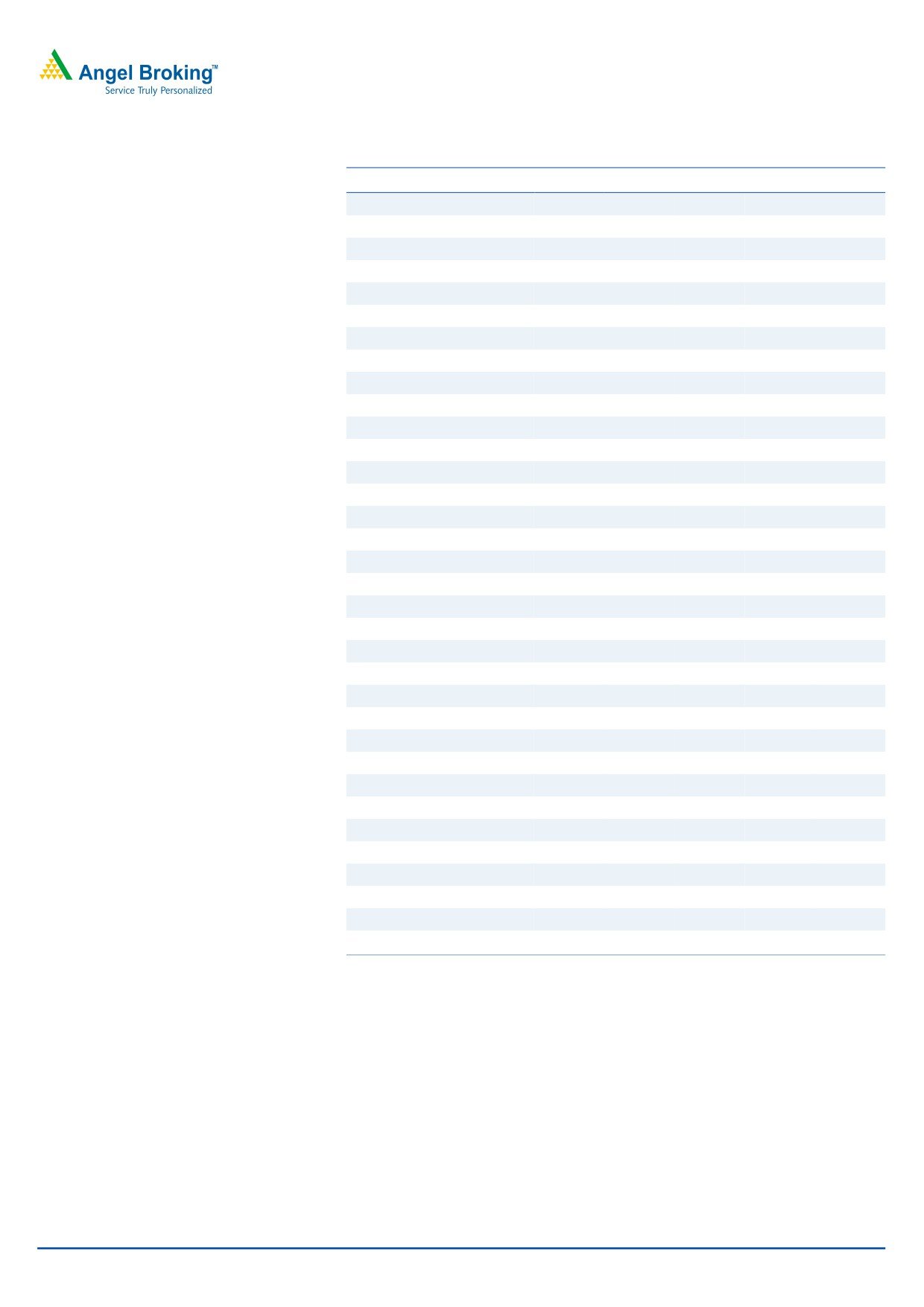

Profit and Loss Statement

Y/E March (` cr)

FY2008*

FY2009*

FY2010

FY2011

FY2012

Total operating income

5,141

8,366

5,642

5,524

6,434

% chg

62.8

(32.6)

(2.1)

16.5

Net Raw Materials

2,399

5,099

3,651

2,937

3,497

% chg

112.6

(28.4)

(19.5)

19.0

Other Mfg costs

1,312

1,369

552

925

1,011

% chg

4.3

(59.7)

67.6

9.3

Personnel

236

382

359

400

424

% chg

61.7

(6.2)

11.6

5.9

Other

902

1,113

740

861

1,102

% chg

23.4

(33.5)

16.4

28.0

Total Expenditure

4,850

7,963

5,302

5,124

6,034

EBITDA

291

403

340

400

399

% chg

38.5

(15.6)

17.6

(0.1)

(% of Net Sales)

5.7

4.8

6.0

7.2

6.2

Depreciation & Amortisation

83

87

106

113

143

EBIT

208

316

234

287

257

% chg

52.2

(25.9)

22.5

(10.6)

(% of Net Sales)

4.0

3.8

4.2

5.2

4.0

Interest & other Charges

66

111

71

69

49

Other Income

100

119

180

137

167

(% of Net Sales)

2.0

1.4

3.2

2.5

2.6

Recurring PBT

142

206

164

218

207

% chg

45.3

(20.3)

32.8

(4.7)

PBT (reported)

242

325

344

354

374

Tax

84

114

109

110

125

(% of PBT)

34.7

35.2

31.8

30.9

33.5

PAT (reported)

158

211

234

245

249

Extraordinary Expense/(Inc.)

(1)

-

-

(1)

(1)

ADJ. PAT

159

211

234

246

250

% chg

32.7

11.3

4.9

1.8

(% of Net Sales)

3.1

2.5

4.2

4.4

3.9

Basic EPS (`)

2.9

3.8

4.2

4.5

4.5

Fully Diluted EPS (`)

2.9

3.8

4.2

4.5

4.5

% chg

32.7

11.3

4.9

1.8

Note: *Standalone

March 7, 2013

4

OFS note | RCF

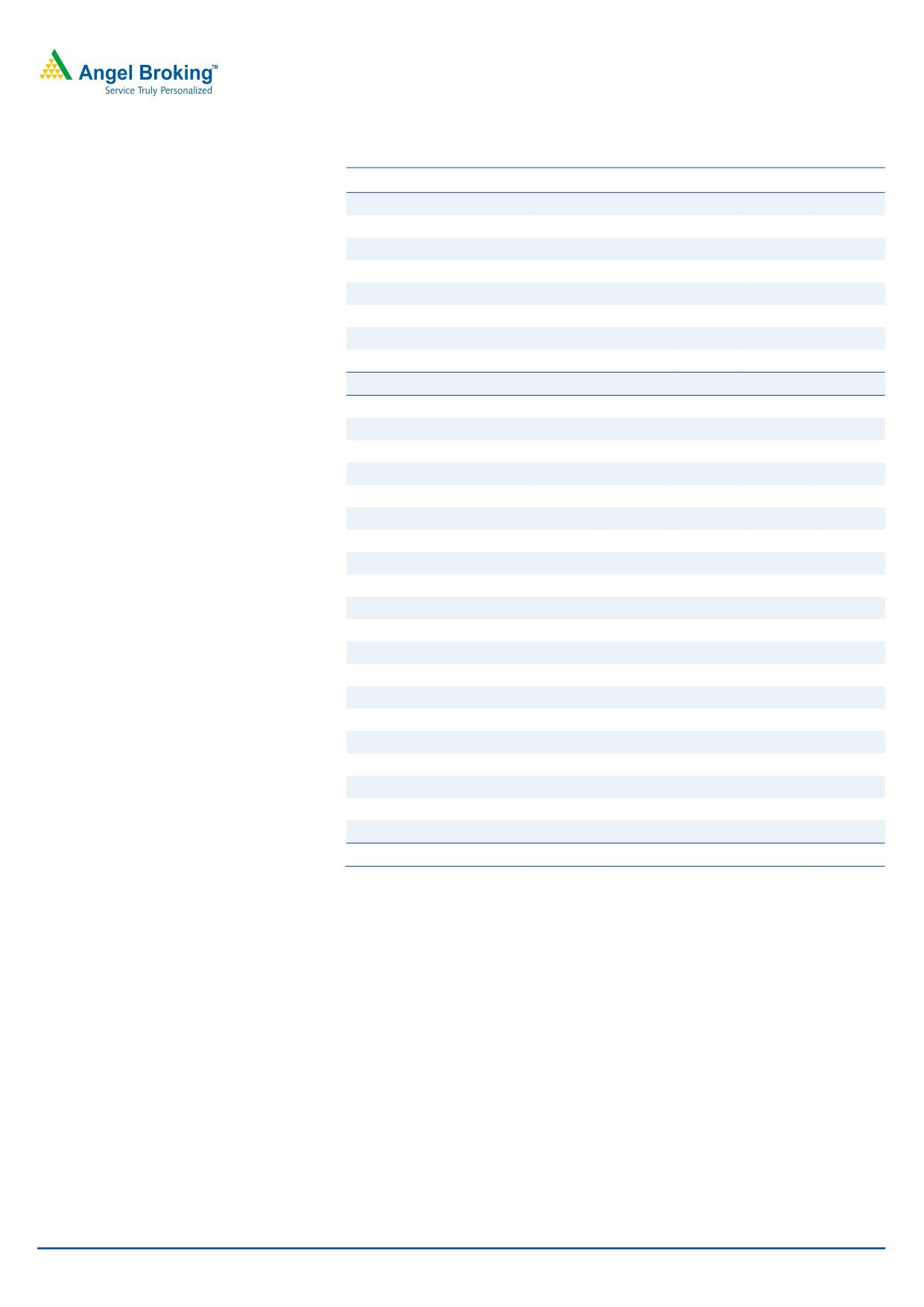

Balance Sheet Statement

Y/E March (` cr)

FY2008*

FY2009*

FY2010

FY2011

FY2012

SOURCES OF FUNDS

Equity Share Capital

552

552

552

552

552

Reserves& Surplus

987

1,120

1,284

1,460

1,620

Shareholder’s Funds

1,539

1,672

1,836

2,012

2,171

Total Loans

1,243

1,425

1,355

422

1,185

Other Long Term Liabilities

0

0

-

85

72

Long Term Provisions

0

0

-

108

127

Deferred Tax (Net)

166

149

164

156

214

Total Liabilities

2,948

3,245

3,354

2,783

3,770

APPLICATION OF FUNDS

Gross Block

2,778

2,875

3,116

3,264

3,521

Less: Acc. Depreciation

1,693

1,762

1,867

1,980

2,123

Less: Impairment

31

31

1

1

1

Net Block

1,054

1,082

1,247

1,282

1,397

Capital Work-in-Progress

115

248

178

82

177

Lease adjustment

0

-

-

-

-

Goodwill

0

-

-

-

-

Investments

360

20

0

15

18

Long Term Loans and advances

0

0

-

98

136

Other Non-current asset

0

0

-

14

16

Current Assets

2,290

3,819

2,883

2,257

3,874

Cash

49

412

785

419

592

Loans & Advances

231

926

830

88

85

Inventory

872

693

410

535

1,178

Debtors

1,138

1,788

859

857

1,978

Other current assets

-

357

41

Current liabilities

872

1,925

954

966

1,848

Net Current Assets

1,418

1,894

1,929

1,291

2,026

Misc. Exp. not written off

2

1

-

-

-

Total Assets

2,948

3,245

3,354

2,783

3,770

Note: *Standalone

March 7, 2013

5

OFS note | RCF

Cash Flow Statement

Y/E March (` cr)

FY2008*

FY2009*

FY2010 FY2011 FY2012

Profit before tax

242

325

344

354

374

Depreciation

83

87

106

113

143

Change in Working Capital

(166)

(113)

338

273

(562)

Direct taxes paid

(84)

(114)

(109)

(110)

(125)

Others

62

84

(38)

25

20

Cash Flow from Operations

138

269

640

656

(150)

(Inc.)/Dec. in Fixed Assets

(115)

(230)

(170)

(53)

(353)

(Inc.)/Dec. in Investments

(360)

340

20

(15)

(3)

(Incr)/Decr In LT loans & adv.

-

(112)

(39)

Others

3

20

52

116

98

Cash Flow from Investing

(472)

130

(99)

(64)

(296)

Issue of Equity

0

-

-

-

-

Inc./(Dec.) in loans

288

181

(69)

(933)

763

Dividend Paid (Incl. Tax)

(5)

(5)

(7)

(8)

(8)

Others

(130)

(211)

(92)

(16)

(136)

Cash Flow from Financing

153

(36)

(168)

(957)

619

Inc./(Dec.) in Cash

(181)

363

372

(365)

173

Opening Cash balances

231

49

412

785

419

Closing Cash balances

49

412

785

419

592

Note: *Standalone

March 7, 2013

6

OFS note | RCF

Key Ratios

Y/E March

FY2008*

FY2009*

FY2010

FY2011

FY2012

Valuation Ratio (x)

P/E (on FDEPS)

15.2

11.5

10.3

9.8

9.7

P/CEPS

10.0

8.1

7.1

6.7

6.2

P/BV

1.6

1.4

1.3

1.2

1.1

EV/Net sales

0.6

0.4

0.5

0.4

0.5

EV/EBITDA

11.2

8.5

8.8

6.0

7.5

EV / Total Assets

1.2

1.1

0.9

0.9

0.8

Per Share Data (`)

EPS (Basic)

2.9

3.8

4.2

4.5

4.5

EPS (fully diluted)

2.9

3.8

4.2

4.5

4.5

Cash EPS

4.4

5.4

6.2

6.5

7.1

DPS

0.1

0.1

0.1

0.1

0.1

Book Value

27.9

30.3

33.3

36.5

39.4

DuPont Analysis

EBIT margin

4.0

3.8

4.2

5.2

4.0

Tax retention ratio

0.7

0.6

0.7

0.7

0.7

Asset turnover (x)

2.3

3.5

2.5

2.6

2.3

ROIC (Post-tax)

6.0

8.5

7.2

9.4

6.2

Cost of Debt (Post Tax)

3.9

5.4

3.5

5.4

4.1

Leverage (x)

0.5

0.6

0.3

(0.0)

0.3

Operating ROE

7.1

10.3

8.3

9.4

6.7

Returns (%)

ROCE (Pre-tax)

7.5

10.2

7.3

10.9

7.2

Angel ROIC (Pre-tax)

9.2

13.1

10.5

13.6

9.3

ROE

10.6

13.1

13.4

12.8

12.0

Turnover ratios (x)

Asset TO (Gross Block)

1.9

3.0

1.9

1.7

1.9

Inventory / Net sales (days)

57

34

36

31

49

Receivables (days)

72

64

86

57

80

Payables (days)

-

64

99

68

85

WC cycle (ex-cash) (days)

97

65

74

58

81

Solvency ratios (x)

Net debt to equity

0.5

0.6

0.3

(0.0)

0.3

Net debt to EBITDA

2.9

2.5

1.7

(0.0)

1.4

Int. Coverage (EBIT/ Int.)

3.1

2.9

3.3

4.1

5.2

Note: *Standalone

March 7, 2013

7

OFS note | RCF

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

March 7, 2013

8

OFS note | RCF

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Viral Shah

Sr. Analyst (Infrastructure)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, FMCG)

Yaresh Kothari

Analyst (Automobile)

Ankita Somani

Analyst (IT, Telecom)

Sourabh Taparia

Analyst (Banking)

Bhupali Gursale

Economist

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Tejas Vahalia

Research Editor

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

March 7, 2013

9