Market Outlook

August 21, 2015

Dealer’s Diary

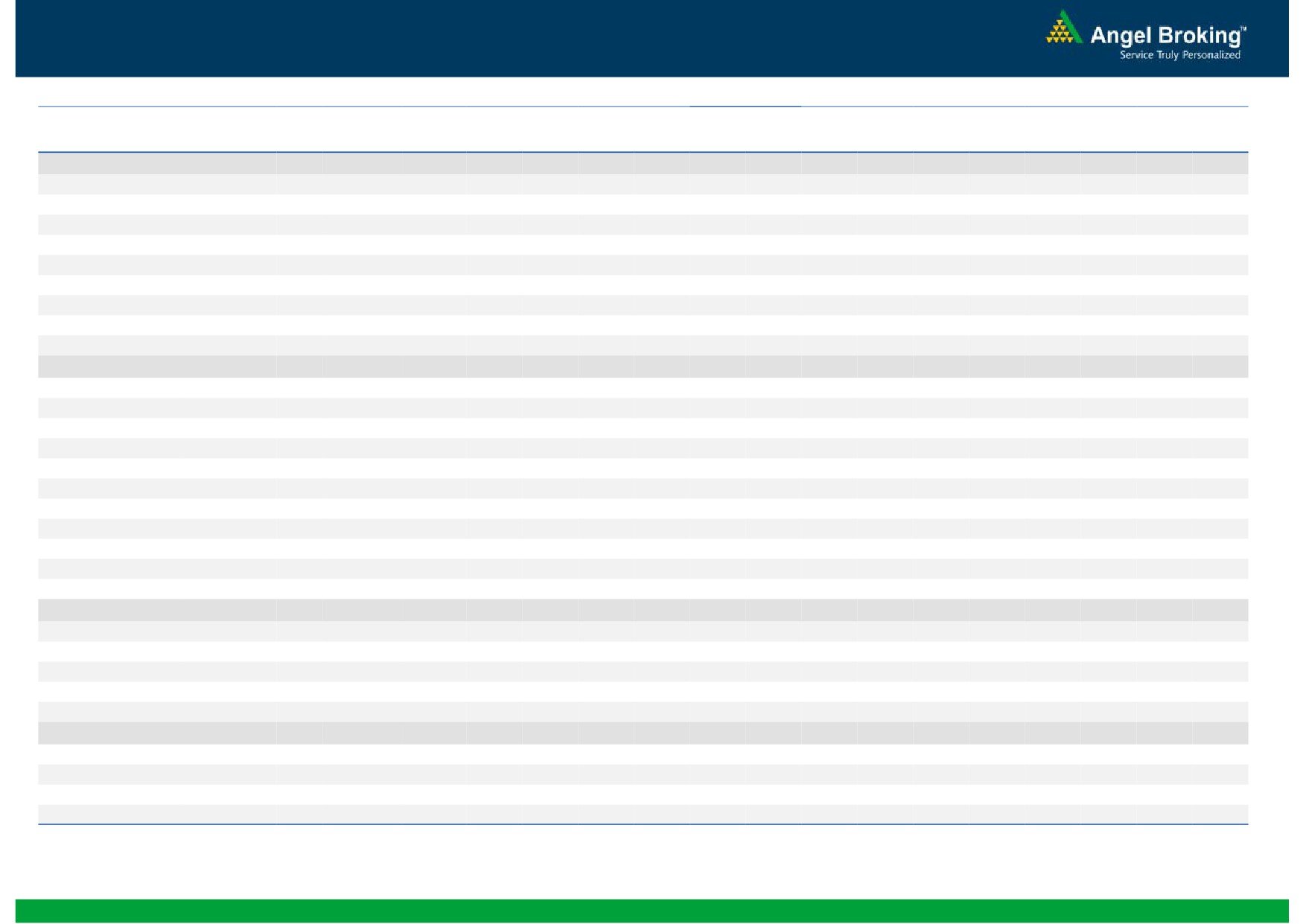

Domestic Indices

Chg (%)

(Pts)

(Close)

BSE Sensex

(1.2)

(324)

27,608

Indian markets are expected to open negatively given the weak global cues.

Nifty

(1.4)

(122)

8,373

US markets declined sharply, reaching the lowest level in 2015 amid worries over

MID CAP

(2.0)

(231)

11,318

the global slowdown.

SMALL CAP

(2.0)

(240)

11,681

BSE HC

0.4

69

18,437

European markets tanked on back of latest US Fed commentary, steep decline in oil

BSE PSU

(2.0)

(150)

7,230

and continued concerns on growth in Greece and China.

BANKEX

(2.3)

(500)

20,957

Indian markets ended in the red led by decline in the banking and oil stocks.

AUTO

(1.8)

(353)

19,192

METAL

(2.4)

(183)

7,470

News & Result Analysis

OIL & GAS

(1.8)

(165)

9,239

Aurobindo Pharma receives USFDA Approval for Omeprazole & Ibandraonate

BSE IT

(2.3)

(270)

11,585

Sodium

Lupin gets USFDA nod for Fenofibrate Tablets

Global Indices

Chg (%)

(Pts)

(Close)

Sun Pharma announces US FDA approval for XiminoTM

Dow Jones

(2.1)

(358)

16,991

Dr Reddy's recalls Rivastigmine Tartrate capsules from US

NASDAQ

(2.8)

(142)

4,877

Infosys announces Aikido enhanced service offerings

FTSE

(0.6)

(36)

6,368

Refer detailed news & result analysis on the following page

Nikkei

(0.9)

(189)

20,034

Markets Today

Hang Sang

(1.8)

(410)

22,757

The trend deciding level for the day is 27,712 / 8,411 levels. If NIFTY trades above

Straits Times

(1.0)

(31)

3,010

this level during the first half-an-hour of trade then we may witness a further rally up

Shanghai Com

(3.4)

(130)

3,664

to 27,860 - 28,113 / 8,463 - 8,553 levels. However, if NIFTY trades below

27,712 / 8,411 levels for the first half-an-hour of trade then it may correct towards

Indian ADR

Chg (%)

(Pts)

(Close)

27,460 - 27,312 / 8,321 - 8,270 levels.

INFY

(4.7)

(0.9)

$17.3

Indices

S2

S1

PIVOT

R1

R2

WIT

(4.2)

(0.5)

$12.0

SENSEX

27,312

27,460

27,712

27,860

28,113

IBN

(3.6)

(0.3)

$9.4

NIFTY

8,270

8,321

8,411

8,463

8,553

HDB

(2.0)

(1.2)

$60.2

Net Inflows (August 19, 2015)

Advances / Declines

BSE

NSE

` cr

Purch

Sales

Net

MTD

YTD

Advances

757

302

FII

3,146

3,436

(290)

(759)

140,210

Declines

2,111

1,226

MFs

1,034

709

325

1,208

59,156

Unchanged

88

36

FII Derivatives (August 20, 2015)

Volumes (` cr)

` cr

Purch

Sales

Net

Open Interest

BSE

3,355

Index Futures

1,869

3,640

(1,771)

13,464

NSE

20,480

Stock Futures

4,501

4,158

343

52,575

Gainers / Losers

Gainer

Loser

Company

Price (`)

chg (%)

Company

Price (`)

chg (%)

DELTACORP

75

8.4

AMTEKAUTO

64

(28.4)

LUPIN

1,892

5.4

CENTRALBK

87

(17.4)

ITC

329

3.9

VIDEOIND

119

(16.9)

CRISIL

1,980

3.0

VAKRANGEE

127

(16.3)

ALOKTEXT

7

2.8

IL&FSTRANS

102

(12.5)

Market Outlook

August 21, 2015

Aurobindo Pharma receives USFDA Approval for Omeprazole &

Ibandraonate Sodium

Aurobindo Pharma has received final approvals from the US Food & Drug

Administration (USFDA) to manufacture and market Ibandronate Sodium Injection,

3mg/3mL (1mg/mL), (ANDA 205332) & Omeprazole Delayed-release Capsules

USP, 10mg, 20mg and 40mg (ANDA 203270).

Omeprazole Delayed-release Capsules are indicated for short-term treatment of

active duodenal ulcer in adults. The product has an estimated market size of

US$422mn for the twelve months ending June 2015 according to IMS. The market

for the Omeprazole Delayed-release capsules is highly competitive.

Ibandronate Sodium Injection, 3mg/3mL

(1mg/mL) is bioequivalent and

therapeutically equivalent to the reference listed drug product (RLD) Boniva®

Injection, 3mg/3mL (1mg/mL) of Hoffmann-La Roche, Inc. Ibandronate Sodium

Injection is indicated for the treatment of osteoporosis in postmenopausal women.

The Ibandronate Sodium Injection is competitive with 4-5 players already in the

market and has estimated sales of ~US$20mn.

Thus, given the competitive landscape of Omeprazole Delayed-release capsules

and small size of Ibandronate Sodium Injection, we think the drugs will not

contribute significantly to sales. We are neutral on the stock.

Lupin gets USFDA nod for Fenofibrate Tablets

Lupin got approval for key anti-cholestrol drug Fenofibrate from USFDA.

Fenofibrate is mainly used to reduce cholesterol levels in patients at risk of

cardiovascular disease. Like other fibrates, it reduces low-density lipoprotein (LDL)

and very low density lipoprotein (VLDL) levels, as well as increasing high-density

lipoprotein (HDL) levels and reducing triglyceride levels. Though the drug is highly

competitive and hence unlikely to contribute significantly to the company, it’s

positive as the approval has come from Lupin's Goa plant, which underwent

US FDA audit and got a 483 with 9 observations. However, we maintain our

neutral stance on the stock.

Sun Pharma announces US FDA approval for XiminoTM

Sun Pharmaceutical today announced that the U.S. Food and Drug Administration

(FDA) has approved its Supplemental New Drug Application (sNDA) for XiminoTM

(Minocycline HCl) extended-release capsules 45 mg, 90 mg and 135 mg.

XiminoTM extended-release capsules are indicated for inflammatory lesions of non-

nodular moderate to severe acne vulgaris in patients 12 years of age and older.

This approval further strengthens the Company’s branded dermatology portfolio in

the US. It expects XiminoTM extended-release capsules to be available for patients

during the fourth quarter of 2015.

The US market is the largest market for the global acne products with about 50mn

suffering from acne in the country. As of January 31, 2015 is a $3.0bn market in

the US branded prescription market. The market is split between oral antibiotics

($1.7bn in sales) or lotions, creams and ointments ($1.3bn in sales).The acne

market is so fragmented that numerous companies are selling hundreds of

Market Outlook

August 21, 2015

millions worth of drug treatments. Thus, the landscape is very competitive, with no

dominant leader. The most prominent brand in the US Solodyn has US sales of

US$300-400mn. Thus, the product can garner decent sales from the product.

However given the generic competition, conservatively we estimate the product can

contribute around US$50-80mn to the annual sales of the company, with net

profit around US$25-40mn. We remain neutral on the stock.

Dr Reddy's recalls Rivastigmine Tartrate capsules from US

Dr Reddy's Laboratories (DRL) has initiated voluntary recall of Rivastigmine Tartrate

capsules of 1.5 mg strength from the USA market, following 'Failed Dissolution

Specifications'. A total of 60 bottles of 2952 units are recalled on the direction of

US Food and Drug Administration (USFDA). According to a notification issued by

the agency, the batch was manufactured at DRL's Ltd, Bachupally unit and the

recall was initiated under "Class II" classification.

Rivastigmine Tartrate Capsules are indicated for the treatment of mild to moderate

dementia of the Alzheimer's type or Parkinson's disease. According to the US

health regulator, Class II recall is a situation in which the use of or exposure to a

violative product may cause temporary or medically reversible adverse health

consequences or where the probability of serious adverse health consequences is

remote. We remain neutral on the stock.

Infosys announces Aikido enhanced service offerings

Infosys announced three services to help it succeed in its strategy of focusing on

renewing existing businesses and move into new areas. The offerings, together

called AiKi-Do, will focus on Artificial Intelligence, Knowledge-based IT and Design

thinking to help the IT firm's enterprise clients.

The knowledge-based IT service (called Ki) will include developing operating

roadmaps and plans to rationalise existing IT initiatives, curation services to help

companies consolidate and transition operations and their workforce, among

other offerings.

The Design Thinking service offering (called Do) will offer strategic design

consulting and the enablement of the future workforce. Both the services will be

offered by Infosys Consulting, Sikka said.

The Artificial Intelligence services will include the Infosys Automation Platform, a

Service Automation Platform and the other platforms in Infosys Edge unit. These

services will be called Ai, the company said.

In addition, Infosys said it would offer platforms to address the Internet of Things

and application programming interface requirements of its clients. "Ai, Ki and Do

combine into Aikido, the east Asian martial arts, and just as Aikido aims to

understand the forces, and redirect these it into a fundamental strength, our Ai, Ki

and Do services will help combine the knowledge and energy in an enterprise

towards its strategic path and priorities. Currently, we have Accumulate rating on

the stock.

Market Outlook

August 21, 2015

Economic and Political News

FM Arun Jaitley steps up rate cut pressure on RBI

Cheap imports hurting domestic paper industry

Centre invites comments on revised bid document for BOO power projects

Corporate News

RIL raises $225 million through overseas bond issue

Dr Reddy's recalls Rivastigmine Tartrate capsules from US

Maruti cars turn dearer by `3,000-9,000

Market Outlook

August 21, 2015

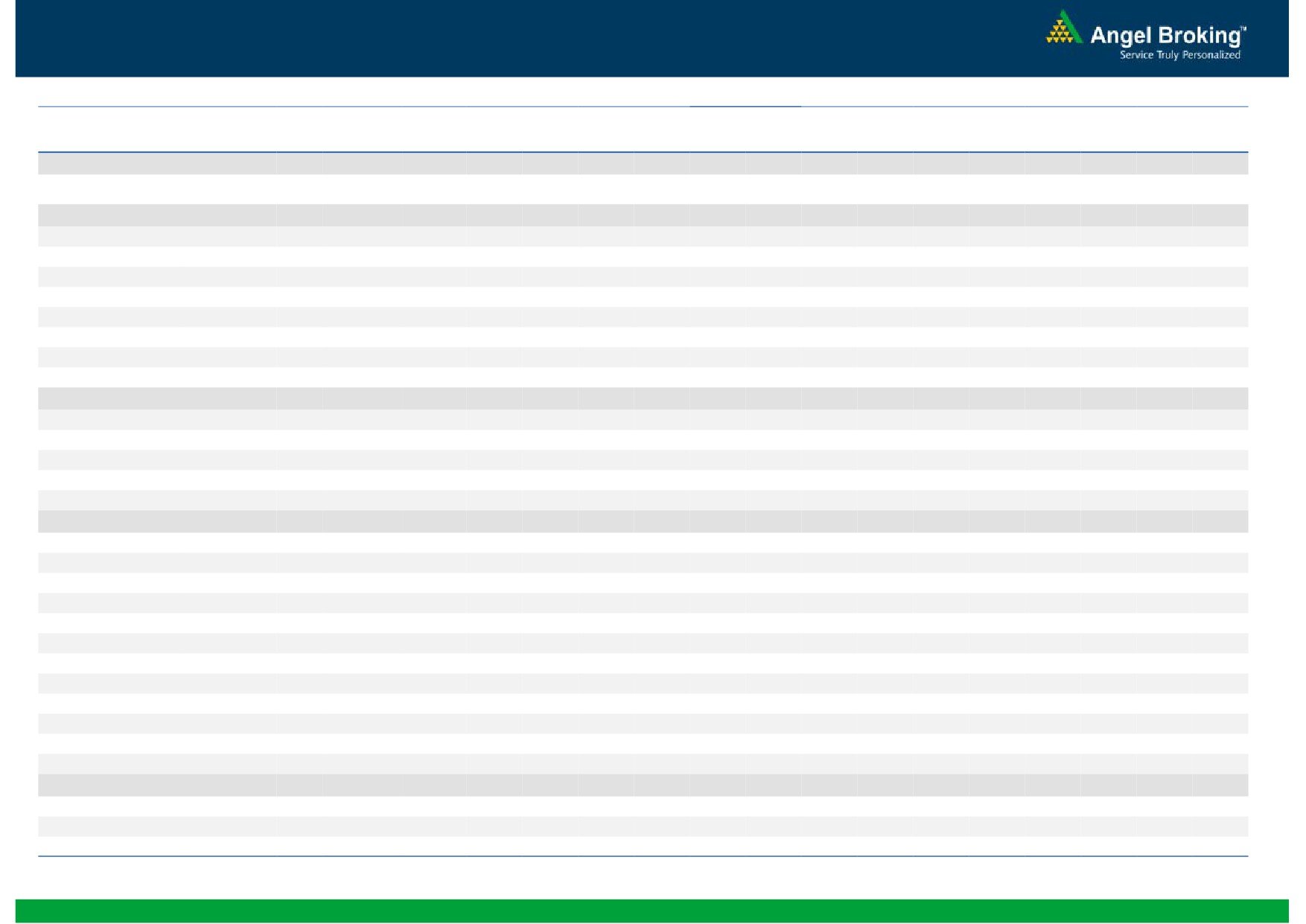

Top Picks

Large Cap

Market

CMP

Target

Upside

Company

Sector

Rating

Cap (` Cr)

(`)

(`)

(%)

Axis Bank

Financials

126,941

Buy

534

716

34.0

ICICI Bank

Financials

173,170

Buy

298

370

24.0

Inox Wind

Capital Goods

8,752

Buy

394

505

28.0

LIC Housing Fin. Financials

23,795

Buy

472

590

25.1

Power Grid

Power

71,123

Buy

136

170

25.0

TCS

IT

527,133

Buy

2,691

3,168

17.7

Tech Mahindra IT

53,817

Buy

560

646

15.4

Yes Bank

Financials

30,096

Buy

719

989

37.5

Infosys

IT

261,438 Accumulate

1,138

1,306

14.7

Source: Angel Research, Bloomberg

Mid Cap

Market

CMP

Target

Upside

Company

Sector

Rating

Cap (` Cr)

(`)

(`)

(%)

Bajaj Electricals

Others

2,597

Buy

258

341

32.4

Hindustan Media Ven. Media

1,659

Buy

226

292

29.2

JK Tyre

Auto Ancillary

2,561

Buy

113

147

30.2

MBL Infrastructures

Construction

1,057

Buy

255

360

41.2

Radico Khaitan

Others

1,255

Buy

94

112

18.8

Surya Roshni

Others

600

Buy

137

183

33.7

Garware Wall Ropes Others

726

Buy

332

390

17.5

Minda Industries

Auto Ancillary

933 Accumulate

588

652

10.8

MT Educare

Others

548

Neutral

138

-

-

Source: Angel Research, Bloomberg

Market Outlook

August 21, 2015

Global economic events release calendar

Date

Time

Country Event Description

Unit

Period

Bloomberg Data

Last Reported Estimated

August 21, 2015

7:30PM

Euro Zone Euro-Zone Consumer Confidence

Value

Aug A

(7.10)

(6.90)

1:00PM

Germany PMI Services

Value

Aug P

53.80

53.70

1:00PM

Germany PMI Manufacturing

Value

Aug P

51.80

51.60

August 25, 2015

11:30AM

Germany GDP nsa (YoY)

% Change

2Q F

1.60

--

7:30PM

US

New home sales

Thousands

Jul

482.00

513.50

7:30PM

US

Consumer Confidence

S.A./ 1985=100

Aug

90.91

93.00

August 27, 2015

6:00PM

US

GDP Qoq (Annualised)

% Change

2Q S

2.30

3.20

August 28, 2015

2:00PM

UK

GDP (YoY)

% Change

2Q P

2.60

2.60

September 1, 2015

1:25PM

Germany Unemployment change (000's)

Thousands

Aug

9.00

--

6:30AM

China

PMI Manufacturing

Value

Aug

50.00

--

2:00PM

UK

PMI Manufacturing

Value

Aug

51.90

--

September 3, 2015

5:15PM

Euro Zone ECB announces interest rates

%

Sep 3

0.05

--

September 4, 2015

2:30PM

Euro Zone Euro-Zone GDP s.a. (QoQ)

% Change

2Q P

0.30

--

6:00PM

US

Change in Nonfarm payrolls

Thousands

Aug

215.00

--

6:00PM

US

Unnemployment rate

%

Aug

5.30

--

September 8, 2015

China

Exports YoY%

% Change

Aug

(8.30)

--

September 9, 2015

7:00AM

China

Consumer Price Index (YoY)

% Change

Aug

1.60

--

2:00PM

UK

Industrial Production (YoY)

% Change

Jul

1.50

--

September 10, 2015

India

Imports YoY%

% Change

Aug

(10.28)

--

India

Exports YoY%

% Change

Aug

(10.30)

--

4:30PM

UK

BOE Announces rates

% Ratio

Sep 10

0.50

0.50

Source: Bloomberg, Angel Research

Market Outlook

August 21, 2015

Macro watch

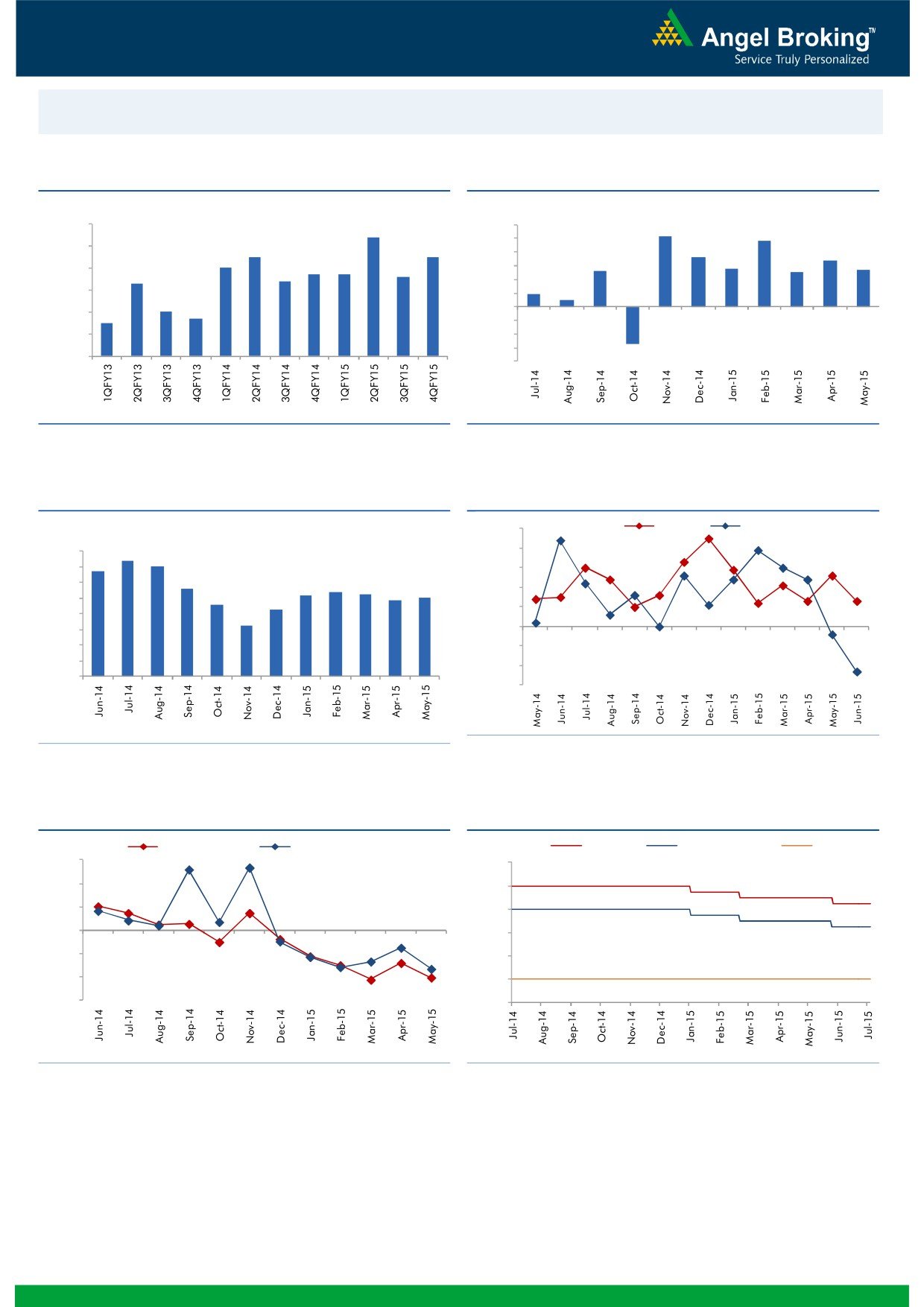

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

9.0

8.4

6.0

5.2

4.8

5.0

8.0

7.5

7.5

3.6

4.0

3.4

7.0

2.8

2.7

6.7

6.7

6.6

2.6

2.5

7.0

6.3

6.4

3.0

2.0

0.9

6.0

0.5

1.0

5.0

4.7

-

5.0

4.5

(1.0)

4.0

(2.0)

(3.0)

3.0

(2.7)

(4.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

(%)

55.0

Mfg. PMI

Services PMI

8.0

7.4

54.0

7.0

6.8

7.0

53.0

5.6

5.2

5.4

5.3

6.0

4.9

5.0

52.0

4.6

5.0

4.3

51.0

4.0

3.3

3.0

50.0

2.0

49.0

1.0

48.0

-

47.0

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

30.0

9.00

20.0

8.00

10.0

7.00

0.0

6.00

(10.0)

5.00

(20.0)

4.00

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

August 21, 2015

Global watch

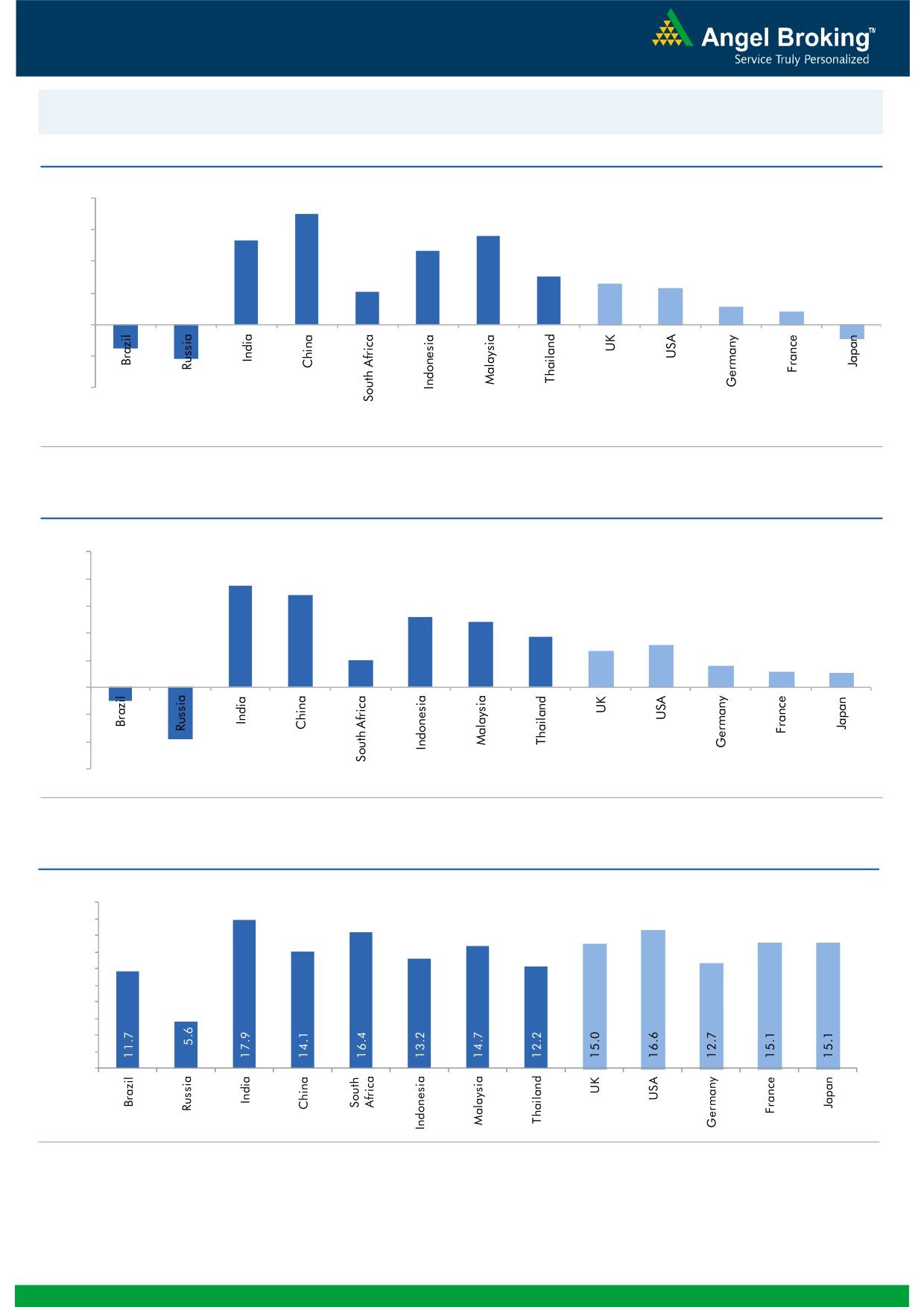

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

7.0

5.6

6.0

5.3

4.7

4.0

3.0

2.6

2.1

2.3

2.0

1.1

0.8

(1.6)

(2.2)

(0.9)

-

(2.0)

(4.0)

Source: Bloomberg, Angel Research

Exhibit 2: 2015 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

10.0

7.5

8.0

6.8

6.0

5.2

4.8

3.7

4.0

3.1

2.7

2.0

1.6

2.0

1.2

1.0

(1.0)

(3.8)

-

(2.0)

(4.0)

(6.0)

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: Bloomberg, Angel Research

Market Outlook

August 21, 2015

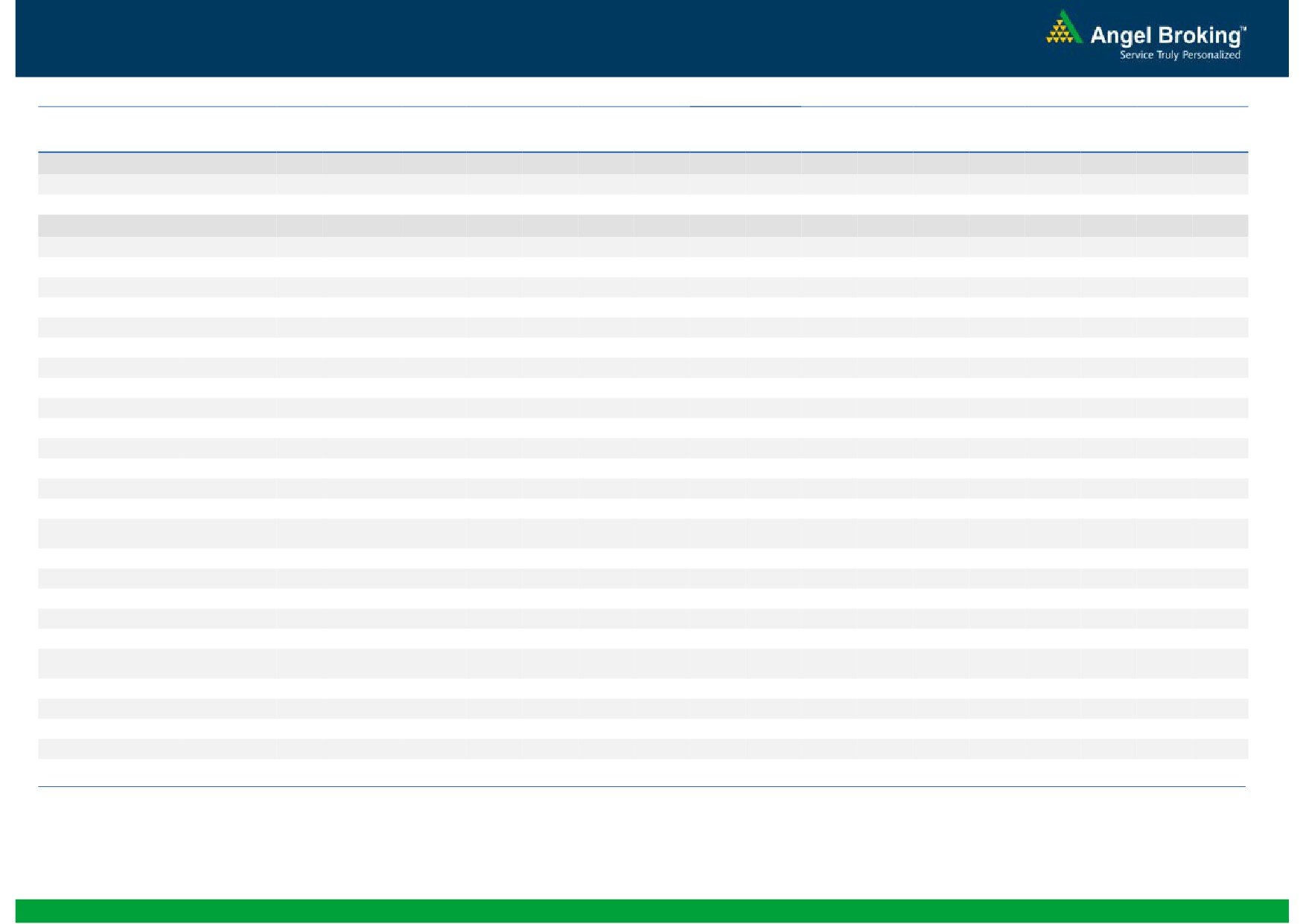

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

46,649

(9.4)

(15.0)

(19.0)

Russia

Micex

1,696

3.7

2.2

17.9

India

Nifty

8,373

(1.8)

(1.0)

8.4

China

Shanghai Composite

3,664

(9.7)

(21.9)

63.6

South Africa

Top 40

44,149

(6.8)

(8.0)

(4.4)

Mexico

Mexbol

43,037

(5.2)

(4.1)

(4.9)

Indonesia

LQ45

748

(12.0)

(19.1)

(16.7)

Malaysia

KLCI

1,577

(9.1)

(12.1)

(15.6)

Thailand

SET 50

890

(8.5)

(11.2)

(12.9)

USA

Dow Jones

16,991

(5.2)

(7.1)

(0.3)

UK

FTSE

6,368

(5.9)

(9.2)

(6.0)

Japan

Nikkei

20,034

(4.7)

(3.1)

29.0

Germany

DAX

10,432

(10.1)

(12.1)

12.0

France

CAC

4,784

(6.3)

(7.0)

8.9

Source: Bloomberg, Angel Research

Market Outlook

August 21, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Agri / Agri Chemical

Rallis

Neutral

220

-

4,285

2,075

2,394

14.4

14.4

9.5

11.0

23.2

20.0

4.6

4.0

21.1

21.3

2.1

1.8

United Phosphorus

Neutral

547

-

23,458

13,698

15,752

17.6

17.6

32.1

38.5

17.1

14.2

3.3

2.8

21.4

21.3

1.8

1.5

Auto & Auto Ancillary

Ashok Leyland

Neutral

96

-

27,221

17,850

20,852

10.6

11.1

3.2

4.3

29.9

22.2

5.0

4.6

16.4

20.8

1.5

1.2

Bajaj Auto

Neutral

2,492

-

72,113

23,842

27,264

19.8

19.6

128.4

144.4

19.4

17.3

5.9

5.1

30.5

29.5

2.6

2.2

Eicher Motors

Accumulate

21,018

22,859

57,047

11,681

15,550

15.3

16.9

358.5

564.3

58.6

37.3

17.6

13.1

29.8

34.9

4.8

3.5

Hero Motocorp

Neutral

2,634

-

52,596

28,500

33,028

13.8

14.1

144.2

166.3

18.3

15.8

6.7

5.7

36.7

36.0

1.7

1.4

L G Balakrishnan & Bros Neutral

465

-

730

1,254

1,394

11.6

11.8

35.9

41.7

13.0

11.2

1.8

1.6

13.5

13.8

0.7

0.6

Mahindra and Mahindra Accumulate

1,338

1,493

83,074

40,088

45,176

13.8

14.0

59.6

70.4

22.4

19.0

3.7

3.3

16.6

17.2

1.7

1.5

Maruti

Neutral

4,632

-

139,916

58,102

68,587

16.7

16.9

182.0

225.5

25.5

20.5

5.1

4.3

19.9

21.0

2.2

1.8

Minda Industries

Accumulate

588

652

933

2,567

2,965

7.3

8.0

38.8

54.3

15.2

10.8

2.2

1.8

14.4

16.8

0.5

0.4

Rane Brake Lining

Accumulate

340

366

269

454

511

11.1

11.4

23.8

28.1

14.3

12.1

2.0

1.8

14.2

15.3

0.7

0.7

Setco Automotive

Neutral

221

-

591

594

741

12.7

13.7

8.4

15.8

26.3

14.0

2.7

2.4

10.4

16.9

1.4

1.2

Tata Motors

Buy

342

432

98,771

267,464

307,211

13.7

13.7

34.6

40.7

9.9

8.4

1.3

1.1

13.2

13.6

0.6

0.5

TVS Motor

Accumulate

232

255

11,013

11,839

13,985

7.0

8.0

10.8

15.9

21.5

14.6

5.5

4.3

25.5

29.7

0.9

0.7

Amara Raja Batteries

Neutral

1,049

-

17,910

5,101

6,224

17.8

17.6

31.1

39.2

33.7

26.8

8.4

6.6

24.8

24.8

3.5

2.8

Exide Industries

Neutral

160

-

13,613

7,363

8,247

13.7

14.5

6.6

7.7

24.3

20.8

3.1

2.8

12.6

13.3

1.6

1.4

Apollo Tyres

Neutral

195

-

9,913

12,428

13,262

16.8

16.4

21.9

21.1

8.9

9.2

1.5

1.3

17.0

14.1

0.9

0.9

Ceat

Accumulate

1,123

1,203

4,544

6,041

6,770

14.3

14.1

101.5

120.3

11.1

9.3

2.2

1.8

20.0

19.6

0.9

0.8

JK Tyres

Buy

113

147

2,561

7,446

7,942

15.2

14.7

19.6

21.0

5.8

5.4

1.5

1.2

25.2

21.7

0.7

0.6

Swaraj Engines

Neutral

950

-

1,180

593

677

14.5

14.8

51.2

60.8

18.6

15.6

4.3

3.9

23.3

24.8

1.8

1.6

Subros

Neutral

90

-

539

1,268

1,488

11.6

11.9

3.7

6.6

24.3

13.6

1.6

1.5

6.8

11.4

0.7

0.6

Indag Rubber

Neutral

199

-

522

283

329

17.0

17.2

13.0

15.4

15.4

12.9

3.4

2.8

21.8

21.6

1.6

1.3

Capital Goods

ACE

Neutral

45

-

441

660

839

4.7

8.2

1.0

3.9

44.6

11.4

1.4

1.2

3.2

11.3

0.8

0.7

BEML

Neutral

1,317

-

5,483

3,277

4,006

6.0

8.9

29.2

64.3

45.1

20.5

2.5

2.3

5.7

11.7

1.8

1.4

BGR Energy

Neutral

128

-

924

3,615

3,181

9.5

9.4

16.7

12.4

7.7

10.3

0.7

0.7

10.0

7.0

0.7

0.8

BHEL

Neutral

253

-

62,010

33,722

35,272

10.8

11.7

10.5

14.2

24.1

17.8

1.8

1.7

7.0

9.0

1.9

1.8

Blue Star

Accumulate

360

387

3,237

3,649

4,209

5.0

5.9

9.2

14.7

39.4

24.4

7.1

6.7

9.1

17.5

1.0

0.8

Crompton Greaves

Accumulate

179

204

11,247

13,484

14,687

4.9

6.2

4.5

7.1

39.9

25.3

2.8

2.6

7.2

10.8

1.0

0.9

Inox Wind

Buy

394

505

8,752

4,980

5,943

17.0

17.5

26.6

31.6

14.8

12.5

4.4

3.3

35.0

30.0

1.9

1.5

Market Outlook

August 21, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Capital Goods

KEC International

Neutral

138

-

3,536

8,791

9,716

6.1

6.8

5.4

8.2

25.5

16.8

2.6

2.3

10.0

14.0

0.6

0.6

Thermax

Neutral

1,029

-

12,262

6,413

7,525

7.4

8.5

30.5

39.3

33.7

26.2

5.2

4.5

15.0

17.0

1.9

1.6

Cement

ACC

Accumulate

1,412

1,548

26,500

11,856

14,092

14.5

17.8

47.6

76.1

29.7

18.6

3.1

2.8

10.6

15.7

2.1

1.7

Ambuja Cements

Neutral

224

-

34,747

10,569

12,022

20.7

22.2

8.7

10.7

25.7

20.9

3.3

3.1

13.0

15.2

2.9

2.5

India Cements

Buy

83

112

2,562

4,716

5,133

15.9

16.9

3.7

7.5

22.5

11.1

0.8

0.8

3.8

7.3

0.8

0.7

JK Cement

Buy

660

767

4,612

4,056

4,748

14.5

17.0

22.6

41.1

29.2

16.1

2.6

2.3

9.3

15.3

1.6

1.3

J K Lakshmi Cement

Buy

354

430

4,169

2,947

3,616

16.7

19.9

11.5

27.2

30.8

13.0

2.9

2.5

9.8

20.8

1.8

1.5

Mangalam Cements

Neutral

250

-

667

1,053

1,347

10.5

13.3

8.4

26.0

29.8

9.6

1.3

1.2

4.3

12.5

1.0

0.8

Orient Cement

Accumulate

172

183

3,527

1,854

2,524

21.2

22.2

7.7

11.1

22.4

15.5

3.2

2.8

13.3

15.7

2.6

1.9

Ramco Cements

Neutral

356

-

8,464

4,036

4,545

20.8

21.3

15.1

18.8

23.5

18.9

2.9

2.6

12.9

14.3

2.6

2.2

Shree Cement^

Neutral

11,065

-

38,547

7,150

8,742

26.7

28.6

228.0

345.5

48.5

32.0

7.1

6.0

15.7

20.3

5.1

4.1

UltraTech Cement

Accumulate

3,049

3,282

83,672

27,562

31,548

20.4

22.3

111.9

143.3

27.3

21.3

3.9

3.3

15.2

16.8

3.1

2.7

Construction

ITNL

Neutral

102

-

2,520

7,360

8,825

34.0

35.9

1.0

5.0

102.2

20.4

0.4

0.4

0.3

1.4

3.8

3.7

KNR Constructions

Neutral

562

-

1,564

915

1,479

14.3

13.9

20.3

37.2

27.7

15.1

2.5

2.2

9.6

15.6

1.8

1.2

Larsen & Toubro

Accumulate

1,782

2,013

165,855

68,920

82,446

10.9

11.5

57.0

73.0

31.3

24.4

2.9

2.7

13.6

15.5

2.6

2.2

Gujarat Pipavav Port

Neutral

188

-

9,101

740

843

53.1

53.6

8.0

10.0

23.5

18.8

3.7

2.9

20.4

19.4

11.9

10.0

MBL Infrastructures

Buy

255

360

1,057

2,313

2,797

12.2

14.6

19.0

20.0

13.4

12.8

1.4

1.3

11.3

10.6

1.2

1.0

PNC Infratech

Neutral

510

-

2,617

1,798

2,132

13.2

13.5

22.0

30.0

23.2

17.0

2.1

1.9

11.5

11.4

1.6

1.3

Financials

Allahabad Bank

Neutral

88

-

5,048

8,859

9,817

3.0

3.0

23.7

30.1

3.7

2.9

0.5

0.4

10.6

12.3

-

-

Axis Bank

Buy

534

716

126,941

26,522

31,625

3.6

3.6

36.2

45.4

14.8

11.8

2.9

2.5

18.2

19.6

-

-

Bank of Baroda

Neutral

201

-

44,484

18,934

21,374

2.0

2.0

13.2

15.1

15.2

13.3

1.1

1.0

7.1

7.7

-

-

Bank of India

Neutral

170

-

11,274

17,402

20,003

2.0

2.1

40.3

50.7

4.2

3.3

0.4

0.4

9.0

10.4

-

-

Canara Bank

Neutral

326

-

16,801

15,805

17,745

2.0

2.2

64.3

73.5

5.1

4.4

0.6

0.5

10.8

11.3

-

-

Dena Bank

Neutral

45

-

2,500

3,580

4,040

2.1

2.2

8.4

10.9

5.3

4.1

0.5

0.4

6.8

8.4

-

-

Federal Bank

Neutral

67

-

11,404

3,522

4,045

3.2

3.2

12.2

14.1

5.5

4.7

0.7

0.6

12.9

13.4

-

-

HDFC

Accumulate

1,248

1,343

196,748

11,198

13,321

3.5

3.5

45.1

53.7

27.7

23.2

5.7

5.1

27.2

28.2

-

-

HDFC Bank

Buy

1,075

1,255

270,128

38,629

47,500

4.5

4.7

52.6

66.4

20.4

16.2

3.7

3.2

19.6

21.2

-

-

ICICI Bank

Buy

298

370

173,170

36,037

41,647

3.5

3.6

22.9

26.7

13.0

11.2

2.2

1.9

15.7

15.9

-

-

IDBI Bank

Neutral

67

-

10,666

9,806

11,371

1.7

1.9

10.0

16.3

6.7

4.1

0.5

0.4

6.8

10.4

-

-

Market Outlook

August 21, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Financials

Indian Bank

Neutral

142

-

6,839

6,454

7,321

2.5

2.6

26.4

33.3

5.4

4.3

0.5

0.4

8.1

9.6

-

-

LIC Housing Finance

Buy

472

590

23,795

2,934

3,511

2.3

2.3

30.9

36.8

15.3

12.8

2.5

2.1

16.8

17.5

-

-

Oriental Bank

Neutral

163

-

4,874

7,930

8,852

2.5

2.5

51.8

57.1

3.1

2.9

0.4

0.3

9.3

9.5

-

-

Punjab Natl.Bank

Neutral

159

-

29,460

24,160

27,777

2.9

3.0

18.5

24.6

8.6

6.5

0.8

0.7

8.8

10.8

-

-

South Ind.Bank

Neutral

23

-

3,038

1,999

2,249

2.4

2.4

3.5

4.0

6.5

5.6

0.8

0.7

12.6

13.1

-

-

St Bk of India

Accumulate

270

285

204,628

86,900

100,550

3.1

3.1

22.1

27.7

12.3

9.8

1.5

1.3

12.7

14.3

-

-

Union Bank

Neutral

201

-

12,792

12,995

14,782

2.4

2.4

32.3

40.9

6.2

4.9

0.7

0.6

10.7

12.3

-

-

Vijaya Bank

Neutral

38

-

3,299

3,474

3,932

1.8

1.9

5.9

7.2

6.5

5.3

0.6

0.5

8.1

9.3

-

-

Yes Bank

Buy

719

989

30,096

7,006

8,825

3.1

3.3

61.4

77.1

11.7

9.3

2.2

1.8

20.1

21.3

-

-

FMCG

Asian Paints

Neutral

883

-

84,740

16,553

19,160

16.0

16.2

17.7

21.5

50.0

41.1

13.3

11.9

29.4

31.2

5.0

4.3

Britannia

Neutral

3,224

-

38,680

8,065

9,395

9.6

10.2

47.2

65.5

68.3

49.2

22.7

21.5

38.3

41.2

4.6

4.0

Colgate

Neutral

1,997

-

27,152

4,836

5,490

19.5

19.7

48.5

53.2

41.2

37.5

30.2

26.3

99.8

97.5

5.5

4.8

Dabur India

Neutral

297

-

52,213

9,370

10,265

17.1

17.2

7.3

8.1

40.5

36.7

12.2

9.9

33.7

30.6

5.5

5.0

GlaxoSmith Con*

Neutral

6,211

-

26,120

4,919

5,742

17.2

17.4

168.3

191.2

36.9

32.5

10.5

8.9

28.8

28.9

4.9

4.1

Godrej Consumer

Neutral

1,308

-

44,532

10,168

12,886

16.1

16.1

32.1

38.4

40.8

34.1

8.3

7.7

19.7

21.0

4.5

3.5

HUL

Neutral

874

-

189,020

34,940

38,957

17.5

17.7

20.8

24.7

42.0

35.4

46.7

37.3

110.5

114.2

5.2

4.7

ITC

Buy

329

409

263,888

41,068

45,068

37.8

37.4

13.9

15.9

23.6

20.7

7.9

7.0

34.1

33.8

6.1

5.5

Marico

Neutral

424

-

27,365

6,551

7,766

15.7

16.0

10.4

12.5

40.9

33.9

11.9

9.9

33.2

32.4

4.1

3.5

Nestle*

Accumulate

6,149

6,646

59,285

11,291

12,847

22.2

22.3

158.9

184.6

38.7

33.3

20.2

18.2

55.0

57.3

5.1

4.4

Tata Global

Accumulate

133

152

8,381

8,635

9,072

9.8

9.9

6.5

7.6

20.5

17.5

2.0

2.0

6.8

7.4

0.9

0.9

IT

HCL Tech^

Buy

962

1,132

135,185

42,038

47,503

23.5

23.5

56.4

62.9

17.1

15.3

4.0

3.0

23.2

19.8

2.8

2.3

Infosys

Accumulate

1,138

1,306

261,438

60,250

66,999

28.0

28.0

58.3

63.7

19.5

17.9

4.1

3.5

20.9

19.7

3.7

3.1

TCS

Buy

2,691

3,168

527,133

108,420

123,559

28.8

28.7

127.2

143.9

21.2

18.7

8.4

7.8

39.9

41.8

4.5

3.9

Tech Mahindra

Buy

560

646

53,817

25,566

28,890

16.0

17.0

26.3

31.9

21.3

17.5

3.8

3.3

17.9

18.6

1.9

1.6

Wipro

Buy

576

719

142,199

52,414

58,704

23.7

23.8

38.4

42.3

15.0

13.6

2.9

2.6

19.5

18.0

2.3

1.9

Media

D B Corp

Accumulate

326

356

5,986

2,241

2,495

27.8

27.9

21.8

25.6

15.0

12.7

3.9

3.5

26.7

28.5

2.6

2.3

HT Media

Neutral

87

-

2,018

2,495

2,603

11.2

11.2

7.3

8.6

11.9

10.1

0.9

0.9

7.4

8.1

0.3

0.3

Jagran Prakashan

Accumulate

139

156

4,557

1,939

2,122

26.0

26.0

8.3

9.2

16.8

15.2

2.9

2.6

17.5

17.1

2.3

2.1

Sun TV Network

Neutral

344

-

13,557

2,779

3,196

70.2

70.5

22.8

27.3

15.1

12.6

3.7

3.4

26.7

28.3

4.6

4.0

Market Outlook

August 21, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Media

Hindustan Media

Buy

226

292

1,659

920

1,031

20.0

20.0

19.2

20.9

11.8

10.8

1.9

1.7

16.4

15.3

1.3

1.2

Ventures

Metals & Mining

Coal India

Buy

350

450

221,104

77,595

89,628

22.9

24.4

27.6

30.0

12.7

11.7

5.5

5.5

33.9

33.2

2.1

1.9

Hind. Zinc

Neutral

139

-

58,859

15,546

16,821

47.5

49.0

19.7

20.3

7.1

6.9

1.2

1.0

17.2

16.6

1.5

1.1

Hindalco

Neutral

85

-

17,552

112,328

119,817

7.7

7.9

16.3

20.1

5.2

4.2

0.4

0.4

8.0

8.5

0.6

0.5

JSW Steel

Neutral

961

-

23,231

48,125

53,595

18.8

21.0

46.9

97.5

20.5

9.9

1.0

0.9

4.4

9.5

1.3

1.2

NMDC

Neutral

94

-

37,249

12,544

13,330

59.5

59.7

16.3

16.5

5.8

5.7

1.0

1.0

5.1

9.9

1.7

1.7

SAIL

Neutral

56

-

23,190

56,365

63,383

6.9

8.0

7.1

8.2

7.9

6.9

0.5

0.5

7.0

7.1

1.0

0.9

Vedanta

Neutral

99

-

29,232

81,842

88,430

30.6

32.8

20.2

25.7

4.9

3.8

0.4

0.3

7.5

8.5

0.7

0.5

Tata Steel

Neutral

242

-

23,469

136,805

149,228

11.3

11.9

26.4

36.8

9.2

6.6

0.7

0.7

6.0

8.0

0.7

0.6

Oil & Gas

Cairn India

Neutral

142

-

26,698

12,617

14,513

33.7

40.0

25.5

27.7

5.6

5.1

0.4

0.4

7.4

7.7

0.8

0.6

GAIL

Neutral

321

-

40,661

75,595

85,554

8.6

8.0

31.8

36.1

10.1

8.9

1.1

1.0

10.7

11.4

0.7

0.6

ONGC

Neutral

256

-

218,935

174,773

192,517

22.7

24.8

34.6

38.2

7.4

6.7

1.1

1.0

14.2

14.9

1.4

1.2

Petronet LNG

Buy

179

210

13,440

39,007

40,785

3.8

4.2

9.2

11.0

19.6

16.3

2.2

2.0

11.6

12.7

0.4

0.4

Reliance Industries

Accumulate

919

1,050

297,537

339,083

384,014

7.8

9.5

75.7

94.5

12.2

9.7

1.2

1.2

10.7

12.2

1.2

1.1

Pharmaceuticals

Alembic Pharma

Neutral

717

-

13,520

2,601

3,115

21.2

20.2

20.8

23.9

34.5

30.0

11.1

8.4

37.2

31.8

5.2

4.3

Aurobindo Pharma

Neutral

798

-

46,627

14,435

16,600

22.6

22.6

36.1

41.2

22.1

19.4

6.6

5.0

34.5

29.3

3.6

3.1

Aventis*

Neutral

4,089

-

9,417

2,156

2,455

15.1

16.8

109.7

133.9

37.3

30.5

5.1

4.2

18.4

22.5

4.1

3.4

Cadila Healthcare

Neutral

1,938

-

39,685

10,224

11,840

20.0

21.0

71.0

85.6

27.3

22.6

7.3

5.8

30.1

28.5

4.0

3.3

Cipla

Neutral

691

-

55,523

14,051

16,515

20.4

18.7

26.6

28.4

26.0

24.3

4.4

3.7

18.2

16.5

3.9

3.3

Dr Reddy's

Neutral

4,297

-

73,258

17,903

20,842

22.7

22.8

160.5

189.5

26.8

22.7

5.4

4.5

22.2

21.7

4.0

3.4

Dishman Pharma

Buy

220

308

1,775

1,716

1,888

20.2

20.2

16.3

21.6

13.5

10.2

1.3

1.1

9.7

11.7

1.2

1.0

GSK Pharma*

Neutral

3,597

-

30,466

2,870

3,158

20.0

22.1

59.5

68.3

60.5

52.7

17.8

18.3

28.5

34.3

10.1

9.2

Indoco Remedies

Neutral

348

-

3,204

1,088

1,262

18.2

18.2

13.1

15.5

26.5

22.4

5.2

4.3

21.2

21.1

3.0

2.6

Ipca labs

Neutral

847

-

10,683

3,507

4,078

17.6

18.6

25.8

32.0

32.8

26.5

4.2

3.7

13.8

14.9

3.3

2.8

Lupin

Neutral

1,892

-

85,131

14,864

17,244

26.9

26.9

62.1

71.1

30.5

26.6

7.4

5.9

27.4

24.6

5.5

4.6

Sun Pharma

Neutral

936

-

225,158

28,163

32,610

25.8

30.7

17.4

26.9

53.8

34.8

5.1

4.4

13.0

16.6

7.5

6.2

Power

Tata Power

Neutral

68

-

18,256

38,302

38,404

14.1

13.1

5.1

6.0

13.1

11.3

1.3

1.2

9.2

10.3

1.4

1.3

NTPC

Buy

125

157

103,192

87,064

98,846

23.5

23.5

11.7

13.2

10.7

9.5

1.2

1.1

11.4

12.1

2.2

2.0

Power Grid

Buy

136

170

71,123

20,702

23,361

86.7

86.4

12.1

13.2

11.3

10.3

1.7

1.5

15.6

15.1

8.4

7.8

Market Outlook

August 21, 2015

Stock Watch

Company Name

Reco

CMP

Target

Mkt Cap

Sales ( Čcr )

OPM(%)

EPS (Č)

PER(x)

P/BV(x)

RoE(%)

EV/Sales(x)

(Č)

Price ( Č)

( Č cr )

FY16E FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

FY16E

FY17E

Telecom

Bharti Airtel

Neutral

379

-

151,641

101,748

109,191

32.1

31.7

12.0

12.5

31.6

30.4

2.2

2.0

6.9

6.7

2.1

1.9

Idea Cellular

Accumulate

157

171

56,482

34,282

36,941

32.0

31.5

5.9

6.2

26.6

25.3

2.4

2.2

9.9

9.3

2.2

2.1

zOthers

Abbott India

Neutral

4,848

-

10,301

2,715

3,153

14.5

14.1

134.3

152.2

36.1

31.8

9.0

7.4

27.4

25.6

3.5

3.0

Bajaj Electricals

Buy

258

341

2,597

4,719

5,287

5.2

5.8

8.6

12.7

30.1

20.4

3.4

3.0

11.4

14.8

0.5

0.5

Finolex Cables

Neutral

253

-

3,868

2,728

3,036

10.8

11.0

14.4

16.8

17.6

15.1

2.7

2.3

15.2

15.3

1.2

1.0

Goodyear India*

Accumulate

610

655

1,406

1,953

1,766

12.4

12.0

67.4

59.6

9.0

10.2

2.3

1.9

27.7

20.2

0.5

0.5

Hitachi

Neutral

1,357

-

3,690

1,806

2,112

9.0

9.2

28.6

29.1

47.5

46.7

11.8

9.5

28.1

22.6

2.1

1.8

Jyothy Laboratories

Neutral

318

-

5,752

1,620

1,847

11.5

11.5

7.3

8.5

43.6

37.5

5.6

5.2

13.3

14.4

3.4

2.9

MRF

Neutral

43,349

-

18,385

20,727

14,841

19.3

18.6

4,905.8

3,351.9

8.8

12.9

2.8

2.3

37.6

19.6

0.8

1.1

Page Industries

Neutral

14,597

-

16,281

1,929

2,450

19.8

20.1

229.9

299.0

63.5

48.8

28.0

19.5

52.1

47.1

8.5

6.6

Relaxo Footwears

Neutral

536

-

6,438

1,767

2,152

12.3

12.5

19.3

25.1

27.9

21.4

6.8

5.3

27.7

27.8

3.7

3.0

Siyaram Silk Mills

Accumulate

1,085

1,221

1,017

1,653

1,873

11.7

12.2

99.3

122.1

10.9

8.9

2.0

1.7

19.5

20.2

0.8

0.7

Styrolution ABS India*

Neutral

820

-

1,441

1,271

1,440

8.6

9.2

32.0

41.1

25.6

20.0

2.6

2.3

10.7

12.4

1.1

1.0

Tree House

Neutral

414

-

1,752

259

324

56.8

56.8

17.0

21.7

24.3

19.1

2.5

2.2

10.1

11.5

6.7

5.5

TVS Srichakra

Accumulate

3,029

3,210

2,319

2,127

2,388

15.2

14.9

237.7

267.5

12.7

11.3

5.4

3.9

51.7

39.8

1.2

1.0

HSIL

Buy

290

434

2,095

2,085

2,436

18.5

18.6

21.7

28.9

13.4

10.0

1.3

1.2

10.0

12.1

1.1

0.9

Kirloskar Engines India

Neutral

285

-

4,120

2,634

3,252

10.1

12.0

10.9

17.4

26.1

16.3

2.9

2.6

11.4

16.8

1.2

0.9

Ltd

M M Forgings

Buy

670

797

809

563

671

22.1

22.9

51.0

66.5

13.1

10.1

2.7

2.2

23.1

24.1

1.6

1.3

Banco Products (India)

Neutral

144

-

1,029

1,208

1,353

11.0

12.3

10.8

14.5

13.4

9.9

1.5

1.4

11.9

14.5

0.8

0.7

Competent Automobiles Neutral

177

-

109

1,007

1,114

3.1

3.1

23.7

28.2

7.5

6.3

1.0

0.9

13.9

14.6

0.1

0.1

Nilkamal

Neutral

1,015

-

1,514

1,948

2,147

10.6

10.3

60.0

67.0

16.9

15.2

2.6

2.3

16.8

16.1

0.8

0.7

Visaka Industries

Neutral

171

-

272

1,158

1,272

8.6

9.5

23.7

32.7

7.2

5.2

0.7

0.7

10.1

12.5

0.4

0.3

Transport Corporation of

Neutral

300

-

2,284

2,830

3,350

8.8

9.0

14.4

18.3

20.9

16.4

3.2

2.8

15.4

17.1

0.9

0.8

India

Elecon Engineering

Accumulate

77

87

843

1,452

1,596

14.0

14.7

4.4

6.2

17.5

12.4

1.5

1.3

8.6

11.2

0.9

0.7

Surya Roshni

Buy

137

183

600

2,992

3,223

8.3

8.5

14.7

18.3

9.3

7.5

0.9

0.8

9.8

11.0

0.5

0.5

MT Educare

Neutral

138

-

548

275

355

18.3

17.3

7.4

8.8

18.6

15.6

3.8

3.3

20.2

21.1

1.9

1.4

Radico Khaitan

Buy

94

112

1,255

1,565

1,687

11.9

12.4

5.4

6.6

17.4

14.3

1.4

1.3

8.0

9.0

1.3

1.2

Garware Wall Ropes

Buy

298

390

652

875

983

10.4

10.6

23.1

27.8

12.9

10.7

1.8

1.6

14.1

14.8

0.8

0.7

Source: Company, Angel Research; Note: *December year end; #September year end; &October year end; Price as on August 20, 2015

Market Outlook

August 21, 2015

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in

the company covered by Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer,

director or employee of company covered by Analyst and has not been engaged in market making activity of the company covered by

Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any

loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt.

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance,

or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have

investment positions in the stocks recommended in this report.