Please refer to important disclosures at the end of this report

1

PB Fintech is India's leading online platform for insurance and lending products.

The company provides convenient access to insurance, credit, and other

financial products and aims to create awareness in India about the financial

impact of death, disease,

and damage. The Company has two business

segments (1) Policybazaar & (2) Paisabazaar.

Positives: (a) The Company has strong brand recall (b)

High renewal rates

providing clear visibility into future business and delivering superior economics

(b) Policybazaar is india’s largest online platform for insurance (c)

Experienced

Board and senior management team.

Investment concerns: (a) PB Fintech is making continuous losses on bottom-

line

front, hence profit concerns remain; (b) the company operate in dynamic a

nd

competitive online fintech industries, which makes it difficult to predict our future

prospects.

Outlook & Valuation: In terms of valuations, the post-

issue FY2021 EV/Sales

works out 47.6x to (at the upper end of the issue price band), which is high

considering ’s historical financial performance (making continu

ous losses on

bottom-line front).

Considering the company's overall business model and

higher valuation, we recommend a NEUTRAL rating on the issue.

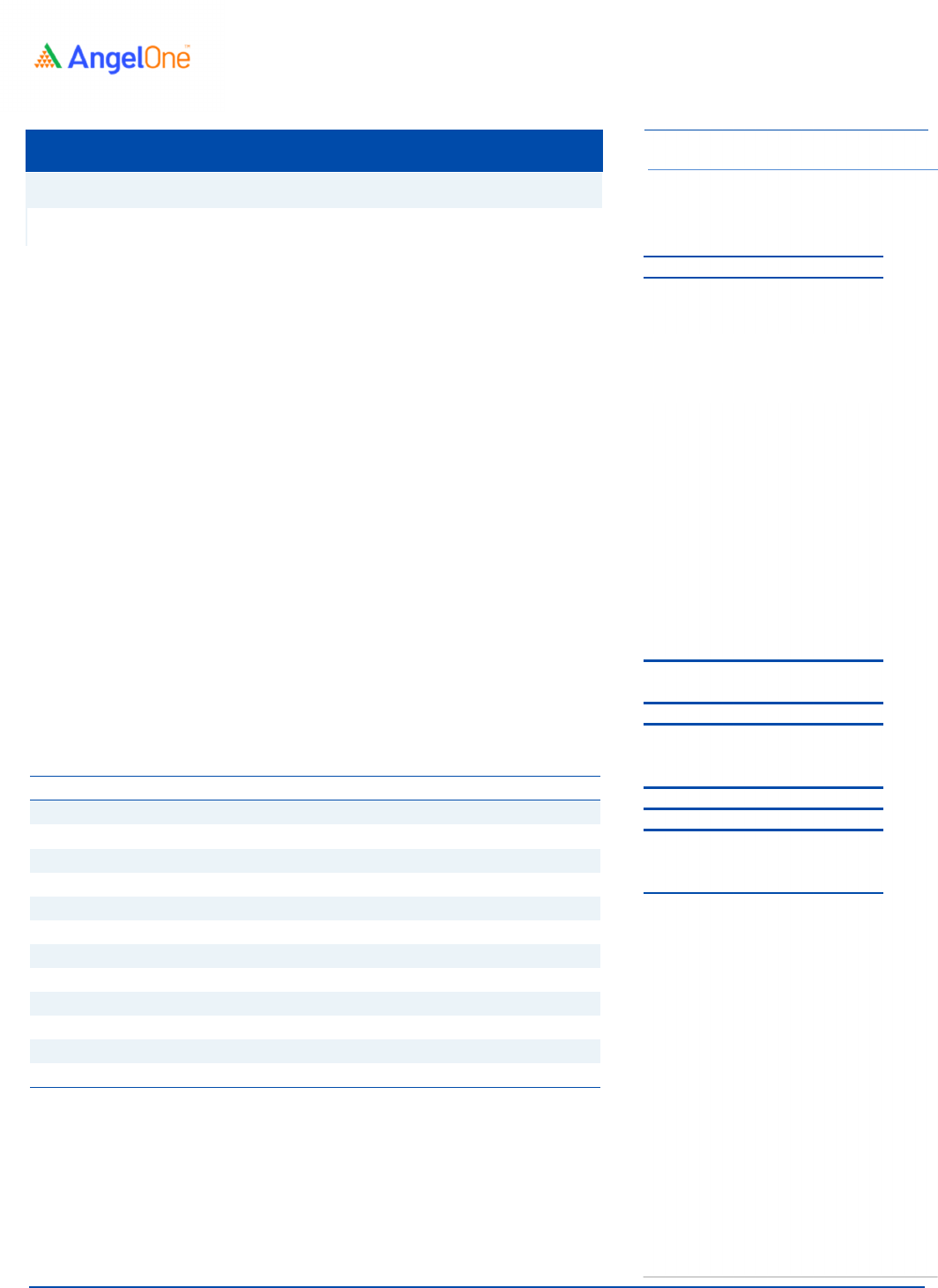

Key Financials

Y/E March (Rs cr)

FY2019

FY2020

FY2021

1QFY21

1QFY22

Net Sales

492

771

887

175

238

% chg

-

56.7

15.0

-

-

Net Profit

(347)

(304)

(150)

(60)

(111)

% chg

-

-

-

-

-

OPM (%)

(68.3)

(41.5)

(18.0)

(34.0)

(49.8)

EPS (Rs)

(8.4)

(7.4)

(3.7)

-

-

P/E (x)

-

-

-

-

P/BV (x)

82.2

31.8

20.2

-

RoE (%)

-

-

-

-

RoCE (%)

-

-

-

-

EV/Sales (x)

81.3

51.0

43.4

-

EV/EBITDA (x)

-

-

-

-

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

Neutral

Issue Open: Nov 01, 2021

Issue Close: Nov 03, 2021

Offer for Sale: `1,960cr

QIBs 75%

Non-Institutional 15%

Retail 10%

Promoters 0.0%

Public 95.0%

Others 5.0%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `89.9cr

Issue size (amount):

`5,710cr

Price Band: `940-980

Lot Size: 15shares

Post-issue mkt.cap: `40,406*– 44,051cr**

Public holding Pre-Issue: 94.5%

Public holding Post-Issue: 95.0%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `3,750cr

Issue Details

Face Value:

`2

Present Eq. Paid up Capital: `82.5cr

Amarjeet S Maurya

+022 39357600, Extn: 6831

amarjeet.maurya@angelbroking.com

PB Fintech Limited

IPO Note |

Online

October, 29, 2021

PB Fintech Ltd |

IPO Note

October 29, 2021

2

Company background

PB Fintech is India's leading online platform for insurance and lending products. The

company provides convenient access to insurance, credit, and other financial

products and aims to create awareness in India about the financial impact of death,

disease, and damage. The Company has two business segments (1) Policybazaar &

(2) Paisabazaar.

(1) In 2008, PB Fintech launched Policybazaar aimed at catering to consumers who

need more information, choice, and transparency in insurance policies. Policybazaar

is an online platform for consumers and insurer partners to buy and sell insurance

products. 51 insurer partners offered over 390 term, health, motor, home, and travel

insurance products on the policy bazaar platform, as of September 2021.

Policybazaar offers its users with i) pre-purchase research, ii) purchase, including

application, inspection, medical check-up, and payment; and iii) post-purchase

policy management, including claims facilitation, renewals, cancellations, and

refunds. The company's technology solutions are focused on automation and self-

service-driven consumer experiences requiring minimal human intervention.

According to Frost & Sullivan, Policybazaar was India's largest digital insurance

marketplace with a 93.4% market share based on the number of policies sold in

Fiscal 2020. Also, in the same year, 65.3% of all digital insurance sales in India by

volume were transacted through Policybazaar.

(2) PB Fintech also launched Paisabazaar in 2014 intending to provide ease,

convenience, and transparency in selecting a variety of personal loans and credit

cards for the consumers. The company has partnered with 56 large banks, NBFCs,

and fintech lenders offering a wide choice of products to consumers across personal

credit categories, including personal loans, business loans, credit cards, home loans,

and loans against property. According to Frost & Sullivan, Paisabazaar was India's

largest digital consumer credit marketplace with a 51.4% market share, based on

disbursals in Fiscal 2020.

PB Fintech Ltd |

IPO Note

October 29, 2021

3

Issue details

PB Fintech is raising `5,710cr through fresh issue (`3,750cr) and

offer for sale by

the company’s shareholder of `1,960cr.

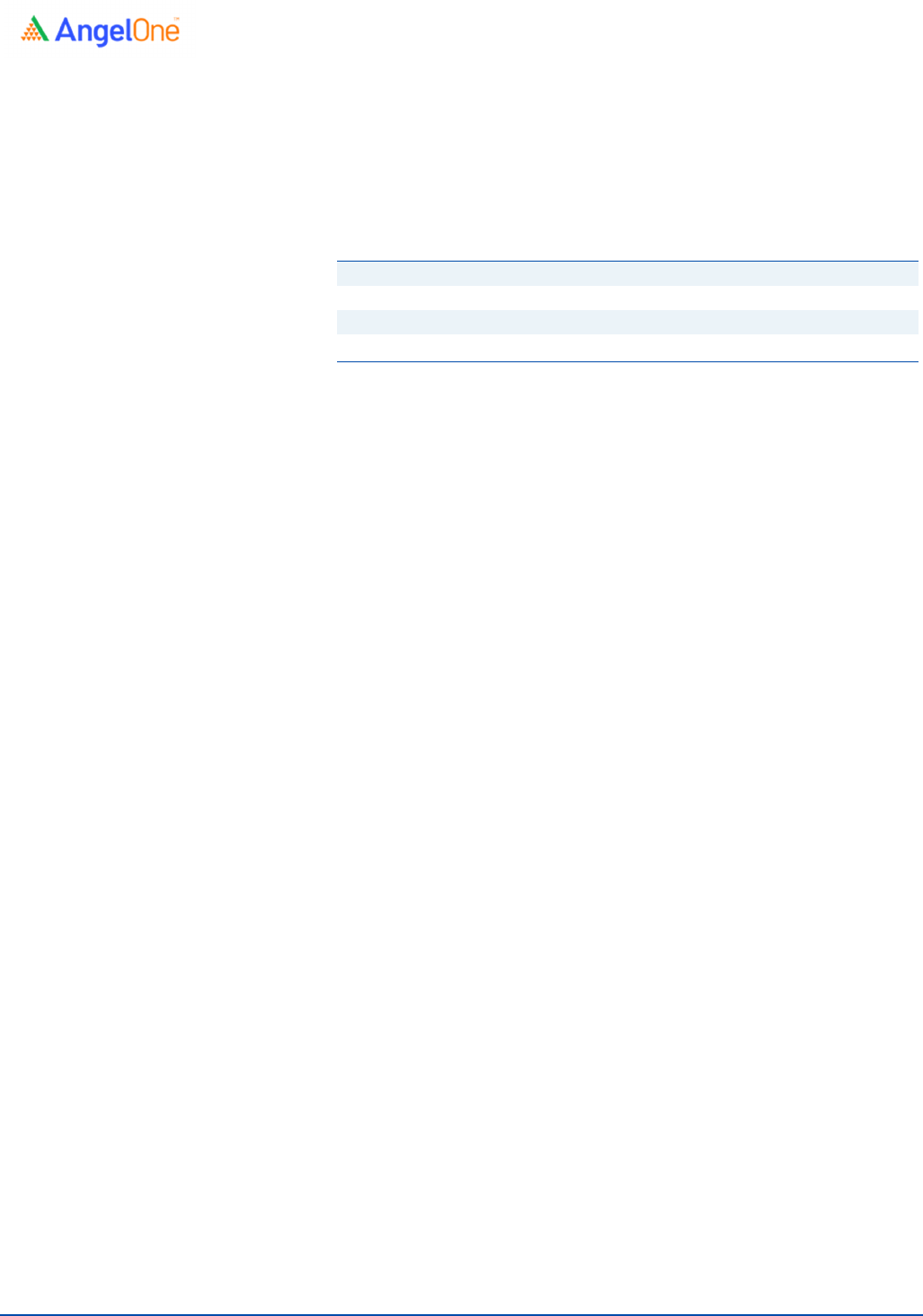

Exhibit 1: Pre and post IPO shareholding pattern

No of shares (Pre-issue) % (Post-issue)

%

Promoter - 0.

0%

- 0.

0%

Public

388,697,000

94.5%

426,962,306

95.0%

Other 22,537,500 5.5%

22,537,500

5.0%

Total

411,234,500

100.0%

449,499,806

100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the Offer

For enhancing visibility and awareness of company’s brands, including

but not limited to “Policybazaar” and “Paisabazaar” - `1500cr

New opportunities to expand company’s consumer base including offline

presence - `375cr

Funding strategic investments and acquisitions - `600cr

Expanding presence outside India - `3,75cr and

General corporate purposes.

PB Fintech Ltd |

IPO Note

October 29, 2021

4

Exhibit 2: Consolidated Income Statement

Y/E March (` cr)

FY2019

FY2020 FY2021

Net Sales

492

771

887

% chg

56.7

15.0

Total Expenditure

828

1,091

1,046

Personnel

398

521

554

Others Expenses

431

570

492

EBITDA

(336)

(320)

(160)

% chg (4.8) (50.1)

(% of Net Sales)

(68.3)

(41.5) (18.0)

Depreciation& Amortisation

30

47

41

EBIT

(366)

(367)

(201)

% chg

0.2

(45.2)

(% of Net Sales)

(74.4)

(47.6) (22.7)

Interest & other Charges

8

12

12

Other Income

37

84

71

(% of PBT)

(10.8)

(28.6) (49.9)

Share in profit of Associates

-

- -

Recurring PBT

(337)

(295)

(142)

% chg (12.6) (51.9)

Tax

9

9

8

(% of PBT)

(2.8)

(3.1) (5.9)

PAT (reported)

(347)

(304)

(150)

Basic EPS (`)

(8.4)

(7.4) (3.7)

% chg (12.3) (50.6)

Source: Company, Angel Research

PB Fintech Ltd |

IPO Note

October 29, 2021

5

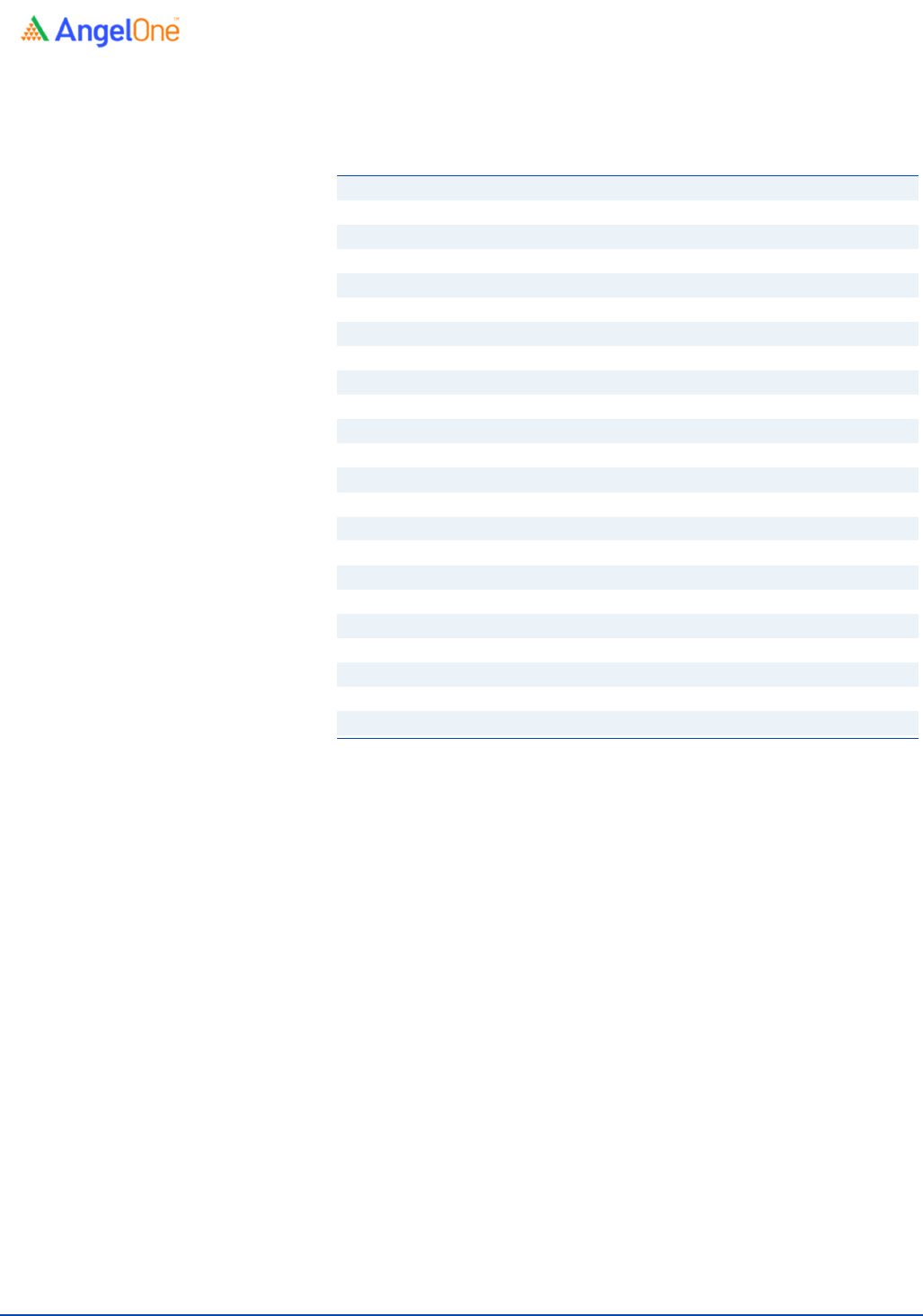

Consolidated Balance Sheet

Y/E March (` cr) FY2019 FY2020 FY2021

SOURCES OF FUNDS

Equity Share Capital

1

1

1

Reserves& Surplus

489

1,265

1,991

Shareholders Funds

490

1,266

1,992

Total Loans

89

108

109

Deferred Tax Liability

-

-

-

Total Liabilities

579

1,374

2,100

APPLICATION OF FUNDS

Net Block

119

147

125

Capital Work-in-Progress

-

-

-

Investments

125

2

138

Current Assets

507

1,427

2,068

Inventories

-

-

-

Sundry Debtors

131

179

173

Cash

267

1,106

1,810

Loans & Advances

16

25

19

Other Assets

93

118

66

Current liabilities

172

202

230

Net Current Assets

335

1,225

1,838

Deferred Tax Asset

-

-

-

Total Assets

579

1,374

2,100

Source: Company, Angel Research

PB Fintech Ltd |

IPO Note

October 29, 2021

6

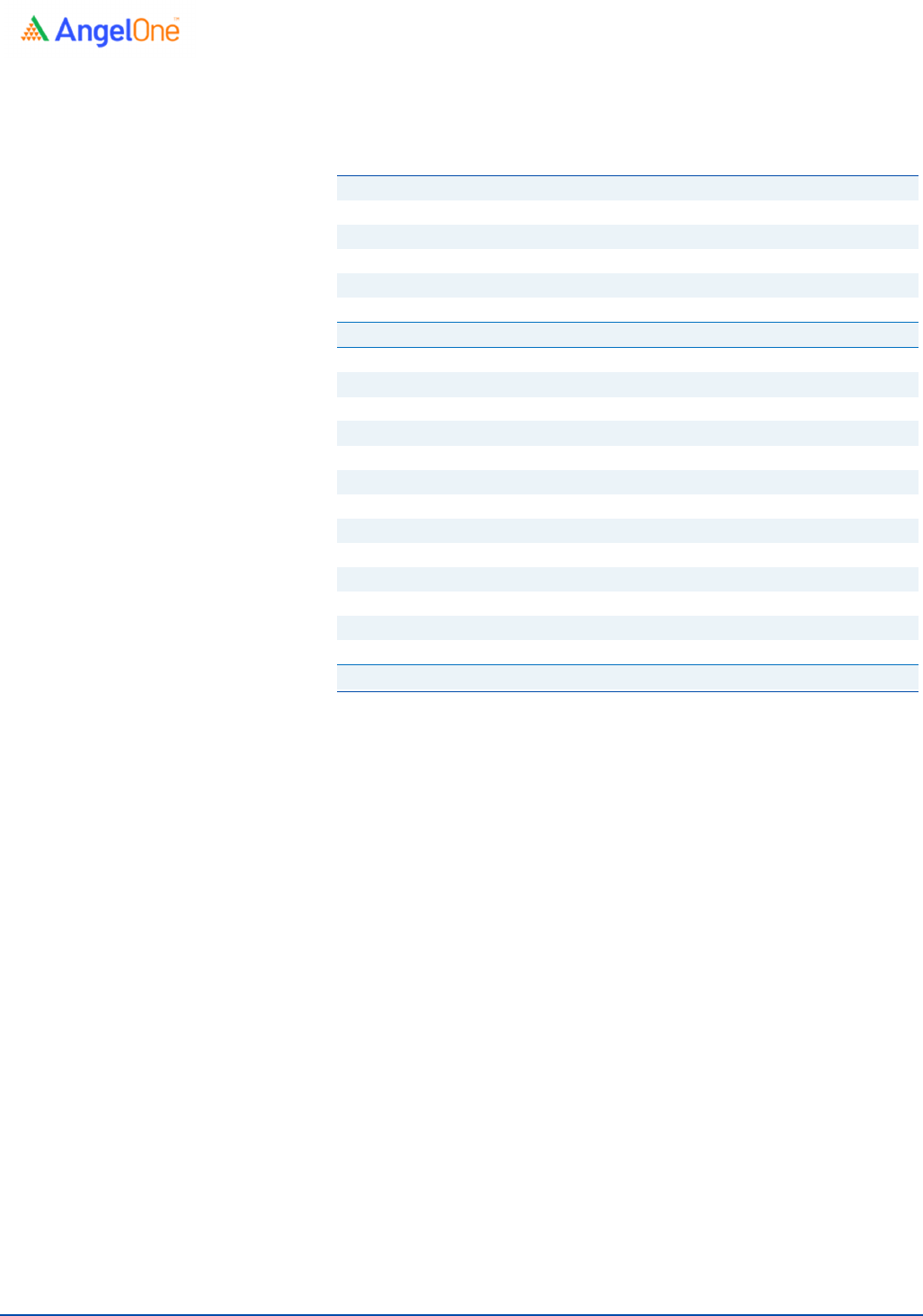

Consolidated Cash Flow Statement

Y/E March (` cr)

FY2019 FY2020 FY2021

Profit before tax

(337)

(295)

(142)

Depreciation

30

47

41

Change in Working Capital

33

(24)

39

Interest / Dividend (Net)

7

2

(24)

Direct taxes paid

(35)

(39)

48

Others

20

(55)

65

Cash Flow from Operations

(282)

(364)

29

(Inc.)/ Dec. in Fixed Assets

(35)

(32)

(5)

(Inc.)/ Dec. in Investments

410

112

(1197)

Cash Flow from Investing

375

79

(1202)

Issue of Equity

0

1059

781

Inc./(Dec.) in loans

(16)

(18)

(11)

Dividend Paid (Incl. Tax)

0

0

0

Interest / Dividend (Net)

(7)

(10)

(12)

Cash Flow from Financing

(23)

1031

759

Inc./(Dec.) in Cash

69

746

(415)

Opening Cash balances

38

107

853

Closing Cash balances

107

853

439

Source: Company, Angel Research

PB Fintech Ltd |

IPO Note

October 29, 2021

7

Key Ratios

Y/E March FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS) -

-

-

P/CEPS -

-

-

P/BV

82.2

31.8

20.2

EV/Sales

81.3

51.0

43.4

EV/EBITDA -

-

-

EV / Total Assets

69.1

28.6

18.3

Per Share Data (Rs)

EPS (Basic) (8.4)

(7.4)

(3.7)

EPS (fully diluted) (8.4)

(7.4)

(3.7)

Cash EPS (7.7)

(6.2)

(2.6)

Book Value

11.9

30.8

48.4

Returns (%)

ROCE -

-

-

Angel ROIC (Pre-tax) -

-

-

ROE -

-

-

Turnover ratios (x)

Asset Turnover (Net Block)

4.1

5.2

7.1

Inventory / Sales (days) -

-

-

Receivables (days)

97

85

71

Payables (days)

82

56

42

Working capital cycle (ex-cash) (days)

15

29

29

Source: Company, Angel Research

PB Fintech Ltd |

IPO Note

October 29, 2021

8

Research Team

Tel: 022

-

39357800 E

-

mail: research@angelbroking.

com Website:

www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited

has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or

other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.