Market Outlook

October 28, 2015

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are expected to open on a Flat to Negative note tracking the SGX

BSE Sensex

(0.4)

(109)

27,253

Nifty and most Global markets.

Nifty

(0.3)

(28)

8,233

The US markets moved lower and ended in the negative territory yesterday as the

Mid Cap

0.2

17

11,098

traders booked profits ahead of FOMC rate decision and Federal Reserve

Small Cap

0.2

17

11,454

commentary. Disappointing Durable Goods orders, which declined by 1.2% in

September and decline in US Consumer Confidence to 97.6 also added to the

Bankex

(0.1)

(24)

20,325

negative sentiment.

The European markets also ended in the red yesterday as disappointing quarterly

Global Indices

Chg (%)

(Pts)

(Close)

earnings from companies like BASF and Novartis and poor U.K. GDP growth

Dow Jones

(0.2)

(42)

17,581

(declined by 0.5% vs. expected growth of 0.6%) dampened investor sentiment.

Nasdaq

(0.1)

(5)

5,030

Indian markets were down throughout the day as mixed corporate earnings

FTSE

(0.8)

(52)

6,365

continued to disappoint traders.

Nikkei

(0.9)

(172)

18,775

Hang Seng

0.1

26

23,143

News & Result Analysis

Shanghai Com

0.1

5

3,434

Result Review: Axis Bank, Lupin, Alembic Pharma, Ceat

Detailed analysis on Pg2

Advances / Declines

Bse

Nse

Investor’s Ready Reckoner

Advances

1,220

657

Key Domestic & Global Indicators

Declines

1,482

825

Stock Watch: Latest investment recommendations on 150+ stocks

Unchanged

154

92

Refer P6 onwards

Top Picks

Volumes (` Cr)

CMP

Target

Upside

Company

Sector

Rating

BSE

2,809

(`)

(`)

(%)

Axis Bank

Financials

Buy

521

674

29.3

NSE

16,899

HCL Tech

IT

Buy

868

1,132

30.5

ICICI Bank

Financials

Buy

284

370

30.4

Net Inflows (` Cr)

Net

Mtd

Ytd

Power Grid

Power

Buy

134

170

27.2

FII

10

5,049

(28,830)

TCS

IT

Buy

2,530

3,165

25.1

MFs

(165)

(2,940)

55,963

More Top Picks on Pg4

Key Upcoming Events

Top Gainers

Price (`)

Chg (%)

Previous

Consensus

Date

Region

Event Description

Bfutilitie

589

19.5

Reading

Expectations

Oct 28

US

FOMC rate decision

0.25

0.25

Tvsmotor

276

13.2

Oct 29

Germany

Unemployment change (000's)

2.0

(4)

Finolexind

320

5.9

Oct 29

US

GDP Qoq (% change)

3.9

1.6

Niittech

579

5.0

Nov 1

China

PMI Manufacturing

49.8

-

Cox&Kings

252

4.7

Top Losers

Price (`)

Chg (%)

Lupin

1,946

(5.3)

Shreecem

12,220

(4.2)

Ongc

248

(3.1)

Hdfc

1,275

(2.9)

Gsfc

73

(2.8)

As on October 27, 2015

Market Outlook

October 28, 2015

Result Review

Axis Bank (CMP: `521 / TP: `673 / Upside: 29.2%)

Axis Bank reported a positive set of numbers for 2QFY2016 with steady asset

quality and 18.9% yoy growth in profit to `1,915.6cr which was well in-line with

the expectations. On the balance sheet front, Advances for the quarter grew by

23% yoy, which is strong, considering the slower credit growth in the economy.

Retail Advances grew 27% yoy and accounted for 40% of the Net Advances of the

Bank. On the operating front, the Net Interest Income for the bank grew at a

moderate pace by 15.2% yoy which was slightly below expectations likely due to

higher than expected impact of base rate cut. Provisions for the bank declined 37%

qoq whereas on a yoy basis, it declined by 2.5% which was much below our

expectations.

On the asset quality front, the bank reported a steady set of numbers, as its

reported Gross as well as Net NPA ratio was constant at 1.38% and 0.48% which

is similar to the previous quarter. Slippages too came in at `583cr which were

much below than the previous quarter at `1,186cr suggesting better asset quality.

However, we would wait for more clarity regarding any sale to ARC’s for the

quarter.

Hence, given the bank’s healthy advances growth, better than expected asset

quality combined with consistent growth in earnings, we are of the view that the

stock is attractively valued at 2.1x FY2017E P/ABV. We recommend a BUY rating

on the stock.

Y/E

Op. Inc

NIM

PAT

EPS ABV ROA ROE

P/E P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2016E

40,401

3.6

8,784

37.1

214.2

1.8

18.7

14.1

2.4

FY2017E

47,741

3.6 10,746

45.3

249.4

1.8

20.0

11.5

2.1

Lupin (CMP: `1,944 / TP: -/Upside: -)

For 2QFY2016, the company posted bad set of numbers, with OPM’s coming in

lower than expected, consequently net profit. The company posted a 2.0% growth

in sales to end the period at `3178cr V/s `3272cr estimated, mainly driven by

European markets. Its key market US (`11,550cr), posted a dip of 9.2%, on slow

pace of approvals. The company launched 4 products in US during the period.

The company expects the US sales to get normalized by 4QFY2016. Other key

markets: India, Europe, Japan, South Africa and ROW, which posted a growth of

9.4%, 32.2%, -6.5%, -5.6% and 52.9% yoy respectively.

On operating front, the Gross margins came in at 64.5% V/s 65.7% expected.

However, a lower growth and 19.4% and 36.2% rise in the Staff cost and R&D

expenditure lead the OPM come in at 16.6% V/s 24.6% expected and 24.9% in

2QFY2015. Thus, the net profit came in at `408.5cr V/s `578.6cr expected and

`630.0cr, a yoy dip of 35.2%. We maintain our Neutral stance on the stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

13,092

25.0

2,266

50.4

22.8

38.6

8.0

26.0

6.5

FY2017E

15,110

27.9

2,891

64.3

23.4

30.3

6.4

19.7

5.5

Market Outlook

October 28, 2015

Alembic Pharma (CMP: `664 / TP: -/Upside: -)

For 2QFY2016, company posted numbers well ahead of expectations. The

company posted an 84.5% growth in sales to end the period at `1008cr V/s `750c

expected. This was primarily driven by gAbilify launch in the US. Overall

formulations were 84% of sales in 2QFY2016, with International generic (45% of

sales) and Indian branded (34% of sales). The international generic (`559.3cr)

posted sales growth of 342% yoy. The Indian formulation branded sales (`2846cr)

posted sales growth of 3.3% yoy. The API business posted a yoy growth of 43%

yoy. On operating front, the OPM came in at 37.2% V/s 27.8% expected V/s

19.5% in 2QFY2015. R&D expenditure during the quarter was 9.4% of sales V/s

13.0% of sales in 2QFY2015. The net profit consequently came in at `289cr V/s

`177.3cr expected and V/s `77.3cr in 2QFY2015, a yoy growth of 273.9%. We

maintain our Neutral stance on the stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

2,601

21.2

391

20.8

37.2

32.0

10.3

22.6

4.8

FY2017E

3,115

20.2

451

23.9

28.4

27.8

7.7

19.5

3.8

Ceat (CMP: `1,178 / TP: -/Upside: -)

Ceat Ltd 2QFY2016 results were in line with our estimates. Revenues, on the

expected lines dipped marginally 2% yoy to `1,409 cr. Pricing cuts to pass on the

soft raw material prices along with subdued domestic demand and increased

Chinese imports continue to put pressure on the top line. Operating margins

improved sharply 220bp yoy to 14.4% primarily on account of soft raw material

prices and were in line with our estimates of 14.1%. Given the improvement in the

operating metrics, the Net profit grew strongly 30% yoy to `107.4 cr meeting our

estimates of `102 cr. We currently have Neutral view on the stock but would

review estimates post the management interaction.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

6,041

14.3

410

101.5

20.0

11.6

2.3

6.5

0.9

FY2017E

6,597

14.1

472

116.6

19.1

10.1

1.9

5.7

0.8

Economic and Political News

Government sets up panel to simplify Income Tax laws

India Inc's external borrowings down 32% at $2.6bn in Sept

Government to award 100 highway projects on PPP next year

Corporate News

Hero aims to sell 600,000 two-wheelers in October

Cairn-Vedanta merger deal not to be reworked

Bharat Forge rejigs European operations

Market Outlook

October 28, 2015

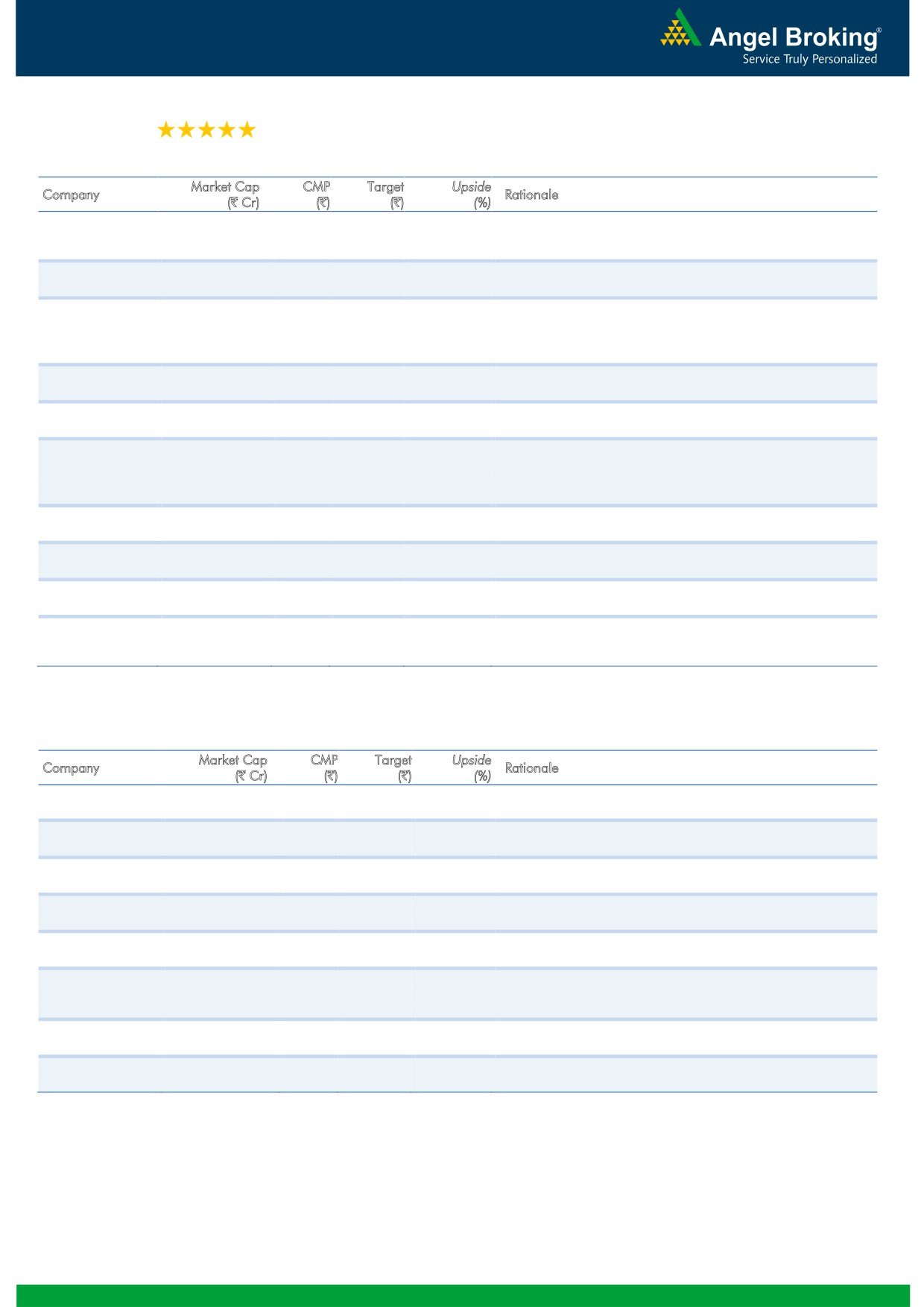

Top Picks

Large Cap

M

arket Cap

CM

P

T

arget

Upsid

e

Company

Rationale

(` Cr)

(`)

(`)

(%)

Healthy pace of branch expansion, backed by distribution

Axis Bank

1,23,958

521

674

29.3

network, will be the driving force for the bank’s retail business

and overall earnings.

The stock is trading at attractive valuations and is factoring all

HCL Tech

1,22,049

868

1,132

30.5

the bad news.

Due to its robust franchise and capital adequacy position, the

bank is well positioned to grow by at least a few percentage

ICICI Bank

1,64,764

284

370

30.4

points higher than the average industry growth rate from a

structural point of view.

Back on the growth trend, expect a long term growth of 14% to

Infosys

2,63,793

1,148

1,306

13.7

be a US$20bn in FY2020.

Government thrust on Renewable sector and strong order book

Inox Wind

8,932

403

505

25.5

would drive future growth.

LICHF continues to grow its retail loan book at a healthy pace

with improvement in asset quality. We expect the company to

LIC HFL

24,741

490

570

16.3

post a healthy loan book which is likely to reflect in a strong

earnings growth.

Direct beneficiary of the huge investments lined up in the power

Power Grid

69,894

134

170

27.2

transmission sector.

Growth to pick up from 2HFY2017, attractive given the risk-

TCS

4,98,479

2,530

3,165

25.1

reward.

Tech Mahindra

51,740

538

646

20.2

Acquisitions, to drive growth, normalised valuations attractive.

An improving liability franchise, capital adequacy well above

Yes Bank

31,471

751

906

20.6

Basel III requirements and lowest NPA ratio in the industry, will

help Yes Bank to deliver a stronger growth.

Source: Company, Angel Research

Mid Cap

M

arket Cap

CM

P

T

arget

Upsid

e

Company

Rationale

(` Cr)

(`)

(`)

(%)

Bajaj Electricals

2,502

248

341

37.5

Visible turnaround in E&P business to drive the earnings

Garware Wall Ropes

739

338

390

15.5

Higher exports & easing material prices to drive profitability

Comfortable balance sheet to support strong growth; this

MBL Infrastructures

875

211

360

70.5

coupled with attractive valuation to lead to rerating.

New product introductions and increased sourcing by clients to

Minda Industries

818

516

652

26.4

enable outpace industry growth

Strong brand & quality teaching with innovative technologies &

MT Educare

548

138

169

22.7

higher government educational spending to boost growth

Earnings boost on back of stable material prices and favourable

Radico Khaitan

1,296

97

112

15.0

pricing environment. Valuation discount to peers provides

additional comfort

Structural shift in the Lighting industry towards LED lighting will

Surya Roshni

616

141

183

30.2

drive growth.

Tree House

1,193

282

449

59.2

Robust expansion plan for pre-schools to drive growth

Source: Company, Angel Research

Market Outlook

October 28, 2015

Quarterly Bloomberg Brokers Consensus Estimate

Dabur India- October 28, 2015

Particulars (` cr)

2QFY16E

2QFY15

y-o-y (%)

1QFY16

q-o-q (%)

Net sales

2,127

1,924

10.6

2,064

3.1

EBITDA

410

351

16.8

322

27.3

EBITDA margin (%)

19.3

18.2

15.6

Net profit

332

288

15.3

261

27.2

Exide industries- October 28, 2015

Particulars (` cr)

2QFY16E

2QFY15

y-o-y (%)

1QFY16

q-o-q (%)

Net sales

1,771

1,761

0.6

1,795

(1.3)

EBITDA

245

208

17.8

266

(7.9)

EBITDA margin (%)

13.8

11.8

14.8

Net profit

142

126

12.7

155

(8.4)

Market Outlook

October 28, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.