FPO Note | Banking

May 10, 2011

Power Finance Corporation

SUBSCRIBE

Issue Open: May10, 2011

High-powered growth

Issue Close: May 13, 2011

Strong growth outlook: The surge in power sector projects in the past few years,

Issue Details

especially from the private sector, has led to a sharp increase in funding

requirements, visible in PFC’s huge outstanding loan sanctions of `1.7lakh crore.

Face Value: `10

This alone provides high loan growth visibility in the next few years (we have

Present Eq. Paid-up Capital: `1147.8cr

factored in a 25% CAGR in loan growth over FY2012-13E). Moreover, with banks

having seen a 47% CAGR in power sector lending in the past two years, their

Offer Size: 22.96cr Shares

exposures in most cases have reached close to board-mandated limits, creating

Fresh Issue: 17.22cr Shares

even more space for specialised lenders such as PFC to grow. This will be further

aided by the company’s expanded net worth post the FPO and higher

Offer for sale:5.74cr Shares

concentration limits pursuant to an infrastructure finance company (IFC) status.

Post Eq. Paid-up Capital: ` 1,320cr

Healthy profitability: Structurally, as is the case with several other niche NBFCs,

regulatory arbitrage vis-à-vis banks allows PFC to earn healthy NIMs, further

Issue size (amount):** `4,353-4,573cr

aided by its close-to-sovereign credit rating. Moreover, reduction in risk weightage

Fresh Issue: **`3,265-3,434cr

from 100% to 20% due to the IFC status makes funding from banks ~100bp

cheaper. Cyclically, we have conservatively factored in a 50bp NIM compression

Offer for sale: ** `1,088-1,143cr

over FY2012-13E due to rising funding costs. That said, the recent

Price Band: `193-203#

underperformance of the stock, in our view, over discounted the

~75bp

sequential NIM compression in 4QFY2011 (calculated), which was partly on

Post-issue implied mkt cap**: ` 25,474cr-

26,795cr

account of large bond and ECB issuances (issue costs accounted upfront) as well

as large disbursements towards the quarter-end.

Promoters holding Pre-Issue: 89.8%

With 87% of loans to public sector utilities so far, asset quality has not been an

Promoters holding Post-Issue: 73.7%

issue irrespective of the financial health of utilities. In our view, the scenario

Note: **At the lower and upper price band,

respectively, # 5% discount to retail investors

pertaining to PSU borrowers is likely to remain unchanged, further aided by the

likely benign approach towards any required restructuring and NPA recognition

pertaining to such loans, given quasi-sovereign status as well as systemic issues of

Book Building

the alternative. The increasing proportion of private sector loan sanctions, in our

view, does increase the risk profile. Though, in any case, this is unlikely to

QIBs

Up to 50%

manifest in the next few years, when most loans relate to projects under

Non-Institutional

At least 15%

implementation, the substantial valuation discount to PFC’s historical valuation

range provides further margin of safety.

Retail

At least 35%

Attractive valuations: At the CMP, the stock is trading at 1.1x FY2013 P/ABV.

Historically, the stock has traded at 1.2-2.2x one-year forward ABV with a median

Post Issue Shareholding Pattern

of 1.75x. Considering asset-quality issues that could creep up as exposure to

private sector increases, we have assigned an FY2013E P/ABV multiple of 1.4x,

Promoters Group

73.7

20% lower than PFC’s median P/ABV multiple since listing. The resultant target

MF/Banks/Indian

26.3

price of `254 implies an upside of 25% from the upper end of the price band.

FIs/FIIs/Public & Others

Hence, we recommend Subscribe to the issue.

Key financials

Y/E March (` cr)

FY2010 FY2011E FY2012E FY2013E

NII

2,874

3,466

4,056

4,733

Vaibhav Agrawal

% chg

44.1

20.6

17.0

16.7

022 - 3935 7800 Ext: 6808

Net profit

2,357

2,619

3,073

3,601

% chg

19.7

11.1

17.4

17.2

Shrinivas Bhutda

NIM (%)

3.9

3.8

3.6

3.3

022 - 3935 7800 Ext: 6845

EPS (`)

20.5

22.8

23.3

27.3

P/E (x)

9.9

8.9

8.7

7.4

P/ABV (x)

1.7

1.5

1.3

1.1

Varun Varma

RoA (%)

3.1

2.7

2.6

2.4

022 - 3935 7800 Ext: 6847

RoE (%)

18.3

18.1

16.6

15.8

Source: RHP, Angel Research. Note: Valuations at the upper price band

Please refer to important disclosures at the end of this report

1

Power Finance Corporation | FPO Note

Company background

Power Finance Corporation Ltd. (PFC) is a leading power sector public financial

institution and a non-banking financial company, providing fund and non-fund

based support for development of the Indian power sector. The company plays a

major role in channelising investment into the power sector and acts as a vehicle

for development of this sector. PFC enjoys the highest credit rating in the Indian

market; while in international markets, the company is rated at par with the Indian

Sovereign rating. The company is registered as a non-banking financial company

(NBFC) by the RBI and was conferred with the status of Nav-Ratna PSU by the

Government of India on June 22, 2007. The company was conferred with the

status of NBFCND-IFC (Non Banking Finance Company-Non Deposit Taking-

Infrastructure Finance Company) on July 28, 2010.

Details of the issue

The IPO comprises an issue of 22.95cr equity shares of face value of `10 each in

the price band of `193-203 per share. The issue comprises a fresh issue of

17.22cr equity shares and an offer for sale of 5.74cr equity shares by the

Government of India. The company expects to raise between `3,092cr and

`3,262cr at the lower and upper price band, respectively. The primary issue of

shares would result in a dilution of the promoter’s holding by 16.1% to 73.7%.

The issue proceeds are planned to be utilised for augmenting the capital base to

ensure compliance with requisite capital adequacy norms and to meet future

capital requirements arising out of growth in the business and for general

corporate purposes.

Investment arguments

Strong growth outlook

The surge in power sector projects in the past few years, especially from the private

sector, has led to a sharp increase in funding requirements, visible in PFC’s huge

outstanding loan sanctions of `1.7lakh crore. This alone provides high loan

growth visibility in the next few years (we have factored in a 25% CAGR in loan

growth over FY2012-13E). Moreover, with banks having seen a 47% CAGR in

power sector lending in the past two years, their exposure in most cases has

reached close to board-mandated limits, creating even more space for specialised

lenders such as PFC to grow. This will be further aided by the company’s expanded

net worth post the FPO and higher concentration limits pursuant to its IFC status.

May 10, 2011

2

Power Finance Corporation | FPO Note

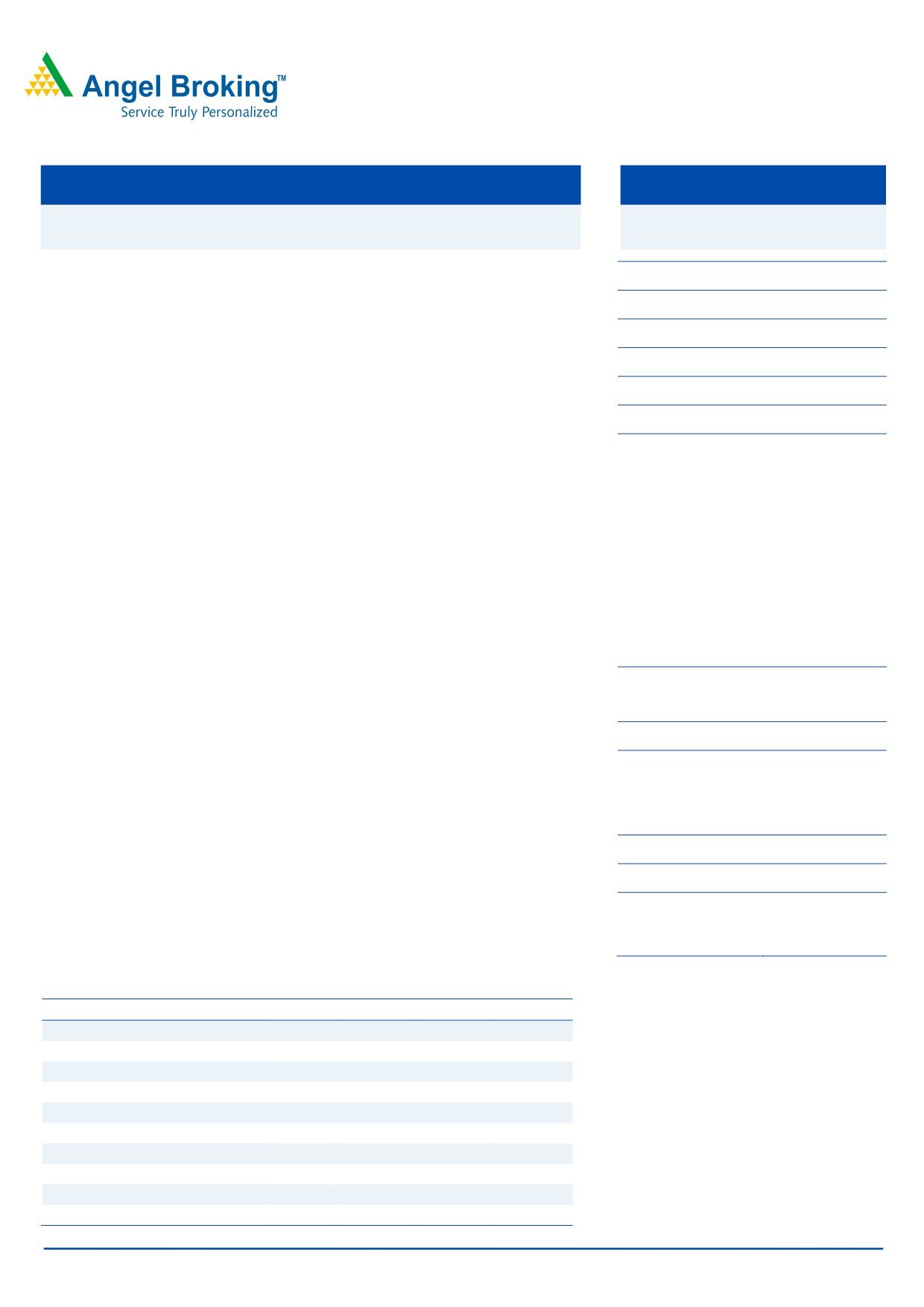

Exhibit 1: Outstanding sanction mix* - Sector wise

Exhibit 2: Outstanding sanction mix* - Project wise

1%

3%

3%

8%

Generation

23%

State Sector

Transmission

11%

Central Sector

Distribution

6%

Joint Sector

R-APDRP (Part A)

8%

63%

Private sector

R-APDRP (Part B)

74%

Others

Source: RHP, Angel Research; Note: *As of December 31, 2010

Source: RHP, Angel Research; Note: *As of December 31, 2010

Outstanding sanctions as of December 31, 2010, stood at 1.7lakh crore, with

higher concentration towards public sector (~77% of total outstanding sanctions)

and generation projects (~74% of total outstanding sanctions).

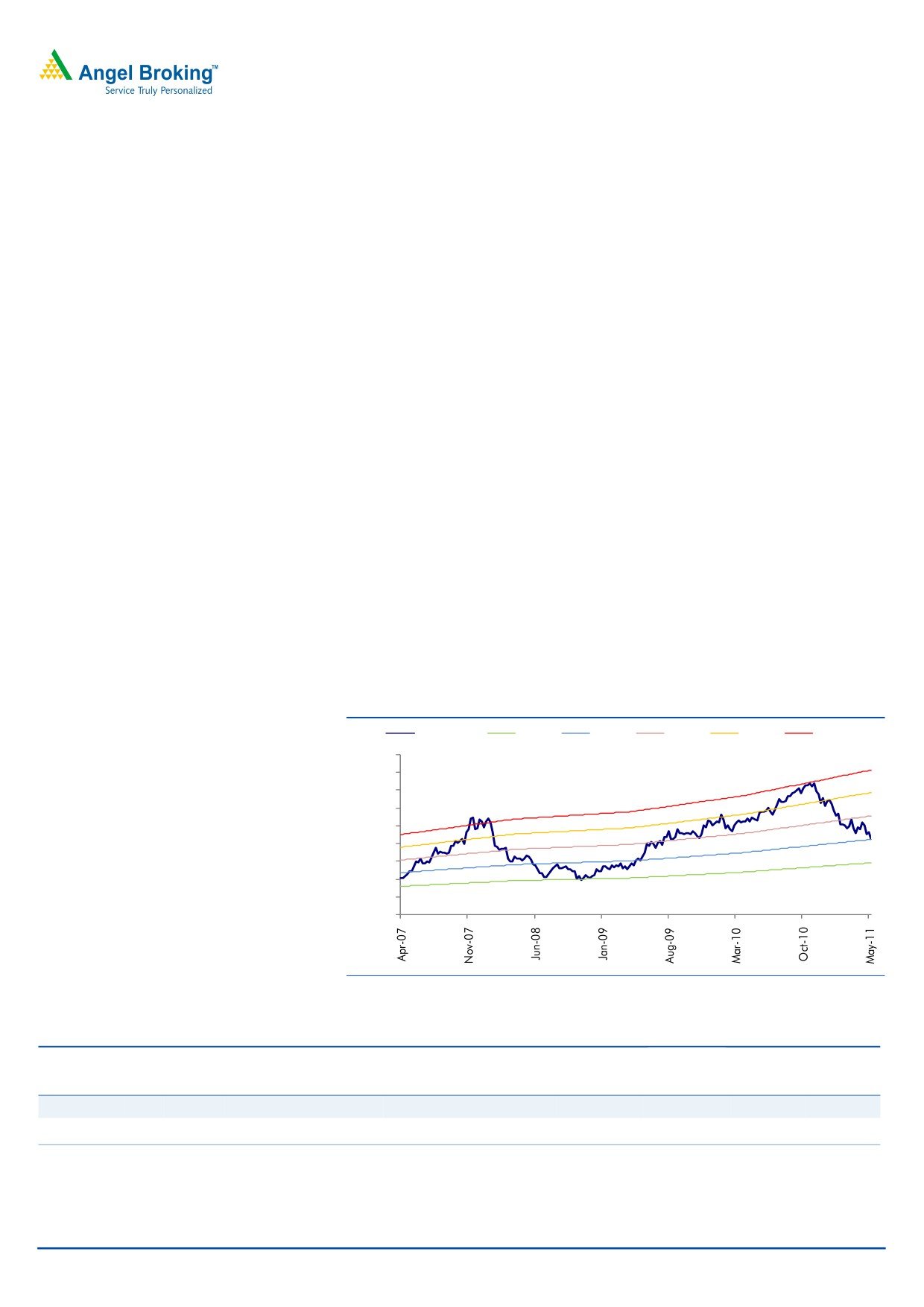

Exhibit 3: Healthy yoy loan growth

Exhibit 4: Disbursements and sanctions

30.00

Disbursements (`cr)

Sanctions (`cr)

24.94

24.68

23.36

23.94

25.00

80,000

20.00

17.49

60,000

15.00

40,000

10.00

20,000

5.00

0

0.00

2007

2008

2009

2010

9MFY109MFY11

2007

2008

2009

2010

2011

Source: RHP, Angel Research

Source: RHP, Angel Research

Loan growth has been healthy on a yearly basis, and seeing the large demand

supply gap in power requirements and increasing needs for power financing, we

expect loan growth to sustain at 25% levels for FY2013. The disbursement and

sanctions over FY2007-9MFY2011 have also been healthy (`22,270cr worth

disbursements and `61,077 worth sanctions done in 9MFY2011).

May 10, 2011

3

Power Finance Corporation | FPO Note

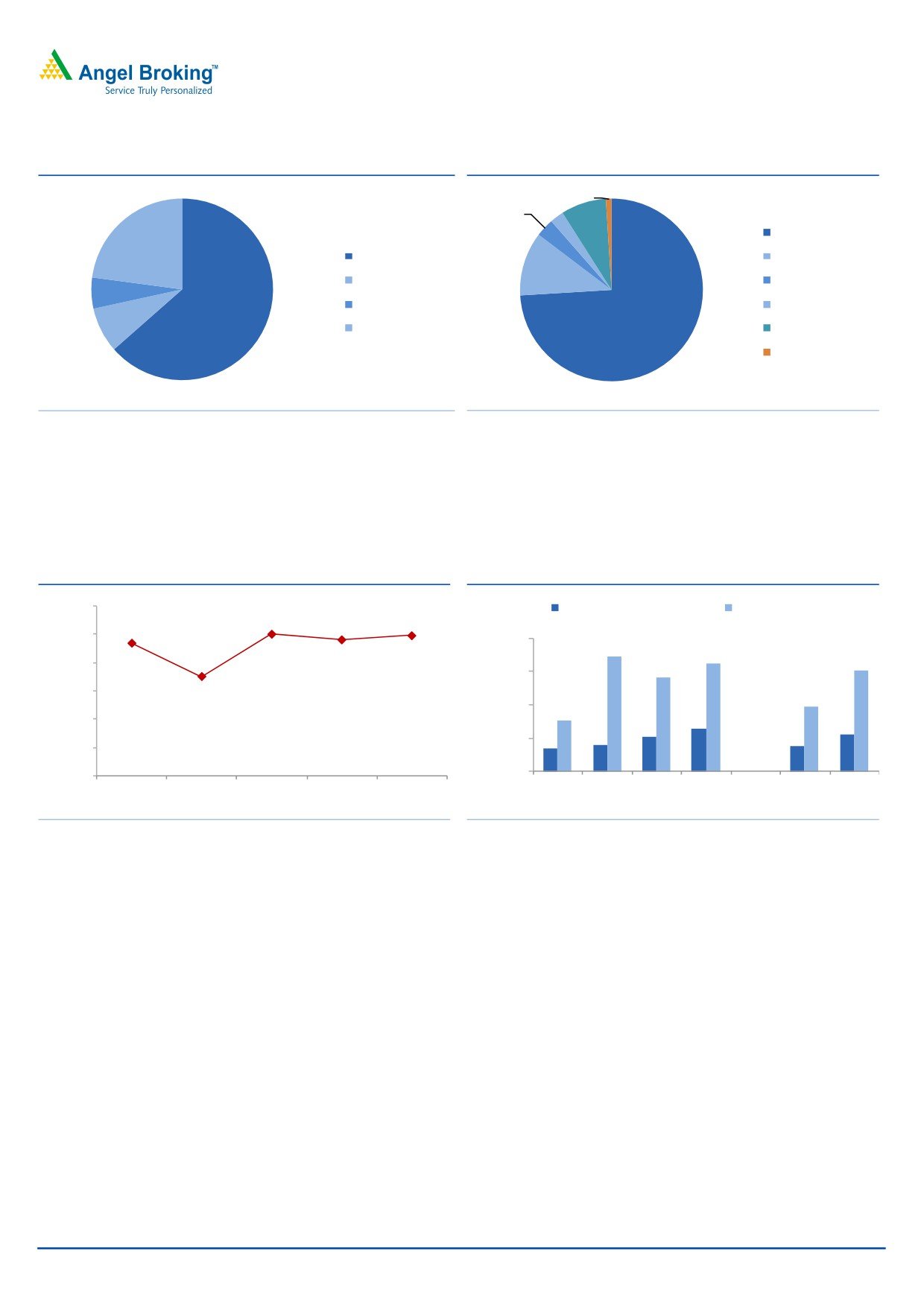

Exhibit 5: Outstanding loan mix* - Sector wise

Exhibit 6: Outstanding loan mix* - Project wise

3%

7%

12%

8%

State Sector

Generation

Central Sector

20%

TnD

Joint Sector

Others

65%

Private Sector

85%

Source: Company, Angel Research; Note: *As of December 31, 2010

Source: Company, Angel Research; Note: *As of December 31, 2010

Outstanding loans as of December 31, 2010, stood at `92,040cr, with higher

concentration to public sector units (~93% of total loans outstanding) and to

generation projects (85% of total loans outstanding).

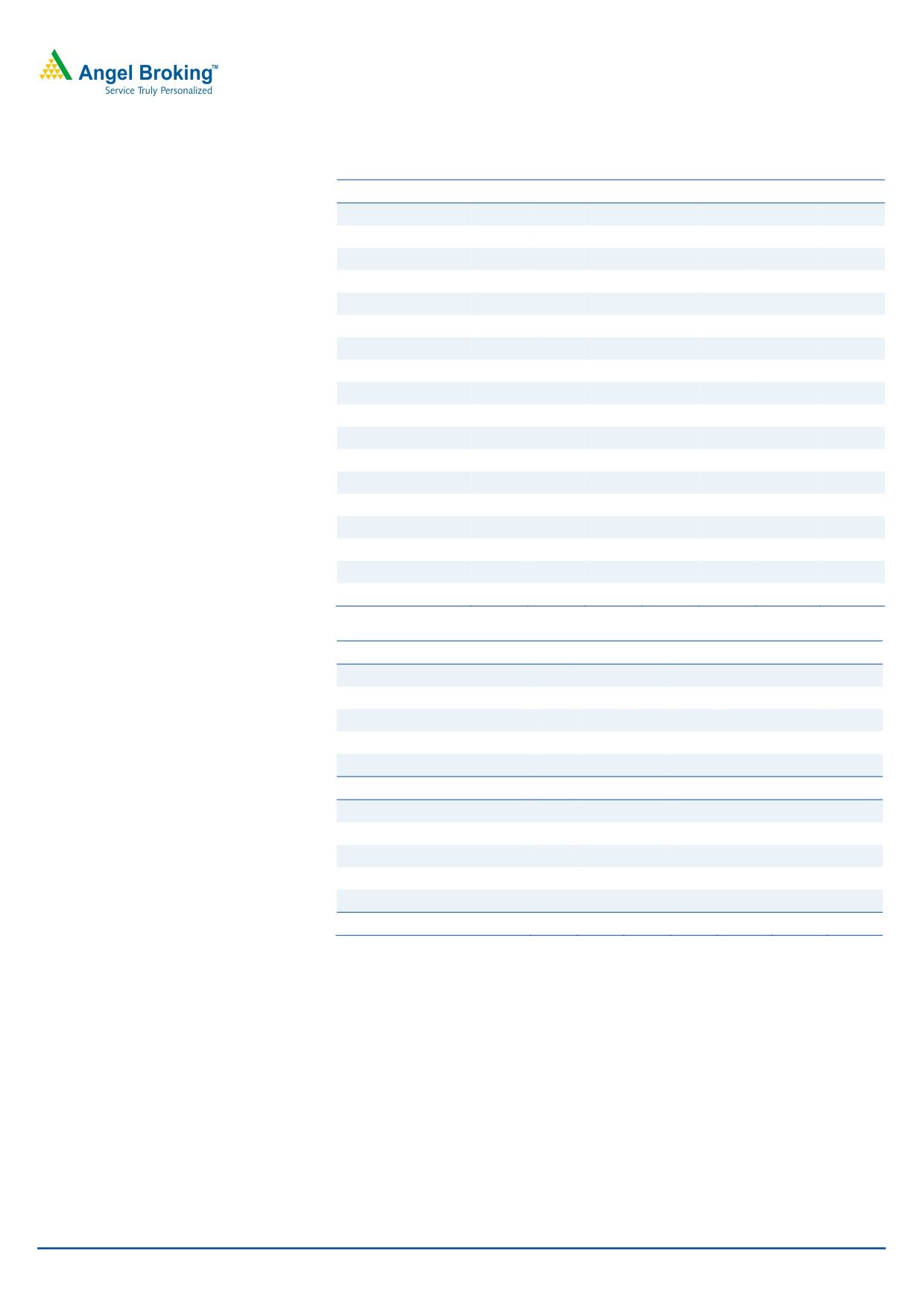

Exhibit 7: Borrowing profile (%)

Borrowing Profile (%)

4QFY2009

1QFY2010 2QFY2010 3QFY2010 4QFY2010 1QFY2011 2QFY2011 3QFY2011

Bonds

70.7

71.4

73.7

73.0

69.5

74.1

73.7

73.6

Term Loans

26.6

26.4

24.5

25.2

27.1

25.4

25.9

25.1

Short-term Loans

2.7

2.1

1.8

1.7

3.5

0.5

0.3

1.3

Total

100

100

100

100

100

100

100

100

Rupee Denominated

95.0

95.4

97.3

97.5

95.9

96.1

94.8

95.0

Foreign Currency Loans

5.0

4.6

2.7

2.5

4.1

3.9

5.2

5.0

Total

100

100

100

100

100

100

100

100

Source: Company, Angel Research

Healthy profitability

Structurally, as is the case with several other niche NBFCs, regulatory arbitrage vis-

à-vis banks allows PFC to earn healthy NIMs, further aided by its close-to-

sovereign credit rating. Moreover, reduction in risk weightage from 100% to 20%

due to the IFC status makes funding from banks ~100bp cheaper. Cyclically, we

have conservatively factored in a 50bp NIM compression over FY2012-13E due to

rising funding costs. That said, the recent underperformance of the stock, in our

view, over discounted the ~75bp sequential NIM compression in 4QFY2011

(calculated), which was partly on account of large bond and ECB issuances (issue

costs accounted upfront) as well as large disbursements towards the quarter-end.

With 87% of loans to public sector utilities so far, asset quality has not been an

issue irrespective of the financial health of the utilities. In our view, the scenario

pertaining to PSU borrowers is likely to remain unchanged, further aided by the

likely benign approach towards any required restructuring and NPA recognition

pertaining to such loans, given quasi-sovereign status as well as systemic issues of

the alternative. The increasing proportion of private sector loan sanctions, in our

view, does increase the risk profile. Though, in any case, this is unlikely to manifest

May 10, 2011

4

Power Finance Corporation | FPO Note

in the next few years, when most loans relate to projects under implementation, the

substantial valuation discount to PFC’s historical valuation range provides further

margin of safety.

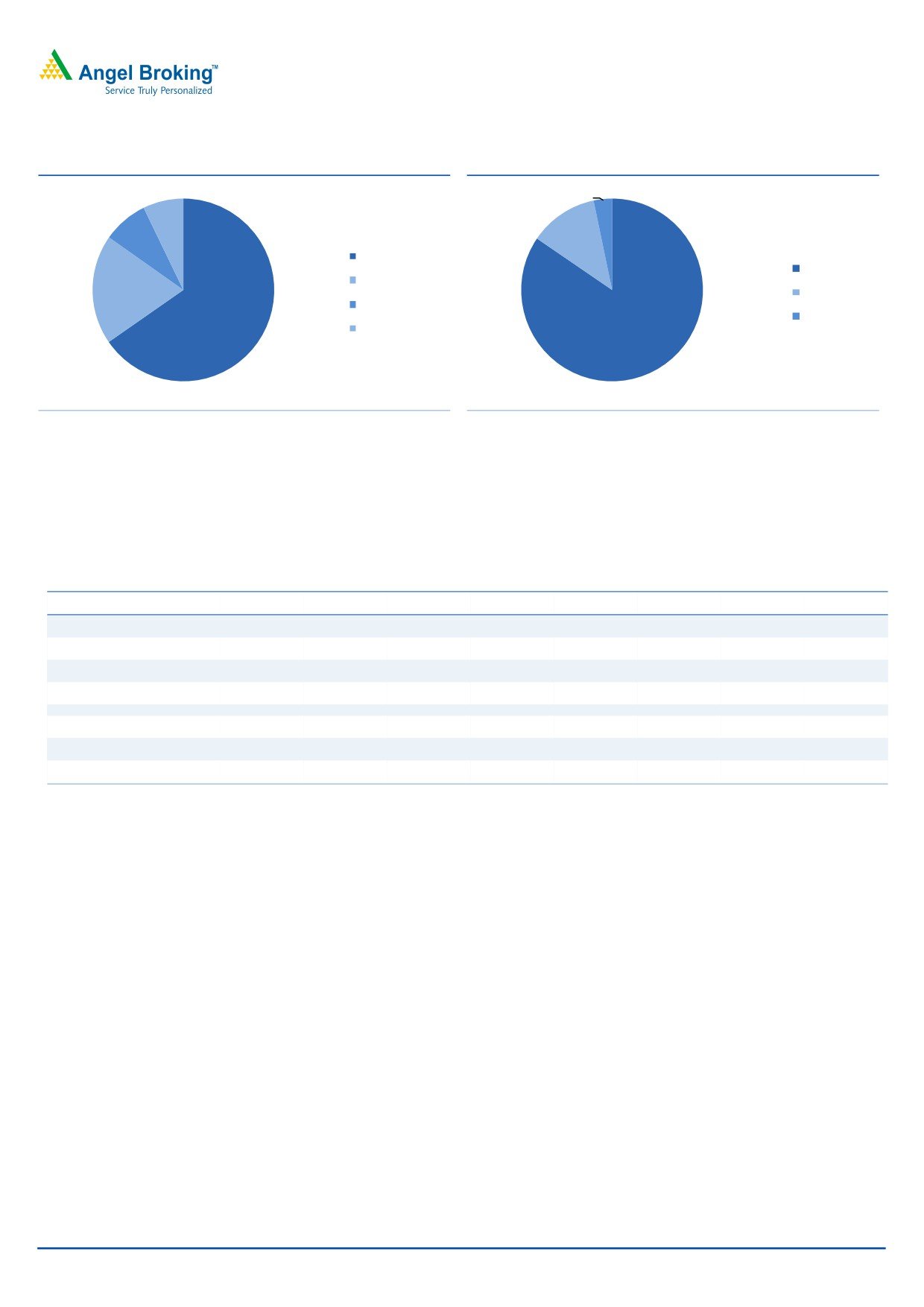

Overall, driven by 25% loan growth and NIM of 3.3% by FY2013E, we estimate

PAT CAGR of 17.3% (EPS CAGR 0f 9.4%) over FY2011-13. PFC has delivered

healthy ROAs and ROEs over FY2007-10. Going forward, we expect ROAs and

ROEs to sustain at 2.4% and 15.8%, respectively.

Exhibit 8: Healthy NIMs and...

Exhibit 9: ...low C-I* ratio leading to higher profitability

4.0

6.0

5.0

3.8

4.0

3.6

3.0

3.4

2.0

3.2

1.0

3.0

0.0

FY07

FY08

FY09

FY10

FY11E FY12E FY13E

FY07

FY08

FY09

FY10

FY11E FY12E FY13E

Source: Company, Angel Research

Source: Company, Angel Research, Note * Cost-to-income ratio

Exhibit 10: Near negligible NPAs for PFC

Gross NPA as on

2006

2007

2008

2009

2010 9MFY11

Public sector (`cr)

31.7

25.9

4.2

4.2

4.2

4.2

Private sector (`cr)

59.3

16.4

8.9

8.9

8.9

8.9

Total

909.9

423.1

131.6

131.6

131.6

131.6

GNPA ratio (Public, %)

0.01%

0.01%

0.00%

0.00%

0.00%

0.00%

GNPA ratio (Private, %)

0.21%

0.05%

0.02%

0.02%

0.02%

0.01%

GNPA Total (%)

0.26%

0.10%

0.03%

0.02%

0.02%

0.01%

Source: RHP, Angel Research

Exhibit 11: Healthy ROAs...

Exhibit 12: ...and healthy ROEs

(%)

(%)

4.0

25.0

3.2

3.1

18.3

18.1

3.2

2.7

20.0

17.3

16.6

2.6

15.8

2.4

2.4

2.4

2.4

15.0

11.9

11.0

1.6

10.0

0.8

5.0

0.0

0.0

FY07

FY08

FY09

FY10

FY11E FY12E FY13E

FY07

FY08

FY09

FY10

FY11E FY12E FY13E

Source: Company, Angel Research

Source: Company, Angel Research

May 10, 2011

5

Power Finance Corporation | FPO Note

IFC status to aid in capitalising on available financing

opportunities in the power sector

PFC before being categorised as an IFC was categorized as a loan company (a

category of NBFCs). Thus, loans given to PFC (despite it having AAA rating

accorded by CRISIL and CARE) were assigned a 100% risk weightage, as a bank’s

claims on all categories of NBFCs except AFCs and IFCs are uniformly risk

weighted at 100%.

However, bank claims on corporates, asset finance companies (AFCs) IFCs

(NBFC-IFC) are risk weighted as per the ratings assigned by rating agencies

registered with the SEBI and accredited by the RBI. Hence, post conferral of IFC

status to PFC (July 28, 2010), the risk weightage assigned to loans given to PFC by

banks stands at 20%, allowing banks to keep aside lower capital (1/5th of the

previous amount required) to meet capital adequacy norms and, hence, employ

higher leverage to increase their ROAs. These gains, which accrue to banks in

terms of higher returns, will enable PFC relatively easier and cheaper access to

funds than what it had when it was classified as a loan company. In our view, the

benefit to PFC in the form of lower cost of funds from banks works out to ~100bp.

The IFC status also makes PFC eligible to raise, under the automatic route, ECBs

up to US$500mn each fiscal, subject to the aggregate outstanding ECBs not

exceeding 50.0% of the net worth. With foreign currency loans coming at a

cheaper cost than domestic borrowings, we expect PFC to maximise this advantage

by raising more foreign currency borrowings in future. As of December 31, 2010,

foreign currency borrowings stood at

`3,813cr

(4.0% of total borrowings).

The company recently availed (February 2011) of a JPY, denominated foreign

currency loan equivalent to US$260mn

Exhibit 13: Concentration of credit / investment

NBFC Type

Loan company

IFC

Lending ceilings

Lending to any single borrower

15% (+ 5*)

25%

Lending to any single group of borrowers

25% (+ 10*)

40%

Investing ceilings

Investing in shares of a company

15% (+ 5*)

15% (+ 5*)

Investing in shares of a single group of companies

25% (+ 10*)

25% (+ 10*)

Loans and investment taken together

Lending and investing to single party

25% (+ 5*)

30%

Lending and investing to single group of parties

40% (+ 10*)

50%

Source: RHP, Angel Research Note: * Additional exposure applicable in case of infrastructure loans

Classification of PFC as an IFC will permit banks to take an exposure of up to 20%

(15% for NBCFs engaged in infra lending) of their capital funds to PFC. Also, as a

government-owned NBFC, loans made to central and state entities in the power

sector (92.9% of total loan portfolio as of December 31, 2010) are currently

exempt from the RBI's prudential lending norm (0.4% provisioning for standard

assets) that are applicable to other non-government owned NBFCs (hit of ~`340cr

to P&L if this exemption is withdrawn).

May 10, 2011

6

Power Finance Corporation | FPO Note

PFC, now being classified as an IFC, is also allowed to issue infrastructure bonds

that offer tax benefits to investors (currently these bonds can only be issued by IFCI,

LIC, IDFC and IFCs). The company recently raised `235cr via issue of these

infrastructure bonds (March 31, 2011).

Investment risks

Historically, PFC has witnessed superior asset quality, which is reflected in the near

zero NPAs that the company has maintained on its loan portfolio. Although, state

electricity boards, to which PFC has the highest exposure, have been in poor health

for a while now, there default seems unlikely given their quasi-sovereign status;

however, the risk of restructuring cannot be ruled out. As of December 31, 2010,

the top 10 borrowers accounted for 54.1% of the loan portfolio, indicating high

borrower concentration. A single default or restructure on these accounts could

send the NPAs soaring and stem asset-quality concerns, which the company has

successfully managed to evade until now.

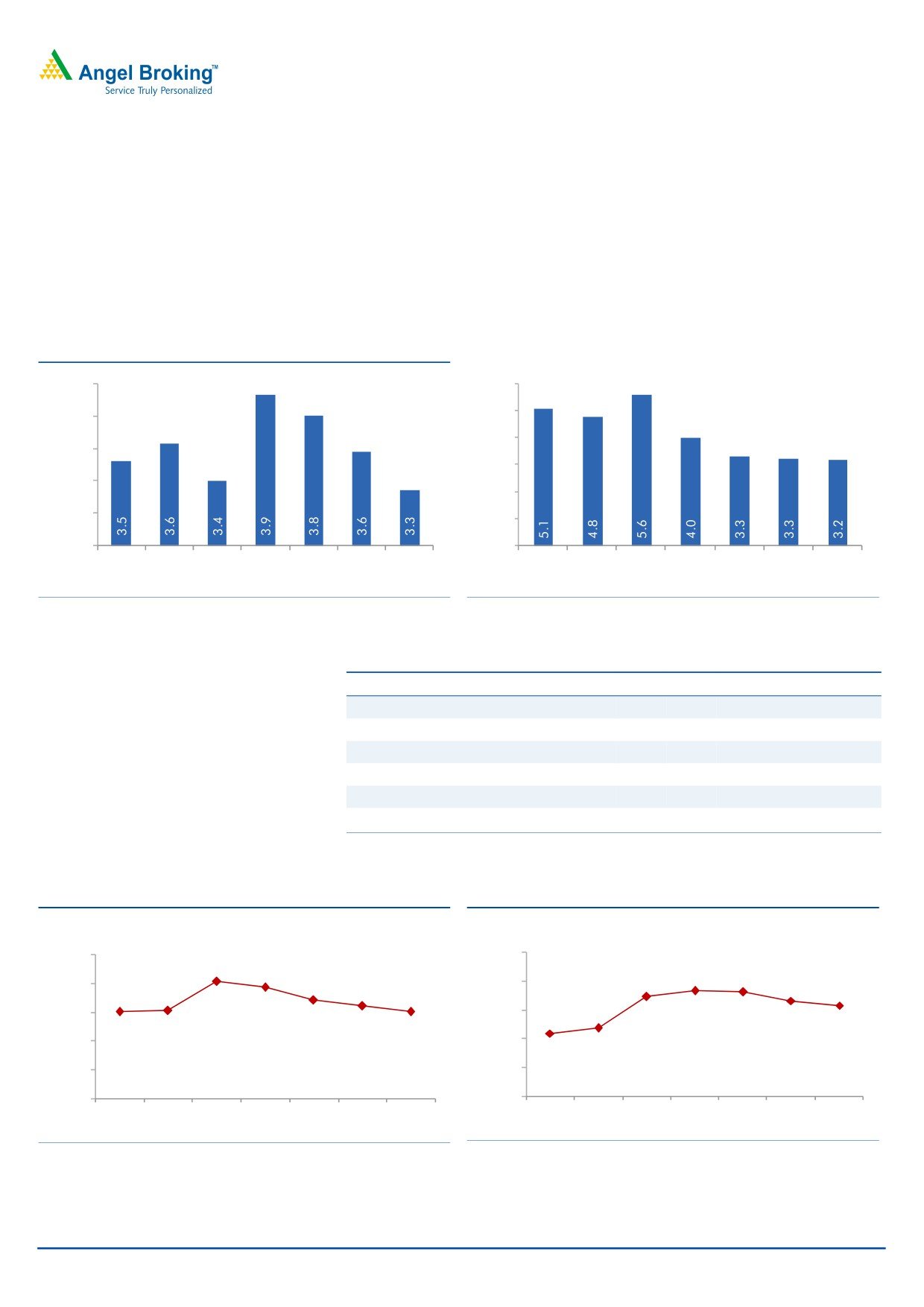

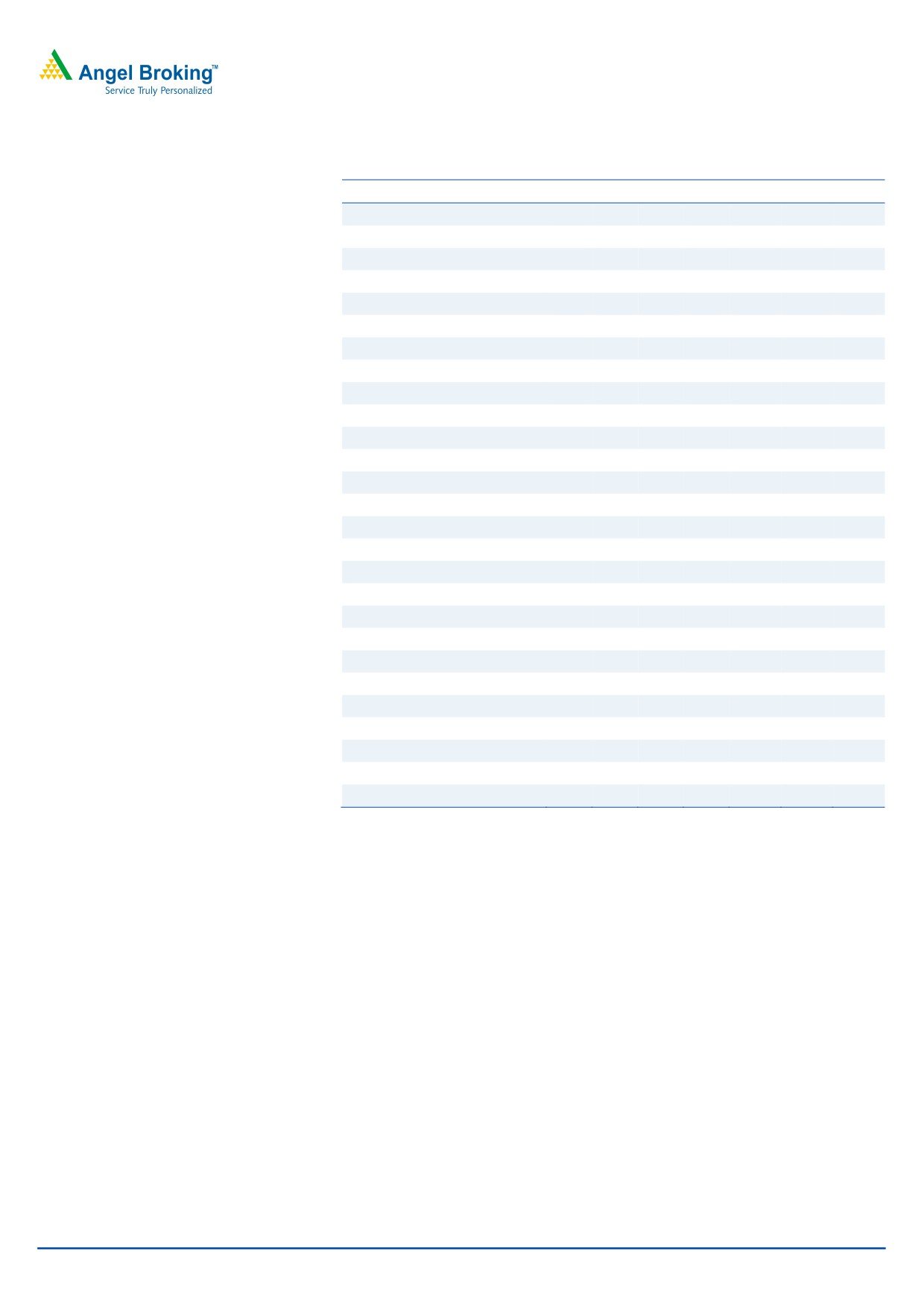

Outlook and valuation

At the CMP, the stock is trading at 1.1x FY2013 P/ABV. Historically, the stock has

traded in at 1.2-2.2x one-year forward ABV with a median of 1.75x. Considering

asset-quality issues that could creep up as exposure to private sector increases,

we have assigned an FY2013E P/ABV multiple of 1.4x, 20% lower than PFC’s

median P/ABV multiple since listing. The resultant target price of `254 implies an

upside of 25% from the upper end of the price band. Hence, we recommend

Subscribe to the issue.

Exhibit 14: P/ABV band

Price (`)

0 .9x

1 .3x

1 .7x

2 .1x

2.50

450

400

350

300

250

200

150

100

50

-

Source: Company, Angel Research

Exhibit 15: Reco summary

FY11E-13E

Tgt. Price

FY2013E

FY2013E Tgt.

FY2013E P/E

FY2013E FY2013E

Comp

Reco. CMP (`)

Upside (%)

EPS CAGR

(`)

P/ABV (x)

P/ABV (x)

(x)

RoA (%)

RoE (%)

(%)

PFC

Buy

203$

254

25.2

1.1

1.4

7.4

9.4

2.4

15.8

REC*

NA

222

NA

NA

1.3

NA

6.4

16.3

3.0

21.4

Source: Company, Angel Research; Note * Bloomberg estimates for REC, $ At the upper end of the issue

May 10, 2011

7

Power Finance Corporation | FPO Note

Income statement

Y/E March (` cr)

FY07

FY08

FY09

FY10

FY11

FY12E

FY13E

Net Interest Income

1,417

1,758

1,994

2,874

3,466

4,056

4,733

- YoY Growth (%)

16.5

24.1

13.4

44.1

20.6

17.0

16.7

Other Income

176

119

118

266

202

240

300

- YoY Growth (%)

46.2

(32.0)

(0.9)

124.5

(23.8)

18.8

25.0

Operating Income

1,593

1,878

2,113

3,140

3,668

4,296

5,033

- YoY Growth (%)

19.2

17.9

12.5

48.6

16.8

17.1

17.1

Operating Expenses

81

90

118

126

121

140

161

- YoY Growth (%)

13.5

10.9

31.6

6.4

(3.5)

15.0

15.0

Pre - Provision Profit

1,512

1,788

1,994

3,014

3,547

4,157

4,872

- YoY Growth (%)

19.5

18.3

11.6

51.1

17.7

17.2

17.2

Prov. and Cont.

0

-

4

0

3

6

8

- YoY Growth (%)

(83)

(100)

NA

(89)

670

76

44

Profit Before Tax

1,512

1,788

1,990

3,013

3,543

4,151

4,864

- YoY Growth (%)

19.5

18.3

11.3

51.4

17.6

17.1

17.2

Provision for Taxation

525

581

21

656

925

1,077

1,262

- as a % of PBT

34.8

32.5

1.0

21.8

26.1

26.0

26.0

PAT

986

1,207

1,970

2,357

2,619

3,073

3,601

- YoY Growth (%)

1.6

22.4

63.2

19.7

11.1

17.4

17.2

Balance sheet

Y/E March (` cr)

FY07

FY08

FY09

FY10

FY11

FY12E FY13E

Share Capital

1,148

1,148

1,148

1,148

1,148

1,320

1,320

Reserve & Surplus

8,677

9,249 11,269 12,184

14,264

19,904

22,656

Borrowings

33,584 40,648 52,160 67,108

85,591

104,804

133,508

- Growth (%)

24.7

21.0

28.3

28.7

27.5

22.4

27.4

Other Liabilities & Provisions

2,129

2,443

3,586

4,375

5,804

7,480

9,401

Total Liabilities

45,538 53,487 68,163 84,815 106,806

133,508

166,885

Investments

59

66

36

31

54

67

84

Advances

43,919 51,574 64,436 79,856

99,562

124,453

155,566

- Growth (%)

23.3

17.4

24.9

23.9

24.7

25.0

25.0

Fixed Assets

81

77

75

75

77

96

120

Other Assets

1,478

1,770

3,616

4,853

7,114

8,892

11,115

Total Assets

45,538 53,487 68,163 84,815 106,806

133,508

166,885

May 10, 2011

8

Power Finance Corporation | FPO Note

Key Ratios

Year end March

FY07

FY08

FY09

FY10 FY11

FY12E

FY13E

Per Share Data (`)

EPS

8.6

10.5

17.2

20.5

22.8

23.3

27.3

ABVPS ( 75% Coverage for NPAs)

85.6

90.6

108.2

116.1

134.3

160.8

181.6

DPS

2.3

3.5

4.5

5.5

3.5

4.5

5.5

Profitability ratios (%)

NIMs

3.5

3.6

3.4

3.9

3.8

3.6

3.3

ROA

2.4

2.4

3.2

3.1

2.7

2.6

2.4

ROE

11.0

11.9

17.3

18.3

18.1

16.6

15.8

Asset Quality (%)

Gross NPAs

0.03

0.02

0.02

0.02

0.02

0.02

0.02

Net NPAs

0.00

0.00

0.01

0.01

0.01

0.01

0.01

$

Valuation Ratios

PER (x)

23.6

19.3

11.8

9.9

8.9

8.7

7.4

P/ABVPS (x)

2.4

2.2

1.9

1.7

1.5

1.3

1.1

Dividend Yield

1.1

1.7

2.2

2.7

1.7

2.2

2.7

DuPont Analysis (%)

NII

3.5

3.6

3.3

3.8

3.6

3.4

3.2

(-) Prov. Exp.

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Adj NII

3.5

3.6

3.3

3.8

3.6

3.4

3.1

Other Inc.

0.4

0.2

0.2

0.3

0.2

0.2

0.2

Op. Inc.

3.9

3.8

3.5

4.1

3.8

3.6

3.3

Opex

0.2

0.2

0.2

0.2

0.1

0.1

0.1

PBT

3.7

3.6

3.3

3.9

3.7

3.5

3.2

Taxes

1.3

1.2

0.0

0.9

1.0

0.9

0.8

ROA

2.4

2.4

3.2

3.1

2.7

2.6

2.4

Leverage

4.6

4.9

5.3

5.9

6.6

6.5

6.6

ROE

11.0

11.9

17.3

18.3

18.1

16.6

15.8

Note: $ Valuations at the upper price band

May 10, 2011

9

Power Finance Corporation | FPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

May 10, 2011

10