Market Outlook

May 25, 2016

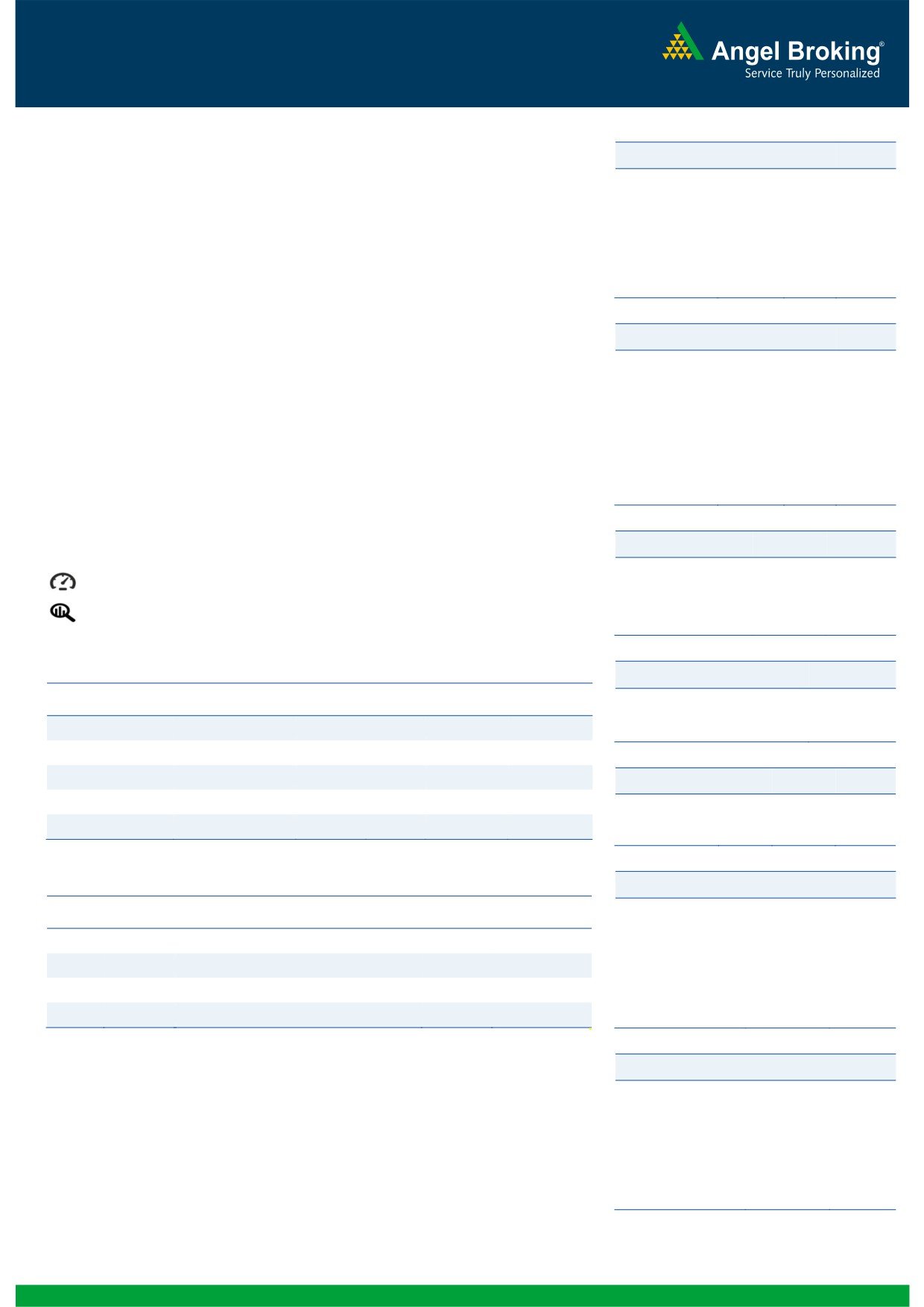

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

0.3

75

25,305

Indian Markets are expected to open in the green tracking global cues and the SGX

Nifty

0.2

18

7,749

Nifty.

Mid Cap

(0.2)

(18)

10,973

U.S markets closed sharply higher led by receding fear of a rate hike and sharp

Small Cap

(0.6)

(71)

10,852

16.6% jump in new home sales in the month of April. This was way ahead of the

expectations of a 2.3% increase in home sales as predicted by economists.

Bankex

0.3

52

18,703

European markets ended with significant gains, following reduced fears of a Brexit,

after the latest polls showed a rise in support for the U.K. to remain a member of the

Global Indices

Chg (%)

(Pts)

(Close)

European Union.

Dow Jones

1.2

213

17,706

Indian markets kept gyrating between positive and negative territory before finally

Nasdaq

2.0

95

4,861

closing in the green. Markets also saw some pressure ahead of the expiry of the

FTSE

1.3

83

6,219

derivative series due on Thursday.

Nikkei

(0.9)

(156)

16,499

News Analysis

Hang Seng

0.1

21

19,830

Result Review - Cipla, Tech Mahindra, Linc Pen & Plastics

Shanghai Com

(0.8)

-22

2,822

Detailed analysis on Pg2

Advances / Declines

BSE

NSE

Investor’s Ready Reckoner

Advances

899

492

Key Domestic & Global Indicators

Declines

1,638

1,075

Stock Watch: Latest investment recommendations on 150+ stocks

Unchanged

169

64

Refer Pg6 onwards

Top Picks

Volumes (` Cr)

CMP

Target

Upside

Company

Sector

Rating

BSE

2,608

(`)

(`)

(%)

Amara Raja

Auto/Auto Ancillary

Buy

894

1,076

20.3

NSE

15,172

HCL Tech

IT

Buy

738

1,000

35.6

LIC Housing

Financials

Buy

435

592

36.1

Net Inflows (` Cr)

Net

Mtd

Ytd

Bharat Electronics

Capital Goods

Buy

1,109

1,414

27.5

FII

(36)

1,083

12,873

Navkar Corporation Others

Buy

187

265

41.9

MFs

15

3,773

6,369

More Top Picks on Pg5

Key Upcoming Events

Top Gainers

Price (`)

Chg (%)

Previous

Consensus

Date

Region

Event Description

Redington

121

11.3

Reading

Expectations

Fsl

42

5.3

May 26 UK

GDP (YoY)

2.1

2.1

May 26 US

Initial Jobless claims

278

275

Neyvelilig

71

4.7

May 27 US

GDP QoQ (Annualised)

0.5

0.9

Hathway

33

4.1

May 30 US

Consumer Confidence

94.2

96.1

Edelweiss

69

4.0

6.(

More Events on Pg6

Top Losers

Price (`)

Chg (%)

Gvkpil

5

(11.5)

Justdial

641

(8.7)

Hindcopper

43

(8.2)

Welcorp

82

(6.8)

Balramchin

104

(5.7)

As on May 24, 2016

Market Outlook

May 25, 2016

Result Review

Cipla (CMP: `495 / TP: / Upside: )

The company posted results much below expectations. For 4QFY2016, Cipla

posted sales of `3207cr V/s `3274cr expected a yoy growth of 7.6%. The sales

growth was as expected driven by the domestic formulations (`1258cr), which

posted a yoy growth of 15.9%, while the exports are expected to post a yoy growth

of 7.4%. Exports of formulations increased 3.2% to `1,744cr during 4QFY2016,

while Exports of APIs flat at `204cr during 4QFY2016. On operating front, the

EBDITA came in at 5.0% V/s 13.3% in 4QFY2015 and against the 13.8%

expected, mainly driven by the dip in gross profit margins, which came in at 55.8%

V/s 61.1% in 4QFY2015. The, reported EBDITA Margins include a lot of one-offs,

adjusting for which the OPM was 15.8%. The net profit thus came in at `81cr V/s

`399cr expected and V/s `260cr in 4QFY2015, a yoy de-growth of 68.9%. We

would review our rating on the stock.

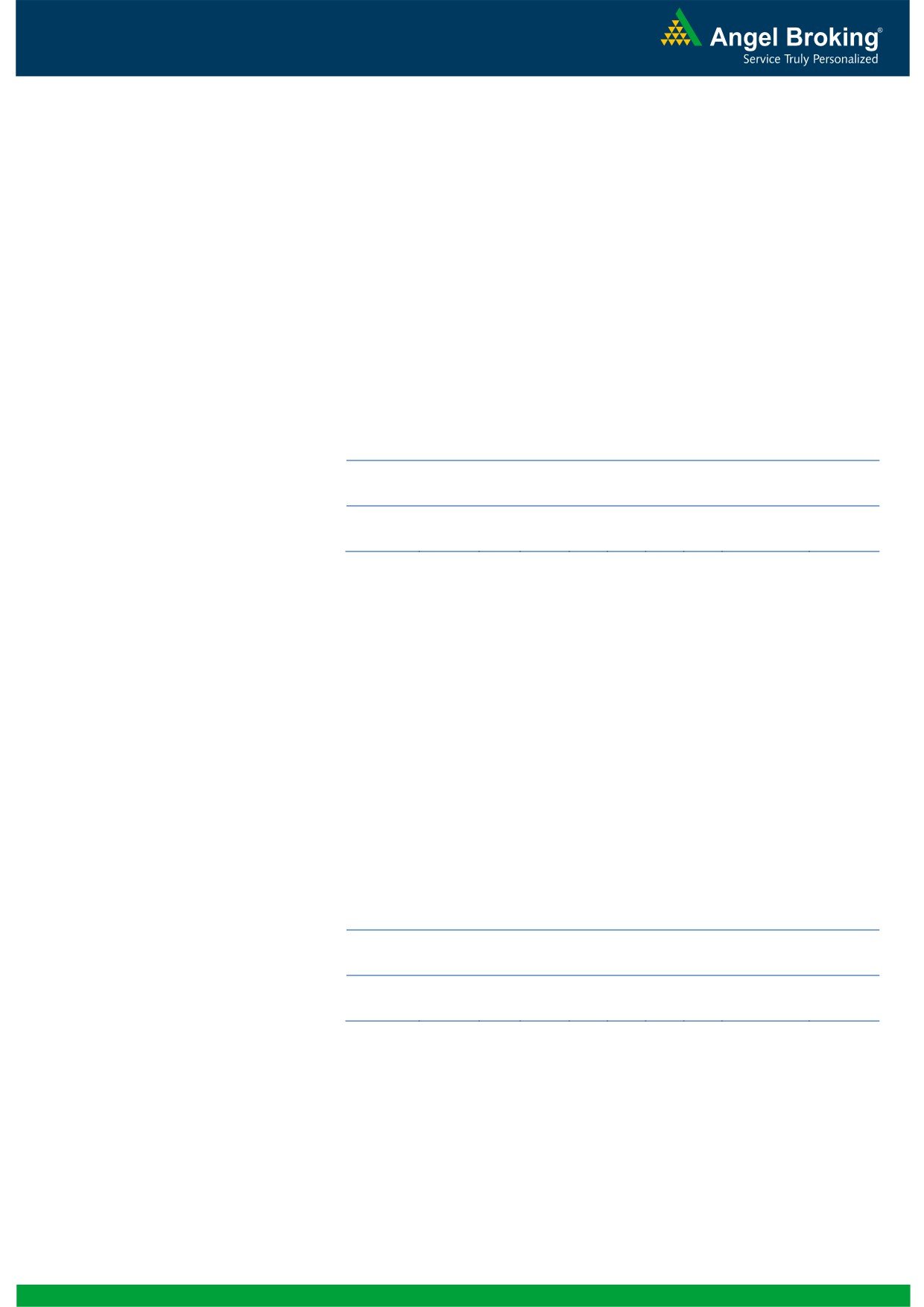

Y/E

Sales OPM

PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

13,979

20.2

2,064

25.7

17.6

19.3

3.1

14.1

2.8

FY2017E

16,447

18.6

2,208

27.5

16.1

18.0

2.7

12.7

2.4

Tech Mahindra (CMP: `479 / TP: `530 / Upside: 10.6%)

For 4QFY2016, Tech Mahindra, posted sales of

`6884cr V/s

`6701cr in

3QFY2016, a QoQ growth of 2.7%. On US$ terms, the company posted sales of

US$ 1023mn V/s expectations of US$1021mn, a QoQ growth of 0.8%. In terms

of geography, the ROW drove the growth, with ROW (24.7% of sales V/s 23.2% of

sales in 3QFY2016). Europe was 28.5% of sales V/s 28.9% in 3QFY2016, while

USA was 46.8% of sales V/s 47.8% of sales in 3QFY2016. In terms of Industry,

the growth was driven by BFSI (which was 10.6% of sales V/s 9.8% of sales in

3QFY2016). On operating front, the EBDITA came in at 16.9% V/s 16.6% in

3QFY2016, while EBIT came in at 13.7% V/s 14.4% in 3QFY2016. On the

operational front the attrition levels, came in at 21% V/s 20% in 3QFY2016, while

utilization was flat at 77%. Amongst the client additions, the company added 6

clients. The net profit came in at `897cr V/s `759cr in 3QFY2016, a QoQ growth

of 18.1%, this was mainly driven by the other income, which came in at `166cr

V/s `64cr in 3QFY2016. We maintain our accumulate on the stock.

Y/E

Sales OPM

PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016E

26,254

16.2

2,771

28.8

19.3

16.6

3.2

9.9

1.6

FY2017E

29,177

17.0

3,224

33.6

19.1

14.3

2.7

8.1

1.4

Linc Pen & Plastics (CMP: `189 / Neutral rating)

For 4QFY2016, Linc Pen & Plastics Ltd (LPPL) outperformed our estimates on top-

line and bottom-line front. The company’s top-line grew by ~13% YoY to ~INR

105cr, mainly due to higher growth in the domestic as well as the exports

segment. On the operating front, the company reported a margin expansion (up

by 268bp YoY to 10.1%), primarily on account of lower raw material costs. The

reported net profit grew by ~65% YoY to INR 6.3cr on account of higher sales

Market Outlook

May 25, 2016

growth and strong operating performance. Going ahead, we expect LPPL to report

a healthy top-line & bottom-line growth owing to strong domestic as well as export

sales (which are a high margin business). Currently we have a NEUTRAL rating on

the stock.

Economic and Political News

IT dept has decided to declare the names of tax defaulters

Odisha to auction seven mines (iron ore, manganese and one bauxite) by

August this year

India signs $100 mn loan agreement with World Bank for Karnataka Urban

Water Supply Modernisation Project.

Corporate News

Monsanto to reject Bayer bid, seek higher price-sources

Cinepolis to invest `400 crore, add 160 screens across India

Tata Power's generation capacity up by close to 5% in FY16

Quarterly Bloomberg Brokers Consensus Estimate

Tata Steel Ltd. Consol - May 25, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY16

q-o-q (%)

Net sales

29,782

33,337

(10.7)

27,819

7.1

EBITDA

1,389

1,543

(10.0)

776

79.1

EBITDA margin (%)

4.7

4.6

2.8

Net profit

(994)

(5,674)

0.0

(2,127)

0.0

Larsen & Toubro Ltd. - May 25, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY16

q-o-q (%)

Net sales

20,935

18,968

10.4

25,387

(17.5)

EBITDA

2,647

2,490

6.3

2,650

(0.1)

EBITDA margin (%)

12.6

13.1

10.4

Net profit

1,853

2,061

(10.1)

1,035

79.1

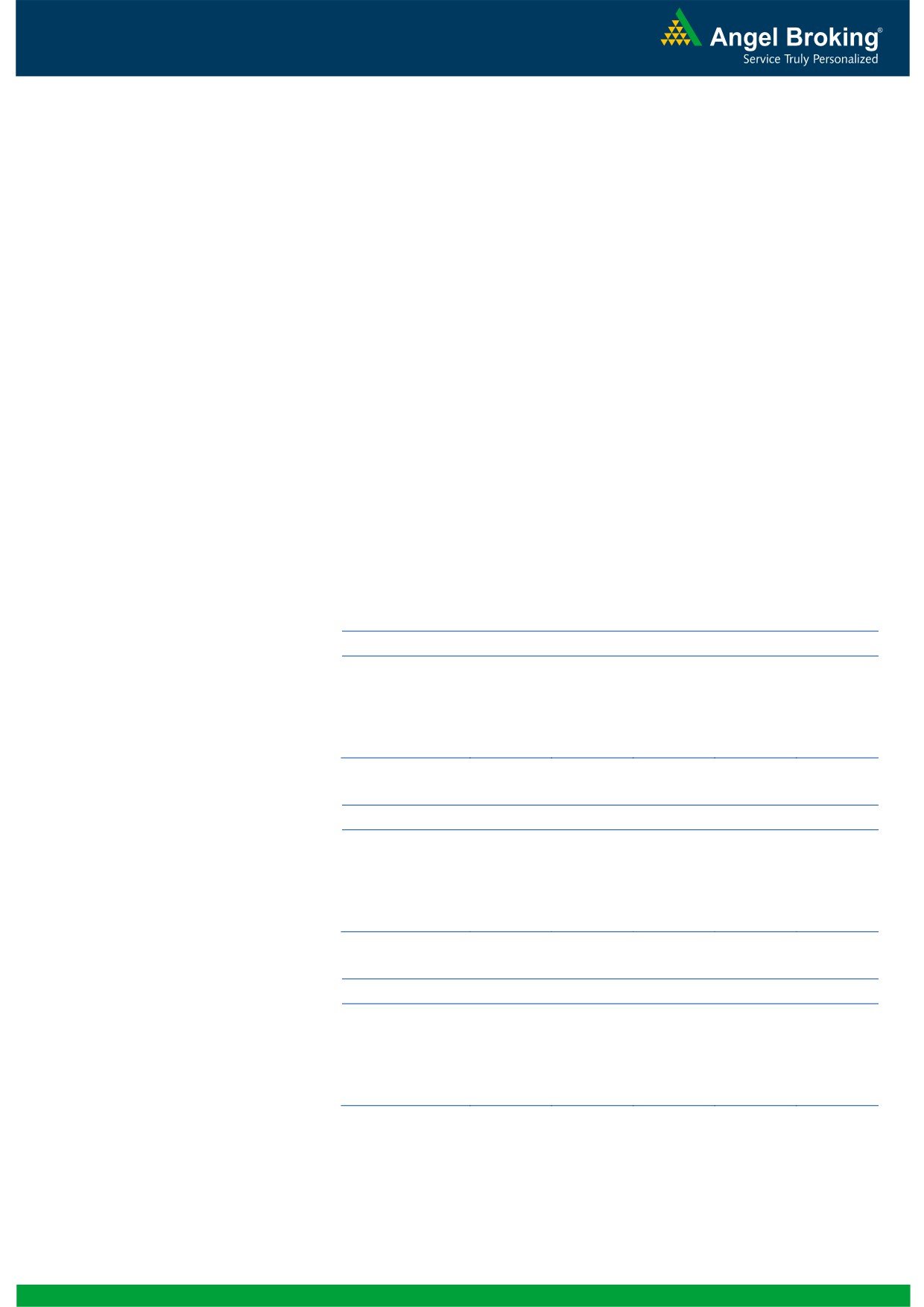

Ashok Leyland Ltd. - May 25, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY16

q-o-q (%)

Net sales

5,911

4,436

33.3

4029

46.7

EBITDA

756

457

65.4

423

78.7

EBITDA margin (%)

12.8

10.3

10.5

Net profit

425

230

84.6

199

113.6

Market Outlook

May 25, 2016

Bajaj Auto Ltd. - May 25, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY16

q-o-q (%)

Net sales

5,240

4,624

13.3

5463

(4.1)

EBITDA

1,100

838

31.3

1171

(6.1)

EBITDA margin (%)

21.0

18.1

21.4

Net profit

803

622

29.1

901

(10.9)

GAIL Ltd. - May 25, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY16

q-o-q (%)

Net sales

13,421

14,235

(5.7)

13380

0.3

EBITDA

1,238

643

92.4

1156

7.1

EBITDA margin (%)

9.2

4.5

8.6

Net profit

706

511

38.3

664

6.3

Cummins India Ltd. - May 25, 2016

Particulars (` cr)

4QFY16E

4QFY15

y-o-y (%)

3QFY16

q-o-q (%)

Net sales

1,224

1,114

9.9

1,116

9.7

EBITDA

200

176

13.7

171

17.0

EBITDA margin (%)

16.3

15.8

15.3

Net profit

193

190

1.3

178

8.4

Bosch Ltd. - May 25, 2016

Particulars (` cr)

1QCY16E

1QCY15

y-o-y (%)

4QCY15

q-o-q (%)

Net sales

2,464

2,355

4.7

2,349

4.9

EBITDA

452

432

4.5

467

(3.4)

EBITDA margin (%)

18.3

18.4

19.9

Net profit

299

306

(2.3)

287

4.1

Oil and Natural Gas Corp. Ltd. - May 25, 2016

Particulars (` cr)

1QCY16E

1QCY15

y-o-y (%)

4QCY15

q-o-q (%)

Net sales

15,878

21,303

(25.5)

18,397

(13.7)

EBITDA

6,489

7,619

(14.8)

4,049

60.3

EBITDA margin (%)

40.9

35.8

22

Net profit

2,482

3,935

(36.9)

1,286

93

Market Outlook

May 25, 2016

Top Picks ★★★★★

Large Cap

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

To outpace battery industry growth due to better technological

Amara Raja Batteries

15,278

894

1,076

20.3

products leading to market share gains in both the automotive

OEM and replacement segments.

Uptick in defense capex by government when coupled with

Bharat Electronics

26,614

1,109

1,414

27.5

BELs strong market positioning, indicate that good times are

ahead for BEL.

The stock is trading at attractive valuations and is factoring all

HCL Tech

1,04,036

738

1,000

35.6

the bad news.

Strong visibility for a robust 20% earnings trajectory, coupled

HDFC Bank

2,88,510

1,141

1,262

10.6

with high quality of earnings on account of high quality retail

business and strategic focus on highly rated corporates.

Back on the growth trend, expect a long term growth of 14%

Infosys

2,72,923

1,188

1,374

15.6

to be a US$20bn in FY2020.

LICHF continues to grow its retail loan book at a healthy pace

with improvement in asset quality. We expect the company to

LIC Housing Finance

21,948

435

592

36.1

post a healthy loan book which is likely to reflect in a strong

earnings growth.

Huge bid pipeline of re-development works at Delhi and other

NBCC

11,269

939

1,089

16.0

State Governments and opportunity from Smart City, positions

NBCC to report strong growth, going forward.

Source: Company, Angel Research

Mid Cap

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the market

Blue Star

3,863

429

481

12.0

growth. EMPPAC division's profitability to improve once

operating environment turns around.

With a focus on the low and medium income (LMI) consumer

Dewan Housing

5,356

184

270

47.1

segment, the company has increased its presence in tier-II &

III cities where the growth opportunity is immense.

Commencement of new projects, downtrend in the interest

IL&FS Transport

2,245

68

93

36.3

rate cycle, to lead to stock re-rating

Economic recovery to have favourable impact on advertising

& circulation revenue growth. Further, the acquisition of a

Jagran Prakashan

5,642

173

205

18.8

radio business (Radio City) would also boost the company's

revenue growth.

Speedier execution and speedier sales, strong revenue visibilty

Mahindra Lifespace

1,776

433

554

28.0

in short-to-long run, attractive valuations

Massive capacity expansion along with rail advantage at ICD

Navkar Corporation

2,663

187

265

41.9

as well CFS augurs well for the company

Earnings boost on back of stable material prices and

Radico Khaitan

1,119

84

125

48.6

favourable pricing environment. Valuation discount to peers

provides additional comfort

Strong brands and distribution network would boost growth

Siyaram Silk Mills

947

1,010

1,354

34.0

going ahead. Stock currently trades at an inexpensive

valuation.

Source: Company, Angel Research

Market Outlook

May 25, 2016

Key Upcoming Events

Result Calendar

Date

Company

May 25, 2016

Bajaj Auto, Bosch India, Ashok Leyland, Cummins India, Thermax, LMW, Power Fin.Corpn., Hindustan

Media Ventures, Tata Steel, GAIL, Abbott India, GSK Pharma

May 26, 2016

Tata Chemicals, India Cements, Mphasis, HT Media, BPCL, Finolex Cables, Banco, Power Grid Corpn,

UFO Moviez

May 27, 2016

BHEL, Crompton Greaves, St Bk of India, Canara Bank, Rural Elec.Corp., Central Bank, ONGC, IOC,

HPCL, Cravatex, Surya Roshni, Indoco Remedies, Reliance Power, GIPCL, S H Kelkar & Co.

May 28, 2016

Coal India, Hindalco, Divi's Lab., NHPC, Reliance Infra.

May 30, 2016

Tata Motors, M&M, Blue Star, SAIL, Bajaj Electrical, Hitachi, Sun Pharma, Aurobindo Pharma, NTPC,

Unitech, Transport Corporation of India

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country Event Description

Unit

Period

Last Reported Estimated

May 26, 2016 2:00 PM UK

GDP (YoY)

% Change

1Q P

2.10

2.10

6:00 PM US

Initial Jobless claims

Thousands

May 21

278.00

275.00

May 27, 2016 6:00 PM US

GDP Qoq (Annualised)

% Change

1Q S

0.50

0.90

May 30, 2016 7:30 PM US

Consumer Confidence

S.A./ 1985=100 May

94.20

96.10

May 31, 2016 2:30 PM Euro Zone Euro-Zone Consumer Confidence Value

May F

-7.00

1:25 PM Germany Unemployment change (000's) Thousands

May

-16.00

Jun 01, 2016

1:25 PM Germany PMI Manufacturing

Value

May F

52.40

2:00 PM UK

PMI Manufacturing

Value

May

49.20

6:30 AM China

PMI Manufacturing

Value

May

50.10

50.00

Jun 02, 2016

5:15 PM Euro Zone ECB announces interest rates

%

Jun 2

0.00

Jun 03, 2016

1:25 PM Germany PMI Services

Value

May F

55.20

6:00 PM US

Change in Nonfarm payrolls

Thousands

May

160.00

165.00

6:00 PM US

Unnemployment rate

%

May

5.00

4.90

Jun 07, 2016

2:30 PM Euro Zone Euro-Zone GDP s.a. (QoQ)

% Change

1Q F

0.50

11:00 AM India

RBI Reverse Repo rate

%

Jun 7

6.00

Source: Bloomberg, Angel Research

Market Outlook

May 25, 2016

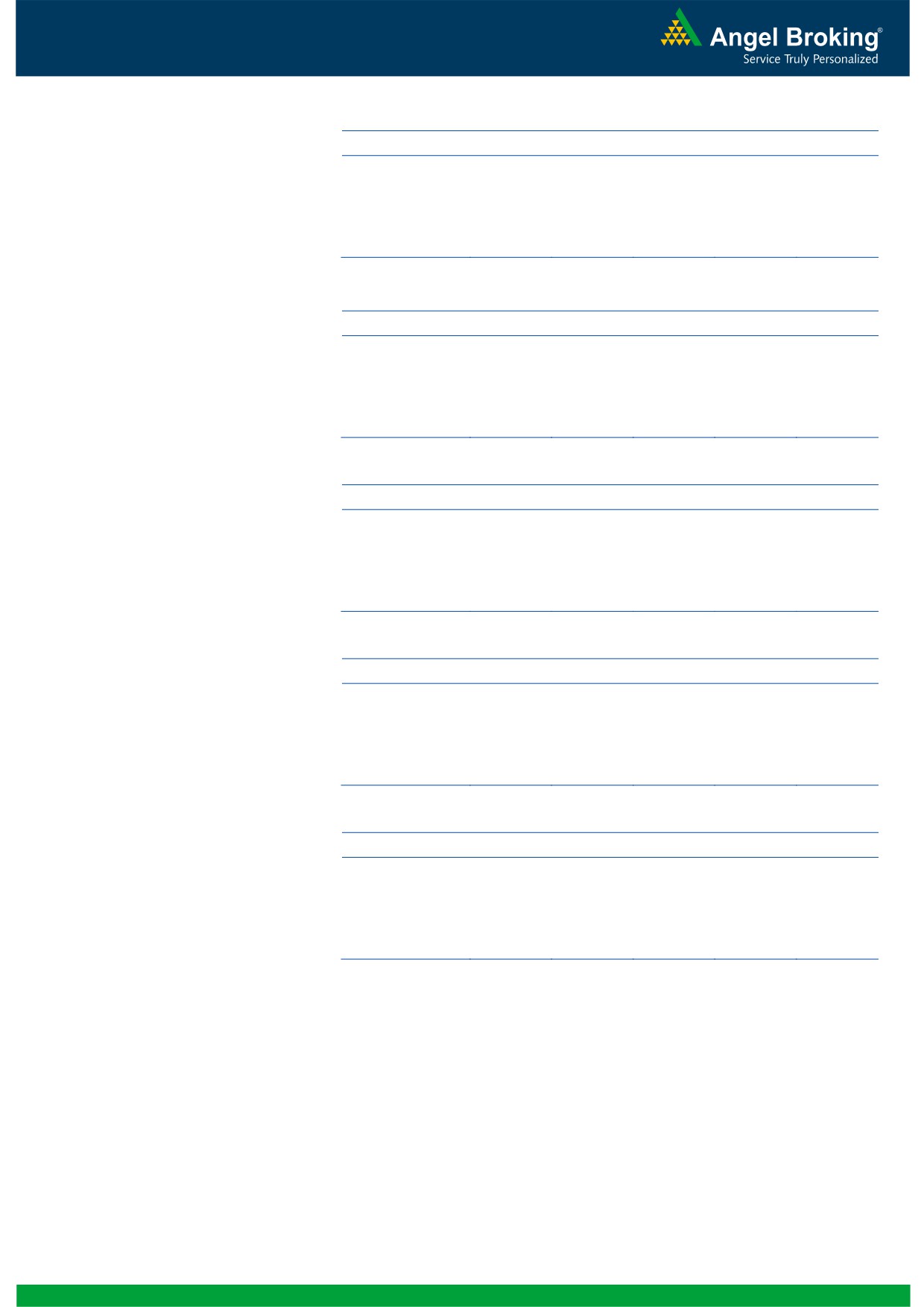

Macro watch

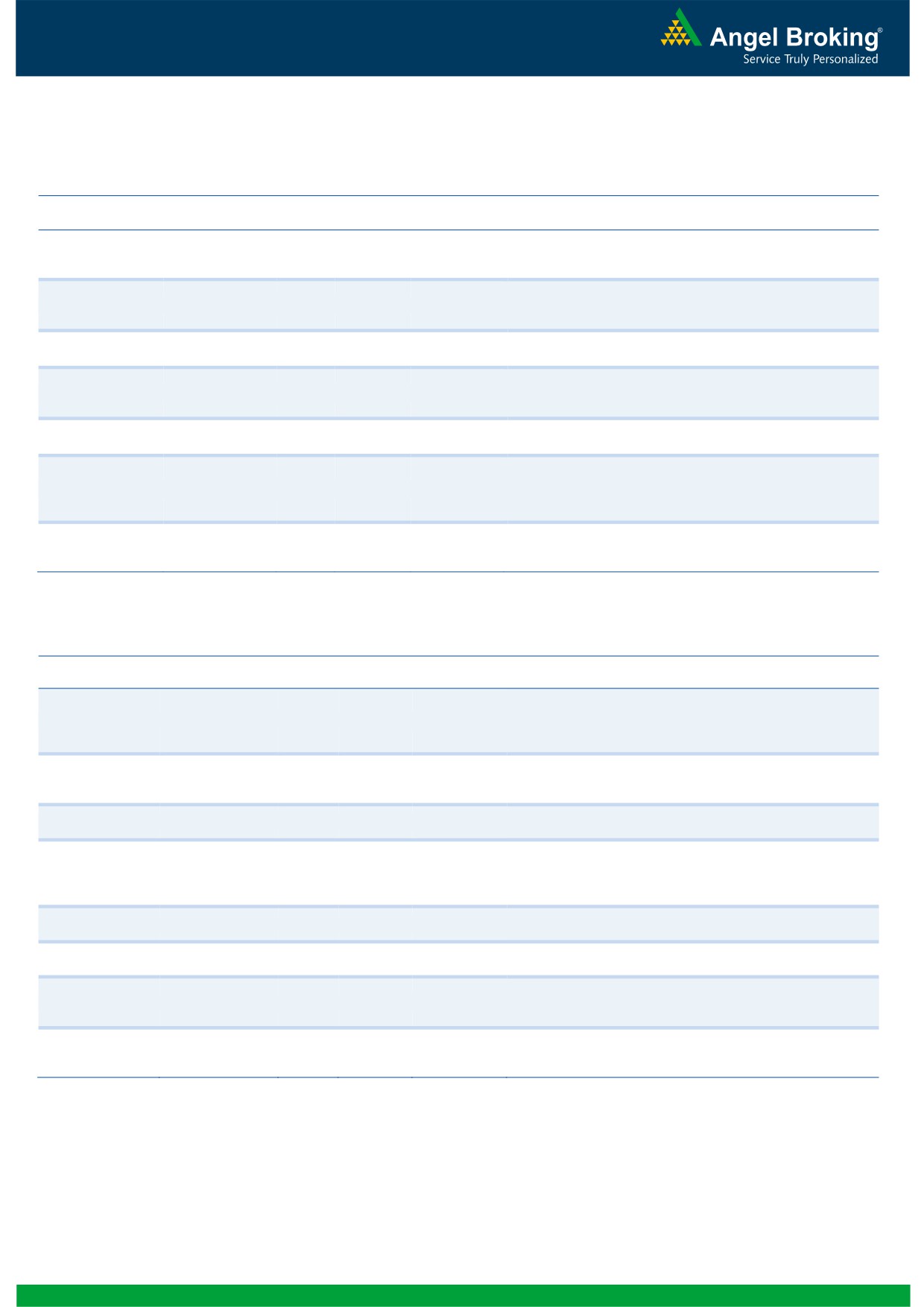

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.3

12.0

9.9

7.8

7.7

8.0

7.5

7.6

10.0

7.3

8.0

6.3

6.7

6.6

6.7

7.0

6.4

6.0

4.2

4.3

3.7

5.8

4.0

2.5

6.0

2.0

2.0

0.1

5.0

4.5

-

4.0

(2.0)

(0.9)

(1.5)

(4.0)

3.0

(3.4)

(6.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

Mfg. PMI

Services PMI

(%)

56.0

5.6

5.7

6.0

5.4

5.4

5.4

5.3

5.0

5.0

54.0

4.8

5.0

4.4

52.0

3.7

3.7

4.0

50.0

3.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

0.0

7.50

(5.0)

7.00

6.50

(10.0)

6.00

(15.0)

5.50

(20.0)

5.00

4.50

(25.0)

4.00

(30.0)

3.50

(35.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

May 25, 2016

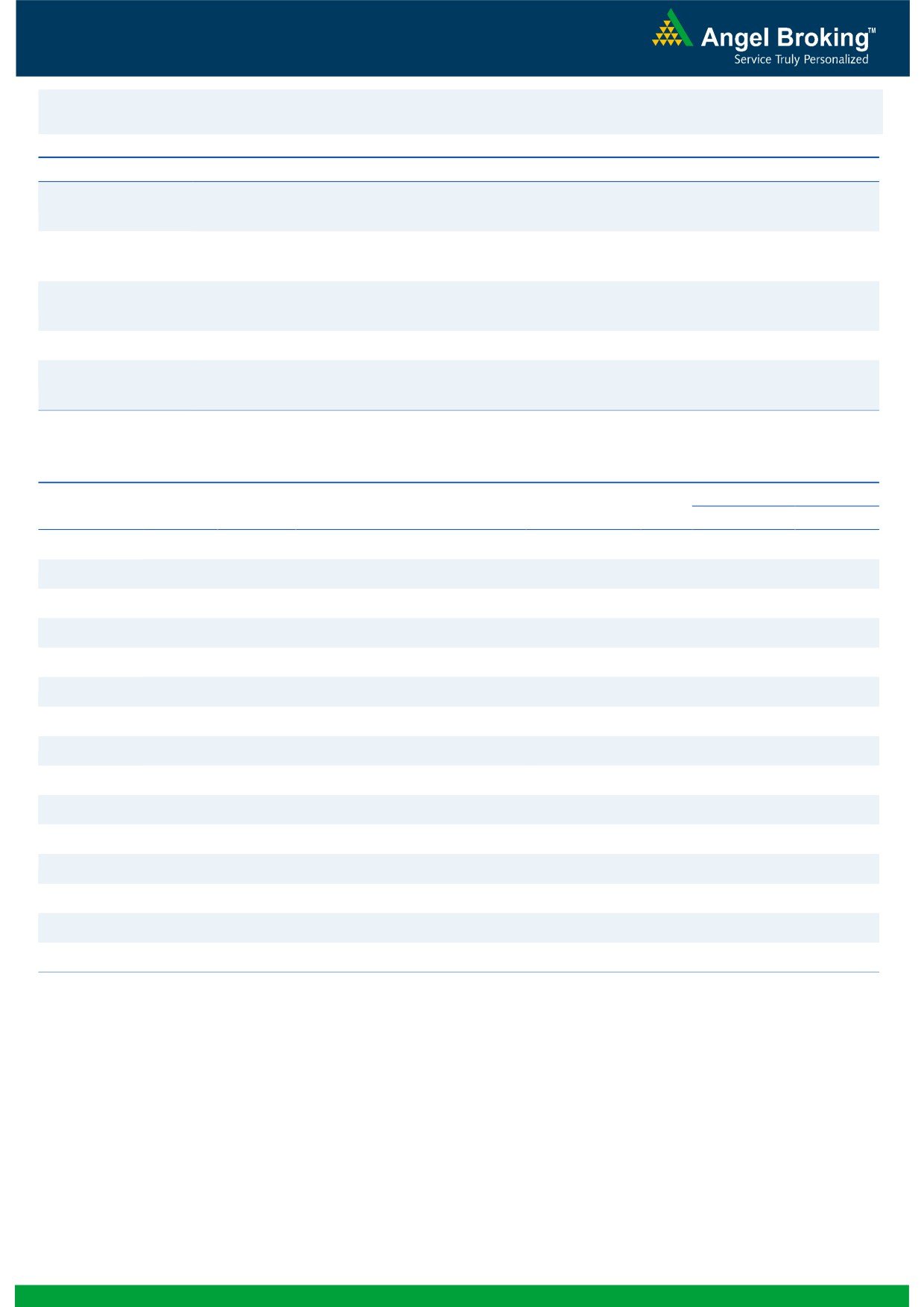

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.7

6.0

5.3

4.9

4.2

4.0

3.2

2.1

1.9

2.0

1.3

1.3

0.6

-

-

(2.0)

(1.2)

(4.0)

(6.0)

(5.9)

(8.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

10.0

7.5

8.0

6.5

6.0

4.9

4.4

4.0

3.0

2.4

1.9

1.5

2.0

1.1

0.6

0.5

(3.8)

(1.8)

-

(2.0)

(4.0)

(6.0)

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

May 25, 2016

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

49,345

(6.7)

14.1

(12.2)

Russia

Micex

1,884

(2.4)

6.4

13.1

India

Nifty

7,749

(1.9)

9.9

(7.4)

China

Shanghai Composite

2,822

(4.2)

(2.4)

(33.8)

South Africa

Top 40

47,034

(0.5)

5.5

(1.8)

Mexico

Mexbol

45,497

(0.3)

4.9

2.5

Indonesia

LQ45

806

(4.7)

(3.9)

(10.6)

Malaysia

KLCI

1,626

(5.6)

(3.1)

(10.2)

Thailand

SET 50

882

(0.9)

9.7

(11.3)

USA

Dow Jones

17,706

(1.7)

7.8

(2.5)

UK

FTSE

6,219

(2.5)

4.5

(11.7)

Japan

Nikkei

16,499

1.4

4.2

(15.7)

Germany

DAX

10,057

(3.6)

7.1

(13.9)

France

CAC

4,432

(3.0)

3.1

(11.4)

Source: Bloomberg, Angel Research

Market Outlook

May 25, 2016

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.