Please refer to important disclosures at the end of this report

1

Incorporated in 2000, One 97 Communications Ltd is India's leading digital

ecosystem for consumers as well as merchants. In 2009, the company launched

the first digital mobile payment platform, "Paytm App" to offer cashless payment

services to customers and now, it became India's largest payment platform and the

most valuable payments brand. It offers payment services, commerce and cloud

services, and financial services to 337 million registered consumers and over 21.8

million registered merchants, as of June 30, 2021. Its software and cloud services

allows large, medium and small merchants to improve their business operations

and access important financial tools such as banking, wealth and credit facilities.

Positives: (a) India's leading digital payment service platform. (b) Strong brand

identity with a brand value of USD6.3 billion. (c) Huge customer base with 333

million total customers, 114 million annual transacting users, and 21 million

registered merchants. (d) Paytm Super-app to access a wide range of digital

payment services over mobile phones. (e) Will be one of the biggest beneficiaries

of 5x growth in mobile payments to USD 3,065bn between FY2021-FY2026.

Investment concerns: (a) Increase in payment processing charges to financial

institutions and card networks. (b) Failure by Paytm Payments Bank to support

services. (c) Unable to grow relationships, increase transaction volume, and attract

new merchants to ecosystem. (d) History of net losses and negative cash flows in

prior years.

Outlook & Valuation: At the upper end of the price band, Paytm is valued at 49.7x

its FY21 revenues. While valuations may appear to be expensive, Paytm has

become synonymous with digital payments through mobile and is the market

leader in the mobile payment space. Patym is well positioned to benefit from the

exponential 5x growth in mobile payments between FY2021 – FY2026 and hence

believe that the valuations are justified. We recommend investors to SUBSCRIBE to

the issue.

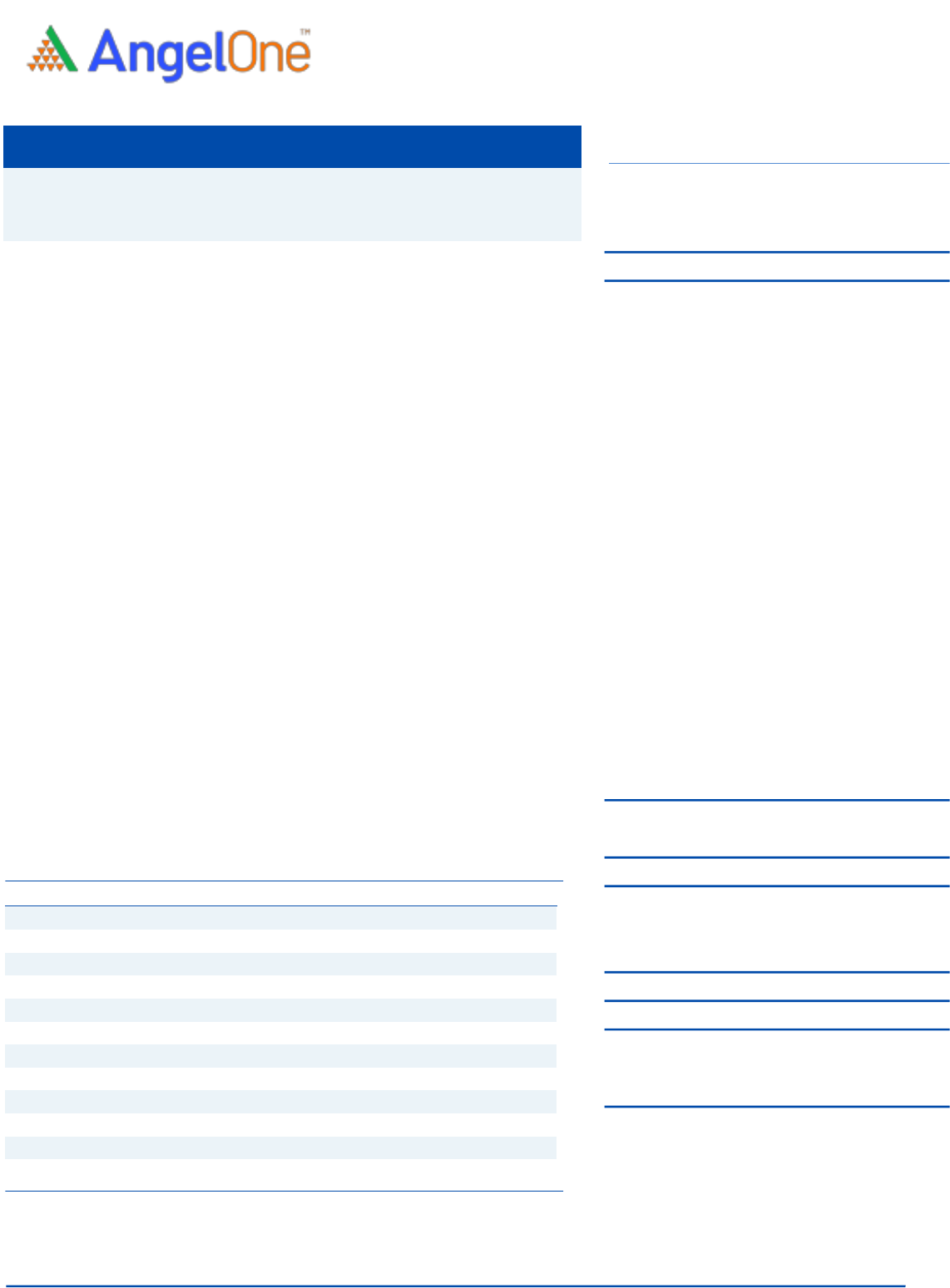

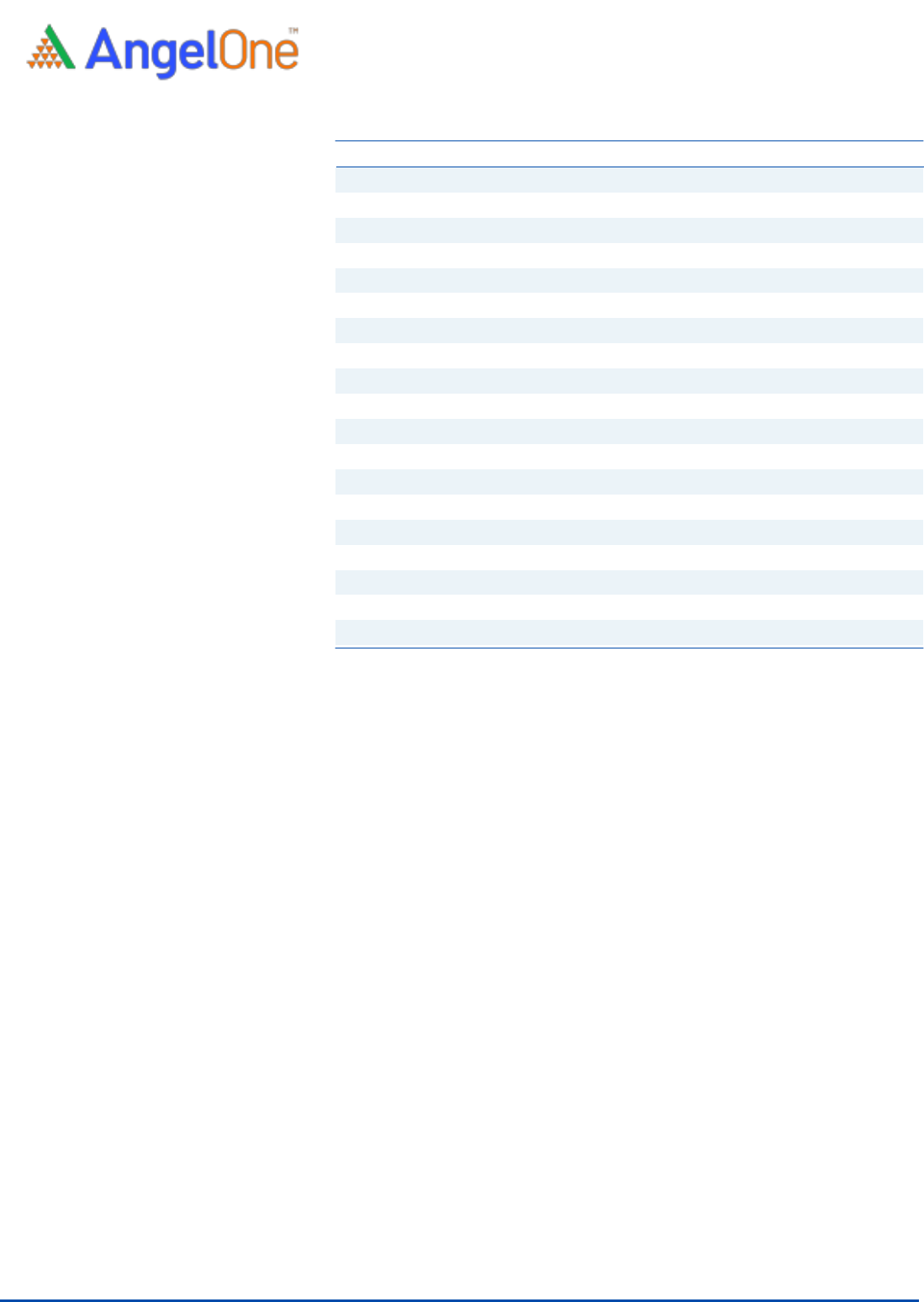

Key Finances

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

3,232

3,281

2,802

% chg

-

1.5

-14.6

Net Profit

-4,231

-2,942

-1,701

% chg

-

-30.5

-42.2

EBITDA (%)

-135.1

-80.3

-63.1

EPS (Rs)

(73.6)

(48.7)

(28.1)

P/E (x)

(29.2)

(44.1)

(76.5)

P/BV (x)

21.6

16.0

19.9

ROE (%)

(73.9)

(36.3)

(26.0)

ROCE (%)

(66.4)

(31.8)

(25.8)

EV/EBITDA

(28.4)

(49.2)

(73.6)

EV/Sales

38.4

39.5

46.4

Source: Company, Angel Research

SUBSCRIBE

Issue Open: Nov 08, 2021

Issue Close: Nov 10, 2021

Offer for Sale: `10,000 cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Public (Founder,

Investor & other Sh)

59.9%

Public (Other) 40.1%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `64.8cr

Issue size (amount): `18,300 cr

Price Band: `2080-2150

Lot Size: 6 shares and in multiple thereafter

Post-issue mkt. cap: * `1,34,841 cr - ** `1,39,379 cr

Public (Founder, Investor & other Sh) Pre-Issue: 71.3%

Public (Founder, Investor & other Sh) Post-Issue: 59.9%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `8, 300 cr

Issue Details

Face Value: `1

Present Eq. Paid up Capital: `60.9 cr

One 97 Communications Limited (Paytm)

One 97 Communications Limited

(Paytm)|IPO Note

November 03, 2021

One 97 Communications Limited| IPO Note

Nov 03, 2021

2

Company background

One97 Communications Limited (“Paytm”) was incorporated on December 22,

2000. The company is India’s leading digital ecosystem for consumers and

merchants. Paytm offers ‘Payment Services’, ‘Commerce and Cloud Services’, and

‘Financial Services’ to 33.3 crore consumers and over 2.18 crore merchants

registered with them, as of June 30, 2021. The company launched Paytm in 2009,

as a “mobile-first” digital payments platform to enable cashless payments. Paytm

is available across the country with “Paytm karo” (i.e. “use Paytm”) evolving into a

verb for hundreds of millions of Indian consumers, shopkeepers, merchants and

small businesses.

Issue details

The issue comprises of offer for sale of upto `10,000 crore and Fresh issue of

`8,300Cr in the price band of `2080-2150.

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Public (Founder, Investor & other Sh)

434,511,102

71.3

387,999,474

59.9

Public (Other)

175,157,906

28.7

260,274,185

40.1

Total

609,669,008

100.0

648,273,659

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

Growing and strengthening Paytm ecosystem, including through

acquisition and retention of consumers and merchants and providing them

with greater access to technology and financial services - ₹ 4,300 Crores.

Investing in new business initiatives, acquisitions and strategic partnerships

- ₹ 2,000 Crores.

General corporate purpose.

Key Management Personnel

Mr. Vijay Shekhar Sharma is the Managing Director and Chief Executive Officer of

the Company and the Chairman of Board. Mr. Sharma is the founder of the

Company and oversees the Company's key strategic efforts including engineering,

design and marketing.

Mr. Munish Varma is a Non-Executive Director of Company and a nominee of

SVF on Board. He currently serves as a managing partner at SoftBank

Investment Advisers. He was also associated with Deutsche Bank AG.

Mr. Ravi Chandra Adusumalli is a Non-Executive Director of the Company and

a nominee of SAIF and Elevation Capital on Board. He holds a bachelor’s

degree in economics and government from Cornell University. He is currently

the managing partner of Elevation Capital

One 97 Communications Limited| IPO Note

Nov 03, 2021

3

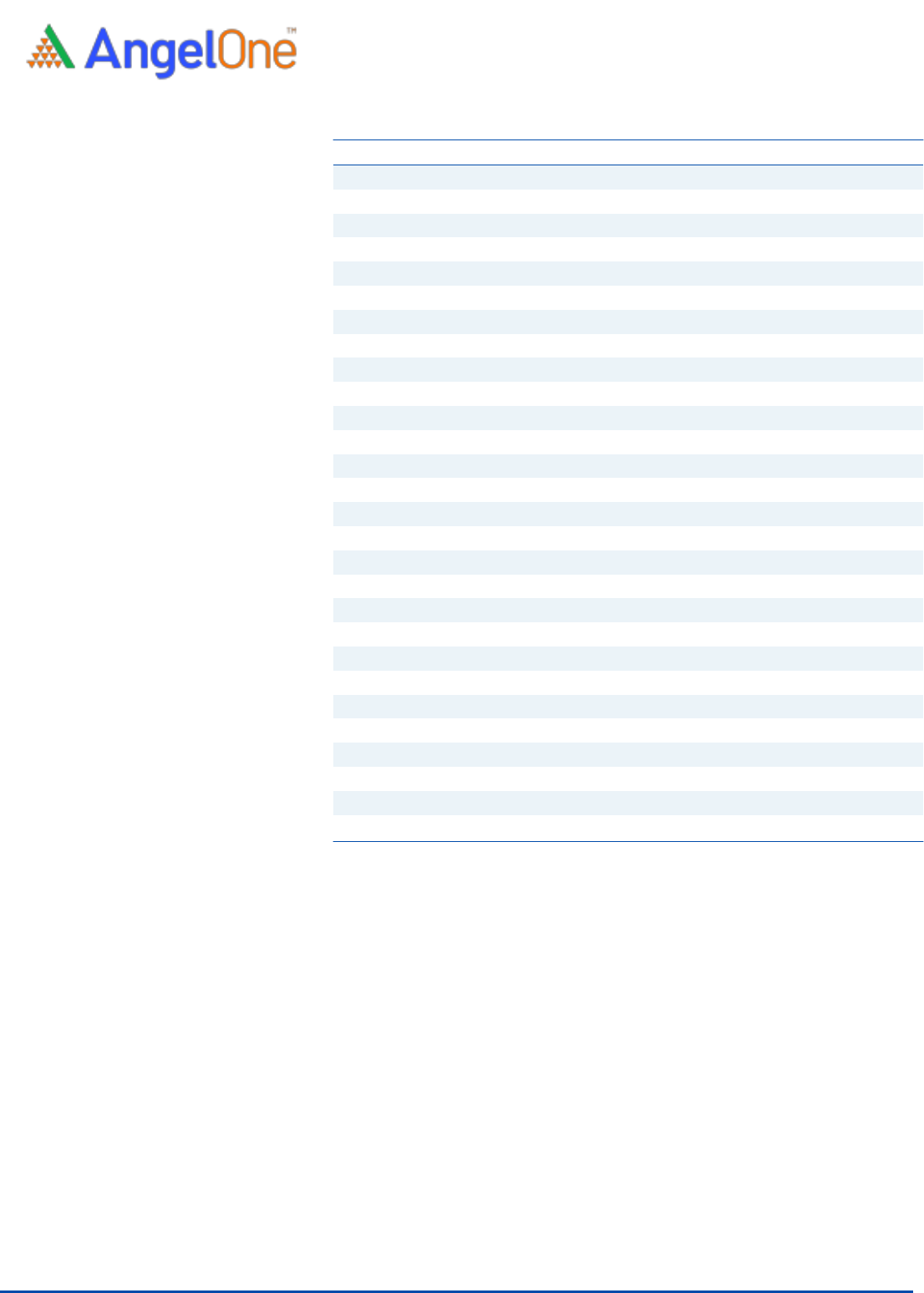

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Total operating income

3,232.0

3,280.8

2,802.4

890.8

% chg

-

1.5

-14.6

61.6

Total Expenditure

7,598.1

5,915.2

4,569.7

1,261.7

Payment processing charges

2,257.4

2,265.9

1,916.8

526.5

Marketing and promotional expenses

3,408.3

1,397.1

532.5

137.7

Employee benefits expense

856.2

1,119.3

1,184.9

350.7

Software, cloud and data expenses

309.6

360.3

349.8

105.8

Other expenses

766.6

772.6

585.7

141.0

EBITDA

-4,366.1

-2,634.4

-1,767.3

-370.9

% chg

-

-39.7

-32.9

11.9

(% of Net Sales)

-135.1

-80.3

-63.1

-41.6

Depreciation& Amortisation

111.6

174.5

178.5

40.9

EBIT

-4,477.7

-2,808.9

-1,945.8

-411.8

% chg

-

-37.3

-30.7

10.7

(% of Net Sales)

-138.5

-85.6

-69.4

-46.2

Finance costs

34.2

48.5

34.8

9.7

Other Income- Gen

347.7

259.9

384.4

57.2

Other income(from joint venture)

14.6

-56.0

-74.0

-12.1

(% of Sales)

0.5

-1.7

-2.6

-1.4

Recurring PBT

-4,149.6

-2,653.5

-1,670.2

-376.4

% chg

-

-36.1

-37.1

34.2

Exceptional item

-82.5

-304.7

-28.1

-2.4

Tax

-6.5

-15.8

2.7

3.1

Loss frm discontinuation

-5.3

-

-

-

PAT (reported)

-4,230.9

-2,942.4

-1,701.0

-381.9

% chg

-

-30.5

-42.2

34.3

(% of Net Sales)

-130.9

-89.7

-60.7

-42.9

Basic & Fully Diluted EPS (Rs)

-73.6

-48.7

-28.1

Source: Company, Angel Research

One 97 Communications Limited| IPO Note

Nov 03, 2021

4

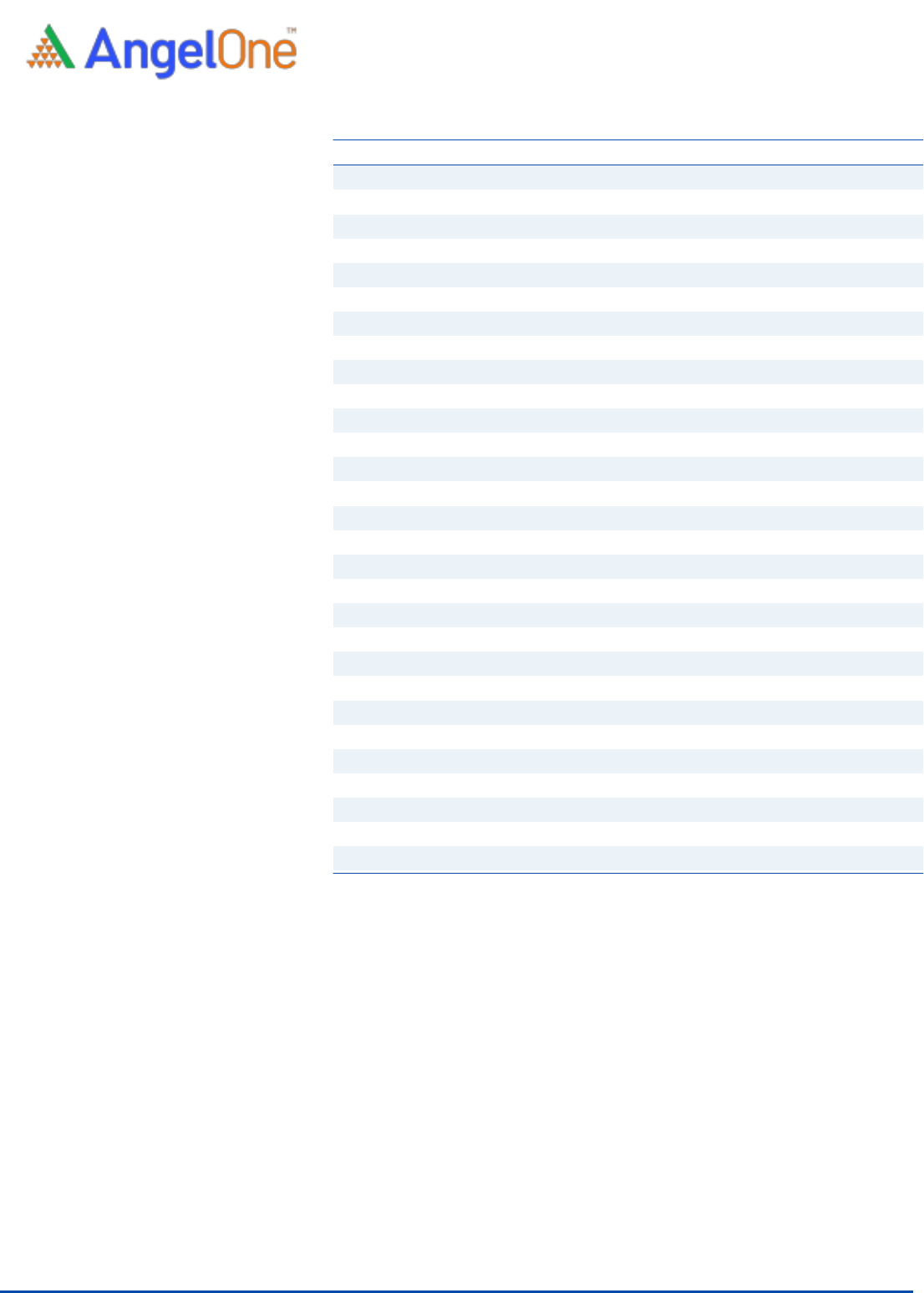

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

SOURCES OF FUNDS

Equity Share Capital

57.5

60.4

60.5

60.5

Other equity (Retained Earning)

5,667.4

8,044.8

6,474.3

6,205.3

Shareholders’ Funds

5,724.9

8,105.2

6,534.8

6,265.8

Non-Cont. Interest

86.2

-14.0

-18.6

-20.3

Total Loans

696.2

208.7

544.9

476.0

Other liabilities

233.8

545.9

479.9

476.6

Total Liabilities

6,741.1

8,845.8

7,541.0

7,198.1

APPLICATION OF FUNDS

Property, plant and equipment

199.9

261.6

299.2

290.7

Right-of-use-assets

274.8

267.4

128.3

157.7

Capital work-in-progress

51.3

13.1

20.8

18.9

Goodwill

293.0

46.7

46.7

44.3

Other intangible assets

73.4

17.8

17.1

17.6

Intangible assets under development

4.3

1.6

2.8

1.2

Investment in joint ventures

46.0

76.2

-

-

Investment in associates

200.2

246.8

231.7

232.9

Current Assets

6,670.9

6,435.7

7,399.8

7,415.7

Investments

2,497.9

3,189.4

147.2

623.0

Trade receivables

454.4

493.2

471.3

534.9

Cash and cash equivalents

325.5

423.2

546.8

650.4

Bank balances other than CCE

135.8

117.0

2,329.6

1,847.6

Loans

276.4

24.2

161.1

72.7

Other financial assets

1,567.2

874.5

2,338.6

2,527.4

Other current assets

1,413.7

1,314.2

1,405.2

1,159.7

Current Liability

2,025.7

1,457.3

1,610.3

2,260.9

Net Current Assets

4,645.2

4,978.4

5,789.5

5,154.8

Other Non-Current Asset

953.0

2,936.2

1,004.9

1,280.0

Total Assets

6,741.1

8,845.8

7,541.0

7,198.1

Source: Company, Angel Research

One 97 Communications Limited| IPO Note

Nov 03, 2021

5

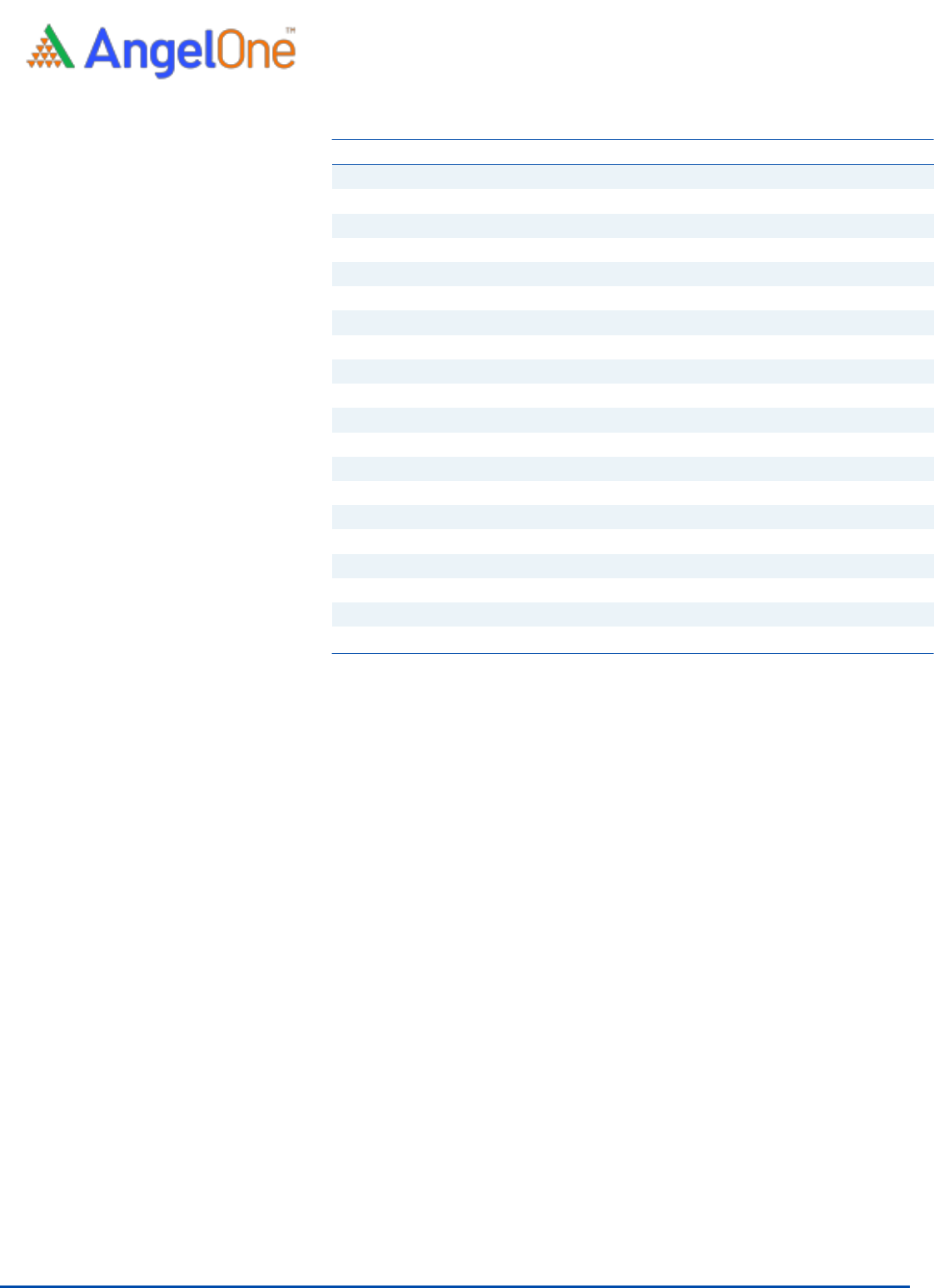

Exhibit 3: Consolidated Cash flows

Y/E March (`cr)

FY2019

FY2020

FY2021

Q1FY2022

Operating profit before working capital changes

-4,160.1

-2,356.9

-1,579.4

-313.9

Net changes in working capital

-132.3

6.8

-690.2

661.7

Cash generated from operations

-4,292.4

-2,350.1

-2,269.6

347.8

Direct taxes paid (net of refunds)

-183.5

-26.5

187.1

-17.1

Net cash flow operating activities

-4,475.9

-2,376.6

-2,082.5

330.7

Purchase of property, plant and equipment,

-177.3

-190.7

-192.7

-40.1

Proceeds from property, plant and equipment

2.4

4.1

5.6

1.2

Others

2,085.9

-1,809.7

2,116.9

-107.0

Cash Flow from Investing

1,911.0

-1,996.3

1,929.8

-145.9

Proceeds from issue of shares

2,189.3

5,054.0

10.7

1.5

Share issue expenses

-2.4

-14.0

-

-

Share application (pending allotment)

-

*

0.2

0.2

Acquisition of non-controlling interests

-36.9

-8.0

-6.3

-

Repayment of borrowings

-3.1

-

-

-

Others

-36.4

127.9

-226.7

413.6

Cash Flow from Financing

2,110.5

5,159.9

-222.1

415.3

Inc./(Dec.) in Cash

-454.4

787.0

-374.8

600.1

Opening Cash balances

89.7

-370.1

416.2

45.4

Exchange effect

-5.4

-0.7

4.0

4.6

Closing Cash balances

-370.1

416.2

45.4

650.1

Source: Company, Angel Research

One 97 Communications Limited| IPO Note

Nov 03, 2021

6

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

(29.2)

(44.1)

(76.5)

P/CEPS

(30.0)

(46.9)

(85.4)

P/BV

21.6

16.0

19.9

EV/Sales

38.4

39.5

46.4

EV/EBITDA

(28.4)

(49.2)

(73.6)

Per Share Data (Rs)

EPS (Basic)

(73.6)

(48.7)

(28.1)

EPS (fully diluted)

(73.6)

(48.7)

(28.1)

Cash EPS

(71.6)

(45.8)

(25.2)

Book Value

99.6

134.2

108.0

Returns (%)

ROE

(73.9)

(36.3)

(26.0)

ROCE

(66.4)

(31.8)

(25.8)

Turnover ratios (x)

Receivables (days)

51.3

54.9

61.4

Inventory (days)

-

-

-

Payables (days)

83.1

68.0

78.8

Working capital cycle (days)

(31.8)

(13.2)

(17.4)

Source: Company, Angel Research

One 97 Communications Limited| IPO Note

Nov 03, 2021

7

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelone.in

DISCLAIMER

Angel One Limited (formerly known as Angel Broking Limited) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity

& Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has

not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

1.Financial interest of research analyst or Angel or his Associate or his relative No

2.Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3.Served as an officer, director or employee of the company covered under Research No

4.Broking relationship with company covered under Research No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

Hold (Fresh purchase not recommended)