Please refer to important disclosures at the end of this report

1

Nykaa is a consumer technology platform, delivering a content-led, lifestyle retail

experience to consumers. The company has a diverse portfolio of beauty, personal

care, and fashion products, including their own brand products manufactured by

them. The company has an Omnichannel experience, online and offline with an

endeavor to cater to the consumers’ preferences and convenience. The different

consumer journeys exist in two business verticals, Nykaa- Beauty and personal care

and Nykaa fashion – Apparel and accessories. Nykaa provides its customers with a

wide variety of products and as of 31st Aug, 2021, Nykaa offered approximately

3.1 million SKUs from 4,078 national and international brands to their consumers.

Positives: (a) One of India's leading specialty beauty and personal care companies.

(b) Major brands offering their products on Nykaa's platform for sale. (c)

Company's advanced technology platform (d) Founder-led company with an

experienced management team.

Investment concerns: (a) Fail to acquire new consumers in a cost-effective manner.

(b) Business depends on the growth of online commerce industry in India &

company ability to leverage technology platform. (c) Business incurred losses in

past which may impact value of equity shares. (d) Changing digital or business

regulation in India.

Outlook & Valuation: The IPO is being valued at price/sales of 21.0-21.8x FY2021

revenues of `2,441 crore. The company has also posted strong revenue CAGR of

48.2% between FY2019-20 despite the Covid crisis and register a profit in

FY2021. While valuations may appear to be expensive on a P/E basis Nykaa is

one of the very few profitable Unicorns in India and we believe that the company is

well positioned to benefit from the exponential growth in the online beauty and

fashion retailing business over the next decade. Hence we believe that that the

valuations are justified and hence we recommend SUBSCRIBE to the issue.

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

1,111

1,768

2,441

% chg

-

59.0

38.1

Net Profit

-25

-16

62

% chg

-

-33.4

-479.1

EBITDA (%)

1.8

4.6

6.6

EPS (Rs)

(0.5)

(0.3)

1.3

P/E (x)

-

-

848.7

P/BV (x)

228.0

163.2

107.3

ROE (%)

(10.6)

(5.1)

12.6

ROCE (%)

(1.9)

3.0

11.9

EV/Sales

48.1

30.2

21.8

Source: Company, Angel Research.

Note: Valuation ratios at upper price band.

SUBSCRIBE

Issue Open: Oct 28, 2021

Issue Close: Nov 01, 2021

Offer for Sale: `4721.92 cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 52.6%

Others 47.4%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `47.3cr

Issue size (amount): `5,351.92 cr

Price Band: `1085-1125

Lot Size: 12 shares and in multiple thereafter

Post-issue mkt. cap: * `51,312 cr - ** `53,204 cr

Promoters holding Pre-Issue: 54.22%

Promoters holding Post-Issue: 52.56%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `630 cr

Issue Details

Face Value: `1

Present Eq. Paid up Capital: `46.7 cr

FSN E-Commerce (Nykaa) LIMITED

FSN E-Commerce Venture (Nkyaa)|IPO Note

October 27, 2021

Nykaa Limited | IPO Note

Oct 27, 2021

2

Company background

Company was incorporated as ‘FSN E-Commerce Ventures Private Limited’ on

April 24, 2012. The company was promoted by Falguni Nayar, Sanjay Nayar,

Falguni Nayar Family Trust, and Sanjay Nayar Family Trust. It is digitally native

consumer technology platform, delivering a content-led, lifestyle retail experience

to consumers. Company has invested both capital and creative energy towards

designing a differentiated journey of brand discovery for its consumers.

Issue details

The issue comprises of offer for sale of upto `4721.92 crore and Fresh issue of

`630Cr in the price band of `1085-1125.

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

253,365,357

54.2

248,565,357

52.6

Public

213,959,193

45.8

224,359,193

47.4

Total

467,324,550

100.0

472,924,550

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

Investment of ₹42 Cr in their subsidiaries, namely, FSN Brands and / or

Nykaa Fashion for funding the set-up of new retail stores.

Capital expenditure of ₹42 Cr to be incurred by the company and of their

subsidiaries, namely, Nykaa E-Retail, Nykaa Fashion and FSN Brands for

funding the set-up of new warehouses.

Repayment or prepayment of outstanding borrowings availed by company

and its Subsidiaries, namely, Nykaa E-Retail amounting to ₹156 Cr.

Expenditure to acquire and retain customers by enhancing the visibility

and awareness of our brands for 234 Cr.

General corporate purpose.

Key Management Personnel

Falguni Nayar is the Founder, Executive Chairperson & Managing Director and

Chief Executive Officer of the company. She has over 26 years of experience in e-

commerce, investment banking and broking. Prior to founding the company, she

was associated with Kotak Mahindra Capital Co Ltd for 18 years where she also

served as a managing director.

Sanjay Nayar is a Non-Executive Director of the Company. He has over 35

years of experience in the banking, and private equity. He was associated with

Citibank N.A. for over 23 years, where he also served as the as chief executive

officer of the bank in India over six years.

Adwaita Nayar is an Executive Director of the Company, since July 1, 2021.

She also serves as the chairperson and chief executive officer of Nykaa

Fashion. She co-founded the Company and has been involved in the areas of

marketing, operations and product development.

Nykaa Limited | IPO Note

Oct 27, 2021

3

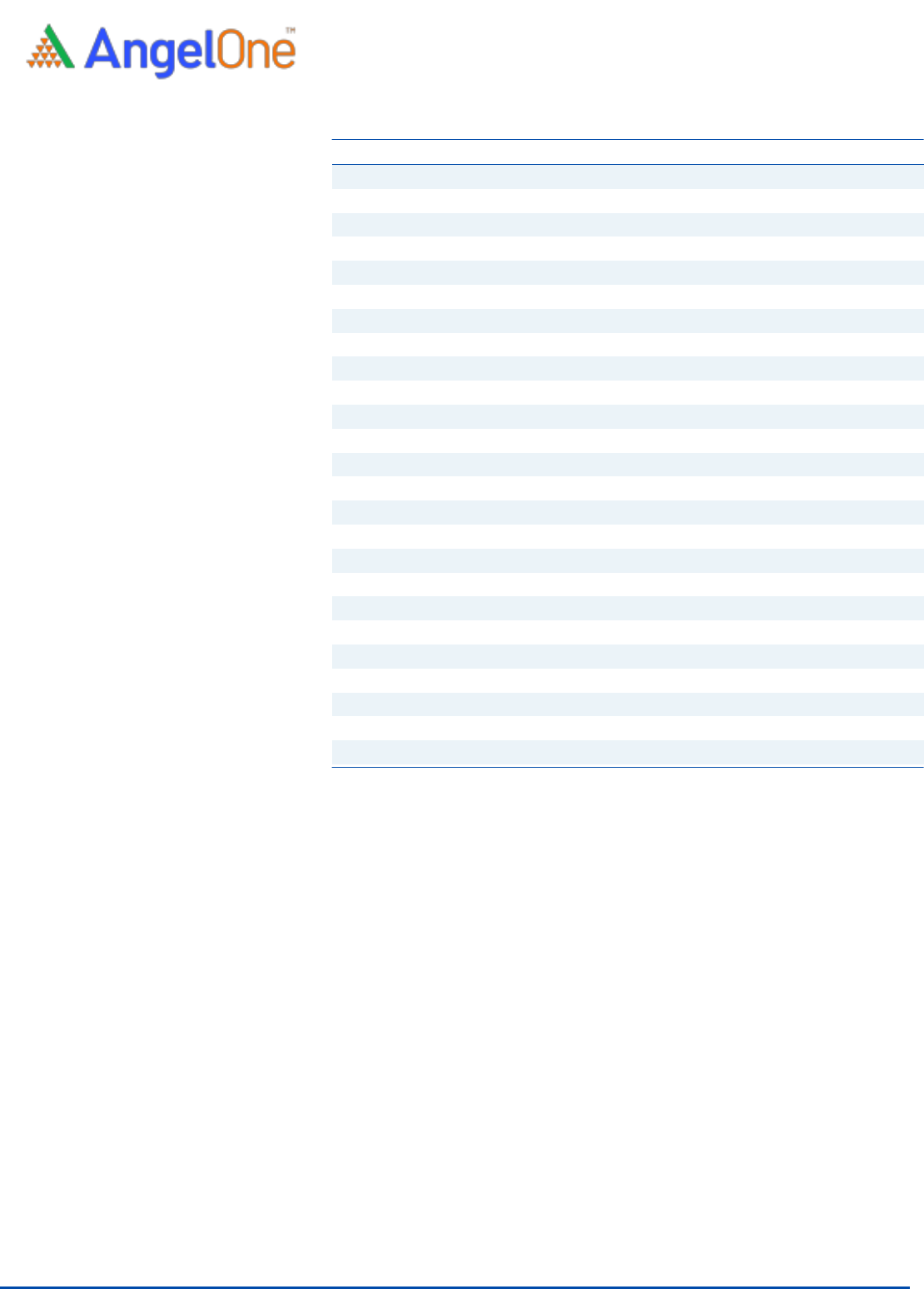

Exhibit 1: Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Total operating income

1,111.4

1,767.5

2,440.9

817.0

% chg

-

59.0

38.1

183.0

Total Expenditure

1,090.9

1,686.5

2,279.5

790.1

Cost of material consumed

0.2

17.3

38.2

22.9

Purchase of traded goods

785.2

1,178.7

1,495.6

550.9

Changes in finished goods and stock-in-trade

-125.2

-181.9

-46.0

-88.5

Employee benefits expense

117.3

195.6

283.6

88.5

Other expenses

313.3

476.7

508.0

216.3

EBITDA

20.5

81.1

161.4

26.9

% chg

-

295.2

99.2

-159.4

(% of Net Sales)

1.8

4.6

6.6

3.3

Depreciation& Amortisation

30.9

59.5

67.1

19.5

EBIT

-10.4

21.5

94.3

7.4

% chg

-

-307.9

337.7

-112.4

(% of Net Sales)

-0.9

1.2

3.9

0.9

Finance costs

26.3

44.3

30.7

9.0

Other Income- Gen

5.0

10.3

11.7

4.7

Recurring PBT

-31.7

-12.4

75.3

3.1

% chg

-

-60.8

-706.1

-104.8

Exceptional item

-

-

-

-

Tax

-7.2

3.9

13.4

-0.4

PAT (reported)

-24.5

-16.3

61.9

3.5

% chg

-

-33.4

-479.1

-106.5

(% of Net Sales)

-2.2

-0.9

2.5

0.4

Basic & Fully Diluted EPS (Rs)

-0.5

-0.3

1.3

0.1

Source: Company, Angel Research

Nykaa Limited | IPO Note

Oct 27, 2021

4

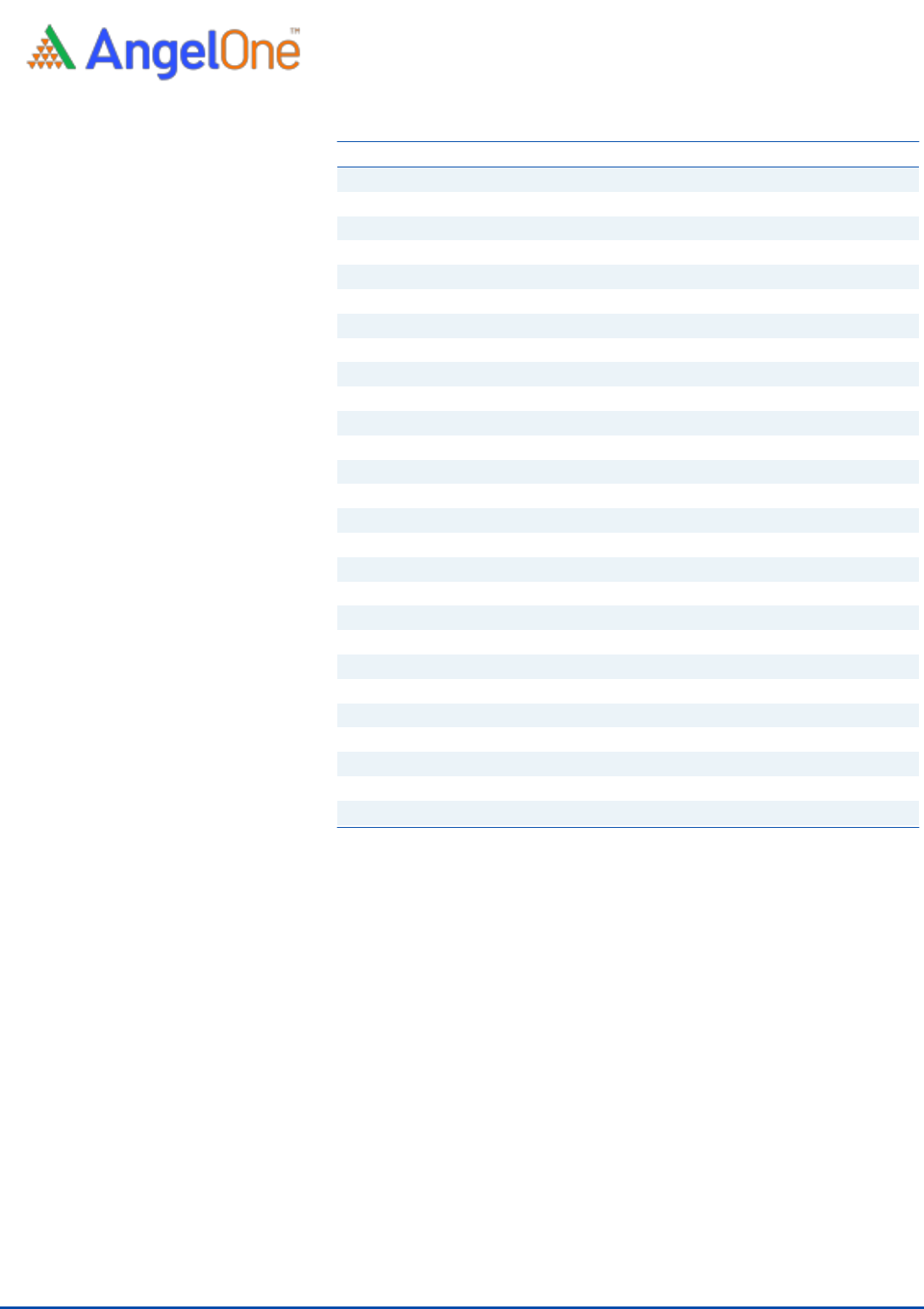

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

SOURCES OF FUNDS

Equity Share Capital

14.2

14.6

15.1

15.5

Other equity (Retained Earning)

216.3

307.6

474.9

683.4

Shareholders’ Funds

230.6

322.1

489.9

698.9

Non-Cont. Interest

0.5

0.7

0.8

0.9

Total Loans

225.6

267.5

187.5

268.1

Other liabilities

78.8

135.5

114.7

123.8

Total Liabilities

535.5

726.0

793.0

1,091.8

APPLICATION OF FUNDS

Property, plant and equipment

42.9

70.1

68.7

79.1

Right of use assets

85.9

144.0

138.9

154.2

Capital work in progress

0.3

0.8

2.0

2.1

Goodwill

0.1

0.1

0.5

0.5

Other Intangible assets

10.6

12.7

23.0

20.8

Intangible assets under development

-

1.2

0.4

1.9

Current Assets

564.0

815.5

963.0

1,248.5

Inventories

244.6

445.3

498.1

591.0

Investments

135.0

-

-

-

Trade receivables

57.9

98.4

76.6

75.7

Cash and cash equivalents

11.4

101.2

83.6

281.8

Bank balance other than CCE

0.5

74.4

164.1

103.9

Other financial assets

51.5

33.3

57.4

79.0

Other current assets

63.0

62.8

83.2

117.2

Current Liability

240.2

398.5

509.0

539.7

Net Current Assets

323.8

417.0

454.0

708.8

Other Non-Current Asset

71.7

79.9

105.5

124.4

Total Assets

535.5

726.0

793.0

1,091.8

Source: Company, Angel Research

Nykaa Limited | IPO Note

Oct 27, 2021

5

Exhibit 3: Consolidated Cash flows

Y/E March (` cr)

FY2019

FY2020

FY2021

Q1FY2022

Operating profit before changes

28.7

89.0

190.3

32.2

Net changes in working capital

-128.4

-78.6

-27.3

-117.2

Cash generated from operations

-99.7

10.4

163.0

-85.1

Direct taxes paid (net of refunds)

0.0

-4.3

-13.2

-28.9

Net cash flow from operating activities

-99.7

6.2

149.8

-114.0

Purchase of property, and others

-34.9

-45.7

-42.1

-16.0

Investment deposits

-0.2

-73.9

-89.7

60.2

Others

-126.8

134.5

2.0

1.9

Cash Flow from Investing (B)

-162.0

14.9

-129.7

46.1

Proceeds from issue of equity shares

0.7

0.5

0.6

0.1

Proceeds from securities premium (net)

133.3

103.2

102.3

202.8

Proceeds from share application

-

0.0

-

0.6

Proceeds from borrowings (net)

-0.2

0.0

1.5

-

Proceeds(repayment) of current borrowings

142.7

41.9

-81.5

80.7

Others

-40.9

-76.9

-60.6

-18.2

Cash Flow from Financing

235.7

68.7

-37.7

266.0

Inc./(Dec.) in Cash

-26.0

89.8

-17.6

198.1

Opening Cash balances

37.4

11.4

101.2

83.6

Exchange effect

0.0

0.0

0.0

0.2

Closing Cash balances

11.4

101.2

83.6

281.8

Source: Company, Angel Research

Nykaa Limited | IPO Note

Oct 27, 2021

6

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

-

-

848.7

P/CEPS

-

-

407.3

P/BV

228.0

163.2

107.3

EV/Sales

48.1

30.2

21.8

EV/EBITDA

2,604.5

658.4

330.2

Per Share Data (Rs)

EPS (Basic)

(0.5)

(0.3)

1.3

EPS (fully diluted)

(0.5)

(0.3)

1.3

Cash EPS

0.1

0.9

2.8

Book Value

4.9

6.9

10.5

Returns (%)

ROE

(10.6)

(5.1)

12.6

ROCE

(1.9)

3.0

11.9

Turnover ratios (x)

Receivables (days)

19.0

20.3

11.5

Inventory (days)

80.3

92.0

74.5

Payables (days)

59.7

64.7

47.3

Working capital cycle (days)

39.7

47.6

38.7

Source: Company, Angel Research

Nykaa Limited | IPO Note

Oct 27, 2021

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelone.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.