Market Outlook

October 27, 2015

Market Cues

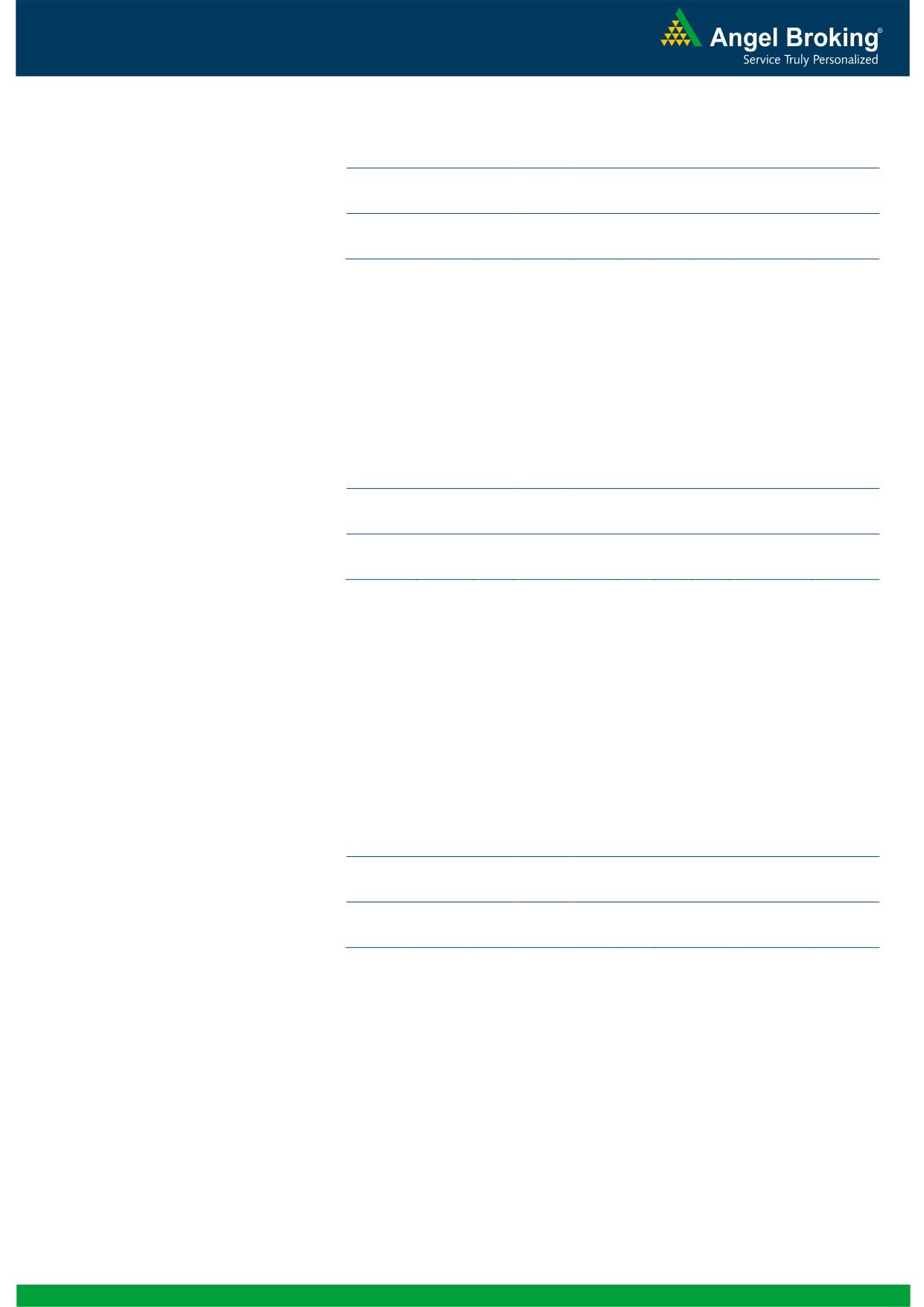

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are expected to open on a Flat to Negative note tracking the SGX

BSE Sensex

(0.4)

(109)

27,362

Nifty and most Global markets.

Nifty

(0.4)

(35)

8,261

After a substantial rally in the previous two sessions, US markets showed weakness

Mid Cap

(0.5)

(58)

11,081

and closed on a flat note as traders were reluctant in participating ahead of Federal

Small Cap

(0.7)

(82)

11,437

Reserve’s (Fed) Monetary Policy announcement on Wednesday.

Bankex

(0.6)

(129)

20,349

Major European markets closed yesterday’s trading session on a negative note as

traders booked profits after the extended gains. Additionally, there was little

economic data to drive trading action and traders were also reluctant ahead of Fed

Global Indices

Chg (%)

(Pts)

(Close)

announcement.

Dow Jones

(0.1)

(24)

17,623

Indian markets erased its early gains and closed yesterday’s trading session in the

Nasdaq

0.1

3

5,035

negative zone as domestic companies reported earnings that continued to

FTSE

(0.4)

(27)

6,417

disappoint traders.

Nikkei

0.6

122

18,947

Hang Seng

(0.2)

(36)

23,116

News & Result Analysis

Shanghai Com

0.5

18

3,430

Result Review: HDFC, UPL, Wonderla Holidays, Hindustan Media Ventures, Blue

Star Ltd, Hitachi Home.

Result Preview: Lupin, Alembic Pharma, Maruti Suzuki, TVS Motors

Advances / Declines

Bse

Nse

Detailed analysis on Pg2

Advances

968

496

Investor’s Ready Reckoner

Declines

1,753

1,018

Key Domestic & Global Indicators

Unchanged

143

75

Stock Watch: Latest investment recommendations on 150+ stocks

Refer P8 onwards

Volumes (` Cr)

BSE

2,665

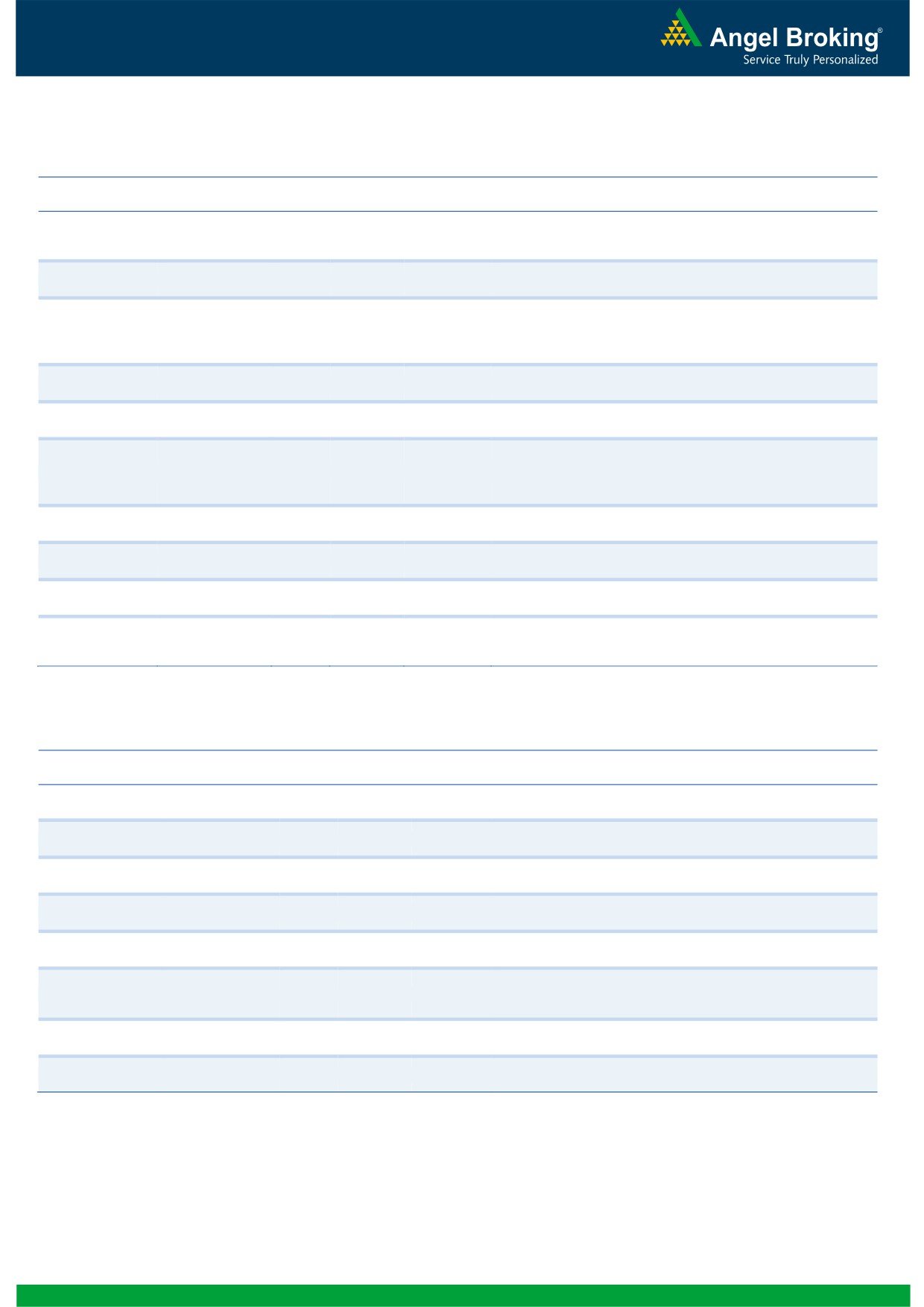

Top Picks

NSE

14,166

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Axis Bank

Financials

Buy

521

674

29.4

Net Inflows (` Cr)

Net

Mtd

Ytd

HCL Tech

IT

Buy

863

1,132

31.2

FII

725

5,039

(28,839)

ICICI Bank

Financials

Buy

285

370

29.7

MFs

(156)

(2,244)

56,129

Power Grid

Power

Buy

136

170

25.1

TCS

IT

Buy

2,535

3,165

24.8

Top Gainers

Price (`)

Chg (%)

More Top Picks on Pg7

Gsfc

75

8.5

Key Upcoming Events

Niittech

552

4.9

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

Bajajfinsv

1,907

4.1

Oct 27

UK

GDP(YoY)

2.4

-

Godrejind

380

3.9

Oct 27

US

Consumer Confidence

103.0

102

Bhel

218

3.7

Oct 28

US

FOMC rate decision

0.25

0.25

Oct 28

Germany

Unemployment change (000's)

2.0

-

Top Losers

Price (`)

Chg (%)

Sreinfra

47

(7.6)

Jswenergy

88

(5.2)

Asianpaint

817

(4.7)

Justdial

1,004

(4.6)

Jpinfratec

13

(4.6)

As on October 26, 2015

Market Outlook

October 27, 2015

Result Review

HDFC (CMP: `1,313/ TP: -/Upside: -)

HDFC reported in-line standalone earnings performance for the quarter. PBT level

earnings, adjusted for dividends and sale of investments, for the company grew at

4.3%, which was slightly below expectations. Individual loan book growth was 23%

yoy (after adding back the loans sold in the preceding 12 months) whereas the

corresponding reported loan book growth was 14.0% which was lower than

expected. This was likely due to greater amount of loans sold to HDFC bank in

recent quarters. Asset quality was stable with Gross NPA at 0.71%. NII for the

company grew at 6.2% yoy due to lower than expected loan growth. Non-interest

income for the company came in at `486.6cr as compared to `242.2cr in

2QFY2015. The increase is attributed to the dividend income from HDFC Bank,

which in FY 2015 was received in first quarter, whereas in FY 2016, it has been

received in this quarter. Operating income and pre-provisioning profit grew at

16.7% and 17.8% yoy, respectively. Provisioning expenses came in at `52cr,

marginally higher than `50cs for 1QFY2016. Overall, the company reported

standalone earnings growth of 18.2% yoy.

HDFC continues to post good set of numbers despite sluggish economic

environment. Overall, we expect HDFC to post a healthy PAT CAGR of 15.3% over

FY2015-17E. The stock has surged significantly from the lows witnessed in the

month of August 2015 and currently, HDFC’s core business (after adjusting

`482/share towards the value of its subsidiaries) trades at 4.5x FY2017E ABV,

which in our view, offers limited scope for upside here on. Hence, we maintain our

Neutral rating on the stock.

Y/E

Op. Inc

NIM

PAT

EPS ABV ROA ROE

P/E P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2016E

10,883

3.4

6,764

43.0

216.7

1.1

25.9

30.6

6.1

FY2017E

12,799

3.4

7,969

50.6

240.3

1.1

26.7

25.9

5.5

UPL (CMP: `448 / TP: `510 /Upside:13.8%)

For 2QFY2016, the company posted a 4.2% growth in sales to end the period at

`2729cr. Its key markets India and Latin America posted a yoy 5% and 8%

respectively. ROW and USA, posted a yoy growth of 12% and 10% respectively.

The only market which posted a dip was Europe, which posted a 10% yoy dip in

the sales. The volume growth during the period was 13% yoy, while price increases

contributed around 2% yoy. Exchange rate on the other hand, dipped by 11% yoy.

On operating front, the Gross margins came in at

49.9% V/s

50.5% in

2QFY2015, which aided the OPM to come in at 16.5% V/s 16.7% in 2QFY2015.

This led the company to post a 12.3% yoy dip in the PBT excluding the extra-

ordinaries and profits from associates and subsidiaries. However, a higher share

of profitability from associates and subsidiaries, the company posted an Adj. PAT

of `190cr V/s `180cr, a yoy growth of 5.8%. We maintain our Accumulate on the

stock with a price target of `510.

Market Outlook

October 27, 2015

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

13,698

20.0

1,376

32.1

21.4

14.0

2.7

10.3

1.8

FY2017E

15,752

20.0

1,651

38.5

21.3

11.6

2.3

8.6

1.5

Wonderla Holidays (CMP: `315 / TP: `322 /Upside: -)

Wonderla Holidays 2QFY2016 results have come in ahead of our expectations.

The company’s top-line for the quarter grew by a healthy ~26% yoy to `43cr (our

estimate was of `38cr), mainly due to healthy growth in footfalls and increase in

average realisation. On the operating front, the company reported

margin improvement by

265bp yoy to 34%, primarily on account of lower

employee, advertisement and other expenses. The net profit grew by ~86% yoy

to `12cr due to improvement in performance at the operating level, higher other

income and lower taxes.

Going ahead, we expect the company to report a healthy growth in footfalls with it

setting up a new amusement park in Hyderabad, which would be operational in

FY2017. Moreover, the company has negative working capital, negligible debt,

and is able to post a healthy return ratio, which makes the balance sheet all the

more attractive. Currently, the stock is trading close to our target price; we will

update our investment recommendation on the stock shortly, i.e. post results

conference call.

Hindustan Media Ventures (CMP: `272 / TP: `295 /Upside: 8%)

For 2QFY2016, Hindustan Media Ventures Ltd (HMVL) reported earnings above

our estimates. The top-line grew by ~14% yoy to ~`227cr, mainly due to decent

growth in both the segments, i.e. (a) advertising revenues reported a ~18% yoy

growth and (b) circulation revenues reported a ~8% yoy growth. For the quarter,

the company reported an operating profit of ~`52cr, up ~33% yoy. Further, the

company’s operating margin expanded by 334bp yoy to 22.9% for the quarter,

primarily on account of lower raw material prices which were down 452bp as a

percentage of sales, mainly due to decrease in newsprint costs. The net profit grew

by ~43% yoy to ~`45cr due to improvement in performance at the operating level

and higher other income. Currently, we have an Accumulate rating on the stock.

Blue Star Ltd (CMP: `360/ TP: `388 / Upside: 7.7%)

For 2QFY2016, Blue Star reported numbers that were broadly in line with our

estimates. The standalone top-line for the quarter reported an impressive 12.3%

yoy increase to `717cr. This is in-line with our estimate of `714cr. The Electro

Mechanical Projects and Packaged Air-conditioning Systems (EMPPAC) business

revenue grew by 14.8% yoy to `459cr, the Cooling Products business revenue

grew by an impressive 19.1% yoy to `246 and PEIS business revenue de-grew by

66.0% yoy to `12cr. On operating front, the EBITDA margin expanded by 54bp

yoy to 3.8% vis-à-vis our estimate of 3.3%. The raw material cost as a percentage

of sales increased by 136bp yoy to 70.2% but this was made up by 109bp yoy and

81bp yoy decline in Employee and Other expenses to

8.9% and

17.1%,

respectively. The EBIT margins for EMPPAC, Cooling Products and PEIS were 5.7%,

5.7% and 17.2% respectively. On account of lower other income and adjusting for

Market Outlook

October 27, 2015

exceptional expenses arising from VRS related expenses of `16cr, the net profit de-

grew by 24.3% yoy to `7cr, against our estimate of `4cr.

Going ahead, we expect Blue Star to maintain its performance on the back of

improving conditions for the EMPPAC business and superior performance from the

Cooling Products business. The company has significantly increased its distribution

network to 2250 dealers as compared to 1950 dealers during the same period in

the previous year which helped in enhancing revenue of the Cooling Products

business.

At the current market price, the stock is trading at EV/Sales of 0.8x for FY2017E.

We maintain our Accumulate rating on the stock and with a target price of `388

based on target EV/Sales of 0.9x for FY2017E. We may revise our numbers post

2QFY2016 earnings call.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

3,641

5.4

94

10.4

19.7

34.5

6.5

18.1

1.0

FY2017E

4,196

6.1

140

15.5

26.0

23.2

5.6

13.7

0.8

Hitachi Home (CMP: `1,518/ TP: -/ Upside: -)

For 2QFY2016, the company reported disappointing set of numbers. The top-line

declined by 1.2% yoy to `251cr, far lower than our estimate of `320cr. The muted

performance can be attributed to lower realizations which had impacted some

players in the industry on the back of excess inventory build-up. Operating

expenses as a percentage of sales grew by 7.4% on yoy basis. This was due to

387bp yoy increase in raw materials as a percentage of sales to 63.5% and

398bp yoy increase in other expenses as a percentage of sales. As a result, the

company reported operating net loss of `5cr. On account of higher depreciation

and lower other income, the company reported a net loss of `11cr against

estimated net profit of `6cr.

At the current market price, the stock is trading at PE of 30.1x for FY2017E.

Although Hitachi Home has strong parental support in terms of technological

support and is expected to benefit from consolidation of its operations (to Gujarat),

the valuations remain expensive. Hence we maintain our Neutral view on the

stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

Mar

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

1,780

8.1

63

23.2

18.4

63.8

10.8

28.7

2.3

FY2017E

2,082

8.8

90

33.1

21.7

44.7

8.8

22.4

2.0

Preview

Lupin (CMP: `2,053 / TP: -/Upside: -)

For 2QFY2016, the company is expected to post a 5.0% growth in sales to end

the period at `3272cr, mainly driven by domestic markets. On operating front, the

Gross margins are expected to come in at 65.7%, same as last year during the

corresponding period. Consequently, the OPM is expected to come in at 24.6%

Market Outlook

October 27, 2015

V/s 24.9% in 2QFY2015. The net profit is expected to come in at `578.6cr V/s

`630.0cr, a yoy dip of 8.2%. We maintain our Neutral stance on the stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

13,092

25.0

2,266

50.4

22.8

40.7

8.4

27.5

6.9

FY2017E

15,110

27.9

2,891

64.3

23.4

31.9

6.7

20.8

5.8

Alembic Pharma (CMP: `679 / TP: -/Upside: -)

For 2QFY2016, the company is expected to post a 37.3% growth in sales to end

the period at `750cr. primarily driven by gAbilify launch in the US. Conservative

estimate suggest ~USD20mn sales from gAbilify in 2QFY2016.On operating

front, the OPM is expected to come in at 27.8% V/s 19.5% in 2QFY2015. The net

profit is expected to come in at `177.3cr V/s `77.3cr, a yoy growth of 129.4%. We

maintain our Neutral stance on the stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

2,601

21.2

391

20.8

37.2

32.7

10.5

23.2

4.9

FY2017E

3,115

20.2

451

23.9

28.4

31.8

7.9

20.0

4.0

Maruti Suzuki (CMP: `4,388 / TP: `4,960 /Upside: 13%)

Maruti Suzuki India Ltd (MSIL) is slated to announce its 2QFY2016 results today.

MSIL’s top line is expected to grow strongly 14% yoy to `14,007 cr. Volume growth

in 2QFY2016 has been close to double digits and would be the prime driver for

top line. Realisation/vehicle is expected to improve 4% yoy on account of better

product mix and price hikes. On the EBIDTA front, the margins are likely to

improve sharply by 380bp yoy to 16.2% on account of JPY depreciation, lower

discounting and operating leverage. EBIDTA is estimated to grow strongly 49% yoy

to `2,265cr. Given the robust operating performance, the Net Profit is estimated to

grow 45% yoy to `1,248cr. We currently have Accumulate rating on the stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

58,102

16.7

5,498

182.0

19.9

24.1

4.8

12.9

2.1

FY2017E

68,687

16.9

6,812

225.5

21.0

19.5

4.1

10.5

1.7

TVS Motors (CMP: `244 / TP: -/ Upside: -)

TVS Motors (TVSM) would announce its 2QFY2016 results today. TVSM’s topline is

expected to remain flattish yoy at `2,718 cr. Both volumes and realization are

estimated to remove flat. On the EBIDTA front, the margins at 6% are likely to

remain flat. Higher interest expenses would dent profitability. Net Profit is

estimated to decline 4% yoy to Rs 91cr. We currently have Neutral rating on the

stock.

Market Outlook

October 27, 2015

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

11,702

6.8

479

10.1

24.5

24.2

5.9

17.4

1.1

FY2017E

13,713

7.7

689

14.5

28.3

16.8

4.8

14.9

0.9

Economic and Political News

Government to launch Gold Monetisation Scheme ahead of Diwali

Centre to address regulatory, financial issues in infra sector

India's fuel consumption to be higher in 18 months, says Moody's

The Department of Disinvestment wants PSU stake sale target to be more than

halved

Corporate News

REC plans to raise `700cr via tax-free non-convertible bonds

Aban Offshore bags $50mn order from ONGC

Crompton Greaves to sell power systems business in Canada CAD20mn

Sterling Holidays acquires Nature Trails

Market Outlook

October 27, 2015

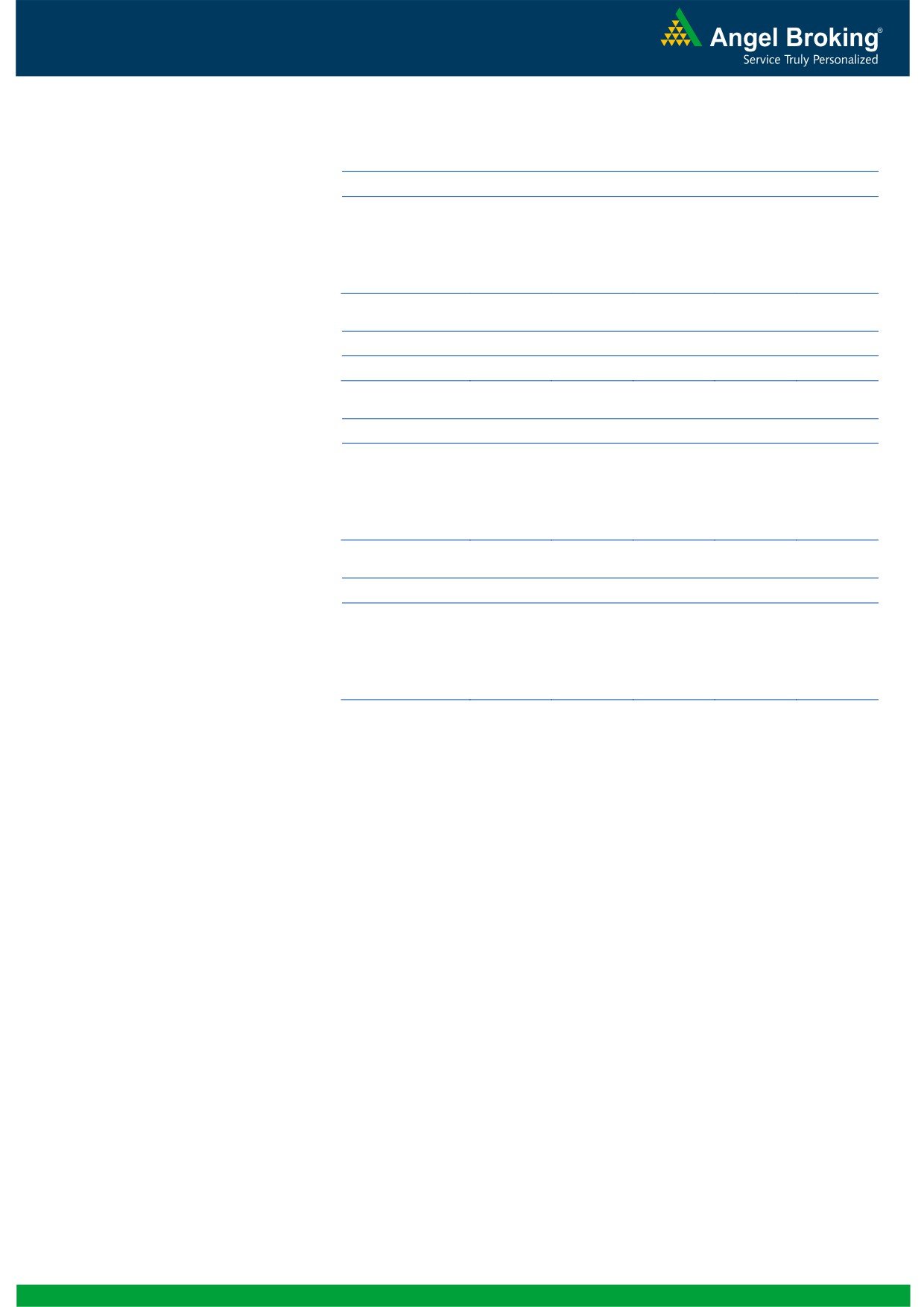

Top Picks ★★★★★

Large Cap

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Healthy pace of branch expansion, backed by distribution

Axis Bank

1,23,922

521

674

29.4

network, will be the driving force for the bank’s retail business

and overall earnings.

The stock is trading at attractive valuations and is factoring all

HCL Tech

1,21,317

863

1,132

31.2

the bad news.

Due to its robust franchise and capital adequacy position, the

bank is well positioned to grow by at least a few percentage

ICICI Bank

1,65,635

285

370

29.7

points higher than the average industry growth rate from a

structural point of view.

Back on the growth trend , expect a long term growth of 14% to

Infosys

2,64,470

1,151

1,306

13.4

be a US$20bn in FY2020.

Government thrust on Renewable sector and strong order book

Inox Wind

8,651

390

505

29.5

would drive future growth.

LICHF continues to grow its retail loan book at a healthy pace

with improvement in asset quality. We expect the company to

LIC HFL

24,602

488

570

16.9

post a healthy loan book which is likely to reflect in a strong

earnings growth.

Direct beneficiary of the huge investments lined up in the power

Power Grid

71,071

136

170

25.1

transmission sector.

Growth to pick up from 2HFY2017, attractive given the risk-

TCS

4,99,543

2,535

3,165

24.8

reward.

Tech Mahindra

52,187

542

646

19.1

Acquisitions, to drive growth, normalised valuations attractive.

An improving liability franchise, capital adequacy well above

Yes Bank

31,265

746

906

21.4

Basel III requirements and lowest NPA ratio in the industry, will

help Yes Bank to deliver a stronger growth.

Source: Company, Angel Research

Mid Cap

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Bajaj Electricals

2,535

251

341

35.7

Visible turnaround in E&P business to drive the earnings

Garware Wall Ropes

747

341

390

14.3

Higher exports & easing material prices to drive profitability

Comfortable balance sheet to support strong growth; this

MBL Infrastructures

893

215

360

67.1

coupled with attractive valuation to lead to rerating.

New product introductions and increased sourcing by clients to

Minda Industries

806

508

652

28.4

enable outpace industry growth

Strong brand & quality teaching with innovative technologies &

MT Educare

546

137

169

23.2

higher government educational spending to boost growth

Earnings boost on back of stable material prices and favourable

Radico Khaitan

1,288

97

112

15.7

pricing environment. Valuation discount to peers provides

additional comfort

Structural shift in the Lighting industry towards LED lighting will

Surya Roshni

615

140

183

30.4

drive growth.

Tree House

1,197

283

449

58.7

Robust expansion plan for pre-schools to drive growth

Source: Company, Angel Research

Market Outlook

October 27, 2015

Quarterly Bloomberg Brokers Consensus Estimate

Maruti Suzuki India Ltd Consol - October 27, 2015

Particulars (` cr)

2QFY16E

2QFY15

y-o-y (%)

1QFY16

q-o-q (%)

Net sales

13,950

11,996

16.3

13,078

6.7

EBITDA

2,237

1,521

47.1

2,189

2.2

EBITDA margin (%)

16.0

12.7

16.7

Net profit

1,259

863

45.9

1,193

5.5

Axis Bank Consol - October 27, 2015

Particulars (` cr)

2QFY16E

2QFY15

y-o-y (%)

1QFY16

q-o-q (%)

PAT

1,944

1,611

20.7

1,978

(1.7)

Vedanta Ltd Consol - October 27, 2015

Particulars (` cr)

2QFY16E

2QFY15

y-o-y (%)

1QFY16

q-o-q (%)

Net sales

16,083

19,448

(17.3)

16,951

(5.1)

EBITDA

3,803

6,327

(39.9)

3,992

(4.7)

EBITDA margin (%)

23.6

32.5

23.6

Net profit

625

1,619

(61.4)

866

(27.8)

Lupin Ltd Consol - October 27, 2015

Particulars (` cr)

2QFY16E

2QFY15

y-o-y (%)

1QFY16

q-o-q (%)

Net sales

3,346

3,117

7.4

3,074

8.8

EBITDA

858

833

3.1

817

5.1

EBITDA margin (%)

25.7

26.7

26.6

Net profit

570

639

(10.9)

525

8.6

Market Outlook

October 27, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.