1

1

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Market Cues

Indian markets are likely to open negative tracking global indices and SGX Nifty.

The US stocks moved sharply lower over the course of the trading day on Tuesday,

extending the pullback seen in the previous session. The major averages continued

to give back ground after ending last Friday's trading at their best closing levels in

over a month. The Dow, fell sharply by 2.7 per cent to 23,019 and the Nasdaq

plunged by 3.5 percent to 8,263.

UK stocks were sharply lower on yesterday, with commodity-related companies

feeling the heat of a global selloff, after the price of U.S. crude oil plunged below

zero overnight on concerns that demand for oil is collapsing amid Covid-19

pandemic. The FTSE 100 slumped by 1.6 percent to 5,718.

On domestic front, Indian shares tumbled yesterday, mirroring weak global markets

after a historic plunge in oil prices underscored deep economic ructions from the

coronavirus pandemic, which has so far killed over 170,000 people globally The

benchmark BSE Sensex nosedived by 3.2 per cent to 33,637.

News Analysis

Global firms consider to shift from China to India

Detailed analysis on Pg2

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg7 onwards

Top Picks

Company

Sector

Rating

CMP

(`)

Target

(`)

Upside

(%)

Avenue Supermarts

Others

Accumulate

2,237

2,735

22.3

Nestle India

FMCG

Accumulate

16,997

20,687

21.7

Asian Paints

Paints

Buy

1,726

1,981

14.8

Bata India

Cement

Buy

1,202

1,561

29.9

More Top Picks on Pg3

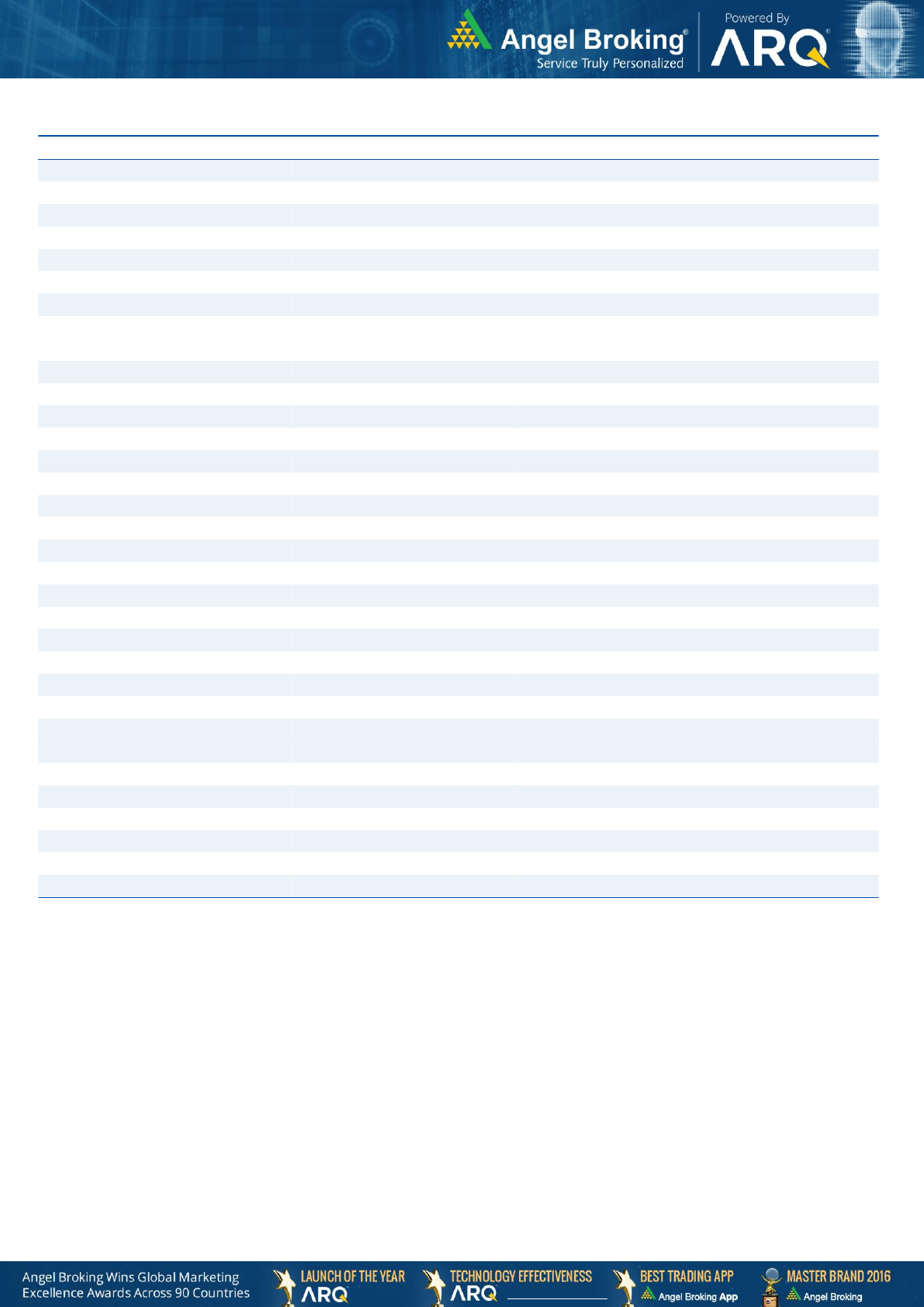

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

-3.2

-1,011

30,637

Nifty

-3

-280

8,981

Mid Cap

-2.7

-322

11,477

Small Cap

-3

-322

10,565

Bankex

-5.5

-1,293

22,129

Global Indices

Chg (%)

(Pts)

(Close)

Dow Jones

-2.7

-632

23,019

Nasdaq

-3.5

-298

8,263

FTSE

-1.6

-94

5,718

Nikkei

-2

-388

19,281

Hang Seng

-2.2

-536

23,794

Shanghai Com

-0.9

-26

2,827

Advances / Declines

BSE

NSE

Advances

716

492

Declines

1,697

1,344

Unchanged

152

76

Volumes (` Cr)

BSE

2,193

NSE

48,255

Net Inflows (` Cr)

Net

Mtd

Ytd

FII

2,082

850

(51,385)

*MFs

8

1,100

31,191

Top Gainers

Price (₹)

Chg (%)

RELCAPITAL

6

10.0

HEG

863

5.0

IPCALAB

1599

6.4

AUROPHARMA

644

19.2

J&KBANK

18

6.6

Top Losers

Price (

`

)

Chg (%)

MOTHERSUMI

72

-15.0

SRTRANSFIN

589

-14.1

INDUSINDBK

401

-12.3

BHARATFORG

260

-10.6

MCX

1027

-10.6

As on April 21, 2020

2

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

News Analysis

Global firms consider to shift from China to India

Global manufacturers have initiated talks with Indian firms to explore the

possibility of shifting a part of their supply chains from China as they seek to

diversify their operations following the covid-19 outbreak.

Most of these multinationals have suffered widespread disruptions to their

businesses as authorities enforced strict lockdown measures to contain the

pandemic, which originated in Wuhan city in China’s Hubei province. Wuhan is

one of China’s so-called “motor cities", housing several automotive factories.

First of the lot are companies interested in sourcing automobile components and

electronic products from India, according to industry executives.

May futures settled at minus $37.63 a barrel on Monday, a 306% daily drop,

driven by the rapid filling of the United States' main storage hub at Cushing,

Oklahoma - the delivery point for West Texas crude.

Part of the demand is also coming from Indian companies who were heavily

reliant on China for sourcing components, but suffered because of the novel

coronavirus-induced disruption in China, which, over the years, has emerged as a

manufacturing powerhouse.

Economic and Political News

FinMin gives Rs 46,000 cr in April devolution as states fight coronavirus

RBI considers standing deposit facility to manage extra liquidity

Lockdown hits production of anti-TB drugs, health min seeks to ban export

Maharashtra govt withdraws Covid-19 lockdown relaxations for Mumbai,

Pune

Corporate News

IOC, BPCL restart project-work after relaxation of Covid-19 lockdown norms

Air India sale to be delayed as govt mulls extending last date for EOI

Shale holdings of RIL, GAIL come under pressure amid oil price crash

Cement companies resume ops with minimal production

3

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Top Picks

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

Hawkins Cooker

2,503

4,732

5,500

16.2

We forecast HCL to report healthy top-line CAGR

of ~14% to `976cr over FY19-22E on the back of

government initiatives, new product launches,

strong brand name and wide distribution network.

On the bottom-line front, we estimate ~23% CAGR

to `100cr due to strong revenue and operating

margin improvement

Asian Paints

1,65,519

1,726

1,981

14.8

Asian Paints (APL) is India's largest paints company.

We expect APL to report healthy bottom-line CAGR

of ~19% over FY2019-22E due to leadership

position, strong brand, wide distribution network

(60,000+ dealers across the country) and

improvement in operating margins (back of falling

crude prices).

Bata India

15,446

1,202

1,561

29.9

We expect Bata India to report net revenue CAGR

of ~11% to ~`3,974cr over FY2019-22E mainly

due to increasing brand consciousness among

Indian consumers, new product launches, higher

number of store additions in tier II/ III cities and

focus on high growth women’s segment. Further,

on the bottom-line front, we expect CAGR of ~20%

to `562cr over the same period on the back of

margin improvement (increasing premium product

sales).

Nestle India

1,63,874

16,997

20,687

21.7

Nestle India Ltd (Nestle) manufactures and sells a

variety of food products such as Milk & Nutrition,

Prepared Dishes & Cooking Aids, Powdered &

Liquid Beverages and Confectionery. Going

forward, we expect healthy growth and profitability

on the back of strong brand recall, wide

distribution network (4.6mn outlets across

India) and new product launches.

Hindustan Unilever

5,01,454

2,316

3,080

33.0

Hindustan Unilever Ltd (HUL) is engaged in

manufacturing of branded and packaged FMCG

products. We expect HUL to report healthy bottom-

line CAGR of ~12% over FY2019-22E due to

healthy volume growth on the back of strong

brand, wide distribution network

Colgate Palmolive

38,180

1,404

1,680

19.7

We believe that the company should ultimately be

able to see sharper market share gain in

toothpastes segment on the back of higher ad-

spend and re-launch of Colgate Strong Teeth

(decent traction seen in last quarter)

Avenue Supermarts

1,44,920

2,237

2,735

22.3

Avenue Supermarts owns and operates the

supermarket chain ‘D-MART’. Focused on value

retailing, it offers a wide range of fast-moving

consumer (food and non-food) products, general

merchandise and apparel.We expect DMART to

report consolidated revenue/PAT CAGR

of 18%/26%, respectively over FY2019-22E.

P&G Hygiene

34,974

10,774

12,230

13.5

P&GHH manufactures, distributes and markets

three major brands in India – Whisper, Vicks, and

Old Spice. Sanitary Pads having less than 20%

market penetration leaves immense growth

opportunity for Whisper.

Going forward, we expect healthy growth and

profitability on the back of strong brand, wide

distribution network and new product launches.

4

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Continue....

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

Ipca Lab

20,201

1,599

1,900

18.8

54% of revenue comes from domestic generic and

API business. Generics and API continues to provide

revenue growth for Ipca. Expected to outperform

the Indian Pharmaceutical market(IPM) by 8%-

10% p.a in FY 22.

Bharti Airtel

2,73,242

501

594

18.6

Telecom operators have increased tariffs by ~35%

in Nov’19. There is a possibility of another round

of tariff hikes by telecom companies in FY21 given

that tariffs are still very low . If Vodafone Idea goes

out of business, Bharti would benefit significantly

from addition of subscribers.

Infosys

2,69,616

633

758

19.7

We expect the company to post

revenue/EBITDA/PAT growth of 7.5%/3.7%/5.1%

between FY19-FY22 despite Covid-19 outbreak

impacting FY21 numbers. Rupee depreciation from

~71 levels to ~77 to the US dollar will have a

positive impact on top line and bottom-line and will

mitigate the adverse impact due to Covid-19

outbreak to a large extent.

L&T Infotech

25,224

1,449

1,803

24.5

We expect the company to post

revenue/EBITDA/PAT growth of 6.7%/8.4%/4.8%

between FY19-FY22 despite Covid-19 outbreak

impacting FY21 numbers. We expect limited impact

of Covid-19 outbreak on LTI as most IT companies

have already shifted ~90% of employees to work

from home.

Britannia Industries

68,797

2,861

3,320

16.0

BRIT has an overall distribution reach of 5.5

million outlets. BRIT has narrowed the gap with the

No. 1 player. The gap with the largest distributed

brand is now just 0.8 million outlets which it

expects to bridge soon and thereby become the

largest player over the medium to long term.

Dabur India

88,009

498

570

14.4

Company increased market share of the company

across most of its categories. The company further

improved its rural reach to 51.5k villages and is set

to touch 60k villages by end of

FY20. Going forward, we expect healthy growth

and profitability on the back of strong brand, wide

distribution network and new product launches.

Reliance Ind.

7,83,568

1,236

1,412

14.2

Reliance Industries Ltd. (RIL) is India’s largest

company with a dominant presence in Refining,

Petrochemicals, Telecom and Retail businesses.

Telecom business to witness robust growth over

next few years due to tariff hikes and shift of

subscribers from Vodafone Idea to other telecom

players.

Alkem Lab.

30,835

2,579

3,300

28.0

67% of revenue comes from domestic generic and

API business. Anti-

infectives and Cronic business continues to provide

revenue growth for Alkem. Expected to outperform

the Indian Pharmaceutical market(IPM) by 1.5x

growth rate for the next 2 years. We

expect alkem to grow its top line by 13-15% in the

upcoming years

5

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Fundamental Call

Company

Market Cap

(` Cr)

CMP

(`)

Target

(`)

Upside

(%)

Rationale

CCL Products

2,472

186

360

93.8

CCL is likely to maintain the strong growth

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

LT Finance Holding

11,808

59

150

154.7

L&T Fin’s new management is on track to achieve

ROE of 18% by 2020 and recent capital infusion

of `3000cr would support advance growth.

Inox Wind

636

29

NA

NA

We expect Inox Wind to report exponential growth

in top-line and bottom-line over FY19-20E. The

growth would be led by changing renewable

energy industry dynamics in favor of wind energy

segment viz. changes in auction regime from

Feed-In-Tariff (FIT) to reverse auction regime and

Government’s guidance for 10GW auction in

FY19 and FY20 each.

Jindal Steel & Power Limited

8,456

83

NA

NA

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom

line front, we expect JSPL to turn in to profit by

FY19 on back of strong operating margin

improvement.

ICICI Bank

2,14,637

332

440

32.7

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

resolution of NPA would reduce provision cost,

which would help to report better ROE.

GMM Pfaudler

5,010

3,427

3,437

0.3

Post the GMM Pfaudler (CMP INR 2542.5)

Q3FY20 numbers we are introducing our FY22

EPS estimate of INR 114.5. We raise our target

price to INR 2864 (25xFY22E EPS estimate)

4

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Macro watch

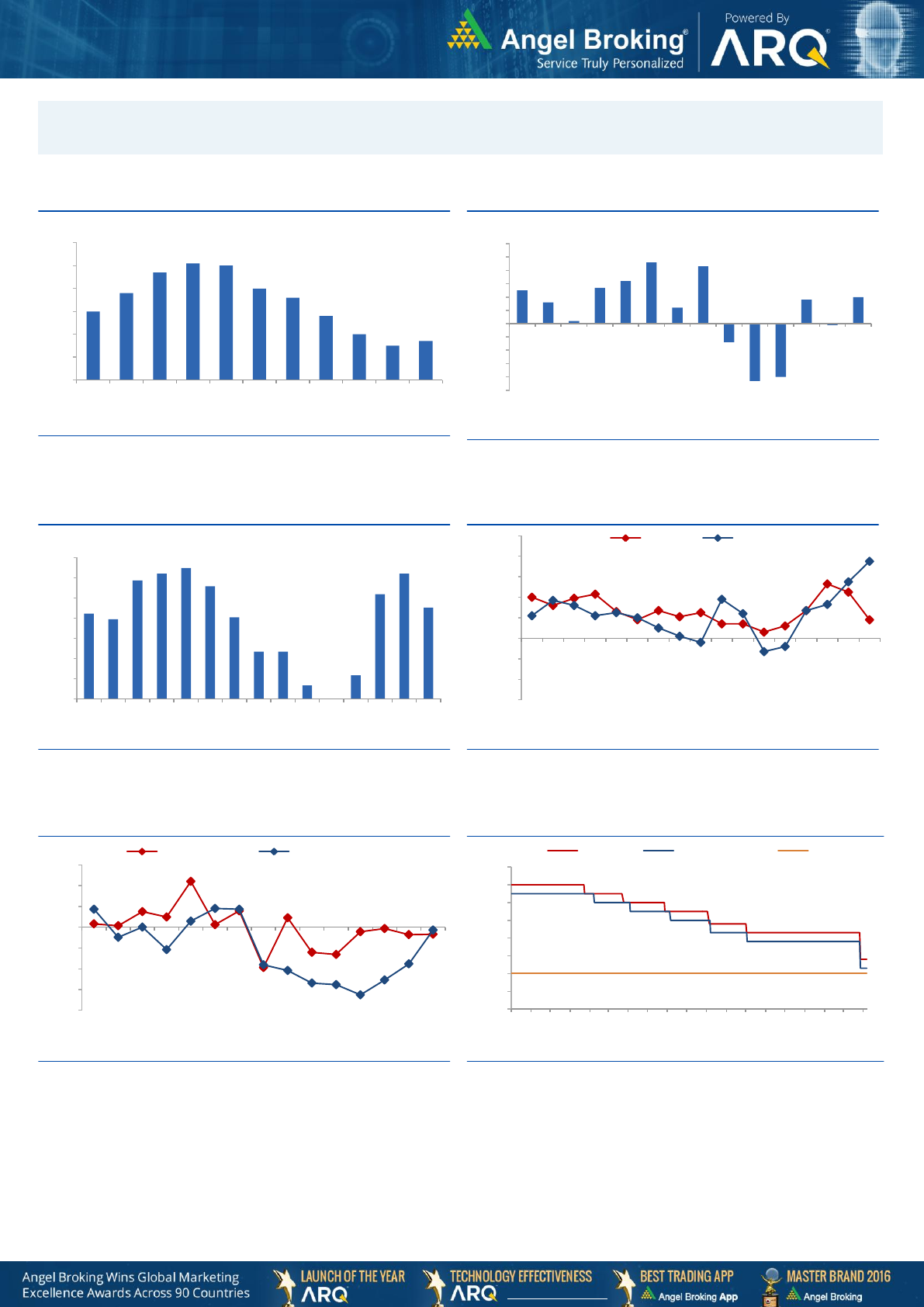

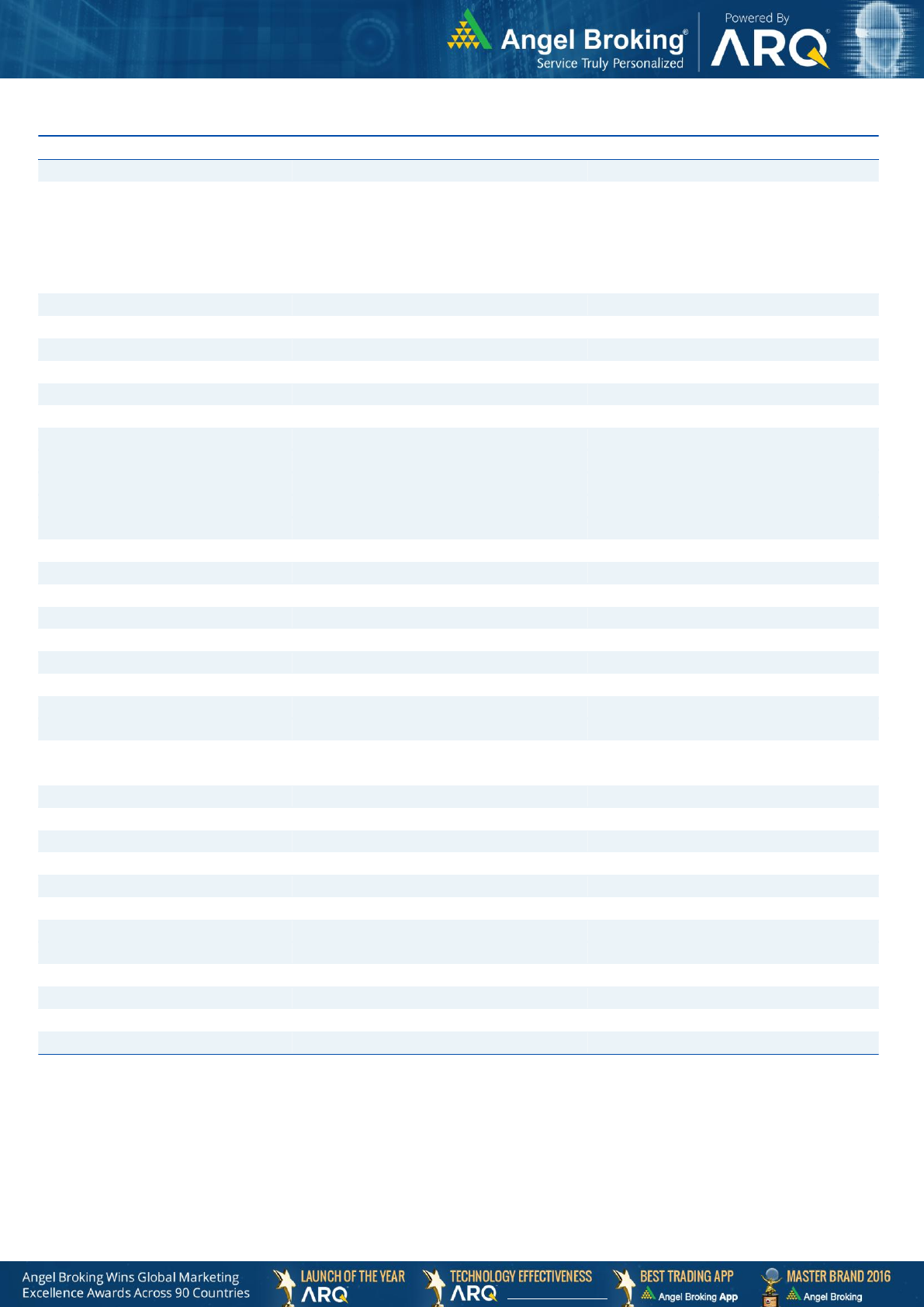

Exhibit 1: Quarterly GDP trends

Source: CSO, Angel Research

Exhibit 2: IIP trends

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Source: MOSPI, Angel Research

Exhibit 4: Manufacturing and services PMI

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Source: Bloomberg, Angel Research As of 06 April, 2020

Exhibit 6: Key policy rates

Source: RBI, Angel Research

6.0

6.8

7.7

8.1

8.0

7.0

6.6

5.8

5.0

4.5

4.7

3.0

4.0

5.0

6.0

7.0

8.0

9.0

1QFY18

2QFY18

3QFY18

4QFY18

1QFY19

2QFY19

3QFY19

4QFY19

1QFY20

2QFY20

3QFY20

(%)

2.5

1.6

0.2

2.7

3.2

4.6

1.2

4.3

(1.4)

(4.3)

(4.0)

1.8

(0.1)

2.0

(5.0)

(4.0)

(3.0)

(2.0)

(1.0)

-

1.0

2.0

3.0

4.0

5.0

6.0

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

(%)

2.11

1.97

2.9

3.1

3.24

2.79

2.0

1.2

1.2

0.3

0.0

0.6

2.6

3.1

2.3

0

0.5

1

1.5

2

2.5

3

3.5

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

(%)

44

46

48

50

52

54

56

58

60

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Mfg. PMI

Services PMI

(20.0)

(15.0)

(10.0)

(5.0)

0.0

5.0

10.0

15.0

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Exports yoy growth

Imports yoy growth

(%)

3

3.5

4

4.5

5

5.5

6

6.5

7

Oct-18

Nov-18

Dec-18

Jan-19

Feb-19

Mar-19

Apr-19

May-19

Jun-19

Jul-19

Aug-19

Sep-19

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

Repo rate

Reverse Repo rate

CRR

(%)

5

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Global watch

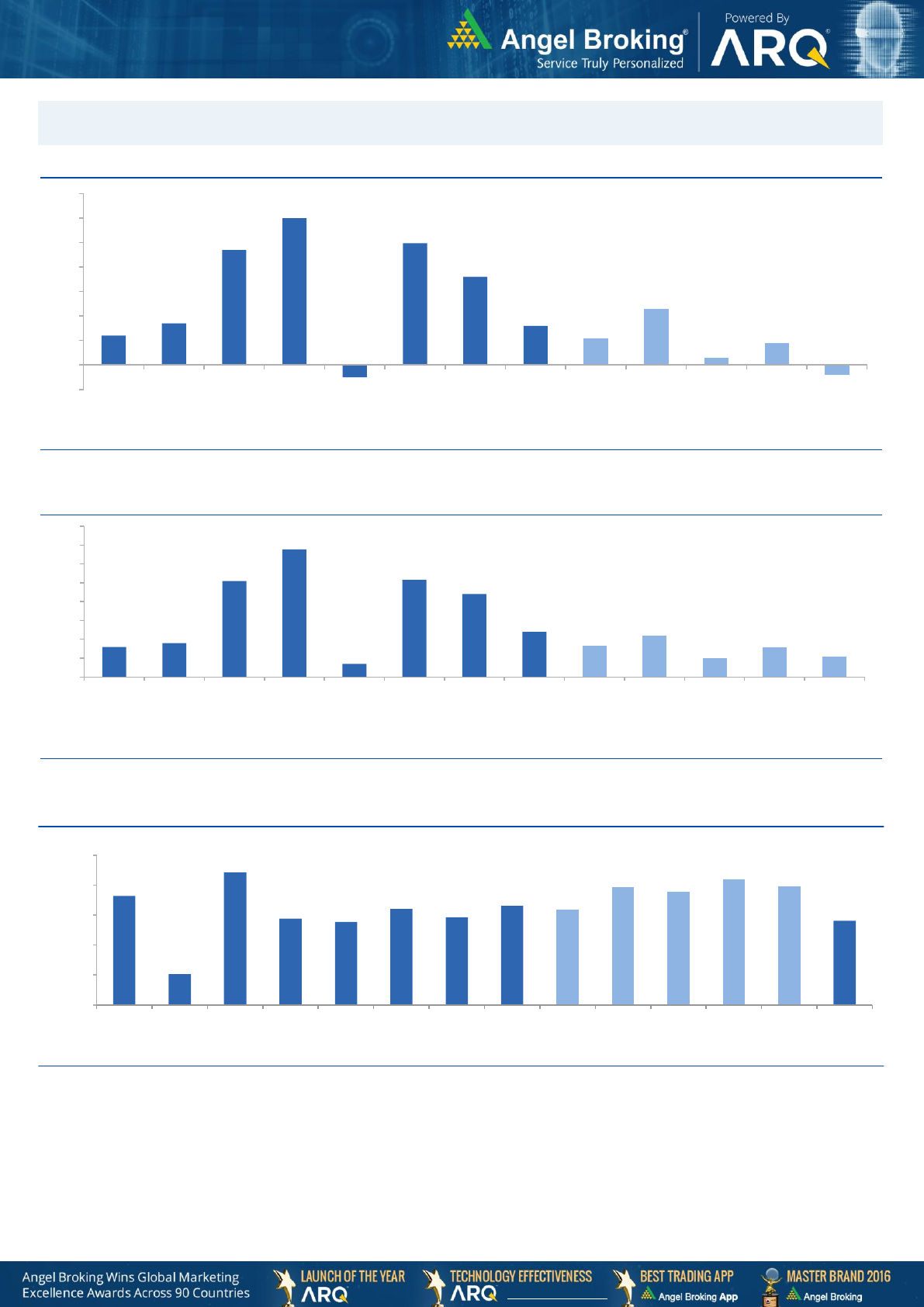

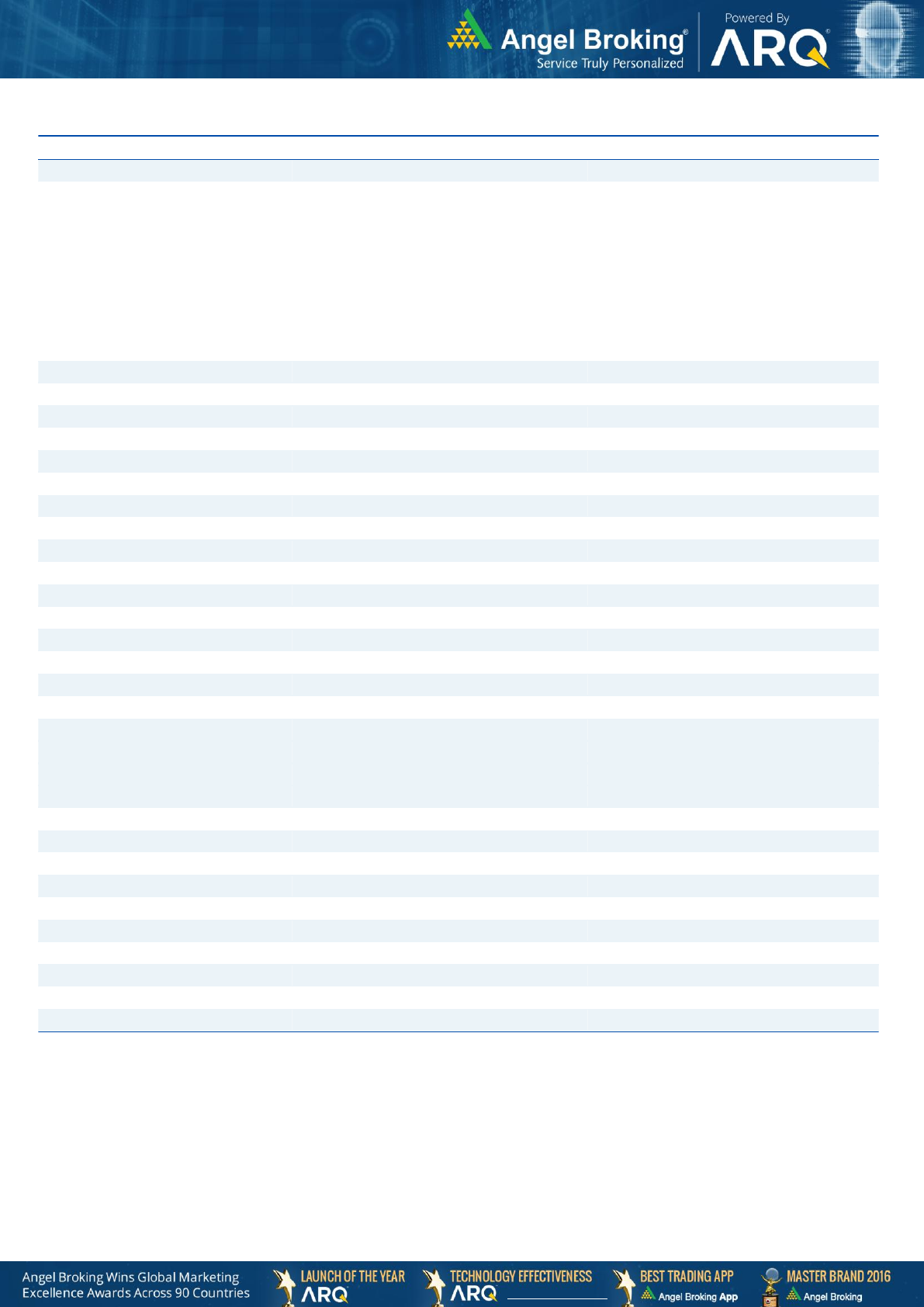

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

Source: IMF, Angel Research As of 18 March, 2020

1.2

1.7

4.7

6.0

(0.5)

5.0

3.6

1.6

1.1

2.3

0.3

0.9

(0.4)

(1.0)

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Brazil

Russia

India

China

South Africa

Indonesia

Malaysia

Thailand

UK

USA

Germany

France

Japan

(%)

1.6

1.8

5.1

6.8

0.7

5.2

4.4

2.4

1.7

2.2

1.0

1.6

1.1

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Brazil

Russia

India

China

South Africa

Indonesia

Malaysia

Thailand

UK

USA

Germany

France

Japan

(%)

18.2

5.1

22.1

14.4

13.9

16.0

14.7

16.5

15.9

19.7

18.9

21.0

19.8

14.0

-

5.0

10.0

15.0

20.0

25.0

Brazil

Russia

India

China

South

Africa

Mexico

Indonesi

a

Malaysi

a

Thailan

d

UK

USA

German

y

France

Japan

(x)

6

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

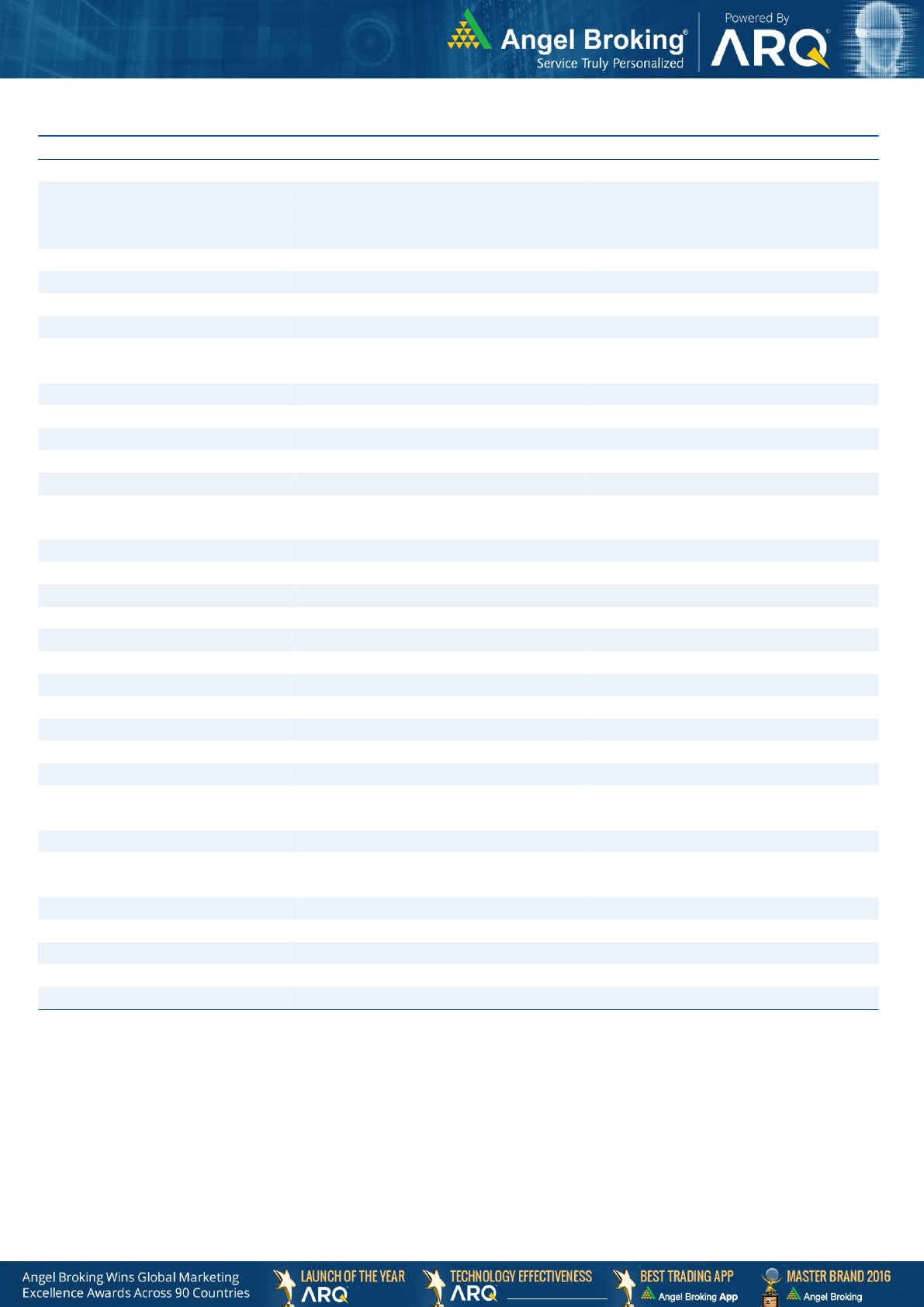

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

72254

-31.5

-38.6

-23.5

Russia

Micex

2573

-8.8

-16.4

1.2

India

Nifty

8084

-27.4

-34.2

-31.0

China

Shanghai Composite

2764

-8.2

-10.4

-14.9

South Africa

Top 40

40739

-14.4

-20.3

-23.2

Mexico

Mexbol

33591

-21.8

-24.7

-25.4

Indonesia

LQ45

702

-23.9

-31.2

-31.5

Malaysia

KLCI

1331

-10.7

-17.4

-19.1

Thailand

SET 50

767

-16.1

-27.9

-30.0

USA

Dow Jones

21413

-17.4

-25.2

-18.3

UK

FTSE

5415

-19.4

-29.0

-27.0

Japan

Nikkei

17820

-15.5

-23.2

-18.0

Germany

DAX

9576

-20.1

-27.6

-19.9

France

CAC

4186

-22.4

-30.7

-23.5

Source: Bloomberg, Angel Research As of 06 April, 2020

7

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Exhibit 7: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

17-04-2020

Top Picks

Reliance Ind.

1,205

1,412

Open

16-04-2020

Top Picks

Britannia Ind.

2,832

3,320

Open

16-04-2020

Top Picks

Dabur India

501

570

Open

16-04-2020

Top Picks

Infosys

625

758

Open

16-04-2020

Top Picks

L&T Infotech

1,493

1,803

Open

09-04-2020

Top Picks

Dr.Lal Path Labs

1,462

Closed(09/04/2020)

06-04-2020

Top Picks

Dr.Lal Path Labs

1,384

1,768

Open

06-04-2020

Top Picks

Ipca Labs

1,332

1,900

Open

16-04-2020

Top Picks

Bharti Airtel

510

594

Open

09-04-2020

Top Picks

Bharti Airtel

462

543

Open

06-04-2020

Top Picks

Bharti Airtel

421

492

Open

16-04-2020

Top Picks

P&G Hygiene

11,128

12,230

Open

02-04-2020

Top Picks

P&G Hygiene

10,161

11,670

Open

09-04-2020

Top Picks

Nestle India

16,848

20,687

Open

30-03-2020

Top Picks

Nestle India

15,091

17,355

Open

09-04-2020

Top Picks

Hindustan Unilever

2,459

3,080

Open

30-03-2020

Top Picks

Hindustan Unilever

2,140

2,461

Open

09-04-2020

Top Picks

Colgate Palmolive

1,341

1,680

Open

06-04-2020

Top Picks

Colgate Palmolive

1,241

1,450

Open

30-03-2020

Top Picks

Colgate Palmolive

1,152

1,325

Open

09-04-2020

Top Picks

Avenue Supermart

2,300

2,735

Open

30-03-2020

Top Picks

Avenue Supermart

2,038

2,395

Open

09-04-2020

Top Picks

Asian Paints

1,610

1,981

Open

11-03-2020

Top Picks

Asian Paints

1,864

2,118

Open

21-04-2020

Fundamental

Ultratech Cement

3,409

Closed(21/04/2020)

30-03-2020

Fundamental

Ultratech Cement

3,148

5,373

Hold

30-10-2019

Top Picks

Ultratech Cement

4,481

5,373

Open

25-02-2020

Top Picks

Larsen Toubro

1,250

Closed(25/02/2020)

29-10-2019

Top Picks

Larsen Toubro

1,365

1,689

Open

06-04-2020

Top Picks

Hawkins Cooker

3,860

5,500

Open

28-01-2020

Top Picks

Hawkins Cooker

4,332

4,732

Open

13-01-2020

Top Picks

Hawkins Cooker

3,591

4,353

Open

06-06-2019

Fundamental

Inox Wind

55

Hold

10-08-2018

Top Picks

Inox Wind

107

127

Open

Source: Company, Angel Research

8

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Exhibit 8: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

08-11-2019

Top Picks

TTK Prestige

6075

Closed(08/11/2019)

30-11-2018

Top Picks

TTK Prestige

7,206

8,200

Open

09-08-2018

Top Picks

TTK Prestige

6,206

7,500

Open

07-10-2019

Fundamental

Aurobindo Pharma

460

Closed(07/10/2019)

26-09-2019

Fundamental

Aurobindo Pharma

610

Hold

07-09-2019

Top Picks

Aurobindo Pharma

759

870

Open

06-07-2018

Top Picks

Aurobindo Pharma

603

780

Open

15-04-2020

Top Picks

RBL Bank

121

Closed(15/04/2020)

11-03-2020

Top Picks

RBL Bank

227

Hold

31-10-2019

Top Picks

RBL Bank

312

410

Open

22-07-2019

Top Picks

RBL Bank

500

650

Open

04-04-2019

Top Picks

RBL Bank

649

775

Open

30-08-2018

Top Picks

RBL Bank

626

690

Open

06-07-2018

Top Picks

RBL Bank

565

670

Open

02-12-2019

Fundamental

Yes Bank

64

Closed(02/12/2019)

18-07-2019

Fundamental

Yes Bank

98

Hold

30-04-2019

Fundamental

Yes Bank

168

Hold

25-01-2019

Top Picks

Yes Bank

214

280

Open

27-07-2019

Top Picks

Yes Bank

370

435

Open

06-07-2018

Top Picks

Yes Bank

348

418

Open

05-10-2019

Fundamental

Jindal Steel & Power

94

Hold

24-05-2019

Top Picks

Jindal Steel & Power

152

250

Open

07-02-2019

Top Picks

Jindal Steel & Power

135

249

Open

15-11-2018

Top Picks

Jindal Steel & Power

175

320

Open

30-06-2018

Top Picks

Jindal Steel & Power

222

350

Open

15-04-2020

Top Picks

Shriram Transport Finance Com

685

Closed(15/04/2020)

11-03-2020

Top Picks

Shriram Transport Finance Com

987

Hold

05-02-2020

Top Picks

Shriram Transport Finance Com

1,047

1410

Open

22-01-2020

Fundamental

Shriram Transport Finance Com

1,090

1410

Hold

30-10-2019

Top Picks

Shriram Transport Finance Com

1,156

1410

Open

07-08-2019

Top Picks

Shriram Transport Finance Com

1,000

1385

Open

25-05-2019

Top Picks

Shriram Transport Finance Com

1,106

1470

Open

20-06-2018

Top Picks

Shriram Transport Finance Com

1,466

1,764

Open

Source: Company, Angel Research

9

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Exhibit 9: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

09-04-2020

Top Picks

Bata India

1,240

1,561

Open

06-04-2020

Top Picks

Bata India

1,190

1,650

Open

12-03-2020

Top Picks

Bata India

1,411

1,800

Open

06-02-2020

Fundamental

Bata India

1,856

Closed(06/02/2020)

03-09-2019

Fundamental

Bata India

1,538

1,865

Hold

03-08-2019

Top Picks

Bata India

1,310

1,525

Open

13-02-2019

Top Picks

Bata India

1,189

1,479

Open

03-11-2018

Top Picks

Bata India

1,008

1,243

Open

30-07-2018

Top Picks

Bata India

918

1,007

Open

23-07-2018

Top Picks

Bata India

842

955

Open

01-07-2018

Top Picks

Bata India

862

948

Open

18-06-2018

Top Picks

Bata India

779

896

Open

16-04-2020

Fundamental

Amber Enterprises

1,116

Closed(16/04/2020)

30-03-2020

Fundamental

Amber Enterprises

1,221

1,830

Hold

31-01-2020

Top Picks

Amber Enterprises

1,540

1,830

Open

09-01-2020

Fundamental

Amber Enterprises

1,209

Hold

25-09-2019

Top Picks

Amber Enterprises

901

1100

Open

16-02-2019

Top Picks

Amber Enterprises

637

910

Open

08-08-2018

Top Picks

Amber Enterprises

939

1135

Open

14-06-2018

Top Picks

Amber Enterprises

1,026

1,230

Open

07-11-2019

Top Picks

M&M

580

Closed(07/11/2019)

09-08-2019

Top Picks

M&M

550

724

Open

15-02-2019

Top Picks

M&M

626

850

Open

07-06-2018

Top Picks

M&M

918

1050

Open

04-05-2018

Top Picks

M&M

860

990

Open

22-01-2020

Fundamental

HDFC Bank

1244

Closed(22/01/2020)

20-01-2020

Fundamental

HDFC Bank

1278

1390

Hold

23-10-2019

Top Picks

HDFC Bank

1241

1390

Open

23-07-2019

Top Picks

HDFC Bank

2264

2620

Open

22-01-2019

Top Picks

HDFC Bank

2145

2500

Open

24-07-2018

Top Picks

HDFC Bank

2158

2350

Open

02-05-2018

Top Picks

HDFC Bank

1944

2315

Open

04-05-2018

Top Picks

Matrimony.com Ltd

573

1016

Closed(17/08/2018)

20-04-2018

Top Picks

Matrimony.com Ltd

781

984

Open

31-01-2020

Top Picks

Parag Milk Foods Limited

138

Closed(31/01/2020)

25-10-2019

Top Picks

Parag Milk Foods Limited

149

200

Open

07-08-2019

Top Picks

Parag Milk Foods Limited

190

306

Open

12-02-2019

Top Picks

Parag Milk Foods Limited

211

359

Open

06-11-2018

Top Picks

Parag Milk Foods Limited

256

330

Open

15-05-2018

Top Picks

Parag Milk Foods Limited

310

410

Open

Source: Company, Angel Research

10

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Exhibit 10: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

16-04-2018

Top Picks

Parag Milk Foods Limited

249

333

Open

06-04-2020

Fundamental

GMM Pfaudler Limited

2,597

3,437

Hold

29-02-2020

Top Picks

GMM Pfaudler Limited

2,528

3,437

Open

19-02-2020

Fundamental

GMM Pfaudler Limited

3,255

3,437

Hold

07-02-2020

Top Picks

GMM Pfaudler Limited

2,925

3,437

Open

04-02-2020

Fundamental

GMM Pfaudler Limited

2,979

Hold

29-01-2020

Top Picks

GMM Pfaudler Limited

2,528

2,864

Open

15-01-2020

Fundamental

GMM Pfaudler Limited

1,986

Hold

19-11-2019

Top Picks

GMM Pfaudler Limited

1688

2059

Open

23-09-2019

Top Picks

GMM Pfaudler Limited

1520

1740

Open

11-06-2019

Top Picks

GMM Pfaudler Limited

1470

1570

Open

13-03-2019

Top Picks

GMM Pfaudler Limited

1265

1400

Open

27-08-2018

Top Picks

GMM Pfaudler Limited

1,170

1,287

Open

18-08-2018

Top Picks

GMM Pfaudler Limited

1,024

1,200

Open

07-08-2018

Top Picks

GMM Pfaudler Limited

984

1,100

Open

29-06-2018

Fundamental

GMM Pfaudler Limited

932

1,020

Open

14-05-2018

Fundamental

GMM Pfaudler Limited

818

900

Open

06-04-2018

Fundamental

GMM Pfaudler Limited

712

861

Open

06-12-2019

Fundamental

Ashok Leyland

75

Closed(06/12/2019)

06-06-2019

Fundamental

Ashok Leyland

70

Hold

17-08-2018

Top Picks

Ashok Leyland

128

156

Open

07-03-2018

Fundamental

Ashok Leyland Ltd

139

163

Closed (26/04/2018)

16-12-2019

Fundamental

Greenply Industries

160

Closed(16/12/2019)

31-05-2018

Fundamental

Greenply Industries

256

364

Open

03-03-2018

Fundamental

Greenply Industries

340

395

Open

16-04-2020

Fundamental

Safari Industries

402

Closed(16/04/2020)

30-03-2020

Fundamental

Safari Industries

392

492

Hold

24-03-2020

Top Picks

Safari Industries

328

492

Open

43816

Top Picks

Safari Industries

623

807

Open

27-08-2018

Top Picks

Safari Industries

974

1,071

Open

14-08-2018

Top Picks

Safari Industries

868

1,000

Open

07-08-2018

Top Picks

Safari Industries

788

870

Open

16-07-2018

Top Picks

Safari Industries

693

800

Open

16-04-2018

Top Picks

Safari Industries

651

750

Open

21-02-2018

Top Picks

Safari Industries

532

650

Open

31-05-2018

Top Picks

HSIL Ltd

348

Closed (31/05/2018)

16-02-2018

Top Picks

HSIL Ltd

433

510

Open

04-11-2019

Fundamental

Elantas Beck India Ltd.

2500

Closed(04/11/2019)

07-02-2018

Fundamental

Elantas Beck India Ltd.

2155

2500

Open

Source: Company, Angel Research

11

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Exhibit 11: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

01-04-2020

Fundamental

ICICI Bank

311

440

Hold

02-03-2020

Top Picks

ICICI Bank

497

590

Open

27-01-2020

Fundamental

ICICI Bank

536

590

Hold

09-12-2019

Top Picks

ICICI Bank

526

590

Open

29-10-2019

Top Picks

ICICI Bank

437

532

Open

25-05-2019

Top Picks

ICICI Bank

431

490

Open

15-02-2019

Top Picks

ICICI Bank

343

460

Open

30-07-2018

Top Picks

ICICI Bank

307

411

Open

01-02-2018

Top Picks

ICICI Bank

352

416

Open

06-03-2020

Fundamental

Aditya Birla Capital

75

Closed(06/03/2020)

06-09-2019

Fundamental

Aditya Birla Capital

93

118

Open

09-08-2019

Top Picks

Aditya Birla Capital

89

118

Open

04-06-2019

Top Picks

Aditya Birla Capital

102

130

Open

01-02-2018

Top Picks

Aditya Birla Capital

167

218

Open

04-01-2018

Fundamental

CCL Products

278

360

Open

03-01-2018

Fundamental

Nilkamal Ltd

1,449

Closed (29/01/2020)

03-01-2018

Fundamental

Nilkamal Ltd

1880

2178

Open

01-01-2018

Fundamental

Capital First Ltd

693

850

Closed (15/01/2018)

30-12-2017

Fundamental

Shreyans Industries Ltd

205

247

Closed

09-05-2018

Fundamental

Prism Cement Ltd

160

Closed (09/05/2018)

21-12-2017

Fundamental

Prism Cement Ltd

118

131

18-12-2017

Fundamental

Menon Bearings Limited

92

114

Closed (17/01/2018)

14-12-2017

Top Picks

Ruchira Papers Ltd.

188

244

Closed (09/02/2018)

17-05-2018

Top Picks

Century Plyboards India

280

Closed(17/05/2018)

28-11-2017

Top Picks

Century Plyboards India

317

400

Open

19-12-2017

Top Picks

LT Foods

85

Closed(18/06/2018)

06-11-2017

Top Picks

LT Foods

74

96

16-10-2017

Fundamental

Endurance Technologies Ltd

1111

1277

Closed (01/12/2017)

30/01/2020

Fundamental

GIC Housing

154

Closed (30/01/2020)

06-06-2019

Fundamental

GIC Housing

252

Hold

11-09-2017

Top Picks

GIC Housing

533

655

Open

28-01-2020

Fundamental

Music Broadcast Limited

29

Closed (28/01/2020)

06-06-2019

Fundamental

Music Broadcast Limited

58

Hold

10-10-2017

Top Picks

Music Broadcast Limited

404

475

Open

20-07-2017

Top Picks

Music Broadcast Limited

368

434

Open

Fundamental

L&T Finance Holding

Hold

03-05-2018

Fundamental

L&T Finance Holding

171

210

Open

07-07-2017

Fundamental

L&T Finance Holdings Ltd

149

179

Closed (28/8/2017)

Source: Company, Angel Research

12

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Exhibit 12: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

06-07-2017

Fundamental

Syngene International

478

564

Closed (1/3/2018)

28-01-2020

Top Picks

Maruti

7,065

Closed(28/01/2020)

30-07-2019

Top Picks

Maruti

5558

7,783

Open

29-10-2018

Top Picks

Maruti

6705

8,552

Open

27-07-2017

Top Picks

Maruti

9315

10820

Open

05-06-2017

Top Picks

Karur Vysya Bank

127

100

Closed (12/03/2018)

16-04-2020

Fundamental

KEI Industries

279

Closed (16/04/2020)

06-04-2020

Fundamental

KEI Industries

295

400

Hold

19-03-2020

Top Picks

KEI Industries

257

400

Open

21-01-2020

Top Picks

KEI Industries

517

658

Open

13-11-2019

Fundamental

KEI Industries

542

Hold

07-08-2019

Top Picks

KEI Industries

464

556

Open

12-02-2019

Top Picks

KEI Industries

349

486

Open

23-05-2018

Top Picks

KEI Industries

481

589

Open

21-05-2018

Top Picks

KEI Industries

433

508

Open

25-01-2018

Top Picks

KEI Industries

400

486

Open

04-01-2017

Top Picks

KEI Industries

167

207

Open

17-04-2020

Top Picks

Alkem Lab.

2,687

3,300

Open

31-05-2018

Top Picks

Alkem Lab

1978

Closed (31/05/2018)

01-12-2016

Top Picks

Alkem Lab

1700

2441

Open

17-10-2016

Top Picks

Asian Granito

267

534

Closed (18/02/2018)

17-05-2018

Top Picks

TV Today Network

460

Closed (17/05/2018)

04-08-2016

Top Picks

TV Today Network

297

603

Open

30-01-2019

Fundamental

DHFL

162

Closed(30/01/2019)

05-04-2016

Top Picks

DHFL

189

720

Open

25-06-2018

Top Picks

Navkar Corporation

207

Closed(25/06/2018)

05-01-2016

Top Picks

Navkar Corporation

207

265

Open

09-12-2019

Top Picks

Blue Star

813

Closed(09/12/2019)

08-12-2015

Top Picks

Blue Star

357

867

Open

29-01-2020

Fundamental

Siyaram Silk Mills

229

Closed(28/01/2020)

06-06-2019

Fundamental

Siyaram Silk Mills

337

Hold

30-10-2015

Top Picks

Siyaram Silk Mills

186

851

Open

Source: Company, Angel Research

13

www.angelbroking.com

Market Outlook

April 22, 2020

www.angelbroking.com

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.