Market Outlook

July 30, 2015

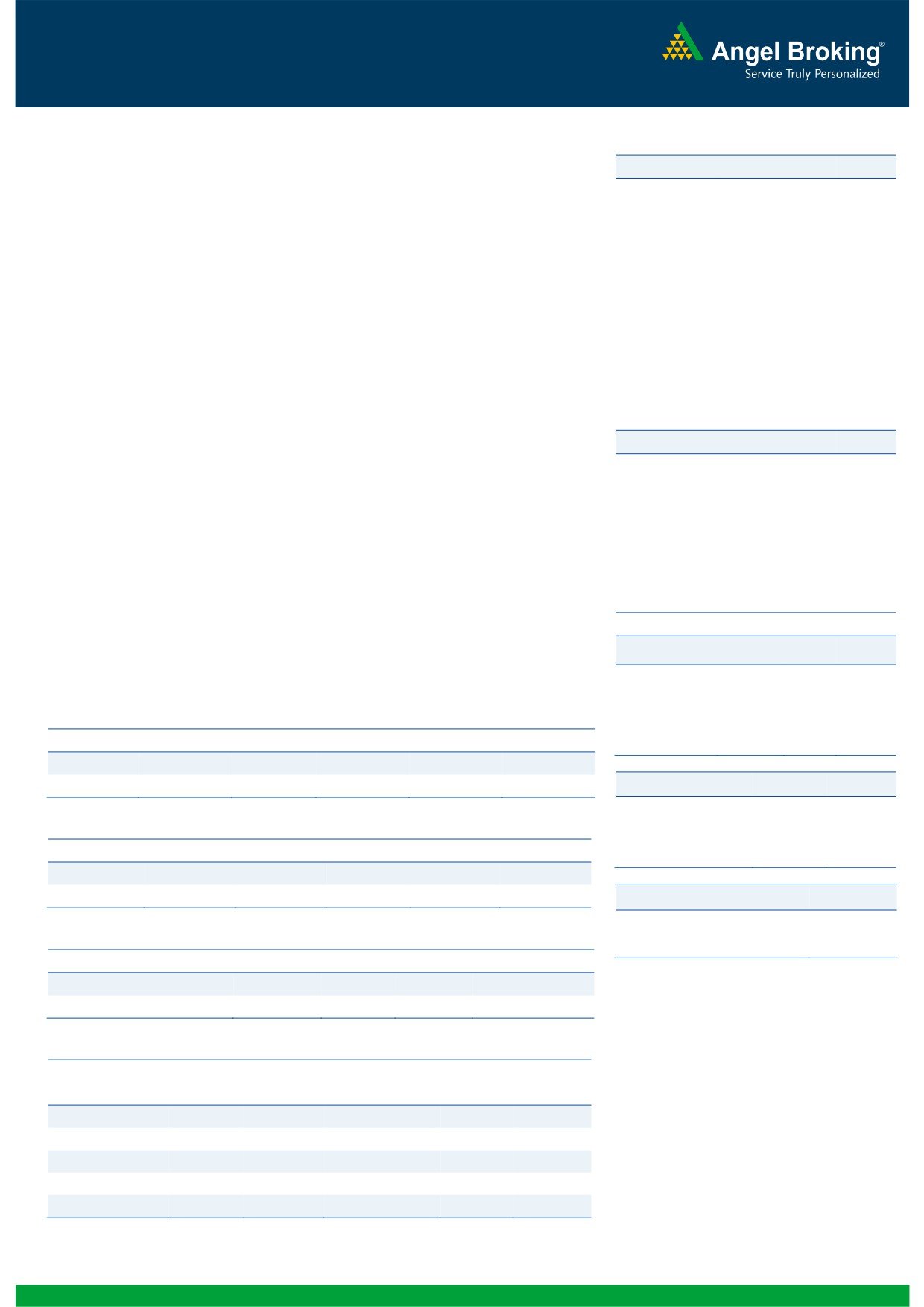

Dealer’s Diary

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

0.4

104

27,563

Indian markets are expected to open in green tracking SGX Nifty.

Nifty

0.5

38

8,375

With Fed leaving rates unchanged, US markets ended in green. Investors were also

MID CAP

0.9

97

11,071

encouraged by strong earnings from Gilead Systems and other companies. Fed

SMALL CAP

0.9

96

11,619

cited progress in U.S. labor market, a sign it remains on course to raise rates at

BSE HC

0.5

85

16,587

some point this year, but it also flagged nagging concern about low inflation, which

BSE PSU

(0.3)

(23)

7,545

could give some officials pause.

BANKEX

0.2

46

21,023

U.K. stocks climbed Wednesday, notching second day of gains, with Barclays, Sky

AUTO

(1.4)

257

18,719

and British American Tobacco moving higher after reporting surge in profits. Other

METAL

0.4

30

8,539

European markets, France’s CAC and Germany’s DAX 30 index closed in green.

OIL & GAS

(0.2)

(18)

9,899

BSE IT

1.5

160

11,012

Key Indian benchmark Indices snapped four-day losing streak to close marginally

Global Indices

Chg (%)

(Pts)

(Close)

higher amid consolidation on Wednesday as investors turned cautious ahead of Fed

Dow Jones

0.7

121

17,751

meet and expiry of July derivatives contracts.

NASDAQ

0.4

23

5,111

News & Result Analysis

FTSE

1.2

76

6,631

Result Review: UPL

Nikkei

(0.1)

(26)

20,303

Result Preview: IPCA Labs, Dr. Reddy’s Lab., Indoco Remedies

Hang Sang

0.5

116

24,619

Refer detailed news & result analysis on the following page

Straits Times

0.1

3

3,284

Markets Today

Shanghai Com

3.4

126

3,789

The trend deciding level for the day is 27,548 / 8,365 levels. If NIFTY trades above

this level during the first half-an-hour of trade then we may witness a further rally up

Indian ADR

Chg (%)

(Pts)

(Close)

to 27,625 - 27,687 / 8,392 - 8,408 levels. However, if NIFTY trades below

INFY

0.4

0.1

$17.0

27,548 / 8,365 levels for the first half-an-hour of trade then it may correct towards

WIT

0.8

0.1

$12.3

27,486 - 27,408 / 8,349 - 8,322 levels.

IBN

(1.2)

(0.1)

$9.4

Indices

S2

S1

PIVOT

R1

R2

HDB

0.2

0.1

$61.6

SENSEX

27,408

27,486

27,548

27,625

27,687

NIFTY

8,322

8,349

8,365

8,392

8,408

Advances / Declines

BSE

NSE

Advances

1,664

862

Net Inflows (July 28, 2015)

Declines

1,161

569

` cr

Purch

Sales

Net

MTD

YTD

Unchanged

123

103

FII

4,235

5,545

(1,310)

5,630

141,010

MFs

1,460

643

817

3,247

56,856

Volumes (` cr)

BSE

3,348

FII Derivatives (July 29, 2015)

NSE

17,194

` cr

Purch

Sales

Net

Open Interest

Index Futures

5,060

6,452

(1,391)

22,627

Stock Futures

15,256

15,448

(191)

54,795

Gainers / Losers

Gainer

Loser

Company

Price (`)

chg (%)

Company

Price (`)

chg (%)

JETAIRWAYS

390

18.7

RAJESHEXPO

481

(9.2)

SUNTV

303

10.6

TATACOM

439

(7.2)

CEATLTD

880

7.4

JPASSOCIAT

9

(5.1)

MANNAPURAM

27

6.5

PMCFIN

3

(4.7)

GDL

355

6.2

GLENMARK

951

(4.2)

Market Outlook

July 30, 2015

Result Review

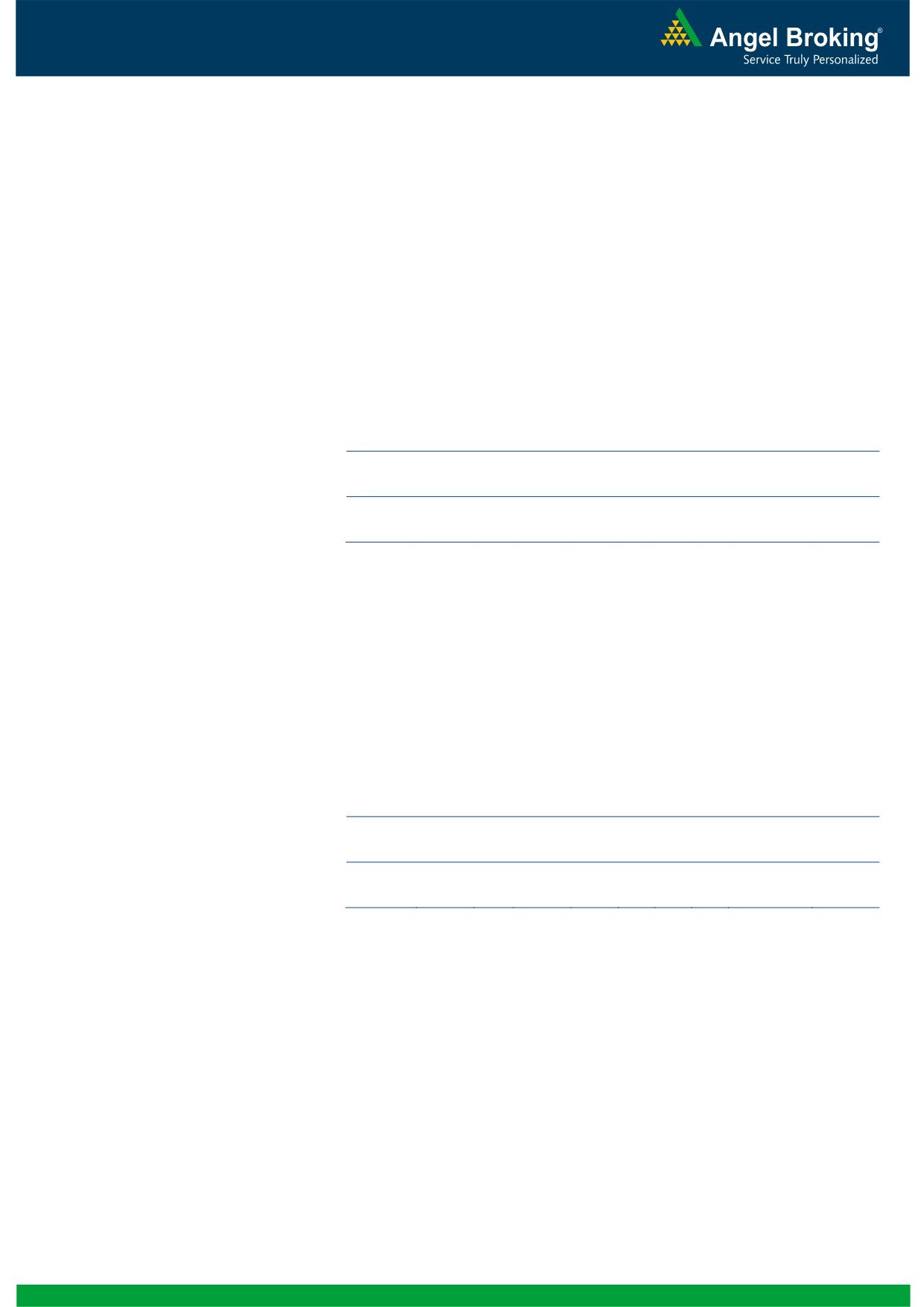

UPL (CMP: `526/ TP: /Upside :)

UPL, for its 1QFY2016 results, posted an 11.0% yoy growth in sales to end the

period at `3,064cr, driven by domestic sales (`1,083cr), which rose 15% yoy,

while exports (`1,981cr) posted a growth of 9%. The exports were driven by the

Latin America, which posted a 21% yoy and ROW which posted a 10% yoy growth.

Other key markets, Europe and USA, which posted a yoy growth of 1% and 5%,

respectively. The overall growth was driven by the volumes, which rose by 16%

yoy, while the exchange rate impact was -5% yoy, while pricing remained constant.

The EBDITA margins came in at 19.0% almost similar to 1QFY2015, while the

gross margins saw an expansion, which came in at 39% V/s 38% in 1QFY2015.

PAT is expected to come in at `275cr V/s `289cr in 1QFY2015, de-growth of

5.0% yoy. We maintain our neutral rating on the stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

13,698

17.6

1,376

32.1

21.4

16.4

3.2

8.7

1.5

FY2017E

15,752

17.6

1,651

38.5

21.3

13.4

2.7

7.2

1.3

Result Preview

IPCA Labs (CMP: `691/ TP: `736 /Upside: 6.5%)

IPCA Labs, for its 1QFY2016 results, is expected to post an 11.7% yoy decline in

sales on top line to end the period at `820cr. The dip in the sales is expected on

back of import alerts for its USFDA facilities. The EBDITA margins consequently are

expected to come in at 12.6% v/s 24.0% in 1QFY2015, on back of lower sales

during the quarter. Consequently the PAT is expected to come in at `36cr V/s

`145cr expected, a de-growth of 75.0% yoy. We maintain our accumulate rating

on the stock with a target price of `736.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

3,533

18.6

356

28.2

15.0

22.7

3.2

13.6

2.5

FY2017E

4,109

19.6

440

34.8

15.9

18.4

2.7

11.0

2.1

Indoco Remedies (CMP: `371/ TP: /Upside: )

Indoco Remedies, for its 1QFY2016 results, is expected to post a 28.3% yoy

growth in sales on top line to end the period at `254cr, mainly driven by exports.

The EBDITA margins consequently are expected to come in at 18.0% v/s 18.1% in

1QFY2015, inspite of higher R&D expenditure mainly driven by robust sales

growth. R&D expenditure during the quarter is expected to be 3.5% of sales V/s

2.2% of sales in 1QFY2015. Consequently, the PAT is expected to come in at

`27cr V/s `20cr in 1QFY2015, a growth of 34.5% yoy. We maintain our neutral

rating on the stock, on back of valuations.

Market Outlook

July 30, 2015

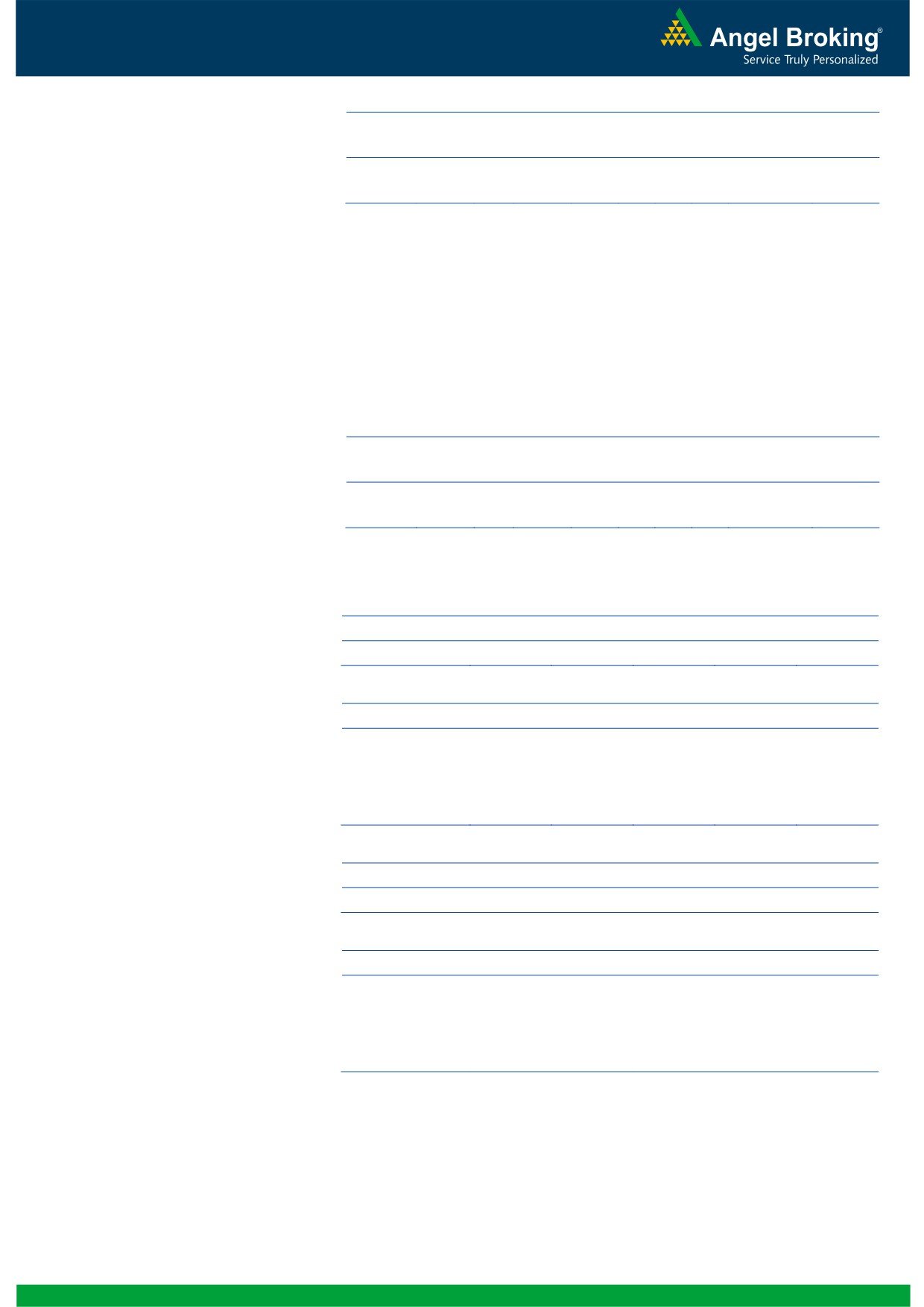

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

1,088

18.2

120

13.1

21.2

28.4

5.5

18.0

3.3

FY2017E

1,262

18.2

143

15.5

21.1

23.9

4.6

15.2

2.8

Dr Reddy’s Laboratories (CMP: `3,713/ TP: `3,963/Upside: 6.7%)

Dr Reddy’s Lab (DRL), for its 1QFY2016 results, is expected to post a 13.7% yoy

growth in sales on top line to end the period at `4,000cr, mainly driven by exports.

The EBDITA margins are expected to come in at 23.3% v/s 23.2% in 1QFY2015.

R&D expenditure during the quarter is expected to be 12.9% of sales V/s 11.0% of

sales in 1QFY2015. Consequently; the PAT is expected to come in at `642cr V/s

`550cr in 1QFY2015, a growth of 16.6% yoy. We maintain our accumulate rating

on the stock, on back of valuations.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

1,088

18.2

120

13.1

21.2

28.4

5.5

18.0

3.3

FY2017E

1,262

18.2

143

15.5

21.1

23.9

4.6

15.2

2.8

Quarterly Bloomberg Brokers Consensus Estimate

Kotak Mahindra Bank Ltd- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

PAT

600

430

40

527

14

Exide Industries Ltd- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

1,940

1,910

2

1,645

18

EBITDA

300

291

3

238

26

EBITDA margin (%)

15

15

14

Net profit

185

185

0

138

35

Bank of Baroda- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

PAT

901

1,362

(34)

6

14,952

IDFC Ltd (Consol)- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

900

2,123

(58)

2,571

(65)

EBITDA

840

1,784

(53)

1,944

(57)

EBITDA margin (%)

93

84

76

Net profit

374

482

(22)

382

(2)

Market Outlook

July 30, 2015

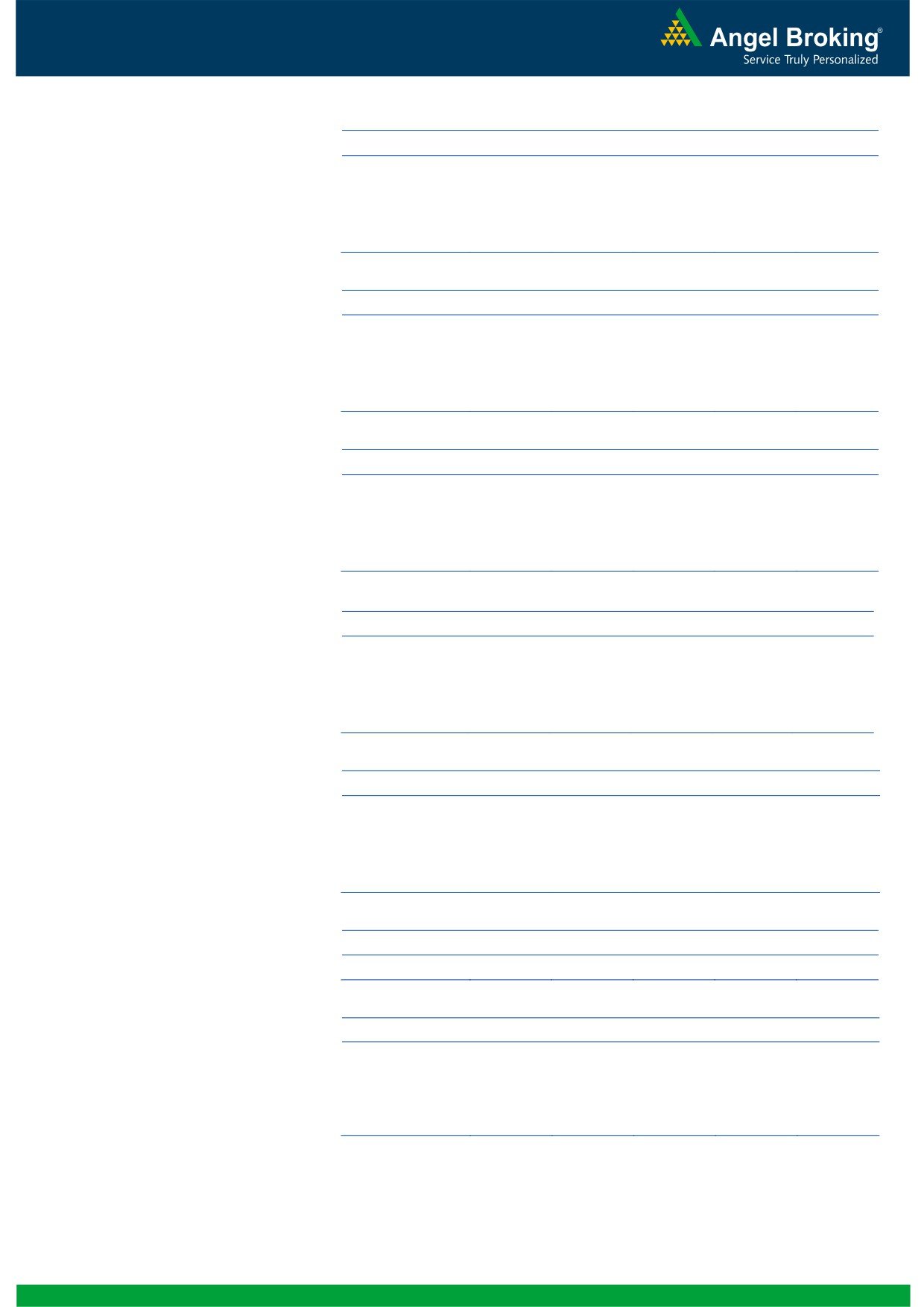

ITC Ltd- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

9,349

9,164

2

9,188

2

EBITDA

3,380

3,278

3

3,243

4

EBITDA margin (%)

36

36

35

Net profit

2,322

2,186

6

2,361

(2)

Colgate-Palmolive India Ltd- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

1,051

951

11

1,022

3

EBITDA

232

194

20

247

(6)

EBITDA margin (%)

22

20

24

Net profit

156

135

16

164

(5)

Dr Reddy's Laboratories Ltd (Consol)- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

3,859

3,518

10

3,870

0

EBITDA

863

779

11

765

13

EBITDA margin (%)

22

22

20

Net profit

554

550

1

519

7

Glenmark Pharmaceuticals Ltd (Consol)- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

1,778

1,478

20

1,754

1

EBITDA

366

342

7

281

30

EBITDA margin (%)

21

23

16

Net profit

208

185

12

11

1857

NTPC Ltd- July 30, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

18,571

18,086

3

19,230

(3)

EBITDA

4,195

3,519

19

4,649

(10)

EBITDA margin (%)

23

19

24

Net profit

2,116

2,201

(4)

2,944

(28)

ICICI Bank Ltd- July 31, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

PAT

2,920

2,655

10

2,922

0

Shriram Transport Finance Co Ltd- July 31, 2015

Particulars (` cr)

1QFY16E

1QFY15

y-o-y (%)

4QFY15

q-o-q (%)

Net sales

1,114

2,016

(45)

2,311

(52)

EBITDA

844

1437

(41)

1,670

(49)

EBITDA margin (%)

76

71

72

Net profit

329

306

7

317

4

Market Outlook

July 30, 2015

Economic and Political News

Govt to assess impact of MAT on IND-AS companies

Govt clears GST amendments, states to be compensated for 5 yrs

Govt clears seven FDI proposals worth `981cr

Corporate News

Eveready to enter home and kitchen appliances biz

BPCL buys first shipment of Russian Far East crude grade

SpiceJet in talks with Airbus, Boeing to acquire over 100 planes

Top Picks

Large Cap

Market Cap

CMP

Target

Upside

Company

Sector

Rating

(` Mn)

(`)

(`)

(%)

Axis Bank

Financials

134,744

Buy

567

716

26.2

ICICI Bank

Financials

167,872

Buy

289

392

35.5

Infosys

IT

249,264

Buy

1,085

1,306

20.3

Power Grid

Power

73,242

Buy

140

170

21.4

TCS

IT

491,269

Buy

2,508

3,168

26.3

Tech Mahindra

IT

50,471

Buy

525

646

23.1

Yes Bank

Financials

34,105

Buy

816

1,006

23.3

Ashok Leyland

Auto

24,090 Accumulate

85

88

4.0

LIC Housing Fin.

Financials

24,612 Accumulate

488

553

13.4

MRF

Others

16,758 Accumulate

39,513

43,439

9.9

Source: Angel Research, Bloomberg

Mid Cap

Market

CMP

Target

Upside

Company

Sector

Rating

Cap (` Mn)

(`)

(`)

(%)

Action Const. Equip. Capital Goods

450

Buy

45

54

18.8

Bajaj Electricals

Others

2,590

Buy

257

341

32.7

Hindustan Media Ven. Media

1,800

Buy

245

292

19.1

MBL Infrastructures

Construction

1,171

Buy

283

395

39.6

Mangalam Cements Cement

725

Buy

272

349

28.5

MT Educare

Others

465

Buy

117

141

20.8

Radico Khaitan

Others

1,217

Buy

92

112

22.4

Setco Automotive

Auto Ancillary

604

Buy

226

286

26.5

JK Tyre

Auto Ancillary

2,521

Buy

111

127

14.3

Source: Angel Research, Bloomberg

Market Outlook

July 30, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.