2

Error!

Refer

ence

sourc

September 13, 2020

2

Impact of changes in MF regulations on Small caps

SEBI circular on Mutual Funds could broaden market rally

SEBI has surprised all market participants with its latest circulars wherein multi-cap

mutual funds will be required to increase their exposure to mid and small caps

stocks to 25% of their AUM by January 2021. Based on our calculations Multi-cap

funds may need to decrease their exposure to large caps by `40,650 crore and

increase their exposure to mid and small cap stocks by `12,960 crore and

`27,690 crore by January 2021. While the allocation shift should not cause too

much of an issue for large and mid cap stocks given better liquidity it can lead to a

rerating for the small cap space given limited availability of quality stocks. We

believe that flows would go the most liquid names in the small cap space where

there are reasonable MF holdings rather than in smaller name with low liquidity

and fund holdings. As per our analysis the top 100 small caps stocks with relatively

large market caps and MF holdings have a free float market cap of ~`2,36,000

crore and could attract the majority of the flows (10-12% of free float on higher

side) to small caps if any. In our top picks portfolio we have six stocks which are

from the above list viz. Chalet Hotels, Hawkins Cooler, Inox Leisure, JK Lakshmi

Cement, Persistent Systems and VIP Industries. Metropolis Healthcare though not

part of the above list is part of the Nifty Smallcap 100 index and could also attract

MF flows while Zensar Technologies and Swaraj Engines are other high conviction

small cap stocks in the portfolio.

SEBI Circular could cause disruptions to existing multicap schemes

SEBI issued a circular on the 11th of September 2020 with a view to diversify the

investments of underlying investments of multi-cap funds across mid and small

caps. Under the new guidelines SEBI has proposed raising the minimum

investment in equities for Multi Cap Funds to 75% of assets from the earlier 65%

along with other proposed changes listed below:

Minimum investment of 25% of total assets in large cap companies.

Minimum investment of 25% of total assets in mid cap companies.

Minimum investment of 25% of total assets in small cap companies.

Some shift in AUM to Mid and small caps likely over bext few months

As per our calculations multi-cap funds have a total AUM of `1,46,500 crore with

almost 74% of AUM being allocated to large caps while allocation to mid and

small caps are 16.5% and 6.2% respectively. If the SEBI recommendations are

implement then there could be shift of `40,650 crore from large caps to mid and

small caps on the higher side. However the situation is still fluid and the actual shift

could be lower as MF houses are most likely to ask SEBI to reconsider the

proposal. However even if SEBI does not reconsider the proposal then fund houses

have the option of either merging it with existing large cap schemes or changing

the fund categorization to minimize the impact.

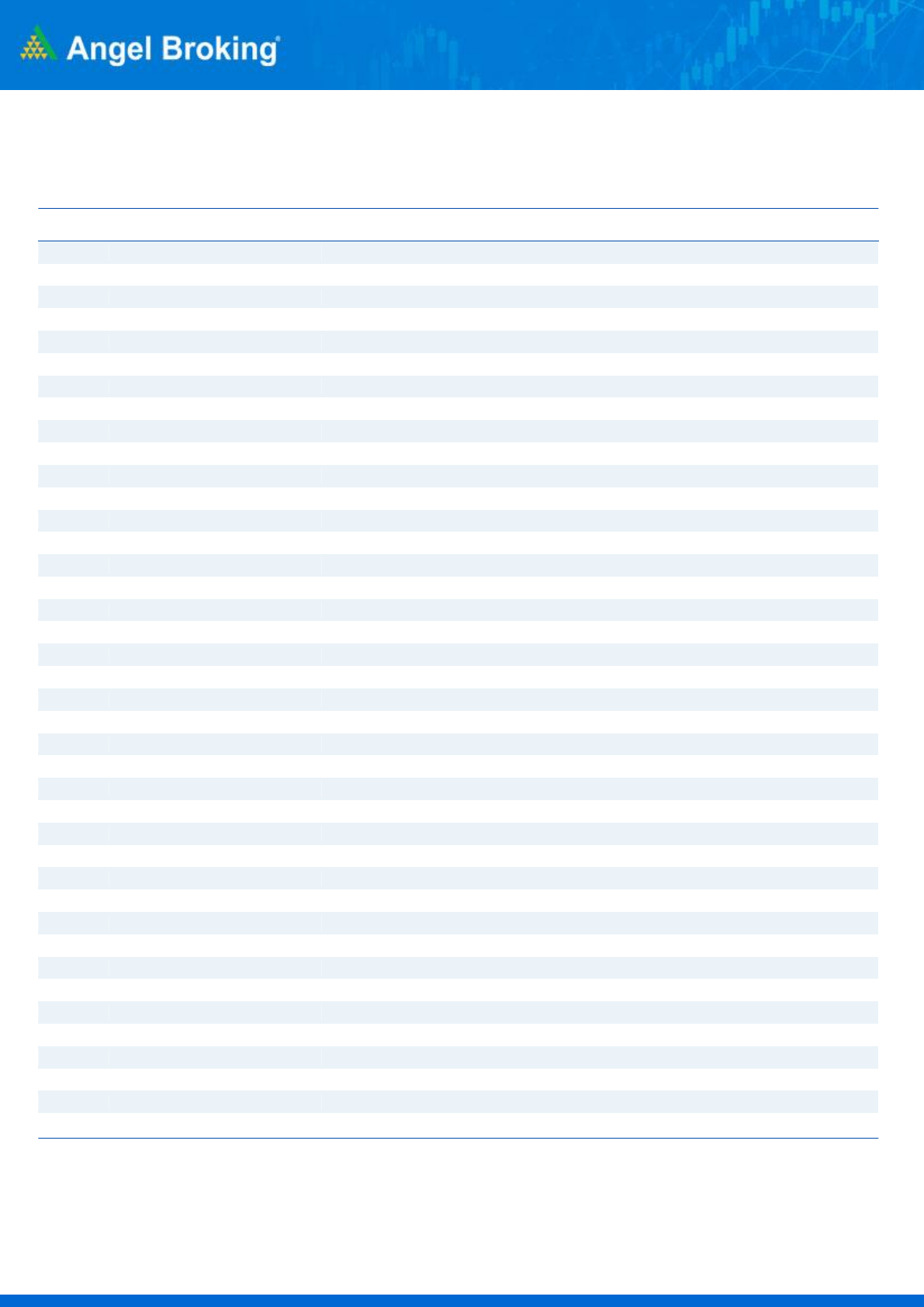

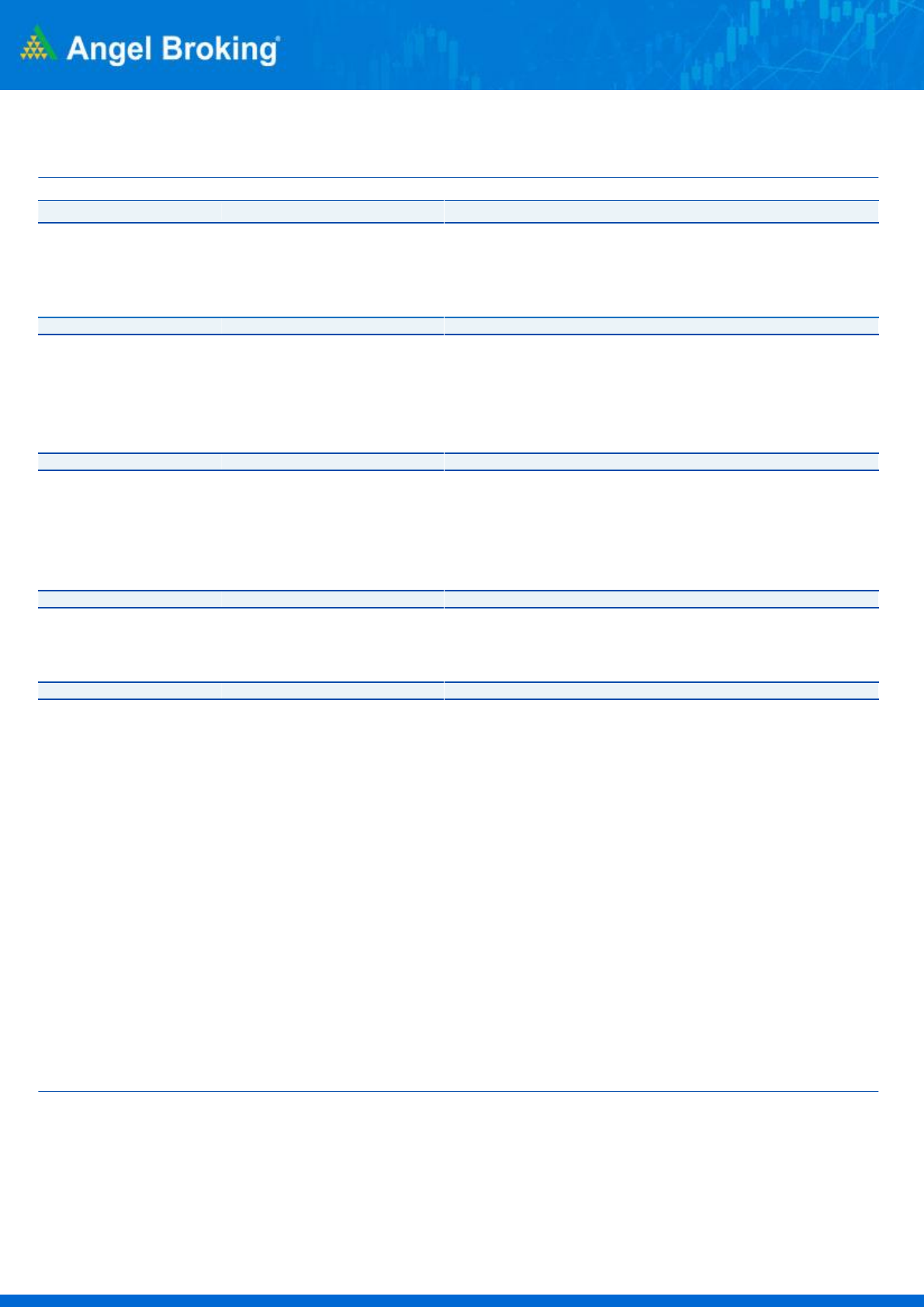

Exhibit 1: Summary of likely shift in aggregate AUM for multi-cap schemes

Scheme Profile

Amt (` Cr)

Possibility of churn

+/- (` Cr)

AUM

Large Cap

Mid Cap

Small Cap

Cash &

Equivalent

Large Cap

Mid Cap

Small Cap

Total

146,501

108,140

24,224

9,040

5,093

(40,650)

12,960

27,690

Source: Company, Angel Research

Top Picks

Company

CMP (`)

TP (`)

Auto

Endurance Technologies

1,080

1,297

Swaraj Engines

1,615

1,891

Banking/NBFC

Cholamandalam Inv.

225

280

IDFC First Bank

31

36

IT

Persistent Systems

1,011

1,276

Zensar Technologies

174

204

Pharma & Healthcare

Metropolis Healthcare

1,751

2,156

Telecom/ Others

Chalet Hotels

152

200

Hawkins cooker

4,838

5,682

Hindustan Aero.

852

1125

Inox Leisure

289

350

JK Lakshmi cement

256

328

Reliance Industries

2,319

2,543

VIP Industries

283

348

Source: Company, Angel Research

Note: Closing price as on 11

th

Sept.,2020

3

Error!

Refer

ence

sourc

September 13, 2020

3

Impact of changes in MF regulations on Small caps

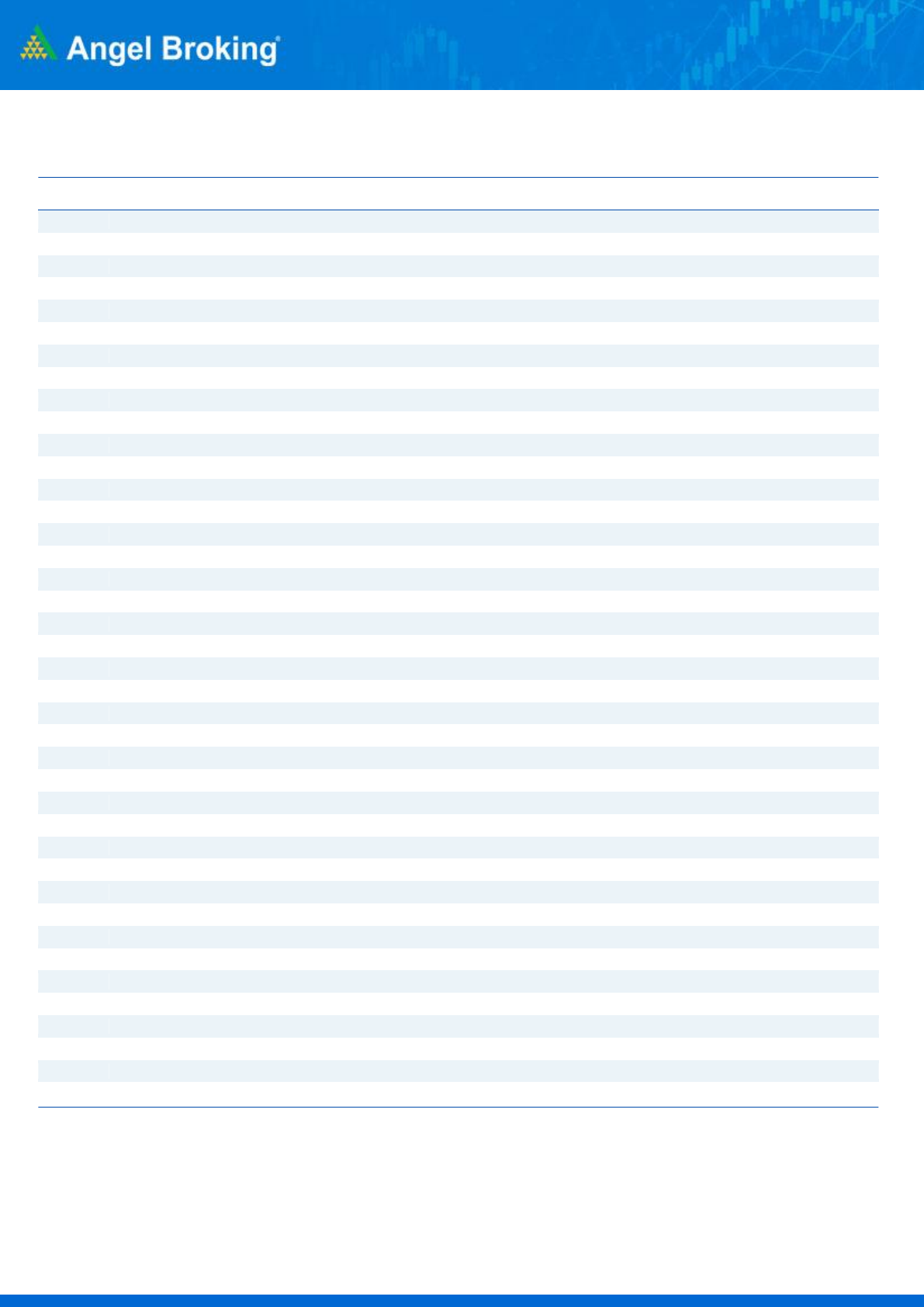

Exhibit 2: List of top100 smallcap stocks based on market cap and MF holdings

Sr.

No

Company

Name

Free Float

Market Cap (` Cr)

Market Cap

(` Cr)

Mutual Funds

Holdings (%)

1

Multi Comm. Exc.

7928

7928

21.8

2

Indian Energy Ex

5699

5699

14.8

3

PVR

5623

6924

16.9

4

Persistent Sys

5296

7727

24.7

5

Tata Chemicals

4883

7464

17.4

6

Redington India

4334

4334

11.5

7

Strides Pharma

4321

6147

15.6

8

CESC

4149

8285

19.7

9

K E C Intl.

4033

8344

22.8

10

Chola Financial

3979

7770

24.8

11

Kajaria Ceramics

3946

7528

16.5

12

Apollo Tyres

3880

6650

17.2

13

C D S L

3727

4659

13.3

14

APL Apollo Tubes

3718

6036

10.2

15

Can Fin Homes

3646

5208

11.4

16

SKF India

3623

7641

24.0

17

VST Industries

3591

5294

13.9

18

Blue Star

3563

5818

21.3

19

JM Financial

3559

7882

7.7

20

Cyient

3199

4168

21.4

21

EIH

3149

4864

10.7

22

Natl. Aluminium

3144

6483

7.7

23

Radico Khaitan

3141

5262

13.3

24

Amber Enterp.

3112

5559

6.5

25

Finolex Inds.

2981

6271

12.9

26

ERIS Lifescience

2948

6633

10.7

27

Karur Vysya Bank

2875

2937

16.9

28

Rallis India

2868

5747

16.3

29

Carborundum Uni.

2775

4789

23.7

30

Finolex Cables

2734

4263

19.7

31

Birlasoft Ltd

2725

4601

6.6

32

J B Chem & Pharm

2724

6177

12.2

33

GE Shipping Co

2713

3828

20.2

34

V-Guard Industri

2685

7205

11.0

35

Timken India

2624

8148

10.2

36

Orient Electric

2535

4124

16.5

37

Quess Corp

2464

5511

13.1

38

Elgi Equipments

2439

3582

9.6

39

Westlife Develop

2425

5931

12.4

40

Grindwell Norton

2399

5755

15.9

Source: Company, Angel Research, Capitaline

4

Error!

Refer

ence

sourc

September 13, 2020

4

Impact of changes in MF regulations on Small caps

Exhibit 3: List of top100 smallcap stocks based on market cap and MF holdings Contd.

Sr.

No

Company

Name

Free Float

Market Cap (` Cr)

Market Cap

(` Cr)

Mutual Funds

Holdings (%)

41

TTK Prestige

2398

8105

11.2

42

Chambal Fert.

2390

5962

13.7

43

Vaibhav Global

2372

5716

9.0

44

Narayana Hrudaya

2364

6540

14.6

45

Sonata Software

2353

3276

12.2

46

Affle India

2344

7413

9.0

47

DCB Bank

2261

2656

27.8

48

Team Lease Serv.

2234

3725

9.9

49

Guj Pipavav Port

2198

3926

25.0

50

Ratnamani Metals

2108

5292

13.4

51

Firstsour.Solu.

2057

4461

7.8

52

Engineers India

1963

4047

17.3

53

Jyothy Labs

1954

5266

13.9

54

Bajaj Electrical

1930

5241

11.4

55

CEAT

1930

3620

6.6

56

KEI Industries

1920

3227

21.0

57

Delta Corp

1917

2862

6.6

58

Century Textiles

1879

3774

8.9

59

V I P Inds.

1861

3998

9.7

60

Galaxy Surfact.

1839

6325

12.8

61

Balrampur Chini

1817

3091

8.2

62

IRB Infra.Devl.

1785

4224

6.8

63

PNC Infratech

1774

4038

22.8

64

CCL Products

1770

3272

10.3

65

Brigade Enterpr.

1767

3322

17.9

66

Kalpataru Power

1763

3865

21.9

67

Sheela Foam

1709

6838

19.7

69

Birla Corpn.

1707

4602

10.9

70

V-Mart Retail

1676

3431

17.2

71

Vardhman Textile

1632

4318

20.3

72

JK Lakshmi Cem.

1622

3015

16.8

73

KNR Construct.

1581

3515

32.0

74

NLC India

1532

7363

8.4

75

Johnson Con. Hit

1510

5865

13.6

76

Linde India

1509

6036

10.6

77

Symphony

1459

5838

10.1

78

Cera Sanitary.

1453

3192

10.1

79

Inox Leisure

1429

2971

19.7

80

Thyrocare Tech.

1403

4132

7.9

81

ICRA

1281

2661

15.0

Source: Company, Angel Research, Capitaline

5

Error!

Refer

ence

sourc

September 13, 2020

5

Impact of changes in MF regulations on Small caps

Exhibit 4: List of top100 smallcap stocks based on market cap and MF holdings Contd.

Sr.

No

Company

Name

Free Float

Market Cap (` Cr)

Market Cap

(` Cr)

Mutual Funds

Holdings (%)

82

Dilip Buildcon

1258

5033

6.7

83

SpiceJet

1234

3078

9.5

84

Star Cement

1204

3623

7.5

85

BEML Ltd

1186

2579

19.8

86

eClerx Services

1180

2555

17.9

87

Cochin Shipyard

1169

4308

6.9

88

MAS FINANC SER

1166

4417

8.8

89

Hawkins Cookers

1125

2559

14.1

90

Advanced Enzyme

1078

2569

8.6

91

TCI Express

1028

3108

8.1

92

K P R Mill Ltd

986

3977

16.5

93

Mishra Dhatu Nig

979

3766

14.1

94

GE Power

970

3086

13.4

95

Century Plyboard

965

3581

6.7

96

Chalet Hotels

894

3126

18.2

97

Dhanuka Agritech

879

3516

12.8

98

Sundaram Clayton

832

3330

12.2

99

Prism Johnson

672

2675

7.9

100

GE T&D India

636

2545

12.5

Source: Company, Angel Research, Capitaline

Note: In order to arrive at stocks which are most likely to attract investments by multi-cap funds we have initially considered stocks ranked

between 250-450 in terms of market cap as of the 11

th

of September. Within the top 200 small cap stocks by market cap we have considered

100 stocks with the largest percentage of MF holdings.

6

Error!

Refer

ence

sourc

September 13, 2020

6

Impact of changes in MF regulations on Small caps

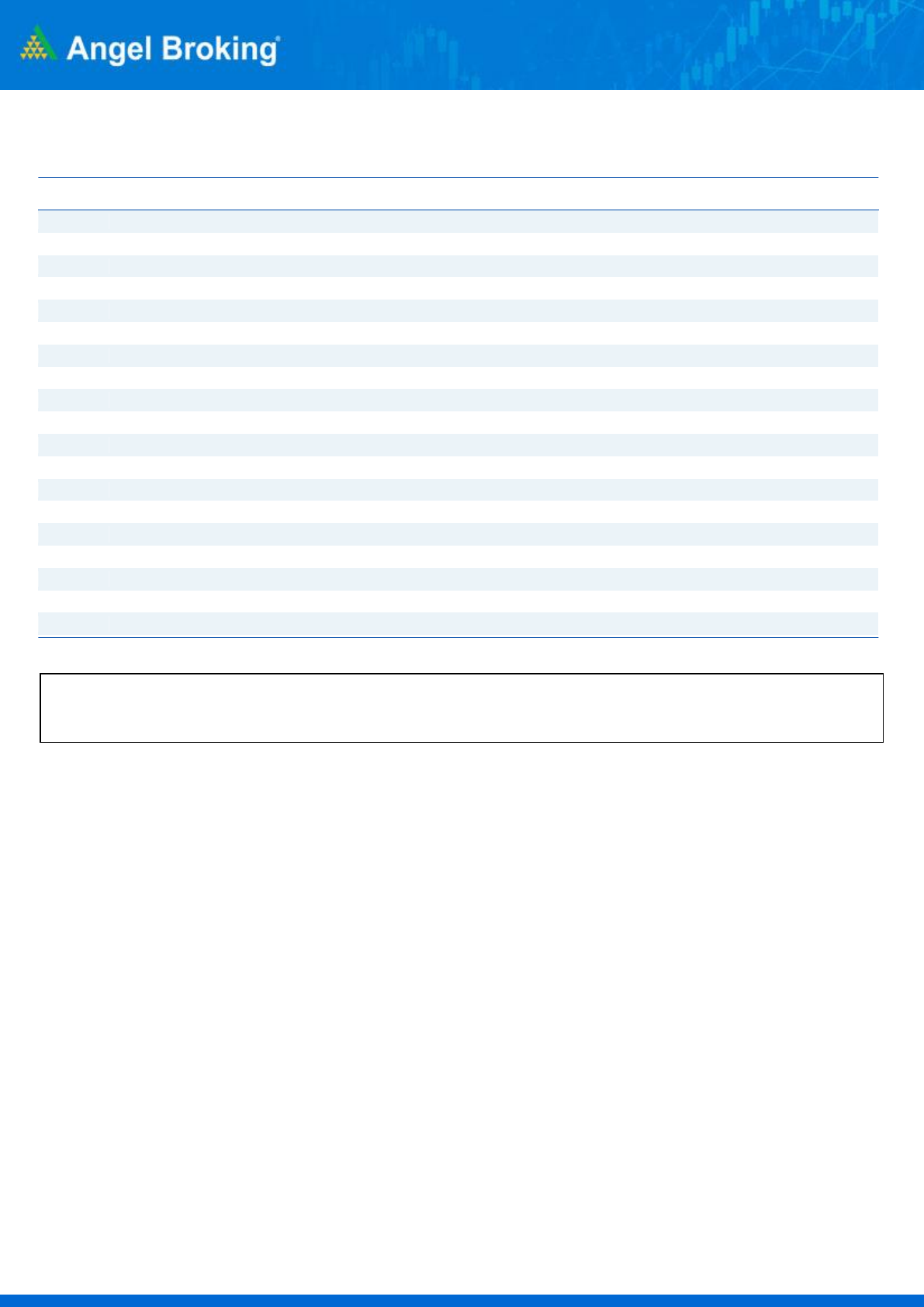

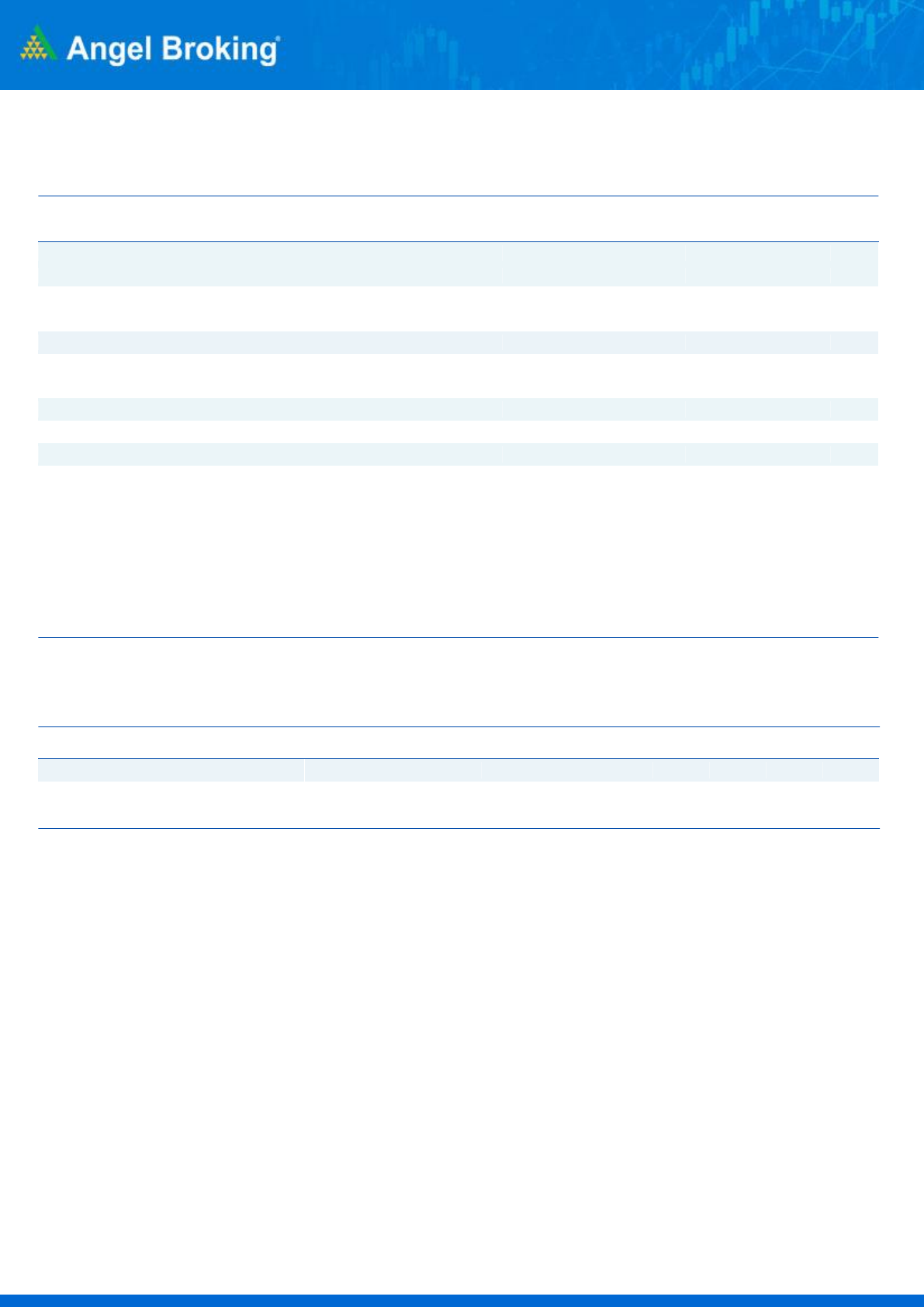

Exhibit 5: Rationale - Top Picks Stocks

Company

CMP (`)

TP (`)

Rationale

Auto

Endurance Technologies

1,080

1,297

Pent up demand and consumer preference for personal transportation is

positive for domestic 2W companies, which would benefit Endurance.

Swaraj Engines

1,615

1,891

Strong recovery in the tractor industry (due to robust Rabi crop, hike in MSP

& a normal monsoon) will benefit players like Swaraj Engines.

BFSI

Cholamandalam Inv.

225

280

Diversified product mix will help capture growth in LCV, tractor and 2W

segment. Adequate capital adequacy (20%+) and declined trend in Cost of

fund and strong parentage provide comfort.

IDFC First Bank

31

36

We believe efforts to built retail liability franchise, fresh capital infusion and

provision taken on the wholesale book will help to tide over this difficult

time.

IT

Persistent Systems

1,011

1,276

Company has won deals worth USD 150mn in Q1Y21 and management

has highlighted strong deal pipeline which will drive growth in H2FY21.

Zensar Technologies

174

204

We expect strong sequential growth in Q2FY21 driven by ramp up of

existing projects and limited exposure to sectors like retail and Oil & gas.

Pharma & Healthcare

Metropolis Healthcare

1,751

2,156

We are positive on the company given expected long term growth rates of

~15% CAGR, stable margins profile and moderating competitive intensity.

Telecom/ Others

Chalet Hotels

154

200

Company has posted strong sequential revpar growth in July and future

improvement is expected over next few months led by increased occupancy.

Hawkins cooker

4,838

5,682

Gaining market share with peer, strong demand post Covid-19 and

increase in penetration of cooking gas to drive higher growth.

Hindustan Aeronautics

852

1,125

Strong order book of Rs. 52,000 crore with likely order flow of Rs. 39,000

crore in FY2021 to drive growth over best few years

Inox Leisure

289

350

Share prices have corrected more than 40% as all theatres are closed down

due to covid-19 issue. Although, long term fundamentals are intact. Covid-

19 can lead to further consolidation in the industry.

JK Lakshmi Cement

256

328

It is trading at a significant discount compared to other north based cement

company such as JK Cement as well as historical valuation.

Reliance Industries

2,319

2,543

Digital and retail business to be key growth driver for the company. Spin off

and investment by strategic investor in O2C business is key monitarable.

VIP Industries

283

348

Market leader (~50%+ share) with strong brand and wide distribution

network. Recent correction provides investment opportunity in high quality

stock from long term perspective

Source: Company, Angel Research

7

Error!

Refer

ence

sourc

September 13, 2020

7

Impact of changes in MF regulations on Small caps

Exhibit 6: Top Picks Valuation Table

Market Cap

(` cr)

CMP

(`)

Sales

(`)

PAT

(`)

ROE

(%)

P/E

(x)

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

Auto

Endurance Technologies

15,186

1,080

5,884

7,465

281

608

8.7

16.2

54.0

25.0

Swaraj Engines

1,959

1,615

711

899

64

86

16.2

17.1

30.6

22.8

IT

Persistent Systems

7,727

1,011

4,159

4,756

415

488

15.4

15.9

18.6

15.8

Zensar Technologies

3,917

174

4,059

4,558

319

384

12.5

14.3

12.3

10.2

Pharma & Healthcare

Metropolis Healthcare

8,918

1,751

920

1,156

144

217

23.0

27.4

62.0

41.1

Telecom/Others

Chalet Hotels

3,126

152

484

995

(73)

83

(4.6)

4.9

NA

37.8

Hawkins cooker

2,558

4,838

575

728

51

77

32.5

42.4

50.2

33.2

Hindustan Aeronautics

28,503

852

21,293

25,552

2,961

3,791

23.3

24.0

9.6

7.5

Inox Leisure

2,971

289

628

2,153

(146)

162

NA

14.5

NA

18.3

JK Lakshmi cement

3,015

256

3,793

4,306

223

278

14.5

12.3

13.5

10.8

Reliance

15,680

2,319

3,342

4,241

264

420

5.7

8.7

59.5

37.3

VIP Industries

3,998

283

808

1,650

(136)

108

NA

19.6

NA

37.0

Source: Company, Angel Research * RIL standalone numbers (market cap, revenues & PAT in ‘00’ crore)

Exhibit 7: Top Picks Valuation Table – Banking/NBFC

Particular

Market Cap

(` Cr)

CMP

(`)

NII

(` Cr)

PAT

(` Cr)

EPS

(`)

ROE

(%)

P/BV

(x)

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

FY21

FY22

IDFC First Bank

17,613

31

6,939

8,121

90

1530

0.2

2.7

0.5

8.0

1.1

1.0

Cholamand. Inv. & Fin

18,400

225

3,783

3,962

987

1346

12.0

17.0

11.5

14.1

2.0

1.8

1.1

1.0

Source: Company, Angel Research

Note: CMP is Closing price as of 11

th

Sep, 2020

8

Error!

Refer

ence

sourc

September 13, 2020

8

Impact of changes in MF regulations on Small caps

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information

Ratings (Based on expected returns Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period): Reduce (-5% to -15%) Sell (< -15)

9

Error!

Refer

ence

sourc

September 13, 2020

9

Impact of changes in MF regulations on Small caps