1

Please refer to important disclosures at the end of this report

1

1

Monetary Policy Committee (MPC), in it’s bi monthly MPC meeting reduced Repo

rate & Reverse Repo rate by 40bps to 4% & 3.35%, respectively, and maintained

an accommodative stance.

Post Covid 19 outbreak, RBI advanced it’s MPC meeting twice and lowered Repo

rate by total of 115bps (i.e. on March 27, 2020 by 75bps and May 22, 2020 by

40bps) along with other regulatory measures in order to support the economy. In

the latest policy announcement, the RBI has tried to address liquidity issues of

MSME, state Governments, exporters and importers, along with extending

moratorium on term and working capital loans by another 3 months.

Further, RBI only gave directional guidance on inflation and economic growth and

refrained from giving any numerical projections. RBI also noted the deterioration

in economic growth prospects and acknowledged negative GDP print for FY21.

RBI expects headline inflation will fall below 4% over Q3FY21 and Q4FY21.

Hence, overall risks to growth are severe while those to inflation may be

temporary. However, on positive side, kharif sowing is robust.

Moratorium extended for 3 months: In order to ease financial stress, the RBI has

allowed extension of moratorium on term loans by an additional three months till

August 31, 2020. Similarly, RBI has also allowed deferment of interest on working

capital facilities for another three months till August 31, 2020 and considering

lockdown led strain on cash flow, it allowed accumulated interest to be converted

into a term loan and repayable by the end of FY2021

Measures to improve the functioning of markets

Special Refinancing facility of `15,000cr to SIDBI extended by additional 90

days.

Additional duration (extension of 3 months) to meet investment limit by FPI

under Voluntary Retention route (VRR).

Measures to support exports and imports

Increase in export credit sanctioned by banks from existing one year to 15

months, for disbursements made up to July 31, 2020.

Liquidity Facility to Exim Bank of India of `15,000cr for a period of 90 days.

Extension of time for payment for normal imports from six to twelve months.

Measures to ease financial stress

Moratorium extended by 3 months on term loans till August 31, 2020.

Accumulated interest on working capital facilities will be converted into a

funded interest term loan which shall be repaid in current FY21.

Extension of resolution timeline.

Group exposure limit increased from 25% to 30%.

Measures to ease State Government financial stress

Ease financial stress of state governments by relaxing the rules governing

withdrawal from Consolidated Sinking Fund (CSF).

Monetary Policy Review – May 2020

Another off cycle rate cut

Monetary Policy Review | Banking

May 23, 2020

2

Monetary Polycy Review

May 23, 2020

2

OurTake: We believe RBI has been taking calibrated move and responding to the

evolving situation, like announcing extension of moratorium for another 3 months

and other supporting measures. However, investors were also expecting an

announcement of a comprehensive restructuring of loans. We opine that RBI will

come up with one-time restructuring once the lockdown is lifted. Any successful

restructuring requires some certainty of cash flow, hence, once the lockdown is

lifted, RBI will have better understanding of the cash flow position of every sector

and accordingly will announce restructuring plans.

All measures by RBI are intended towards easing the funding pressures and

liquidity provided by RBI to banks ideally be addressing the liquidity issues of

stressed segments of the economy. However, banks are parking excess liquidity of

over `7 lakh cr with the RBI, which clearly indicates little demand for credit and

heightened risk aversion among the banks. Rate cut would not immediately

improve credit off take for banks given the lack of economic activity, negative

growth prospects coupled with the reluctance of corporates to add debt in present

scenario. Hence, everything depends on when the lockdown will end and

economic activity resumes.

We expect extension of moratorium could have negative impact on financial

institutions. It could lead to lower collection, as cash flow of borrowers would not

improve immediately once economic activity resumes. Consequently, it will impact

asset quality. Additionally, there is a risk of credit culture being affected due to a

prolonged moratorium period. Hence, we expect higher slippages and provision

costs in FY21.

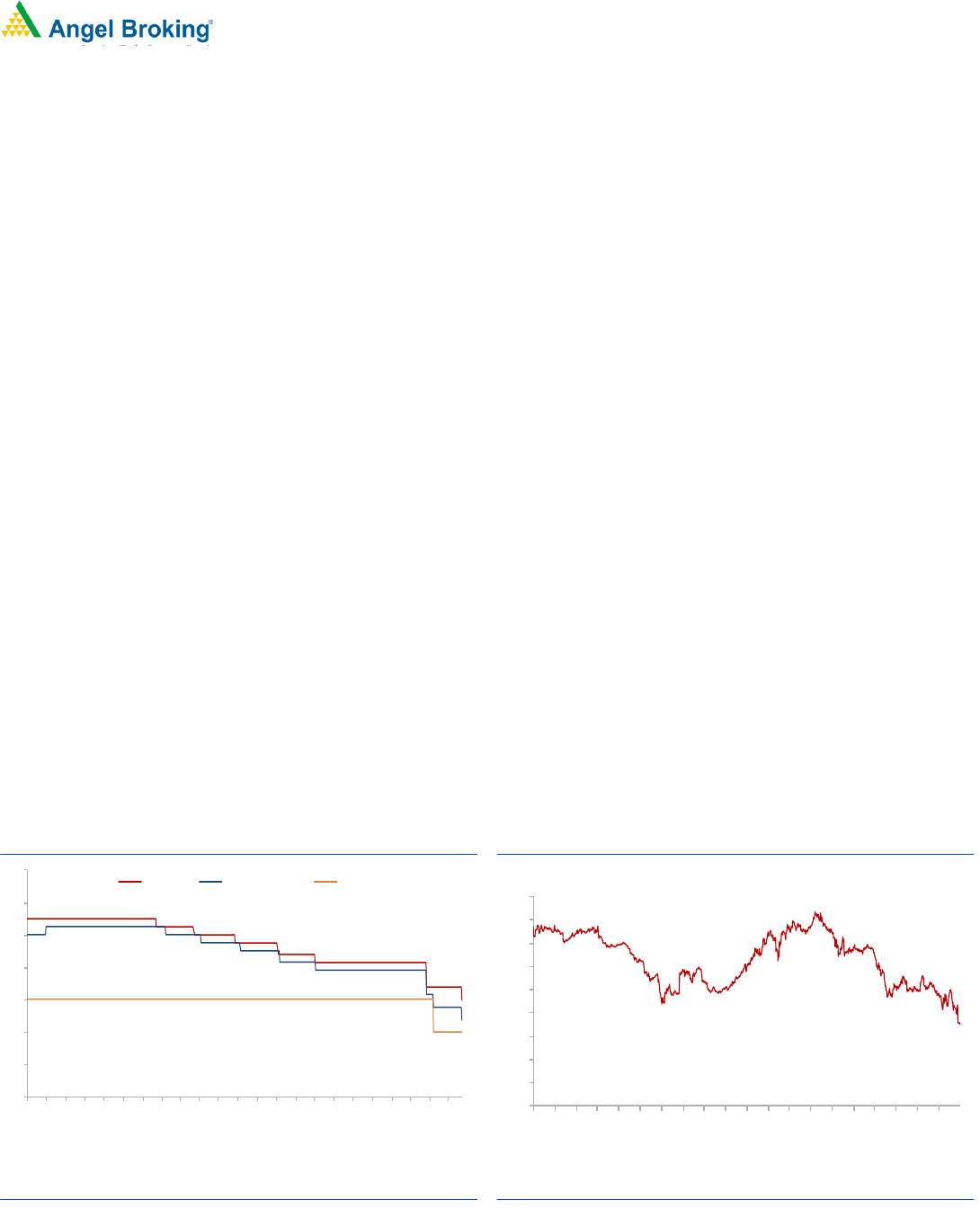

Exhibit 1: Repo rate lowerd 115bps in last two months

1

2

3

4

5

6

7

8

Jul-18

Aug-18

Sep-18

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Repo rate

Reverse Repo rate

CRR

Source: Company, Angel Research

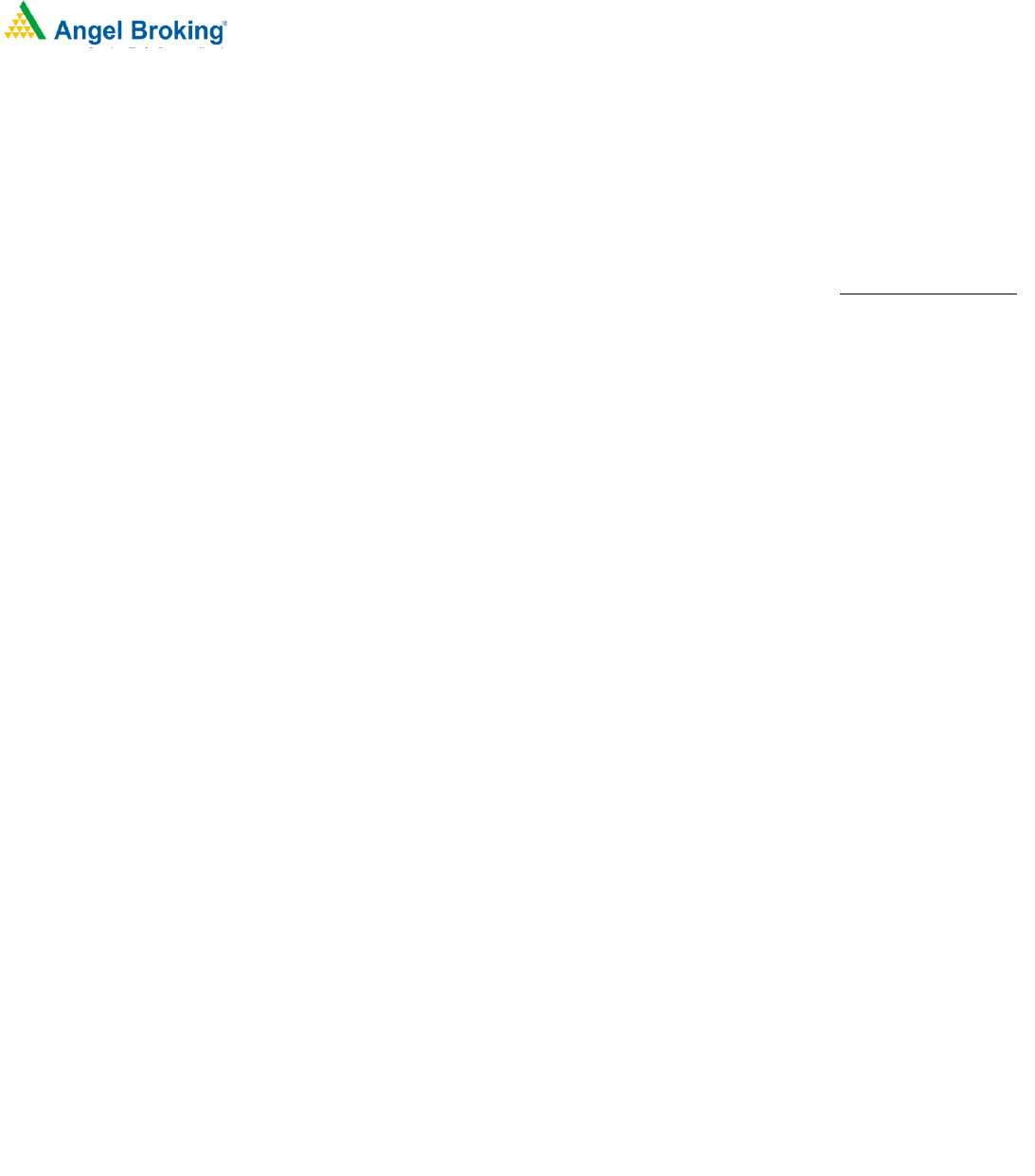

Exhibit 2: 10 year G-sec Movement

4

4.5

5

5.5

6

6.5

7

7.5

8

8.5

May-15

Aug-15

Nov-15

Feb-16

May-16

Aug-16

Nov-16

Feb-17

May-17

Aug-17

Nov-17

Feb-18

May-18

Aug-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

Source: Company, Angel Research

3

Monetary Polycy Review

May 23, 2020

3

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.